Ground Ambulance Surprise Bills Public vs Private

Ground ambulance surprise bills public private – Ground ambulance surprise bills: public vs private – it’s a terrifying scenario many face. Imagine this: you’re in a serious accident, the ambulance whisks you away, and later you’re hit with a massive bill, even with insurance. The difference between public and private insurance coverage in these situations can be staggering, leading to financial ruin for some.

This post dives deep into the confusing world of ambulance billing, exploring the legal loopholes, insurance disparities, and real-life stories of people caught in this frustrating system.

We’ll examine the current state of surprise billing, the legal frameworks that (or don’t) protect you, how public and private insurers handle ambulance costs, and the impact on patients. We’ll also explore potential solutions and policy recommendations to make this system fairer and more transparent for everyone.

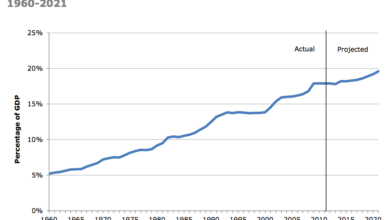

The Prevalence of Surprise Billing in Ground Ambulance Services

Source: nyt.com

Surprise medical bills are a significant problem in the United States, and ground ambulance services are a major contributor. The lack of price transparency and inconsistent insurance coverage creates a landscape where patients frequently face unexpected and often substantial charges, regardless of their insurance status. This issue disproportionately affects individuals with lower incomes and those with limited health literacy, further exacerbating existing health disparities.The current landscape of surprise medical billing in ground ambulance transport is complex, varying significantly depending on the type of insurance coverage (public or private) and the state or region.

While federal regulations have attempted to address this issue, significant gaps remain, leaving many patients vulnerable to unexpected costs. The lack of standardized pricing and the prevalence of out-of-network billing practices contribute to the problem’s persistence. Public insurance programs, such as Medicaid and Medicare, often have negotiated rates with ambulance providers, but these rates may not cover the full cost of service, leading to balance billing for the patient.

The unpredictable costs of ground ambulance surprise bills, whether from public or private providers, are a huge worry. This financial uncertainty is mirrored in other healthcare areas, like the struggles faced by rural hospitals, especially regarding labor and delivery services, as highlighted in this insightful article on Rural Hospitals Labor Delivery &. The lack of transparency and potential for unexpected costs seems to be a common thread, impacting both ambulance rides and rural healthcare access.

Private insurance plans have varying levels of coverage and network arrangements, creating further complexities and increasing the likelihood of surprise billing.

The unpredictable costs of ground ambulance services, split between public and private providers, are a major headache. Imagine the administrative burden reduced if billing was streamlined, which brings to mind how nuance integrates generative AI scribe with Epic EHRs , potentially automating much of the paperwork. This kind of AI-driven efficiency could significantly impact the clarity and speed of ambulance billing, ultimately lessening the surprise bill problem.

Surprise Billing Rates by Insurance Type and Region

The frequency of surprise billing incidents related to ground ambulance services varies considerably across different states and regions. Precise, comprehensive national data is difficult to obtain due to inconsistencies in reporting and data collection methods. However, anecdotal evidence and reports from consumer advocacy groups suggest that surprise billing is a widespread problem. The following table presents hypothetical data illustrating the potential range of surprise billing rates; please note that these figures are illustrative and should not be taken as definitive statistics.

Actual rates may vary considerably depending on factors such as the specific provider, the type of service rendered, and the patient’s insurance plan.

| State/Region | Public Insurance Surprise Bill Rate | Private Insurance Surprise Bill Rate | Total Surprise Bill Rate |

|---|---|---|---|

| California | 15% | 25% | 20% |

| Texas | 20% | 30% | 25% |

| Florida | 12% | 20% | 16% |

| Northeast Region (Example) | 18% | 28% | 23% |

Examples of Scenarios Leading to Surprise Ambulance Bills

Several common scenarios can lead to surprise ambulance bills for patients, regardless of their insurance coverage. Understanding these scenarios can help patients better prepare for potential costs and advocate for fair billing practices.For patients with public insurance: A common scenario involves a situation where a patient is transported by an out-of-network ambulance service, even if the emergency room they are taken to is in-network.

Because public insurance programs often have limited networks, patients may be unaware of the ambulance provider’s status, resulting in significant out-of-pocket expenses. Another example is when the ambulance service bills for services not fully covered by the public plan, leading to balance billing.For patients with private insurance: A frequent occurrence is when a patient receives emergency care from an out-of-network ambulance provider.

Even with seemingly comprehensive insurance coverage, the patient may be responsible for a large portion of the bill if the ambulance provider is not in their insurance plan’s network. Another common scenario involves ambulance services exceeding the allowed amount under the patient’s insurance plan, leading to a significant balance due. This often occurs due to a lack of transparency regarding pricing and the services rendered.

Patients may be unaware of the potential costs before the service is provided.

Legal and Regulatory Frameworks Governing Ground Ambulance Billing

Source: healthsystemtracker.org

The landscape of ground ambulance billing is complex, interwoven with federal and state regulations designed to protect consumers from exorbitant and unexpected costs. Navigating this system requires understanding the interplay between ambulance providers, insurance companies, and government agencies, particularly concerning transparency and the prevalence of out-of-network charges. This section will explore the legal and regulatory frameworks governing these billing practices.

Federal Regulations Concerning Ambulance Billing

The federal government’s influence on ambulance billing is primarily indirect, focusing on broader healthcare regulations that impact ambulance services. For instance, the No Surprises Act, enacted in 2020 as part of the Consolidated Appropriations Act, significantly addresses surprise medical bills in many healthcare contexts, including emergency services. However, its application to ground ambulance transport varies by state, as some states have pre-existing or more robust regulations.

The Act generally protects patients from unexpected out-of-network bills for emergency services, including ambulance transport in certain circumstances. However, the definition of “emergency” and the specific protections offered can differ depending on the individual state’s interpretation and implementation of the No Surprises Act. It is crucial to understand the nuances of the Act’s application in your specific location.

State Regulations Concerning Ambulance Billing

State regulations play a crucial role in governing ambulance billing practices, often setting more specific rules than federal guidelines. Many states have implemented laws aimed at increasing price transparency, requiring ambulance providers to disclose their charges upfront or provide estimates before transport. Some states also have regulations concerning out-of-network billing, potentially limiting the amount an out-of-network provider can charge or establishing independent dispute resolution processes.

These state-level regulations vary considerably, creating a patchwork of rules across the country. For example, some states may have specific requirements for ambulance providers to participate in networks with insurers, while others may have weaker or no such mandates. The lack of nationwide uniformity makes it essential to research the specific regulations in your state.

Legal Protections Under Public Versus Private Insurance

Consumers with public insurance, such as Medicare and Medicaid, generally have some level of protection against surprise billing, though the extent of this protection can depend on the specific program and state regulations. Medicaid programs, for instance, often negotiate rates with ambulance providers, potentially limiting the cost to the patient. Medicare has its own reimbursement rates for ambulance services.

Private insurance plans, however, have varying levels of protection. The No Surprises Act offers some protection, but the specific details depend on the plan’s network participation and the interpretation of the Act within each state. Patients with private insurance might find themselves responsible for significant out-of-network charges if their ambulance provider is not in their plan’s network, unless specific state laws or the No Surprises Act provide additional protection.

Roles and Responsibilities in Preventing Surprise Billing

Ambulance providers have a responsibility to provide clear and upfront pricing information, comply with state and federal regulations, and participate in network agreements with insurers whenever possible. Insurance companies are responsible for negotiating fair rates with ambulance providers and clearly outlining coverage for their members. Government agencies, including state insurance departments and federal agencies like the Centers for Medicare & Medicaid Services (CMS), play a crucial role in enforcing regulations, investigating complaints, and working to improve transparency in ambulance billing.

They also have the responsibility of ensuring that consumers have access to information and mechanisms for resolving billing disputes. A collaborative effort between these three entities is essential to minimize surprise billing in ground ambulance services.

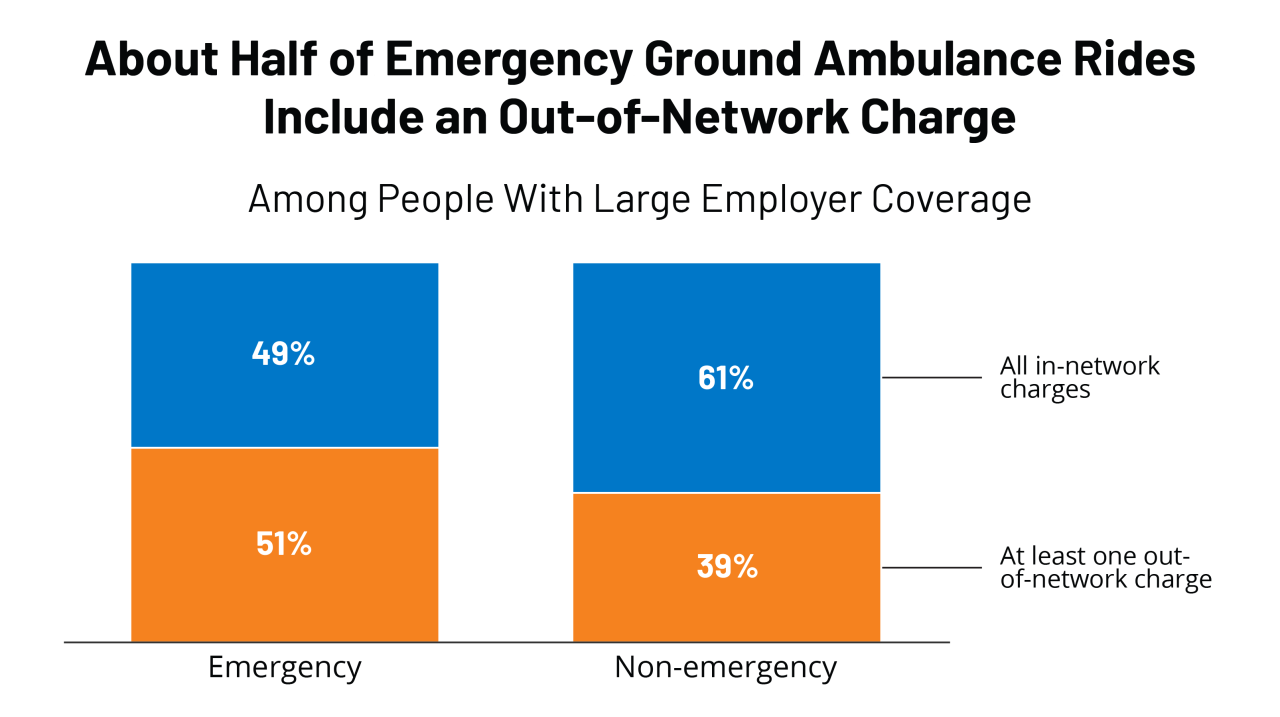

The Role of Public and Private Insurance in Ground Ambulance Coverage: Ground Ambulance Surprise Bills Public Private

Source: pirg.org

Navigating the complexities of ground ambulance billing often leaves patients bewildered, especially concerning the roles of public and private insurance. Understanding the differences in coverage and reimbursement is crucial to avoiding unexpected costs. This section will delve into the nuances of how Medicare, Medicaid, and private insurers handle ground ambulance transportation, highlighting factors contributing to surprise billing.

Public and private insurance providers differ significantly in their coverage policies and reimbursement rates for ground ambulance services. These differences stem from varying regulations, contractual agreements with ambulance providers, and the overall structure of each insurance program. Understanding these differences is key to predicting out-of-pocket expenses.

Coverage Policies and Reimbursement Rates

Public insurance programs like Medicare and Medicaid typically have established reimbursement rates for ground ambulance services. These rates are often lower than those negotiated by private insurers with ambulance providers. Medicare, for example, uses a fee schedule based on geographic location and the level of service provided. Medicaid programs vary by state, but generally follow similar principles of pre-determined reimbursement rates.

Private insurers, on the other hand, negotiate rates with ambulance providers, often resulting in higher reimbursements but also leading to potential variations in coverage depending on the specific plan and provider network. This negotiation process can lead to discrepancies in what the insurer will pay versus what the ambulance provider charges, potentially resulting in balance billing for the patient.

Factors Influencing Surprise Billing, Ground ambulance surprise bills public private

Several factors influence the likelihood of surprise billing in ground ambulance transportation. Network participation plays a critical role. If an ambulance service is out-of-network for a patient’s private insurance plan, the insurer may not cover the full cost, leading to a balance bill for the patient. Pre-authorization requirements, common with some private insurers, further complicate matters. Failure to obtain pre-authorization can result in denied or partially denied claims, leaving the patient responsible for a significant portion of the bill.

With public insurance, while pre-authorization might not be explicitly required, adherence to specific billing codes and documentation is crucial to avoid delays or denials. The lack of transparency in pricing and billing practices from some ambulance providers also contributes to surprise billing, leaving patients unprepared for the final cost.

Comparison of Public and Private Insurance Coverage

The following table summarizes key differences in ground ambulance coverage between public and private insurance:

| Insurance Type | Network Coverage | Reimbursement Rates | Patient Responsibility |

|---|---|---|---|

| Medicare | Generally covers medically necessary transport; limited network impact | Pre-determined rates based on location and service level; often lower than private pay | Co-pays, deductibles, and potentially uncovered charges depending on the specific circumstances |

| Medicaid | Coverage varies by state; network participation can impact reimbursement | State-specific rates; often lower than private pay | Co-pays, deductibles, and potentially uncovered charges depending on state and plan |

| Private Insurance | Highly variable; in-network providers generally offer lower out-of-pocket costs | Negotiated rates; can be higher than public rates but may lead to balance billing if out-of-network | Co-pays, deductibles, and potentially significant balance billing if out-of-network or pre-authorization is not obtained |

Patient Experiences and Perspectives on Surprise Ambulance Bills

Surprise ambulance bills represent a significant financial and emotional burden for many Americans. The lack of transparency in pricing and the complexities of insurance networks often leave patients feeling helpless and overwhelmed when faced with unexpected, substantial medical expenses. This section explores the real-life experiences of individuals grappling with these bills, illustrating the far-reaching consequences of this pervasive problem.

The financial and emotional toll of surprise medical bills extends far beyond the immediate cost. The stress associated with navigating complex billing systems, dealing with insurance companies, and potentially facing collections can have lasting negative impacts on mental health and overall well-being. The following examples highlight the severity of this issue.

Anecdotal Accounts and Case Studies Illustrating the Financial and Emotional Burdens

Several anecdotal accounts and case studies vividly illustrate the devastating impact of surprise ambulance bills on patients. These stories highlight the unexpected financial strain and emotional distress experienced by individuals across various socioeconomic backgrounds.

- A single mother of two, working a minimum wage job, received a $5,000 ambulance bill after a car accident. Unable to afford the payment, she faced mounting debt and the threat of collections, significantly impacting her ability to provide for her children. The stress contributed to anxiety and sleeplessness, further exacerbating her situation.

- A retired couple on a fixed income experienced a medical emergency requiring ambulance transport. The resulting $4,000 bill, exceeding their savings, forced them to delay necessary medical follow-up care due to financial constraints. The emotional distress from this unexpected financial burden significantly affected their quality of life.

- A young professional with good health insurance faced a surprise bill of $2,000 after an ambulance ride, due to a disagreement between the ambulance provider and their insurance company about in-network status. Despite having insurance, the unexpected expense created significant financial strain, forcing them to delay other financial goals.

Hypothetical Scenario Demonstrating the Financial Impact of a Surprise Ambulance Bill

Consider a family facing a medical emergency requiring ambulance transport. The ambulance bill is $3,

000. Let’s analyze the impact across different income levels and insurance types:

| Family Income | Insurance Type | Impact |

|---|---|---|

| $30,000/year | No insurance | The $3,000 bill could represent a significant portion of their annual income, potentially leading to debt, financial hardship, and difficulty meeting basic needs. |

| $60,000/year | High-deductible health plan | The family may still face a substantial out-of-pocket expense, potentially requiring them to deplete savings or take on debt. |

| $100,000/year | Comprehensive health plan | While the comprehensive plan may cover a portion of the bill, the family might still face a significant copay or coinsurance, leading to financial strain. |

Process for Contesting or Appealing a Surprise Ambulance Bill

The process of contesting or appealing a surprise ambulance bill can be complex and time-consuming, often requiring persistence and thorough documentation. It typically involves several steps:

- Review the bill carefully: Identify the specific charges and ensure their accuracy. Note any discrepancies between the services provided and the billed amounts.

- Contact the ambulance provider: Explain the situation and request an itemized bill, clarifying the charges and the reason for the out-of-network billing. Attempt to negotiate a payment plan or reduced cost.

- Contact your insurance company: File a dispute with your insurance provider, providing all necessary documentation, including the itemized bill and any communication with the ambulance company. Appeal their decision if necessary.

- Consider state-specific consumer protection laws: Many states have laws in place to protect consumers from surprise medical bills. Research your state’s laws and consider seeking legal advice if necessary.

- Explore options for financial assistance: Consider applying for financial assistance programs or seeking help from consumer advocacy groups if you cannot afford the bill.

Potential Solutions and Policy Recommendations to Address Surprise Billing

The problem of surprise medical bills, particularly from ground ambulance services, demands a multi-pronged approach. Addressing this issue requires a concerted effort from legislators, regulators, insurance companies, and ambulance providers themselves. Solutions must balance the need for patient protection with the financial viability of ambulance services, ensuring access to necessary emergency care remains affordable and accessible.

Legislative and Regulatory Solutions

Effective legislation is crucial to curb surprise ambulance billing. Many states have already enacted legislation addressing surprise billing in other medical areas, but ambulance services often fall into regulatory gaps. Comprehensive legislation needs to clearly define what constitutes an “emergency” situation, ensuring that only genuinely emergent transport qualifies for out-of-network billing exceptions. Furthermore, laws should establish transparent pricing structures and require clear disclosure of costs upfront, where feasible, or at the very least, before a patient incurs significant debt.

The unpredictable costs of ground ambulance services, split between public and private providers, are a huge headache for patients. Understanding these billing discrepancies is crucial, and I recently came across a fascinating study on study widespread digital twins healthcare , which got me thinking – could better data management, perhaps facilitated by digital twins, help streamline billing processes and prevent these surprise bills?

Ultimately, tackling these surprise bills requires a multi-pronged approach, and improved data transparency could be a game-changer.

Stronger enforcement mechanisms are also needed to hold providers accountable for non-compliance. For example, a state could implement a system of fines for providers who repeatedly violate pricing transparency regulations. The state of California, for instance, has implemented legislation addressing surprise medical bills in a broader context; however, specific regulations targeting ambulance services might need further refinement to ensure effectiveness.

Industry-Based Solutions

Beyond legislative action, the ambulance service industry itself can take proactive steps. This includes adopting industry-wide best practices for price transparency, such as readily available online price lists for common transport scenarios. Greater collaboration between ambulance providers and insurance companies can also lead to negotiated rates and improved network participation. This could involve the creation of regional or statewide networks of providers, enabling more predictable and consistent pricing.

Furthermore, industry self-regulation through professional organizations could establish ethical guidelines and best practices for billing transparency and patient communication. For example, the National Association of EMTs could develop a certification program recognizing ambulance services committed to transparent billing practices.

Enhanced Consumer Protections

Strengthening consumer protections is vital. This includes implementing mandatory pre-authorization requirements for non-emergency transport, allowing patients to obtain price quotes before services are rendered. This requires robust consumer education initiatives to inform patients of their rights and the steps they can take to avoid surprise bills. Government websites and public awareness campaigns could highlight these rights and resources.

Additionally, establishment of independent dispute resolution mechanisms could provide a fair and impartial process for resolving billing disputes between patients, providers, and insurers. This could mirror existing models used in other healthcare settings, offering mediation or arbitration services to address disagreements.

Policy Proposal: A Comprehensive Approach

This policy proposal recommends a multi-faceted approach: First, all states should enact legislation mandating price transparency for ambulance services, including clear disclosure of charges before or immediately after transport. Second, a statewide network of ambulance providers should be established, negotiating rates with insurers to ensure reasonable reimbursement and limit out-of-network charges. Third, a robust consumer education program should be implemented, informing patients about their rights and available resources.

Finally, an independent dispute resolution mechanism should be created to handle billing disputes fairly and efficiently. This comprehensive strategy aims to reduce surprise ambulance bills while maintaining access to essential emergency services. This proposal would require collaboration between government agencies, ambulance providers, insurance companies, and patient advocacy groups.

Outcome Summary

Navigating the world of ground ambulance surprise bills is undeniably stressful. The disparity between public and private insurance coverage highlights a critical flaw in our healthcare system. While there’s no single, easy fix, increased transparency, stronger consumer protections, and clearer regulations are crucial steps towards preventing these unexpected financial burdens. Sharing your experiences and advocating for change can help create a more equitable system for everyone.

Remember, you’re not alone in this fight.

FAQ Section

What constitutes an “out-of-network” ambulance provider?

An out-of-network provider is one who doesn’t have a contract with your insurance company. This often leads to significantly higher costs for the patient.

Can I negotiate my ambulance bill?

Yes, it’s often worth attempting to negotiate a lower payment. Be polite, but firm, and explain your financial situation. You may be able to set up a payment plan.

What if I can’t afford my ambulance bill?

Explore options like applying for financial assistance from the ambulance provider or a charitable organization. You may also be able to work out a payment plan or seek legal counsel.

Where can I find more information on my state’s ambulance billing laws?

Your state’s insurance department website is a good starting point. You can also search online for your state’s specific ambulance billing regulations.