Medicare Shared Savings Losses Traditional JAMA Health

Medicare shared savings losses traditional jama health – Medicare Shared Savings Losses: Traditional JAMA Health – it’s a headline that’s grabbed my attention lately, and I bet it’s got yours too. We’re talking about the complexities of the Medicare Shared Savings Program (MSSP), a value-based care initiative aiming to improve healthcare quality while controlling costs. But the reality? Not all ACOs (Accountable Care Organizations) participating are seeing the promised savings.

In fact, some are experiencing significant losses. This post dives into the reasons why, exploring the challenges of transitioning from traditional fee-for-service medicine and examining the successes and failures within the MSSP.

We’ll unpack the different tracks within the MSSP, looking at how the program’s structure and goals impact ACO performance. We’ll analyze the financial data, highlighting both the success stories and the cautionary tales of ACOs struggling to make ends meet under this new model. Understanding these financial realities is crucial to figuring out how to improve the MSSP and ensure its long-term viability.

The shift from traditional fee-for-service to value-based care isn’t easy, and we’ll explore the specific hurdles ACOs face in this transition.

Medicare Shared Savings Program Overview

The Medicare Shared Savings Program (MSSP) is a key component of the Affordable Care Act, aiming to improve the quality of care for Medicare beneficiaries while simultaneously reducing healthcare costs. It incentivizes healthcare providers to transition from a fee-for-service model to a value-based care model, rewarding them for achieving cost savings and improving patient outcomes. This shift encourages a more proactive and coordinated approach to patient care, focusing on preventative measures and managing chronic conditions effectively.The MSSP operates on the principle of shared savings and risk.

Participating Accountable Care Organizations (ACOs) work collaboratively to provide coordinated care to their assigned Medicare beneficiaries. If the ACO successfully reduces healthcare spending below a predetermined benchmark while meeting quality standards, it shares in the savings with Medicare. Conversely, if costs exceed the benchmark, the ACO may be responsible for a portion of the losses, depending on the specific track they’ve chosen.

The recent JAMA article highlighting Medicare Shared Savings Program losses for traditional Medicare beneficiaries got me thinking about how we can improve healthcare data analysis. This is where advancements like those discussed in this article on google cloud healthcare amy waldron generative AI become incredibly relevant. Could AI-driven insights help us identify and address the systemic issues contributing to these losses and ultimately improve care for seniors?

This shared risk incentivizes efficient and effective care delivery.

MSSP Tracks

The MSSP offers several different participation tracks, each with varying levels of risk and reward. These tracks allow ACOs of different sizes and capabilities to participate in the program, tailoring their engagement to their organizational readiness and capacity. Choosing the right track is crucial for an ACO’s success and sustainability within the program.

Track 1: Shared Savings Only

This track offers ACOs the opportunity to participate in shared savings without incurring any financial risk. ACOs in Track 1 receive a portion of the cost savings they generate, but they are not financially responsible for any cost overruns. This lower-risk option is often appealing to ACOs that are new to value-based care or have limited financial resources. It allows them to gain experience and build their infrastructure before taking on more significant financial risk.

Track 2: Shared Savings and Shared Losses

Track 2 ACOs share in both the savings and losses generated relative to a benchmark. This track involves a higher degree of risk but also offers the potential for greater rewards. ACOs in this track are motivated to achieve even greater cost reductions and quality improvements, as they directly share in the financial outcomes. This track is suitable for more established ACOs with a strong infrastructure and a proven track record of success in value-based care.

Track 3: Advanced Alternative Payment Model

Track 3 is an alternative payment model that represents a significant departure from the fee-for-service model. ACOs participating in this track accept greater financial responsibility for their patients’ healthcare costs. This track is suitable for ACOs that are highly experienced in value-based care and have the capability to manage a significant amount of financial risk.

Significant MSSP Changes and Updates

The MSSP has undergone several significant changes and updates since its inception in 2012. These changes reflect the ongoing evolution of value-based care and the continuous refinement of the program’s design to achieve its goals.

Timeline of Key MSSP Developments, Medicare shared savings losses traditional jama health

While a comprehensive list of every update is extensive, some key milestones include the introduction of different tracks (as detailed above), adjustments to benchmark calculations, changes in the shared savings/loss rates, and the increasing emphasis on quality measures. These adjustments aim to continuously improve the program’s effectiveness and adaptability to the changing healthcare landscape.

The recent news about Medicare shared savings losses impacting traditional JAMA health models got me thinking about the bigger picture. It seems counterintuitive, given that major players like Walgreens are expanding their healthcare footprint – check out this article on walgreens raises healthcare segment outlook summit acquisition – which suggests a growing demand for accessible care. Perhaps these seemingly disparate trends reflect a complex shift in how we approach and fund healthcare in the US.

Financial Performance of MSSP ACOs

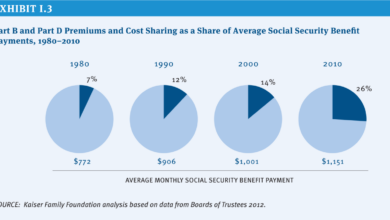

The Medicare Shared Savings Program (MSSP) aims to improve the quality of care while reducing healthcare costs. However, the financial performance of Accountable Care Organizations (ACOs) participating in the program has been varied, with some experiencing significant losses. Understanding these financial outcomes is crucial for assessing the program’s effectiveness and identifying areas for improvement.The financial success or failure of an MSSP ACO hinges on its ability to effectively manage the cost of care for its assigned beneficiaries while simultaneously improving the quality of that care.

While the program offers shared savings incentives for exceeding quality and cost targets, the inherent risks associated with managing a large patient population and the complexities of healthcare delivery can lead to substantial financial losses for some ACOs.

The recent JAMA article on Medicare shared savings losses and the impact on traditional healthcare models got me thinking. It highlights the pressures on the system, and these pressures are clearly felt on the front lines, as evidenced by the ongoing new york state nurse strike NYSNA Montefiore Mount Sinai. These nurses’ fight for better staffing and patient care underscores the urgent need for systemic change to address the financial constraints impacting quality healthcare.

Factors Contributing to MSSP ACO Losses

Several factors contribute to financial losses among MSSP ACOs. These include challenges in coordinating care across multiple providers, difficulties in accurately predicting and managing risk, inadequate data analytics capabilities, and the unexpected high cost of care for certain patient populations. For example, an ACO might underestimate the cost of treating a patient with a chronic condition requiring extensive hospitalization, resulting in exceeding the benchmark spending target and negating any potential savings.

Additionally, the time lag between providing care and receiving reimbursement can create cash flow challenges for some ACOs, particularly those with limited financial reserves.

Examples of Successful MSSP ACOs and Their Strategies

Despite the challenges, some ACOs have demonstrated significant success within the MSSP. These successful organizations typically implement robust care management programs, invest heavily in data analytics and technology, and foster strong collaborative relationships among participating providers. For example, an ACO might utilize advanced analytics to identify high-risk patients and proactively intervene with preventative care, reducing the need for costly hospitalizations down the line.

Another successful strategy involves developing comprehensive care plans that coordinate services across different healthcare settings, ensuring efficient and cost-effective care delivery. Successful ACOs also often prioritize strong communication and collaboration among physicians, nurses, and other healthcare professionals, fostering a cohesive team approach to patient care. These strategies lead to better patient outcomes and more predictable cost management, ultimately contributing to financial success within the MSSP framework.

Impact of Traditional Fee-for-Service (FFS) Medicine: Medicare Shared Savings Losses Traditional Jama Health

Source: christianacare.org

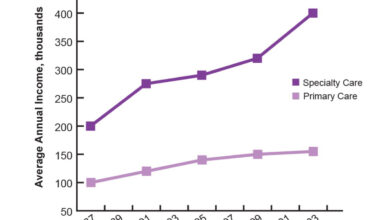

The transition from the traditional fee-for-service (FFS) model of healthcare reimbursement to value-based care models like the Medicare Shared Savings Program (MSSP) represents a significant shift in how healthcare is delivered and paid for. For decades, FFS incentivized volume over value, rewarding providers for the number of services rendered rather than the quality of care or overall patient outcomes.

This system, while seemingly straightforward, has contributed to escalating healthcare costs and inconsistencies in care quality. The move towards value-based care aims to address these shortcomings.The fundamental difference between FFS and MSSP lies in their cost structures and reimbursement mechanisms. In the FFS system, providers receive payment for each individual service provided, regardless of the patient’s overall health status or the effectiveness of the treatment.

This creates a financial incentive to perform more procedures, even if they are not medically necessary. In contrast, the MSSP rewards Accountable Care Organizations (ACOs) for keeping their assigned patients healthy and managing their care efficiently. ACOs receive shared savings if they achieve cost reductions and quality improvements compared to a benchmark. The risk-sharing nature of MSSP encourages ACOs to focus on preventative care, care coordination, and reducing unnecessary hospitalizations and readmissions, ultimately leading to better patient outcomes and lower costs.

FFS to Value-Based Care Transition Challenges

Shifting from the ingrained FFS model to a value-based system like MSSP presents numerous challenges for ACOs. One significant hurdle is the need for substantial changes in infrastructure and operational processes. ACOs must invest in robust data analytics capabilities to track patient outcomes, identify areas for improvement, and demonstrate their performance to Medicare. This requires significant upfront investment in technology and personnel.

Furthermore, ACOs need to establish effective care coordination mechanisms to ensure seamless transitions between different healthcare settings and providers. This often involves building relationships with specialists, hospitals, and other community-based organizations, which can be time-consuming and complex. Finally, the success of an ACO relies heavily on the engagement and participation of its clinicians and staff. A cultural shift is needed to move away from the volume-based mindset ingrained in the FFS system and embrace the principles of shared responsibility and collaborative care that underpin value-based care.

For example, a rural ACO might face unique challenges in recruiting specialists and coordinating care across geographically dispersed populations, requiring creative solutions and potentially higher initial investment. Conversely, a large urban ACO may encounter challenges in data integration across multiple disparate healthcare systems.

Outcome Summary

Source: medicareabc.com

The Medicare Shared Savings Program, while aiming for a noble goal, reveals a complex reality. The transition to value-based care isn’t a simple switch, and the financial pressures on ACOs are substantial. While some thrive, others struggle, highlighting the need for a deeper understanding of the challenges involved and a more nuanced approach to supporting ACOs. The journey towards better healthcare requires a careful balance of innovative models and realistic financial considerations.

Ultimately, the success of the MSSP depends on addressing these challenges and learning from both successes and failures. It’s a continuous process of adaptation and improvement, and it’s a journey worth following closely.

Frequently Asked Questions

What are the biggest challenges ACOs face in the MSSP?

ACOs often struggle with managing risk, coordinating care across multiple providers, and adapting their infrastructure to meet the demands of value-based care. Data collection and analysis can also be a significant hurdle.

How does the MSSP differ from traditional fee-for-service?

Fee-for-service reimburses providers for each service rendered, while the MSSP rewards ACOs for keeping patients healthy and managing costs. This shifts the focus from volume to value.

Are there any resources available to help ACOs succeed in the MSSP?

Yes, CMS provides resources and technical assistance to ACOs, including training and support for data analysis and care coordination. There are also many private consulting firms that specialize in helping ACOs succeed in value-based care.