Hospital Prices Commercial Plans vs. Medicare Advantage

Hospital prices higher commercial health plans Medicare Advantage health affairs – it’s a complex issue affecting millions. Why do hospital bills seem so much higher when using a commercial health plan compared to Medicare Advantage? This isn’t just about numbers; it’s about access to care, the financial burden on patients, and the intricate dance between hospitals, insurance companies, and government programs.

We’ll delve into the pricing strategies hospitals employ, the negotiation tactics of different insurance plans, and the ultimate impact on patients’ wallets and healthcare choices.

This post breaks down the key factors contributing to this disparity. We’ll examine how hospital negotiating power influences prices, explore the differences in contract structures between commercial and Medicare Advantage plans, and analyze the role of insurance company profit margins and administrative costs. We’ll also look at patient cost-sharing, the lack of price transparency, and the potential consequences for healthcare access and quality.

Get ready to uncover the hidden costs of healthcare!

Hospital Pricing Strategies

Hospital pricing is a complex issue, significantly impacting both patients and the healthcare system. The differences in pricing between commercial health plans and Medicare Advantage plans are substantial, driven by a variety of factors including negotiation power, payment models, and the overall structure of the healthcare market. Understanding these differences is crucial for navigating the complexities of healthcare costs.

Pricing Models: Commercial vs. Medicare Advantage

Hospitals utilize different pricing strategies when negotiating with commercial health plans and Medicare Advantage plans. Commercial plans typically negotiate individual contracts with hospitals, resulting in a wide range of negotiated rates. This process often involves complex negotiations, with the hospital leveraging its market position and the insurer seeking to control costs. In contrast, Medicare Advantage plans operate under a different framework.

While they also negotiate rates, these rates are often subject to government oversight and regulations, resulting in greater transparency and potentially more standardized pricing, though variation still exists. The pricing model itself inherently influences the final cost to the patient.

Factors Contributing to Higher Prices for Commercial Plans, Hospital prices higher commercial health plans medicare advantage health affairs

Several factors contribute to the higher prices charged to commercial health plans. One key factor is the negotiating power of hospitals, particularly in markets with limited competition. Hospitals in such areas can command higher prices because insurers have fewer options to choose from. Another factor is the lack of transparency in commercial pricing. The complex nature of these contracts makes it difficult for patients and even insurers to understand the rationale behind specific prices.

Additionally, the inclusion of a wider range of services and benefits within commercial plans, compared to the more standardized offerings in Medicare Advantage, can inflate overall costs. Finally, the use of different payment models, such as fee-for-service versus bundled payments, can lead to significant price differences. Fee-for-service models, prevalent in commercial plans, incentivize higher volume of services, potentially increasing costs.

Hospital Negotiating Power and Price Setting

Hospitals with strong market positions, such as those located in areas with limited competition or those offering specialized services in high demand, have greater leverage in negotiations with both commercial and Medicare Advantage plans. These hospitals can negotiate higher rates due to the lack of readily available alternatives. Conversely, hospitals in more competitive markets with a greater number of competing facilities have less negotiating power and may need to accept lower rates to attract patients and insurers.

The impact of negotiating power is particularly pronounced in commercial negotiations, where the lack of regulatory oversight allows for more significant variations in pricing. Medicare Advantage plans, while still subject to negotiation, are subject to greater regulatory scrutiny, limiting the extent to which hospitals can leverage their market power to drive up prices.

Average Costs for Common Procedures

The following table provides a hypothetical comparison of average costs for common procedures across commercial and Medicare Advantage plans. It’s important to note that these figures are illustrative and actual costs will vary significantly based on location, hospital, and specific circumstances.

| Procedure | Commercial Plan Average Cost | Medicare Advantage Average Cost | Cost Difference |

|---|---|---|---|

| Knee Replacement | $50,000 | $40,000 | $10,000 |

| Heart Bypass Surgery | $75,000 | $60,000 | $15,000 |

| Appendectomy | $15,000 | $12,000 | $3,000 |

| C-Section | $25,000 | $20,000 | $5,000 |

Medicare Advantage Plan Design and Negotiation

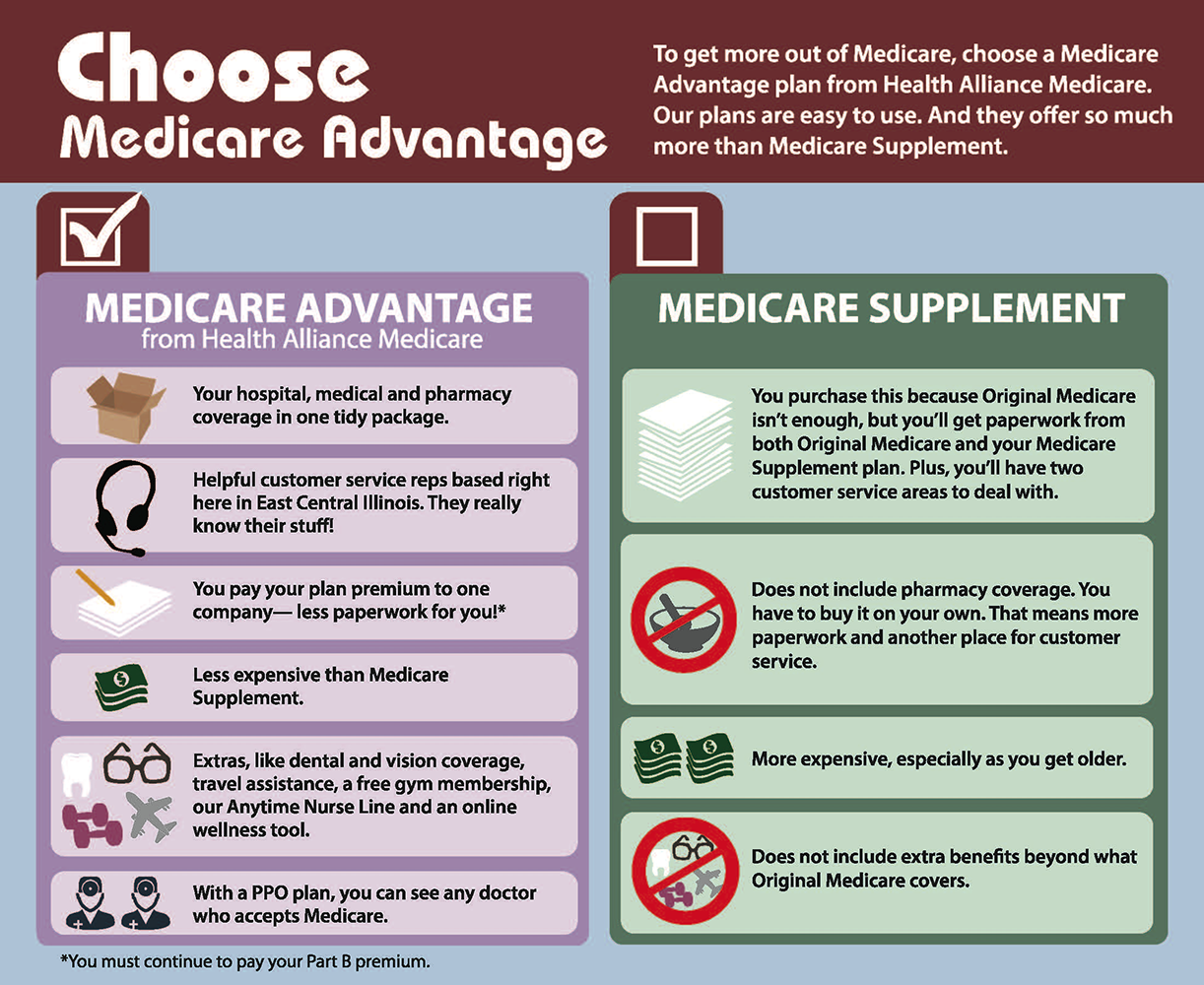

Medicare Advantage (MA) plans, a popular alternative to Original Medicare, play a significant role in shaping hospital reimbursement and influencing healthcare costs. Their negotiation strategies differ considerably from those of commercial health plans, impacting both hospitals and beneficiaries. Understanding these mechanisms is crucial for comprehending the complexities of the US healthcare system.Negotiating hospital rates is a cornerstone of MA plan operations.

Unlike Original Medicare, which largely relies on fee-for-service reimbursement, MA plans negotiate bundled payments or discounted fee-for-service rates with hospitals. This negotiation process leverages the plan’s enrollment size and the potential for a large volume of patients to secure favorable pricing. The plans often employ sophisticated actuarial models to predict their healthcare spending and use this data to inform their negotiations.

Contract Structures: Commercial vs. Medicare Advantage

Commercial health plans and MA plans utilize distinct contract structures when negotiating with hospitals. Commercial plans frequently engage in complex, individualized negotiations with each hospital, often involving specific service line contracts and varying payment models. These contracts can be highly customized and often include detailed performance metrics. In contrast, MA plans often utilize standardized contracts or a smaller set of contract templates, simplifying the negotiation process and allowing for greater scale and efficiency.

This standardization can lead to broader coverage but may also limit flexibility in addressing the specific needs of individual hospitals or regions. For instance, a commercial plan might negotiate a specialized oncology contract with a leading cancer center, while an MA plan might focus on a broader network agreement encompassing a range of hospital services.

Impact of Risk Adjustment Models on Hospital Reimbursement

Risk adjustment models are integral to MA plan reimbursement. These models account for the differing health statuses of beneficiaries enrolled in different plans. Plans with a higher proportion of sicker beneficiaries receive higher payments from Medicare, influencing their ability to negotiate hospital rates. Hospitals, therefore, may be more willing to negotiate lower rates with plans that have a healthier beneficiary population, knowing that the plan will receive less reimbursement overall.

Conversely, plans covering sicker populations might have more leverage in negotiations, as they are receiving greater reimbursement from Medicare. This dynamic introduces a level of complexity beyond simple volume-based negotiations. For example, a plan with a high concentration of beneficiaries with chronic conditions might negotiate a bundled payment for managing those conditions, including inpatient and outpatient care.

Medicare Advantage Strategies for Controlling Hospital Costs

MA plans employ a variety of strategies to control hospital costs. These include negotiating lower per-diem rates, implementing utilization management programs (such as pre-authorization for certain procedures), and promoting the use of less expensive care settings, like outpatient clinics or rehabilitation facilities. They also frequently leverage their network size to encourage hospitals to compete for patients, leading to price pressure.

Furthermore, some plans incorporate value-based purchasing models into their contracts, rewarding hospitals for achieving better quality outcomes and efficiency metrics. An example of this could be a contract where the hospital receives a bonus if it achieves a specific reduction in hospital readmissions within a specified time frame. Another strategy is the increased emphasis on preventive care and early intervention programs to reduce the need for costly hospitalizations in the first place.

The Role of Health Insurance Companies

Source: cloudfront.net

Health insurance companies play a pivotal role in shaping hospital pricing and ultimately, the cost of healthcare for individuals and the nation. Their profit margins, network structures, and administrative costs all significantly influence the final price a patient pays for medical services. Understanding their dynamics is crucial to comprehending the complexities of the US healthcare system.The profit margins of health insurance companies vary considerably between commercial plans and Medicare Advantage plans.

Generally, commercial plans, which cover individuals and families through employers or direct purchase, tend to have higher profit margins than Medicare Advantage plans. This difference is partly due to the regulatory environment surrounding Medicare Advantage, which includes stricter oversight and reimbursement rates. However, the complexity of the market and variations in plan designs make direct comparisons challenging. Some commercial plans, particularly those with narrow networks and aggressive cost-containment strategies, might have lower profit margins than some higher-cost Medicare Advantage plans.

The competitive landscape and the mix of insured populations also influence profitability.

Profit Margins in Commercial and Medicare Advantage Plans

Profitability in the health insurance industry is a complex issue. While publicly traded companies report financial data, extracting precise profit margins specifically attributable to commercial versus Medicare Advantage plans requires detailed financial analysis, often unavailable publicly. However, it’s generally accepted that commercial plans, due to factors such as higher premiums and less regulatory oversight, typically yield higher profit margins.

Hospital prices are insane, right? Commercial health plans and Medicare Advantage often leave patients with massive bills, fueling the already intense debate about healthcare costs. This is further highlighted by the recent new york state nurse strike montefiore richmond university deals , where staffing shortages and fair compensation are at the heart of the issue, directly impacting the overall cost of care and ultimately contributing to those sky-high hospital bills we all dread.

The specifics vary considerably based on the insurer, the geographic market, the specific plan design, and the health status of the enrolled population. For example, a commercial plan focused on a young, healthy population might have higher profit margins than a Medicare Advantage plan serving a sicker, older population.

Influence of Insurance Company Network Structures on Hospital Pricing

Insurance company network structures exert significant influence on hospital pricing. Narrow networks, which include a limited number of hospitals and physicians, typically negotiate lower rates with healthcare providers. This is because hospitals are incentivized to accept lower reimbursement rates to maintain access to the insured population within the network. Conversely, broader networks, encompassing a wider range of providers, often lead to higher prices due to less leverage in negotiations.

The strategic choices made by insurers regarding network design significantly impact the cost of care for consumers. For instance, a large national insurer might negotiate significantly lower rates with a major hospital system, whereas a smaller regional insurer may have less bargaining power and thus pay higher prices.

Impact of Insurance Company Administrative Costs on Patient Prices

Administrative costs, including claims processing, marketing, and overhead, are a substantial component of the final price paid by patients. These costs are built into the premiums and influence the overall cost of healthcare. While insurance companies strive for efficiency, administrative overhead can be considerable, varying depending on the size and structure of the insurer, the complexity of their plans, and the technological infrastructure they utilize.

These costs are often passed on to consumers, leading to higher premiums and out-of-pocket expenses. For example, a smaller insurer with less advanced technology might have higher administrative costs than a larger insurer with streamlined processes and sophisticated technology.

Methods Used by Commercial Health Plans to Manage Hospital Costs

Managing hospital costs is a critical function for commercial health plans. They employ various strategies to control expenses and maintain profitability.

- Negotiating lower reimbursement rates with hospitals through network structures.

- Implementing utilization management programs to monitor and control the use of expensive services.

- Promoting the use of cost-effective healthcare settings, such as outpatient clinics and ambulatory surgery centers.

- Employing care management programs to coordinate patient care and prevent unnecessary hospitalizations.

- Developing value-based payment models that incentivize providers to deliver high-quality care at lower costs.

- Investing in data analytics and technology to identify and address cost drivers.

Patient Cost-Sharing and Out-of-Pocket Expenses

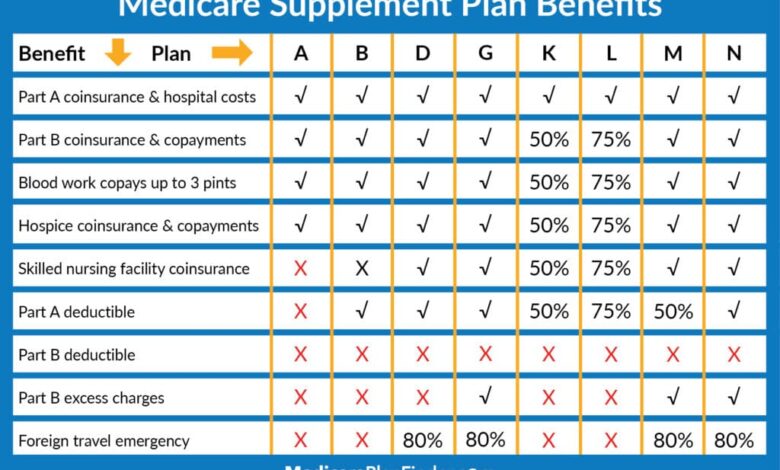

Source: medicaretalk.net

Navigating the complexities of healthcare costs can be daunting, especially when comparing the financial responsibilities under different insurance plans. This section will delve into the nuances of patient cost-sharing for hospital services under commercial and Medicare Advantage plans, highlighting the significant impact these variations have on both individual patients and the overall healthcare system.Patient cost-sharing mechanisms, primarily deductibles, co-pays, and coinsurance, significantly influence patient out-of-pocket expenses and access to care.

Understanding these differences is crucial for making informed healthcare decisions.

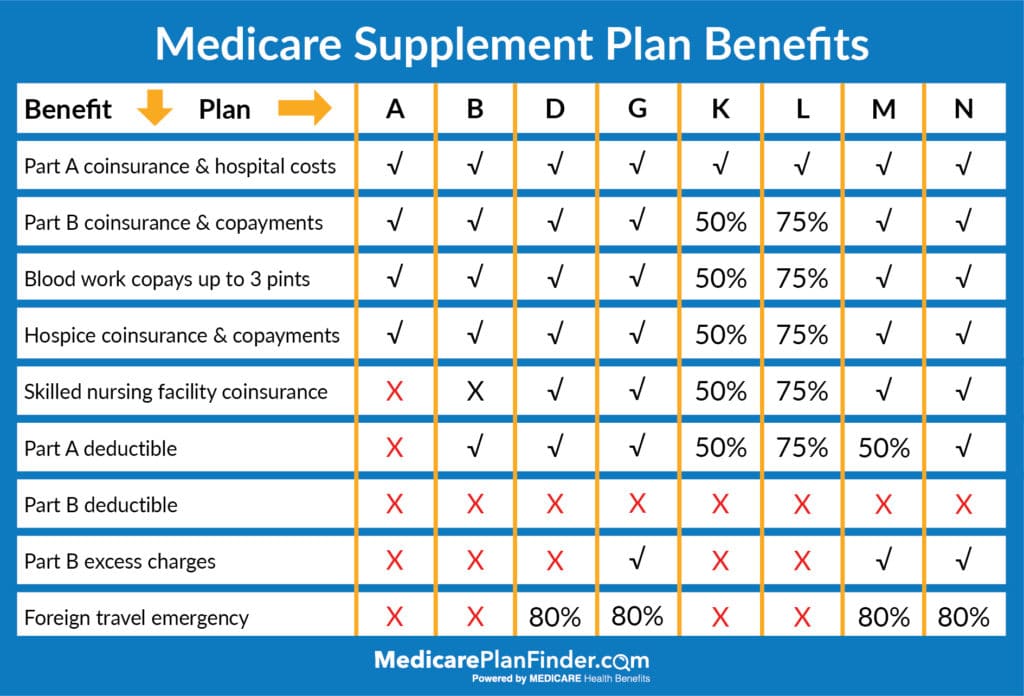

Comparison of Patient Cost-Sharing Mechanisms

Commercial plans and Medicare Advantage plans utilize different cost-sharing structures, leading to variations in patient out-of-pocket expenses. Commercial plans often feature higher premiums but potentially lower cost-sharing once the deductible is met. Medicare Advantage plans, on the other hand, typically have lower premiums but may have higher deductibles, co-pays, and coinsurance, resulting in potentially higher out-of-pocket expenses for some beneficiaries.

The specific cost-sharing amounts vary widely depending on the plan’s design and the specific services received. For instance, a commercial plan might have a $1,000 deductible with a 20% coinsurance rate after the deductible, while a Medicare Advantage plan might have a $5,000 deductible with a higher co-pay for each visit.

Impact of Cost-Sharing Variations on Healthcare Spending

Variations in patient cost-sharing significantly influence healthcare spending. High deductibles and coinsurance can deter patients from seeking necessary care, leading to delayed treatment and potentially worsening health conditions. Conversely, plans with lower cost-sharing may encourage greater utilization of healthcare services, potentially increasing overall spending. This dynamic interplay between cost-sharing and healthcare utilization is a key factor influencing the overall cost of healthcare.

For example, a patient facing a high deductible might delay a needed specialist visit, leading to a more expensive emergency room visit later. Conversely, a patient with low cost-sharing might schedule more preventative care appointments, potentially preventing more serious and costly health problems in the long run.

Impact of High Deductibles on Patient Access to Care

High deductibles can create a significant barrier to accessing necessary healthcare services. Many patients, particularly those with lower incomes, may struggle to meet high deductibles, leading to delayed or forgone care. This can have serious consequences for their health and well-being.

Hospital prices are a constant headache, with commercial health plans and Medicare Advantage plans often leaving patients with hefty bills. Understanding these complex pricing structures is crucial, and innovative solutions are needed. I recently read an interesting article about how google cloud healthcare amy waldron generative AI could help analyze and potentially predict these costs.

This technology might eventually help us navigate the confusing world of healthcare billing and make those hospital prices a little more transparent and manageable. Ultimately, better data analysis could lead to fairer pricing for everyone dealing with the high cost of healthcare.

| Plan Type | Deductible | Copay (Doctor Visit) | Coinsurance |

|---|---|---|---|

| Commercial Plan A | $2,000 | $50 | 20% |

| Commercial Plan B | $5,000 | $75 | 10% |

| Medicare Advantage Plan C | $3,000 | $30 | 30% |

| Medicare Advantage Plan D | $1,000 | $25 | 25% |

This table illustrates the wide range of deductibles and other cost-sharing amounts. A patient with a $5,000 deductible faces a substantial financial hurdle before their insurance begins to cover a significant portion of their medical expenses.

Financial Burden of High Out-of-Pocket Expenses

High out-of-pocket expenses can place a significant financial burden on patients, potentially leading to financial hardship and even bankruptcy. Unexpected medical bills can deplete savings, create debt, and negatively impact a family’s financial stability. This is particularly true for those with chronic conditions requiring ongoing medical care or those facing unexpected medical emergencies. For example, a family facing a $100,000 hospital bill with a high deductible and coinsurance could easily find themselves facing insurmountable debt, even with insurance coverage.

Transparency and Price Disclosure

The current state of hospital pricing transparency is, frankly, a mess. Patients navigating the complex world of healthcare often find themselves facing unexpected and exorbitant bills, leaving them feeling bewildered and frustrated. This lack of clarity impacts both those with commercial insurance and those enrolled in Medicare Advantage plans, although the challenges differ slightly. The opacity surrounding pricing contributes significantly to the overall high cost of healthcare in the United States.The current level of transparency regarding hospital pricing is woefully inadequate for both commercial and Medicare Advantage plans.

While some hospitals publish price lists online, these are often difficult to navigate, incomplete, and lack the context needed for patients to understand the actual cost of their care. Medicare Advantage plans, while theoretically offering some protection from high costs, often have complex formularies and benefit structures that make it challenging to predict out-of-pocket expenses. The lack of standardized pricing and clear communication from hospitals and insurers creates a system where patients are essentially flying blind when it comes to the financial implications of their healthcare decisions.

Methods to Improve Price Transparency

Several strategies could significantly enhance price transparency. One crucial step is the implementation of standardized, easily accessible price lists for all hospital services. These lists should be presented in a clear, user-friendly format, avoiding complex medical jargon. Furthermore, the lists should include not only the hospital’s charges but also the expected payer reimbursement rates for both commercial and Medicare Advantage plans.

This would give patients a more realistic understanding of their likely out-of-pocket costs. Another critical improvement would be the development of online tools that allow patients to estimate their costs based on their specific procedure and insurance coverage. These tools should incorporate data from multiple hospitals and insurance plans to facilitate comparison shopping. Finally, increased government regulation and oversight could ensure hospitals adhere to standardized pricing disclosure requirements.

Influence of Improved Price Transparency on Consumer Choices and Healthcare Costs

Improved price transparency would empower consumers to make more informed healthcare decisions. Armed with clear cost information, patients could compare prices across different hospitals and choose the most affordable option for their needs. This increased consumer awareness could, in turn, incentivize hospitals to compete on price, leading to potential cost reductions. For example, a patient needing a knee replacement could compare the estimated cost at three different hospitals, factoring in their insurance coverage and potential out-of-pocket expenses.

This ability to compare apples to apples would lead to greater cost-consciousness and potentially drive down prices as hospitals compete for patients.

Visual Representation of Lack of Transparency in Hospital Pricing

Imagine a tangled, opaque web. Each strand represents a different hospital, insurance plan, procedure, and billing code. The web is so dense and complex that it’s impossible to see clearly through it. Some strands are brightly colored, representing the advertised prices, but these are often misleading or incomplete. Many strands are dark and hidden, representing the hidden fees, negotiated rates, and out-of-pocket costs that patients only discover after receiving a bill.

The overall image is one of chaos and confusion, highlighting the lack of transparency and the difficulty patients face in understanding the true cost of their healthcare. The tangled nature of the web visually represents the complexity of the system, where patients are left to navigate a labyrinthine maze of billing codes and hidden fees without any clear guidance.

This visual metaphor effectively communicates the overwhelming nature of the problem and the urgent need for improved transparency.

Impact on Healthcare Access and Quality

Source: medicareplanfinder.com

Higher hospital prices, particularly when coupled with limited insurance coverage or high deductibles, create a significant barrier to healthcare access for many individuals with commercial insurance. This impacts not only the ability to receive necessary care but also the timing and quality of that care. The financial burden can lead to delayed or forgone treatment, resulting in worsened health outcomes and increased healthcare costs in the long run.The relationship between hospital pricing and healthcare access is complex.

For example, a patient facing a high deductible might delay seeking treatment for a potentially serious condition until their symptoms become unbearable, leading to more expensive and intensive care later. Similarly, individuals may choose less expensive but potentially lower-quality care options, or avoid care altogether, due to cost concerns.

Access to Care for Commercially Insured Patients

High hospital prices directly impact access to care for patients with commercial insurance plans. The extent of this impact depends on several factors including the patient’s deductible, co-insurance, and out-of-pocket maximum. Patients with high deductibles may be unable to afford even routine care, leading to delayed or forgone treatment. This is particularly true for those with chronic conditions requiring ongoing care.

The financial strain can lead to difficult choices between paying for essential medications, food, or healthcare, ultimately compromising their overall health and well-being. For example, a patient with a $10,000 deductible might delay a necessary surgery until they’ve met their deductible, even if the delay increases the risk of complications.

Quality of Care Comparison: Commercial vs. Medicare Advantage

While both commercially insured patients and those enrolled in Medicare Advantage plans experience the effects of high hospital prices, the comparison of care quality is nuanced. It’s not simply a matter of one being superior to the other. Quality of care depends on various factors including the specific hospital, the physician’s expertise, and the patient’s individual health needs.

However, Medicare Advantage plans, with their negotiated rates and focus on preventative care, may, in some cases, provide more comprehensive coverage and incentivize preventative measures, potentially leading to better long-term health outcomes for some patients. Conversely, commercially insured patients may have access to a wider network of providers, though at potentially higher costs. The quality of care isn’t solely determined by the type of insurance, but rather by the interaction of many factors.

Financial Incentives and Hospital Decisions

Hospitals, like any business, are driven by financial incentives. Higher reimbursement rates from commercial insurers can incentivize hospitals to focus on procedures and services that generate higher revenue, even if those services aren’t necessarily the most cost-effective or beneficial for patients in the long term. This can lead to overutilization of certain services and potentially less emphasis on preventative care.

Soaring hospital prices, squeezing both commercial health plans and Medicare Advantage, are a huge problem. This cost inflation is directly linked to the staffing crisis; as this article highlights, healthcare executives say talent acquisition and labor shortages are a major business risk , impacting services and driving up expenses. Ultimately, these staffing issues only exacerbate the already unsustainable rise in hospital costs for everyone.

For instance, a hospital might prioritize elective surgeries with high reimbursement rates over less profitable but equally important preventative services like screenings. The financial structure can inadvertently influence medical decisions, potentially impacting the overall quality and cost-effectiveness of care.

Consequences of Hospital Cost-Cutting Measures

Hospitals often employ cost-cutting measures to manage expenses in the face of rising costs and shrinking reimbursements. These measures, while aimed at improving financial stability, can have unintended negative consequences for patient care. Examples include reducing staff, limiting access to advanced technologies or specialized services, or increasing patient-to-nurse ratios. These measures can lead to increased wait times, reduced quality of care, and higher rates of medical errors.

For example, a hospital might reduce the number of nurses on a floor, potentially increasing the risk of medication errors or delayed responses to patient needs. The impact on patient safety and experience should be carefully considered when implementing cost-cutting strategies.

Closure

Navigating the complexities of hospital pricing requires understanding the interplay between various stakeholders. While Medicare Advantage plans often negotiate lower rates, the system isn’t without its flaws. The lack of transparency in hospital pricing leaves patients vulnerable, and the high cost of commercial plans can significantly impact access to care. Ultimately, increased price transparency, along with reforms aimed at promoting fairer negotiations and reducing administrative costs, are crucial steps toward a more equitable and affordable healthcare system.

Understanding these dynamics empowers you to make informed decisions about your healthcare and advocate for change.

FAQ Corner: Hospital Prices Higher Commercial Health Plans Medicare Advantage Health Affairs

What are the main differences between commercial and Medicare Advantage plans regarding hospital negotiations?

Medicare Advantage plans often leverage their large enrollee base to negotiate lower rates with hospitals, whereas commercial plans may have less negotiating power, leading to higher prices.

How do high deductibles affect patient access to care?

High deductibles can deter patients from seeking necessary care, especially for non-emergency situations, leading to delayed treatment and potentially worse health outcomes.

Are there any resources available to help patients understand hospital prices?

Several websites and organizations offer tools and resources to help patients compare hospital prices for specific procedures, though comprehensive price transparency remains a challenge.

What role do insurance company profit margins play in hospital pricing?

Insurance company profit margins, especially for commercial plans, can influence the prices they negotiate with hospitals, ultimately impacting what patients pay.