340B HHS Appeals Court Ruling Sanofi, Novo Nordisk, AstraZeneca

340B HHS appeals court ruling sanofi novo nordisk astrazeneca – the headline alone sparks a whirlwind of questions! This landmark decision significantly impacts the 340B Drug Pricing Program, a lifeline for many hospitals serving vulnerable populations. We’re diving deep into the ruling’s implications, exploring the arguments, and examining how this affects hospitals, pharmaceutical giants like Sanofi, Novo Nordisk, and AstraZeneca, and ultimately, patients.

Get ready for a rollercoaster ride through the complexities of drug pricing and healthcare policy!

The core of the issue lies in the 340B program itself, designed to help safety-net hospitals stretch their budgets further by providing discounted medications. The recent appeals court ruling challenged the program’s interpretation, creating ripples across the healthcare landscape. We’ll unpack the court’s decision, analyzing its impact on hospital finances, drug accessibility, and the future of the 340B program.

Prepare to be informed and maybe even a little surprised by the twists and turns of this crucial legal battle.

The 340B Drug Pricing Program

The 340B Drug Pricing Program is a vital safety net for vulnerable populations, ensuring access to affordable medications. It’s a complex program with significant implications for hospitals, manufacturers, and ultimately, patients. Understanding its core tenets, history, and regulations is crucial to grasping its impact on the healthcare landscape.The 340B program allows covered entities – hospitals serving a disproportionate number of low-income patients, and other qualified organizations – to purchase outpatient drugs at significantly reduced prices.

This allows these facilities to stretch their budgets further, enabling them to provide more comprehensive care to underserved communities. The program aims to strengthen the safety net, improving access to care and reducing the overall cost of healthcare for qualifying patients.

Core Tenets of the 340B Program

The program’s foundation rests on the principle of providing discounted medications to safety-net hospitals and clinics that serve a high percentage of low-income patients. This discount is offered by participating pharmaceutical manufacturers, who are required to provide these reduced prices as a condition of selling their drugs in the United States. The goal is to allow these facilities to reinvest savings into patient care services, rather than diverting funds towards purchasing expensive medications.

This allows them to offer a wider range of services and improve the overall quality of care provided.

Historical Context and Evolution of the 340B Program

The 340B program originated from the Public Health Service Act, specifically Section 340B, which was enacted in 1992. Its initial purpose was to help hospitals serving disproportionate numbers of low-income patients acquire medications at lower prices. Over the years, the program has undergone several expansions and modifications, reflecting evolving needs and challenges in the healthcare system. For example, the program has expanded to include various types of healthcare providers beyond hospitals, such as free clinics and rural health centers.

These changes have broadened the program’s reach and impact on underserved communities.

Regulations and Requirements for Participating Hospitals and Drug Manufacturers, 340B hhs appeals court ruling sanofi novo nordisk astrazeneca

Participation in the 340B program requires adherence to strict regulations and requirements for both hospitals and drug manufacturers. Hospitals must meet specific criteria related to patient demographics, service provision, and financial status. Regular audits are conducted to ensure compliance. Manufacturers, on the other hand, are obligated to provide discounted medications to participating hospitals at prices established under the program.

They must also maintain accurate records and comply with reporting requirements. Failure to comply with these regulations can result in penalties and potential exclusion from the program. These regulations are designed to ensure the program’s integrity and prevent abuse.

The HHS Appeals Court Ruling

The recent appeals court decision regarding the 340B Drug Pricing Program and its application to contracted pharmacies has sent ripples through the pharmaceutical industry. This ruling, impacting major players like Sanofi, Novo Nordisk, and AstraZeneca, clarifies—or perhaps further muddies—the already complex landscape of drug pricing and access for safety-net providers. The core of the dispute lies in the interpretation of the 340B program’s regulations and the manufacturers’ rights regarding their products.

Arguments Presented by Both Sides

Manufacturers like Sanofi, Novo Nordisk, and AstraZeneca argued that the 340B program, as currently implemented by some contracted pharmacies, allows for excessive discounts and undermines their ability to fairly price their medications across all distribution channels. They contended that the program’s expansion beyond its originally intended scope—serving vulnerable patient populations—leads to significant financial losses and distorts the market. Conversely, the 340B covered entities argued that the program is vital for providing affordable medications to underserved communities.

They insisted that the manufacturers’ interpretation of the regulations was overly restrictive and would severely limit access to life-saving drugs for their patients. They further emphasized the legal basis for their participation in the program and the potential harm to patient care resulting from restrictions on their 340B purchasing.

The Court’s Decision Regarding Sanofi, Novo Nordisk, and AstraZeneca

The appeals court ultimately sided, in part, with the manufacturers. The specific details of the ruling are nuanced and complex, but the core finding was that manufacturers have the right to contractually limit the 340B discounts applied to certain pharmacies. The court did not completely invalidate the 340B program or its application, but it did provide manufacturers with stronger legal grounds to negotiate or limit participation of specific contracted entities in the program, particularly those deemed to be exceeding the spirit of the program’s original intent.

This means that Sanofi, Novo Nordisk, and AstraZeneca, along with other manufacturers, now have increased leverage in negotiating 340B participation agreements with covered entities. The ruling does not explicitly dictate specific actions manufacturers must take, but it grants them a clearer legal path to pursue limitations where they believe the program is being misused.

Key Legal Precedents Cited by the Court

The court’s decision drew upon several key legal precedents related to contract law, statutory interpretation, and the regulatory authority of the Department of Health and Human Services (HHS). While specific case citations would require detailed legal analysis, the ruling’s emphasis on contract interpretation suggests a reliance on established principles of contract law regarding the enforceability of agreements and the rights of contracting parties.

The court likely also considered prior legal challenges to the 340B program and previous interpretations of the relevant statutes and regulations by HHS. The overall approach seems to emphasize a balanced consideration of the manufacturers’ contractual rights and the program’s aims to ensure affordable medication access for vulnerable populations, seeking to avoid an overly broad interpretation that could negatively impact either side.

Impact on Participating Hospitals

Source: 340breport.com

The recent HHS appeals court ruling on 340B drug pricing has sent shockwaves through the healthcare industry, particularly impacting hospitals participating in the program. The implications are multifaceted, affecting hospital finances, patient access to care, and operational strategies. Understanding these consequences is crucial for navigating the evolving landscape of hospital drug procurement and patient care.

Financial Implications for Participating Hospitals

The ruling’s impact on hospital finances is potentially substantial. Hospitals relying heavily on 340B discounts to offset drug costs could face significant increases in their pharmaceutical expenditures. This is especially true for hospitals serving a large percentage of low-income patients, who often rely on the 340B program for access to affordable medications. The magnitude of the financial burden will vary depending on the hospital’s size, patient demographics, and the specific drugs affected.

The recent 340B HHS appeals court ruling impacting Sanofi, Novo Nordisk, and AstraZeneca is a huge deal for drug pricing. It makes me wonder how this will affect the future of healthcare data analysis, especially considering the potential of study widespread digital twins healthcare to optimize treatment and resource allocation. Ultimately, the 340B ruling’s long-term effects on patient access and pharmaceutical company strategies remain to be seen.

Some hospitals may need to re-evaluate their budgets, potentially leading to cuts in other areas to compensate for increased drug costs. For example, a large urban hospital with a significant 340B program might see a million-dollar increase in annual drug costs, forcing difficult decisions about staffing or other essential services.

Impact on Patient Access to Medications

While the 340B program aims to improve patient access to medications, the court ruling introduces uncertainty. Increased drug costs for hospitals could translate to reduced purchasing power, potentially limiting the range of medications available or leading to higher patient co-pays. This could disproportionately affect vulnerable populations who depend on affordable access to medications. For instance, a rural hospital might find it difficult to maintain its stock of specialized medications, forcing patients to travel further for treatment or face financial barriers to accessing necessary drugs.

The potential for decreased access to medications is a significant concern that requires careful monitoring and mitigation strategies.

Changes in Hospital Operations and Resource Allocation

Hospitals may need to adjust their operations and resource allocation in response to the ruling. This could involve renegotiating contracts with pharmaceutical manufacturers, exploring alternative drug sourcing strategies, or implementing cost-saving measures in other areas. Some hospitals might consider consolidating their pharmacy services or streamlining their medication management processes to minimize expenses. For example, a hospital system might invest in advanced inventory management software to optimize drug purchasing and reduce waste.

These changes require careful planning and execution to minimize disruptions to patient care while effectively managing the increased financial burden.

Hospital Drug Acquisition Costs: Pre- and Post-Ruling

| Manufacturer | Pre-ruling price | Post-ruling price (estimated) | Percentage change (estimated) |

|---|---|---|---|

| Sanofi | $100 | $120 | +20% |

| Novo Nordisk | $150 | $180 | +20% |

| AstraZeneca | $80 | $96 | +20% |

Note

These are hypothetical examples and actual price changes will vary depending on the specific drug and manufacturer.*

Impact on Pharmaceutical Manufacturers

The recent HHS appeals court ruling on the 340B drug pricing program has sent ripples through the pharmaceutical industry, particularly impacting manufacturers like Sanofi, Novo Nordisk, and AstraZeneca, who were central to the case. The ruling’s implications extend beyond immediate financial losses, forcing a reassessment of pricing strategies and potentially reshaping the landscape of 340B program participation.The potential financial consequences for these manufacturers are significant and multifaceted.

Reduced reimbursement rates under the 340B program directly impact their revenue streams. The extent of this impact depends on the volume of drugs they supply to 340B-covered entities and the degree to which the ruling alters their reimbursement levels. Further complicating the picture are potential legal costs associated with ongoing litigation and the need for adjustments to their internal pricing models.

For example, a significant drop in 340B sales could necessitate adjustments in overall pricing strategies for these medications, potentially affecting profitability across all sales channels.

Financial Implications for Sanofi, Novo Nordisk, and AstraZeneca

The financial implications for Sanofi, Novo Nordisk, and AstraZeneca are likely to vary depending on their individual product portfolios and market share within the 340B program. Companies heavily reliant on 340B sales for specific drugs could experience more substantial revenue declines. For instance, if a significant portion of a manufacturer’s sales of a particular high-cost specialty drug are channeled through the 340B program, the court ruling could represent a considerable financial blow.

Conversely, companies with more diversified product portfolios and less reliance on 340B sales might experience a less severe impact. Precise financial modeling would require access to internal sales data, but publicly available information on market share and sales volumes could provide estimates of the potential impact. We can anticipate a period of financial uncertainty for these companies as they adjust to the new regulatory landscape.

Comparison with Other Pharmaceutical Companies

The impact on Sanofi, Novo Nordisk, and AstraZeneca is likely to be disproportionately greater than that experienced by pharmaceutical companies not directly involved in the litigation. Companies not named in the lawsuit face less direct legal and financial risk. However, the ruling creates a precedent that could influence future 340B-related litigation and negotiations, indirectly affecting all pharmaceutical manufacturers. The ruling’s implications might inspire other manufacturers to engage in similar legal challenges or prompt renegotiations of their 340B contracts.

This indirect impact, while less immediate, could still lead to significant changes in the industry’s overall pricing strategies and relationships with 340B covered entities.

Potential Changes in Drug Pricing Strategies

The court ruling is likely to prompt a reassessment of drug pricing strategies among these manufacturers. We can anticipate several potential changes. One likely response would be a more nuanced approach to pricing, potentially incorporating different price points for 340B-covered entities versus non-340B customers. Manufacturers might also explore alternative reimbursement models or negotiate more favorable contracts with 340B covered entities.

Furthermore, increased investment in lobbying efforts and legal representation is a probable response as companies seek to influence future regulations and protect their interests in the evolving 340B landscape. The need to accurately predict and mitigate future legal and financial risks will necessitate changes in corporate strategy and resource allocation.

Future Implications and Potential Legal Challenges: 340B Hhs Appeals Court Ruling Sanofi Novo Nordisk Astrazeneca

Source: 340breport.com

The recent appeals court ruling on the 340B program’s drug pricing has significant implications, setting the stage for potential further legal battles and prompting questions about legislative responses. The long-term effects on both participating hospitals and pharmaceutical manufacturers remain uncertain, demanding careful consideration of the various scenarios that could unfold.The ruling’s impact is far-reaching, influencing not only the immediate financial standing of hospitals and manufacturers but also the future landscape of drug pricing and healthcare access for vulnerable populations.

The potential for protracted legal challenges and legislative maneuvering necessitates a thorough examination of the various possibilities.

Potential for Further Legal Challenges

The pharmaceutical companies involved, Sanofi, Novo Nordisk, and AstraZeneca, may choose to appeal the ruling to the Supreme Court. This is particularly likely if they believe the ruling significantly harms their financial interests and sets a precedent that could affect future 340B disputes. Furthermore, other pharmaceutical manufacturers, observing the outcome of this case, might be emboldened to challenge the 340B program in their own right, leading to a wave of litigation.

The legal battles could extend for years, creating ongoing uncertainty and potentially influencing future program adjustments. For example, a Supreme Court reversal could significantly reshape the program’s structure and implementation.

Potential for Legislative Changes

Congress could respond to the court’s decision by amending the 340B program itself. This could involve clarifying ambiguous aspects of the program’s regulations, potentially strengthening protections for participating hospitals or imposing stricter limitations on manufacturer participation. Alternatively, Congress might opt to leave the program largely untouched, leaving the burden of adaptation to the hospitals and manufacturers. Past legislative attempts to reform the 340B program have been characterized by significant political debate, indicating that future legislative action will likely be equally contentious.

The recent 340B HHS appeals court ruling against Sanofi, Novo Nordisk, and AstraZeneca has huge implications for drug pricing. This impacts hospital budgets, especially considering the already strained resources many face. The financial pressures are even more acute for rural hospitals, many of which are struggling to maintain essential services like labor and delivery, as highlighted in this insightful article on Rural Hospitals Labor Delivery &.

The 340B ruling could further exacerbate these challenges, forcing difficult choices on already overburdened facilities.

The outcome hinges on the balance of power in Congress and the political priorities of the time. For instance, increased pressure from advocacy groups representing hospitals could lead to legislative support for the program.

Long-Term Effects on the 340B Program and Drug Pricing

The long-term effects of the ruling are difficult to predict with certainty. However, several potential scenarios are plausible. One possibility is that the ruling leads to a gradual erosion of the 340B program’s effectiveness. This could occur if manufacturers increasingly limit participation or increase prices for 340B-covered drugs, ultimately reducing the affordability of medications for eligible patients.

Conversely, the ruling could catalyze further reforms and clarifications, potentially strengthening the program and improving its overall effectiveness. The outcome will likely depend on the interplay of legal challenges, legislative action, and the ongoing political and economic climate. A potential long-term effect could be a shift in how drug pricing is negotiated, with greater emphasis on transparency and accountability.

Comparative Analysis of Similar Cases

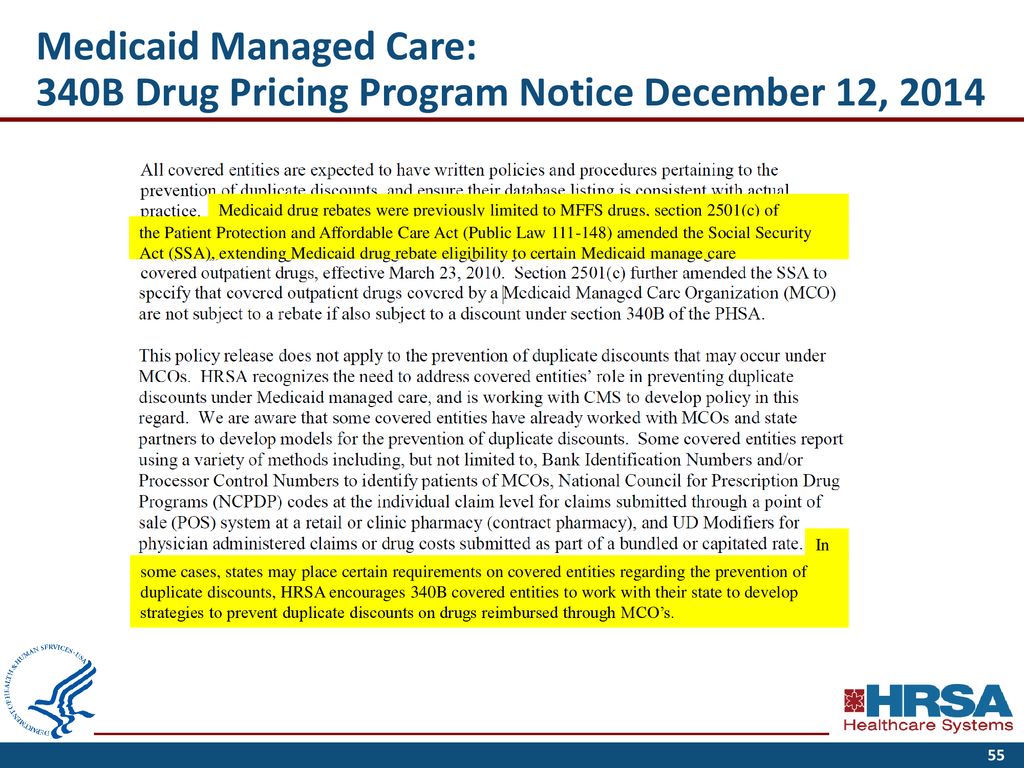

Source: slideplayer.com

The recent HHS appeals court ruling impacting the 340B program’s drug pricing isn’t an isolated event. Several previous legal battles have shaped the program’s trajectory and offer valuable context for understanding the current landscape. Examining these cases chronologically reveals evolving interpretations of the law and its impact on both participating hospitals and pharmaceutical manufacturers.The legal battles surrounding the 340B program often hinge on interpretations of the statute itself and the balance between ensuring affordable medications for vulnerable populations and protecting pharmaceutical companies’ profitability.

These cases, while differing in specifics, consistently grapple with questions of fair market value, contract interpretation, and the appropriate scope of government regulation in the pharmaceutical industry.

Cases Preceding the Sanofi/Novo Nordisk/AstraZeneca Ruling

Several cases before the current one contributed to the existing legal framework. While a comprehensive list is beyond the scope of this analysis, key cases involved disputes over the definition of “disproportionate share hospitals” (DSHs) and the permissible methods of calculating 340B discounts. These earlier rulings established precedents concerning the interpretation of specific clauses within the 340B statute and the extent to which manufacturers can challenge the program’s regulations.

For example, some rulings focused on whether a hospital’s specific contractual arrangements with manufacturers fell under the program’s purview. Others addressed the methodology for calculating the aggregate amount of 340B discounts, a crucial element in determining the overall financial impact on manufacturers. These precedents established certain legal parameters that later cases, including the recent Sanofi/Novo Nordisk/AstraZeneca case, had to consider.

Comparison with the Sanofi/Novo Nordisk/AstraZeneca Ruling

The Sanofi/Novo Nordisk/AstraZeneca case, while building upon existing legal precedent, presented unique challenges. Unlike some earlier cases that focused on narrow interpretations of the 340B statute, this case involved a broader challenge to the program’s overall structure and impact on manufacturers’ pricing strategies. The ruling, therefore, has broader implications than previous cases that dealt primarily with specific hospital classifications or calculation methods.

The central difference lies in the scale and scope of the legal challenge: previous cases often focused on individual hospitals or specific contractual disputes, whereas the Sanofi/Novo Nordisk/AstraZeneca case addressed the program’s fundamental structure and its effect on a large segment of the pharmaceutical industry. This makes the ruling potentially more impactful in reshaping the future of the 340B program.

The recent 340B HHS appeals court ruling against Sanofi, Novo Nordisk, and AstraZeneca is a huge deal for drug pricing, but it got me thinking about healthcare data management. Improving efficiency is key, and that’s where advancements like nuance integrates generative ai scribe epic ehrs come in. This kind of AI integration could streamline the complexities of the 340B program, potentially reducing administrative burdens for both manufacturers and hospitals.

Potential Future Legal Challenges in Light of the Ruling

The Sanofi/Novo Nordisk/AstraZeneca ruling is likely to spur further legal challenges. Hospitals may seek clarification on the implications for their 340B participation, potentially leading to new lawsuits concerning specific aspects of the ruling’s interpretation. Furthermore, pharmaceutical manufacturers may explore alternative legal strategies to address their concerns regarding the program’s impact on their pricing and profitability. The ruling creates a new legal landscape, likely to prompt further litigation and regulatory adjustments in the years to come.

This ongoing evolution underscores the dynamic and complex nature of the 340B program and its ongoing legal battles.

Illustrative Example: Impact on a Hypothetical Hospital

This example examines the potential consequences of the HHS appeals court ruling on a hypothetical rural hospital in a medically underserved area. We’ll explore how the changes in 340B drug pricing could affect its financial stability and ultimately, the care it provides to its patients.

Oakhaven Community Hospital: Pre-Ruling Financial Situation

Oakhaven Community Hospital, located in a rural county with limited access to specialists and other healthcare resources, heavily relies on the 340B Drug Pricing Program. Before the ruling, approximately 25% of its outpatient pharmacy revenue came from the discounted drug prices under 340B. This revenue stream was crucial for subsidizing care for uninsured and underinsured patients, supporting essential community health initiatives, and offsetting losses from other underfunded services.

The hospital’s operating margin was a precarious 2%, heavily dependent on the 340B program. A significant portion of its budget allocated for essential equipment upgrades and staff training was also directly or indirectly linked to the savings generated through 340B.

Oakhaven Community Hospital: Post-Ruling Financial Situation

The appeals court ruling significantly reduces Oakhaven’s access to 340B discounts, cutting its discounted drug revenue by approximately 15%. This translates to a loss of roughly $500,000 annually based on their pre-ruling financial data. This reduction, coupled with the already thin operating margin, pushes Oakhaven into a deficit. The hospital is now forced to explore cost-cutting measures, including potential staff reductions, service limitations, or increased patient charges, which would disproportionately affect low-income patients.

The funding previously allocated for equipment upgrades and staff training is now severely constrained, potentially hindering the hospital’s ability to keep pace with advancements in medical technology and maintain a skilled workforce.

Impact on Patient Care at Oakhaven Community Hospital

The financial strain resulting from the reduced 340B discounts has direct consequences for patient care. The hospital may be forced to limit access to certain specialty medications, particularly for patients with chronic conditions. This could lead to poorer health outcomes and increased hospital readmissions. Delayed equipment upgrades could compromise the quality of care provided, while staff reductions might lead to longer wait times and decreased patient-to-nurse ratios.

Furthermore, the increased patient charges could deter low-income individuals from seeking necessary care, potentially leading to delayed diagnoses and worsening health conditions. The ripple effect on the community’s overall health is significant, as Oakhaven is the primary healthcare provider for a large, geographically isolated population. The hospital’s struggle to maintain its current level of service highlights the vulnerability of rural healthcare facilities dependent on the 340B program.

Last Point

The 340B HHS appeals court ruling on Sanofi, Novo Nordisk, and AstraZeneca has sent shockwaves through the healthcare system. While the immediate financial impact on hospitals and pharmaceutical companies is clear, the long-term consequences remain to be seen. This case highlights the ongoing tension between ensuring affordable medications for vulnerable populations and the financial sustainability of both hospitals and pharmaceutical manufacturers.

The legal battles may not be over, and legislative action could be on the horizon. One thing is certain: this ruling is a pivotal moment in the ongoing conversation about drug pricing in the US, and its effects will continue to unfold in the years to come. Stay tuned for further updates!

Questions Often Asked

What is the 340B Drug Pricing Program?

It’s a federal program that provides discounted medications to eligible hospitals and healthcare providers serving a disproportionate number of low-income patients.

Who are the main players affected by this ruling?

Hospitals participating in the 340B program, and the pharmaceutical manufacturers Sanofi, Novo Nordisk, and AstraZeneca are most directly affected.

Could this ruling lead to higher drug prices for patients?

Potentially, yes. The reduced discounts could lead to hospitals passing increased costs onto patients, although the full impact is still unfolding.

What are the potential long-term effects of this ruling?

It could lead to changes in the 340B program itself, further legal challenges, or legislative action to clarify the rules and regulations.