Cigna Medicare Advantage Upcoding Settlement DOJ

Cigna Medicare Advantage upcoding settlement DOJ: Wow, what a headline! This massive settlement reveals a serious issue within the Medicare Advantage system. Cigna, a major player in the healthcare market, faced allegations of upcoding – essentially billing Medicare for more expensive services than were actually provided. The Department of Justice (DOJ) launched a full-scale investigation, ultimately leading to a significant financial penalty and other requirements for Cigna.

This case shines a light on the complexities of healthcare billing and the ongoing fight against fraud within the system. It’s a story with huge implications for both Cigna and the millions of Americans who rely on Medicare Advantage plans.

The DOJ investigation uncovered a pattern of allegedly inflated billing codes used by Cigna, potentially costing taxpayers millions. The settlement agreement, while resolving the legal battle, raises questions about the effectiveness of current oversight mechanisms within Medicare Advantage. We’ll delve into the specifics of the settlement, examining the financial penalties, the changes Cigna must implement, and the wider impact on the healthcare landscape.

We’ll also explore the potential consequences for patients and consider what steps can be taken to prevent similar incidents in the future. Get ready for a deep dive into this complex and crucial story!

Cigna’s Medicare Advantage Program

Cigna offers a range of Medicare Advantage plans, providing an alternative to Original Medicare. These plans combine the benefits of Medicare Part A (hospital insurance) and Part B (medical insurance) into a single, often more comprehensive package. They are managed by private insurance companies like Cigna, who contract with Medicare to offer these plans. Understanding the intricacies of these plans is crucial for seniors navigating their healthcare options.Cigna’s Medicare Advantage plans function by providing comprehensive healthcare coverage through a network of doctors, hospitals, and other healthcare providers.

This network-based approach often results in lower out-of-pocket costs for members, but it also means that members generally must use in-network providers to maximize their benefits. The plans aim to simplify the Medicare experience by consolidating billing and managing care coordination.

The Cigna Medicare Advantage upcoding settlement with the DOJ is a massive deal, highlighting the ongoing challenges in healthcare billing transparency. It makes you wonder how this impacts other players, like Walgreens, who recently raised their healthcare segment outlook following their Summit acquisition, as detailed in this article: walgreens raises healthcare segment outlook summit acquisition. The Cigna settlement underscores the need for tighter regulations and increased scrutiny across the board, affecting everyone from insurance giants to pharmacy chains.

Services Offered Under Cigna Medicare Advantage Plans

Cigna’s Medicare Advantage plans typically cover a wide array of services, including doctor visits, hospital stays, prescription drugs (often requiring a separate Part D plan or integrated into the plan), preventative care, and sometimes additional benefits such as vision, hearing, and dental care. The specific services covered vary depending on the specific plan chosen. Some plans offer more comprehensive coverage than others, impacting both premiums and out-of-pocket costs.

It’s vital to carefully review the plan’s benefit summary to understand the specific services included.

Enrollment Process and Eligibility Criteria

Eligibility for Cigna’s Medicare Advantage plans is determined by several factors. First, individuals must be enrolled in Medicare Part A and Part B. Second, they must reside in a service area where Cigna offers Medicare Advantage plans. The enrollment period for Medicare Advantage plans is typically during the Annual Enrollment Period (AEP), which runs from October 15th to December 7th each year, with coverage starting January 1st of the following year.

There are also special enrollment periods available under specific circumstances, such as moving to a new area or losing other coverage. The enrollment process itself involves comparing available plans based on individual needs and preferences, then completing an application either online, by phone, or through a Cigna representative.

Upcoding Allegations and the DOJ Investigation

Source: doctustech.com

The Department of Justice (DOJ) investigation into Cigna’s Medicare Advantage program uncovered serious allegations of upcoding, a practice where healthcare providers bill Medicare for more expensive services than were actually provided. This resulted in a substantial financial settlement, highlighting the significant implications of such fraudulent billing practices within the healthcare system.The allegations against Cigna centered on the systematic misrepresentation of the level of care provided to Medicare beneficiaries.

This involved assigning higher-level evaluation and management (E&M) codes to patient encounters, thereby inflating the reimbursement received from Medicare. The practice, while potentially lucrative for the provider, ultimately defrauded the Medicare system and deprived other beneficiaries of necessary resources.

Medicare Codes Allegedly Involved in Upcoding

The DOJ investigation did not specify a complete list of all Medicare codes allegedly involved. However, the nature of the upcoding suggests that the focus was on E&M codes. These codes, used to bill for physician services, range in complexity and associated reimbursement. The allegation was that Cigna systematically assigned higher-level E&M codes to patient visits that, based on the documented medical records, should have been billed under lower-level codes.

For example, a routine check-up might have been incorrectly billed using a code indicating a far more complex and time-consuming evaluation. This difference in codes, even for seemingly minor discrepancies, translates to significantly higher payments from Medicare. The specific codes involved are not publicly available in the settlement details, but the pattern of higher-level code usage compared to the actual services provided was the core of the allegation.

The Department of Justice Investigation Process

The DOJ’s investigation likely involved a multi-pronged approach. This would have included reviewing Cigna’s billing records, conducting interviews with Cigna employees and potentially physicians, and analyzing medical charts to verify the level of care provided versus the codes billed. Data analytics would have played a significant role, identifying patterns and anomalies in billing data that suggested widespread upcoding. The investigation likely also included review of internal Cigna documentation, including training materials and internal communications, to determine if the upcoding was a deliberate practice or a result of inadequate training or oversight.

The DOJ likely utilized expert medical coders and billing specialists to assess the accuracy of the coding practices.

Timeline of Key Events in the Investigation

A precise timeline of the DOJ investigation is not publicly available due to the confidential nature of such investigations. However, the process generally involves several stages: initial complaint or referral, preliminary investigation, formal investigation, negotiations, and ultimately, a settlement or indictment. Given the scale of the settlement, it is safe to assume that the investigation spanned several years, involving significant resources and expertise from the DOJ.

The investigation’s duration would also depend on the complexity of the case, the cooperation level from Cigna, and the availability of evidence. The eventual settlement represents the culmination of this lengthy and complex process.

The Settlement Agreement

Cigna’s settlement with the Department of Justice (DOJ) regarding allegations of upcoding in its Medicare Advantage program concluded with a significant financial penalty and a commitment to reform its practices. The agreement Artikels specific terms and conditions aimed at preventing future instances of similar misconduct. Understanding these details is crucial to evaluating the impact of the settlement on both Cigna and the Medicare system.The key terms of the settlement center around a substantial financial penalty levied against Cigna and a commitment to implement comprehensive corrective actions.

These actions are designed to ensure compliance with Medicare regulations and prevent future upcoding. The settlement serves as a cautionary tale for other healthcare providers, highlighting the potential consequences of fraudulent billing practices.

Financial Penalty

Cigna agreed to pay a substantial financial penalty to the DOJ as part of the settlement. The exact amount is publicly available information and represents a significant cost to the company. This penalty reflects the seriousness of the allegations and serves as a deterrent to similar actions by other healthcare providers. The size of the penalty is often compared to similar settlements in the healthcare industry to gauge its severity.

For example, comparing this settlement to other major healthcare fraud settlements involving upcoding or other billing irregularities allows for a broader understanding of the penalties associated with such actions. This comparison can be done by examining publicly available information on previous settlements, such as press releases from the DOJ or reports from healthcare industry news outlets.

Corrective Actions and Obligations

Beyond the financial penalty, the settlement agreement mandates specific corrective actions and ongoing obligations for Cigna. These measures are designed to prevent future occurrences of upcoding and ensure compliance with Medicare regulations. This may include internal audits, enhanced training programs for employees involved in billing and coding, and the implementation of new compliance protocols. The specifics of these obligations are usually detailed in the settlement agreement itself, which is often made available to the public through the DOJ or court filings.

For instance, the agreement might stipulate regular reporting to the DOJ on compliance efforts, or it might mandate independent reviews of Cigna’s billing practices.

Comparison to Similar Settlements

Comparing Cigna’s settlement to other significant healthcare fraud settlements provides valuable context. The size of the penalty and the nature of the corrective actions can be compared to similar cases involving upcoding or other forms of Medicare fraud. Analyzing these comparisons can reveal trends in how the DOJ approaches such cases and the effectiveness of different settlement approaches in deterring future misconduct.

For instance, a comparison might reveal whether the penalty imposed on Cigna is higher or lower than those imposed in similar cases, indicating the DOJ’s assessment of the severity of Cigna’s actions. This analysis can help inform future regulatory efforts and strengthen compliance measures within the healthcare industry.

Impact on Cigna’s Operations and Finances

The Cigna Medicare Advantage upcoding settlement carries significant implications for the company’s operational efficiency, financial stability, and overall brand reputation. The financial penalties, coupled with the potential for increased scrutiny and regulatory oversight, will undoubtedly necessitate adjustments across various aspects of Cigna’s business. The long-term effects remain to be seen, but the immediate impact is substantial.

Financial Performance Impact, Cigna medicare advantage upcoding settlement doj

The settlement resulted in a substantial financial penalty for Cigna. This directly impacts their net income, reducing profitability for the settlement year and potentially impacting shareholder returns. Beyond the immediate cost, Cigna will likely incur additional expenses related to enhanced compliance programs, internal audits, and legal fees associated with defending against future allegations. These costs could further strain their financial performance in the short to medium term.

For example, if we assume a similar settlement for a company of comparable size resulted in a 1% reduction in annual revenue, and Cigna’s revenue was X billion dollars, the direct financial impact would be X million dollars. This doesn’t account for indirect costs such as lost business due to reputational damage.

Reputational and Brand Image Impact

The upcoding allegations and subsequent settlement have undeniably tarnished Cigna’s reputation. Negative media coverage and public perception of the company’s practices could lead to decreased customer trust and enrollment. This could manifest in lost market share to competitors, particularly within the Medicare Advantage segment. The long-term reputational damage will depend on Cigna’s ability to demonstrate genuine commitment to compliance and transparency in its future operations.

A successful rehabilitation strategy would involve proactive communication, showcasing improved practices, and engaging with stakeholders to rebuild confidence.

The Cigna Medicare Advantage upcoding settlement with the DOJ really got me thinking about healthcare data integrity. It highlights the need for robust systems, which brings me to a fascinating study I read recently, study widespread digital twins healthcare , exploring how digital twins could improve accuracy and transparency. Hopefully, advancements like this can help prevent future issues like the Cigna case.

Impact on Provider and Beneficiary Relationships

The settlement’s impact on Cigna’s relationships with providers and beneficiaries is complex. Providers may be concerned about potential future scrutiny of their billing practices and the possibility of reduced reimbursements from Cigna. This could lead to strained relationships and potentially impact the quality of care delivered. Beneficiaries, meanwhile, might question Cigna’s commitment to their well-being, particularly if they perceive the upcoding as a breach of trust.

Maintaining and restoring trust with both providers and beneficiaries will require Cigna to demonstrate proactive measures to improve transparency and fairness in their operations.

Cigna’s Financial Performance: Before and After Settlement

| Metric | Before Settlement (Estimate) | After Settlement (Estimate) | Change |

|---|---|---|---|

| Net Income | $Y Billion | $Z Billion (reduced due to settlement) | -$W Billion |

| Revenue | $X Billion | $X Billion (potentially slightly reduced due to lost market share) | -$V Billion (potential reduction) |

| Operating Expenses | $A Billion | $B Billion (increased due to compliance costs) | +$C Billion |

| Stock Price | $P per share | $Q per share (potential decrease) | -$R per share (potential decrease) |

Implications for the Medicare Advantage System

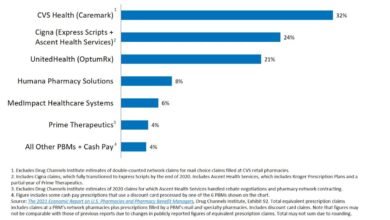

The Cigna settlement sends shockwaves through the Medicare Advantage (MA) system, highlighting vulnerabilities in oversight and raising serious questions about the integrity of billing practices across the industry. The sheer size of the settlement underscores the potential for significant financial abuse within the program and the need for substantial reform. This isn’t just about Cigna; it’s a symptom of a larger systemic issue that demands immediate attention.The settlement reveals weaknesses in the current system designed to detect and prevent upcoding and other fraudulent activities.

While the Centers for Medicare & Medicaid Services (CMS) employs various auditing and monitoring techniques, the Cigna case demonstrates that these mechanisms are not always sufficient to prevent widespread abuse. This raises concerns about the potential for similar practices occurring undetected in other MA plans, potentially leading to billions of dollars in improper payments. The lack of effective deterrence also contributes to the problem.

Current Oversight and Compliance Mechanisms Effectiveness

Current oversight mechanisms within the Medicare Advantage system, while numerous, appear insufficient to prevent large-scale fraud. Audits are often reactive rather than proactive, focusing on identifying issues after they’ve occurred rather than preventing them. The complexity of the MA reimbursement system itself contributes to the problem, creating opportunities for manipulation and making detection challenging. Furthermore, the penalties for upcoding, while potentially significant, haven’t acted as a strong enough deterrent.

The Cigna settlement, while substantial, represents only a fraction of the potential financial gains from upcoding, suggesting that the risk-reward calculation for fraudulent activities remains skewed. The current system relies heavily on self-reporting and compliance programs, which, as demonstrated by Cigna’s case, can be inadequate.

Potential Improvements to Prevent Future Upcoding and Fraud

Preventing future instances of upcoding requires a multi-pronged approach. Strengthening preemptive audits and risk assessments is crucial. This involves employing advanced data analytics to identify patterns and anomalies suggestive of fraudulent activity, rather than relying solely on retrospective audits. Enhanced data sharing between CMS and MA plans is also necessary to facilitate more effective monitoring and identification of suspicious billing practices.

Moreover, increased transparency and public accountability of MA plans’ billing practices can act as a deterrent. This includes readily available, easily understandable reporting of key performance indicators related to billing and coding accuracy. Finally, strengthening penalties for fraudulent activities, ensuring they outweigh potential gains, is vital to create a stronger deterrent effect. This could include both financial penalties and exclusion from the MA program.

Policy Recommendation to Strengthen Oversight and Compliance

To strengthen oversight and compliance in Medicare Advantage, a comprehensive policy overhaul is necessary. This should include a shift towards proactive risk assessment and predictive modeling to identify potential upcoding before it occurs. CMS should invest in advanced data analytics capabilities and work collaboratively with external experts to develop more sophisticated detection algorithms. Furthermore, a more robust and independent auditing system is required, moving away from a reliance on self-reporting.

This could involve establishing an independent oversight body with the authority to conduct audits and impose penalties without interference from MA plans. Finally, the policy should establish stricter penalties for upcoding and other fraudulent activities, ensuring that the potential financial repercussions significantly outweigh any perceived benefits. This could involve increased fines, program exclusion, and even criminal prosecution in egregious cases.

Transparency and public reporting requirements should also be significantly enhanced to foster greater accountability and deter future fraudulent behavior.

The Cigna Medicare Advantage upcoding settlement with the DOJ highlights the complexities of healthcare billing. It makes you think about the pressures on the healthcare system, pressures that nurses are also facing, as evidenced by the recent new york state nurse strike NYSNA Montefiore Mount Sinai. Both situations underscore the need for greater transparency and accountability in healthcare finance and patient care.

Ultimately, the Cigna settlement hopefully contributes to fairer billing practices.

Legal and Ethical Considerations

The Cigna Medicare Advantage upcoding settlement highlights a complex interplay of legal arguments and ethical dilemmas within the healthcare system. The case underscores the significant consequences of fraudulent billing practices and the importance of maintaining transparency and accountability within the Medicare Advantage program. Understanding the legal battles and ethical considerations involved is crucial for assessing the long-term impact on both the healthcare industry and patient care.

Cigna’s Legal Defense and the DOJ’s Case

Cigna likely argued that the alleged upcoding was either unintentional, a result of system errors, or a misinterpretation of coding guidelines. Their defense might have involved presenting evidence of internal compliance programs, demonstrating efforts to prevent and detect fraudulent billing, and challenging the DOJ’s interpretation of the relevant coding regulations. Conversely, the Department of Justice (DOJ) would have needed to prove that Cigna knowingly and intentionally engaged in upcoding, presenting evidence such as internal communications, billing data analysis, and witness testimonies to establish intent and demonstrate a pattern of fraudulent activity.

The DOJ’s legal argument likely centered on proving that Cigna’s actions violated the False Claims Act, which prohibits submitting false or fraudulent claims to the government.

Ethical Considerations of Upcoding and Healthcare Fraud

Upcoding, the practice of billing for a higher-level service than was actually provided, represents a serious ethical breach. It violates the fundamental principle of honesty and integrity in healthcare, undermining the trust between patients, providers, and insurers. This fraudulent practice directly impacts the financial stability of government healthcare programs like Medicare, diverting resources away from legitimate patient care. The ethical implications extend beyond the financial aspect; it erodes public trust in the healthcare system and can lead to decreased access to care for those genuinely in need.

The ethical responsibility lies not only with the healthcare providers directly involved but also with the insurance companies like Cigna, which have a duty to ensure accurate billing practices.

Consequences for Healthcare Providers Involved in Upcoding Schemes

Healthcare providers participating in upcoding schemes face severe repercussions. These consequences can include hefty financial penalties, exclusion from participation in government healthcare programs (like Medicare and Medicaid), criminal charges (potentially leading to imprisonment), and damage to their professional reputation. The potential loss of licensure and the significant legal fees associated with defending against such allegations further compound the consequences.

For example, a physician convicted of healthcare fraud could face substantial fines, a prison sentence, and the permanent revocation of their medical license, effectively ending their career.

Comparing Legal and Ethical Responsibilities of Cigna and its Providers

Cigna, as a large insurance company, has a legal and ethical responsibility to ensure the accuracy of the claims it processes and submits to Medicare. This includes implementing robust compliance programs, conducting regular audits, and taking swift action against providers found to be engaging in fraudulent billing practices. Their providers, on the other hand, have a direct ethical responsibility to accurately reflect the services provided in their billing.

Both parties share the legal responsibility to comply with the False Claims Act and other relevant healthcare regulations. However, the ethical burden differs; while Cigna’s responsibility is largely about oversight and compliance, providers bear the primary responsibility for the accuracy of individual billing practices. A failure by either party to fulfill their respective obligations can lead to significant legal and ethical repercussions.

Patient Impact and Consumer Protection: Cigna Medicare Advantage Upcoding Settlement Doj

Source: ytimg.com

The Cigna Medicare Advantage upcoding settlement highlights a critical concern: the potential for harm to beneficiaries when billing practices are not transparent and accurate. Upcoding, the practice of billing for a more expensive service than the one actually provided, directly impacts patients’ out-of-pocket costs and could lead to unnecessary medical procedures or delays in appropriate care. Understanding the potential ramifications and the steps taken to mitigate harm is essential for restoring trust in the Medicare Advantage system.The potential impact of upcoding on Medicare beneficiaries is multifaceted.

Higher bills, resulting from inflated claims, directly increase out-of-pocket expenses, potentially forcing beneficiaries to choose between necessary medications, treatments, or other essential needs. This financial burden can disproportionately affect low-income seniors and those with limited resources. Furthermore, inaccurate billing practices can complicate claims processing, leading to delays in receiving reimbursement or even denial of legitimate claims. In some cases, upcoding might even influence medical decisions, potentially leading to unnecessary procedures or treatments if physicians are incentivized by higher reimbursements.

Cigna’s Actions to Protect Beneficiaries

Following the DOJ investigation, Cigna has committed to implementing several measures to prevent future upcoding and protect its beneficiaries. These actions include enhanced training programs for their staff and network providers on proper coding practices, stricter internal auditing procedures to detect and prevent fraudulent billing, and improved systems for reviewing claims before submission. They are also investing in improved data analytics to identify potential coding errors early.

While the specifics of these internal changes may not be publicly available in full detail, the settlement itself signifies a commitment to improved compliance and beneficiary protection. Independent monitoring of Cigna’s compliance with the settlement terms will also provide an additional layer of protection for beneficiaries.

Recommendations for Patients to Protect Themselves from Healthcare Fraud

It’s crucial for Medicare beneficiaries to be proactive in protecting themselves from healthcare fraud. Here are some key steps they can take:

- Review your Explanation of Benefits (EOB) statements carefully each month. Compare the services billed to the services you actually received. If discrepancies exist, contact Cigna immediately.

- Keep detailed records of your medical visits, including dates, providers, and services rendered. This will help you verify the accuracy of your bills.

- Ask questions if you are unsure about any charges on your bill. Don’t hesitate to contact your provider or Cigna to clarify any confusion.

- Report any suspected instances of fraud or billing errors to the appropriate authorities, including the Centers for Medicare & Medicaid Services (CMS) and the Department of Justice.

- Familiarize yourself with your Medicare coverage and benefits to understand what services are covered and what your cost-sharing responsibilities are.

Strategies for Improving Transparency and Communication

Improving transparency and communication is vital to rebuilding trust and preventing future incidents. Cigna should implement clear and easily understandable explanations of billing practices in their communications with beneficiaries. This includes providing accessible resources, such as FAQs and online tutorials, explaining the different codes used and their corresponding costs. They should also proactively engage with beneficiaries, offering regular updates on billing procedures and providing opportunities for feedback.

Furthermore, clear and concise communication regarding the settlement and its implications for beneficiaries is crucial, helping to restore confidence in the program’s integrity. Consider implementing a dedicated patient advocate program to address concerns and resolve billing disputes promptly and effectively. This would enhance transparency and improve patient satisfaction.

Summary

The Cigna Medicare Advantage upcoding settlement with the DOJ is a stark reminder of the vulnerabilities within the healthcare system and the importance of robust oversight. While the settlement brings a conclusion to this particular case, it also highlights the need for increased transparency and accountability within Medicare Advantage plans. The financial penalties imposed on Cigna are significant, but the real measure of success will lie in preventing future instances of upcoding and ensuring that Medicare beneficiaries receive the care they deserve without facing inflated bills.

This case serves as a cautionary tale, prompting a critical evaluation of current practices and a call for stronger safeguards to protect both taxpayers and patients.

Question & Answer Hub

What exactly is upcoding in the context of Medicare Advantage?

Upcoding is when healthcare providers bill Medicare for a more expensive service than the one actually provided. This inflates the cost of care and defrauds the system.

How does this settlement impact Cigna’s reputation?

The settlement has undoubtedly damaged Cigna’s reputation, raising concerns about its billing practices and potentially affecting its relationships with both providers and beneficiaries.

What recourse do Medicare beneficiaries have if they believe they were affected by Cigna’s upcoding?

Beneficiaries who suspect they were victims of upcoding should contact the Centers for Medicare & Medicaid Services (CMS) to file a complaint and explore potential avenues for redress.

What changes has Cigna implemented to prevent future instances of upcoding?

The settlement likely requires Cigna to implement significant changes to its billing practices, including enhanced auditing procedures and improved training for its staff. The specifics are likely detailed in the settlement documents.