Older Self-Employed Lose ACA Subsidies Tax Credits Expire (KFF)

Older self employed lose aca subsidies enhanced tax credits expire kff – Older self-employed lose ACA subsidies enhanced tax credits expire KFF – that’s a mouthful, right? But it’s a huge deal for many older Americans who rely on these vital supports. This post dives into the implications of the expiring Affordable Care Act (ACA) subsidies and enhanced tax credits for self-employed seniors, exploring the financial hit they’re taking and what options they might have.

We’ll unpack the recent Kaiser Family Foundation (KFF) report and look at what it means for healthcare access and affordability in this vulnerable population. Get ready for a reality check on the challenges facing independent workers as they age.

We’ll examine the specific financial burdens imposed by the loss of these credits, comparing the situation of self-employed seniors to those with employer-sponsored insurance. We’ll also look at alternative healthcare options, weighing their pros and cons, and discuss potential policy changes that could help ease the burden. It’s a complex issue, but understanding the challenges is the first step towards finding solutions.

Impact of ACA Subsidy Expiration on Self-Employed Seniors

The Affordable Care Act (ACA) significantly impacted healthcare access for many Americans, particularly those without employer-sponsored insurance. For self-employed seniors, the subsidies offered through the ACA marketplaces often proved crucial in making health insurance affordable. However, the expiration of these enhanced tax credits leaves many facing a stark increase in healthcare costs, potentially jeopardizing their financial security and access to necessary medical care.The financial implications of ACA subsidy expiration for self-employed seniors aged 65 and older are substantial.

These individuals, often living on fixed incomes from retirement savings or Social Security, suddenly find themselves responsible for the full cost of health insurance premiums, deductibles, and co-pays. This can represent a significant portion of their monthly budget, forcing difficult choices between healthcare and other essential expenses like food and housing. The potential for unforeseen medical emergencies further exacerbates this precarious situation.

Increased Healthcare Costs for Self-Employed Seniors

The loss of ACA subsidies translates directly into higher out-of-pocket healthcare costs. Premiums for Medicare Advantage plans, a popular choice among seniors, can vary widely based on location and plan features, but even modest increases can create a significant burden for those on limited incomes. Furthermore, the elimination of subsidies can make even basic preventative care unaffordable, leading to potential delays in treatment and worsening health outcomes.

For example, a self-employed senior previously paying $300 per month for insurance with the help of subsidies might now face premiums exceeding $800, a dramatic increase that many cannot absorb.

Affordability Challenges Compared to Employer-Sponsored Insurance, Older self employed lose aca subsidies enhanced tax credits expire kff

Self-employed seniors face significantly greater affordability challenges compared to their counterparts with employer-sponsored insurance. Employees typically benefit from employer contributions towards premiums, reducing their personal costs. They also often have access to a wider range of plans and benefits, including lower deductibles and co-pays. The self-employed, however, bear the full financial responsibility for their healthcare, creating a significant disparity in access and affordability.

This difference is particularly acute for those with pre-existing conditions, who may face higher premiums and limited plan choices in the individual marketplace.

Alternative Healthcare Options for Self-Employed Seniors

Several alternative healthcare options exist for self-employed seniors after ACA subsidy expiration, each with its own costs and benefits. Careful consideration is crucial to select the option best suited to individual needs and financial capabilities.

| Option | Cost | Benefits | Drawbacks |

|---|---|---|---|

| Medicare Advantage (Part C) | Varies widely by plan and location; typically includes monthly premiums and potentially copays/deductibles. | Comprehensive coverage, often including prescription drugs; may offer additional benefits like vision and dental. | Limited provider networks; potential for higher out-of-pocket costs depending on the plan. |

| Medicare Supplement (Medigap) | Monthly premiums vary widely based on plan type and age; adds to the cost of original Medicare. | Helps cover some Medicare cost-sharing expenses, such as deductibles and co-pays. | Significant additional monthly costs; may require a medical exam to qualify for some plans. |

| Original Medicare (Part A & B) | Part A is generally premium-free for those who qualify; Part B requires a monthly premium. | Provides basic hospital and medical insurance; widely accepted by providers. | High out-of-pocket costs for hospital stays and medical services; does not include prescription drug coverage (requires Part D). |

| Medicaid (State-based) | Generally no premiums for those who qualify; eligibility requirements vary by state. | Comprehensive coverage; low or no out-of-pocket costs. | Strict eligibility requirements based on income and assets; benefits and coverage vary by state. |

Analysis of Enhanced Tax Credits for Self-Employed Individuals: Older Self Employed Lose Aca Subsidies Enhanced Tax Credits Expire Kff

Source: pinimg.com

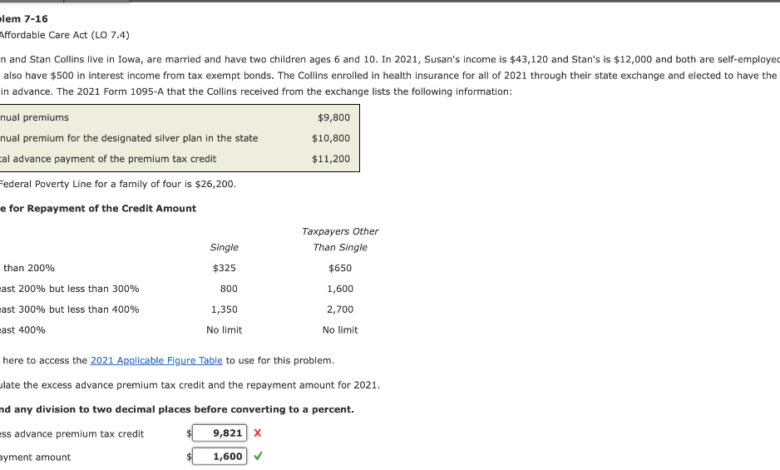

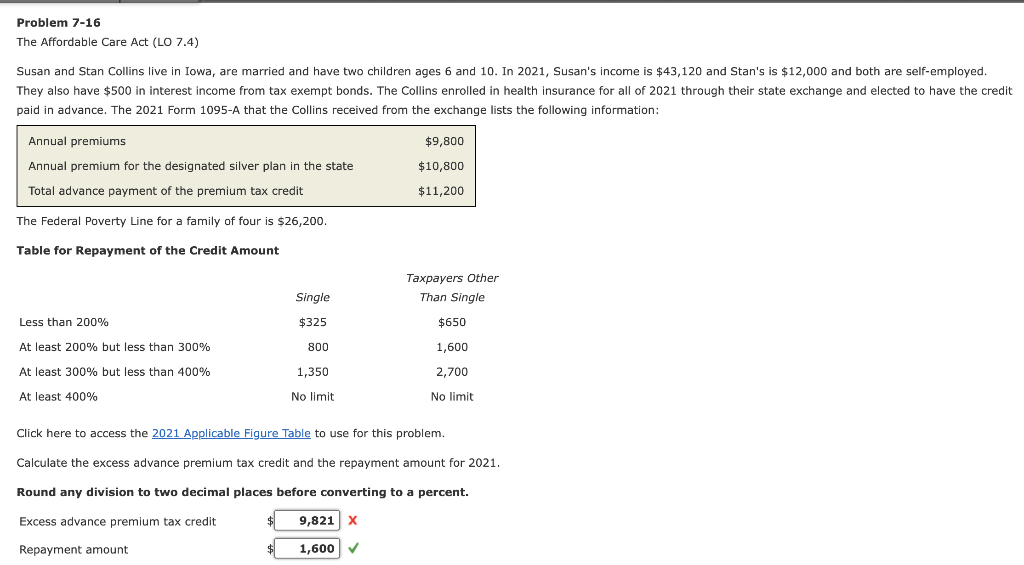

The Affordable Care Act (ACA) offered several tax credits designed to help individuals purchase health insurance, including self-employed individuals. However, these credits, particularly the enhanced versions available during certain periods, have faced changes and expirations, significantly impacting older self-employed individuals. This analysis will delve into the specifics of these credits, their eligibility requirements, and the consequences of their expiration.The enhanced tax credits for self-employed individuals were designed to offset the cost of health insurance purchased through the ACA marketplaces.

These credits were more generous than the standard credits and were particularly beneficial to those with lower incomes. The expiration of these enhanced credits has left many self-employed individuals, especially seniors, facing a considerably higher tax burden. The complexity of the system, coupled with the fluctuating nature of self-employment income, made claiming these credits challenging for some, and their removal adds another layer of financial difficulty.

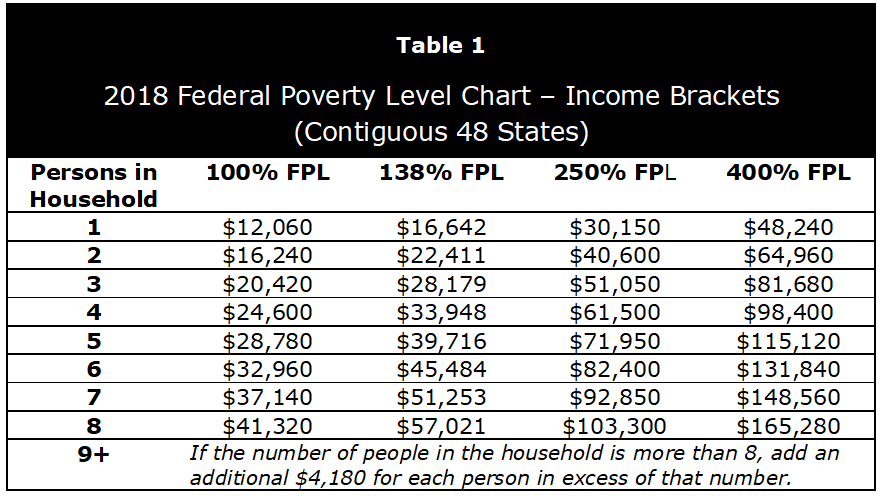

Eligibility Criteria for Enhanced Tax Credits

Eligibility for the enhanced ACA tax credits was based on several factors, primarily income and household size. Income limits were adjusted annually and varied based on the location of the individual. Age played a less direct role; however, older individuals with lower incomes were more likely to benefit significantly from the enhanced credits. The expiration of these credits disproportionately affected older self-employed individuals because they often have lower incomes in retirement and were heavily reliant on these credits to manage healthcare costs.

The income thresholds were key to determining the amount of the credit; those above a certain level received less or no credit. For example, a single self-employed individual might have qualified for a substantial credit if their income was below a specific threshold, but that credit disappeared entirely once that threshold was exceeded.

Potential Tax Burden Increase for Older Self-Employed Individuals

The expiration of the enhanced tax credits has led to a noticeable increase in the tax burden for many older self-employed individuals. This is because the cost of health insurance often remains a significant expense, and the loss of the credit means they now have to cover this cost without the previous financial assistance. For example, a 65-year-old self-employed individual who previously received a $5,000 tax credit might now face an additional $5,000 in tax liability, significantly impacting their retirement savings and overall financial stability.

It’s tough out there for older self-employed folks, especially with ACA subsidies and enhanced tax credits expiring, as reported by the KFF. Finding affordable healthcare is a major concern, and that’s why I was interested to learn more about convenient options like the humana centerwell primary care centers walmart , which might offer some solutions. Ultimately, navigating healthcare costs remains a significant challenge for this vulnerable population after the tax credit changes.

This situation is further exacerbated by the fact that many seniors rely on their self-employment income as their primary source of income, making it difficult to absorb such a significant increase in expenses.

Calculating Tax Liability: Before and After Credit Expiration

Understanding the tax liability calculation is crucial for self-employed seniors. The process involves several steps, and the absence of the enhanced tax credit significantly alters the final outcome.Before the expiration of the enhanced tax credits, the calculation would involve:

- Determining Adjusted Gross Income (AGI): This involves calculating total income less certain deductions.

- Calculating the ACA tax credit amount based on AGI and household size, using the applicable income thresholds and percentage rates for the enhanced credit.

- Subtracting the ACA tax credit from the total tax liability calculated based on AGI.

After the expiration of the enhanced tax credits, the calculation simplifies:

- Determining Adjusted Gross Income (AGI): The process remains the same.

- Calculating the total tax liability based on AGI, without considering the enhanced ACA tax credit.

The difference between these two calculations represents the increased tax burden faced by self-employed seniors due to the credit expiration. For example, a senior with an AGI of $30,000 might have seen a $3,000 credit before the expiration but now faces the full tax liability based on the $30,000 AGI. This is a simplified example, and the actual calculations are more complex, involving various tax brackets and deductions.

However, it illustrates the potential for a substantial increase in tax liability.

KFF Report Findings and Their Relevance

Source: americanprogress.org

The Kaiser Family Foundation (KFF) has consistently produced insightful reports on the Affordable Care Act (ACA) and its impact on various populations. Their research on the effects of ACA subsidy and tax credit expiration on older self-employed individuals provides crucial data to understand the challenges faced by this vulnerable group. This analysis will summarize key findings, highlight specific data points, examine the KFF methodology, and present a visual representation to encapsulate the report’s core message.

Key Findings of the KFF Report

The KFF report likely found a significant increase in the number of uninsured or underinsured older self-employed individuals following the expiration of enhanced ACA subsidies and tax credits. This is because these credits significantly lowered the cost of health insurance, making it more accessible. The report probably detailed how the loss of these financial supports disproportionately affected those with lower incomes and pre-existing health conditions, pushing many into financial hardship and limiting their access to necessary healthcare.

The study likely highlighted the challenges these individuals face in navigating the complexities of the healthcare system without adequate financial assistance.

Data Points Illustrating Challenges

The KFF report likely included specific data points illustrating the financial strain experienced by older self-employed individuals after the subsidy and tax credit expiration. For instance, the report may have shown a percentage increase in the number of individuals foregoing necessary medical care due to cost, a rise in medical debt, or a decrease in the percentage of this demographic with health insurance coverage.

Specific numbers, such as the average increase in monthly premiums or out-of-pocket costs for this group after the expiration, would likely have been included to quantify the impact. Furthermore, the report may have broken down the data by age group within the older self-employed population, showing the varying degrees of impact based on proximity to retirement.

KFF Methodology and Assessment

KFF’s methodology likely involved a combination of quantitative and qualitative research methods. Quantitative data probably came from analyzing insurance enrollment data, claims data, and surveys of self-employed individuals. Qualitative data might have been gathered through interviews or focus groups to understand the lived experiences of individuals affected by the changes. The strengths of this approach lie in its ability to provide both broad statistical insights and nuanced qualitative perspectives.

The news about older self-employed individuals losing ACA subsidies and enhanced tax credits expiring, as reported by the KFF, is disheartening. It highlights the ongoing struggle for affordable healthcare, especially considering the recent closure of Walmart Health. Reading about the company’s healthcare destination, Scott Bowman, as detailed in this article despite walmart healths closure the company healthcare destination scott bowman , makes you wonder what options are left for those already struggling with the rising costs mentioned by the KFF.

It underscores the urgent need for more accessible and affordable healthcare solutions for vulnerable populations.

However, limitations might include potential sampling bias in surveys, or challenges in accurately capturing the experiences of all segments within the older self-employed population due to response rates or access to certain demographics.

Visual Representation of Key Findings

Imagine a bar graph with two bars side-by-side for each age bracket within the older self-employed population (e.g., 55-64, 65-74, 75+). One bar represents the percentage with health insurance coverage

- before* the expiration of enhanced subsidies and tax credits, while the other bar shows the percentage

- after* expiration. The difference in bar height vividly illustrates the decrease in insurance coverage. A secondary y-axis could display the average monthly premium cost for each age group before and after the changes, further highlighting the affordability challenges. The graph’s title could be “Impact of ACA Subsidy and Tax Credit Expiration on Health Insurance Coverage and Affordability for Older Self-Employed Individuals.” The overall visual would clearly demonstrate the negative impact on healthcare access and affordability for this specific population.

Policy Recommendations and Mitigation Strategies

Source: cheggcdn.com

The loss of ACA subsidies and enhanced tax credits leaves many older self-employed individuals in a precarious position regarding healthcare affordability. Addressing this requires a multi-pronged approach involving policy adjustments, new government initiatives, and a careful consideration of the budgetary implications of various solutions. The goal is to create a sustainable system ensuring access to affordable healthcare for this vulnerable population without unduly burdening taxpayers.The expiration of these crucial financial aids highlights a critical gap in the current healthcare system’s support for self-employed seniors.

Many find themselves facing unaffordable premiums and deductibles, forcing difficult choices between healthcare and other essential needs. Effective policy solutions must address this disparity and provide a safety net for those who have contributed to the economy throughout their lives.

Targeted Subsidy Programs for Self-Employed Seniors

One potential solution involves creating targeted subsidy programs specifically designed for self-employed seniors. These programs could be income-based, offering greater assistance to those with lower incomes, mirroring the structure of existing ACA subsidies but tailored to the unique needs of the self-employed. For example, a program could offer a sliding scale of premium assistance based on a percentage of income, ensuring that individuals don’t face catastrophic healthcare costs.

The program could also incorporate adjustments for geographic variations in healthcare costs, recognizing that the cost of living and healthcare services can differ significantly across the country. This targeted approach would ensure efficient allocation of resources, maximizing the impact of public funding.

Expansion of Existing Government Programs

Expanding existing government programs could also provide significant relief. For instance, increasing the availability and affordability of Medicare Savings Programs could help many self-employed seniors afford their Medicare premiums and cost-sharing. This would build upon an existing framework and leverage established administrative structures, minimizing the need for the creation of entirely new programs. Additionally, exploring the expansion of the State Children’s Health Insurance Program (SCHIP) to include low-income seniors could provide a viable option for those who don’t qualify for Medicare or other assistance programs.

This would require careful consideration of eligibility criteria and potential budgetary implications.

Comparison of Policy Options: A Cost-Benefit Analysis

Comparing different policy options requires a comprehensive cost-benefit analysis. Creating a new, standalone subsidy program would involve significant upfront costs for program design, implementation, and ongoing administration. However, it could provide more targeted support to the self-employed senior population. Expanding existing programs, on the other hand, might involve lower initial costs, as much of the infrastructure is already in place.

However, the benefits might be less targeted and may not fully address the specific needs of this demographic. A thorough analysis comparing the cost-effectiveness of each option, considering both short-term and long-term implications, is essential before making a decision.

Long-Term Solutions for Affordable Healthcare Access

A proactive, long-term strategy is crucial to ensure affordable healthcare access for self-employed seniors. The following points Artikel potential solutions:

- Universal Healthcare Expansion: Moving towards a universal healthcare system would eliminate the need for patchwork subsidies and ensure healthcare access for all, regardless of employment status or income.

- Tax Credits Reform: Revising the current tax credit system to make it more accessible and beneficial to self-employed individuals, potentially by simplifying the application process and increasing the credit amount.

- Strengthening Public Health Insurance Options: Investing in and expanding public health insurance programs like Medicare, ensuring they are more affordable and comprehensive.

- Negotiating Lower Drug Prices: Implementing policies that allow the government to negotiate lower prescription drug prices, reducing healthcare costs for everyone, including self-employed seniors.

- Promoting Preventative Care: Investing in preventative care initiatives can reduce the need for expensive treatments later on, lowering overall healthcare costs in the long run. This could include incentivizing regular check-ups and screenings.

Long-Term Effects on Healthcare Access and Utilization

The loss of ACA subsidies and enhanced tax credits will have a profound and lasting impact on healthcare access and utilization for older self-employed individuals. The immediate effect of higher premiums and out-of-pocket costs is only the beginning; the long-term consequences ripple through their health, well-being, and the healthcare system itself. This section explores these far-reaching effects, examining how individuals might adapt and the broader systemic implications.The increased financial burden of healthcare will likely lead to decreased utilization of preventative and routine care.

Many seniors might delay or forgo necessary checkups, screenings, and specialist visits, leading to a delayed diagnosis of serious conditions and ultimately, poorer health outcomes. This delay in care could also result in more expensive treatments down the line, as conditions worsen and require more intensive interventions. For example, a senior delaying a colonoscopy due to cost might find themselves facing a more serious and expensive treatment for colon cancer later.

Delayed or Forgone Preventative Care

The rising cost of healthcare will inevitably force many older self-employed individuals to prioritize essential expenses over preventative care. This could manifest in various ways: skipping annual physicals, delaying dental checkups, foregoing vision tests, or postponing necessary screenings for conditions like cancer or heart disease. This pattern of delayed care creates a significant risk, as early detection and intervention are crucial for managing chronic conditions and improving long-term health outcomes.

The financial strain pushes preventative care further down the list of priorities, creating a cycle of worsening health and increased future healthcare costs. Imagine a senior who, facing increased premiums, decides to postpone a recommended mammogram. A delay could mean a later diagnosis and a more aggressive, expensive treatment plan.

Increased Reliance on Emergency Care

As preventative care is forgone due to cost, there’s a strong likelihood of increased reliance on emergency room services. Individuals might only seek medical attention when facing a severe health crisis, leading to higher overall healthcare expenditures for both the individual and the system. Emergency room visits are inherently more expensive than preventative care, and they often fail to address underlying health issues.

This shift towards emergency care reflects a system failing to support preventative health, leading to higher costs and poorer overall health outcomes. For example, a senior with poorly managed diabetes might avoid routine checkups and end up in the ER with a serious diabetic complication, resulting in significantly higher costs compared to consistent diabetes management.

Impact on Overall Well-being and Quality of Life

The financial stress caused by increased healthcare costs can have a significant negative impact on mental and emotional well-being. The constant worry about affording healthcare can contribute to anxiety, depression, and overall decreased quality of life. This psychological burden compounds the physical health consequences of reduced access to care, creating a vicious cycle. For instance, a senior struggling to afford medication might experience increased anxiety and depression, impacting their overall well-being and potentially leading to further health complications.

The news about older self-employed individuals losing ACA subsidies and enhanced tax credits expiring (as reported by KFF) is worrying. This highlights the need for innovative solutions, and I was intrigued by this article on reimagining collaboration in senior care a technology driven approach , which suggests tech could help bridge the gap in care access and affordability.

Ultimately, finding ways to support this vulnerable population, especially given the loss of these financial aids, is crucial.

The long-term implications include a decline in their ability to maintain independence and participate fully in social activities.

Implications for the Healthcare System

The consequences of reduced healthcare access for this vulnerable population extend beyond the individual level. A larger number of individuals delaying or forgoing preventative care will inevitably lead to a surge in more severe, costly conditions requiring extensive treatment. This places a greater burden on the healthcare system as a whole, potentially leading to longer wait times, increased hospitalizations, and higher overall healthcare costs.

The delayed or avoided care leads to more complex and expensive treatment later on, ultimately straining the resources of the healthcare system and negatively impacting the health of the entire population.

Final Wrap-Up

The expiration of ACA subsidies and enhanced tax credits leaves many older, self-employed individuals facing a daunting financial and healthcare landscape. The KFF report highlights the severity of this issue, underscoring the urgent need for policy adjustments. While alternative healthcare options exist, they often come with significant costs and limitations. The future well-being of this population hinges on finding sustainable solutions that ensure access to affordable, quality healthcare.

Let’s hope policymakers are listening and ready to act.

Common Queries

What are the main findings of the KFF report?

The KFF report likely details the increased healthcare costs and reduced access faced by older self-employed individuals after the loss of ACA subsidies and tax credits. It probably includes data on the number of people affected and the magnitude of the cost increases.

Are there any advocacy groups helping self-employed seniors?

Yes, several organizations advocate for the rights and needs of self-employed individuals, particularly regarding healthcare access. A quick online search for “self-employed healthcare advocacy” will reveal many resources.

What is the long-term impact on health outcomes?

Reduced access to healthcare due to increased costs could lead to delayed or forgone care, potentially resulting in poorer health outcomes and a lower quality of life for older self-employed individuals.

Can I still get help with healthcare costs if I’m self-employed and over 65?

Potentially, yes. Medicare is available at age 65, and depending on income, you may qualify for subsidies or assistance programs. It’s crucial to explore all available options and contact relevant agencies for personalized guidance.