UnityPoint Health & Presbyterian Healthcare Merger

Unitypoint health presbyterian healthcare services cross market merger – UnityPoint Health and Presbyterian Healthcare Services’ cross-market merger is shaking up the healthcare landscape. This massive undertaking promises significant changes for patients, providers, and the overall economic health of the region. The merger brings together two large healthcare systems, each with its own established footprint and patient base, creating a new behemoth in the industry. This post will explore the intricacies of this merger, examining its financial implications, operational integration, impact on patient care, and regulatory hurdles.

We’ll delve into a detailed market analysis, comparing the geographic reach and services of both organizations before the merger. We’ll also investigate the projected financial benefits, including cost savings and revenue increases, while acknowledging potential risks. The operational integration process will be examined, considering the complexities of merging IT systems, staff, and organizational cultures. Finally, we’ll discuss the potential impact on patient access, cost, and quality of care, as well as the regulatory and legal considerations involved in such a large-scale merger.

Market Analysis of UnityPoint Health and Presbyterian Healthcare Services

The merger of UnityPoint Health and Presbyterian Healthcare Services represents a significant shift in the healthcare landscape of the regions they serve. Understanding the pre-merger market dynamics is crucial to assessing the potential impact of this consolidation. This analysis will examine the geographic reach, overlapping services, and demographics served by both systems, both individually and as a combined entity.

Geographic Market Share Before the Merger

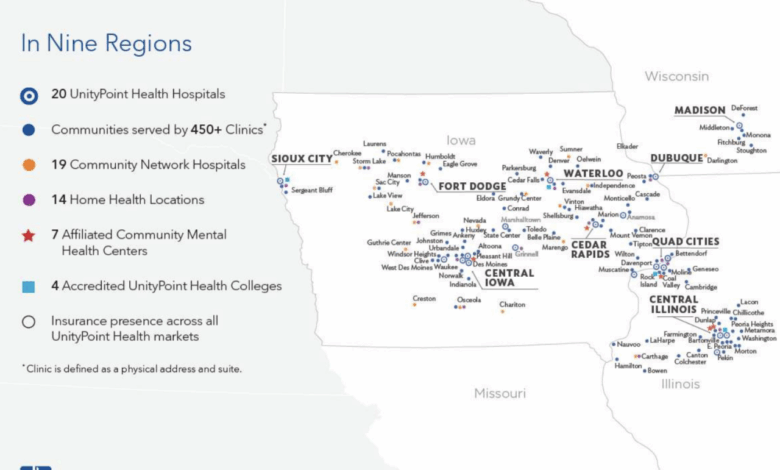

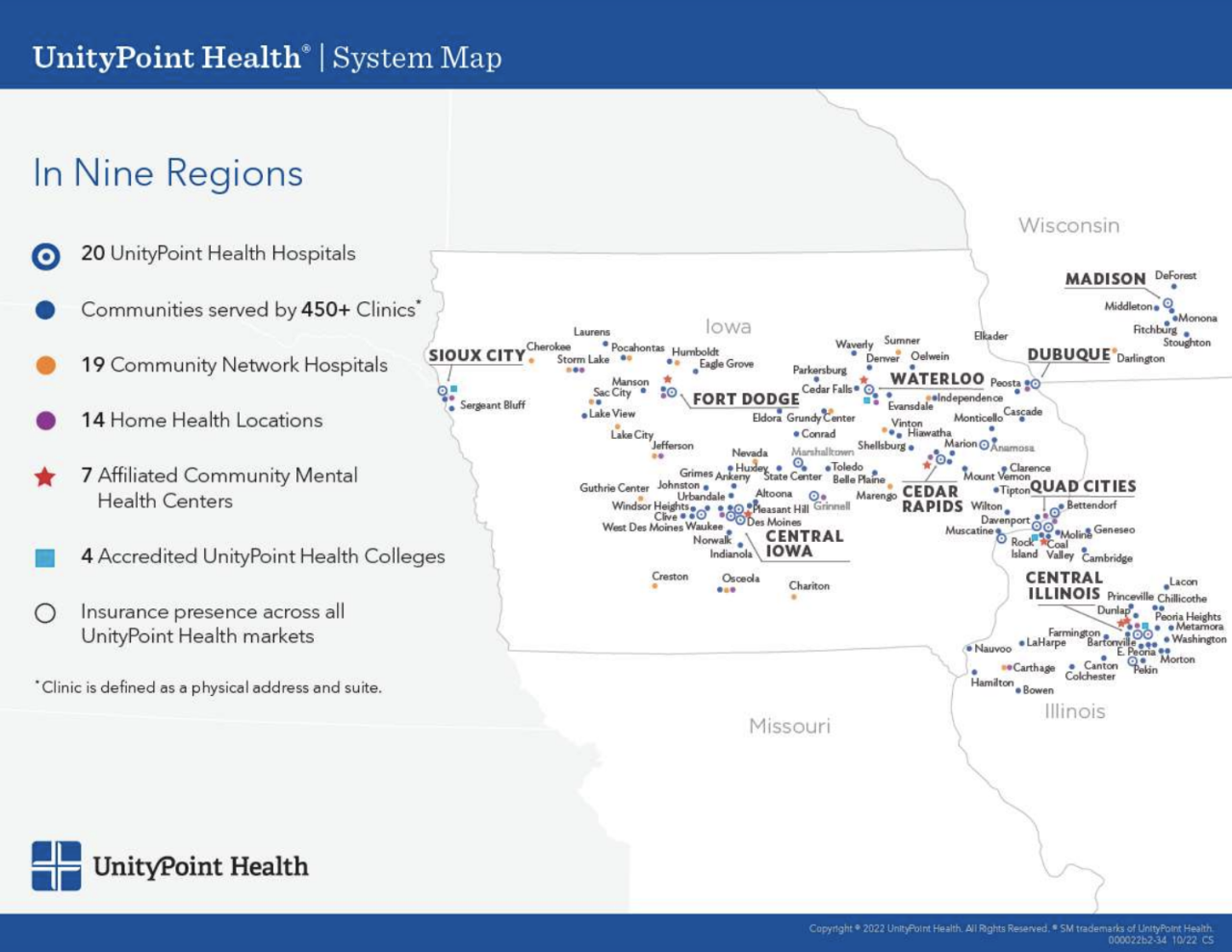

Prior to the merger, UnityPoint Health and Presbyterian Healthcare Services held distinct, though sometimes overlapping, geographic market shares. UnityPoint Health, with a larger footprint, operated across Iowa, Illinois, and Wisconsin, serving a diverse population across urban and rural areas. Presbyterian Healthcare Services, conversely, primarily focused on New Mexico, concentrating its services in Albuquerque and surrounding areas. Precise market share figures require detailed market research reports specific to each region, but it’s clear that before the merger, their geographic markets were largely non-competitive, with minimal overlap.

This lack of direct competition prior to the merger was a significant factor enabling the merger itself.

Overlapping Service Areas Before the Merger

While their primary service areas were geographically distinct, some limited overlap might have existed in specialized services. For example, both systems likely offered telehealth services, potentially reaching patients beyond their immediate geographic reach and creating a small area of indirect competition. Similarly, any national referral networks or specialized centers of excellence could have resulted in limited competition for patients seeking highly specialized care.

However, the degree of this overlap was likely minimal compared to the overall size of their respective service areas.

Demographics Served by Each System

UnityPoint Health served a broad demographic range across its multi-state footprint. This included diverse populations in terms of age, ethnicity, socioeconomic status, and rural versus urban location. Presbyterian Healthcare Services, while serving a more geographically concentrated population in New Mexico, also served a diverse demographic, including significant Hispanic and Native American populations. Post-merger, the combined entity serves an even broader demographic spread across several states, making it a large and diverse healthcare provider.

Key Services Offered by Each System Before the Merger

The following table summarizes the key services offered by each system before the merger:

| Service Type | UnityPoint Offering | Presbyterian Offering | Overlap/Differentiation |

|---|---|---|---|

| Primary Care | Extensive network of clinics and physician practices | Significant network within New Mexico | Overlap in core service, differing geographic reach |

| Hospital Care | Multiple hospitals across Iowa, Illinois, and Wisconsin, varying levels of specialization | Hospitals in Albuquerque and surrounding areas | Overlap in core service, differing geographic reach and hospital specialization |

| Specialty Care (e.g., Cardiology, Oncology) | Wide range of specialties across its hospitals and clinics | Significant offerings in key specialties | Overlap in many specialties, potential for differentiation in specific sub-specialties |

| Home Health & Hospice | Services available in most service areas | Services available in New Mexico | Overlap in core service, differing geographic reach |

Financial Implications of the Merger

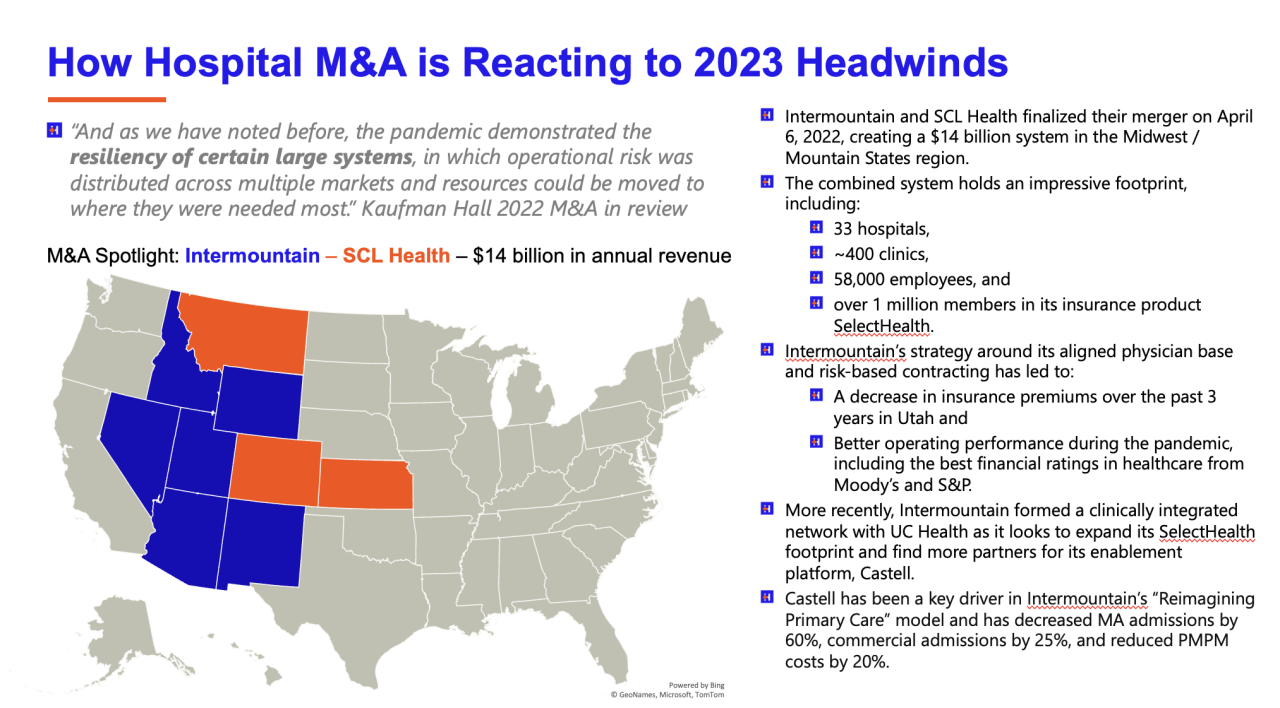

The merger of UnityPoint Health and Presbyterian Healthcare Services presents a complex interplay of financial opportunities and challenges. Successfully navigating this landscape requires a thorough understanding of potential cost savings, revenue impacts, and the overall return on investment (ROI). This analysis will explore these key aspects, providing a hypothetical framework for evaluating the financial viability of the combined entity.

Cost Savings from Economies of Scale

The merger offers significant potential for cost reduction through economies of scale. By consolidating operations, the combined entity can negotiate better prices with suppliers for medical equipment, pharmaceuticals, and other goods and services. Administrative functions can also be streamlined, reducing overhead costs. For example, consolidating IT infrastructure, merging billing departments, and reducing redundant administrative staff could lead to substantial savings.

The UnityPoint Health and Presbyterian Healthcare Services merger highlights the ongoing reshaping of the healthcare landscape. It makes you wonder about the impact on staffing, especially considering the intense pressure healthcare workers face, as evidenced by the recent new york state nurse strike NYSNA Montefiore Mount Sinai. These kinds of labor disputes underscore the need for sustainable solutions in healthcare mergers, ensuring fair compensation and safe working conditions for everyone.

A conservative estimate suggests that a 5-10% reduction in operating costs is achievable within the first three years post-merger, translating to millions of dollars in annual savings. This assumes effective integration of systems and personnel. Further savings might be realized through optimized supply chain management and the elimination of duplicate services.

Impact on Revenue Streams

The merger’s impact on revenue streams is multifaceted. Initially, there might be a slight dip due to the integration process and potential disruption to existing patient flows. However, long-term benefits are expected. Increased market share resulting from the combined network will attract more patients and providers. This expanded reach can also lead to greater negotiating power with insurance companies, potentially securing more favorable reimbursement rates.

Furthermore, the combined entity can leverage its expanded expertise and resources to develop new revenue streams through specialized services or strategic partnerships. For instance, a joint venture focusing on telehealth or a specialized medical center could generate significant new revenue. The successful integration of electronic health records and a unified patient portal could improve patient access and satisfaction, leading to enhanced revenue generation.

Projected Financial Benefits and Risks

The projected financial benefits of the merger include substantial cost savings, increased revenue, and improved market position. A successful integration could result in a significant increase in profitability within three to five years. However, several risks exist. These include the challenges of integrating diverse organizational cultures, IT systems, and operational procedures. Potential disruptions during the integration process could negatively impact revenue and patient satisfaction.

Furthermore, regulatory hurdles and antitrust concerns could delay or impede the merger’s completion. Finally, unexpected economic downturns or changes in healthcare policy could also affect the financial performance of the combined entity.

Hypothetical Financial Model: Demonstrating Potential ROI

Let’s assume a hypothetical scenario. UnityPoint Health has annual revenues of $5 billion and Presbyterian Healthcare Services has annual revenues of $3 billion. Post-merger, a conservative estimate suggests a 7% increase in revenue within five years due to market expansion and improved efficiency. Simultaneously, cost savings of 8% are achieved through economies of scale within three years.

The UnityPoint Health and Presbyterian Healthcare Services merger highlights the ongoing consolidation in the healthcare industry. It makes you wonder about the long-term effects on competition, especially when you consider news like the nextgen exploring sale reuters story; it seems like everyone’s looking for a partner or buyer these days. This trend, in turn, will likely influence future mergers and acquisitions within UnityPoint Health’s market and beyond.

Annual Revenue (Year 0): $8 Billion

Revenue Growth (Years 1-5): 7% annually

Cost Savings (Years 1-3): 8% annually

Investment Costs (Merger, Integration): $500 Million (spread over 3 years)

Discount Rate: 10%The UnityPoint Health and Presbyterian Healthcare Services merger raises questions about the future of healthcare consolidation. It makes you wonder about the impact on staffing and patient care, especially considering the recent labor disputes, like the one highlighted in this article about the new york state nurse strike montefiore richmond university deals. Ultimately, the success of the UnityPoint/Presbyterian merger hinges on addressing these very real concerns about workforce stability and patient access.

This simplified model, ignoring many complexities, suggests a positive ROI within five years. The exact figures would depend on numerous factors, including the specifics of the integration plan, market conditions, and regulatory approvals. A detailed financial model, incorporating more variables and forecasting methodologies, would be required for a precise assessment. This hypothetical model serves as a basic illustration, highlighting the potential for significant financial returns.

Operational Integration and Synergies

Source: hospitalogy.com

Merging two large healthcare systems like UnityPoint Health and Presbyterian Healthcare Services presents a significant operational challenge, but also a wealth of opportunities for synergy. Successful integration will hinge on meticulous planning and execution across IT, personnel, and facilities. The ultimate goal is to create a more efficient, cost-effective, and patient-centered healthcare organization.The integration process will require a phased approach, starting with a detailed assessment of both organizations’ current operational structures and identifying areas of overlap and potential conflict.

This will inform the development of a comprehensive integration plan, encompassing timelines, resource allocation, and key performance indicators (KPIs). Transparency and open communication with staff at all levels will be crucial for minimizing disruption and fostering buy-in.

IT System Integration

The unification of IT systems is paramount. This will involve migrating disparate electronic health records (EHRs), patient portals, and administrative systems onto a common platform. This process will likely involve significant upfront investment in new software, hardware, and staff training. Challenges could include data migration issues, system compatibility problems, and the need to address potential security vulnerabilities.

A robust project management plan, involving experienced IT professionals from both organizations, is essential for minimizing disruption to patient care during the transition. Successful integration could lead to improved data interoperability, streamlined administrative processes, and reduced IT costs in the long run. For example, a unified system could facilitate better communication between clinicians, leading to improved patient outcomes.

Staff and Resource Consolidation

Combining the workforces of two large healthcare systems requires careful consideration. This will involve analyzing staffing levels across various departments, identifying potential redundancies, and developing a plan for integrating staff. Strategies could include offering early retirement packages, re-training programs, and internal transfers. A transparent and fair process for evaluating and placing staff will be critical for maintaining morale and avoiding potential legal challenges.

The goal is to create a leaner, more efficient workforce while retaining valuable expertise. For instance, combining purchasing power for medical supplies could lead to significant cost savings. Conversely, potential challenges could arise from differing compensation structures, benefits packages, and union contracts between the two organizations.

Facility Consolidation and Resource Optimization

The merger will likely involve consolidating facilities to optimize resource utilization. This could involve closing underutilized facilities, renovating existing ones, or building new ones in strategic locations. Decisions regarding facility consolidation will need to be made based on factors such as patient demographics, geographic accessibility, and cost-effectiveness. For example, consolidating certain specialized services at a single, larger facility could lead to improved efficiency and quality of care.

However, closing facilities could lead to job losses and negatively impact access to care in certain communities.

Organizational Culture and Management Style Integration

Integrating different organizational cultures and management styles is often the most challenging aspect of a merger. UnityPoint Health and Presbyterian Healthcare Services may have differing approaches to decision-making, communication, and employee engagement. To mitigate potential conflicts, it is essential to establish a clear integration plan that addresses cultural differences and establishes a unified organizational culture. This could involve workshops, team-building activities, and cross-organizational communication initiatives.

A well-defined leadership structure and a clear communication strategy will be vital for ensuring a smooth transition and maintaining employee morale. A failure to address these issues could lead to decreased employee satisfaction, increased turnover, and ultimately, hinder the success of the merger.

Potential Synergies and Conflicts

The integration process presents both significant opportunities for synergy and potential areas of conflict.

- Synergies: Increased market share, improved bargaining power with suppliers, economies of scale in purchasing and administration, enhanced clinical expertise through staff collaboration, expanded service offerings, improved patient access.

- Conflicts: Differing organizational cultures and management styles, integration of IT systems and medical records, staffing redundancies and potential job losses, facility consolidation and its impact on access to care, potential legal challenges related to employee rights and compensation.

Impact on Patients and Healthcare Access

Source: ytimg.com

The merger of UnityPoint Health and Presbyterian Healthcare Services presents a complex picture regarding patient access, costs, and quality of care. While the potential for improved efficiency and expanded services exists, careful planning and transparent communication are crucial to ensure a positive outcome for patients. The following sections detail the anticipated effects across these key areas.

Patient Access to Care

The combined network of UnityPoint Health and Presbyterian Healthcare Services will likely expand access to care in certain areas, particularly in underserved communities where either system previously had a limited presence. For example, if Presbyterian’s strength lies in rural healthcare delivery while UnityPoint excels in urban specialized care, the merger could create a more comprehensive network reaching more patients in both settings.

However, it’s equally important to acknowledge potential challenges. Consolidation could lead to the closure of less profitable facilities or services, potentially reducing access for some patients if not carefully managed. This necessitates a robust transition plan that prioritizes patient needs and minimizes disruptions. The success of this aspect hinges on strategic planning and a commitment to maintaining or expanding access across the entire service area.

Changes in Healthcare Costs for Patients

Predicting the precise impact on patient costs is challenging. The merger could lead to cost savings through economies of scale and streamlined operations, potentially resulting in lower prices for some services. However, there’s also a risk of increased prices if the merged entity gains significant market power. For instance, a reduction in competition could allow for higher charges for procedures or services.

Furthermore, changes in insurance networks are possible, potentially affecting patient out-of-pocket expenses. Transparency in pricing and clear communication about insurance coverage will be essential to manage patient concerns and mitigate any potential negative impacts. Successful cost management strategies from similar mergers, like those seen in other healthcare systems, could serve as valuable models for minimizing price increases.

Impact on Quality of Care

The impact on quality of care is multifaceted. The merger could lead to improvements in quality through access to advanced technologies, specialized expertise, and improved coordination of care. For example, the sharing of best practices and clinical protocols between the two systems could enhance the overall standard of care. Conversely, the integration process itself could create temporary disruptions, potentially affecting patient experience and care coordination during the transition.

Maintaining or improving quality will require careful attention to staffing, training, and the seamless integration of electronic health records and other systems. Regular monitoring of patient satisfaction scores and quality metrics will be essential to assess the impact of the merger and address any arising concerns. A commitment to quality improvement initiatives, including data-driven performance tracking, will be crucial for sustained success.

Communication Strategy for Patients

A comprehensive communication strategy is vital to keep patients informed throughout the merger process. This should involve multiple channels, including websites, social media, email updates, town hall meetings, and direct mail communications. The messaging should be clear, concise, and easily understandable, avoiding technical jargon. The strategy must address patient concerns proactively, providing clear answers to frequently asked questions about access to care, insurance coverage, and changes in healthcare providers.

Regular updates on the integration process and its impact on patients should be provided. Furthermore, a dedicated helpline or online portal should be established to address individual patient questions and concerns. Examples of successful communication strategies from similar healthcare mergers should be studied and adapted to this specific situation. Open and honest communication will be essential to build and maintain trust with patients.

Regulatory and Legal Considerations

Source: workweek.com

The merger between UnityPoint Health and Presbyterian Healthcare Services presents significant regulatory and legal hurdles, primarily concerning antitrust concerns and the acquisition of necessary approvals. Navigating this complex landscape requires a thorough understanding of the legal framework governing healthcare mergers and a proactive approach to compliance. Failure to address these considerations could lead to lengthy delays, substantial financial penalties, or even the complete collapse of the merger.The process of obtaining the necessary approvals involves multiple federal and state agencies, each with its own set of criteria and timelines.

The sheer complexity of the legal framework necessitates the engagement of specialized legal counsel experienced in healthcare mergers and acquisitions.

Antitrust Review

The primary regulatory concern revolves around antitrust laws, designed to prevent monopolies and promote competition. The Department of Justice (DOJ) and the Federal Trade Commission (FTC) will scrutinize the merger to determine its potential impact on competition within the relevant geographic markets. Key factors considered include market concentration, the presence of alternative providers, and the potential for increased prices or reduced quality of care.

The agencies may request extensive data on market share, pricing, and service offerings from both UnityPoint Health and Presbyterian Healthcare Services. If the merger is deemed anti-competitive, the DOJ or FTC could seek to block it, potentially through litigation. A similar scenario played out with the attempted merger of Advocate Health Care and NorthShore University HealthSystem, which was ultimately abandoned due to antitrust concerns.

State Regulatory Approvals

Beyond the federal level, state regulatory bodies in the relevant jurisdictions will also need to approve the merger. These approvals often involve demonstrating compliance with state-specific regulations concerning healthcare providers, certificate of need requirements, and potentially public health planning mandates. The timeline for state-level approvals can vary significantly depending on the complexity of the merger and the specific regulations in each state.

For example, some states might require extensive public hearings and community impact assessments. Delays at the state level could significantly impact the overall merger timeline.

Healthcare Merger Legal Framework

The legal framework governing healthcare mergers and acquisitions is multifaceted, drawing from federal antitrust laws like the Clayton Act and Sherman Act, as well as state-specific regulations. These laws aim to balance the potential benefits of consolidation (such as increased efficiency and economies of scale) with the need to protect consumers from anti-competitive practices. Key legal considerations include the definition of the relevant geographic market, the analysis of market power, and the assessment of potential anti-competitive effects, such as price increases or reduced service quality.

Legal counsel will play a crucial role in ensuring compliance with all applicable laws and regulations throughout the merger process.

Regulatory Milestones and Anticipated Outcomes

A realistic timeline for regulatory approvals would likely extend over several months, if not years. Key milestones include:

- Filing of Pre-merger Notification: This initial step involves submitting the necessary documentation to the DOJ and FTC, outlining the proposed merger and providing relevant market data.

- Second Request for Information: If the agencies require additional information, a “second request” will be issued, demanding extensive documentation and potentially delaying the process considerably.

- State Regulatory Reviews: Concurrent with the federal review, state-level approvals will be sought, potentially leading to staggered timelines and varying requirements across jurisdictions.

- Agency Decision: The DOJ and FTC will make a final determination on whether to approve or block the merger, potentially subject to conditions.

- Potential Litigation: If the agencies decide to block the merger, legal challenges could ensue, further prolonging the process.

The anticipated outcome will depend on the agencies’ assessment of the merger’s competitive impact and the effectiveness of any proposed remedies. A successful outcome would involve securing all necessary approvals, potentially with conditions such as divestitures or operational changes to mitigate antitrust concerns. Conversely, an unsuccessful outcome could lead to the termination of the merger agreement.

Long-Term Strategic Goals

The merger of UnityPoint Health and Presbyterian Healthcare Services represents a significant step towards creating a leading integrated healthcare system in the region. This unification aims to establish a robust and sustainable organization capable of navigating the evolving healthcare landscape and delivering exceptional patient care for years to come. The long-term strategic goals focus on enhancing quality, expanding access, and fostering innovation to ensure the combined entity thrives in a competitive market.The merger positions the new organization for future growth and sustainability through several key initiatives.

By leveraging economies of scale, the combined entity will be better positioned to negotiate favorable contracts with insurance providers, invest in advanced technologies, and attract and retain top medical talent. This strategic alignment will lead to improved operational efficiency and financial stability, enabling the organization to reinvest profits back into patient care and infrastructure improvements.

Market Positioning and Competitive Advantage, Unitypoint health presbyterian healthcare services cross market merger

The combined strengths of UnityPoint Health and Presbyterian Healthcare Services create a powerful force in the regional healthcare market. The merger significantly expands the geographic reach and service offerings, allowing the new organization to compete effectively against larger national healthcare systems. This enhanced scale provides a distinct advantage in attracting and retaining patients, physicians, and other healthcare professionals. The integrated network will offer a broader spectrum of specialized services, advanced technologies, and research opportunities, attracting patients seeking comprehensive and high-quality care.

For example, the combined research capabilities could lead to breakthroughs in treatment and improved patient outcomes, further solidifying the organization’s competitive position.

Enhanced Quality and Patient Care

A primary long-term strategic goal is to enhance the quality and accessibility of patient care. The merger facilitates the sharing of best practices, resources, and expertise between the two organizations. This collaboration leads to the standardization of care protocols, the implementation of evidence-based practices, and the adoption of advanced technologies, all contributing to improved patient outcomes and satisfaction. The combined organization will focus on enhancing patient experience through improved communication, streamlined processes, and a more patient-centered approach to care delivery.

For instance, implementing a unified electronic health record system across all facilities will enhance care coordination and reduce medical errors.

Financial Sustainability and Growth

The merger is expected to yield significant financial benefits in the long term. Economies of scale will reduce operational costs, improve negotiating power with suppliers, and enhance revenue generation through increased patient volume and market share. The combined organization will be better positioned to invest in capital improvements, research and development, and employee training and development. This sustained financial strength will ensure the long-term sustainability and growth of the organization, allowing it to continue providing high-quality care to the community.

A successful example of a similar merger resulting in increased financial stability can be found in the case of [Insert example of a successful healthcare merger and its financial outcomes, with verifiable sources].

Mission and Vision Alignment

The merger directly supports the overall mission and vision of creating a leading healthcare system dedicated to providing high-quality, patient-centered care. The combined organization will leverage the strengths and expertise of both UnityPoint Health and Presbyterian Healthcare Services to achieve this shared vision. The unified culture will emphasize collaboration, innovation, and a commitment to excellence in patient care.

The merged entity will continue to invest in community outreach programs, supporting the health and well-being of the populations it serves. This commitment to the community strengthens the organization’s reputation and solidifies its position as a trusted healthcare provider.

Last Word

The UnityPoint Health and Presbyterian Healthcare Services merger is a complex undertaking with far-reaching consequences. While promising increased efficiency and potentially improved patient care through economies of scale and expanded service offerings, the success of this merger hinges on effective integration, careful management of potential conflicts, and transparent communication with patients and stakeholders. The long-term impact will depend on the ability of the combined entity to navigate regulatory hurdles, maintain quality of care, and adapt to the evolving healthcare landscape.

Only time will tell if this bold move truly benefits the communities served.

Clarifying Questions: Unitypoint Health Presbyterian Healthcare Services Cross Market Merger

What are the potential job losses resulting from the merger?

While some redundancies are expected due to overlapping roles, the official statements emphasize a focus on retaining staff and minimizing job losses through redeployment and attrition.

Will my insurance coverage change after the merger?

It’s best to contact your insurance provider directly to understand any potential changes to your coverage as a result of the merger. The merged entity may negotiate new contracts, but your current coverage should remain unaffected in the short term.

How will the merger affect access to specialists?

The merger aims to improve access to specialists by consolidating resources and potentially expanding the network of specialists available to patients. However, the specific impact will vary depending on location and specialty.