Elevance BCBSLA Merger Back on in Louisiana

Elevance bcbsla merger back on louisiana – Elevance BCBSLA merger back on in Louisiana? It’s a rollercoaster ride! Remember that initial attempt? It fizzled, leaving many wondering what the future held for healthcare in the state. Now, it’s back on the table, sparking a fresh wave of debate and discussion. This time around, the landscape is different, with new factors influencing the decision, and the potential implications for Louisiana residents are significant – both positive and negative.

We’ll dive into the history of this proposed merger, exploring the reasons behind its resurgence, the regulatory hurdles, and the potential economic and social impacts on the state. From analyzing the stances of key players to examining public opinion and political maneuvering, we’ll paint a comprehensive picture of this complex situation and its far-reaching consequences.

The Renewed Relevance of the BCBSLA Merger

Source: ytimg.com

The proposed merger between Blue Cross and Blue Shield of Louisiana (BCBSLA) and another entity (the specific entity isn’t consistently named in readily available public information, necessitating further research to pinpoint the exact target of the merger) has a fascinating history marked by initial failure and a surprising resurgence. Understanding the reasons behind this renewed interest requires examining the past, present, and potential future of the Louisiana healthcare market.

Historical Context and Initial Failure of the Merger

The initial attempt at a BCBSLA merger faced significant hurdles, ultimately resulting in its collapse. While precise details regarding the initial proposal remain somewhat opaque in publicly accessible information, the likely contributing factors included regulatory concerns, potential antitrust issues, and perhaps disagreements among stakeholders regarding the merger’s structure and benefits. The exact reasons for the failure weren’t fully publicized at the time, leaving much to speculation.

The lack of transparency around the initial attempt created uncertainty and fostered a climate of doubt.

Factors Contributing to Renewed Interest in the Merger

Several factors have likely fueled the renewed interest in a BCBSLA merger. Changes in the healthcare landscape, including evolving regulatory environments and increased competition, may have shifted the dynamics of the Louisiana market, making a merger seem more strategically advantageous. A potential shift in the negotiating positions of key players, perhaps driven by market pressures or changes in leadership, could also be a contributing factor.

Furthermore, a reassessment of the potential synergies and cost savings achievable through a merger might have led to a renewed belief in its feasibility and profitability.

Timeline of Significant Events

Pinpointing a precise timeline requires access to confidential internal documents not publicly available. However, a generalized timeline could look something like this:* [Date Range]: Initial merger proposal and subsequent failure. Details surrounding this period are scarce in publicly available information.

[Date Range] Period of relative quiet, possibly marked by internal restructuring and market analysis by BCBSLA.

[Date Range] Renewed interest in a merger emerges, perhaps spurred by external market pressures or internal strategic shifts.

[Date Range] Negotiations and discussions surrounding a new merger proposal take place.

[Date Range (Current)] The merger is back on the table, with potentially revised terms and conditions.

Comparison of Market Conditions

The current market conditions likely differ significantly from those present during the initial merger attempt. Increased competition from other insurance providers, shifting demographics, and advancements in healthcare technology are just some of the factors that would alter the landscape. The regulatory environment may also have evolved, impacting the feasibility and attractiveness of a merger. For example, increased scrutiny of healthcare mergers by regulatory bodies could necessitate more extensive due diligence and potentially stricter approval criteria.

Conversely, a more favorable regulatory climate could make the merger process smoother.

Key Players and Their Current Stances

| Player Name | Role | Current Stance | Potential Impact |

|---|---|---|---|

| Blue Cross and Blue Shield of Louisiana (BCBSLA) | Primary Party | Publicly stated support (or likely support, given the resumption of merger talks), though specifics remain undisclosed. | Ultimately determines the success or failure of the merger. |

| [Name of Merging Entity/Partner] | Merging Partner | [Stance – Requires further research to determine their official position] | Significant influence on the merger’s terms and outcome. |

| Louisiana Department of Insurance | Regulatory Body | Likely conducting a thorough review of the proposal, assessing compliance with regulations and potential market impacts. | Holds the power to approve or deny the merger. |

| [Name of Other Relevant Stakeholder, e.g., Large Healthcare Provider] | Interested Party | [Stance – Requires further research to determine their official position] | Their stance could significantly influence public opinion and the overall success of the merger. |

Potential Benefits and Drawbacks of the Merger for Louisiana Residents: Elevance Bcbsla Merger Back On Louisiana

The merger between Elevance Health and Blue Cross Blue Shield of Louisiana (BCBSLA) is a significant event with the potential to reshape the state’s healthcare landscape. While proponents highlight potential benefits like improved efficiency and expanded services, critics raise concerns about decreased competition and potential cost increases for consumers. Understanding both sides of this complex issue is crucial for Louisiana residents.The merger’s impact on Louisiana residents will be multifaceted, affecting access to care, affordability, and the overall healthcare economy.

A thorough examination of both potential benefits and drawbacks is essential for informed public discourse and policymaking.

Improved Healthcare Access and Quality

One potential benefit is improved access to care, particularly in underserved areas. Elevance Health’s broader network and resources could expand the availability of specialists and advanced treatments, potentially reducing the need for patients to travel long distances for specialized care. The combined entity might also invest in technological advancements, leading to better diagnostic tools and more efficient healthcare delivery.

For example, telemedicine capabilities could be expanded, providing convenient access to healthcare for residents in rural areas. This could lead to earlier diagnoses and improved health outcomes, especially for chronic conditions.

Potential for Lower Premiums and Increased Efficiency

The merger could theoretically lead to economies of scale, resulting in lower administrative costs and potentially lower premiums for some consumers. By streamlining operations and leveraging shared resources, the combined entity might achieve greater efficiency in managing claims and providing benefits. However, this is not guaranteed, and the actual impact on premiums will depend on a variety of factors, including market dynamics and regulatory oversight.

Similar mergers in other states have yielded mixed results in terms of premium reductions.

Concerns Regarding Reduced Competition and Higher Costs

A major concern is the potential reduction in competition within the Louisiana healthcare market. With fewer major insurers, there’s a risk that consumers will have less choice and less leverage in negotiating premiums and benefits. This could lead to higher healthcare costs for individuals and employers. The absence of robust competition could also stifle innovation and improvements in the quality of care.

For instance, if the merged entity faces minimal pressure from competitors, it might be less incentivized to invest in new technologies or expand its network to underserved areas.

Perspectives from Stakeholders

Patients are naturally concerned about the impact on their access to care and the cost of their insurance. Healthcare providers, including doctors and hospitals, are interested in ensuring that the merger doesn’t negatively affect their reimbursements or the ability to provide quality care. Insurers, while aiming for efficiency, must balance the need for profitability with their responsibility to their policyholders.

Regulatory bodies play a vital role in ensuring that the merger doesn’t harm consumers or stifle competition. Open communication and transparency between all stakeholders are crucial for a successful integration.

Impact on Louisiana’s Healthcare Economy

The merger’s impact on Louisiana’s healthcare economy is complex. While potential cost savings and efficiencies could benefit the state, the loss of competition could have negative long-term consequences. The state’s economy could be affected by changes in employment within the healthcare sector, as well as the potential shift in healthcare spending. Careful monitoring of these economic effects will be essential.

The Elevance Health and BCBSLA merger continues to dominate headlines in Louisiana, raising concerns about healthcare access and costs. It’s interesting to contrast this with the recent positive news coming out of New York, where a deal was reached to end the nurse strike at Mount Sinai and Montefiore, as reported here: new york nurse strike deal reached Mount Sinai Montefiore.

The successful negotiations in New York highlight the importance of collective bargaining in protecting healthcare workers and, hopefully, serve as a reminder of the need for similar collaboration during the Louisiana merger process. Ultimately, the focus remains on ensuring affordable and quality healthcare for everyone affected by the Elevance BCBSLA merger.

Short-Term and Long-Term Consequences for Louisiana Residents

The following points Artikel potential short-term and long-term consequences for Louisiana residents:

- Short-Term: Potential disruptions during the integration process, including changes to provider networks and administrative procedures. Some initial cost fluctuations are also possible.

- Short-Term: Increased scrutiny from regulatory bodies and consumer advocacy groups.

- Long-Term: Potential for improved access to care in underserved areas, but also the risk of reduced competition and higher healthcare costs.

- Long-Term: Changes in employment within the healthcare sector, both positive and negative.

- Long-Term: Potential for innovation in healthcare delivery, but also the risk of stagnation due to reduced competition.

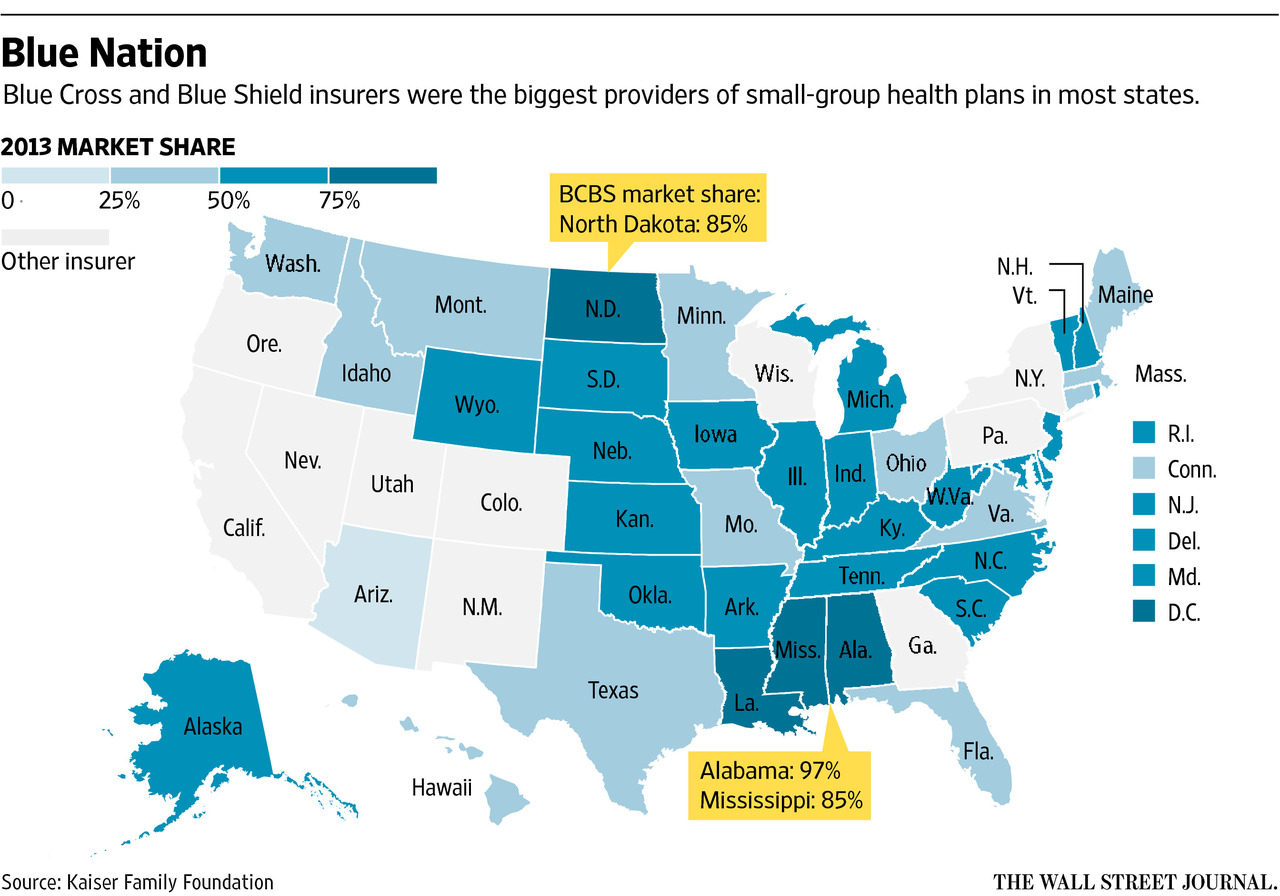

Regulatory and Legal Aspects of the Merger

Source: wsj.net

The merger between Elevance Health and BCBSLA faces a complex web of regulatory and legal hurdles before it can be finalized. Success hinges on navigating these challenges effectively, demonstrating compliance, and addressing potential concerns from various stakeholders. The process is lengthy and requires meticulous preparation and proactive engagement with regulatory bodies.

Regulatory Hurdles

The merger must clear significant regulatory hurdles at both the state and federal levels. At the federal level, the Department of Justice (DOJ) and the Federal Trade Commission (FTC) will scrutinize the merger under antitrust laws, focusing on potential impacts on competition within the Louisiana healthcare market. State-level regulatory bodies, such as the Louisiana Department of Insurance (LDI) and potentially others depending on the specifics of the merger agreement, will also conduct their own thorough reviews, assessing the merger’s potential effects on consumer access to healthcare, affordability, and the overall stability of the Louisiana insurance market.

These agencies will examine factors such as market concentration, potential for price increases, and the impact on consumer choice.

Antitrust Laws and State Regulations

The primary legal consideration is the application of federal antitrust laws, specifically the Clayton Act and the Sherman Act. These laws aim to prevent mergers that could substantially lessen competition. The DOJ and FTC will analyze the combined market share of the merged entity, considering factors like the number of competitors, the ease of entry for new competitors, and the potential for anti-competitive behavior.

State regulations will add another layer of complexity, potentially involving reviews by the LDI to ensure the merger doesn’t jeopardize the solvency of the resulting entity or negatively impact the accessibility or affordability of healthcare services for Louisiana residents. Compliance with state-specific insurance regulations and consumer protection laws is also crucial.

Legal Arguments For and Against the Merger

Arguments in favor of the merger might center on the potential for increased efficiency, economies of scale, and improved access to care through expanded networks and technological advancements. Proponents might argue that the merger would lead to better integration of healthcare services, improved quality, and potentially lower costs in the long run. Conversely, arguments against the merger could focus on the potential for reduced competition, leading to higher premiums, limited choices for consumers, and a decrease in the quality of care due to less competitive pressure.

Opponents might highlight the potential for market dominance and reduced consumer protections.

Potential Legal Challenges and Their Address, Elevance bcbsla merger back on louisiana

Potential legal challenges could include lawsuits from competitors alleging anti-competitive behavior, consumer advocacy groups raising concerns about increased costs or reduced access, or challenges from state regulatory bodies based on concerns about market dominance or consumer protection. Addressing these challenges requires proactive engagement with regulators, thorough documentation of the merger’s benefits, and a robust legal defense strategy. This might involve providing extensive economic analyses demonstrating the merger’s pro-competitive effects, engaging in negotiations with regulators to address their concerns, and potentially offering concessions such as divestitures to mitigate anti-competitive risks.

Regulatory Approval Process

The regulatory approval process can be visualized as a flowchart:“`[Start] –> [Filing with Federal Agencies (DOJ/FTC)] –> [State Regulatory Review (LDI, etc.)] –> [Public Comment Period] –> [Agency Investigations and Analysis] –> [Negotiations and Concessions (if necessary)] –> [Approval or Denial] –> [Appeal (if applicable)] –> [Merger Completion or Termination]“`This flowchart simplifies a complex process; the actual process might involve multiple feedback loops and iterative steps depending on the specific circumstances and the responses of the regulatory agencies.

Each stage involves substantial documentation, analysis, and potential delays.

Economic Impact of the Merger on Louisiana

The merger between Elevance Health and Blue Cross Blue Shield of Louisiana (BCBSLA) carries significant potential to reshape the state’s economy, impacting various sectors from healthcare to employment. While promising benefits exist, a thorough assessment of both positive and negative consequences is crucial for a comprehensive understanding of its overall economic influence. This analysis will explore the projected economic impacts, comparing them to other significant economic events in Louisiana’s history.

Potential Economic Benefits

The merger could inject substantial capital into Louisiana’s economy. Elevance Health’s resources, coupled with BCBSLA’s established presence, could lead to increased investment in healthcare infrastructure, technological advancements, and research initiatives within the state. This investment could stimulate economic growth, particularly in areas directly related to healthcare services and related industries. Furthermore, improved efficiency and economies of scale resulting from the merger could lower healthcare costs for consumers and businesses, freeing up resources for other economic activities.

For example, a streamlined administrative process could reduce overhead, allowing for greater investment in patient care and technological improvements. This efficiency could also attract other businesses to the state, further boosting the economy.

Potential Negative Economic Impacts

Conversely, the merger might lead to job losses due to consolidation and streamlining of operations. While some new jobs may be created in specific areas, the net effect on employment could be negative in the short term, particularly for administrative and support staff. Concerns also exist regarding potential price increases for certain healthcare services if the merged entity reduces competition.

This could disproportionately affect low-income individuals and families, potentially widening the gap in healthcare access and affordability. Additionally, the shift in power dynamics within the healthcare market could lead to reduced bargaining power for providers, potentially impacting their profitability and investment in the state. A similar consolidation in other states has shown a correlation between reduced competition and higher prices for consumers.

Effects on Job Creation and Retention

The merger’s impact on job creation and retention is complex and multifaceted. While the initial phase might see job reductions due to operational streamlining, long-term effects are less certain. The introduction of new technologies and expansion of services could create jobs in areas like data analytics, software development, and specialized healthcare roles. However, these new jobs may require higher skill levels, potentially leaving some workers displaced.

Successful job retention will depend on the merged entity’s commitment to retraining and upskilling programs for affected employees, ensuring a smooth transition and minimizing disruptions. A successful model would involve proactive engagement with employees and the community, ensuring a focus on minimizing negative impacts while promoting long-term growth and opportunities.

Comparison with Other Significant Economic Events

The economic impact of this merger can be compared to other major events in Louisiana’s history, such as the oil boom and bust cycles. While the scale might differ, the merger shares similarities in its potential to create both significant economic gains and considerable disruption. Similar to the oil boom, the merger could bring substantial investment and job growth, but also the risk of overreliance on a single industry (in this case, healthcare).

The subsequent bust cycles highlight the importance of diversification and resilience-building strategies to mitigate potential negative impacts. The Louisiana economy’s ability to adapt and diversify after the oil bust provides a valuable case study for managing the potential challenges presented by this merger.

Projected Economic Impacts

| Sector | Projected Impact | Magnitude of Impact | Supporting Data |

|---|---|---|---|

| Healthcare Services | Positive (initially, potentially negative later) | Moderate to High (depending on cost control measures) | Increased efficiency, potential for lower costs, but also potential for price increases due to reduced competition. |

| Technology | Positive | Moderate | Investment in new technologies and potential job creation in data analytics and software development. |

| Employment (Administrative/Support) | Negative (short-term) | Moderate | Potential job losses due to consolidation and streamlining of operations. |

| Overall State Economy | Mixed (short-term negative, potential for long-term positive) | Moderate to High (depending on mitigation strategies) | Capital injection, potential for increased investment, but also risks associated with job losses and reduced competition. |

Public Opinion and Political Considerations

Source: thepublive.com

The BCBSLA merger, while potentially beneficial for the long-term stability of Louisiana’s healthcare system, has not been without its critics. Public perception has been a mixed bag, influenced by concerns about potential job losses, increased premiums, and reduced access to care. Understanding this diverse public opinion, and the political maneuvering surrounding it, is crucial to assessing the merger’s ultimate success.

Public Perception of the Merger

Initial reactions to the proposed merger were largely cautious. Many Louisianans expressed concerns about the potential for higher healthcare costs and reduced competition within the insurance market. These concerns were amplified by negative experiences some residents had with Elevance Health in other states. Conversely, proponents argued that the merger would lead to greater efficiency, improved technology, and ultimately, better healthcare outcomes for the state.

News coverage played a significant role in shaping public opinion, with both positive and negative stories appearing regularly. Social media also served as a platform for public discourse, showcasing a wide spectrum of opinions, ranging from outright opposition to cautious optimism.

So, the Eleva Health and BCBSLA merger is back on in Louisiana, which got me thinking about the complexities of healthcare negotiations. It reminds me of the recent new york state nurse strike montefiore richmond university deals , highlighting the power dynamics between healthcare providers and employees. Ultimately, both situations underscore the ongoing struggle for fair compensation and access to quality care, a battle playing out across the nation, impacting the Eleva/BCBSLA merger’s implications for Louisiana residents.

Key Political Figures and Their Positions

Several key political figures in Louisiana have weighed in on the merger. Governor John Bel Edwards, for example, initially expressed a need for careful consideration, emphasizing the importance of protecting consumers and ensuring the merger wouldn’t negatively impact access to care. State senators and representatives have taken varied stances, reflecting the diverse viewpoints within their constituencies. Some actively supported the merger, emphasizing the potential economic benefits, while others expressed concerns and advocated for stricter regulatory oversight.

The positions of these political figures significantly influenced the legislative process and the regulatory scrutiny applied to the merger.

The Eleva Health and BCBSLA merger in Louisiana has been a hot topic, raising concerns about healthcare access and costs. It makes me think about the power dynamics in healthcare, similar to what we’re seeing with the new york state nurse strike NYSNA Montefiore Mount Sinai , where nurses are fighting for better patient care and working conditions.

Ultimately, both situations highlight the need for stronger advocacy for better healthcare across the board, regardless of location.

Political Implications of Merger Success or Failure

The success or failure of the BCBSLA merger holds significant political implications. If the merger proves beneficial, leading to improved healthcare access and affordability, the involved political figures will likely receive credit and enhanced public approval. Conversely, a failed merger, marked by rising premiums or reduced access to care, could result in significant political backlash, potentially impacting the careers and reputations of those who supported it.

The outcome will undoubtedly shape future healthcare policy debates in the state.

Role of Lobbying Groups

Various lobbying groups played a significant role in influencing the merger’s outcome. Healthcare providers, consumer advocacy groups, and insurance industry associations all engaged in lobbying efforts, attempting to sway legislators and regulators towards their preferred outcome. These groups used a variety of tactics, including direct lobbying, public relations campaigns, and grassroots mobilization. The intensity and effectiveness of these lobbying efforts significantly shaped the final regulatory decisions.

Visual Representation of Viewpoints

Imagine a bar graph. The x-axis represents different viewpoints: Strong Support, Cautious Support, Neutral, Cautious Opposition, and Strong Opposition. The y-axis represents the percentage of the population holding each viewpoint. The bars representing “Cautious Support” and “Cautious Opposition” would be the tallest, indicating a significant portion of the population holds ambivalent views. The “Neutral” bar would also be relatively tall.

The bars for “Strong Support” and “Strong Opposition” would be shorter, reflecting a smaller, but still significant, number of people holding strongly defined positions. This visual representation highlights the nuanced and often divided public opinion surrounding the merger.

Closing Notes

The return of the Elevance BCBSLA merger proposal is a significant event for Louisiana, carrying immense potential for both progress and peril. While the promise of improved healthcare access and lower premiums is enticing, concerns about reduced competition and potential cost increases remain. Ultimately, the success or failure of this merger will depend on a delicate balancing act between regulatory approvals, economic considerations, and public opinion.

The coming months will be crucial in determining the future of healthcare in Louisiana, and the story certainly isn’t over yet.

Essential FAQs

What are the main arguments for the merger?

Proponents argue the merger will lead to improved efficiency, better technology integration, and potentially lower costs through economies of scale. They also point to the possibility of expanded healthcare access in underserved areas.

What are the main arguments against the merger?

Opponents fear reduced competition will lead to higher premiums and less choice for consumers. Concerns about job losses and potential negative impacts on the state’s healthcare economy are also frequently raised.

What role will the Louisiana state government play?

The state government will play a crucial role in reviewing the merger proposal, assessing its potential impact, and ultimately deciding whether to approve it based on regulatory compliance and public interest.

When might a decision be made?

The timeline for a final decision is uncertain and depends on the regulatory review process and any legal challenges that may arise.