Atrium Health Ends Policy, Suing Patients Medical Debt Advocate Weighs In

Atrium Health ends policy suing patients medical debt advocate – that headline alone speaks volumes, doesn’t it? For years, Atrium Health’s aggressive debt collection practices faced criticism. Now, a significant shift has occurred, sparking lawsuits and igniting a fiery debate about the ethics of medical debt and the role of healthcare providers in a system that often leaves patients financially devastated.

This isn’t just about dollars and cents; it’s about the human cost of healthcare in America. Let’s dive into the details and see what this means for patients and the future of medical debt collection.

The recent change in Atrium Health’s policy, moving from aggressive lawsuits to a (hopefully) more patient-centered approach, follows years of controversy. The lawsuits filed against them highlight the struggles many patients face when medical bills spiral out of control. This situation shines a light on the crucial role of medical debt advocates, who act as a bridge between overwhelmed patients and powerful healthcare systems.

We’ll explore the legal battles, the advocacy efforts, and what this all means for the broader healthcare landscape.

Atrium Health’s Debt Collection Practices

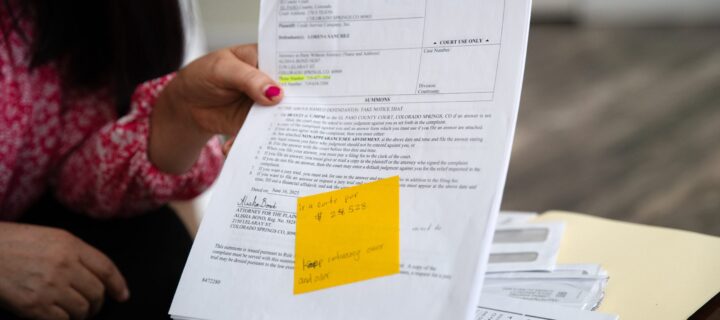

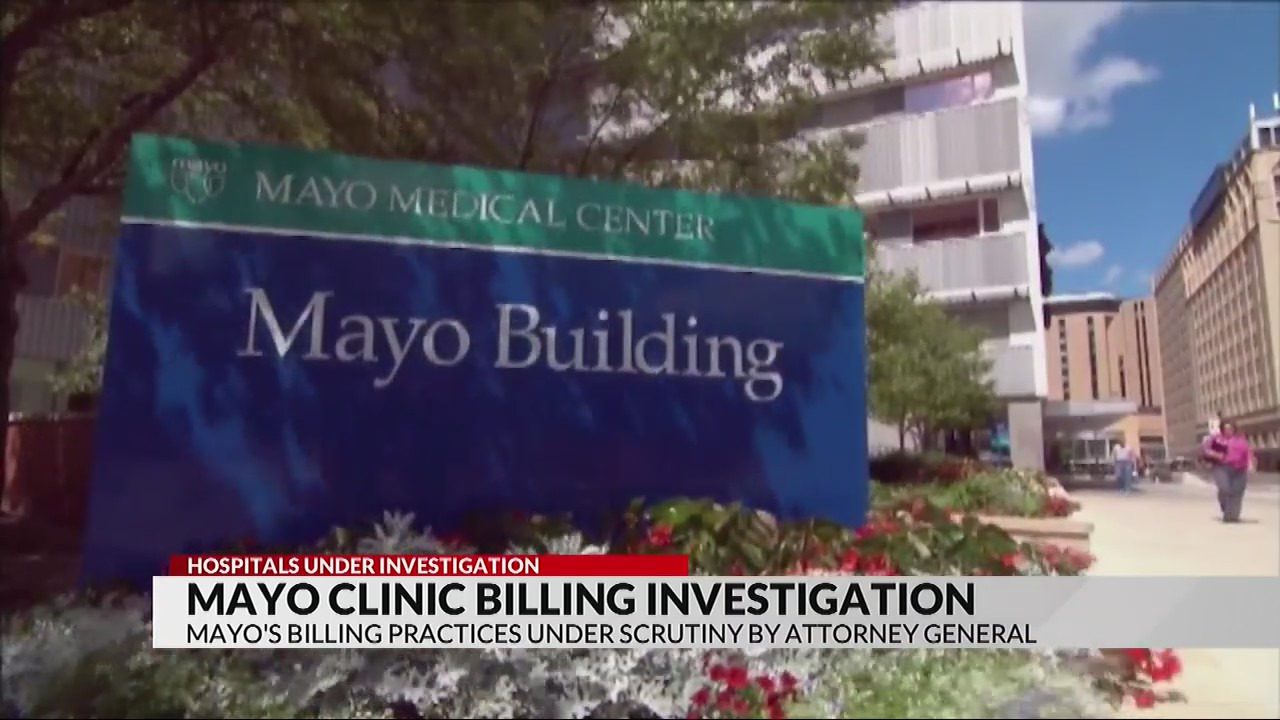

Source: kaaltv.com

Atrium Health, a large non-profit healthcare system, has faced significant criticism regarding its policies and practices concerning patient medical debt. The recent lawsuits highlight a complex issue involving the balance between financial responsibility and patient care. Understanding the evolution of Atrium Health’s debt collection approach is crucial to grasping the context of the legal challenges.Atrium Health’s Previous Policies Regarding Patient Medical DebtPrior to the changes that sparked the lawsuits, Atrium Health, like many other large healthcare providers, employed a multi-stage debt collection process.

This typically involved sending bills, making phone calls, and potentially referring unpaid balances to collections agencies. While they offered payment plans, the specifics and accessibility of these options varied, and the overall system lacked transparency for many patients. The lack of clear communication and readily available financial assistance programs contributed to patient frustration and mounting debt.Changes Implemented in the New Policy that Led to the LawsuitsThe specific changes in Atrium Health’s policy that directly resulted in the lawsuits are not publicly available in comprehensive detail due to the ongoing litigation.

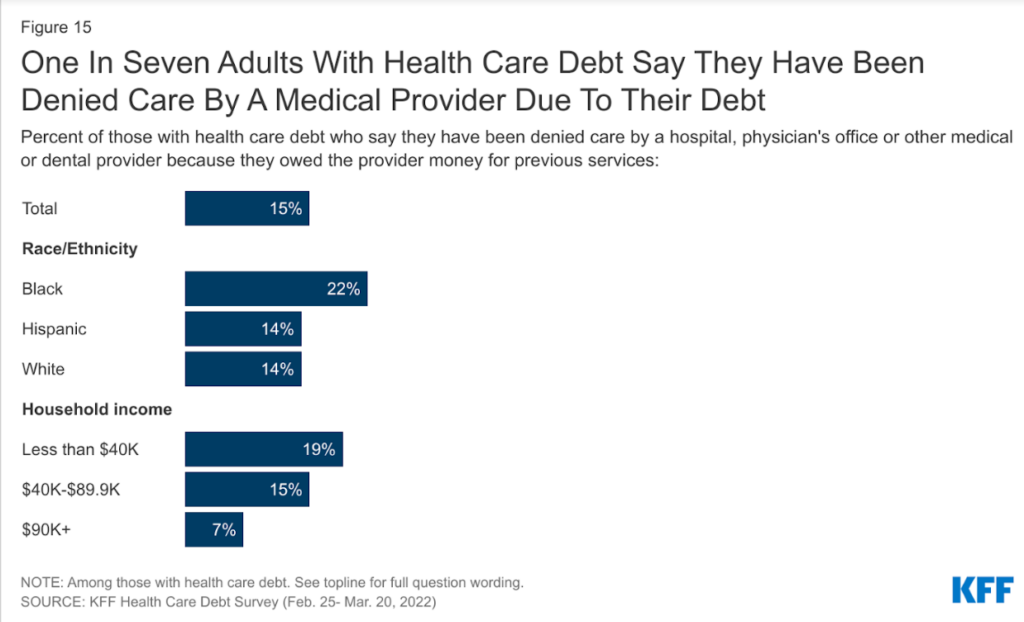

However, news reports and legal filings suggest that the lawsuits stem from accusations of aggressive debt collection tactics, including the use of wage garnishment and lawsuits against patients with relatively small balances. The perceived shift from a more lenient approach to a more aggressive strategy is a central point of contention. This aggressive approach allegedly disproportionately affected low-income patients, exacerbating existing health disparities.Comparison of Atrium Health’s Debt Collection Practices to Those of Similar Healthcare ProvidersWhile Atrium Health’s practices are under scrutiny, it’s important to note that aggressive debt collection is not unique to this healthcare system.

Many large hospital systems across the United States employ similar strategies, often outsourcing debt collection to specialized agencies. However, the lawsuits against Atrium Health raise concerns about the scale and intensity of their practices compared to peers. A comparative analysis of their methods against other major healthcare providers in the region, considering factors like the percentage of debt referred to collections, the use of legal action, and the types of financial assistance offered, would be necessary to fully understand their relative position.

Such an analysis is currently unavailable due to the lack of publicly accessible, comparable data across different healthcare systems.Timeline of Events Leading up to the LawsuitsPinpointing exact dates is challenging due to the ongoing nature of the litigation. However, a general timeline can be constructed based on available information. The period leading up to the lawsuits likely involved a period of increasing patient complaints regarding Atrium Health’s billing and collections practices.

This was followed by increasing media attention and advocacy efforts on behalf of patients struggling with medical debt. Finally, formal lawsuits were filed, initiating the legal proceedings. The specific dates of key decisions, such as the filing of the lawsuits and any preliminary rulings, are not consistently reported across all news sources and require further research from official court records.

A more precise timeline would require access to court documents and internal Atrium Health records, which are not currently publicly accessible.

The Lawsuits Against Atrium Health

Atrium Health, like many large healthcare systems, has faced legal challenges related to its billing and debt collection practices. These lawsuits highlight concerns about the aggressive pursuit of medical debt and the impact on patients’ financial well-being. Understanding the details of these cases is crucial for patients and advocates alike.

So Atrium Health finally ended its policy of suing patients over medical debt – a huge win for patient advocates! It makes you think about the bigger picture of healthcare affordability, and how the struggles faced by patients are often mirrored by the struggles of healthcare workers. The recent new york state nurse strike NYSNA Montefiore Mount Sinai highlighted the burnout and understaffing plaguing hospitals, which can directly impact patient care and contribute to rising costs.

Hopefully, this shift in Atrium’s approach signals a broader move towards compassion and affordability within the healthcare system.

Key Plaintiffs and Legal Arguments

Several lawsuits against Atrium Health have been filed by individual patients and, in some cases, groups of patients represented by legal aid organizations or private law firms. The plaintiffs generally allege that Atrium Health engaged in unfair, deceptive, and abusive debt collection practices. Their legal arguments often center on violations of the Fair Debt Collection Practices Act (FDCPA) and state-specific consumer protection laws.

These laws aim to protect consumers from harassment, intimidation, and misleading practices by debt collectors. Plaintiffs argue that Atrium Health’s actions, such as aggressive phone calls, threatening letters, and the filing of lawsuits without proper justification, violate these protections.

So Atrium Health finally ended its policy of suing patients over medical debt – a huge win for medical debt advocates! It makes you think about the power of collective action, like the nurses in New York who recently reached a deal ending their strike at Mount Sinai and Montefiore, as reported here: new york nurse strike deal reached Mount Sinai Montefiore.

Hopefully, Atrium’s decision will inspire other healthcare systems to prioritize patient well-being over aggressive debt collection.

Allegations of Wrongdoing

The specific allegations vary across lawsuits but commonly include claims of: inaccurate billing, failure to provide adequate notice of debt, aggressive and harassing debt collection tactics, pursuing debt beyond the statute of limitations, and filing lawsuits without proper legal basis. Some plaintiffs allege that Atrium Health failed to properly investigate billing disputes before pursuing legal action, while others contend that the hospital system targeted vulnerable patients with limited financial resources.

The accusations paint a picture of a system prioritizing revenue collection over patient care and financial responsibility.

Current Status of Lawsuits

The current status of the lawsuits against Atrium Health varies depending on the specific case. Some cases have been settled out of court, often resulting in the dismissal of debt or a reduction in the amount owed. Others are still pending, with ongoing litigation involving discovery, motions, and potential trials. The outcomes of these cases will significantly impact Atrium Health’s future debt collection practices and potentially set precedents for other healthcare providers.

It’s important to note that the details of settlements are often confidential, limiting public access to specific information.

Summary of Key Lawsuits

| Plaintiff Name(s) | Filing Date | Allegations | Current Status |

|---|---|---|---|

| (Example: Jane Doe) | (Example: October 26, 2022) | (Example: FDCPA violations, inaccurate billing, harassment) | (Example: Settled out of court) |

| (Example: John Smith et al.) | (Example: March 15, 2023) | (Example: Violation of state consumer protection laws, failure to investigate billing disputes) | (Example: Pending litigation) |

| (Example: Legal Aid Society on behalf of multiple plaintiffs) | (Example: June 1, 2023) | (Example: Class action lawsuit alleging systemic issues with debt collection practices) | (Example: Discovery phase) |

| (Example: ABC Law Firm representing multiple plaintiffs) | (Example: August 8, 2024) | (Example: Aggressive debt collection tactics, pursuing statute-barred debt) | (Example: Motion to dismiss filed) |

The Role of Medical Debt Advocates

Source: healthjournalism.org

Navigating the complex world of medical billing and insurance can be incredibly daunting, especially for those facing financial hardship. Medical debt advocates play a crucial role in helping patients understand their rights, negotiate with healthcare providers, and ultimately reduce or eliminate their medical debt. They act as intermediaries, leveraging their expertise to navigate the often-opaque system and advocate for patients who may feel overwhelmed and powerless.Medical debt advocates employ a variety of strategies to assist patients.

These strategies range from simple letter writing to complex legal negotiations, depending on the individual circumstances and the nature of the debt. Their primary goal is to find solutions that are both financially feasible for the patient and acceptable to the healthcare provider.

Negotiation Strategies Used by Medical Debt Advocates

Medical debt advocates utilize several negotiation tactics to resolve medical debt disputes. These include negotiating lower balances, establishing payment plans that fit the patient’s budget, and exploring options like charity care or financial assistance programs offered by the healthcare provider. They often leverage their knowledge of federal and state laws related to debt collection practices to challenge unfair or illegal billing practices.

For example, they might point out discrepancies in billing statements or argue for the application of existing hospital financial assistance policies. A successful negotiation frequently involves a thorough review of the patient’s financial situation and the healthcare provider’s billing practices to identify areas of compromise. Advocates often present a comprehensive case demonstrating the patient’s inability to pay the full amount, thereby increasing the likelihood of a favorable outcome.

Effectiveness of Different Advocacy Methods

The effectiveness of different advocacy methods varies greatly depending on several factors, including the specific healthcare provider, the amount of debt, and the patient’s individual circumstances. Direct negotiation with the healthcare provider is often the first step, and it can be very effective if the provider is willing to work with the patient. If direct negotiation fails, advocates may employ more assertive strategies, such as appealing to the provider’s internal appeals process or involving a consumer protection agency.

In some cases, legal action may be necessary. While legal action can be effective, it is often a last resort due to its time-consuming and costly nature. The success rate of each method is difficult to quantify precisely because it depends on many variables, but generally, a multi-pronged approach that combines negotiation, appeals, and potential legal action tends to yield the best results.

Resources Available to Patients Struggling with Medical Debt

Several resources are available to patients struggling with medical debt. These include non-profit credit counseling agencies that can provide guidance on debt management and negotiation strategies. Many hospitals and healthcare systems have financial assistance programs that offer reduced or waived costs for patients who meet specific financial criteria. State and federal government agencies also offer resources and programs to assist individuals facing financial hardship, such as Medicaid and CHIP.

Additionally, many legal aid organizations provide free or low-cost legal assistance to individuals facing medical debt-related legal issues. Understanding and accessing these resources is often the first critical step in effectively managing medical debt.

Steps to Take When Facing Overwhelming Medical Debt

The following flowchart Artikels the steps a patient should take when facing overwhelming medical debt:[Imagine a flowchart here. It would start with a box labeled “Overwhelmed by Medical Debt?” with a “Yes” branch leading to a box labeled “Contact your healthcare provider’s billing department to discuss payment options.” A “No” branch would lead to the end of the flowchart.

The “Contact billing department” box would branch to “Negotiate a payment plan?” “Yes” leads to “Success?” “Yes” leads to the end. “No” leads to “Contact a medical debt advocate or non-profit credit counseling agency.” “Success?” “Yes” leads to the end. “No” leads to “Explore financial assistance programs and government resources.” “Success?” “Yes” leads to the end.

“No” leads to “Consider legal options.”]

Public Perception and Impact

The Atrium Health lawsuits have ignited a firestorm of public debate, highlighting the complex and often ethically murky world of medical debt. The reaction has been varied, ranging from outrage and sympathy for patients struggling under the weight of unexpected medical bills to staunch defense of Atrium Health’s business practices. This case serves as a stark reminder of the deep societal divisions surrounding healthcare access and affordability.The potential impact of this case on healthcare policies and practices nationwide is significant.

It’s forcing a much-needed conversation about the sustainability of current debt collection methods within the healthcare industry and the ethical implications of aggressive pursuit of medical debt from vulnerable populations. The outcome could influence legislation regarding patient protections, debt limits, and the transparency of hospital billing practices. We might even see increased pressure on insurance companies to cover a wider range of medical expenses.

Public Reaction to Atrium Health’s Policy and Lawsuits

News outlets have reported widespread public criticism of Atrium Health’s aggressive debt collection tactics, particularly the suing of patients for relatively small amounts of debt. Social media has been ablaze with stories from individuals and families facing financial ruin due to medical bills, with many expressing frustration and anger at what they perceive as predatory practices. Conversely, some commentators have argued that hospitals have a right to recoup their costs and that patients should be responsible for their medical bills.

This has created a highly polarized public discourse, with little common ground between opposing viewpoints.

Potential Impact on Healthcare Policies and Practices

This case could lead to several significant changes in healthcare policies and practices. For example, several states are already considering legislation that would limit the amount hospitals can sue patients for, or that would mandate greater transparency in hospital billing. Furthermore, the case might encourage hospitals to adopt more patient-centered approaches to debt collection, such as offering payment plans or working with patients to explore financial assistance programs.

The long-term impact on the industry’s approach to patient debt could be profound, potentially shifting the focus from aggressive collection to proactive financial assistance and prevention. This could involve increased investment in financial counseling services and improved communication with patients about billing and payment options.

Ethical Considerations Surrounding Medical Debt Collection

The ethical implications of suing patients for medical debt are substantial. Critics argue that it’s morally wrong to pursue legal action against individuals who are already struggling financially due to illness. The argument is that healthcare should be a right, not a privilege determined by one’s ability to pay. This raises questions about the role of hospitals in a society that prioritizes equitable access to healthcare.

Conversely, some argue that hospitals are businesses and have a right to collect their debts, particularly when patients have insurance coverage that should have covered the expenses. This highlights the tension between the humanitarian goals of healthcare and the financial realities of running a hospital system.

Potential Financial Implications for Atrium Health

The lawsuits against Atrium Health could have significant financial implications. Legal fees alone could be substantial, especially if the cases proceed to trial. Furthermore, a negative outcome could damage the hospital’s reputation and lead to a loss of public trust, potentially impacting patient volume and revenue in the long term. There’s also the risk of reputational damage and potential for future class-action lawsuits.

The financial burden of defending these lawsuits, coupled with potential payouts, could represent a considerable financial strain.

So Atrium Health finally ended its policy of suing patients over medical debt – a huge win for medical debt advocates! It makes you wonder, though, if better preventative measures could be in place. A recent study on the widespread use of digital twins in healthcare, like the one discussed in this insightful article study widespread digital twins healthcare , suggests that personalized preventative care might be a game changer, potentially reducing the need for such drastic measures in the first place.

Hopefully, this positive change from Atrium signals a broader shift towards more patient-centric approaches.

Potential Long-Term Consequences for Healthcare Systems

The outcome of these lawsuits could have far-reaching consequences for healthcare systems nationwide.

- Increased scrutiny of hospital billing practices and greater transparency requirements.

- Wider adoption of patient-centered approaches to debt collection, such as financial assistance programs and payment plans.

- Potential changes in state and federal legislation regarding medical debt collection.

- Shift in the public perception of hospitals and the healthcare industry, potentially leading to increased advocacy for healthcare reform.

- Increased pressure on insurance companies to improve coverage and reduce out-of-pocket costs for patients.

Alternative Debt Resolution Methods

The recent lawsuits against Atrium Health, and similar situations across the healthcare industry, highlight a critical need for more patient-centric approaches to managing medical debt. Instead of resorting to aggressive collection tactics, healthcare providers can implement alternative methods that prioritize patient well-being and financial stability, ultimately preventing the escalation to legal action. This shift requires a fundamental change in how hospitals view patient financial responsibility, moving from a purely transactional model to one that incorporates empathy and proactive support.

Effective alternative debt resolution hinges on open communication, transparent pricing, and readily available financial assistance programs. Hospitals should proactively engage patients about their financial concerns early in the treatment process, offering various payment options and exploring eligibility for financial aid. This proactive approach not only reduces patient anxiety but also mitigates the risk of unpaid bills escalating into legal disputes.

By understanding a patient’s financial situation, providers can tailor payment plans that are both manageable and sustainable, fostering a positive patient experience and improving overall financial outcomes for the hospital.

Examples of Successful Patient-Centric Debt Resolution Programs, Atrium health ends policy suing patients medical debt advocate

Several healthcare systems have successfully implemented programs that demonstrate the efficacy of patient-centric debt resolution. For instance, some hospitals have adopted “financial counseling” programs, where trained professionals work directly with patients to create personalized payment plans, explore eligibility for charity care, and connect them with external resources like government assistance programs. Other successful initiatives include implementing online patient portals with easy-to-understand billing information and streamlined payment options, allowing patients to manage their accounts with greater ease and transparency.

These programs often include automated payment reminders and options for installment payments, making it easier for patients to stay current on their bills. The success of these programs is often measured by decreased bad debt, improved patient satisfaction scores, and a reduction in the number of lawsuits related to unpaid medical bills.

Proactive Communication and Financial Assistance Programs

Proactive communication is paramount in preventing medical debt from escalating into legal action. Hospitals should implement systems that automatically identify patients facing financial hardship based on factors like income level, insurance coverage, and prior payment history. Early intervention, through personalized outreach, can offer patients options like payment plans, financial assistance applications, or referrals to community resources before the debt becomes unmanageable.

These programs should be clearly advertised and easily accessible to all patients, regardless of their socioeconomic status. Transparency in billing practices is also crucial; patients should receive clear and concise explanations of their bills, including itemized charges and available payment options. This transparency fosters trust and encourages open communication, preventing misunderstandings and potential disputes.

Comparison of Financial Assistance Programs

A comparison of financial assistance programs across various healthcare providers reveals a wide range of offerings. Some hospitals offer only limited charity care based on strict income guidelines, while others have more comprehensive programs that include sliding-scale discounts, payment plans, and assistance with applying for government programs like Medicaid and Medicare. The availability and scope of these programs can vary significantly based on the hospital’s size, financial resources, and overall mission.

Some systems also partner with external organizations to provide additional financial assistance resources to patients. A standardized approach, where financial assistance policies are easily accessible and consistently applied, would significantly improve patient experiences and reduce disparities in access to care.

Best Practices for Hospitals in Handling Patient Financial Responsibility

A comprehensive approach to managing patient financial responsibility requires a multifaceted strategy. Best practices include:

- Implementing a robust financial counseling program staffed with trained professionals.

- Offering a variety of payment options, including installment plans and extended payment terms.

- Providing clear and transparent billing statements with itemized charges.

- Proactively identifying patients facing financial hardship and offering assistance.

- Partnering with community organizations to provide additional resources to patients.

- Regularly reviewing and updating financial assistance policies to ensure they are equitable and effective.

- Utilizing technology to streamline the billing process and improve communication with patients.

- Tracking key metrics, such as the number of patients receiving financial assistance, the percentage of debt collected, and the number of lawsuits filed, to assess program effectiveness.

Closure: Atrium Health Ends Policy Suing Patients Medical Debt Advocate

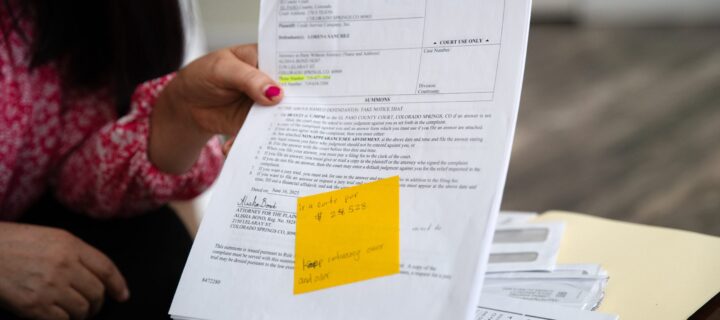

Source: yellowscene.com

The Atrium Health case serves as a stark reminder of the broken system many face when confronted with medical debt. The shift in policy, while a positive step, doesn’t erase the past. The ongoing lawsuits and the ongoing debate about the ethical implications of aggressive debt collection practices highlight a critical need for systemic change. We need more patient-centric approaches, increased transparency, and robust support systems for individuals struggling with the financial burden of healthcare.

The fight for fair and accessible healthcare is far from over, and this case is a crucial battle in that ongoing war.

Quick FAQs

What specific legal arguments are the plaintiffs using in the lawsuits against Atrium Health?

Plaintiffs’ arguments likely center around claims of unfair debt collection practices, violations of consumer protection laws, and potentially breaches of contract or fiduciary duty. The specifics would vary depending on the individual lawsuit.

How can patients find a medical debt advocate?

Many non-profit organizations offer assistance, and some consumer advocacy groups specialize in medical debt. Online searches for “medical debt advocacy” or contacting your local consumer protection agency can be a good starting point.

What are some alternative debt resolution methods besides lawsuits?

Negotiating payment plans, seeking financial assistance programs offered by the hospital or charities, and exploring options like debt settlement or bankruptcy are possibilities. A medical debt advocate can help navigate these options.

What is the long-term impact of this case on other healthcare systems?

The outcome could influence other hospitals to review their debt collection practices and potentially adopt more patient-friendly approaches to avoid similar legal challenges and negative publicity. It could also spur legislative action to regulate medical debt collection more effectively.