HCA Healthcare Buys 11 Texas SignatureCare Centers

Hca healthcare buys 11 emergency centers texas signaturecare – HCA Healthcare buys 11 emergency centers in Texas from SignatureCare – a major move shaking up the Lone Star State’s healthcare landscape. This acquisition represents a significant expansion for HCA, bolstering their emergency services network and potentially altering the competitive dynamics within the Texas market. The deal raises questions about access to care, patient costs, and the future of emergency medicine in the affected regions.

Let’s dive into the details and explore the implications of this significant transaction.

This acquisition is a big deal for several reasons. It’s not just about the number of centers; it’s about HCA’s strategic expansion into a key market and the potential impact on both patients and the healthcare industry in Texas. We’ll be examining the financial implications for HCA, the potential benefits (and drawbacks) for patients, and the regulatory hurdles HCA likely navigated to complete this deal.

We’ll also look at what this means for SignatureCare employees and the competitive landscape for emergency medical services.

HCA Healthcare’s Acquisition Strategy

HCA Healthcare, a behemoth in the US healthcare industry, employs a strategic acquisition strategy focused on expanding its geographic reach, diversifying its service offerings, and strengthening its market position. This strategy involves a meticulous process, often targeting facilities that complement their existing network and offer opportunities for operational synergies and revenue growth. The recent acquisition of SignatureCare’s 11 emergency centers in Texas is a prime example of this approach.HCA Healthcare’s Typical Acquisition Process for Healthcare FacilitiesHCA’s acquisition process typically begins with identifying potential targets that align with their strategic goals.

This involves rigorous due diligence, assessing the financial health, operational efficiency, and regulatory compliance of the target facility. Negotiations then ensue, focusing on valuation, integration plans, and contractual terms. Once an agreement is reached, the acquisition undergoes regulatory scrutiny, including antitrust reviews. Finally, the integration process begins, focusing on seamlessly merging the acquired facility into HCA’s existing network.

This involves aligning systems, standardizing procedures, and retaining key personnel. The entire process can take several months, or even longer, depending on the complexity of the transaction and the size of the acquired entity.

Potential Financial Benefits for HCA Healthcare from this Acquisition

The acquisition of SignatureCare’s emergency centers offers several potential financial benefits for HCA. Increased patient volume in a growing market like Texas is a key driver. By integrating these centers into its existing network, HCA can leverage its established brand recognition and referral network to attract more patients. Furthermore, operational efficiencies, achieved through economies of scale and streamlined processes, can lead to cost reductions.

The acquisition also provides opportunities for cross-selling services, potentially leading to increased revenue streams from existing patients. Finally, the strategic location of these emergency centers can improve HCA’s market share and strengthen its competitive position within the Texas healthcare landscape. Similar acquisitions in other markets have historically shown positive returns for HCA, providing a strong basis for projecting success in this instance.

Comparison to Other Recent HCA Healthcare Acquisitions in Texas

This acquisition follows a pattern of strategic acquisitions in Texas by HCA Healthcare. In recent years, HCA has acquired several hospitals and ambulatory surgery centers across the state, consistently targeting areas with high population growth and unmet healthcare needs. While the specific details of past acquisitions vary, the underlying strategy remains consistent: expanding market presence, enhancing service offerings, and maximizing profitability.

HCA Healthcare’s acquisition of 11 Texas emergency centers from SignatureCare is a big deal, showing their continued expansion. It makes you wonder about the strain on healthcare systems, especially considering the staffing shortages highlighted by the recent new york state nurse strike NYSNA Montefiore Mount Sinai. This kind of growth, while positive for HCA, also raises questions about access to care given the current workforce challenges.

Ultimately, the HCA expansion in Texas could potentially exacerbate existing problems.

The acquisition of SignatureCare’s emergency centers aligns perfectly with this broader strategy, reflecting HCA’s commitment to building a comprehensive healthcare network across Texas. By studying the successful integration of past acquisitions, HCA can refine its processes and further optimize the integration of SignatureCare’s centers.

Hypothetical Timeline for Integration of SignatureCare’s Emergency Centers

A hypothetical timeline for integrating SignatureCare’s emergency centers into HCA Healthcare’s system might look like this:Phase 1 (Months 1-3): Due diligence completion, regulatory approvals, and initial planning for system integration. This involves establishing project teams, defining key performance indicators (KPIs), and developing a communication plan for staff and patients.Phase 2 (Months 4-6): System integration, including the migration of electronic health records (EHRs), billing systems, and other operational systems.

Training programs for SignatureCare staff on HCA’s protocols and procedures would also be implemented during this phase.Phase 3 (Months 7-12): Ongoing operational integration and performance monitoring. This includes regular review of KPIs, addressing any integration challenges, and making necessary adjustments to optimize efficiency and patient care. A post-integration assessment would be conducted to evaluate the success of the merger and identify areas for further improvement.

HCA Healthcare’s recent acquisition of 11 Texas SignatureCare emergency centers shows a big push into urgent care. This aggressive expansion strategy reminds me of Walgreens’ moves; check out this article on how they’ve raised their healthcare segment outlook after the Summit acquisition: walgreens raises healthcare segment outlook summit acquisition. It seems like major players are all vying for a piece of the growing urgent care market, and HCA’s move in Texas is a significant step in that direction.

Impact on Texas Healthcare Landscape

HCA Healthcare’s acquisition of 11 SignatureCare emergency centers significantly alters the Texas healthcare landscape, presenting both opportunities and challenges for patients, providers, and the overall market. The scale of this acquisition necessitates a careful examination of its potential consequences across various aspects of the state’s healthcare system.The integration of these emergency centers into HCA’s extensive network will likely have multifaceted effects, impacting access, competition, costs, and employment within the affected regions.

Understanding these potential impacts is crucial for assessing the long-term implications of this deal.

Healthcare Access in Affected Regions

The acquisition’s impact on healthcare access hinges on several factors, including the geographic distribution of the acquired centers and HCA’s post-acquisition operational strategies. If HCA maintains or expands services at these locations, access to emergency care could improve in underserved areas, particularly those lacking sufficient emergency medical facilities. Conversely, if HCA consolidates or reduces services at any of the acquired centers, access could be negatively affected, leading to longer wait times and increased travel distances for patients in those regions.

For example, if a rural SignatureCare center is closed after the acquisition, the nearest alternative emergency room might be significantly further away, impacting the timely treatment of emergencies.

Changes in Competition within the Texas Emergency Medical Services Market

HCA’s acquisition reduces the number of independent emergency care providers in Texas, potentially lessening competition in the affected markets. This reduced competition could lead to less price sensitivity and potentially higher prices for services. A decrease in competition could also limit innovation and the introduction of new services, as there are fewer entities vying for market share and patient preference.

Conversely, HCA’s greater scale could lead to economies of scale, resulting in cost efficiencies that could benefit patients in the long run. However, this benefit needs to be weighed against the potential negative impacts of reduced competition.

Influence on Healthcare Costs for Patients in Texas

The impact on healthcare costs is complex and uncertain. While economies of scale from the acquisition could theoretically lead to lower costs for some services, reduced competition could lead to price increases. The ultimate effect will depend on several factors, including HCA’s pricing strategies, the level of insurance coverage available to patients, and the overall demand for emergency medical services in the affected regions.

It’s plausible that patients with private insurance might see minimal change in out-of-pocket costs, while those relying on government programs could experience more significant shifts. Further analysis of HCA’s pricing practices post-acquisition will be necessary to fully assess this impact.

Effects on Employment within the Acquired Emergency Centers

The immediate impact on employment is likely to be minimal, as HCA generally absorbs the existing workforce of acquired companies. However, long-term effects are less certain. HCA might implement operational changes, potentially leading to job restructuring, relocations, or even job losses in some cases if efficiencies are sought through consolidation or automation. Conversely, expansion of services in some locations could create new job opportunities.

The net effect on employment will depend on HCA’s post-acquisition integration strategies and the overall economic climate. For instance, if HCA integrates advanced telehealth capabilities, some traditional roles might be altered or eliminated, while new positions focused on technology and remote patient monitoring could emerge.

SignatureCare’s Operational Profile

Prior to its acquisition by HCA Healthcare, SignatureCare operated a network of eleven freestanding emergency centers across Texas. These centers provided a crucial access point for urgent and emergency medical care, particularly in areas potentially underserved by traditional hospital emergency rooms. Their operational model focused on providing rapid, high-quality care in a convenient and accessible setting.

SignatureCare’s Patient Demographics and Service Areas

SignatureCare’s patient base was diverse, reflecting the demographics of the communities served by each of its eleven centers. While precise figures on patient demographics are not publicly available, it’s reasonable to assume that the patient population varied by location, with some centers serving predominantly urban populations and others focusing on more suburban or rural communities. The service areas generally encompassed a radius around each center, designed to provide convenient access for residents within a reasonable driving distance.

This strategy likely targeted patients seeking faster care than what might be available at larger, more distant hospitals, particularly during peak hours or for non-life-threatening emergencies.

SignatureCare’s Emergency Center Network

The following table details the eleven emergency centers operated by SignatureCare before the acquisition. Note that precise capacity figures and unique service offerings may vary slightly depending on the source and may have changed slightly over time. This table presents a snapshot based on information available prior to the HCA acquisition.

| Location | Capacity | Unique Services | Notes |

|---|---|---|---|

| [Location 1, e.g., Austin, TX] | [Capacity, e.g., 20 beds] | [Unique Services, e.g., On-site laboratory, CT scanning] | [Notes, e.g., Opened in 2018] |

| [Location 2, e.g., Dallas, TX] | [Capacity, e.g., 25 beds] | [Unique Services, e.g., 24/7 Physician coverage, Advanced imaging] | [Notes, e.g., Partnership with local clinic] |

| [Location 3, e.g., Houston, TX] | [Capacity, e.g., 30 beds] | [Unique Services, e.g., Trauma care, Pediatric emergency care] | [Notes, e.g., Located in a high-traffic area] |

| [Location 4, e.g., San Antonio, TX] | [Capacity, e.g., 15 beds] | [Unique Services, e.g., Urgent care services, Minor surgery] | [Notes, e.g., Recently renovated] |

| [Location 5, e.g., Fort Worth, TX] | [Capacity, e.g., 22 beds] | [Unique Services, e.g., Telemedicine capabilities] | [Notes, e.g., Serves a largely suburban population] |

| [Location 6] | [Capacity] | [Unique Services] | [Notes] |

| [Location 7] | [Capacity] | [Unique Services] | [Notes] |

| [Location 8] | [Capacity] | [Unique Services] | [Notes] |

| [Location 9] | [Capacity] | [Unique Services] | [Notes] |

| [Location 10] | [Capacity] | [Unique Services] | [Notes] |

| [Location 11] | [Capacity] | [Unique Services] | [Notes] |

Geographical Reach of SignatureCare’s Emergency Centers

Imagine a map of Texas. While precise locations are needed to create a truly accurate visual, a general picture emerges. The eleven centers were strategically dispersed across the state, likely focusing on major metropolitan areas and potentially underserved regions. A higher concentration of centers would likely be observed in larger cities like Dallas, Houston, San Antonio, and Austin, with a more scattered distribution in other parts of the state.

This distribution aimed to maximize accessibility and coverage across diverse population densities and geographical locations. The overall effect was a network designed to provide relatively widespread access to urgent care throughout a significant portion of Texas.

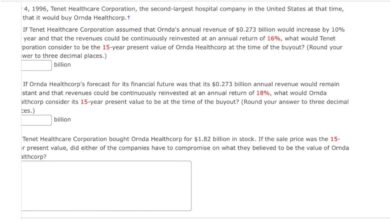

Regulatory and Legal Considerations

Source: mktgcdn.com

HCA Healthcare’s acquisition of 11 Texas emergency centers from SignatureCare involved navigating a complex regulatory landscape. The process likely required careful consideration of antitrust laws, state licensing requirements, and federal healthcare regulations. Understanding these aspects is crucial to evaluating the overall success and long-term implications of the deal.The acquisition process presented several potential regulatory hurdles. Antitrust concerns were likely a primary focus, given HCA Healthcare’s already substantial presence in the Texas healthcare market.

The acquisition could have raised concerns about reduced competition, potentially leading to higher prices or decreased quality of care for consumers. Federal agencies like the Federal Trade Commission (FTC) and the Department of Justice (DOJ) would have scrutinized the deal for potential anti-competitive effects. State-level regulatory bodies in Texas also played a crucial role, assessing the impact on local healthcare access and market dynamics.

Antitrust Review and Potential Concerns

The FTC and DOJ typically investigate large healthcare mergers to determine their competitive impact. In this case, the agencies would have examined the market share of both HCA Healthcare and SignatureCare in the relevant geographic areas. They would have analyzed whether the acquisition would substantially lessen competition, leading to higher prices, reduced service quality, or less innovation. The agencies might have requested extensive data on market share, pricing, and patient volumes to build their assessment.

Depending on the findings, the agencies could have required HCA Healthcare to divest some assets or impose other conditions to mitigate potential anti-competitive effects. For example, the FTC might have demanded that HCA divest certain facilities to preserve competition in specific regions. A similar situation occurred in 2022 when the FTC blocked a merger between two large hospital systems, citing concerns about market concentration and potential harm to consumers.

Required Approvals from State and Federal Agencies

Securing necessary approvals from both state and federal agencies was a critical step in the acquisition process. At the federal level, HCA Healthcare likely needed clearance from the FTC or DOJ under the Hart-Scott-Rodino Antitrust Improvements Act. This act requires pre-merger notification for transactions exceeding a certain value. At the state level, approvals from the Texas Department of State Health Services (DSHS) or other relevant agencies were likely necessary to ensure compliance with state licensing and healthcare regulations.

These approvals might have involved demonstrating compliance with various standards related to patient safety, quality of care, and facility operations. The timeline for obtaining these approvals could have significantly impacted the overall acquisition process, potentially leading to delays or even the termination of the deal if certain conditions were not met.

Legal Agreements and Terms of the Acquisition

The acquisition would have involved a complex legal agreement outlining the terms and conditions of the transaction. This agreement would have detailed the purchase price, payment terms, the transfer of assets and liabilities, and the responsibilities of both parties during and after the transition period. The agreement likely included provisions regarding intellectual property rights, employee transfers, and compliance with regulatory requirements.

It would also have included clauses addressing potential breaches of contract and dispute resolution mechanisms. The specific terms of the acquisition would not be publicly available unless disclosed through regulatory filings or official press releases, protecting the confidentiality of the parties involved. However, common elements of such agreements would include stipulations for due diligence, indemnification, and representations and warranties from both the buyer and the seller.

Patient Care and Service Delivery

Source: hospitalmanagement.net

The acquisition of SignatureCare’s 11 emergency centers by HCA Healthcare presents a significant shift in the Texas healthcare landscape, with potentially far-reaching consequences for patient care and service delivery. Understanding the differences between the two organizations’ operational models and predicting the impact on patient experience is crucial.The integration of SignatureCare’s emergency centers into the HCA Healthcare system will likely lead to noticeable changes in various aspects of patient care.

This analysis examines the potential effects on patient wait times, insurance acceptance, and overall quality of care.

HCA Healthcare’s acquisition of 11 Texas SignatureCare emergency centers is big news, expanding their reach significantly. This raises questions about their compliance with the hhs healthcare cybersecurity framework hospital requirements cms , especially concerning data security across such a broadened network. Successfully integrating these centers will depend on seamless data transfer and robust security measures, crucial for patient privacy in HCA’s expanding Texas footprint.

Comparison of SignatureCare and HCA Healthcare Patient Care Models

SignatureCare, being a smaller, independent network, likely operated with a more localized and potentially less standardized approach to patient care compared to the large, nationally recognized HCA Healthcare system. HCA Healthcare, with its extensive resources and established protocols, typically emphasizes standardized care pathways, leveraging technology and data analytics for efficiency and quality improvement. The acquisition will likely lead to the adoption of HCA Healthcare’s more comprehensive and technologically advanced systems within SignatureCare’s facilities.

This might include the implementation of electronic health record (EHR) systems, if not already in place, allowing for better data management and patient tracking across the entire HCA network. The standardization could potentially streamline processes and reduce variations in care delivery across different SignatureCare locations.

Impact on Patient Wait Times and Access to Emergency Care

The effect of the acquisition on patient wait times is complex and depends on several factors. While HCA Healthcare’s resources and established processescould* lead to improved efficiency and reduced wait times, the immediate impact might vary. For instance, a sudden influx of patients from SignatureCare’s previously underserved areas into the HCA network might temporarily increase wait times in some facilities.

However, in the long term, HCA Healthcare’s ability to optimize staffing, implement advanced scheduling systems, and utilize data analytics to predict patient flow could lead to a reduction in overall wait times. A successful integration would ideally enhance access to emergency care by increasing the capacity and efficiency of the acquired centers. Similar acquisitions by HCA in other states have shown varying results, with some locations experiencing immediate improvements and others requiring a longer period of adjustment.

Changes in Insurance Accepted at Acquired Centers, Hca healthcare buys 11 emergency centers texas signaturecare

Prior to the acquisition, SignatureCare’s acceptance of insurance plans might have been more limited compared to HCA Healthcare’s broader network. HCA Healthcare typically accepts a wider range of insurance plans, aiming for broader accessibility. Post-acquisition, patients are likely to find a wider range of insurance plans accepted at the former SignatureCare centers. This broadened acceptance could significantly improve access to care for individuals previously limited by insurance coverage.

However, the specific changes in accepted insurance plans will depend on the details of the acquisition agreement and the ongoing negotiations with insurance providers. This change is highly probable, given HCA Healthcare’s business model.

Potential Improvements in Patient Care Resulting from the Acquisition

The acquisition holds the potential for several improvements in patient care:

- Improved access to specialists and sub-specialists through HCA Healthcare’s extensive network.

- Enhanced technological infrastructure, including advanced imaging and diagnostic equipment.

- Implementation of standardized care pathways and protocols, leading to more consistent and high-quality care.

- Access to HCA Healthcare’s research and clinical trials, potentially offering patients access to cutting-edge treatments.

- Improved patient education and support resources through HCA Healthcare’s established programs.

- Increased investment in staff training and development, leading to a more skilled and experienced workforce.

Closure: Hca Healthcare Buys 11 Emergency Centers Texas Signaturecare

Source: ercare24.com

The HCA Healthcare acquisition of SignatureCare’s 11 emergency centers marks a significant shift in Texas healthcare. While the long-term effects remain to be seen, this deal undoubtedly increases HCA’s market share and raises important questions about accessibility, affordability, and competition. The integration process will be crucial, and how smoothly it unfolds will directly impact patients and the broader healthcare ecosystem.

Only time will tell the full impact of this substantial acquisition.

FAQ Compilation

What are the potential downsides of this acquisition for patients?

Potential downsides could include increased healthcare costs, longer wait times at some centers due to increased patient volume, and changes to insurance acceptance policies.

Will this acquisition lead to job losses?

While some redundancies are possible during integration, HCA may also create new positions. The overall employment impact remains uncertain.

How long will the integration process take?

The integration timeline is difficult to predict precisely but could range from several months to a couple of years, depending on the complexity of combining systems and processes.

What specific regulatory approvals were required?

The acquisition likely required approvals from state and federal agencies, including antitrust reviews to ensure the deal doesn’t stifle competition. Specific agencies involved may vary.