CMS Independent Pharmacy Pay PBM Plans Explained

CMS independent pharmacy pay PBMs plans: Navigating the complex world of pharmacy reimbursement can feel like deciphering a secret code. Independent pharmacies face a constant battle for fair compensation, caught in the crossfire between powerful Pharmacy Benefit Managers (PBMs) and the regulations set by the Centers for Medicare & Medicaid Services (CMS). This post dives deep into the intricacies of how independent pharmacies get paid, exploring the various payment models, the influence of CMS, and strategies for survival and growth in this challenging landscape.

We’ll unpack the impact of Direct and Indirect Remuneration (DIR) fees, the art of negotiating PBM contracts, and how these dynamics affect patient access to medications. We’ll also look at innovative technological solutions and explore the future of independent pharmacies in an increasingly consolidated healthcare system. Get ready to unravel the mysteries of pharmacy reimbursement!

Independent Pharmacy Payment Models: Cms Independent Pharmacy Pay Pbms Plans

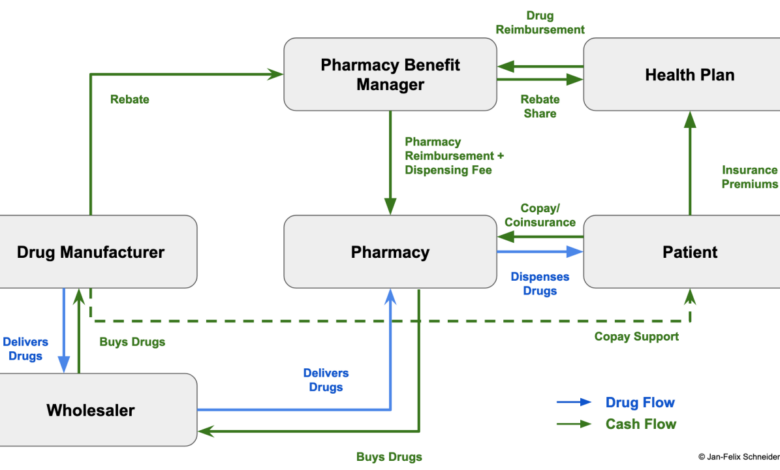

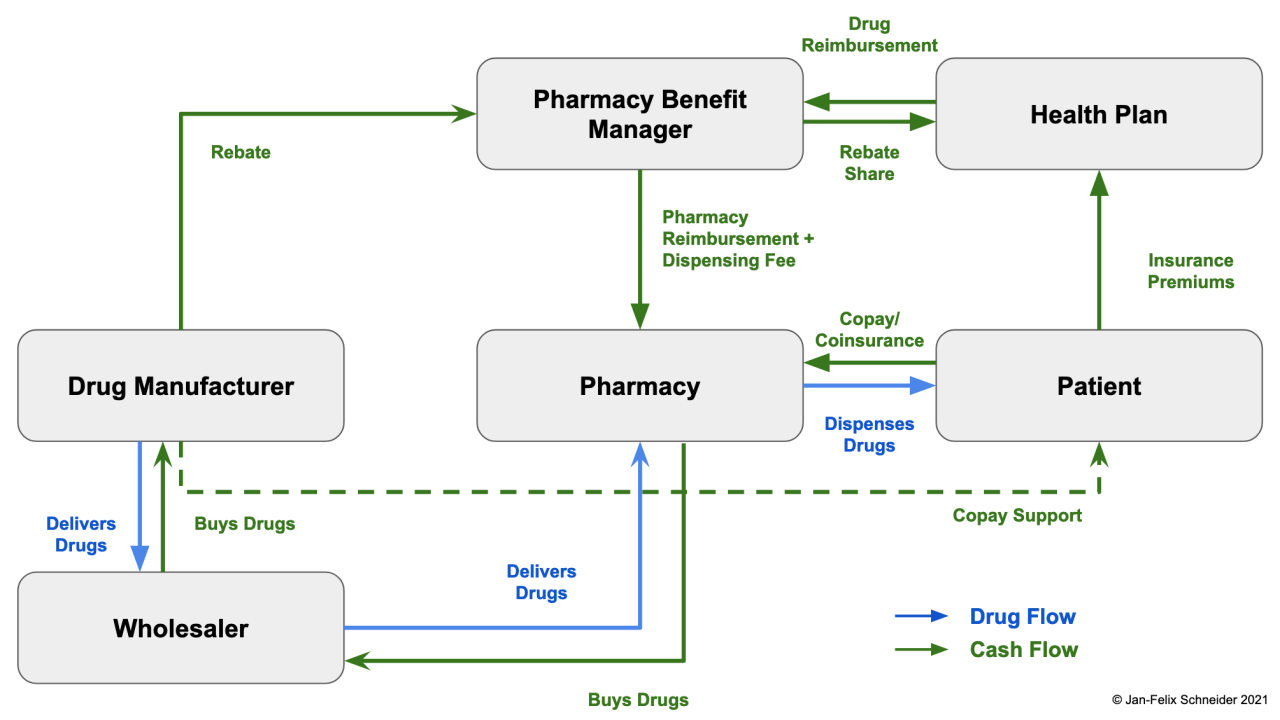

The relationship between independent pharmacies and Pharmacy Benefit Managers (PBMs) is complex, often characterized by fluctuating reimbursement rates and opaque fee structures. Understanding the various payment models employed by PBMs is crucial for independent pharmacies to navigate the financial landscape and ensure their viability. This discussion will delve into the intricacies of these models, highlighting their impact on profitability.

PBM Payment Model Comparisons

PBMs utilize several payment models to reimburse independent pharmacies for dispensing medications. These models vary significantly in their transparency and fairness, leading to considerable differences in profitability for pharmacies. Common models include fee-for-service, per-prescription, and managed care contracts, each with its own set of advantages and disadvantages. Fee-for-service models offer a relatively straightforward reimbursement based on the dispensed medication’s cost, while per-prescription models offer a fixed payment per prescription regardless of medication cost.

Managed care contracts are more complex, often involving bundled payments and performance-based incentives. The lack of standardization across these models contributes to the challenges faced by independent pharmacies in negotiating favorable terms.

Variations in Reimbursement Rates

Reimbursement rates across different PBM contracts can vary dramatically, even for the same medication. Factors influencing these variations include the specific PBM, the type of plan (e.g., Medicare Part D, commercial), the medication’s cost, and the pharmacy’s location. For instance, a high-volume, urban pharmacy might negotiate higher rates compared to a rural pharmacy with lower prescription volume. Furthermore, PBMs often employ tiered formularies, where preferred medications receive higher reimbursement, while non-preferred medications receive significantly lower payments.

This variability creates an uneven playing field for independent pharmacies, forcing them to navigate a complex web of negotiations to secure adequate reimbursement.

Impact of DIR Fees on Independent Pharmacy Profitability

Direct and Indirect Remuneration (DIR) fees represent a significant challenge to independent pharmacy profitability. These fees, often hidden within PBM contracts, are deducted from pharmacies’ reimbursements after the dispensing of the medication. DIR fees can include various charges, such as rebates, performance-based incentives, and administrative fees, many of which are not transparently disclosed upfront. The unpredictable nature and retroactive application of DIR fees significantly impact a pharmacy’s bottom line, creating financial instability and making accurate budgeting difficult.

The lack of transparency surrounding DIR fees has been a major point of contention between PBMs and independent pharmacies.

Comparison of PBM Contracts

The following table provides a simplified comparison of key features across different hypothetical PBM contracts. Note that actual contract terms vary significantly and are subject to negotiation.

| PBM Contract Type | Reimbursement Rate (Example) | Administrative Fees (Example) | Performance Metrics |

|---|---|---|---|

| Fee-for-Service (PBM A) | Average Wholesale Price (AWP) – 20% | $5 per claim | Prescription accuracy, patient satisfaction |

| Per-Prescription (PBM B) | $8 per prescription | $2 per prescription | Medication adherence rates |

| Managed Care (PBM C) | Negotiated rates based on volume and performance | Variable, based on performance | Star ratings, cost containment |

| Managed Care (PBM D) | AWP – 25% + performance bonuses | $10 per month + variable fees | Patient retention, medication utilization |

CMS (Centers for Medicare & Medicaid Services) Influence on Pharmacy Reimbursement

Source: keycentrix.com

The Centers for Medicare & Medicaid Services (CMS) plays a pivotal role in shaping the landscape of pharmacy reimbursement, particularly for independent pharmacies participating in Medicare Part D. Their regulations directly impact the financial health and sustainability of these businesses, influencing everything from medication pricing to the administrative burden pharmacies face. Understanding CMS’s influence is crucial for independent pharmacies to navigate the complexities of reimbursement and plan for their future.CMS’s role in regulating pharmacy reimbursement under Medicare Part D is primarily to ensure fair pricing, access to medications for beneficiaries, and program integrity.

They achieve this through a complex system of regulations, payment models, and oversight mechanisms. This system, while intended to benefit both patients and providers, often presents challenges for independent pharmacies, which often lack the resources of larger chain pharmacies to navigate the intricacies of the system.

Medicare Part D Payment Regulations Impacting Independent Pharmacies

Key regulations impacting independent pharmacy payments from Medicare Part D plans include the establishment of maximum allowable costs (MAC) for drugs, the use of payment models based on Average Sales Price (ASP) plus a percentage, and the complex processes involved in prior authorization and step therapy. These regulations can significantly affect reimbursement rates, leaving independent pharmacies with lower profit margins compared to larger chains.

For example, the MAC pricing system, while intended to control costs, can sometimes lead to reimbursement rates that are below the actual acquisition cost for independent pharmacies, forcing them to absorb losses. Furthermore, the administrative burden associated with prior authorization requests can consume valuable staff time and resources, impacting profitability.

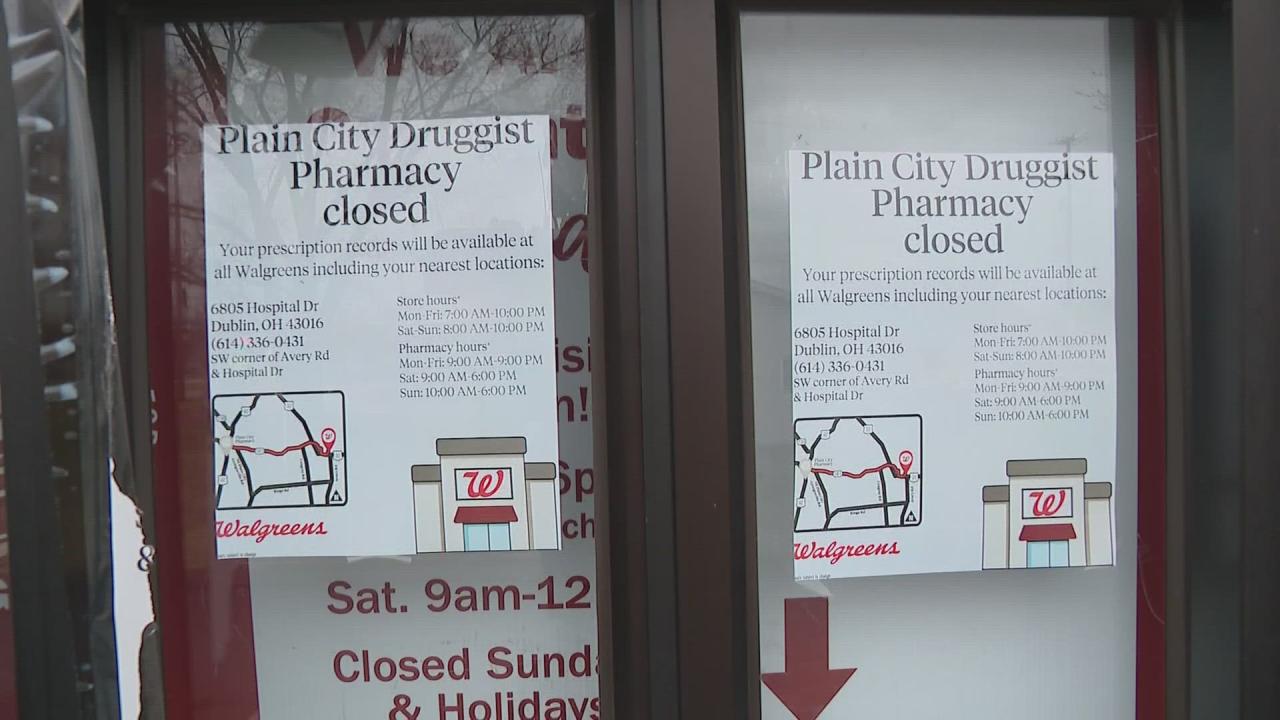

Implications of CMS Policies on Independent Pharmacy Financial Viability

The cumulative effect of these CMS policies can significantly impact the financial viability of independent pharmacies. Many independent pharmacies operate on thin profit margins, and the constant pressure of decreasing reimbursement rates, coupled with increasing administrative burdens, can make it difficult to remain profitable. This can lead to pharmacy closures, reduced access to medications in underserved communities, and a shift towards larger chain pharmacies that possess greater resources to manage the complexities of the system.

The lack of sufficient reimbursement can hinder investment in technology upgrades, staff training, and patient care initiatives, further compromising the quality of services offered.

CMS Initiatives Supporting Independent Pharmacies

While many CMS policies present challenges, there are also initiatives aimed at supporting independent pharmacies. For example, CMS has explored alternative payment models that aim to provide more equitable reimbursement for independent pharmacies. These models often focus on rewarding pharmacies for providing comprehensive medication management services, rather than simply dispensing medications. Additionally, CMS has implemented programs to improve data transparency and reduce administrative burdens, helping independent pharmacies better understand and navigate the reimbursement system.

However, the effectiveness and reach of these initiatives are still being evaluated, and further improvements are needed to adequately address the challenges faced by independent pharmacies.

Negotiating with PBMs

Negotiating with Pharmacy Benefit Managers (PBMs) can be a daunting task for independent pharmacies, but securing favorable contracts is crucial for survival and profitability. Understanding PBM tactics, developing strong negotiation strategies, and knowing your leverage are key to achieving fair reimbursement rates. This section Artikels a practical approach to navigating the complexities of PBM negotiations.

Independent pharmacies often find themselves at a disadvantage when negotiating with large, powerful PBMs. However, a well-prepared and strategic approach can significantly improve your chances of securing a better deal. This involves thorough preparation, understanding your pharmacy’s strengths, and knowing your bottom line.

Strategies for Effective Negotiation

Effective negotiation requires a multifaceted approach. It’s not simply about demanding higher rates; it’s about presenting a compelling case for your value and demonstrating your pharmacy’s commitment to patient care. This involves data analysis, showcasing your performance metrics, and understanding the PBM’s needs and priorities. For example, highlighting your high patient satisfaction scores or your expertise in managing complex medications can demonstrate your value beyond simply dispensing prescriptions.

Step-by-Step Guide to Negotiating Favorable Reimbursement Rates

- Preparation: Analyze your current reimbursement rates, compare them to industry benchmarks, and identify areas where you’re underpaid. Gather data on your pharmacy’s performance, including patient satisfaction, medication adherence rates, and cost-saving initiatives.

- Define Objectives: Clearly state your desired reimbursement rates and other contract terms. Be realistic, basing your requests on data and market comparisons. For example, you might aim for a rate increase of X% based on your performance exceeding Y% of other pharmacies in your region.

- Identify Leverage: Determine your strengths. Do you have a strong patient base? Are you a leader in providing specialized services? Do you have a strong reputation in the community? Highlight these strengths during negotiations.

- Negotiation: Present your case clearly and concisely. Support your requests with data and evidence. Be prepared to compromise, but don’t undervalue your services. Negotiate multiple contract terms simultaneously to create a balanced deal.

- Documentation: Thoroughly document all aspects of the negotiation, including agreements reached and any outstanding issues. This will protect your interests and prevent misunderstandings later.

Key Factors to Consider When Evaluating PBM Contracts

Before signing any PBM contract, carefully review all terms and conditions. Pay close attention to reimbursement rates, DIR fees (Direct and Indirect Remuneration), clawbacks, and other potential deductions. Consider the contract’s length, renewal terms, and termination clauses. Compare offers from multiple PBMs to ensure you’re getting the best possible deal. A detailed cost-benefit analysis will help you make an informed decision.

Common PBM Negotiation Tactics and Counter-Strategies, Cms independent pharmacy pay pbms plans

PBMs often employ various tactics to minimize their reimbursement costs. Understanding these tactics and having counter-strategies is essential for independent pharmacies.

| PBM Tactic | Independent Pharmacy Counter-Strategy |

|---|---|

| Low reimbursement rates | Present data demonstrating your value, compare rates to market benchmarks, and highlight your performance metrics. |

| Complex contract language | Seek legal counsel to review the contract and ensure you understand all terms and conditions. |

| DIR fees and clawbacks | Negotiate for transparent and predictable fee structures, and advocate for PBM reforms to limit these practices. |

| Limited network participation | Assess the potential impact on your patient base and negotiate for favorable terms if you’re considering network participation. |

| Short contract terms | Negotiate for longer contract terms to provide stability and predictability. |

The Impact of PBM Plans on Patient Access to Medications

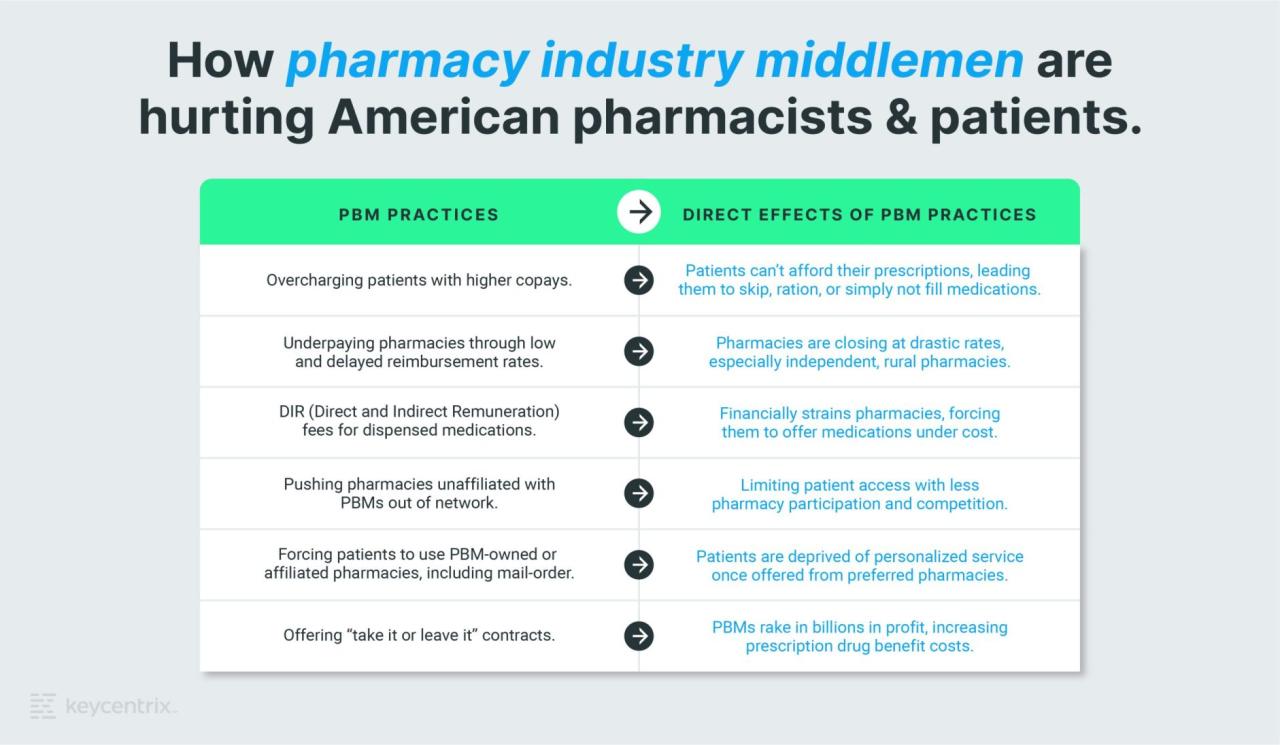

Pharmacy Benefit Managers (PBMs) significantly influence patient access to medications, often in ways that negatively impact patients and independent pharmacies. Their control over formularies, prior authorizations, and reimbursement rates creates a complex system that can limit patient choice and increase healthcare costs. This section will explore how these PBM practices affect patients’ ability to obtain the medications they need.

Formulary Restrictions and Patient Access at Independent Pharmacies

PBMs maintain formularies—lists of covered medications—that dictate which drugs are reimbursed at what cost. These formularies often exclude preferred medications due to cost considerations or exclusive contracts with specific pharmaceutical manufacturers. This exclusion restricts patient choice, forcing them to use less-preferred or more expensive alternatives, or to navigate the complexities of obtaining exceptions. Independent pharmacies, often lacking the negotiating power of large chains, may find themselves unable to stock the medications their patients need, leading to patients seeking care elsewhere, potentially compromising their continuity of care.

For example, a patient with a specific medication need might find their prescribed drug is not on the PBM formulary, forcing them to switch to a different medication, which may be less effective or have more side effects. The inconvenience of finding a pharmacy that carries the necessary medication also places a burden on the patient.

Prior Authorizations and Step Therapy as Barriers to Timely Medication Access

Prior authorizations (PAs) require patients’ doctors to justify the necessity of a particular medication before the PBM will approve coverage. Step therapy mandates patients try less expensive medications before accessing more costly ones, even if the more expensive option is clinically more appropriate. These processes delay access to necessary medications, potentially exacerbating existing health conditions and creating significant administrative burdens for both physicians and patients.

A patient requiring a specific medication for a chronic condition might experience weeks of delay while awaiting prior authorization, during which time their condition could worsen. Similarly, a patient whose condition doesn’t respond to a less expensive medication might suffer unnecessarily while undergoing step therapy before being allowed to try a more effective, though costlier, option.

Increased Patient Costs and Decreased Medication Adherence due to PBM Practices

PBM practices frequently result in higher out-of-pocket costs for patients. High co-pays, coupled with formulary restrictions and prior authorizations, can make medications unaffordable, leading to decreased medication adherence. This, in turn, can worsen health outcomes and increase healthcare costs in the long run. For instance, a patient facing a high co-pay might skip doses or forgo refills entirely, potentially leading to complications and hospitalizations.

Understanding how CMS independent pharmacy pay and PBMs interact is crucial, especially when considering the broader healthcare landscape. The recent new york state nurse strike NYSNA Montefiore Mount Sinai highlights the pressures on healthcare systems, affecting everything from staffing to medication access, which in turn impacts how independent pharmacies negotiate reimbursement rates with PBMs and CMS.

The cumulative effect of these factors significantly impacts patient well-being and the overall cost-effectiveness of healthcare.

Comparison of Patient Cost-Sharing Structures Across Different PBM Plans

The cost-sharing structures vary widely among different PBM plans, making it difficult for patients to compare and choose the most affordable option. The following table illustrates this variability, using hypothetical examples for clarity:

| PBM Plan | Generic Drug Copay | Brand Name Drug Copay | Prior Authorization Fee |

|---|---|---|---|

| Plan A | $10 | $50 | $25 (per authorization) |

| Plan B | $15 | $75 | $0 |

| Plan C | $5 | $100 | $10 (per authorization) |

| Plan D | $20 | $30 (with step therapy) | $0 |

Strategies for Independent Pharmacy Sustainability

The independent pharmacy landscape is undeniably challenging, squeezed between powerful PBMs and the ever-increasing demands of healthcare. However, survival and even thriving are achievable with strategic planning and a commitment to innovation. This section explores key strategies for independent pharmacies to not only withstand PBM pressures but also flourish in the modern healthcare market.

Maintaining Profitability Amidst PBM Pressures

Profitability hinges on optimizing revenue and controlling costs. Negotiating favorable contracts with PBMs is crucial, but it’s rarely a one-size-fits-all solution. Independent pharmacies must leverage their strengths—personalized service, patient relationships, and community ties—to justify higher reimbursement rates. This may involve demonstrating superior medication adherence rates, reduced hospital readmissions among their patients, or providing specialized clinical services that reduce overall healthcare costs.

Data-driven presentations highlighting these benefits can strengthen negotiating positions with PBMs. Furthermore, focusing on higher-margin medications and services can help offset lower reimbursement rates on others.

Alternative Revenue Streams for Independent Pharmacies

Diversifying revenue is essential for long-term sustainability. Beyond dispensing medications, independent pharmacies can offer a range of services. This could include medication therapy management (MTM) services, which are often reimbursed by insurance providers and provide an additional revenue stream while improving patient care. Offering immunizations (flu shots, shingles vaccines) is another proven strategy, generating revenue while enhancing community health.

Point-of-care testing, such as cholesterol screenings or blood glucose monitoring, can also attract patients and provide additional revenue opportunities. Finally, compounding medications to meet specific patient needs is a specialized service that can command higher prices and attract a niche clientele. A well-stocked selection of over-the-counter (OTC) products and health and wellness items also contributes to overall profitability.

Enhancing Patient Loyalty and Engagement

Patient loyalty is the bedrock of an independent pharmacy’s success. Personalized service, going beyond simple medication dispensing, is key. Building strong relationships with patients through proactive communication, personalized medication counseling, and remembering patient details fosters trust and loyalty. Implementing a loyalty program with rewards for repeat business or referrals can also be effective. Utilizing technology, such as mobile apps for medication reminders or refill requests, can improve patient engagement and convenience.

Active participation in community events and sponsoring local initiatives strengthens community ties and enhances the pharmacy’s visibility. Regular patient surveys can provide valuable feedback for improving services and addressing concerns.

Effective Operational Cost Management

Efficient operational cost management is vital for maintaining profitability. This involves optimizing inventory management to minimize waste and spoilage. Negotiating favorable contracts with suppliers can significantly reduce purchasing costs. Streamlining administrative processes, such as utilizing pharmacy management software for automation and efficient workflow, can reduce labor costs. Regular maintenance of equipment and proactive measures to prevent breakdowns can reduce unexpected repair costs.

Energy-efficient practices, such as utilizing LED lighting and optimizing heating and cooling systems, can contribute to long-term cost savings. Careful monitoring of all expenses and regular review of financial statements allow for proactive adjustments and identification of areas for improvement.

Technological Solutions for Independent Pharmacies

Source: tegna-media.com

Navigating the complexities of CMS independent pharmacy pay and PBM plans is tough enough, but it’s getting even harder. Finding qualified staff to handle these intricate reimbursement processes is a major challenge, as highlighted in this article about the healthcare industry’s talent acquisition struggles: healthcare executives say talent acquisition labor shortages business risk. This labor shortage directly impacts pharmacies’ ability to effectively manage their PBM contracts and maximize reimbursements, making the already difficult task even more demanding.

The independent pharmacy landscape is rapidly evolving, and embracing technology is no longer a luxury but a necessity for survival and growth. Modern technology offers independent pharmacies the opportunity to boost efficiency, enhance patient care, and ultimately improve profitability in a fiercely competitive market. By leveraging the right tools, independent pharmacies can streamline operations, reduce administrative burdens, and improve patient outcomes.

Pharmacy Management Software

Efficient pharmacy management software is crucial for streamlining daily operations. These systems consolidate various tasks into a single platform, reducing manual data entry and minimizing errors. Features often include inventory management, prescription processing, billing and claims management, patient profile management, and reporting tools. Examples of such software include PioneerRx, RxOne, and QS/1. These platforms often integrate with other technologies, creating a seamless workflow from prescription intake to dispensing and billing.

The use of such software significantly reduces the time spent on administrative tasks, freeing up staff to focus on patient interaction and medication counseling. The resulting increase in efficiency directly translates to improved profitability and better patient care.

Electronic Prescribing and Medication Adherence Programs

Implementing electronic prescribing (e-prescribing) significantly reduces medication errors, improves prescription turnaround time, and enhances patient safety. E-prescribing eliminates the potential for illegible handwriting or transcription errors. Furthermore, integrating e-prescribing with medication adherence programs allows for proactive monitoring of patient medication usage. These programs often involve automated refill reminders, patient communication tools, and even medication synchronization to simplify medication management for patients.

The benefits are clear: improved patient outcomes, reduced hospital readmissions, and a strengthened patient-pharmacist relationship, leading to increased patient loyalty and revenue for the pharmacy.

Data Analytics in Pharmacy Operations and Patient Care

Data analytics provides independent pharmacies with invaluable insights into their operations and patient needs. By analyzing prescription data, inventory levels, patient demographics, and other relevant information, pharmacies can identify trends, optimize inventory management, personalize patient care, and improve operational efficiency. For example, analyzing patient data can reveal common medication combinations or identify patients at high risk for medication non-adherence, allowing for targeted interventions.

Analyzing sales data can help optimize inventory levels, reducing waste and maximizing profitability. This data-driven approach allows pharmacies to make informed decisions, improve patient outcomes, and enhance their overall business performance.

The Future of Independent Pharmacies

The future of independent pharmacies is a complex landscape, interwoven with challenges and opportunities. The industry faces significant headwinds from larger corporate entities and evolving healthcare models, but also possesses unique strengths that, if leveraged effectively, can ensure its continued relevance and success. Navigating this terrain requires a clear understanding of the forces at play and a proactive approach to adaptation and advocacy.

Challenges Facing Independent Pharmacies

Independent pharmacies are increasingly squeezed by the rising power of Pharmacy Benefit Managers (PBMs) and the trend towards large-scale healthcare consolidation. These forces create significant financial pressures, forcing many independent pharmacies to operate on razor-thin margins. For example, the arbitrary price cuts imposed by PBMs on medications can make it difficult for independent pharmacies to remain profitable, particularly when competing against larger chains with greater negotiating power.

Additionally, the increasing administrative burden associated with insurance reimbursements and electronic health records (EHR) systems places a strain on already limited resources. The difficulty in attracting and retaining qualified pharmacists, particularly in rural areas, further compounds these issues.

The Impact of Healthcare Consolidation

The ongoing consolidation of healthcare providers, including the rise of large hospital systems and pharmacy chains, presents a significant threat to independent pharmacies. These larger entities have greater purchasing power, enabling them to negotiate more favorable contracts with PBMs and secure bulk discounts on medications. This creates an uneven playing field, making it difficult for independent pharmacies to compete on price.

Understanding how CMS independent pharmacy pay works with PBMs is crucial, especially considering the complexities of healthcare negotiations. The recent news about the new york nurse strike deal reached Mount Sinai Montefiore highlights the power of collective bargaining in securing better compensation and working conditions; similarly, independent pharmacies need strong advocacy to ensure fair reimbursement from PBMs within the CMS framework.

Ultimately, both situations underscore the importance of fighting for fair compensation in a complex healthcare system.

Furthermore, the consolidation of healthcare systems often leads to a shift in referral patterns, potentially diverting patients away from independent pharmacies towards those affiliated with larger networks. The result is a decline in patient volume and revenue for independent pharmacies. We can see this effect clearly in rural communities where the closure of local hospitals often precedes the closure of nearby independent pharmacies.

Potential Policy Changes Affecting Independent Pharmacies

Several policy changes at the state and federal levels could significantly impact the future of independent pharmacies. Increased regulation of PBMs, for example, could level the playing field by limiting their ability to engage in practices that harm independent pharmacies. This might include greater transparency in their pricing and rebate structures. Additionally, policies that support the development of direct and alternative payment models for medications could empower independent pharmacies to negotiate more favorable reimbursement rates with insurers.

Conversely, policies that further incentivize the use of mail-order pharmacies or telehealth services could further disadvantage independent pharmacies, reducing patient access to their services. The implementation of value-based care models could also present both challenges and opportunities, requiring independent pharmacies to adapt their business models to demonstrate the value they bring to the healthcare system.

Advocating for Independent Pharmacies

Advocating for policies that support independent pharmacies is crucial for their survival and the preservation of vital healthcare services in communities across the country. Independent pharmacies play a crucial role in providing personalized patient care, medication counseling, and community health services. Their advocacy efforts should focus on promoting legislation that increases transparency and fairness in pharmacy reimbursement, limits the market power of PBMs, and provides financial incentives for independent pharmacies to participate in value-based care models.

Collaboration with other stakeholders, such as patient advocacy groups and healthcare providers, is essential to build a strong and unified voice in support of independent pharmacies. Effective advocacy requires active engagement in the political process, including lobbying efforts and public awareness campaigns to highlight the importance of preserving local, patient-centered pharmacies.

Last Point

Source: substackcdn.com

The fight for fair compensation and patient access is a constant one for independent pharmacies. Understanding the complexities of CMS regulations, PBM contracts, and DIR fees is crucial for survival and thriving. By employing effective negotiation strategies, embracing technological advancements, and advocating for supportive policies, independent pharmacies can not only endure but also flourish, ensuring continued access to vital medications for their communities.

The journey is challenging, but the rewards – both financially and in terms of patient care – are significant.

FAQ Corner

What are DIR fees and why are they so controversial?

DIR fees (Direct and Indirect Remuneration) are fees PBMs charge pharmacies after the initial payment for dispensing medications. They’re controversial because they’re often unpredictable and can significantly reduce a pharmacy’s actual reimbursement, impacting profitability and potentially jeopardizing patient care.

How can I find out which PBMs are the most favorable to work with?

Research is key! Look at independent pharmacy associations and industry publications for reviews and comparisons of PBM contracts. Networking with other pharmacists can also provide valuable insights and recommendations.

What are some alternative revenue streams for independent pharmacies?

Diversifying revenue is crucial. Consider offering medication therapy management services, immunizations, compounding services, and even partnering with local businesses for health-related events or workshops.

What is the role of patient advocacy in this context?

Patient advocacy is vital. Educate your patients about the impact of PBM practices on medication access and affordability. Encourage them to contact their legislators to support policies that protect independent pharmacies.