Medicaid Redeterminations, Post-COVID Hospital Margins & Kaufman Hall

Medicaid redeterminations end of covid 19 emergency hospital margins kaufmal hall – Medicaid redeterminations, the end of the COVID-19 emergency, hospital margins, and Kaufman Hall’s analysis – these factors are all intertwined in a complex web impacting healthcare in the US. The end of the pandemic’s public health emergency has triggered a wave of Medicaid eligibility reviews, potentially leaving millions uninsured. Simultaneously, hospitals are grappling with reduced government funding and rising costs, leading to shrinking margins.

Kaufman Hall’s data paints a stark picture, highlighting the financial pressures facing hospitals and the implications for patient care. This post dives into the details, exploring the connections between these critical issues and what it all means for the future of healthcare.

We’ll examine the projected loss of Medicaid coverage across various states, exploring the different approaches states are taking to manage the redeterminations. We’ll also delve into the financial struggles faced by hospitals, analyzing the impact of reduced revenue and increased expenses. We’ll look closely at Kaufman Hall’s insights, comparing their predictions to those of other analysts and considering their recommendations for hospitals to improve their financial stability.

Finally, we’ll discuss potential policy responses to address the challenges posed by these intertwined issues.

Impact of Medicaid Redeterminations Post-COVID-19 Emergency

The end of the COVID-19 Public Health Emergency (PHE) triggered a massive wave of Medicaid redeterminations across the United States. This process, where states verify the eligibility of individuals enrolled in Medicaid, was paused during the PHE to prevent disruptions to healthcare access during a national crisis. The resumption of these redeterminations has significant implications for millions of Americans and the healthcare system as a whole.Medicaid redeterminations involve a thorough review of an individual’s income, household size, and other factors to ensure they still meet the program’s eligibility criteria.

During the PHE, continuous coverage was guaranteed, meaning individuals remained enrolled regardless of changes in their circumstances. The lifting of this continuous coverage mandate has led to a complex and potentially chaotic process, with states employing varying strategies and facing significant logistical challenges. The sheer volume of individuals requiring review, coupled with staffing shortages and outdated systems in some states, has created delays and uncertainties for millions.

Increased Uninsured Population Due to Redeterminations

The reinstatement of standard Medicaid eligibility checks is projected to lead to a substantial increase in the number of uninsured Americans. Millions of individuals who benefited from continuous coverage during the PHE may no longer qualify based on updated income or other eligibility criteria. This influx of newly uninsured individuals will place a strain on healthcare providers, particularly safety-net hospitals and clinics already burdened by limited resources.

The economic consequences could be significant, with increased reliance on charity care and potentially higher uncompensated care costs for hospitals. For example, the Kaiser Family Foundation projected millions of people losing coverage nationally, leading to increased pressure on the healthcare system. This situation disproportionately affects vulnerable populations, such as children, pregnant women, and individuals with disabilities.

State-by-State Projections of Medicaid Coverage Loss

The projected number of individuals losing Medicaid coverage varies significantly across states, reflecting differences in state-specific policies, income levels, and the efficiency of their redetermination processes. Some states have implemented proactive outreach programs to assist individuals in navigating the redetermination process, while others have faced significant delays and logistical hurdles. The following table presents a hypothetical example to illustrate the potential range of impacts, remembering that actual numbers vary and are constantly being updated by official sources.

This is a simplified illustration and should not be taken as definitive. Actual data should be sourced from official state and federal reports.

| State | Projected Loss | Percentage Change | Relevant State Policies |

|---|---|---|---|

| California | 1,000,000 | 15% | Implemented a streamlined online renewal system. |

| Texas | 1,500,000 | 20% | Experienced significant delays due to understaffing. |

| Florida | 750,000 | 10% | Launched a public awareness campaign to inform residents about the redetermination process. |

| New York | 1,200,000 | 18% | Extended the renewal deadline for certain populations. |

Hospital Margins and the End of the COVID-19 Emergency: Medicaid Redeterminations End Of Covid 19 Emergency Hospital Margins Kaufmal Hall

Source: aha.org

With Medicaid redeterminations looming and the end of COVID-19 emergency funding impacting hospital margins, Kaufman Hall’s projections are grim. Improving healthcare efficiency is crucial, and a recent study, which you can check out here: study widespread digital twins healthcare , suggests that widespread adoption of digital twins could significantly improve predictive modeling and resource allocation. This technology could help hospitals better navigate the challenges posed by reduced funding and increased patient demand following the end of the public health emergency.

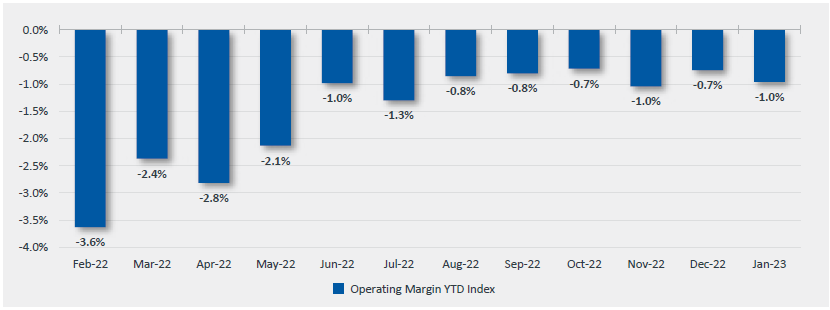

The end of the COVID-19 public health emergency significantly impacted hospital finances, reversing many of the trends observed during the pandemic. While the initial surge saw increased revenue from COVID-19 related treatments and a temporary reduction in elective procedures, the post-emergency period brought a complex array of challenges that squeezed hospital margins. This section explores the financial ramifications for hospitals as government funding decreased and patient volumes shifted.The dramatic shift in hospital finances post-COVID-19 emergency is multifaceted.

Hospitals experienced a sharp decline in revenue from several sources. The reduction in government funding, including supplemental payments related to COVID-19 care, was a major factor. Simultaneously, the increase in non-COVID-19 patient volume, while seemingly positive, often strained resources and led to increased operating costs without a commensurate rise in revenue. This is because many patients delayed care during the pandemic, leading to a backlog of patients needing treatment once restrictions eased.

Furthermore, inflation significantly increased the cost of supplies, medications, and staffing, further eroding profit margins.

Changes in Hospital Revenue and Expenses Post-Emergency

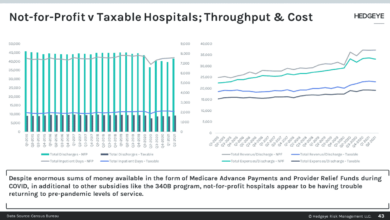

Data from the American Hospital Association (AHA) and other healthcare industry reports illustrate the significant changes. For example, many hospitals reported a decline in operating margins from the positive territory seen during parts of the pandemic (due to increased government funding and reduced elective procedures) to negative margins in the post-emergency period. This is not uniform across all hospitals, with variations depending on location, hospital size, and patient demographics.

The end of the COVID-19 emergency and subsequent Medicaid redeterminations are squeezing hospital margins, especially in places like Kaufmal Hall. This financial pressure is amplified for rural hospitals already struggling with staffing shortages, particularly impacting vital services. The situation is further complicated by challenges in maintaining adequate labor and delivery services, as highlighted in this insightful article on Rural Hospitals Labor Delivery & which shows how these pressures are interconnected.

Ultimately, the combined effect of these factors threatens the viability of rural healthcare, exacerbating the financial strain caused by the end of the public health emergency and the resulting Medicaid changes.

However, the overall trend points towards a considerable financial strain on many healthcare facilities. Specific numerical data illustrating these changes would require accessing and analyzing confidential financial reports from individual hospitals, which is beyond the scope of this blog. However, publicly available reports from organizations like the AHA provide general trends and insights.

Factors Contributing to the Change in Hospital Margins

Several key factors contributed to the narrowing of hospital margins after the COVID-19 emergency. Reduced government funding, as mentioned earlier, was a primary driver. The supplemental payments and waivers that propped up hospital finances during the pandemic were phased out, leaving many hospitals with a revenue shortfall. Increased patient volume, while seemingly beneficial, also contributed to the problem.

The influx of patients needing care after delayed treatments during lockdowns placed significant strain on resources, including staffing and supplies, leading to higher operational costs. Finally, the inflationary pressures on the economy affected hospitals as well, increasing the cost of everything from medical supplies to employee salaries.

Comparison of Hospital Margins Before, During, and After the COVID-19 Emergency

A bar chart visualizing the change in hospital margins would show three distinct bars: one for the pre-pandemic period, one for the period during the COVID-19 emergency, and one for the post-emergency period. The pre-pandemic bar would represent a relatively stable, albeit often narrow, operating margin. The bar representing the COVID-19 emergency period would likely show a significant increase in margins, reflecting the surge in government funding and reduced elective procedures.

Finally, the post-emergency bar would demonstrate a sharp decrease in margins, possibly even showing a negative margin for many hospitals, reflecting the factors discussed above. The precise numerical values would vary significantly depending on the specific hospital and data source, but the general trend would be a clear upward spike during the emergency and a substantial downward drop afterward.

Kaufman Hall’s Analysis of Hospital Financial Performance

Kaufman Hall is a leading healthcare consulting firm that provides insightful analysis on the financial health of hospitals and health systems. Their reports offer a valuable perspective on the challenges and opportunities facing the industry, particularly in the context of significant events like the end of the COVID-19 public health emergency and the subsequent Medicaid redeterminations. Understanding their findings is crucial for grasping the full impact of these changes on hospital margins.Kaufman Hall’s analyses consistently highlight the precarious financial state of many hospitals, even before the recent economic shifts.

Their reports often delve into detailed financial data, examining operating margins, revenue cycles, and the impact of various cost pressures. They use sophisticated modeling to project future trends and offer strategic recommendations to help hospitals navigate these complex financial landscapes.

Key Findings from Kaufman Hall Reports

Kaufman Hall’s research frequently reveals a widening gap between hospital revenues and expenses. For example, their reports may show a decline in inpatient admissions, coupled with increased labor costs and supply chain disruptions, leading to shrinking operating margins. These findings are often broken down by hospital type (e.g., rural vs. urban, teaching vs. non-teaching), revealing significant variations in financial performance across the sector.

Specific data points, like the average operating margin for a particular hospital type in a given quarter, are frequently presented to illustrate the severity of the financial challenges. The impact of government policies, like changes in Medicare and Medicaid reimbursement rates, is also consistently highlighted in their analyses. For instance, a report might demonstrate how a reduction in reimbursement rates directly correlates with a decrease in hospital profitability for a specific region.

Comparison with Other Healthcare Industry Analyses

While other healthcare consulting firms and research organizations also analyze hospital financial performance, Kaufman Hall’s approach often distinguishes itself through its granular level of detail and its focus on predictive modeling. Other analyses might provide broader overviews, while Kaufman Hall’s reports frequently drill down into specific financial metrics and their underlying drivers. This detailed approach allows them to offer more targeted recommendations for improvement.

For instance, where a general industry report might state that labor costs are a major concern, Kaufman Hall might pinpoint specific areas within labor expenses (e.g., nursing staff overtime) that require attention. The differences aren’t necessarily contradictory; rather, they represent varying levels of granularity and focus in the analysis. A comparison might reveal that while both Kaufman Hall and another firm agree on the overall negative trend in hospital margins, Kaufman Hall’s more detailed analysis might offer more precise insights into the specific causes and potential solutions.

Kaufman Hall Data and Medicaid Redeterminations

Kaufman Hall’s data plays a crucial role in understanding the impact of Medicaid redeterminations on hospital margins. Their analyses can demonstrate how the loss of Medicaid coverage for certain patient populations directly translates into reduced revenue for hospitals that rely heavily on Medicaid reimbursements. This is particularly true for hospitals serving low-income communities. For example, a Kaufman Hall report might show a projected decrease in revenue for a specific hospital system based on estimated Medicaid disenrollment numbers and the average cost of care for those patients.

The interplay between these factors and other economic pressures, such as inflation and staffing shortages, can be effectively illustrated through their modeling, providing a comprehensive picture of the financial consequences for hospitals.

Kaufman Hall’s Recommendations for Improved Financial Stability

Kaufman Hall typically offers a range of recommendations to help hospitals improve their financial stability. These recommendations are often tailored to the specific challenges faced by individual hospitals or health systems, but some common themes emerge:

- Optimize Revenue Cycle Management: Improving billing and collection processes to reduce delays and maximize reimbursement.

- Enhance Operational Efficiency: Identifying and eliminating waste in processes and supply chain management.

- Strategic Workforce Planning: Addressing staffing shortages and optimizing labor costs through effective recruitment and retention strategies.

- Diversify Revenue Streams: Expanding services and exploring new revenue opportunities beyond traditional inpatient care.

- Invest in Technology: Leveraging technology to improve efficiency, enhance patient care, and reduce administrative costs.

- Develop Strategic Partnerships: Collaborating with other healthcare providers to achieve economies of scale and improve care coordination.

Interplay Between Medicaid Redeterminations and Hospital Financial Health

Source: cbsnewsstatic.com

The end of the COVID-19 public health emergency has triggered a wave of Medicaid redeterminations across the United States, impacting millions of individuals and significantly altering the financial landscape for hospitals. This process, where eligibility for Medicaid is reassessed, is directly linked to changes in hospital patient volume, revenue streams, and overall financial health. Understanding this complex interplay is crucial for policymakers, hospital administrators, and healthcare professionals alike.The relationship between Medicaid coverage loss and hospital patient volume is demonstrably negative.

As individuals lose their Medicaid coverage, many are left uninsured or underinsured, impacting their ability to access and afford healthcare services. This leads to a decrease in patient visits for non-emergency care, elective procedures, and routine check-ups, directly reducing hospital revenue. Conversely, an increase in uninsured patients often leads to a rise in emergency room visits, which are typically less profitable for hospitals due to higher operating costs and lower reimbursement rates.

Loss of Medicaid Coverage and Changes in Hospital Patient Volume

The loss of Medicaid coverage translates directly into a decline in patients utilizing hospital services for preventative care and non-emergency treatments. Hospitals often rely on a consistent flow of patients covered by Medicaid to maintain operational efficiency and profitability. The sudden decrease in this patient population forces hospitals to adjust their operational strategies and potentially reduce services. For example, a rural hospital heavily reliant on Medicaid patients might see a significant drop in revenue, potentially leading to staff reductions or service cuts.

Conversely, urban hospitals with a more diverse patient mix might experience a less dramatic impact, but still face challenges managing an influx of uninsured patients.

Hospital Adaptations to Increased Uninsured Patients

Hospitals are actively seeking strategies to navigate the challenges posed by an increasing number of uninsured patients. Some hospitals are expanding their financial assistance programs, offering discounts or payment plans to eligible individuals. Others are enhancing their community outreach programs to connect uninsured patients with resources like community health clinics or charitable organizations. Furthermore, hospitals are increasingly utilizing advanced billing and collection practices to maximize reimbursement from commercial insurers and government programs, while simultaneously managing bad debt associated with uninsured care.

For instance, some hospitals are investing in sophisticated data analytics tools to identify and target patients most likely to need financial assistance, allowing for more effective allocation of resources.

With Medicaid redeterminations looming and the end of the COVID-19 emergency impacting hospital margins, Kaufman Hall’s projections are pretty grim. Streamlining administrative tasks is crucial, and that’s where advancements like nuance integrates generative ai scribe epic ehrs become incredibly relevant. This AI-powered scribe could significantly reduce documentation burdens, freeing up staff to focus on patient care and ultimately helping hospitals navigate these financial challenges.

The pressure on hospitals to improve efficiency is undeniable in this post-pandemic landscape.

Impact of Uncompensated Care on Hospital Profitability

Uncompensated care – the cost of providing services to patients who cannot or do not pay – significantly impacts hospital profitability. The increase in uninsured patients following Medicaid redeterminations directly contributes to a rise in uncompensated care. This necessitates hospitals to absorb these costs, potentially impacting their bottom line and limiting their ability to invest in infrastructure, technology, and staff.

Hospitals may experience reduced profit margins, forcing them to make difficult choices regarding staffing levels, service offerings, and expansion plans. For example, a hospital with a high percentage of uninsured patients might need to curtail non-essential services or delay planned capital improvements to compensate for the financial burden of uncompensated care. The resulting financial strain can jeopardize the long-term sustainability of the hospital, especially in areas with limited access to alternative healthcare providers.

Interconnectedness of Medicaid Redeterminations and Hospital Financial Health: A Flow Chart Description

The following describes a flowchart illustrating the relationship between Medicaid redeterminations and hospital financial health. The chart would begin with the “Start” node, representing the initiation of Medicaid redeterminations. This would flow into a node depicting “Loss of Medicaid Coverage,” which branches into two paths: “Increased Uninsured Patients” and “Decreased Patient Volume for Non-Emergency Care.” The “Increased Uninsured Patients” path leads to “Increased Emergency Room Visits,” “Increased Uncompensated Care,” and “Reduced Hospital Revenue.” The “Decreased Patient Volume for Non-Emergency Care” path also leads to “Reduced Hospital Revenue.” Both paths converge at a node labeled “Reduced Hospital Profitability,” which further branches into potential outcomes such as “Service Reductions,” “Staffing Cuts,” and “Delayed Capital Improvements.” Finally, the chart concludes with an “End” node, summarizing the overall negative impact on hospital financial health.

Potential Policy Responses to the Challenges

The end of the COVID-19 public health emergency has triggered a wave of Medicaid redeterminations, threatening both individual access to healthcare and the financial stability of hospitals. Addressing this requires a multifaceted approach involving policy interventions that balance the needs of individuals with limited resources and the financial pressures on healthcare providers. Several potential policy solutions exist, each with its own set of advantages and disadvantages.

Careful consideration of these options is crucial for creating a sustainable and equitable healthcare system.

Policy Options to Mitigate the Impact of Medicaid Redeterminations, Medicaid redeterminations end of covid 19 emergency hospital margins kaufmal hall

The following table Artikels several policy options designed to lessen the negative consequences of Medicaid redeterminations on both individuals and hospitals. These approaches range from expanding eligibility to providing direct financial support, each carrying its own set of benefits and drawbacks.

| Policy Option | Description | Benefits | Drawbacks |

|---|---|---|---|

| Expanding Medicaid Eligibility | Increasing the income thresholds for Medicaid eligibility, potentially including a continuous coverage option. This ensures more individuals maintain coverage. | Reduces the number of individuals losing coverage, improving health outcomes and reducing uncompensated care for hospitals. Improves access to preventative care, leading to better long-term health and reduced healthcare costs. | Increased costs for state and federal governments. Potential for increased administrative burden in processing applications and verifying eligibility. May face political opposition due to budgetary concerns. |

| Providing Financial Assistance to Hospitals | Direct financial aid to hospitals to offset the revenue losses expected from increased numbers of uninsured patients. This could involve grants, tax credits, or other forms of direct support. | Helps hospitals maintain financial stability, preventing closures and service reductions. May help mitigate the impact on hospital staff and the communities they serve. | Requires significant government funding, which may be difficult to secure. May not fully address the underlying issue of access to care for uninsured individuals. Potential for misuse of funds or lack of accountability. |

| Streamlining the Redetermination Process | Improving the efficiency and clarity of the Medicaid redetermination process, making it easier for individuals to maintain their coverage. This could involve simplified applications, better communication, and increased outreach efforts. | Reduces the number of individuals losing coverage due to administrative errors or lack of awareness. Decreases the administrative burden on both individuals and government agencies. | Requires significant investment in technology and personnel. May not fully address the issue of affordability for individuals who lose coverage due to income changes. |

| Increased Outreach and Enrollment Assistance | Providing increased support to individuals navigating the redetermination process, including assistance with applications, appeals, and finding alternative coverage options. | Helps ensure individuals understand their rights and options, increasing the likelihood of maintaining coverage. Reduces administrative burdens on individuals. | Requires significant investment in outreach programs and personnel. Effectiveness depends on individuals actively seeking assistance. May not reach all individuals in need. |

Last Word

Source: thedemlabs.org

The confluence of Medicaid redeterminations and the post-COVID-19 economic realities for hospitals presents a significant challenge to the US healthcare system. The potential for a massive increase in the uninsured population, coupled with the financial strain on hospitals, demands urgent attention. While Kaufman Hall’s analysis offers valuable insights, effective solutions require a multifaceted approach involving policy changes, hospital adaptation strategies, and a renewed focus on ensuring access to affordable healthcare for all.

The coming months will be crucial in determining how effectively we address this complex issue and mitigate its potentially devastating consequences.

Common Queries

What are the biggest challenges hospitals face due to these changes?

Hospitals face reduced government funding, increased uncompensated care for uninsured patients, and rising operational costs, all squeezing their profit margins.

How are states handling the increased number of uninsured?

States are employing various strategies, including outreach programs to help people re-enroll in Medicaid, expanding access to affordable healthcare options, and exploring innovative funding mechanisms.

What are some potential long-term consequences of this situation?

Potential long-term consequences include reduced access to care, worsening health outcomes for uninsured individuals, hospital closures in underserved areas, and further strain on the healthcare system.