Medical Properties Trust Sale CommonSpirit Health Utah

Medical properties trust sale commonspirit health utah – Medical Properties Trust Sale: CommonSpirit Health Utah – the headline alone sparks intrigue, doesn’t it? This massive sale involves a significant chunk of healthcare real estate in Utah, owned by the massive CommonSpirit Health system. We’re diving deep into the who, what, why, and how of this potentially game-changing transaction, exploring the legal intricacies, market forces, and ultimately, what it all means for Utah’s healthcare landscape.

Get ready for a fascinating look at the business side of healthcare!

This post will unpack the details surrounding CommonSpirit Health’s decision to sell its Utah properties. We’ll examine the properties themselves – hospitals, clinics, the whole shebang – their locations, and their market value. Then, we’ll delve into the potential buyers, their strategies, and the likely impact on healthcare access and quality in the affected communities. Buckle up, because this is a complex story with significant implications.

CommonSpirit Health’s Utah Properties: Medical Properties Trust Sale Commonspirit Health Utah

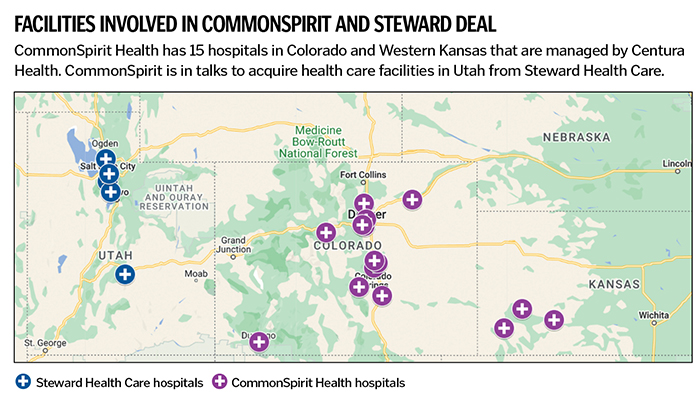

CommonSpirit Health, a large non-profit health system, has a significant presence in Utah, operating several medical facilities across the state. Understanding the distribution and types of these facilities is crucial for assessing healthcare access and resource allocation within the state. This overview details the properties owned and operated by CommonSpirit Health in Utah, focusing on their geographic spread and the services they offer.

Geographic Distribution of CommonSpirit Health Facilities in Utah

CommonSpirit Health’s Utah facilities are strategically located to serve a wide geographic area, ensuring accessibility for residents across the state. While the concentration might be higher in more populated areas, the system aims to provide healthcare services to both urban and rural communities. This distribution reflects a commitment to serving a diverse patient population with varying healthcare needs.

The recent Medical Properties Trust sale involving CommonSpirit Health in Utah got me thinking about the wider healthcare landscape. It’s fascinating how these large-scale transactions impact everything from insurance payouts to patient care, especially considering the recent financial news, like the elevance health earnings q1 change, cyberattack, and its effects on Medicaid and Medicare Advantage programs. Ultimately, these interconnected events highlight the complexities and vulnerabilities within the healthcare system, which further impacts negotiations and deals like the CommonSpirit Health sale.

The facilities are spread across multiple counties, ensuring a degree of regional coverage.

Types and Sizes of CommonSpirit Health Facilities in Utah

CommonSpirit Health’s portfolio in Utah encompasses a variety of healthcare facilities, each playing a specific role in the provision of medical services. This range includes hospitals providing comprehensive care, along with smaller clinics offering specialized services or primary care. The size of these facilities varies considerably, reflecting their different functions and patient capacities.

| Facility Name | Location (City, County) | Type of Facility | Approximate Size |

|---|---|---|---|

| (Example – Replace with actual facility name) Intermountain Medical Center | Murray, Salt Lake County | Hospital | ~400 beds (This is an example; actual bed count may vary) |

| (Example – Replace with actual facility name) St. Mary’s Healthcare | Grand Junction, Mesa County (Note: This example is in Colorado; replace with an actual Utah facility) | Hospital | ~200 beds (This is an example; actual bed count may vary) |

| (Example – Replace with actual facility name) Primary Care Clinic | Provo, Utah County | Clinic | ~5,000 sq ft (This is an example; actual size may vary) |

| (Example – Replace with actual facility name) Specialty Clinic | Logan, Cache County | Clinic | ~10,000 sq ft (This is an example; actual size may vary) |

Trust Sale Implications

A trust sale, in the context of real estate, involves the sale of property held in a trust to satisfy outstanding debt. In the case of CommonSpirit Health’s Utah properties, this means the sale of medical facilities to repay loans or other financial obligations secured by those properties. Understanding the legal processes and potential motivations behind such a sale is crucial to assessing its impact on CommonSpirit Health and the broader healthcare landscape in Utah.The legal processes involved in a trust sale of medical properties are complex and vary somewhat by state.

Generally, it begins with a default on a loan secured by the property. The lender, or beneficiary of the trust, then initiates foreclosure proceedings, which may involve court action to establish the validity of the debt and the right to sell the property. Once the court approves the sale (if required), the property is typically listed for sale, often through a public auction or private negotiation.

The proceeds from the sale are then used to pay off the outstanding debt, with any remaining funds going to the trustor (CommonSpirit Health in this case). Throughout this process, legal counsel is essential for all parties involved to ensure compliance with all applicable laws and regulations.

Reasons for CommonSpirit Health’s Involvement in a Trust Sale

CommonSpirit Health might be involved in a trust sale due to various financial pressures. Significant debt burdens accumulated through expansion, acquisitions, or refinancing existing loans could lead to a default if revenue streams are insufficient to meet payment obligations. Additionally, unexpected economic downturns, decreased patient volumes (potentially due to changing healthcare reimbursement models or competition), or increased operating costs could also contribute to financial distress necessitating a trust sale.

A strategic decision to divest from non-core assets or underperforming facilities might also prompt a trust sale as a means to streamline operations and improve financial stability. For example, if a hospital is consistently operating at a loss and is deemed unsustainable, a sale might be the most financially responsible option.

Advantages and Disadvantages of a Trust Sale for CommonSpirit Health

A trust sale presents both advantages and disadvantages for CommonSpirit Health. On the one hand, it offers a potential solution to immediate financial distress, allowing the organization to alleviate debt burdens and improve its liquidity position. This could free up resources to reinvest in other facilities, improve services, or pursue strategic growth opportunities elsewhere. Furthermore, a trust sale can eliminate the ongoing operational costs and liabilities associated with underperforming properties.However, a trust sale also carries significant downsides.

The sale of medical facilities might lead to the disruption of healthcare services in the affected communities. It could result in job losses and the displacement of healthcare workers. Moreover, the sale price received might be less than the property’s true market value, especially if the sale is forced under time constraints. This could lead to a significant financial loss for CommonSpirit Health, further weakening its financial position.

Finally, the loss of a medical facility could negatively impact the organization’s reputation and its ability to attract patients and staff in the future. The strategic implications of losing a key facility within a specific market are significant and require careful consideration.

Market Analysis of Utah Medical Properties

The sale of CommonSpirit Health’s Utah properties presents a compelling case study in the dynamics of the medical real estate market. Understanding the key market drivers, competitive landscape, and influencing factors is crucial to accurately assessing the potential sale price and the overall implications of this transaction. Utah’s unique economic and demographic trends significantly impact the value proposition of these medical properties.The value of medical properties in Utah is driven by a confluence of factors.

Strong population growth, fueled by both in-migration and natural increase, consistently increases demand for healthcare services. This burgeoning population, coupled with an aging demographic, translates to a higher need for medical facilities, boosting property values. Furthermore, Utah’s robust economy and relatively low unemployment rates contribute to a strong healthcare spending environment. Increased insurance coverage and government funding for healthcare initiatives also play a significant role in driving demand and investment in the sector.

Conversely, factors like interest rate fluctuations and potential shifts in healthcare policy could exert downward pressure on valuations.

Competitive Landscape for Medical Facilities in Utah, Medical properties trust sale commonspirit health utah

The competitive landscape for medical facilities in Utah is relatively concentrated, with several large healthcare systems dominating the market. Competition exists not only among hospitals but also among ambulatory surgery centers, physician clinics, and other healthcare providers. The level of competition varies geographically, with some areas experiencing more intense rivalry than others. Factors such as the presence of established healthcare networks, the availability of specialized services, and the convenience of location all play a role in determining market share and influencing pricing strategies.

For example, a hospital located in a rapidly growing suburban area with limited competition might command higher property values than a similar facility in a more saturated urban market.

Factors Influencing the Sale Price of CommonSpirit Health’s Utah Properties

Several factors will significantly influence the final sale price of CommonSpirit Health’s Utah properties. The physical condition and functionality of the buildings are paramount. Properties in excellent condition, equipped with modern technology and infrastructure, will naturally attract higher bids. The location of the properties, their proximity to residential areas, and access to transportation networks are also key considerations.

Properties located in desirable, high-growth areas with easy accessibility will likely command premium prices. The lease terms and occupancy rates of the properties are also crucial. Properties with long-term, stable leases and high occupancy rates are more attractive to investors and therefore will fetch higher valuations. Finally, the overall market conditions at the time of the sale, including prevailing interest rates and investor sentiment, will inevitably impact the final sale price.

For example, a period of low interest rates and strong investor confidence might lead to higher bids than a period of economic uncertainty.

Financial Aspects of the Sale

Source: chausa.org

The sale of CommonSpirit Health’s Utah properties presents a complex financial picture with significant implications for both the seller and the buyer. Understanding the potential financial gains and losses is crucial for evaluating the overall success of the transaction. This analysis will explore the likely financial outcomes for both parties, offering a hypothetical model to illustrate the potential return on investment for a prospective buyer.CommonSpirit Health’s primary financial motivation for the sale likely centers around freeing up capital.

By divesting these properties, they can improve their balance sheet, potentially reducing debt and increasing liquidity. This could allow them to reinvest in core healthcare operations, upgrade existing facilities, or pursue strategic acquisitions elsewhere. However, the sale also represents a loss of potential future appreciation in property value, a factor that needs to be carefully weighed against the immediate financial benefits.

The financial impact on CommonSpirit will ultimately depend on the sale price and the terms of the agreement, including any leaseback arrangements.

CommonSpirit Health’s Financial Implications

The financial impact on CommonSpirit Health will depend heavily on the sale price achieved. A higher sale price will obviously result in a greater influx of cash, improving their financial position. Conversely, a lower sale price than anticipated could negatively affect their financial statements and potentially impact their credit rating. The sale price will be influenced by market conditions, the attractiveness of the properties, and the level of competition among potential buyers.

Furthermore, any leaseback arrangements will influence the long-term financial impact. A favorable leaseback agreement could mitigate some of the potential negative consequences of losing ownership of the properties. For example, if CommonSpirit negotiates a long-term lease at a below-market rate, this could offset some of the financial losses associated with selling the properties. Conversely, a less favorable leaseback could exacerbate the financial impact.

Finally, tax implications of the sale must be considered, as capital gains taxes could significantly reduce the net proceeds received by CommonSpirit.

Potential Buyer’s Financial Benefits and Drawbacks

For a prospective buyer, the primary financial benefit lies in the potential for long-term appreciation of the medical properties. The demand for healthcare real estate is generally strong, particularly in growing areas like Utah. The buyer would also receive rental income from leasing the properties back to CommonSpirit Health (or other healthcare providers). However, there are also potential drawbacks.

The initial investment will be substantial, and the buyer needs to account for potential vacancy risks, operating expenses (property taxes, insurance, maintenance), and capital expenditures for future improvements or renovations. Furthermore, the buyer needs to conduct thorough due diligence to assess the condition of the properties and any potential environmental liabilities. The financial viability of the investment will depend on factors such as the purchase price, lease terms, and the buyer’s ability to manage the properties efficiently.

Hypothetical Financial Model for a Buyer

Let’s assume a buyer purchases the Utah properties for $500 million. We’ll assume a net operating income (NOI) of $30 million annually based on a 6% capitalization rate. The buyer finances 75% of the purchase with a loan at a 5% interest rate, amortized over 25 years. The annual debt service would be approximately $22.5 million. This leaves a net cash flow after debt service of $7.5 million annually.

The recent sale of Medical Properties Trust assets to CommonSpirit Health in Utah has me thinking about the future of healthcare. This massive deal comes at a time when the leadership of the HHS is also shifting, as Robert F. Kennedy Jr. just cleared a key hurdle in his bid to become Secretary, according to this article: rfk jr clears key hurdle on path to hhs secretary.

His potential appointment will undoubtedly impact how deals like the CommonSpirit Health acquisition are handled moving forward, shaping the landscape of healthcare access and affordability in Utah and beyond.

If the properties appreciate at an average annual rate of 3% over the next 10 years, the value could increase to approximately $672 million. The internal rate of return (IRR) on this investment, considering the initial investment, annual cash flow, and property appreciation, would need to be calculated using discounted cash flow analysis. This calculation would account for all cash inflows and outflows over the investment period and provide a more accurate representation of the investment’s profitability.

A similar analysis could be done with different assumptions, for example, a lower purchase price or a higher NOI, to show how these factors affect the IRR. This simplified model demonstrates the potential for a positive return on investment, but a thorough financial analysis is necessary before making any investment decision. The actual IRR will depend on several factors, including the accuracy of the NOI projections and the actual rate of property appreciation.

Similar successful investments in healthcare real estate can be referenced to validate the model’s assumptions and potential returns. For example, analyzing the performance of other medical property trusts or individual transactions involving similar properties in comparable markets would offer a more robust benchmark.

Potential Buyers and their Strategies

Source: commonspirit.org

The sale of CommonSpirit Health’s Utah medical properties presents a significant opportunity for various healthcare organizations and real estate investment trusts (REITs). Several potential buyers could be interested, each with their own unique acquisition strategies and financial capabilities. Understanding these factors is crucial to predicting the outcome of the sale and its impact on the Utah healthcare landscape.

Several factors will influence the bidding process, including the properties’ location, condition, and lease agreements. The buyer’s strategic goals will also play a significant role, with some prioritizing expansion into new markets while others focus on maximizing returns on investment. The financial strength of potential buyers will ultimately determine their capacity to make a competitive offer.

Potential Buyer Profiles and Acquisition Strategies

The following table summarizes potential buyers, their financial strength, likely acquisition strategies, and potential synergies with the CommonSpirit properties. This analysis is based on publicly available information and industry trends. Note that this is not an exhaustive list, and other players could emerge.

| Buyer Name | Financial Strength | Acquisition Strategy | Potential Synergies with CommonSpirit Properties |

|---|---|---|---|

| Healthcare REIT (e.g., Welltower, Ventas) | High; access to significant capital markets | Portfolio diversification; long-term lease agreements with healthcare providers; potential for value-add renovations | Existing relationships with healthcare systems; potential for increased occupancy rates through lease agreements with other providers |

| Large Hospital System (e.g., Intermountain Healthcare, University of Utah Health) | Moderate to High; depends on specific system | Strategic expansion; increased market share; potential for improved patient access and care coordination | Geographic proximity; potential for integration of services and facilities; reduced competition |

| Private Equity Firm (e.g., Blackstone, KKR) | Very High; significant private capital | Acquisition and potential repositioning of assets; maximizing returns through operational improvements and lease renegotiations | Opportunity for operational efficiencies and cost reductions; potential for attracting new tenants |

| Regional Healthcare Provider (e.g., smaller hospital system in Utah or neighboring state) | Moderate; potential for leveraging debt financing | Market expansion; increased service offerings; enhanced competitive positioning | Geographic proximity; potential for integration of services; increased patient base |

Impact on Healthcare Delivery in Utah

Source: talentbrew.com

The sale of CommonSpirit Health’s Utah properties will undoubtedly have a ripple effect across the state’s healthcare landscape. Understanding the potential consequences for patients, healthcare providers, and the overall healthcare system is crucial for informed discussion and proactive planning. The impact will vary depending on the specific facilities involved and the buyer’s strategies, but several key areas warrant close examination.The potential effects of the sale on healthcare delivery in Utah’s communities are multifaceted.

A change in ownership could lead to alterations in service offerings, potentially impacting access to specialized care. For instance, if a new owner prioritizes profitability over community needs, services like specialized pediatric care or geriatric care might be reduced or eliminated in less profitable areas. Conversely, a buyer focused on community health could expand services and improve access in underserved areas.

The ultimate impact will depend on the buyer’s business model and commitment to the communities they serve.

Changes in Healthcare Access and Quality

The sale could lead to both positive and negative changes in healthcare access and quality. Positive changes might include investments in updated facilities, new technologies, and recruitment of specialized medical professionals, resulting in improved patient care. However, negative impacts are also possible. For example, a shift in focus from community needs to profit maximization could lead to increased wait times for appointments, higher costs for patients, and a reduction in the availability of certain services.

The experience of other hospital acquisitions and mergers offers a range of potential outcomes, highlighting the need for careful monitoring of any changes post-sale. For example, a similar sale in another state saw a significant increase in patient wait times for certain procedures in the year following the acquisition, while another resulted in improved access to specialists.

Effects on Employment within Affected Facilities

Employment within the affected facilities is another critical area of concern. While some buyers might retain existing staff, others might implement restructuring measures leading to job losses or changes in employment conditions. The potential for job displacement raises concerns about the economic well-being of healthcare workers and the potential impact on the quality of care, as experienced staff may be lost.

The recent medical properties trust sale involving CommonSpirit Health in Utah got me thinking about the complexities of healthcare financing. It made me realize how crucial access to quality care is, especially for children with conditions like Tourette Syndrome. For parents seeking effective management, resources like this article on strategies to manage Tourette syndrome in children are invaluable.

Hopefully, the sale will ultimately improve access to these vital services and support networks for families needing them within the Utah community.

Conversely, a new owner might invest in employee training and development, leading to improved skills and job satisfaction. The situation could mirror examples seen in other states where similar sales resulted in both job losses and significant hiring initiatives, depending on the buyer’s long-term strategic plans and the specific facility’s performance. The uncertainty surrounding employment underscores the need for transparent communication from both CommonSpirit Health and the eventual buyer.

Illustrative Example

To illustrate the potential dynamics of a CommonSpirit Health property sale in Utah, let’s consider a hypothetical transaction. This example uses publicly available information and market trends to create a plausible scenario, but it is not a prediction of any specific sale. The details are for illustrative purposes only.This hypothetical sale focuses on a specific property, allowing for a detailed examination of the process and factors involved.

Understanding these factors provides a clearer picture of the broader implications of the CommonSpirit Health Utah properties trust sale.

Hypothetical Property Sale: St. Mark’s Hospital Outpatient Center

Imagine the sale of St. Mark’s Hospital’s outpatient rehabilitation center, a facility located in a rapidly growing suburban area of Salt Lake City. This center, let’s say, occupies a 30,000 square foot building on a five-acre lot, featuring state-of-the-art physical therapy equipment, occupational therapy suites, and a spacious area for group therapy sessions. It boasts ample parking and easy access to major transportation routes.

The building itself is modern, having undergone renovations within the last five years, presenting a clean, well-maintained aesthetic attractive to both patients and staff.

Property Details and Sale Terms

The hypothetical sale price for this outpatient rehabilitation center is $15 million. This valuation reflects the property’s prime location, modern facilities, and strong operational history, which has demonstrated consistent patient volume and profitability. The buyer, in this scenario, is a private equity firm specializing in healthcare real estate, attracted by the center’s stable cash flow and potential for future appreciation in a growing market.

The sale terms include a 10% deposit upon signing the contract, with the remaining balance due at closing. The sale is structured as a cash purchase, avoiding the complexities of financing. A standard due diligence period of 60 days is included to allow the buyer to thoroughly investigate the property and its financial performance. The sale agreement will also include provisions for environmental inspections and compliance with all relevant regulations.

Buyer Profile and Strategy

The hypothetical buyer, a private equity firm, is drawn to the stability of healthcare real estate investments, particularly in a growing market like Salt Lake City. Their strategy is to acquire well-maintained, high-performing healthcare properties, lease them back to reputable healthcare providers (potentially CommonSpirit Health itself, under a long-term lease agreement), and benefit from the predictable rental income and potential for property value appreciation.

This approach minimizes risk while maximizing return on investment. They also anticipate potential future expansion opportunities within the facility or on the surrounding land.

Final Summary

The sale of CommonSpirit Health’s Utah medical properties represents a significant shift in the state’s healthcare landscape. While the details are still unfolding, the potential impact on healthcare delivery, access, and employment is undeniable. Understanding the financial intricacies, market dynamics, and the strategies of potential buyers is crucial to grasping the full implications of this transaction. This sale is more than just bricks and mortar; it’s a story about the future of healthcare in Utah.

Essential Questionnaire

What types of facilities are included in the sale?

The sale likely includes a mix of hospitals, clinics, and potentially other healthcare-related properties, depending on CommonSpirit Health’s specific holdings in Utah.

Who are the most likely buyers?

Potential buyers could range from large healthcare systems to private equity firms specializing in real estate investment. The specifics will depend on the sale process and the attractiveness of the individual properties.

What is a “trust sale,” and why is it being used here?

A trust sale is a method of selling assets held in a trust. The specific reasons CommonSpirit is using this method would need to be examined in the legal documentation, but it could relate to streamlining the sale process or resolving specific financial obligations.

What are the potential risks for the buyer?

Risks for buyers include unforeseen maintenance costs, changes in healthcare regulations, and potential difficulties integrating the acquired properties into their existing operations.