5 Predictions Private Equity Healthcare Lisa Walkush Grant Thornton

5 Predictions Private Equity Healthcare Lisa Walkush Grant Thornton: Dive into the future of healthcare investing with insights from Grant Thornton’s Lisa Walkush. This expert offers a glimpse into five key predictions shaping the healthcare private equity landscape over the next few years, considering current market trends, macroeconomic factors, and technological disruptions. We’ll explore the implications of these predictions, the potential risks and rewards, and what they mean for investors in this dynamic sector.

Get ready for a fascinating look at the future of healthcare M&A.

Lisa Walkush, a prominent figure at Grant Thornton, brings years of experience in healthcare private equity to the table. Her predictions are grounded in a deep understanding of the industry’s complexities, including the influence of regulatory changes, technological advancements, and macroeconomic shifts. We’ll delve into Grant Thornton’s role in this space, examining their approach to investments and comparing it to other major players.

The analysis will consider how macroeconomic factors like interest rates and inflation impact investment strategies, providing a comprehensive overview of the current and future state of healthcare private equity.

Lisa Walkush’s Expertise in Healthcare Private Equity

Source: youtube.com

Lisa Walkush’s career at Grant Thornton has firmly established her as a leading figure in the healthcare private equity landscape. Her deep understanding of the complexities of this sector, coupled with her extensive experience advising clients on a wide range of transactions, makes her a highly sought-after expert. This deep dive explores her background, accomplishments, and network within the industry.Lisa’s expertise stems from years of dedicated work within Grant Thornton’s healthcare practice.

Her role has involved far more than simply crunching numbers; she’s actively shaped strategies, guided investments, and helped navigate the regulatory intricacies that define the healthcare sector. This hands-on approach has given her an unparalleled understanding of the challenges and opportunities present in this dynamic market.

Lisa Walkush’s Background and Experience at Grant Thornton, 5 predictions private equity healthcare lisa walkush grant thornton

Lisa’s journey at Grant Thornton likely began with a strong foundation in accounting or finance, progressing to specialized roles within the healthcare division. Her ascent within the firm reflects her consistent performance and ability to deliver high-value services to clients. Specific details regarding her career progression are not publicly available, but her current position and responsibilities clearly indicate a substantial amount of experience and leadership within the healthcare private equity team.

This likely includes overseeing due diligence processes, financial modeling, and valuations for various healthcare investments, encompassing hospitals, pharmaceutical companies, medical device manufacturers, and other related businesses.

Key Accomplishments and Contributions

While precise details about individual deals are often kept confidential due to non-disclosure agreements, Lisa’s contributions to the healthcare private equity field are demonstrably significant. Her expertise is likely reflected in the successful completion of numerous transactions, contributing to significant returns for her clients. This success could involve identifying undervalued assets, structuring effective investment strategies, and navigating complex regulatory hurdles.

Her work has likely played a crucial role in shaping the growth and success of many healthcare companies. For example, she may have advised on the acquisition of a struggling regional hospital system, guiding the restructuring and turnaround that led to profitability and improved patient care. Another example might involve advising on a strategic partnership between a pharmaceutical company and a technology firm, leading to the development of innovative new treatments.

Professional Network and Connections

Lisa’s extensive experience has undoubtedly fostered a strong network within the healthcare private equity sector. Her professional relationships likely extend to investment firms, portfolio companies, legal counsel, and other key players in the industry. This network allows her to access valuable information, facilitate transactions, and provide her clients with a competitive advantage. The strength of her network is a significant factor contributing to her success and influence within the field.

Her connections likely include senior executives at major private equity firms, CEOs of healthcare companies, and influential regulatory bodies. These relationships are cultivated over years of consistent performance, trust, and collaborative work.

Grant Thornton’s Role in Healthcare Private Equity

Source: bannerbear.com

Grant Thornton plays a significant role in the healthcare private equity landscape, offering a wide array of services designed to support investors throughout the entire investment lifecycle. Their expertise extends beyond traditional accounting and auditing, encompassing strategic advisory, transaction support, and operational improvements, all tailored to the unique complexities of the healthcare sector. This multifaceted approach allows them to provide comprehensive support to private equity firms seeking to maximize returns in this dynamic market.Grant Thornton provides a suite of services designed to navigate the intricacies of healthcare private equity investments.

These services range from due diligence and financial modeling to operational assessments and post-acquisition integration support. Their deep industry knowledge, coupled with their expertise in financial analysis and regulatory compliance, enables them to provide valuable insights and support to their clients. They leverage advanced technologies and data analytics to identify key risks and opportunities, enhancing the decision-making process for their private equity clients.

Grant Thornton’s Service Offerings in Healthcare Private Equity

Grant Thornton’s services for healthcare private equity firms are comprehensive and cover various stages of the investment process. They conduct thorough due diligence investigations, meticulously examining financial statements, operational efficiency, and regulatory compliance. Their financial modeling expertise helps investors accurately assess the potential return on investment and identify potential risks. Beyond the transactional phase, Grant Thornton assists with post-acquisition integration, optimizing operations and driving growth within portfolio companies.

This holistic approach helps clients to successfully navigate the complexities of the healthcare market and maximize their returns.

Lisa Walkush from Grant Thornton’s 5 predictions for private equity in healthcare got me thinking about the future of data analysis in the sector. The speed of innovation is mind-blowing; for example, check out this article on google cloud healthcare amy waldron generative AI , which shows how AI is already transforming healthcare data management. This rapid advancement directly impacts Walkush’s predictions, especially regarding the need for efficient data-driven decision-making in the PE healthcare space.

Examples of Successful Grant Thornton Engagements

While specific client engagements are often confidential due to non-disclosure agreements, Grant Thornton’s website and press releases showcase their involvement in numerous successful healthcare private equity transactions. For instance, they’ve been involved in advising on deals involving significant investments in innovative healthcare technology companies, supporting acquisitions of established healthcare providers, and facilitating mergers and acquisitions within the pharmaceutical industry.

These engagements highlight their capacity to manage complex transactions and deliver successful outcomes for their clients across diverse segments of the healthcare sector. The scale and variety of these transactions underscore their broad expertise within the industry.

Comparison with Other Major Firms

Grant Thornton differentiates itself from other major firms through a combination of factors. While larger firms might possess broader geographic reach, Grant Thornton often emphasizes a more specialized and personalized approach to healthcare private equity. This tailored service model allows for a deeper understanding of client needs and a more effective response to the specific challenges within the healthcare industry.

This focus on specialized industry expertise, coupled with a commitment to building strong client relationships, sets them apart in a competitive market. While other firms may offer similar services, Grant Thornton’s dedicated healthcare private equity team and their deep industry knowledge create a distinct value proposition for their clients.

Current Trends in Healthcare Private Equity: 5 Predictions Private Equity Healthcare Lisa Walkush Grant Thornton

The healthcare private equity landscape is dynamic, constantly evolving due to technological advancements, shifting demographics, and regulatory changes. Understanding these trends is crucial for investors seeking to navigate this complex and lucrative sector effectively. This section will Artikel five key trends and their potential impact on investment strategies.

Increased Focus on Technology-Enabled Healthcare

The integration of technology across all aspects of healthcare is accelerating. This includes telehealth, AI-driven diagnostics, data analytics for personalized medicine, and robotic surgery. Private equity firms are increasingly targeting companies developing and implementing these technologies, recognizing their potential to improve efficiency, reduce costs, and enhance patient outcomes. For example, investments in companies providing remote patient monitoring solutions are booming, driven by the growing demand for convenient and accessible healthcare.

This trend is expected to continue, with a significant increase in funding for companies developing innovative digital health tools.

Growth of the Value-Based Care Model

The shift towards value-based care, where providers are reimbursed based on the quality of care rather than the volume of services, is fundamentally altering the healthcare delivery system. This trend is driving investment in healthcare providers and technology companies that can effectively manage population health, improve patient outcomes, and demonstrate cost-effectiveness. A hypothetical example would be an investment in a large physician group that has successfully transitioned to a value-based care model and demonstrates strong performance metrics in terms of patient satisfaction, cost reduction, and improved health outcomes.

Expansion of the Senior Care Market

The aging global population is fueling significant growth in the senior care market. This includes investments in assisted living facilities, home healthcare services, and technology solutions designed to support aging in place. The demand for high-quality, affordable senior care is outpacing supply, creating attractive opportunities for private equity investors. For instance, investments in companies developing innovative technologies for monitoring and managing chronic conditions in the elderly are becoming increasingly common, reflecting the growing focus on improving the quality of life for seniors.

Lisa Walkush of Grant Thornton’s five predictions for private equity in healthcare got me thinking about the future of the industry. One key area impacting those predictions is the accelerating adoption of new technologies, and I was particularly struck by a recent study on the widespread use of digital twins in healthcare; check out this fascinating report: study widespread digital twins healthcare.

This research really highlights how Walkush’s predictions, especially regarding technological disruption, are already unfolding, shaping the investment landscape in exciting ways.

Consolidation of Healthcare Providers

The healthcare industry is experiencing significant consolidation, with larger systems acquiring smaller practices and hospitals. This trend is driven by the need for economies of scale, improved negotiating power with payers, and access to advanced technologies. Private equity firms are actively participating in this consolidation, providing capital to facilitate acquisitions and mergers. A notable example is the increasing number of private equity-backed acquisitions of regional hospital systems, creating larger, more integrated healthcare networks.

Emphasis on Data Security and Privacy

With the increasing use of technology in healthcare, data security and privacy have become paramount concerns. Private equity firms are prioritizing investments in companies that demonstrate robust data security protocols and comply with evolving regulations, such as HIPAA in the United States. This includes investments in cybersecurity firms specializing in healthcare and companies developing secure data management solutions for healthcare providers.

This focus on data security is not just a risk mitigation strategy but also an opportunity to invest in companies that are providing critical services to the healthcare industry.

Predicting Future Healthcare Private Equity Investments

The healthcare industry is a dynamic landscape, constantly evolving due to technological advancements, shifting demographics, and regulatory changes. This creates both significant challenges and lucrative opportunities for private equity investors. Predicting the future of this sector requires careful consideration of these multifaceted factors, and while certainty is impossible, informed projections can help navigate the complexities of this market.

The following predictions offer a glimpse into the potential trajectory of healthcare private equity investments over the next 3-5 years.

Lisa Walkush of Grant Thornton’s five predictions for private equity in healthcare got me thinking about the future of the industry. One key area is technological advancement, and the news that Nuance is integrating generative AI into its Scribe technology for Epic EHRs, as detailed in this article nuance integrates generative ai scribe epic ehrs , is a perfect example of how these predictions are playing out.

This kind of innovation will likely shape investment strategies in the coming years, impacting Walkush’s broader predictions for the healthcare PE landscape.

Growth in Digital Health and Telehealth Investments

The increasing adoption of telehealth and digital health solutions, accelerated by the COVID-19 pandemic, will continue to drive significant investment. Private equity firms will actively seek opportunities in companies developing innovative technologies for remote patient monitoring, virtual care platforms, and AI-driven diagnostics. This is fueled by the growing demand for accessible and cost-effective healthcare solutions, and the potential for scalability and high returns on investment.

The risks involve regulatory hurdles surrounding data privacy and security, as well as the potential for market saturation as more players enter the field. Opportunities exist in developing integrated solutions that combine various digital health tools and address specific unmet needs within the healthcare ecosystem. For example, investments in companies providing integrated platforms for remote patient monitoring combined with AI-powered diagnostic tools would capitalize on this trend.

Increased Focus on Value-Based Care Models

Private equity will increasingly favor investments in healthcare providers and technology companies that align with value-based care models. This shift reflects a broader industry trend toward rewarding providers based on quality of care and patient outcomes, rather than simply volume of services. The opportunities here lie in acquiring or partnering with organizations that have already demonstrated success in implementing value-based care initiatives, or those developing innovative technologies to support this transition.

The risks include the complexity of transitioning to value-based care models, which requires significant changes in operational processes and financial incentives. Successfully navigating this transition will require careful due diligence and a strong understanding of the regulatory landscape. Consider, for example, investments in home health agencies implementing technology to monitor patient outcomes and reduce readmissions, a direct reflection of value-based care principles.

Strategic Acquisitions in Specialty Pharma and Biotech

Private equity will continue to pursue strategic acquisitions in the specialty pharmaceutical and biotechnology sectors, particularly in areas with high unmet medical needs and strong intellectual property protection. This is driven by the potential for significant returns on investment from the development and commercialization of novel therapies. However, the risks associated with this sector are substantial, including high research and development costs, regulatory uncertainties, and the inherent complexities of bringing new drugs to market.

Opportunities lie in identifying companies with promising drug candidates that have already cleared significant regulatory hurdles or possess strong intellectual property portfolios. For instance, a private equity firm might acquire a smaller biotech company specializing in oncology treatments that has a promising drug in late-stage clinical trials.

Expansion of Investments in Healthcare Services for Aging Populations

With the global population aging rapidly, private equity firms will increase investments in companies providing healthcare services specifically tailored to the needs of older adults. This includes home healthcare, assisted living facilities, and senior-focused technology solutions. The opportunities are significant, driven by the growing demand for these services and the potential for long-term contracts with government and private payers. The risks involve managing the complexities of providing care to a vulnerable population, adhering to stringent regulatory requirements, and mitigating potential operational challenges associated with staffing and quality control.

For example, investment in a company developing AI-powered tools for monitoring the health of elderly patients living at home would represent a significant opportunity in this area.

Rise of Partnerships and Joint Ventures

We will see a rise in strategic partnerships and joint ventures between private equity firms and healthcare providers, technology companies, and other stakeholders. This collaborative approach allows for the sharing of resources, expertise, and risk, fostering innovation and accelerating growth. The opportunities lie in leveraging the complementary strengths of different partners to create more comprehensive and effective healthcare solutions.

The risks involve potential conflicts of interest, challenges in coordinating efforts across multiple organizations, and the need for clear communication and alignment of goals. For example, a private equity firm might partner with a large hospital system and a technology company to develop and implement a new telehealth platform, combining the hospital’s clinical expertise, the technology company’s innovation, and the private equity firm’s financial resources.

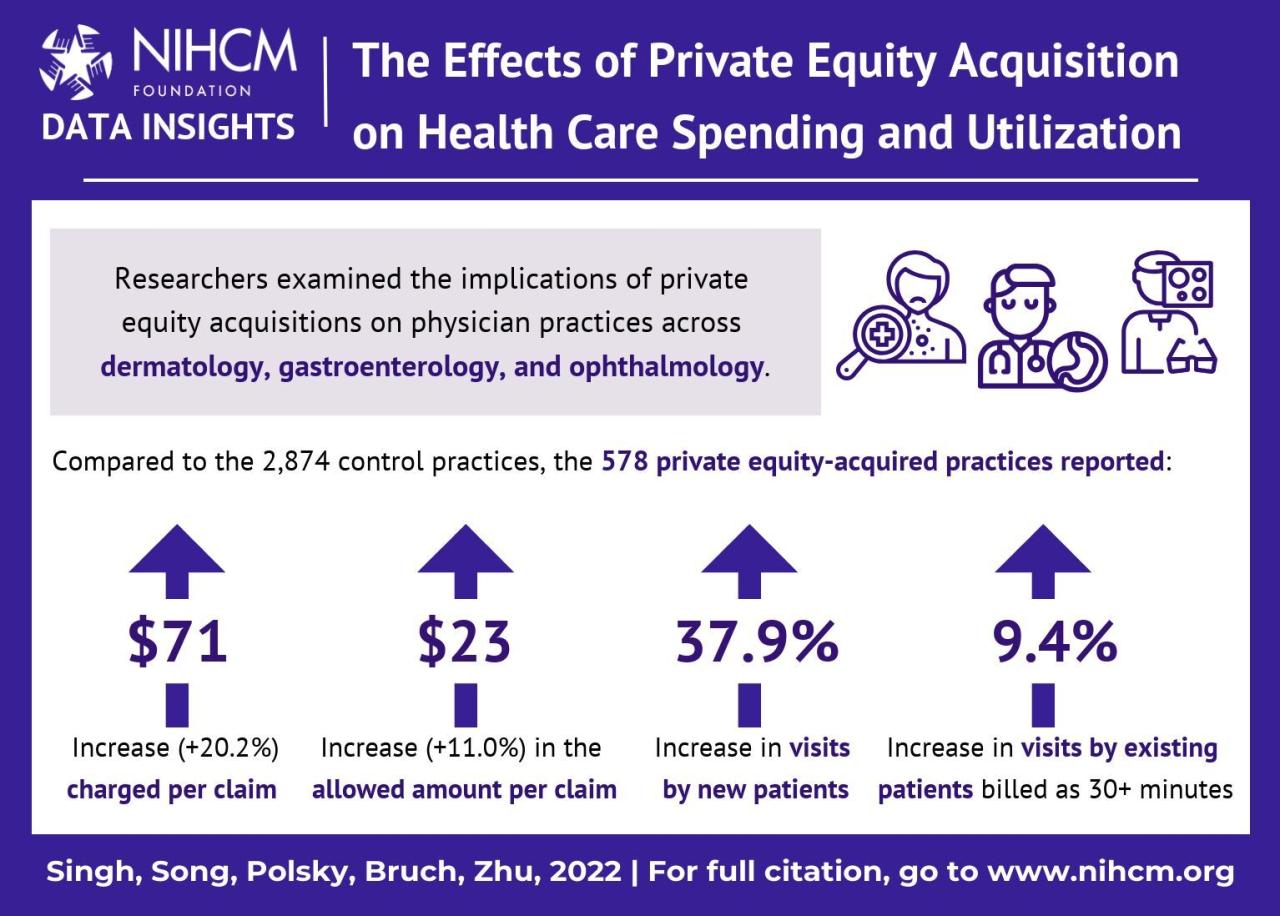

Impact of Macroeconomic Factors

Source: nihcm.org

Macroeconomic conditions significantly influence private equity investment decisions across all sectors, and healthcare is no exception. Interest rates, inflation, and economic growth directly impact the valuation of healthcare companies, the availability of debt financing, and the overall risk appetite of investors. Understanding these dynamics is crucial for navigating the complexities of the healthcare private equity market.The relationship between macroeconomic factors and healthcare private equity investments is complex and multifaceted.

High interest rates, for example, increase the cost of borrowing, making leveraged buyouts (LBOs) more expensive and potentially reducing the number of transactions. Conversely, low interest rates can fuel increased deal activity as borrowing becomes cheaper. Inflation, on the other hand, impacts the operating costs of healthcare providers and can affect the pricing power of these businesses, influencing their attractiveness to investors.

Periods of economic uncertainty or recession often lead to decreased investment activity as investors become more risk-averse.

Past Macroeconomic Events and Their Impact

Past macroeconomic events have demonstrably affected the healthcare private equity sector. The 2008 financial crisis, for instance, led to a significant slowdown in deal activity as credit markets froze and investors became wary of risk. Many transactions were delayed or cancelled, and valuations dropped considerably. Conversely, the period of low interest rates following the crisis spurred a resurgence in activity, with ample capital chasing relatively few opportunities.

The recent inflationary environment and rising interest rates are already beginning to impact deal flow and valuations, causing a shift towards more selective investing and a greater focus on operational improvements rather than solely financial engineering. The COVID-19 pandemic, while not strictly a macroeconomic event in the traditional sense, had a profound impact, initially causing a slowdown followed by a period of intense activity focused on companies involved in testing, therapeutics, and telehealth.

Scenario Analysis of Macroeconomic Impacts

The following table presents a scenario analysis illustrating the potential impact of different macroeconomic environments on future healthcare private equity investments. These are illustrative examples and should not be interpreted as precise predictions.

| Scenario | Interest Rate | Inflation Rate | Investment Impact |

|---|---|---|---|

| Base Case (Stable Growth) | 4-5% | 2-3% | Moderate deal activity, focus on strong fundamentals and operational efficiency. Valuations remain relatively stable. |

| High Interest Rate/High Inflation | 6-8% | 4-6% | Significant slowdown in deal activity. Increased focus on defensive investments and operational improvements. Lower valuations. Increased scrutiny of debt financing. |

| Low Interest Rate/Low Inflation | 1-3% | 1-2% | Increased deal activity, particularly in growth sectors like telehealth and specialized medicine. Higher valuations, greater competition for deals. Increased use of leverage. |

| Recessionary Environment | Variable (potentially high) | Variable (potentially high or low depending on the nature of the recession) | Sharp decline in deal activity. Focus on distressed assets and restructuring opportunities. Significant downward pressure on valuations. |

Technological Disruption in Healthcare

The healthcare industry is undergoing a dramatic transformation driven by rapid technological advancements. This disruption presents both significant challenges and unprecedented opportunities for private equity investors. Understanding the impact of these technologies is crucial for navigating the evolving landscape and identifying promising investment targets. This section will explore the influence of key technological trends on healthcare private equity, highlighting successful and unsuccessful investments.Technological advancements, particularly in artificial intelligence (AI) and telehealth, are reshaping the delivery and financing of healthcare.

AI-powered diagnostic tools offer the potential for earlier and more accurate disease detection, leading to improved patient outcomes and reduced healthcare costs. Telehealth platforms expand access to care, particularly in underserved areas, and offer greater convenience for patients. These innovations are attracting substantial private equity investment, as firms seek to capitalize on the growing demand for technologically advanced healthcare solutions.

However, the successful integration of these technologies requires careful consideration of regulatory hurdles, data security concerns, and the potential for displacement of existing healthcare workers.

Impact of AI on Healthcare Private Equity

AI is rapidly changing the diagnostic and treatment processes within healthcare. For instance, AI-powered image analysis tools are being used to detect cancers earlier and more accurately than traditional methods. This leads to improved patient outcomes and reduced treatment costs. Private equity firms are actively investing in companies developing and deploying these AI-driven solutions. A successful example is the investment in PathAI, a company using AI to improve the accuracy of pathology diagnoses.

Conversely, unsuccessful investments often stem from underestimating the complexities of integrating AI into existing healthcare workflows or failing to secure necessary regulatory approvals. For example, some AI-based diagnostic tools have struggled to gain widespread adoption due to concerns about their accuracy and reliability in real-world clinical settings.

Telehealth’s Influence on Investment Strategies

The COVID-19 pandemic significantly accelerated the adoption of telehealth, demonstrating its effectiveness in providing convenient and accessible healthcare. Private equity firms have responded by investing heavily in telehealth platforms and related technologies. Companies offering virtual consultations, remote patient monitoring, and digital therapeutics have seen substantial growth. Teladoc Health, a leading telehealth provider, is a prime example of a successful investment driven by the telehealth boom.

However, not all telehealth investments have been successful. Challenges include ensuring the quality and security of virtual care, addressing reimbursement issues, and overcoming regulatory barriers in different markets. Companies that failed to adapt to evolving reimbursement models or to effectively address patient privacy concerns have struggled to gain traction.

Visual Representation of Technology and Private Equity Investment

Imagine a Venn diagram. One circle represents the rapidly expanding field of healthcare technologies, encompassing AI, telehealth, genomics, and other innovative solutions. The other circle represents the private equity investment landscape, with various firms and investment strategies. The overlapping area represents the significant intersection of these two forces. Within this overlapping area, individual investments are represented as points of varying sizes, reflecting the magnitude of each investment.

Successful investments appear as larger, brightly colored points, while unsuccessful investments are smaller and perhaps dimmer. The size and color intensity of these points dynamically change over time, reflecting the success and evolution of each investment in response to market forces and technological advancements. The diagram visually illustrates the dynamic interplay between technological innovation and private equity capital in driving the transformation of the healthcare industry.

Regulatory and Policy Changes

The healthcare landscape is constantly evolving, shaped by a complex interplay of regulations and policies. These shifts significantly impact private equity investment strategies, creating both challenges and opportunities for investors navigating this dynamic environment. Understanding the regulatory environment is paramount for successful investment in the healthcare sector.Recent and anticipated changes in healthcare regulations and policies are reshaping the investment landscape.

Increased scrutiny of pricing practices, for instance, is forcing companies to demonstrate value and efficiency. Simultaneously, the push for greater transparency and data interoperability is creating new opportunities for technology-driven solutions and data analytics firms. The implications are far-reaching, impacting everything from drug pricing and reimbursement models to the development and adoption of new medical technologies.

Regulatory Scrutiny and Antitrust Concerns

Increased regulatory scrutiny, particularly regarding antitrust issues and mergers and acquisitions, presents significant challenges. The Federal Trade Commission (FTC) and the Department of Justice (DOJ) are actively reviewing healthcare mergers and acquisitions, scrutinizing their potential impact on competition and patient costs. This heightened scrutiny can lead to longer approval times, increased costs associated with regulatory compliance, and even the blocking of certain transactions.

Conversely, this heightened scrutiny can also create opportunities for investors focused on smaller, less-consolidated market segments, or those specializing in innovative technologies that avoid direct competition with established players. For example, the FTC’s recent blocking of a major hospital merger highlights the increasing challenges in consolidating larger healthcare systems.

Impact of Value-Based Care Models

The shift towards value-based care (VBC) models, which emphasize quality of care and patient outcomes over volume, is driving significant changes in the industry. Private equity investors need to assess how their portfolio companies are adapting to this shift, as reimbursement models are increasingly tied to performance metrics. Successful adaptation may involve investments in technology and data analytics to track and improve patient outcomes, as well as strategic partnerships with providers who are already established in VBC models.

For instance, a private equity firm might invest in a technology company that helps hospitals and physician practices track and improve quality metrics, allowing them to better participate in VBC programs.

Key Regulatory Considerations for Healthcare Private Equity Investors

Understanding the regulatory landscape is critical for successful investment. Investors must consider several key areas:

- Antitrust and Competition Laws: Thorough due diligence is essential to ensure compliance with antitrust regulations before any merger or acquisition. This includes careful analysis of market concentration and potential anti-competitive effects.

- HIPAA Compliance: Protecting patient health information (PHI) is paramount. Investments must ensure strict adherence to HIPAA regulations, particularly concerning data security and privacy.

- State and Federal Licensing and Certification Requirements: Healthcare providers must meet stringent licensing and certification requirements at both the state and federal levels. Investors need to understand these requirements and ensure compliance.

- Fraud and Abuse Laws: The healthcare industry is subject to strict regulations to prevent fraud and abuse. Investors must conduct thorough due diligence to avoid any potential violations.

- Reimbursement Models and Payer Contracts: Understanding the complexities of healthcare reimbursement and payer contracts is crucial. Investors need to assess the financial viability of their investments in the context of evolving reimbursement models.

Closing Notes

Lisa Walkush’s five predictions paint a compelling picture of the future of healthcare private equity. While risks certainly exist, the opportunities presented by technological advancements and evolving market trends are significant. Understanding these predictions and their underlying drivers is crucial for navigating the complexities of this sector and making informed investment decisions. The interplay between macroeconomic forces and technological disruption will continue to shape the landscape, making this a dynamic and potentially highly rewarding area for investors who can adapt to the changing conditions.

Stay tuned for more insights into this exciting field!

Clarifying Questions

What specific technological advancements are most impactful on healthcare private equity?

AI-driven diagnostics, telehealth platforms, and advancements in genomics are significantly influencing investment strategies.

How does Grant Thornton’s approach to healthcare PE differ from its competitors?

This requires further research into Grant Thornton’s specific strategies and comparing them to competitors’ publicly available information. Their focus areas and investment philosophies will differ.

What are the biggest risks associated with investing in healthcare PE right now?

Regulatory uncertainty, macroeconomic volatility, and the rapid pace of technological change all present significant risks.

What is Lisa Walkush’s specific role at Grant Thornton?

This would need to be researched via Grant Thornton’s website or other publicly available information on Ms. Walkush’s professional profile.