Ambulance Surprise Billing Committee Independent Dispute Resolution

Ambulance surprise billing committee independent dispute resolution: Imagine getting a massive bill for an emergency ambulance ride you never anticipated. That’s the harsh reality for many Americans. This post dives into the complexities of surprise medical bills from ambulance services, exploring the role of committees, independent dispute resolution (IDR) processes, and what protections you might have. We’ll unpack the process, from understanding the initial shock of the bill to navigating the appeals process and exploring your rights as a patient.

Get ready for a deep dive into this often-overlooked aspect of healthcare in the US.

We’ll cover the mechanics of how these surprise bills arise, the various players involved (patients, providers, and insurers), and common scenarios leading to unexpected charges. We’ll then delve into the crucial role of the ambulance surprise billing committee and its IDR processes. This includes examining the committee’s structure, decision-making processes, and the steps involved in dispute resolution. We’ll analyze the effectiveness of IDR, comparing it to other methods, and discuss potential improvements for greater fairness and efficiency.

Finally, we’ll cover patient rights, legal protections, and resources available to help navigate these challenging situations. The goal is to equip you with the knowledge to protect yourself and understand your options.

Understanding Ambulance Surprise Billing

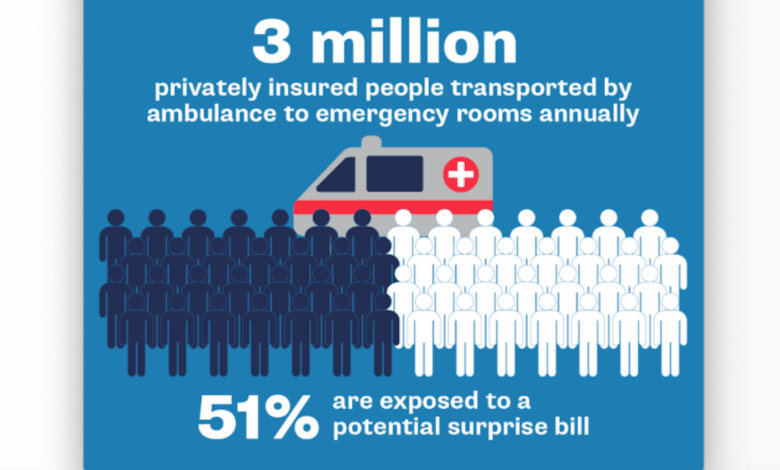

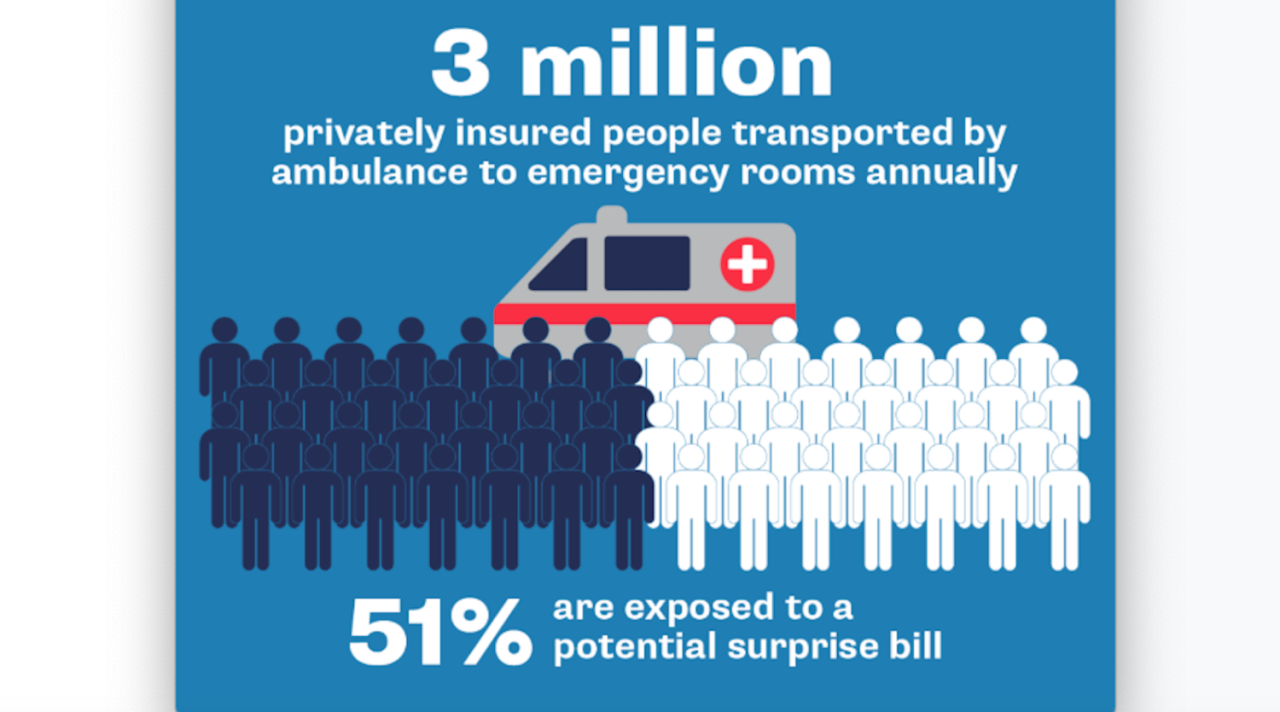

Ambulance surprise billing is a significant problem in the US healthcare system, leaving patients with unexpected and often substantial medical bills. This happens when the cost of an ambulance ride far exceeds what their insurance covers, resulting in a large out-of-pocket expense. Understanding the mechanics behind this issue is crucial to advocating for fairer practices.Ambulance surprise billing occurs due to a complex interplay between patients, ambulance providers (both private and public), and insurance companies.

The patient, needing emergency medical transport, is often focused solely on receiving immediate care and is unaware of the billing complexities involved. Ambulance providers, facing reimbursement rates that are often insufficient to cover their operating costs, frequently bill patients for the difference. Insurance companies, meanwhile, have contracts with various providers, but these contracts may not cover all ambulance services or may only reimburse a portion of the actual cost.

Stakeholders Involved in Ambulance Surprise Billing

The three primary stakeholders are inextricably linked in the process of ambulance surprise billing. Patients are the ones ultimately responsible for paying the balance after insurance reimbursement. Ambulance providers, including private companies and sometimes even public entities, set their prices and bill patients directly or through billing agencies. Insurance companies negotiate rates with providers, but these rates are not always sufficient to cover the full cost of the service, leading to the surprise bills.

The Ambulance Surprise Billing Committee’s independent dispute resolution process is crucial for patient protection, but navigating the complexities can be daunting. It’s interesting to consider this in light of Walgreens’ expansion into healthcare, as seen in their raised outlook following the Summit acquisition; walgreens raises healthcare segment outlook summit acquisition. This growth highlights the increasing need for transparent and efficient billing practices, making the committee’s work even more vital in ensuring fair pricing and avoiding unexpected medical costs.

The lack of transparency and consistent negotiation between providers and insurers creates a situation where the patient is caught in the middle.

Causes of Surprise Ambulance Bills

Several factors contribute to the prevalence of surprise ambulance bills. One major cause is the lack of standardized pricing for ambulance services. Costs can vary wildly depending on the location, the type of service provided (basic life support versus advanced life support), and the distance traveled. Another crucial factor is the imbalance between reimbursement rates offered by insurance companies and the actual costs incurred by ambulance providers.

Insurance companies often negotiate lower rates, and if the provider is out-of-network, the patient is often left with the significant balance. Finally, the complexity of the billing process itself can contribute to confusion and unexpected charges. Patients may not fully understand what services were rendered or the breakdown of charges.

Examples of Surprise Billing Situations

Consider a scenario where a person experiences a heart attack and calls 911. The ambulance transports them to the nearest hospital, which is in-network with their insurance. However, the ambulance provider itself might be out-of-network, leading to a substantial bill that their insurance doesn’t fully cover. Another common example involves a situation where an individual is injured in a car accident.

Even if the hospital and the emergency medical services (EMS) personnel are in-network, the billing can still be confusing and potentially lead to a surprise bill, especially if the patient receives advanced life support services, which are often more expensive. In both cases, the patient is left facing a potentially crippling financial burden due to a lack of price transparency and inconsistent network participation amongst ambulance providers.

The Role of the Committee

Source: slideplayer.com

Independent dispute resolution committees for ambulance surprise billing play a crucial role in ensuring fairness and transparency within the healthcare system. Their existence helps mitigate the financial burden on patients unexpectedly hit with high out-of-pocket costs for emergency medical transport. These committees act as a neutral third party, reviewing disputes and providing binding decisions that aim to resolve the conflict between the patient, the ambulance provider, and potentially the insurance company.The committee’s function is to objectively assess the circumstances surrounding a surprise ambulance bill, considering factors such as the necessity of the transport, the appropriateness of the charges, and the patient’s insurance coverage.

Their decisions are intended to be both equitable and legally sound, providing a more efficient and less adversarial method of resolving these complex billing issues than traditional litigation.

Committee Composition and Responsibilities, Ambulance surprise billing committee independent dispute resolution

Ambulance surprise billing committees typically consist of individuals with expertise in healthcare, insurance, and dispute resolution. Members might include representatives from patient advocacy groups, healthcare providers, insurance companies, and legal professionals. The specific composition can vary depending on the state or organization establishing the committee. Their responsibilities include reviewing submitted disputes, gathering evidence, conducting impartial investigations, and ultimately issuing a final, binding decision on the amount the patient is responsible for paying.

They must adhere to established procedures and guidelines to ensure consistency and fairness in their decisions.

The Committee’s Decision-Making Process

The process begins with a patient submitting a dispute to the committee, typically providing documentation such as the ambulance bill, insurance information, and any relevant medical records. The committee then reviews the submitted materials and may request additional information from the patient, the ambulance provider, or the insurance company. This often involves a detailed review of the medical necessity of the ambulance transport.

Was it truly an emergency? Were there less expensive alternatives available? The committee analyzes the billed charges against usual and customary rates for similar services in the geographic area. After thorough review and potential investigation, the committee convenes to deliberate and reach a decision, often through a voting process. The decision is typically binding on all parties involved, though appeals processes may exist depending on the governing regulations.

The Ambulance Surprise Billing Committee’s independent dispute resolution process is crucial, but its effectiveness hinges on staffing. The current healthcare landscape, as highlighted in this article about the challenges facing healthcare systems, healthcare executives say talent acquisition labor shortages business risk , directly impacts the availability of trained mediators and adjudicators. Without sufficient personnel, the committee’s ability to resolve disputes efficiently and fairly is severely hampered, leading to longer wait times for patients and potentially exacerbating the problem of surprise billing.

Key Criteria for Evaluating Disputes

Several key criteria guide the committee’s evaluation of disputes. These include the medical necessity of the ambulance transport, the reasonableness of the charges compared to regional benchmarks, the patient’s insurance coverage and whether it should have covered the services, and the adherence of the ambulance provider to established billing practices. The committee weighs these factors to determine a fair and equitable resolution.

For example, if the transport was deemed medically unnecessary, the committee might significantly reduce or eliminate the patient’s financial responsibility. Conversely, if the charges were deemed reasonable and the patient’s insurance inadequately covered the service, the committee might adjust the patient’s responsibility accordingly.

Comparison to Other Dispute Resolution Mechanisms

The approach used by ambulance surprise billing committees shares similarities with other dispute resolution mechanisms in various sectors. For instance, the process mirrors aspects of medical malpractice arbitration, where neutral panels review claims and render decisions. It also bears resemblance to insurance claim appeals processes, where patients can challenge denials of coverage. However, ambulance surprise billing committees often have a more streamlined and less formal process than those used in other sectors, aiming for quicker and less costly resolution of disputes.

The focus is on balancing patient protection with provider reimbursement, unlike some other processes which might be more weighted towards one side.

Independent Dispute Resolution (IDR) Processes

Navigating surprise medical bills from ambulance services can be stressful, but the Independent Dispute Resolution (IDR) process offers a fair and impartial way to resolve these disputes. This process aims to prevent patients from being stuck with unexpectedly high bills for emergency medical transportation. It provides a structured path to a resolution that is acceptable to both the patient and the ambulance provider.

The IDR process is designed to be accessible and straightforward, ensuring that patients aren’t overwhelmed by complex legal procedures. It relies on neutral third-party experts to review the billing dispute and arrive at a fair and reasonable outcome, based on the specifics of the case. This often involves considering the patient’s insurance coverage, the services provided, and the applicable state or federal regulations.

IDR Process Steps

The IDR process typically involves several key steps, although the exact details might vary slightly depending on the state and the specific IDR entity involved. Generally, it’s a relatively streamlined process, designed for efficiency and fairness.

| Step | Description | Timeframe |

|---|---|---|

| 1. Dispute Submission | The patient submits a formal dispute to the IDR entity, providing all relevant documentation, including the bill, insurance information, and any supporting evidence. | Typically within a specified timeframe after receiving the bill (e.g., 30 days). |

| 2. Review of Documentation | The IDR entity reviews the submitted documentation to ensure completeness and to determine if the dispute qualifies for IDR. | Within a few business days to a couple of weeks. |

| 3. Notification to Parties | Both the patient and the ambulance provider are notified of the acceptance of the dispute and the next steps in the process. | Within a week of the documentation review. |

| 4. Arbitration or Mediation | Depending on the IDR process, either arbitration or mediation takes place. In arbitration, a neutral arbitrator makes a binding decision. In mediation, a neutral mediator facilitates a negotiation between the parties to reach a mutually agreeable resolution. | This can range from a few weeks to a couple of months, depending on the complexity of the case and the availability of the arbitrator or mediator. |

| 5. Decision/Settlement | The arbitrator issues a binding decision, or the parties reach a mutually agreeable settlement through mediation. The decision Artikels the final amount the patient is responsible for. | Within a set timeframe after the arbitration or mediation session (e.g., 1-2 weeks). |

| 6. Enforcement | The IDR entity ensures that the decision or settlement is enforced. This might involve communication with the ambulance provider to ensure the reduced bill is issued. | A few weeks following the decision or settlement. |

Role of the Independent Arbitrator or Mediator

The independent arbitrator or mediator plays a crucial role in ensuring a fair and impartial resolution. They act as a neutral third party, reviewing all evidence and applying relevant laws and regulations to reach a decision or facilitate a settlement. Their expertise and impartiality are essential to the success of the IDR process. They may have experience in healthcare billing, insurance, or dispute resolution.

The arbitrator’s decision is legally binding, while the mediator’s role is to guide the parties towards a mutually agreeable solution.

Examples of Successful IDR Resolutions

One successful example could involve a patient receiving a significantly reduced bill after the IDR process revealed that the ambulance provider had overcharged for services. Another could involve a successful negotiation between the patient and the provider, leading to a payment plan that accommodates the patient’s financial situation. A third example could be the arbitrator ruling in favor of the provider, but reducing the amount owed based on a review of the services and insurance coverage.

The success stories highlight the IDR process’s effectiveness in resolving billing disputes fairly.

Analyzing the Effectiveness of IDR

Independent Dispute Resolution (IDR) for ambulance surprise billing is a relatively new mechanism, and its effectiveness is still being evaluated. This analysis will compare IDR outcomes with other dispute resolution methods, highlight its strengths and weaknesses, and propose potential improvements to enhance fairness and efficiency. A crucial aspect of this evaluation is considering the varied implementation and results across different states and regions.

Comparison of IDR with Other Dispute Resolution Methods

IDR offers a structured, neutral process for resolving ambulance billing disputes, contrasting with less formal methods like direct negotiation between the patient and provider or involvement of insurance companies alone. Direct negotiation often proves ineffective due to power imbalances and lack of clear guidelines. Insurance company involvement can be slow and lead to protracted disputes, potentially leaving patients with significant financial burdens.

IDR aims to provide a quicker, more equitable resolution compared to these alternatives, though its success depends heavily on implementation and adherence to established protocols. For example, a study might compare the average resolution time of IDR cases to the average time it takes to resolve disputes through direct negotiation or insurance company intervention, revealing the efficiency gains or shortfalls of IDR.

Another study might analyze patient satisfaction rates across different dispute resolution methods to gauge the overall effectiveness and patient experience.

Strengths and Weaknesses of the Current IDR System

The current IDR system for ambulance billing presents both advantages and disadvantages. Strengths include the potential for quicker resolutions than other methods, the impartiality of the process, and a reduction in the likelihood of lengthy legal battles. However, weaknesses include inconsistencies in implementation across states, concerns about access for patients lacking resources or legal expertise, and potential delays caused by bureaucratic hurdles within the IDR process itself.

For instance, some states may have more streamlined IDR processes than others, leading to variations in resolution times and patient satisfaction. The cost of IDR can also be a barrier for some patients, especially those with limited financial means. These aspects significantly influence the overall efficacy of the system.

Potential Improvements to the IDR Process

Several improvements could enhance the fairness and efficiency of the IDR process. Standardization of procedures across all states would ensure consistency and reduce ambiguity. Providing greater access to legal assistance or advocacy services for patients, especially those facing language barriers or complex medical situations, would promote fairness. Streamlining the administrative aspects of the process, such as reducing paperwork and improving communication, would increase efficiency.

Furthermore, implementing clear metrics for evaluating the performance of IDR programs would allow for ongoing monitoring and improvements. For example, tracking key performance indicators like resolution time, patient satisfaction, and cost-effectiveness would provide valuable data for ongoing refinement of the system. Regular audits and reviews of IDR processes could also help identify and address systemic issues promptly.

Comparison of IDR Across States/Regions

The following table compares different aspects of IDR across various states or regions. Note that data collection on IDR effectiveness is still ongoing, and the information below is hypothetical to illustrate the type of comparative analysis needed. Actual data would need to be gathered from reliable sources, such as state government websites or academic studies.

| State/Region | Average Resolution Time (days) | Patient Satisfaction Rate (%) | Average Cost to Patient ($) |

|---|---|---|---|

| State A | 30 | 85 | 50 |

| State B | 45 | 70 | 100 |

| State C | 20 | 90 | 25 |

| Region D | 60 | 60 | 150 |

Patient Protections and Rights

Navigating the complexities of surprise medical bills, especially those from ambulance services, can be daunting. However, patients possess significant rights and protections designed to shield them from unexpected and potentially crippling costs. Understanding these rights is crucial to effectively advocate for yourself and ensure fair treatment.The No Surprises Act, a landmark piece of legislation, significantly bolstered patient protections against surprise medical bills.

This act establishes clear guidelines for resolving disputes between patients, providers, and insurers regarding out-of-network charges, including those incurred for emergency ambulance services. The act aims to prevent patients from being held responsible for exorbitant, unexpected costs, ensuring greater transparency and fairness in the healthcare system.

Patient Rights Regarding Ambulance Surprise Billing

Under the No Surprises Act, patients have the right to receive a “good faith estimate” of charges before receiving out-of-network care, including ambulance services. This allows patients to make informed decisions and potentially avoid unexpected expenses. If the final bill exceeds the estimate by a significant margin, patients have avenues to challenge the charges. Patients also have the right to dispute charges deemed unreasonable or outside the typical range for similar services in their geographic area.

The act protects patients from balance billing, meaning they cannot be held responsible for charges beyond their in-network cost-sharing obligations. This protection is particularly vital in emergency situations where patients may have little choice in selecting their provider.

Appealing Committee or IDR Decisions

If a patient disagrees with the determination of the Independent Dispute Resolution (IDR) process or the committee’s decision regarding a surprise ambulance bill, they have several avenues for appeal. These avenues may vary depending on state laws and the specific details of the case. Generally, patients can seek review through the administrative appeals process of the relevant state insurance regulatory agency or, in some instances, pursue legal action in civil court.

The specifics of the appeals process will typically be Artikeld in the IDR decision or provided by the relevant regulatory authority. Documenting all communication, decisions, and attempts to resolve the issue is vital throughout the process.

Legal Protections Available to Patients

The No Surprises Act provides significant legal protections against surprise medical bills. It establishes a framework for dispute resolution and prevents providers from billing patients for amounts exceeding the in-network cost-sharing responsibility. Patients have the legal right to challenge bills that violate the act’s provisions. State consumer protection laws may also offer additional avenues for recourse. In cases of blatant violations or unethical billing practices, patients can seek legal counsel to pursue legal action against providers or insurers.

The act itself empowers patients with legal standing to pursue redress for unfair billing practices.

Resources for Patients Facing Surprise Medical Bills

Finding assistance when faced with a surprise medical bill can be challenging, but several resources are available to guide patients through the process.

- Your State’s Insurance Department: Each state has an insurance department that can provide information and assistance with resolving disputes related to health insurance claims, including surprise billing.

- The Centers for Medicare & Medicaid Services (CMS): CMS administers the No Surprises Act and offers resources and information on patient rights and protections.

- Consumer Protection Agencies: State and federal consumer protection agencies can investigate complaints about unfair billing practices.

- Legal Aid Organizations: Many legal aid organizations provide free or low-cost legal assistance to individuals facing financial hardship due to medical bills.

- Patient Advocate Groups: Several patient advocacy groups specialize in assisting individuals navigate the complexities of the healthcare system and resolving disputes with providers and insurers.

Future of Ambulance Surprise Billing and IDR: Ambulance Surprise Billing Committee Independent Dispute Resolution

Source: publicinterestnetwork.org

The current system for addressing surprise ambulance billing, while a significant step forward, isn’t without its flaws. Ongoing debates and potential legislative changes promise a continuously evolving landscape, impacting both the experience of patients and the efficiency of the Independent Dispute Resolution (IDR) process. Understanding these potential shifts is crucial for stakeholders across the healthcare system.The long-term effectiveness of the current IDR system hinges on several factors, including its accessibility, transparency, and impartiality.

While designed to protect patients, the process itself can be complex and time-consuming, potentially leading to delays in resolving disputes and causing financial hardship for some individuals. Furthermore, the success of IDR depends heavily on the willingness of both providers and payers to participate fully and in good faith.

The Ambulance Surprise Billing Committee’s independent dispute resolution process is crucial for fair pricing, but the recent headlines about the new york state nurse strike montefiore richmond university deals highlight the broader issue of healthcare affordability. These nurses’ struggles underscore the need for transparent billing practices and effective dispute resolution mechanisms to prevent patients from facing unexpected financial burdens, further emphasizing the importance of the committee’s work.

Potential Legislative Changes Affecting Ambulance Surprise Billing and IDR

Several legislative avenues are being explored to refine the existing framework. One potential change involves increasing transparency in ambulance pricing. This could involve mandates for clearer upfront cost disclosures or the development of standardized pricing models across different regions. Another area of focus is streamlining the IDR process itself, perhaps by simplifying the application process, reducing wait times for decisions, and clarifying the criteria used in arbitration.

For example, some states are considering legislation that mandates faster turnaround times for IDR decisions, aiming for resolutions within a specified timeframe, such as 30 days. This could significantly improve patient experience and reduce financial uncertainty. There is also ongoing discussion around potential modifications to the arbitration process itself, exploring alternative models to ensure fairness and efficiency.

Long-Term Implications of the Current IDR System

The current IDR system’s long-term impact will depend on its ability to adapt to changing circumstances and technological advancements. If the system remains cumbersome or inaccessible to patients, it risks undermining public trust and failing to achieve its intended purpose. Conversely, a streamlined, transparent, and efficient IDR system could significantly improve patient satisfaction and reduce the financial burden associated with surprise ambulance bills.

The long-term financial implications for both patients and healthcare providers also remain uncertain. If IDR consistently favors one party over the other, it could create imbalances within the healthcare market, potentially impacting provider reimbursement rates and patient access to care. Successful long-term implementation requires ongoing monitoring, evaluation, and adaptation to ensure equitable outcomes.

Innovative Approaches to Preventing Surprise Ambulance Billing

Several innovative approaches could help prevent surprise ambulance billing before it even occurs. One promising avenue is the expansion of pre-authorization processes. Requiring pre-authorization for ambulance transport in non-emergency situations could give patients a clearer understanding of costs upfront. Another approach is developing a more robust system for identifying and classifying emergency situations, reducing ambiguity around when ambulance transport is truly necessary.

Improved communication between emergency medical services (EMS), hospitals, and insurance providers could also play a crucial role in minimizing surprise bills. This could involve the development of standardized electronic communication protocols, facilitating real-time information sharing and cost transparency. Furthermore, increased public education campaigns could empower patients to make more informed decisions regarding ambulance transport, particularly in situations where alternative transportation options might be available.

Technological Advancements Improving IDR Efficiency and Transparency

Technological advancements hold significant potential for improving the efficiency and transparency of the IDR process. The implementation of a centralized, online platform for submitting and tracking IDR claims could streamline the entire process, reducing paperwork and administrative burden. This platform could also incorporate features such as real-time status updates, secure messaging between parties, and automated notifications, improving communication and transparency.

Furthermore, the use of artificial intelligence (AI) could assist in the analysis of claims, identifying potential inconsistencies or discrepancies that could expedite the resolution process. For instance, an AI system could be trained to identify patterns in claim denials, allowing for proactive interventions to address common issues and reduce delays. The use of blockchain technology could enhance the security and immutability of IDR records, ensuring data integrity and transparency throughout the process.

Ultimate Conclusion

Navigating surprise ambulance bills can feel overwhelming, but understanding the system, including the role of the committee and IDR processes, is crucial. While the current system has its flaws, knowing your rights and the steps involved in dispute resolution empowers you to advocate for yourself. Remember, you’re not alone in facing this issue, and resources are available to assist you.

Let’s work towards a more transparent and equitable healthcare system where unexpected medical bills don’t add to the stress of an already difficult situation. Stay informed, stay proactive, and remember your rights as a patient.

Essential FAQs

What if the IDR process doesn’t resolve the dispute in my favor?

Depending on your state, you may have further legal options, such as small claims court or pursuing a lawsuit. Consult with a legal professional to explore your options.

How long does the IDR process typically take?

The timeframe varies, but it can often take several months to reach a resolution. The complexity of the case and the volume of disputes can impact the processing time.

Are there any fees associated with the IDR process?

The fees involved depend on your state’s regulations and the specific IDR process. Some states may cover all or part of the costs, while others may require patients to pay a portion or all of the fees.

Can I represent myself in the IDR process, or do I need a lawyer?

You can generally represent yourself, but having legal counsel can be beneficial, especially for complex cases. A lawyer can guide you through the process and ensure your rights are protected.