CVS Retail Pharmacy Pricing Overhaul

CVS Retail Pharmacy Pricing Overhaul: This massive undertaking is shaking up the pharmaceutical world, impacting everything from consumer costs to industry relations. We’re diving deep into the details – from how CVS’s pricing compares to competitors like Walgreens and Walmart, to the potential ripple effects on patients’ access to affordable medications. Get ready for a rollercoaster ride through the complexities of prescription drug pricing!

This isn’t just about numbers on a spreadsheet; it’s about real people and their access to essential healthcare. We’ll explore the potential impacts on consumers with varying insurance coverage, how price changes could affect medication adherence, and the ethical considerations involved in setting medication prices. We’ll also examine how pharmaceutical companies might react, the internal changes CVS will need to make, and the long-term financial implications for the company and its shareholders.

Buckle up, it’s going to be an insightful journey.

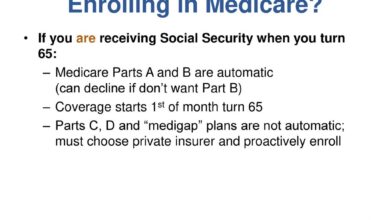

CVS Retail Pharmacy Pricing Strategies

CVS Pharmacy, a giant in the retail pharmacy landscape, employs a complex pricing strategy influenced by various factors to maintain profitability while navigating competitive pressures. Understanding their pricing model is crucial for both consumers and industry analysts.

CVS Retail Pharmacy Pricing Structure

CVS’s pricing structure is multifaceted and isn’t readily transparent to the average consumer. It incorporates a combination of factors, including the cost of goods (the actual medication), dispensing fees (covering the pharmacy’s operational costs for filling prescriptions), and insurance reimbursements (payments from insurance companies). The final price a customer pays depends heavily on their insurance coverage, the specific medication, and any applicable discounts or coupons.

For non-prescription items, CVS utilizes a markup system similar to other retailers, factoring in wholesale costs and desired profit margins. Prices fluctuate based on market demand and promotional periods.

Key Factors Influencing CVS Pricing

Three key factors significantly influence CVS’s pricing decisions. First, the intense competition from other major players like Walgreens and Walmart necessitates strategic pricing to remain competitive. Second, the fluctuating costs of pharmaceuticals themselves directly impact the final price. Third, the complexities of insurance reimbursements play a major role, as the negotiated rates with various insurance providers influence how much CVS receives for each prescription filled.

These reimbursements are often lower than the actual cost of the medication, forcing CVS to adjust pricing to compensate for the difference.

Comparison of CVS Pricing with Competitors

To illustrate CVS’s pricing relative to its competitors, let’s compare prices for two common medications, hypothetically labeled Medication X and Medication Y. These prices are estimates based on publicly available information and may vary by location and insurance plan. Remember that actual prices can fluctuate significantly.

| Competitor | Medication X Price | Medication Y Price | Average Price Difference |

|---|---|---|---|

| CVS | $50 | $30 | – |

| Walgreens | $55 | $35 | +$5 (Medication X), +$5 (Medication Y) |

| Walmart | $45 | $25 | -$5 (Medication X), -$5 (Medication Y) |

Impact of the Overhaul on Consumers

CVS’s retail pharmacy pricing overhaul will undoubtedly have a significant impact on consumers, affecting their out-of-pocket costs and potentially their medication adherence. The changes, while aiming to improve affordability and transparency, will likely create a ripple effect across different patient populations and purchasing behaviors. Understanding these potential impacts is crucial for both consumers and CVS itself.The overhaul’s effect on consumers will vary considerably depending on their insurance coverage.

Impact on Patients with Different Insurance Coverage Levels

Patients with comprehensive insurance plans might see minimal changes in their out-of-pocket costs, as their insurance companies will likely negotiate prices with CVS. However, those with high-deductible plans or limited coverage could experience significant price increases, especially for brand-name medications. Conversely, patients without insurance will be directly exposed to the new pricing structure, potentially facing substantial increases if the overhaul doesn’t lead to overall lower prices.

For example, a patient with a high-deductible health plan might see their cost for a monthly prescription jump from $50 to $100, while a patient with no insurance could see a similar increase from $75 to $150. This disparity highlights the importance of considering the diverse landscape of insurance coverage in assessing the impact of the overhaul.

Effects on Consumer Purchasing Habits and Medication Adherence

Price changes, particularly increases, can significantly influence consumer purchasing habits. Patients might switch to generic medications if available and affordable, opt for less frequent prescriptions to manage costs, or delay filling prescriptions altogether. This last point is particularly concerning, as medication non-adherence can lead to worsening health conditions and increased healthcare costs in the long run. For example, a patient struggling to afford their high blood pressure medication might skip doses, leading to potentially serious health complications.

CVS’s retail pharmacy pricing overhaul is a huge deal, impacting millions. It got me thinking about healthcare costs in general, and how the recent new york nurse strike deal reached Mount Sinai Montefiore highlights the struggles faced by healthcare workers fighting for fair wages and better patient care. Ultimately, both situations underscore the need for systemic change to make healthcare more affordable and accessible for everyone.

CVS needs to consider strategies to mitigate these risks, such as offering patient assistance programs or expanding access to affordable generic alternatives.

Potential Scenarios for Consumer Reaction to Price Changes

The consumer response to the pricing overhaul will likely be diverse and depend on the specific price adjustments. Several scenarios are possible:

Here are some potential scenarios:

- Scenario 1: Price Increases Leading to Negative Feedback and Reduced Loyalty: Significant price increases, especially for essential medications, could trigger widespread negative feedback, potentially leading to consumers switching to other pharmacies or exploring alternative cost-saving strategies. This could negatively impact CVS’s market share and reputation.

- Scenario 2: Price Decreases Resulting in Increased Customer Satisfaction and Sales: If the overhaul leads to lower prices for many commonly prescribed medications, CVS could experience a surge in customer satisfaction and increased sales volume. This could attract new customers and solidify its position as a preferred pharmacy.

- Scenario 3: Minimal Price Changes Resulting in Indifference or Limited Impact: If the price changes are relatively minor, consumer reaction might be muted, with limited impact on purchasing habits or loyalty. This outcome would suggest that the overhaul did not significantly alter the overall cost structure for most consumers.

- Scenario 4: Targeted Price Reductions Leading to Increased Usage of Specific Medications: CVS might choose to strategically reduce prices on certain medications to encourage their use. This could be particularly effective for medications with public health benefits, such as those for chronic diseases. This targeted approach could be more effective than broad-based price changes.

Pharmaceutical Industry Response to the Overhaul

Source: aussiedlerbote.de

CVS’s retail pharmacy pricing overhaul will undoubtedly trigger a multifaceted response from pharmaceutical companies. The changes, depending on their specifics, could significantly impact manufacturers’ revenue streams and market share, forcing them to adapt their strategies to maintain profitability and competitiveness. The industry’s response will likely involve a complex interplay of pricing adjustments, negotiation tactics, and potentially even lobbying efforts.Pharmaceutical companies will need to carefully analyze the implications of CVS’s new pricing strategies on their individual product portfolios.

The impact will vary greatly depending on factors such as the drug’s therapeutic class, market competition, and the drug’s position in its lifecycle. Some companies may find their margins significantly squeezed, while others might see only minor adjustments necessary.

Potential Pricing Model Adjustments by Pharmaceutical Companies

The most direct response from pharmaceutical companies will likely involve adjustments to their pricing models. This could take several forms. Some companies might choose to offer rebates or discounts to CVS to maintain their market presence on CVS shelves. Others might focus on developing alternative pricing structures, such as value-based pricing, which ties the price of a drug to its clinical outcomes.

For example, a company might offer a lower price per dose for a drug if it demonstrates superior efficacy compared to competitors in a head-to-head clinical trial. This strategy shifts the focus from price alone to the overall value proposition. In contrast, some companies may decide to prioritize sales through other retail pharmacy chains or increase direct-to-consumer marketing efforts to bypass the impact of CVS’s price changes.

This could involve strengthening their online presence and offering home delivery services.

Strategies for CVS to Mitigate Negative Reactions from Pharmaceutical Suppliers

CVS needs proactive strategies to mitigate potential negative reactions from pharmaceutical suppliers. Open communication and transparency are crucial. CVS should clearly communicate the rationale behind its pricing overhaul, emphasizing the benefits to consumers and the overall healthcare system. They should also offer incentives for pharmaceutical companies to participate in the new pricing model, potentially including guaranteed volume commitments or preferential shelf placement for cooperating suppliers.

CVS’s retail pharmacy pricing overhaul is a huge undertaking, impacting everything from medication costs to staffing needs. The challenge is amplified by the current healthcare landscape, where, as this article highlights, healthcare executives say talent acquisition labor shortages are a major business risk. This shortage directly affects CVS’s ability to implement the pricing changes effectively, potentially leading to delays and further complications in their ambitious plan.

Furthermore, CVS could explore establishing long-term contracts with key suppliers to ensure a stable supply of essential medications and foster a collaborative relationship rather than an adversarial one. This would involve negotiating mutually beneficial agreements that account for the needs of both parties, potentially involving tiered pricing based on volume or market share. Building strong, collaborative relationships with pharmaceutical companies will be essential to ensure a smooth transition and avoid disruptions in medication availability for consumers.

Internal CVS Operational Changes

Source: wsj.net

The CVS retail pharmacy pricing overhaul represents a significant undertaking, impacting not only customers and the pharmaceutical industry but also the internal operations of CVS itself. A smooth transition requires careful planning, clear communication, and proactive mitigation of potential challenges. This section will delve into the internal aspects of this transformation, exploring communication strategies, operational hurdles, and departmental impacts.

Successfully implementing the new pricing system hinges on effective internal communication. Transparency and clear explanations are crucial to maintain employee morale and ensure a smooth transition.

CVS’s retail pharmacy pricing overhaul is a huge deal, impacting millions. It makes you wonder about the broader healthcare landscape and the pressures on costs, especially considering the recent new york state nurse strike montefiore richmond university deals , which highlighted the struggle for fair wages and better patient care. Ultimately, both situations point to a need for systemic change in how we approach healthcare affordability and worker compensation.

Internal Communication Plan for CVS Employees

A multi-pronged approach is needed to effectively communicate the pricing overhaul to CVS employees. This plan should leverage various communication channels to reach all staff, regardless of their role or location. Initial announcements should come from senior leadership, highlighting the reasons behind the changes and emphasizing the long-term benefits for the company and its customers. Follow-up communications should include detailed explanations of the new system, training materials, and opportunities for employees to ask questions and voice concerns.

Regular updates throughout the implementation process will maintain transparency and address evolving issues. The communication should be tailored to specific roles, using easily understandable language and avoiding technical jargon. For example, pharmacists might need detailed information on the new reimbursement calculations, while cashiers might require training on the updated point-of-sale system. The use of multiple channels, including company-wide emails, intranet updates, departmental meetings, and interactive online training modules, ensures that the message reaches everyone effectively.

Potential Operational Challenges During Implementation

The new pricing system will undoubtedly present several operational challenges. One key concern is the potential for system errors during the initial rollout. The complexity of the new pricing algorithms increases the risk of inaccurate pricing, leading to customer dissatisfaction and potential financial losses. Another significant challenge lies in retraining employees on the new system. The learning curve for navigating the updated software and understanding the new pricing calculations might vary across departments, potentially leading to initial inefficiencies and delays in service.

Finally, there’s the potential for increased workload on customer service representatives as they address customer queries and resolve pricing discrepancies. Anticipating these challenges and developing proactive mitigation strategies is crucial for a successful implementation.

Impact of the Overhaul on Various CVS Departments

| Department | Potential Impact | Mitigation Strategy | Projected Timeline |

|---|---|---|---|

| Accounting | Increased workload due to new pricing calculations and reconciliation processes; potential for initial inaccuracies in financial reporting. | Invest in advanced accounting software; provide extensive training to accounting staff; implement robust auditing procedures. | Ongoing, with significant impact in the first 3-6 months. |

| Customer Service | Increased call volume and customer complaints due to initial confusion and potential pricing discrepancies; need for enhanced training on the new pricing system. | Develop comprehensive FAQs and online resources; provide additional customer service training; implement a robust system for handling customer complaints. | Ongoing, with peak impact in the first 2-3 months. |

| Pharmacy Operations | Changes in reimbursement rates; potential for increased workload due to adjustments in prescription processing and billing; need for staff retraining on new software and procedures. | Provide comprehensive training to pharmacists and pharmacy technicians; streamline prescription processing workflows; invest in updated pharmacy management software. | Ongoing, with significant impact in the first 1-2 months. |

| IT | System integration challenges; potential for system downtime during the transition; need for ongoing system maintenance and support. | Thorough testing of the new system before rollout; establish a robust system monitoring and support infrastructure; plan for potential system outages and implement recovery strategies. | Ongoing, with significant impact during the initial implementation phase. |

Long-Term Financial Implications

The CVS pharmacy pricing overhaul presents a complex picture for long-term financial health. While aiming to increase customer loyalty and market share, the strategy also carries inherent risks, including potential short-term revenue dips and the need for significant operational adjustments. The ultimate success hinges on a multitude of factors, from consumer response to competitor actions and the overall effectiveness of the implemented changes.The potential long-term financial benefits stem from a projected increase in prescription volume driven by enhanced affordability and competitive pricing.

This could translate to higher revenue streams, especially if the overhaul successfully attracts new customers from competing pharmacies. Furthermore, improved customer loyalty could lead to increased sales of other CVS products and services, boosting overall profitability. However, the drawbacks are equally significant. Lower profit margins on individual prescriptions, coupled with the substantial investment required for the overhaul’s implementation and ongoing maintenance, could initially strain profitability.

The risk of losing high-margin customers unwilling to accept the new pricing structure is also a considerable concern.

CVS Stock Price Projection Following Implementation

Following the implementation of the new pricing strategy, a hypothetical scenario could unfold. Initially, we might see a dip in CVS stock price as investors react to the potential for reduced short-term profits. This is particularly true if the market interprets the price cuts as a sign of weakening profitability. However, if the strategy successfully attracts a significant influx of new customers and prescription volume increases substantially, investor confidence could rebound.

A successful outcome could be mirrored by the experience of other companies that initially saw stock dips followed by significant growth after successful price adjustments. For example, consider a company like Walmart, which has seen periods of stock fluctuation following major pricing initiatives, but has ultimately experienced long-term growth due to increased market share and customer loyalty. If CVS demonstrates clear evidence of increased market share and revenue growth within a year or two, we could anticipate a significant rise in the stock price, potentially exceeding pre-overhaul levels.

Profit Margin Comparison: Old vs. New Pricing Models

To compare potential profit margins, let’s consider a simplified scenario. Under the old model, assume an average prescription fills profit margin of 15%, with an average prescription cost of $50. This would yield a profit of $7.50 per prescription. The new model, aiming for increased volume, might reduce the profit margin per prescription to 10%. However, if the volume of prescriptions increases by 20% due to the overhaul, then the profit per prescription would be $5 (10% of $50).

Even with a lower margin, the increased volume (a 20% increase means 1.2 x the original volume) results in a total profit of 1.2 x $5 = $6 per prescription. While the per-prescription profit is lower, the overall profit could be higher due to increased volume. This analysis assumes a constant average prescription cost and ignores potential changes in operational costs associated with the overhaul.

In reality, the outcome will depend on the elasticity of demand for prescription drugs, the competitive landscape, and the success of the new pricing strategy in attracting new customers. Furthermore, this simplified model does not account for the potential increase in sales of other CVS products and services that might offset the reduced margins on prescriptions.

Ethical Considerations

CVS’s pricing overhaul presents a complex ethical landscape, particularly concerning the accessibility of essential medications. Balancing the need for profitability with the responsibility of providing affordable healthcare is a tightrope walk, fraught with potential ethical conflicts. The decisions made will impact not only CVS’s bottom line but also the health and well-being of millions.The core ethical dilemma revolves around the tension between maximizing profits and ensuring equitable access to life-saving drugs.

Raising prices, even strategically, can disproportionately affect vulnerable populations, including the elderly, low-income individuals, and those with chronic illnesses who rely on consistent medication. Conversely, maintaining artificially low prices might jeopardize CVS’s financial stability and potentially limit investment in other crucial areas, like improving pharmacy services or expanding access to care in underserved communities.

Access to Affordable Medications

The impact of CVS’s pricing strategies on access to affordable medications is a paramount ethical concern. Raising prices, even slightly, can create significant barriers for patients who are already struggling to afford their prescriptions. This is particularly true for those without adequate health insurance coverage or those relying on government assistance programs. For example, a small price increase on a regularly needed medication could push a low-income patient into a situation where they cannot afford their prescription, leading to potentially serious health consequences.

CVS needs to carefully analyze the impact of its pricing changes on different demographic groups and explore mitigation strategies to minimize negative consequences.

Potential Ethical Conflicts During Implementation, Cvs retail pharmacy pricing overhaul

Implementing a new pricing structure presents numerous potential ethical conflicts. For example, employees may face ethical dilemmas if they are pressured to prioritize sales targets over patient needs. Transparency is key here. CVS must ensure that employees are adequately trained to handle sensitive conversations about medication costs and are empowered to advocate for patients facing financial hardship.

Another potential conflict arises from the possibility of prioritizing higher-margin drugs over more affordable alternatives, potentially leading to accusations of prioritizing profit over patient well-being. This necessitates clear guidelines and robust oversight mechanisms to prevent such conflicts.

Addressing Ethical Concerns

CVS can proactively address potential ethical concerns through several key strategies. First, fostering open communication with patients, employees, and the wider community is vital. This includes actively seeking feedback on the new pricing structure and addressing concerns transparently. Second, implementing a robust patient assistance program that provides financial support to those struggling to afford their medications would demonstrate a commitment to equitable access.

Third, CVS could collaborate with advocacy groups and healthcare organizations to develop strategies to address the affordability challenges faced by vulnerable populations. Finally, regular ethical reviews of pricing decisions should be conducted, involving diverse stakeholders to ensure the long-term ethical sustainability of the company’s pricing policies.

Visual Representation of Price Changes

Source: wsj.net

Understanding the impact of CVS’s pharmacy pricing overhaul requires a clear visual representation of the projected price changes. Effective visualizations can help consumers, pharmaceutical companies, and CVS itself grasp the scale and nature of these adjustments. Two key visuals would be particularly insightful.

Projected Price Changes Across Medication Categories

This graph would employ a bar chart to display projected percentage changes in medication prices after the overhaul. The horizontal axis would represent broad medication categories (e.g., antibiotics, cholesterol medications, diabetes medications, pain relievers). The vertical axis would represent the percentage change in average price for medications within each category, with positive values indicating price increases and negative values indicating price decreases.

Each bar would represent a specific medication category, and its height would correspond to the projected percentage price change. Error bars could be included to represent the uncertainty in the projections, reflecting the inherent variability in drug pricing and market factors. For example, a bar for “antibiotics” might show a -5% change, indicating an average price decrease in this category, while “diabetes medications” might show a +2% change, reflecting a smaller average price increase.

The chart’s title would clearly state the time period covered by the projections (e.g., “Projected Percentage Change in Medication Prices – Year 1 Post-Overhaul”).

Price Comparison for Select Medications Before and After the Overhaul

A comparative bar chart would effectively illustrate price differences for specific, commonly prescribed medications. The horizontal axis would list the names of these selected drugs (e.g., Lipitor, Metformin, Amoxicillin). Two bars would be displayed for each drug: one representing the average price before the overhaul and another representing the projected average price after the overhaul. Different colors could be used to distinguish between the pre- and post-overhaul prices.

For example, a blue bar could represent the pre-overhaul price and an orange bar the post-overhaul price. The vertical axis would represent the price in US dollars. This visualization would allow for a direct comparison of price changes for individual medications, offering a more granular perspective than the category-level graph. The chart would include a clear legend explaining the color-coding and a title indicating the comparison period (e.g., “Comparison of Average Medication Prices: Before and After CVS Pharmacy Pricing Overhaul”).

This visual would make it immediately apparent which drugs experience significant price increases or decreases. For instance, one might see a substantial price reduction for a generic medication, while a brand-name drug might show a minimal change.

Concluding Remarks: Cvs Retail Pharmacy Pricing Overhaul

The CVS Retail Pharmacy Pricing Overhaul is far more than a simple price adjustment; it’s a complex undertaking with far-reaching consequences. From the potential impact on consumer affordability and medication adherence to the responses from pharmaceutical companies and the internal restructuring within CVS, the overhaul presents a fascinating case study in the intersection of business, healthcare, and ethics. The long-term effects remain to be seen, but one thing is clear: this change will reshape the landscape of retail pharmacy pricing for years to come.

Stay tuned for further developments!

Query Resolution

Will this overhaul affect my specific medications?

It’s difficult to say definitively without knowing your specific medications and insurance plan. The impact will vary depending on many factors.

How will CVS communicate these price changes to customers?

CVS will likely utilize multiple channels, including in-store signage, email notifications, and updates to their website and mobile app.

What if I can no longer afford my medications due to the price changes?

CVS may offer patient assistance programs or suggest exploring other options like manufacturer coupons or negotiating with your insurance provider.

What about the impact on CVS employees?

The overhaul may require additional training for employees and adjustments to workflows, potentially leading to temporary challenges during the transition.