Hospitals, Payers, Medicaid, Pandemic, & Moodys

Hospitals payers medicaid retederminations pandemic Moodys – Hospitals, payers, Medicaid redeterminations, the pandemic, and Moody’s ratings – these elements intertwined to create a perfect storm for the healthcare industry. The continuous upheaval of the past few years has left hospitals grappling with unprecedented challenges, forcing them to navigate complex financial landscapes and shifting policy environments. This post dives deep into the impact of the pandemic on hospital finances, specifically focusing on the crucial role of Medicaid redeterminations and how rating agencies like Moody’s have assessed the resulting instability.

We’ll explore the hurdles hospitals faced during the pandemic’s surge, the complexities of delayed or altered Medicaid redeterminations, and the knock-on effects on their financial health. We’ll also examine how Medicaid payers themselves struggled, analyzing the varied approaches states took to manage the crisis and the innovative strategies implemented to support struggling hospitals. Finally, we’ll look ahead, considering the long-term implications for both hospitals and the Medicaid system, and the potential need for policy changes to ensure sustainable healthcare access for vulnerable populations.

Impact of the Pandemic on Medicaid Redeterminations in Hospitals

The COVID-19 pandemic dramatically altered the landscape of healthcare financing, significantly impacting the already complex process of Medicaid redeterminations for hospitals. The confluence of increased patient volume, staffing shortages, and shifting regulatory priorities created unprecedented challenges for hospitals attempting to maintain accurate patient eligibility and secure timely reimbursements.

Pandemic-Related Challenges to Medicaid Redeterminations

Hospitals faced numerous hurdles during the pandemic. The surge in COVID-19 patients strained resources, diverting staff and attention away from administrative tasks like Medicaid eligibility verification. Furthermore, many states temporarily suspended or slowed down redetermination processes due to the public health emergency, leading to significant backlogs. This was compounded by the increased difficulty in contacting patients, many of whom were experiencing illness, isolation, or disruptions to their communication infrastructure.

The resulting uncertainty regarding patient eligibility created significant financial instability for hospitals.

Impact of Pandemic Policies on Medicaid Redetermination Processes

The federal government implemented several policies to address the challenges of Medicaid redeterminations during the pandemic. The continuous coverage provision, for instance, temporarily prevented states from removing individuals from Medicaid rolls, even if they no longer met the eligibility criteria. This measure aimed to ensure continuous access to healthcare during the crisis. However, it also led to a substantial accumulation of cases requiring review once the continuous coverage period ended.

This created a massive backlog upon the resumption of normal processes, further straining hospital resources and financial stability. States also adopted various strategies, such as extending deadlines and implementing streamlined processes, to manage the backlog, but the impact varied widely depending on state-specific policies and resources.

Financial Implications of Delays and Changes in Redeterminations

Delays and changes in Medicaid redeterminations had profound financial consequences for hospitals. The inability to promptly verify patient eligibility resulted in delayed or reduced reimbursements for services rendered. Hospitals often faced extended billing cycles and increased administrative costs associated with managing the backlog of redetermination requests. The uncertainty surrounding Medicaid funding created significant cash flow challenges, potentially impacting hospitals’ ability to maintain operations, invest in infrastructure, and provide quality care.

For example, rural hospitals, already operating on thin margins, were particularly vulnerable to the financial strain caused by delayed or reduced Medicaid reimbursements. This resulted in some hospitals facing significant financial distress and even closure.

Comparison of Pre-Pandemic and Pandemic-Era Medicaid Redetermination Timelines and Processes

| Aspect | Pre-Pandemic | Pandemic Era |

|---|---|---|

| Timelines | Relatively short and consistent, typically within a defined timeframe (e.g., 6-12 months) | Significantly extended due to continuous coverage and processing backlogs; varied widely by state. |

| Processes | Regular reviews and updates based on established state guidelines. | Temporary suspension or significant slowing of redeterminations in many states; implementation of streamlined processes and extended deadlines in some areas. |

| Verification Methods | In-person interviews, document review, and data matching. | Increased reliance on remote verification methods due to social distancing and restrictions. |

| Impact on Hospitals | Predictable revenue streams based on timely reimbursements. | Significant delays in reimbursements, increased administrative burden, and financial uncertainty. |

Moody’s Ratings and Hospital Financial Health Post-Pandemic

The COVID-19 pandemic dramatically reshaped the healthcare landscape, leaving a lasting impact on hospital finances and, consequently, their credit ratings as assessed by Moody’s. The initial surge in COVID-19 patients, followed by a period of suppressed elective procedures and the ongoing economic fallout, created a perfect storm for many healthcare providers. Understanding how Moody’s evaluated these impacts and the resulting changes in hospital creditworthiness is crucial for navigating the post-pandemic financial realities of the sector.Moody’s ratings reflect a complex interplay of factors, and the pandemic significantly altered many of them.

The agency considered the immediate financial strain caused by the pandemic, the long-term effects on patient volumes and revenue streams, and the ability of hospitals to adapt to the “new normal.” Hospitals that were already financially vulnerable before the pandemic were disproportionately affected, while those with strong balance sheets and diversified revenue streams were better positioned to weather the storm.

Moody’s Rating Changes in Response to the Pandemic

The pandemic resulted in a mixed bag of rating actions by Moody’s. While some hospitals experienced downgrades reflecting their financial struggles, others saw upgrades or maintained stable ratings due to effective pandemic response strategies and robust financial positions. For example, hospitals that successfully secured government funding and implemented cost-cutting measures were often able to mitigate the negative financial impact, resulting in stable or even upgraded ratings.

Conversely, hospitals that faced significant declines in patient volume and revenue, coupled with increased expenses related to COVID-19 care, experienced rating downgrades. A hypothetical example could be Hospital A, a rural hospital with a pre-existing weak financial position, experiencing a downgrade due to a sharp decline in patient volume and increased COVID-related expenses, whereas Hospital B, a large urban hospital with a strong balance sheet and diverse revenue streams, might have maintained a stable rating or even seen an upgrade due to its ability to secure additional funding and manage its resources effectively.

The Interplay Between Medicaid Redeterminations and Moody’s Ratings

Medicaid redeterminations, the process of verifying the eligibility of individuals enrolled in Medicaid, have a direct impact on hospital revenue streams. As discussed previously, the post-pandemic surge in Medicaid redeterminations could lead to a decrease in Medicaid patients and thus, a reduction in revenue for hospitals that heavily rely on Medicaid reimbursement. This reduction in revenue directly impacts a hospital’s financial health, a key factor considered by Moody’s in its rating assessments.

A significant loss of Medicaid patients could trigger a downgrade, particularly for hospitals with a high proportion of Medicaid patients in their patient mix.

Factors Considered by Moody’s in Assessing Post-Pandemic Hospital Financial Health

Moody’s utilizes a multi-faceted approach to assess hospital financial health, considering various key factors in the post-pandemic context. These include operating profitability (margins), liquidity (cash on hand and access to credit), debt levels, capital expenditures, and the overall strength of the hospital’s management team and strategic planning. The agency also evaluates the hospital’s market position, its ability to adapt to changing healthcare trends, and the overall strength of the local economy.

For instance, hospitals located in areas with high unemployment or reduced economic activity may face increased financial challenges, impacting their Moody’s rating. Furthermore, the ability of a hospital to effectively manage its workforce, negotiate favorable contracts with insurers, and implement cost-saving measures is also crucial in determining its overall financial health and subsequent Moody’s rating.

The Role of Medicaid Payers in Hospital Financial Stability: Hospitals Payers Medicaid Retederminations Pandemic Moodys

The COVID-19 pandemic significantly impacted the financial stability of hospitals, and the role of Medicaid payers in navigating this crisis was crucial. Their actions, both proactive and reactive, directly influenced the ability of hospitals to continue providing essential care. Understanding the challenges faced by Medicaid payers and the resulting policies is essential to comprehending the broader impact on the healthcare system.Medicaid payers faced numerous challenges during the pandemic.

The initial surge in COVID-19 patients strained hospital resources and increased the demand for care, often exceeding available capacity. Simultaneously, many hospitals experienced a decline in non-COVID-related revenue due to postponed elective procedures and reduced patient volume. This created a precarious financial situation for hospitals, many of which heavily rely on Medicaid reimbursement. Furthermore, the uncertainty surrounding the pandemic’s duration and severity made accurate financial forecasting extremely difficult, hindering effective resource allocation and strategic planning.

The increased need for personal protective equipment (PPE) and other pandemic-related supplies added further financial pressure.

Medicaid Payer Policies and Hospital Financial Stability

Medicaid payer policies played a pivotal role in influencing hospital financial stability during the pandemic. Many states implemented temporary policies to increase Medicaid payments to hospitals, often providing supplemental payments for COVID-19-related care or covering additional expenses incurred due to the pandemic. These policies aimed to mitigate the financial losses hospitals were experiencing and ensure their continued operation.

However, the extent of these policies varied significantly across states, leading to disparities in hospital financial stability. Some states provided generous supplemental payments, while others offered limited financial support, creating a patchwork of responses across the nation. The timing and duration of these policies also varied, impacting the long-term financial outlook for hospitals.

State-Level Approaches to Medicaid Management During the Pandemic

States adopted diverse approaches to manage their Medicaid programs during the pandemic. Some states proactively increased Medicaid payments to hospitals, anticipating the financial strain the pandemic would place on healthcare providers. Others adopted a more reactive approach, implementing supplemental payments only after hospitals began experiencing significant financial losses. Some states extended Medicaid coverage to individuals who lost their jobs or health insurance due to the pandemic, increasing Medicaid enrollment and the financial burden on the state’s Medicaid program.

Conversely, other states maintained stricter eligibility requirements, potentially exacerbating financial challenges for hospitals already struggling with reduced patient volume. For example, California implemented a comprehensive package of financial support measures for hospitals, including increased Medicaid reimbursement rates and supplemental payments, while states with more limited resources adopted more targeted and less generous approaches.

Moody’s recent report highlighted the financial strain on hospitals due to Medicaid redeterminations post-pandemic. Payer mix shifts are impacting hospital revenue, especially concerning the viability of smaller facilities. This is further complicated by staffing shortages, a problem acutely felt in rural areas, as evidenced by the challenges facing rural hospitals with labor and delivery services, like those detailed in this insightful article: Rural Hospitals Labor Delivery &.

The financial pressures on hospitals, exacerbated by the pandemic, continue to be a major concern for both providers and payers.

Innovative Strategies Employed by Medicaid Payers to Support Hospitals, Hospitals payers medicaid retederminations pandemic Moodys

Several states employed innovative strategies to support hospitals financially during the pandemic. Some states implemented telehealth reimbursement policies to encourage the use of telehealth services, which helped hospitals maintain patient access to care while minimizing the risk of COVID-19 transmission. Others established rapid payment systems to expedite Medicaid reimbursements to hospitals, providing much-needed cash flow during a period of financial uncertainty.

Some states also partnered with private payers or philanthropic organizations to create supplemental funding programs for hospitals, further alleviating the financial strain. For instance, New York State expanded its telehealth coverage and expedited Medicaid payments to hospitals, while other states utilized innovative financing mechanisms, such as the creation of special COVID-19 relief funds, to support their hospitals.

Strategies for Hospitals to Navigate Medicaid Redeterminations

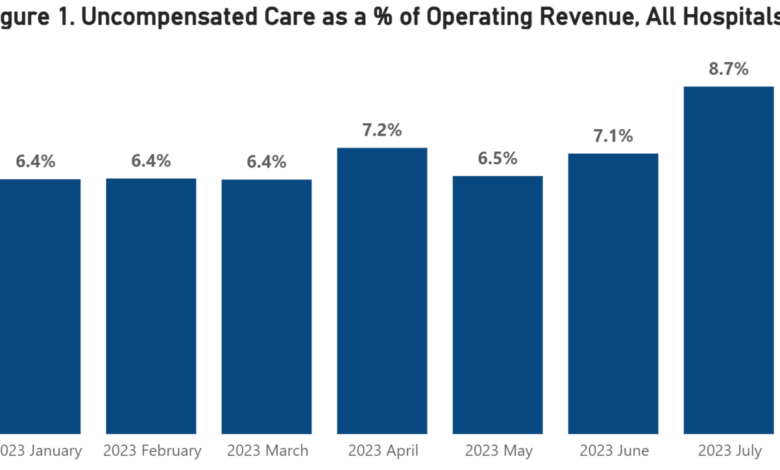

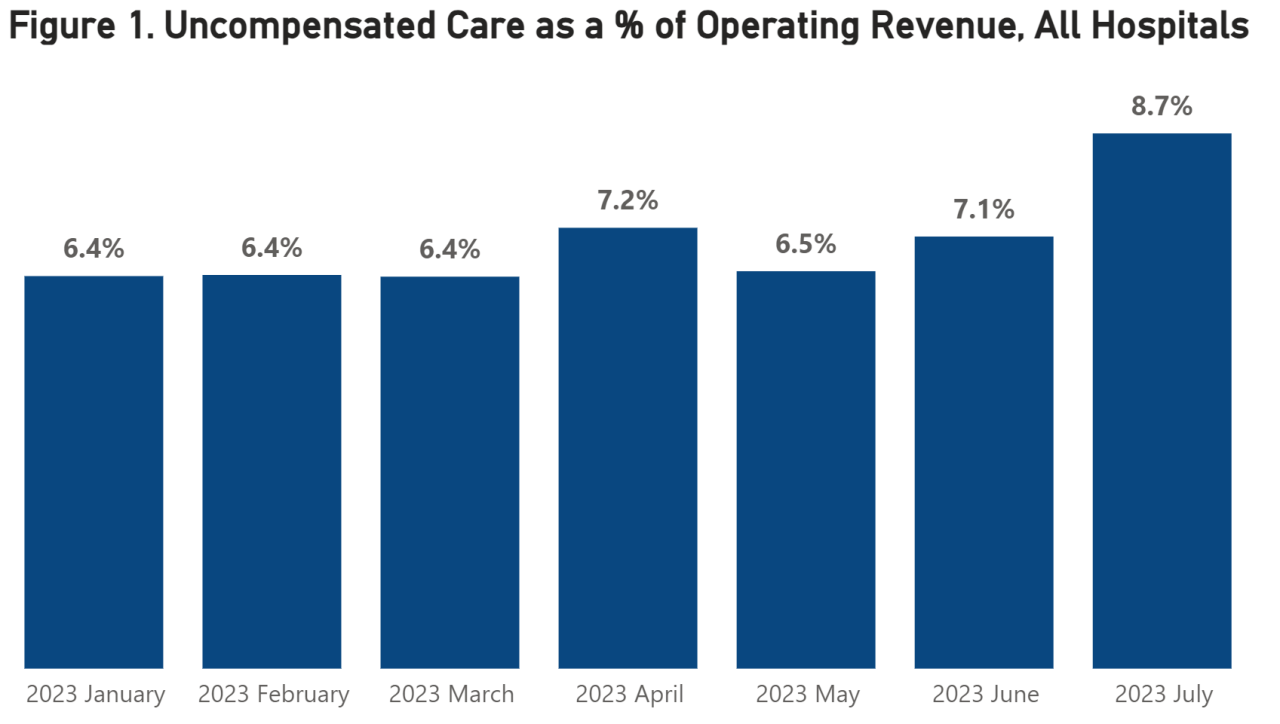

The post-pandemic surge in Medicaid redeterminations presents a significant challenge to hospitals nationwide. Many individuals who gained coverage during the public health emergency are now undergoing eligibility reviews, potentially leading to a substantial loss of revenue for healthcare providers. Hospitals must proactively adapt to this shifting landscape to mitigate financial risks and ensure continued operational stability. A well-defined strategy, incorporating robust communication and efficient internal processes, is crucial for navigating this complex period.

Developing a Proactive Plan for Medicaid Redeterminations

A comprehensive plan should encompass several key areas. First, hospitals need to accurately predict the potential impact of redeterminations on their patient population. This involves analyzing current patient demographics, identifying those most likely to lose coverage, and estimating the resulting revenue shortfall. Secondly, the hospital should establish a dedicated team to manage the redetermination process. This team should be responsible for tracking patients’ eligibility status, assisting patients with the appeals process, and coordinating with Medicaid payers.

Finally, the hospital needs to develop strategies for mitigating revenue loss, such as expanding outreach to uninsured patients and optimizing billing and collection practices. For example, a hospital could implement a system for proactively contacting patients nearing their redetermination date, providing assistance with the renewal process, and exploring alternative payment options.

Best Practices for Minimizing Financial Risks

Minimizing financial risks associated with Medicaid redeterminations requires a multifaceted approach. This includes: investing in advanced data analytics to identify at-risk patients; implementing robust patient communication strategies to ensure timely submission of renewal applications; developing internal protocols for tracking and managing appeals; and exploring alternative revenue streams to offset potential losses. For instance, a hospital could strengthen its charity care program to support patients who lose coverage, or actively seek out contracts with private insurers to broaden its patient base.

A well-structured appeals process, ensuring timely and accurate documentation, is also vital in minimizing financial impact.

Improving Outcomes Through Proactive Communication with Medicaid Payers

Open and consistent communication with Medicaid payers is paramount. Hospitals should establish clear lines of communication with their state Medicaid agencies, regularly sharing data on patient redeterminations and seeking clarification on policy changes. This proactive approach allows for early identification and resolution of potential issues, minimizing disruptions to patient care and revenue cycles. For example, hospitals can engage in collaborative discussions with Medicaid agencies to develop streamlined processes for handling redeterminations, such as joint workshops or webinars for staff training.

This collaborative approach fosters a positive relationship and enables more efficient resolution of disputes.

Flowchart Illustrating Steps for Navigating Medicaid Redeterminations

The following flowchart Artikels the key steps hospitals should take:[Imagine a flowchart here. The flowchart would begin with “Identify Patients Nearing Redetermination,” branch to “Assess Risk of Coverage Loss,” then to “Develop Communication Strategy,” followed by “Assist Patients with Renewal Process,” and then “Track Eligibility Status and Appeals.” Finally, it would lead to “Analyze Financial Impact and Adjust Budget” and “Refine Processes for Future Redeterminations.”] The flowchart visually represents a structured approach, allowing hospitals to systematically manage the process, reducing potential errors and improving efficiency.

This systematic approach ensures that no step is overlooked, resulting in a more effective and less stressful process for both the hospital staff and the patients.

Hospitals, payers like Medicaid, and rating agencies like Moody’s are grappling with the financial fallout from the pandemic and its impact on redeterminations. This makes the findings of a recent study on the widespread adoption of digital twins in healthcare, which you can read about here: study widespread digital twins healthcare , incredibly relevant. The potential for improved efficiency and reduced costs highlighted in the study could be a game-changer for hospitals navigating these complex financial challenges.

Long-Term Implications for Hospitals and Medicaid

Source: myfloridalegal.com

The COVID-19 pandemic dramatically altered the landscape of healthcare financing, particularly the relationship between hospitals and Medicaid. While the immediate crisis response focused on surge capacity and treatment, the long-term effects on hospital finances, Medicaid enrollment, and access to care for vulnerable populations are still unfolding and require careful consideration. The following analysis explores these enduring consequences and the potential need for policy adjustments to ensure a stable and equitable healthcare system.

Projected Changes in Medicaid Enrollment and Impact on Hospitals

The pandemic’s economic fallout led to significant increases in Medicaid enrollment as individuals lost jobs and health insurance coverage. However, the continuous coverage provisions enacted during the Public Health Emergency (PHE) are expiring, triggering a wave of redeterminations. This process involves verifying the eligibility of current enrollees, potentially leading to a substantial reduction in Medicaid beneficiaries. The magnitude of this decrease is uncertain, with projections varying widely depending on state-level policies and economic recovery.

For example, some states anticipate a significant drop in enrollment, potentially impacting hospital revenue streams significantly. Hospitals in states with larger projected enrollment declines face increased financial strain, particularly those serving a high proportion of Medicaid patients. This reduction in Medicaid beneficiaries could translate into millions of dollars lost annually for affected hospitals, depending on their patient demographics and reimbursement rates.

Policy Changes Needed to Support Hospitals and Medicaid Recipients

The impending decrease in Medicaid enrollment necessitates proactive policy changes to mitigate the negative consequences for both hospitals and recipients. These changes could include expanding Medicaid eligibility criteria to cover more individuals, increasing Medicaid reimbursement rates to hospitals, and implementing financial safety nets for hospitals experiencing significant revenue losses due to enrollment declines. Furthermore, investing in initiatives to improve the efficiency and effectiveness of the redetermination process can help to minimize disruptions to care.

For instance, streamlined online applications and enhanced outreach programs could prevent unnecessary disenrollments. A crucial aspect would be targeted support for hospitals in underserved communities that disproportionately rely on Medicaid funding.

Impact on Access to Care for Vulnerable Populations

The potential reduction in Medicaid coverage poses a significant threat to access to care for vulnerable populations, including low-income individuals, children, pregnant women, and people with disabilities. Loss of coverage could lead to delayed or forgone care, exacerbating existing health disparities and potentially leading to worse health outcomes. For example, a significant decrease in Medicaid beneficiaries could result in fewer preventative care visits, leading to a rise in emergency room visits for manageable conditions, increasing healthcare costs overall.

This disproportionately affects marginalized communities who often lack access to alternative care options. Addressing this requires a multi-pronged approach, including improved care coordination, enhanced outreach programs to inform individuals about their options, and continued advocacy for policies that ensure equitable access to care.

Hospitals are facing a perfect storm: Medicaid redeterminations, post-pandemic financial strain, and Moody’s credit rating concerns for many. Streamlining administrative tasks is crucial, and that’s where advancements like nuance integrates generative ai scribe epic ehrs become incredibly relevant. This AI integration could significantly reduce the burden on hospital staff, freeing up time and resources to address the complex financial challenges payers and providers are navigating.

Ultimately, improving efficiency may be key to weathering this storm.

Closure

Source: aha.org

The pandemic exposed vulnerabilities within the healthcare system, highlighting the intricate relationship between hospitals, Medicaid payers, and rating agencies. The challenges faced during this period underscore the urgent need for proactive strategies to manage Medicaid redeterminations and ensure the financial stability of hospitals. Looking forward, collaborative efforts between policymakers, payers, and hospitals are crucial to building a more resilient and equitable healthcare system capable of weathering future crises.

The insights shared here aim to illuminate the path towards a more sustainable and robust healthcare future.

General Inquiries

What are Medicaid redeterminations?

Medicaid redeterminations are the periodic reviews conducted to ensure individuals still qualify for Medicaid benefits. These reviews verify eligibility based on income, assets, and other factors.

How did the pandemic affect Moody’s rating methodology for hospitals?

Moody’s likely adjusted their rating methodology to account for the extraordinary circumstances of the pandemic, considering factors like pandemic-related revenue losses and increased expenses.

What innovative strategies did Medicaid payers use to support hospitals during the pandemic?

Some states provided enhanced Medicaid payments, offered flexibility in reporting requirements, or implemented temporary waivers to streamline processes.

What are the potential long-term consequences of delayed redeterminations?

Delayed redeterminations could lead to decreased Medicaid enrollment, impacting hospital revenue and potentially reducing access to care for vulnerable populations.