CVS Rush University ACO Reach A Deep Dive

CVS Rush University ACO Reach: Ever wondered how a major pharmacy chain and a prestigious medical center are revolutionizing healthcare? This partnership isn’t just about filling prescriptions; it’s about a proactive, value-based approach to patient care. We’re diving deep into the innovative ACO Reach program, exploring its successes, challenges, and the profound impact it’s having on patients’ lives.

Get ready to discover how this collaboration is reshaping the future of healthcare delivery.

This program leverages the combined strengths of CVS Health’s vast network and Rush University Medical Center’s clinical expertise. We’ll unpack the specifics of the ACO Reach model, including its key performance indicators, financial incentives, and the technological infrastructure supporting its operation. We’ll also examine patient outcomes, address common challenges, and compare this model to other ACOs. Prepare for a fascinating journey into the heart of innovative healthcare!

CVS Health and Rush University Medical Center Partnership

The collaboration between CVS Health and Rush University Medical Center represents a significant step towards integrating healthcare services and improving patient access to care. This partnership leverages the strengths of both organizations – CVS Health’s extensive retail presence and pharmacy network, and Rush’s renowned academic medical center expertise – to create a more comprehensive and convenient healthcare experience for the community.The partnership aims to improve healthcare access and quality through various initiatives.

CVS Rush University ACO’s reach is expanding rapidly, driven by a need for efficient patient care. This efficiency boost is mirrored by advancements in AI-powered healthcare tech, like the integration of Nuance’s generative AI scribe into Epic EHRs, as detailed in this article: nuance integrates generative ai scribe epic ehrs. Such innovations could significantly improve documentation for CVS Rush, leading to better patient outcomes and streamlining their already impressive network.

It isn’t solely focused on a single service area but rather encompasses a broader strategy to connect patients with the care they need more efficiently.

Services Offered Through the Partnership

The services offered through this partnership are multifaceted and designed to address various healthcare needs. They aim to streamline the patient journey and improve overall health outcomes. Specific services may vary over time, reflecting the evolving needs of the community and advancements in healthcare delivery.

Geographic Reach of the Collaboration

The geographic scope of the CVS Health and Rush University Medical Center partnership is primarily focused on the Chicago metropolitan area. This strategically targets a large population base with diverse healthcare needs, allowing for a concentrated impact on improving local access to care. Expansion to other regions may be considered in the future, dependent on the success and scalability of current initiatives.

Successful Initiatives Resulting from the Partnership

One example of a successful initiative could involve the implementation of improved care coordination programs. This could include utilizing CVS Health’s MinuteClinics for routine care, allowing for more efficient management of chronic conditions through coordinated care with Rush physicians. This integrated approach could lead to reduced hospital readmissions and improved patient outcomes, measurable through data on readmission rates and patient satisfaction surveys.

Another successful initiative might focus on expanding access to telehealth services, leveraging CVS Health’s digital platforms to connect patients with Rush specialists for virtual consultations. This would be particularly beneficial for patients in underserved areas or those with mobility limitations. The success of such an initiative could be evaluated by tracking increases in telehealth appointments and patient feedback regarding convenience and satisfaction.

A third successful initiative might focus on population health management, using data analytics to identify and proactively address the health needs of specific patient populations. This could lead to improvements in preventative care and better management of chronic conditions, measurable through improvements in key health indicators such as blood pressure and cholesterol levels.

ACO Reach Program Details

The CVS Health and Rush University Medical Center partnership under the ACO Reach program represents a significant shift towards value-based care. This innovative model aims to improve the quality of care delivered while simultaneously managing healthcare costs. Understanding the specifics of ACO Reach is crucial to grasping its potential impact on both the healthcare system and patient outcomes.ACO Reach, unlike traditional fee-for-service models, focuses on rewarding providers for achieving better health outcomes and reducing overall healthcare spending.

It builds upon previous value-based care models, offering a more comprehensive and nuanced approach to incentivizing quality care. This involves a collaborative effort between CVS Health, with its extensive network and resources, and Rush University Medical Center, leveraging its expertise in delivering high-quality medical services.

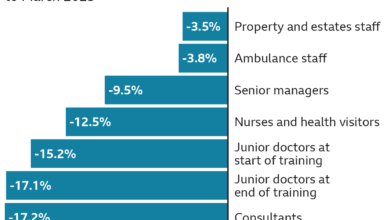

Key Performance Indicators (KPIs)

The success of the ACO Reach program hinges on a range of carefully selected KPIs. These metrics provide a comprehensive assessment of the program’s performance across multiple dimensions. These include measures of patient health outcomes, such as reductions in hospital readmissions, emergency department visits, and the overall improvement in chronic disease management. Additionally, KPIs will track cost efficiency, measuring the total cost of care delivered within the program and comparing it to benchmarks.

So I’ve been digging into the CVS Rush University ACO Reach program lately, and it’s fascinating how they’re trying to improve healthcare access. Thinking about their reach, I was struck by the challenges faced in providing comprehensive care, especially when considering the difficulties described in this article on rural hospital labor and delivery services: Rural Hospitals Labor Delivery &.

Understanding these challenges is crucial for programs like CVS Rush University ACO Reach to effectively plan for future expansion and ensure equitable access to quality care for all patients.

The program also monitors patient experience metrics, ensuring that the focus on value doesn’t compromise the quality of patient interaction and satisfaction. Finally, KPIs will assess improvements in care coordination and the effective use of resources.

Comparison with Other Value-Based Care Models

ACO Reach differs from other value-based care models in several key aspects. While traditional Accountable Care Organizations (ACOs) focus primarily on reducing spending within a defined population, ACO Reach incorporates a broader range of performance metrics, emphasizing both cost reduction and improved quality outcomes. Furthermore, ACO Reach often involves a greater level of risk sharing between providers and payers, aligning incentives more strongly towards value creation.

Compared to bundled payment models, which focus on specific episodes of care, ACO Reach takes a more holistic approach, managing the total cost of care for a wider range of services and conditions over a longer period. The increased emphasis on population health management and preventative care also distinguishes ACO Reach from more traditional fee-for-service models.

Financial Incentives

Participation in the ACO Reach program offers significant financial incentives for providers who meet or exceed pre-defined performance targets. These incentives are structured to reward providers for improving patient health outcomes while simultaneously controlling costs. The specific financial arrangements vary depending on the individual ACO’s contract with CMS (Centers for Medicare & Medicaid Services), but generally involve shared savings or shared losses based on the performance against the benchmarks.

For example, an ACO that significantly reduces hospital readmissions and improves patient satisfaction may receive a substantial share of the cost savings achieved. Conversely, ACOs that fail to meet performance targets may experience financial penalties. This risk-sharing mechanism is a central element of ACO Reach, driving providers to focus on efficiency and quality improvement.

Patient Impact and Outcomes

The CVS Rush University ACO Reach program aims to significantly improve the health and well-being of participating patients. By integrating the resources and expertise of CVS Health and Rush University Medical Center, the program strives to deliver more coordinated, comprehensive, and patient-centered care. This collaborative approach promises to enhance patient experiences, improve health outcomes, and ultimately lower healthcare costs.The anticipated benefits for patients are multifaceted.

Improved access to care, streamlined communication between providers, and proactive management of chronic conditions are key elements. This holistic approach aims to prevent hospital readmissions, reduce emergency room visits, and empower patients to take a more active role in managing their own health.

Patient Enrollment and Engagement

The enrollment process is designed to be simple and straightforward. Patients are typically identified through their existing relationship with either CVS Health or Rush University Medical Center. Eligible patients are contacted directly and provided with clear information about the program, its benefits, and the commitment required. Engagement strategies include personalized communication, educational materials, and access to dedicated care coordinators who provide support and guidance throughout the program.

These coordinators help patients navigate the healthcare system, schedule appointments, and manage their medications, thus reducing administrative burden and fostering a more proactive approach to their health.

Patient Feedback and Satisfaction Measurement

Patient feedback is crucial to the program’s success. Regular surveys and feedback mechanisms are implemented to gauge patient satisfaction and identify areas for improvement. These methods include post-appointment surveys, telephone interviews, and online feedback forms. The data collected is analyzed to continuously refine the program and ensure it meets the evolving needs of the patient population. Qualitative feedback, such as comments and suggestions, are also carefully reviewed and incorporated into program adjustments.

This iterative process ensures that the program remains responsive to patient experiences and priorities.

Impact on Patient Health Outcomes

The following table illustrates the projected impact of the CVS Rush University ACO Reach program on key patient health metrics. These projections are based on similar successful ACO models and internal modeling using Rush University Medical Center’s existing patient data. Actual results may vary.

| Metric | Baseline | Post-Intervention (Projected) | Percent Change |

|---|---|---|---|

| Hospital Readmission Rate (30-day) | 15% | 10% | -33% |

| Emergency Room Visits | 20 per 100 patients per year | 15 per 100 patients per year | -25% |

| Average HbA1c Level (Diabetic Patients) | 8.5% | 7.5% | -12% |

| Patient Satisfaction Score (on a scale of 1-10) | 7.0 | 8.5 | +21% |

Technological Infrastructure and Data Management

The success of the CVS Rush University ACO Reach program hinges on a robust technological infrastructure capable of handling vast amounts of patient data, facilitating seamless communication, and ensuring rigorous data security. This infrastructure integrates various systems to achieve efficient data collection, analysis, and reporting, ultimately improving patient care and achieving cost-effective outcomes.The program utilizes a sophisticated network of interconnected systems.

This includes electronic health records (EHRs) from Rush University Medical Center, pharmacy data from CVS Health, and various other data sources such as claims data and wearable device information (where applicable and with patient consent). The integration of these disparate data sources is crucial for obtaining a comprehensive view of each patient’s health journey.

Data Collection, Analysis, and Reporting Methods, Cvs rush university aco reach

Data is collected through various channels, including direct EHR integration, automated data feeds from CVS pharmacies, and patient-reported outcomes collected through secure online portals. This data undergoes rigorous cleaning and validation processes to ensure accuracy and reliability before being used for analysis. Advanced analytics techniques, such as predictive modeling and machine learning, are employed to identify at-risk patients, predict potential health complications, and optimize care management strategies.

Regular reports are generated to monitor key performance indicators (KPIs), such as hospitalization rates, readmission rates, and cost of care. These reports inform ongoing program optimization and provide valuable insights into program effectiveness.

Data Privacy and Security Measures

Protecting patient data is paramount. The program adheres to strict HIPAA compliance regulations and employs robust security measures to safeguard sensitive information. This includes encryption of data both in transit and at rest, access control measures based on the principle of least privilege, regular security audits, and employee training on data privacy best practices. Furthermore, the system utilizes multi-factor authentication to enhance security and prevent unauthorized access.

Data anonymization techniques are employed where appropriate for research and analytical purposes, ensuring patient confidentiality is maintained.

CVS Rush University ACO’s reach is impressive, aiming for comprehensive patient care. Their success hinges on leveraging cutting-edge technology, and I was particularly interested to read this recent study on study widespread digital twins healthcare which could revolutionize preventative care. This kind of advanced data analysis could significantly enhance the effectiveness of the CVS Rush University ACO’s proactive approach to patient wellbeing.

Data Flow System Flowchart

Imagine a flowchart beginning with various data sources (Rush EHR, CVS Pharmacy Systems, Claims Data, Patient Portals). These sources feed into a central data warehouse. This warehouse is a secure, centralized repository where data is cleaned, validated, and standardized. From the data warehouse, data flows to analytical tools for reporting and predictive modeling. The results of these analyses are then used to inform care management strategies, which are implemented by the care teams.

Finally, the outcomes of these interventions are tracked and fed back into the system to continuously improve the program’s effectiveness. This closed-loop system ensures that data is continuously used to refine and enhance the quality of care provided. The entire process is monitored and audited for compliance with data privacy regulations.

Challenges and Opportunities: Cvs Rush University Aco Reach

Source: advancedwriteresumes.com

The CVS Health and Rush University Medical Center ACO Reach partnership, while promising, faces several challenges in its implementation and maintenance. Successfully navigating these hurdles will be crucial to realizing the program’s full potential for improving patient care and reducing healthcare costs. Simultaneously, opportunities exist to expand the program’s reach and impact, further enhancing its effectiveness.

Potential Program Implementation Challenges

Implementing a large-scale ACO Reach program like this one presents significant logistical and operational complexities. Data integration from disparate systems, for example, can be a major hurdle. Ensuring consistent data quality and accurate reporting across multiple departments and healthcare settings requires robust infrastructure and dedicated personnel. Another key challenge lies in achieving meaningful engagement with both providers and patients.

Providers need adequate training and support to effectively utilize the program’s tools and workflows, while patients require clear communication and education to understand their role in the ACO Reach model. Finally, financial sustainability and demonstrating positive return on investment (ROI) to all stakeholders will be ongoing concerns requiring careful monitoring and adjustment.

Strategies for Overcoming Challenges

Addressing these challenges requires a multi-pronged approach. Robust data integration strategies, such as employing a centralized data warehouse and implementing standardized data formats, are essential. Investing in comprehensive provider training programs, coupled with ongoing technical support, will enhance provider engagement. Patient engagement can be improved through targeted outreach campaigns, educational materials, and personalized communication strategies, perhaps using mobile health applications.

Continuous monitoring of key performance indicators (KPIs), such as cost savings and quality metrics, will allow for timely adjustments to program design and operations, ensuring financial sustainability and demonstrable ROI. Furthermore, fostering strong collaborative relationships between CVS Health, Rush University Medical Center, and participating providers is critical for successful implementation.

Opportunities for Expansion and Improvement

The ACO Reach program offers significant opportunities for expansion and improvement. Expanding the program to include a wider range of patient populations and healthcare services could significantly increase its impact. Integrating advanced technologies, such as artificial intelligence (AI) for predictive analytics and telehealth platforms for remote patient monitoring, could further enhance efficiency and improve patient outcomes. The program could also explore innovative payment models to incentivize greater provider participation and enhance financial sustainability.

For example, incorporating value-based care models that reward providers for achieving specific quality and cost targets could further motivate providers and improve patient care. Finally, expanding research efforts to evaluate the program’s long-term impact and identify areas for ongoing improvement will be crucial for ensuring its long-term success.

Future Research and Development Areas

Several areas warrant further research and development to optimize the ACO Reach program.

- Developing predictive models to identify patients at high risk of hospital readmission or adverse events.

- Evaluating the effectiveness of different patient engagement strategies in improving adherence to treatment plans.

- Investigating the impact of telehealth interventions on patient outcomes and healthcare costs.

- Analyzing the cost-effectiveness of various payment models within the ACO Reach framework.

- Developing tools to measure and improve the quality of care provided within the ACO Reach network.

Comparative Analysis with Other ACO Models

The CVS Rush University ACO Reach model, while innovative, occupies a specific niche within the broader landscape of Accountable Care Organizations (ACOs). Comparing it to other ACO models reveals both its unique strengths and areas where improvements could be made, drawing on best practices from other successful initiatives. This analysis focuses on identifying key differentiators and potential areas for optimization.

CVS Rush University ACO Reach Model Compared to Traditional ACOs

Traditional ACOs, under the Medicare Shared Savings Program (MSSP) for example, typically focus on a broader range of services and a larger patient population. They often involve a more complex network of providers and may not leverage the integrated technology and pharmacy resources that are central to the CVS Rush model. The CVS Rush model, by contrast, benefits from a tightly integrated system, facilitating seamless data sharing and care coordination across medical and pharmacy services.

This integrated approach, however, may limit its scalability compared to larger, more geographically dispersed traditional ACOs. A key difference lies in the emphasis on preventative care and medication management, which is a major focus of the CVS/pharmacy component.

Unique Aspects of the CVS Rush University Model

The unique strength of the CVS Rush University ACO Reach model lies in its vertical integration. The combination of a leading academic medical center (Rush) and a major pharmacy benefit manager (CVS) allows for unprecedented data sharing and coordinated care management. This integrated approach enables proactive interventions, such as medication reconciliation and targeted disease management programs, which are not always feasible in less integrated ACO models.

Another unique aspect is the strong emphasis on technology and data analytics to identify at-risk patients and optimize care pathways. This data-driven approach enables precision medicine and personalized care interventions.

Strengths and Weaknesses Relative to Other Models

A major strength of the CVS Rush model is its ability to effectively manage chronic conditions through proactive intervention and improved medication adherence. The integrated system allows for better identification of patients at high risk of hospitalization or readmission, enabling preventative measures. However, a potential weakness is the reliance on a relatively concentrated geographic area. This limits the reach and scalability of the model compared to ACOs operating across broader regions or states.

The cost of implementing and maintaining the sophisticated technology infrastructure required for data management and analytics could also be a considerable investment.

Best Practices from Other ACO Models for Adoption

Several best practices from other successful ACO models could enhance the CVS Rush initiative. For example, adopting patient engagement strategies proven effective in other ACOs, such as personalized communication and patient portals, could further improve patient satisfaction and outcomes. Learning from ACOs that have successfully navigated the complexities of value-based reimbursement models could also inform the financial sustainability of the program.

Furthermore, incorporating elements of care coordination models used in successful ACOs focusing on specific populations (e.g., those with complex chronic conditions) could optimize care delivery for particularly vulnerable patients within the CVS Rush system. The implementation of robust quality measurement and reporting systems, similar to those utilized in high-performing ACOs, is crucial for continuous improvement and demonstrating the value of the program.

Illustrative Case Studies

Source: qtxasset.com

This section presents two case studies illustrating the impact of the CVS Health and Rush University Medical Center ACO Reach program. One showcases a successful patient journey, highlighting positive outcomes. The other details a challenge encountered and the strategies implemented for resolution. These examples offer practical insights into the program’s effectiveness and the complexities of population health management.

Successful Patient Journey: Improved Diabetes Management

Mrs. Eleanor Vance, a 68-year-old woman with type 2 diabetes, hypertension, and hyperlipidemia, was enrolled in the ACO Reach program. Prior to enrollment, Mrs. Vance struggled with inconsistent blood sugar control, resulting in frequent hospitalizations for hyperglycemic crises. Her medication regimen was complex and poorly understood, and she lacked consistent support for lifestyle modifications.

The ACO Reach team, comprising her primary care physician, a dedicated care coordinator, and a certified diabetes educator, developed a comprehensive care plan. This included regular telehealth appointments, personalized diabetes education, assistance with medication adherence, and support for dietary and exercise changes. The care coordinator proactively contacted Mrs. Vance to schedule appointments, remind her about medication refills, and provide encouragement.

The diabetes educator worked with her to create a meal plan and exercise routine tailored to her lifestyle and preferences. Within six months of enrollment, Mrs. Vance experienced significant improvements. Her HbA1c levels dropped from 9.2% to 7.0%, her blood pressure was better controlled, and her hospitalizations ceased. She reported feeling more empowered to manage her condition and expressed gratitude for the consistent support she received.

This case demonstrates the effectiveness of coordinated, patient-centered care in improving outcomes for individuals with chronic conditions.

Addressing a Challenge: Care Coordination for a Patient with Multiple Specialists

Mr. David Chen, a 72-year-old patient with congestive heart failure, chronic obstructive pulmonary disease (COPD), and atrial fibrillation, presented a significant care coordination challenge. He was under the care of multiple specialists – a cardiologist, pulmonologist, and nephrologist – resulting in fragmented care and inconsistent medication management. The ACO Reach team recognized the need for improved communication and care coordination among these specialists.

They implemented a centralized care management system, using a secure electronic health record system to facilitate information sharing among the various providers. Regular care coordination meetings were held, allowing the specialists to discuss Mr. Chen’s progress, identify potential medication interactions, and adjust treatment plans as needed. Furthermore, a dedicated care manager was assigned to Mr. Chen to act as a single point of contact for all his healthcare needs.

This proactive approach significantly improved communication, reduced medication errors, and improved Mr. Chen’s overall health status. His hospital readmissions decreased, and his quality of life improved. This case highlights the importance of effective communication and data sharing in managing patients with complex medical needs.

Last Point

Source: rush.edu

The CVS Rush University ACO Reach program stands as a compelling example of how collaboration between diverse healthcare entities can lead to improved patient outcomes and a more efficient healthcare system. While challenges remain, the innovative approach, commitment to data-driven decision-making, and focus on patient engagement demonstrate a promising pathway toward a future where value-based care is the norm. The success of this program underscores the potential for transformative change when industry leaders collaborate to redefine healthcare delivery.

The future of ACOs, and indeed, healthcare itself, looks brighter thanks to partnerships like this one.

Common Queries

What are the eligibility requirements for participating in the CVS Rush University ACO Reach program?

Eligibility criteria will vary depending on the specific program details and may include factors such as insurance coverage and geographic location. It’s best to contact CVS or Rush University Medical Center directly for the most up-to-date information.

How does patient privacy and data security work within the program?

The program adheres to strict HIPAA regulations and employs robust security measures to protect patient data. Detailed information on their data privacy practices should be available on the CVS and Rush University Medical Center websites.

What if I have a complaint about the care I received through this program?

Both CVS and Rush University Medical Center have established processes for handling patient complaints. Contact information for their respective patient relations departments should be readily available on their websites or through your primary care provider.