Premiums Rise 7 Percent Employer Health Insurance KFF Report

Premiums rise 7 percent employer sponsored health insurance kff health affairs – that’s the headline grabbing everyone’s attention, and rightfully so! This significant jump in employer-sponsored health insurance premiums is impacting families and businesses across the country. We’re diving deep into the KFF Health Affairs report to unpack the details, explore the reasons behind this increase, and look at what it means for your wallet and your employer’s bottom line.

Get ready to understand the implications of this massive shift in healthcare costs.

From the potential financial strain on employees, especially those in lower income brackets, to the strategies employers are employing to manage these escalating costs, we’ll cover it all. We’ll examine the KFF report’s methodology, dissect the key contributing factors, and consider the Affordable Care Act’s role in this equation. Plus, we’ll gaze into the crystal ball and speculate on future trends in employer-sponsored health insurance, considering the influence of technology and rising healthcare costs.

Impact of 7% Premium Increase on Employees

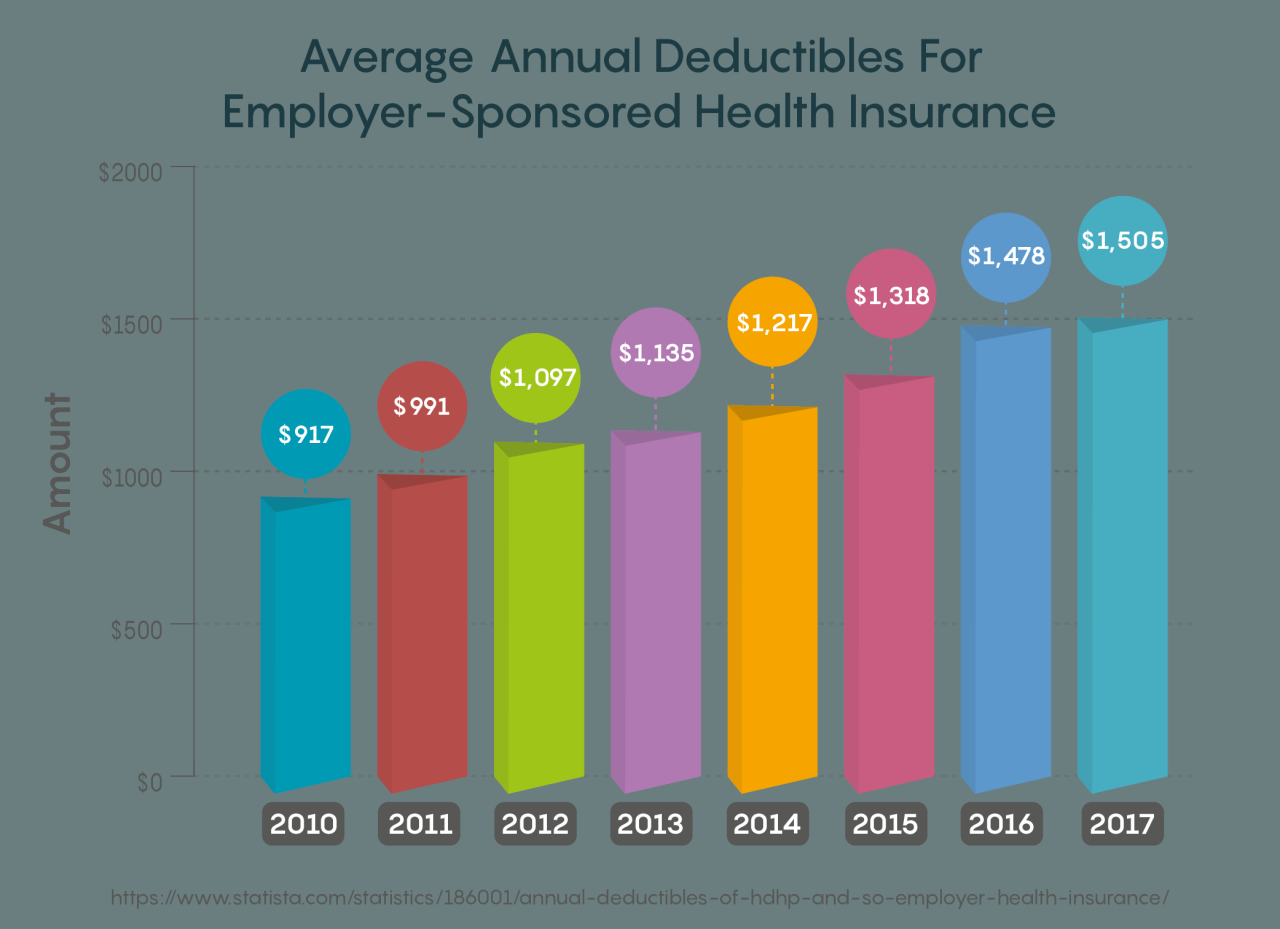

A 7% increase in employer-sponsored health insurance premiums represents a significant financial burden for many employees, potentially impacting their financial stability and overall well-being. This increase, while seemingly small in percentage terms, translates to a substantial dollar amount for most families, especially when considering other rising costs of living. The impact is not uniform across all income brackets; lower-income families are disproportionately affected, forcing difficult choices between healthcare and other essential needs.

Financial Strain on Employees

The 7% premium increase directly translates to higher monthly out-of-pocket expenses for employees. This added cost can strain household budgets, forcing families to cut back on other expenses like groceries, entertainment, or savings. For those already living paycheck to paycheck, this increase can create significant financial hardship, potentially leading to delayed medical care or forgoing necessary treatments due to cost concerns.

So, KFF Health Affairs reported a 7% jump in employer-sponsored health insurance premiums – ouch! It makes you think about the pressures on healthcare systems, and the recent new york nurse strike deal reached Mount Sinai Montefiore highlights just how intense those pressures can be. Ultimately, these rising costs and staffing shortages will likely continue to fuel further increases in premiums.

The cumulative effect of this increase, year after year, can be substantial, eroding savings and increasing financial vulnerability.

Impact Across Income Brackets, Premiums rise 7 percent employer sponsored health insurance kff health affairs

The impact of a 7% premium increase varies considerably across different income brackets. Lower-income families, who typically spend a larger percentage of their income on essential needs, will feel the pinch most acutely. A 7% increase on a already tight budget could represent a significant portion of their disposable income, forcing them to make difficult trade-offs. Higher-income families, while still affected, are likely to absorb the increase with less difficulty due to their greater financial resources.

This disparity highlights the regressive nature of healthcare cost increases, disproportionately impacting those least able to afford them.

Reduced Employee Benefits Utilization

The rising cost of healthcare premiums may lead to reduced utilization of employee benefits. Facing higher monthly premiums, employees might delay or forgo necessary medical care, preventive screenings, or prescription medications due to cost concerns. This can have serious long-term health consequences, potentially leading to more expensive treatments down the line. The fear of incurring significant medical debt can also discourage individuals from seeking timely medical attention, ultimately impacting their health and productivity.

Hypothetical Premium Increases

The following table illustrates the potential increase in monthly premiums for various family sizes and income levels, assuming a 7% increase on a base premium. These figures are hypothetical and will vary based on specific plan details and location.

| Family Size | Income Level (Annual) | Base Monthly Premium | Increased Monthly Premium (7%) |

|---|---|---|---|

| Individual | $40,000 | $300 | $321 |

| Individual | $80,000 | $450 | $481.50 |

| Family (2 Adults, 2 Children) | $40,000 | $1200 | $1284 |

| Family (2 Adults, 2 Children) | $80,000 | $1800 | $1926 |

Employer Strategies for Managing Increased Costs

Source: slideteam.net

Health insurance premiums are skyrocketing – a recent KFF Health Affairs report showed a 7% increase in employer-sponsored plans. This rise makes it even harder for families to afford healthcare, especially considering the recent staffing shortages highlighted by the new york state nurse strike NYSNA Montefiore Mount Sinai , which underscores the immense pressure on the healthcare system and the need for better working conditions and compensation for nurses.

Ultimately, these factors will likely continue to push premiums even higher.

The 7% jump in employer-sponsored health insurance premiums presents a significant challenge for businesses of all sizes. Successfully navigating this increase requires proactive strategies that balance cost containment with employee satisfaction. Ignoring the problem will lead to serious financial strain and potential employee dissatisfaction, ultimately impacting productivity and retention. This section explores various approaches employers can take to mitigate the impact of rising premiums.

Cost-Saving Measures

Employers have several avenues to explore when aiming to reduce healthcare costs. These strategies often involve a combination of approaches, tailored to the specific needs and workforce demographics of the company. Implementing these measures requires careful planning and potentially some employee education to ensure understanding and buy-in.

| Strategy | Description | Cost-Effectiveness | Employee Satisfaction |

|---|---|---|---|

| Wellness Programs | Initiatives promoting employee health through activities like gym memberships, health screenings, and smoking cessation programs. | Moderate to High (long-term cost savings through reduced claims) | Generally High (employees value health and wellness support) |

| Tiered Health Plans | Offering a range of plans with varying premiums and deductibles, allowing employees to choose a plan that best suits their needs and budget. This might include HMOs, PPOs, and high-deductible health plans (HDHPs) with health savings accounts (HSAs). | High (employees selecting lower-cost plans reduces employer contribution) | Moderate (some employees may be unhappy with limited choices or higher deductibles) |

| Negotiating with Insurance Providers | Actively negotiating lower rates with insurance companies by leveraging the company’s size and employee demographics. | High (potential for significant premium reductions) | Neutral (impact depends on the negotiated plan features) |

| Employee Contribution Increases | Increasing the percentage of premiums employees contribute. | High (immediate cost reduction for the employer) | Low (employees bear a larger financial burden) |

Consequences of Unabsorbed Costs

Failure to implement cost-management strategies can have serious repercussions for employers. These consequences can range from financial instability to decreased employee morale and retention. For example, a small business might face significant financial strain, potentially impacting its ability to invest in growth or even remain operational. Larger companies may experience reduced profitability and shareholder dissatisfaction. Employee morale can suffer if employees perceive that the employer is not adequately addressing rising healthcare costs.

This can lead to increased turnover, recruitment difficulties, and ultimately, a less productive workforce. A real-world example is the struggles faced by many small restaurants during the COVID-19 pandemic, where rising insurance costs, coupled with decreased revenue, led to business closures.

KFF Health Affairs Report Analysis: Premiums Rise 7 Percent Employer Sponsored Health Insurance Kff Health Affairs

The KFF (Kaiser Family Foundation) Health Affairs report on employer-sponsored health insurance premium increases provides crucial insights into the rising costs of healthcare in the United States. Understanding the methodology behind their 7% figure, the contributing factors, and the historical context is vital for both employers and employees navigating this increasingly complex landscape. This analysis delves into the key findings of the report.

Methodology for Determining the 7% Premium Increase

The KFF report likely utilizes a combination of data sources and analytical techniques to arrive at the 7% figure. This probably includes surveying a large, representative sample of employers offering health insurance plans. The survey would collect data on premium costs for various plan types, employee contributions, and other relevant factors. Sophisticated statistical modeling, potentially incorporating adjustments for factors like plan design changes and employee demographics, is then used to arrive at a national average percentage increase.

The specific details of the methodology are usually available in the report’s appendix or supplementary materials. It’s important to note that the 7% figure represents an average; actual increases vary significantly depending on factors such as location, industry, and the specific plan design.

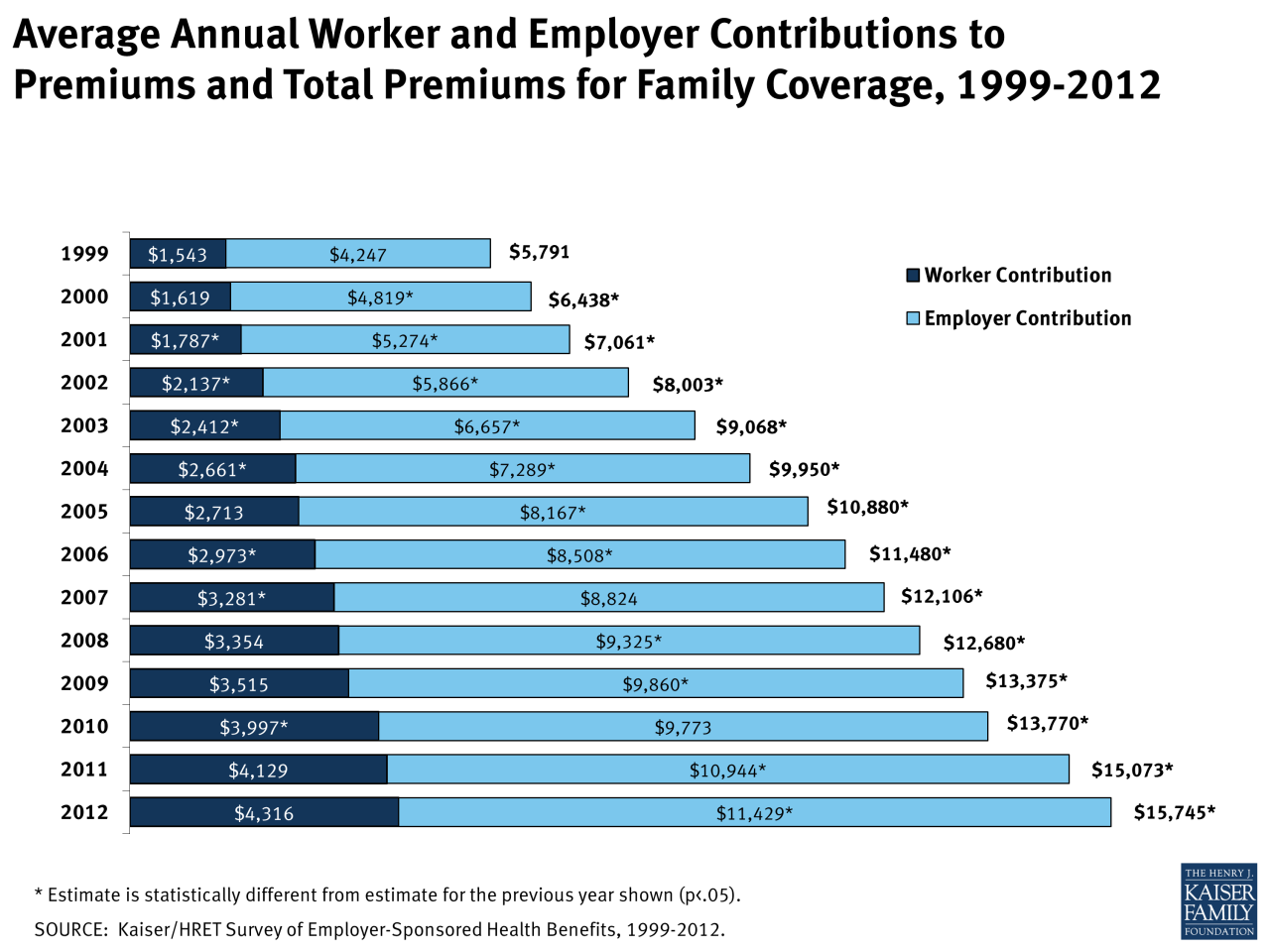

Key Factors Contributing to the Premium Increase

Several factors likely contributed to the 7% increase in premiums. Increased healthcare utilization, driven by factors like an aging population and advancements in medical technology leading to more expensive treatments, is a major contributor. Rising pharmaceutical costs, particularly for specialty drugs, also play a significant role. Administrative costs associated with managing health insurance plans, including billing and claims processing, also contribute to the overall increase.

Finally, the impact of inflation on healthcare provider salaries and operating expenses is another significant driver.

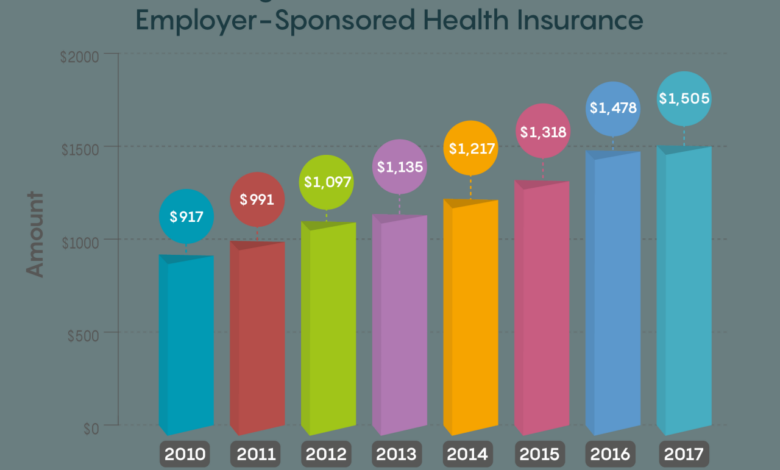

Comparison to Previous Years’ Increases

To contextualize the 7% increase, it’s essential to compare it to previous years’ trends. A visual representation (described below) would effectively illustrate this comparison. The KFF report likely provides this historical data, showing whether the 7% increase is higher, lower, or consistent with previous years. This comparison is crucial in determining whether the current increase is an anomaly or part of a long-term trend.

Understanding this historical context helps stakeholders anticipate future cost increases and develop appropriate strategies.

Visual Representation of Premium Increase Data

Imagine a line graph with the years on the horizontal axis and the percentage premium increase on the vertical axis. Each year’s data point would be represented by a dot, connected by a line to show the trend over time. The graph would clearly display the 7% increase for the current year as a data point alongside the data points for previous years.

Different colors could be used to highlight specific years or periods with significant changes. This visualization allows for a quick and easy comparison of the current year’s increase with the historical trend, allowing for a better understanding of the context of the 7% increase. For example, if the graph shows a consistent upward trend over the past decade, it highlights the need for proactive strategies to manage these escalating costs.

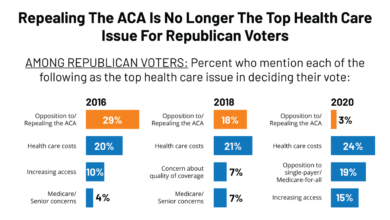

The Role of the Affordable Care Act (ACA)

The Affordable Care Act (ACA), enacted in 2010, significantly reshaped the American healthcare landscape, impacting employer-sponsored health insurance in profound ways. Its influence on premiums, access to care, and the overall cost of healthcare is a complex and ongoing subject of debate and analysis. Understanding the ACA’s role is crucial to comprehending the current trends in employer-sponsored insurance and potential solutions for rising costs.The ACA’s influence on employer-sponsored health insurance costs is multifaceted.

While it didn’t directly mandate employer-sponsored plans, several provisions indirectly affected costs. The expansion of Medicaid and the creation of the Health Insurance Marketplaces (exchanges) increased the number of insured Americans, leading to a larger pool of individuals accessing healthcare services. This increased demand, while improving overall population health, could contribute to rising healthcare costs, which then indirectly impact employer-sponsored premiums.

Yikes, that 7% jump in employer-sponsored health insurance premiums reported by KFF Health Affairs is a real gut punch. It makes you wonder if innovative solutions like those explored in a recent study on the widespread use of digital twins in healthcare, study widespread digital twins healthcare , could offer any long-term cost relief. Maybe personalized medicine via digital twins could eventually help lower those skyrocketing premiums.

Furthermore, the ACA’s preventative care provisions, while beneficial for long-term health, may also contribute to short-term cost increases as more people utilize these services. The ACA also introduced provisions related to cost-sharing reductions and minimum essential health benefits, which influenced plan design and potentially affected employer contributions.

ACA Provisions and Potential Changes to Mitigate Future Premium Increases

Several ACA provisions could be modified to potentially mitigate future premium increases. For example, re-evaluating the essential health benefits package to prioritize cost-effectiveness without compromising quality care could be considered. Streamlining the regulatory burden on insurers, particularly regarding plan design and reporting requirements, could also potentially lower administrative costs, which could indirectly reduce premiums. Increased transparency and competition within the insurance market could encourage insurers to offer more affordable plans.

Further research into the effectiveness of various cost-containment strategies employed by states and insurers could inform future policy decisions. For example, some states have successfully implemented programs focusing on value-based care, which rewards providers for quality of care rather than just quantity of services. This approach could potentially curb the growth of healthcare costs in the long run.

ACA’s Impact on Access to Affordable Healthcare

The ACA significantly expanded access to affordable healthcare for millions of Americans. Prior to the ACA, millions lacked health insurance, leading to delayed or forgone care, resulting in worse health outcomes and higher overall healthcare costs. The ACA’s expansion of Medicaid coverage to more low-income adults in participating states greatly improved access to care for this vulnerable population. The creation of the Health Insurance Marketplaces provided a platform for individuals and families to purchase subsidized health insurance, offering more choices and affordability than previously available.

The ACA’s guaranteed issue and community rating provisions prevented insurers from denying coverage based on pre-existing conditions or charging higher premiums based on health status, ensuring greater access to coverage regardless of health status.

The ACA’s Impact on Different Demographics

The ACA’s impact varied across different demographics. Low-income individuals and families benefited most from the Medicaid expansion and marketplace subsidies, significantly reducing their healthcare costs and improving access to care. However, some middle-income families found themselves in a coverage gap, earning too much to qualify for subsidies but not enough to afford unsubsidized insurance. The impact on older adults was mixed, with some benefiting from Medicare improvements and prescription drug coverage, while others faced challenges navigating the complexities of the system.

Racial and ethnic minorities often faced disparities in access to care, even with the ACA in place, highlighting the need for continued efforts to address systemic inequities in the healthcare system. For instance, studies have shown that while the ACA significantly reduced the uninsured rate among Hispanics, disparities in access to care and health outcomes persist due to factors like language barriers and limited access to healthcare providers in their communities.

Future Trends in Employer-Sponsored Health Insurance

Source: kff.org

The recent 7% premium increase in employer-sponsored health insurance highlights a concerning trend. Understanding the future trajectory of these costs is crucial for both employers and employees. Several interconnected factors will shape the landscape of employer-sponsored health insurance in the coming years, leading to both challenges and potential opportunities.

Premium Growth Projections

Predicting future premium increases requires considering several variables. While a consistent 7% annual increase is unlikely to be sustained indefinitely, we can anticipate continued upward pressure. Factors like inflation, the rising cost of prescription drugs, and advancements (or lack thereof) in preventative care will all play a role. For example, if pharmaceutical companies continue to release expensive new drugs without corresponding increases in generic options, premiums will likely continue to rise at a significant pace.

Similarly, a failure to effectively address chronic disease management through preventative care will continue to drive up healthcare utilization and costs. We might see years of slower growth interspersed with periods of more rapid increases, depending on the interplay of these factors.

Technological Advancements and Cost Impacts

Telehealth has emerged as a significant force in healthcare delivery, and its impact on employer-sponsored insurance costs is complex. While virtual consultations can reduce certain costs associated with in-person visits, the widespread adoption of telehealth isn’t a guaranteed cost-saver. The initial investment in technology and infrastructure, as well as the need for adequate training and support for both providers and patients, can represent substantial upfront expenses.

Furthermore, the long-term cost-effectiveness of telehealth depends on factors such as patient engagement, the types of services offered virtually, and the ability to integrate telehealth seamlessly into existing healthcare systems. For example, while telehealth may reduce costs for routine checkups, it might not be as effective or cost-efficient for complex procedures requiring in-person examination.

The Role of Rising Healthcare Costs

The fundamental driver of rising employer-sponsored health insurance premiums is the overall increase in healthcare costs. This isn’t simply a matter of inflation; it reflects the rising prices of medical services, pharmaceuticals, and hospital stays. The aging population, advances in medical technology (which can be both costly and life-saving), and increased prevalence of chronic diseases all contribute to this upward pressure.

For instance, the increasing prevalence of conditions like diabetes and heart disease, requiring ongoing and often expensive management, places a significant burden on the healthcare system and, consequently, on insurance premiums.

Factors Influencing Future Premiums

The future trajectory of employer-sponsored health insurance premiums will be determined by the interaction of several key factors.

- Inflation and Economic Conditions: High inflation directly impacts healthcare costs and insurance premiums. Economic downturns can also lead to employers seeking ways to reduce benefits costs, potentially impacting coverage levels.

- Legislative and Regulatory Changes: Changes to healthcare legislation, such as modifications to the Affordable Care Act or new regulations impacting drug pricing, can significantly affect premiums. For example, increased regulation of pharmaceutical pricing could lead to lower premiums, while deregulation might have the opposite effect.

- Technological Innovation: The adoption and effectiveness of new technologies, including AI-driven diagnostics and personalized medicine, could influence costs positively or negatively depending on implementation and uptake.

- Healthcare Utilization Patterns: Changes in patient behavior, such as increased preventative care or a shift toward more cost-effective treatment options, can influence overall healthcare spending and, therefore, premiums.

- Employer Strategies: Employer choices regarding benefit design, cost-sharing, and wellness programs can impact the financial burden on both the employer and the employee. For example, incentivizing employees to use preventative care could lower long-term costs.

Closure

Source: quote.com

The 7% increase in employer-sponsored health insurance premiums, as detailed in the KFF Health Affairs report, paints a complex picture. While the financial burden on employees is undeniable, employers are also facing significant challenges. Understanding the contributing factors, from rising healthcare costs to the influence of the ACA, is crucial for navigating this evolving landscape. Looking ahead, proactive strategies, technological advancements, and potential policy changes will play a vital role in shaping the future of healthcare affordability and accessibility for all.

Query Resolution

What specific factors within the KFF report contributed most significantly to the 7% premium increase?

The KFF report likely highlights a combination of factors, such as rising pharmaceutical costs, increased utilization of healthcare services, and changes in the provider reimbursement landscape. Specific details would require reviewing the report itself.

Are there any resources available to help employees struggling to afford the increased premiums?

Many employers offer resources like financial counseling, flexible spending accounts (FSAs), and health savings accounts (HSAs) to help employees manage healthcare costs. Additionally, government programs and community resources may provide assistance to those in need.

How does the 7% increase compare to previous years’ increases in employer-sponsored health insurance premiums?

The KFF report would provide this historical context, showing whether the 7% increase is higher, lower, or in line with the average annual increase in previous years. This comparison helps establish the significance of the current rise.