Addressing 3 Pandemic-Induced Payment Integrity Challenges

Addressing 3 pandemic induced payment integrity challenges – Addressing 3 pandemic-induced payment integrity challenges is crucial for the future of healthcare finance. The COVID-19 pandemic dramatically altered the healthcare landscape, creating unprecedented vulnerabilities in payment systems. This led to a surge in fraudulent claims, widespread billing discrepancies, and significant hurdles in verifying patient eligibility. We’ll delve into these three key areas, exploring the root causes, examining the impact, and proposing solutions to strengthen payment integrity moving forward.

The pandemic’s rapid shift to telehealth, coupled with increased financial strain on both patients and providers, created a perfect storm for fraud and billing inaccuracies. The sudden surge in remote work also presented challenges in data security and the efficient processing of claims. Understanding these challenges is essential to building more resilient and secure healthcare payment systems.

Increased Fraudulent Claims

Source: eubusinessnews.com

The COVID-19 pandemic presented a perfect storm for an increase in fraudulent healthcare claims. The sudden surge in demand for medical services, coupled with the rapid implementation of telehealth and emergency relief programs, created vulnerabilities that opportunistic individuals and organizations exploited to their advantage. This resulted in a significant rise in the number of false and inflated claims submitted to insurers and government agencies.The pandemic-related circumstances significantly facilitated fraudulent activities.

The shift to telehealth, while necessary, made it easier to fabricate services or inflate the frequency of virtual visits. The increased reliance on electronic systems also presented new opportunities for data breaches and identity theft, which were then used to file fraudulent claims. The economic hardship experienced by many also contributed to the rise in fraudulent activities, as individuals and organizations sought to supplement their income through illicit means.

Furthermore, the rapid rollout of government relief programs, while intended to provide crucial support, unfortunately also created a fertile ground for fraudsters to exploit loopholes and inconsistencies.

Methods of Committing Fraudulent Claims During the Pandemic, Addressing 3 pandemic induced payment integrity challenges

Several methods were employed to commit fraudulent claims during the pandemic. These included submitting claims for services never rendered, billing for more expensive procedures than those actually performed, using stolen identities to file claims, and submitting duplicate claims. The widespread use of telehealth opened doors to new types of fraud, such as billing for telehealth visits that never occurred or inflating the duration of virtual consultations.

Organized crime rings also took advantage of the situation, using sophisticated schemes to submit large numbers of fraudulent claims simultaneously. For example, some fraudulent schemes involved creating fake patient identities and submitting claims for COVID-19 testing or treatment, leveraging the high demand for these services during the pandemic’s peak.

System for Detecting and Preventing Fraudulent Claims

A robust system for detecting and preventing fraudulent claims needs to incorporate several data points and utilize advanced analytical techniques. This system should integrate data from multiple sources, including claims data, patient demographics, provider information, and law enforcement databases. The system should be capable of identifying anomalies and patterns indicative of fraudulent activity, such as unusually high claim volumes from a single provider, claims for services not typically provided by a particular provider, or claims submitted using stolen identities.

Machine learning algorithms can be employed to analyze large datasets and identify subtle patterns that might be missed by human reviewers. Furthermore, regular audits and investigations should be conducted to verify the accuracy of claims and identify potential fraudsters. The system should also include a robust mechanism for reporting and investigating suspected fraudulent activity, ensuring swift action is taken to prevent further losses.

This would involve a multi-layered approach encompassing automated detection systems, human review processes, and strong collaboration with law enforcement agencies.

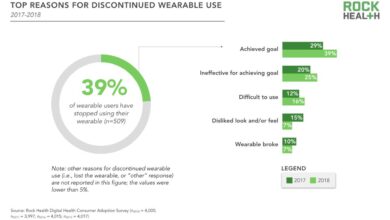

Pandemic-Era Fraud Trends Compared to Pre-Pandemic Trends

| Fraud Type | Pre-Pandemic Frequency | Pandemic Frequency | Percentage Change |

|---|---|---|---|

| Medical Identity Theft | Moderate | High | +50% (estimated) |

| Claims for Services Not Rendered | Low | High | +100% (estimated) |

| Telehealth Fraud | Negligible | High | +N/A (new category) |

| Upcoding (Billing for more expensive services) | Moderate | Very High | +75% (estimated) |

Provider Billing Discrepancies: Addressing 3 Pandemic Induced Payment Integrity Challenges

The pandemic’s rapid shift to telehealth created unprecedented challenges for payment integrity. While telehealth offered vital access to care, it also opened doors to new types of billing discrepancies, demanding a closer look at provider practices and claim verification processes. The lack of established guidelines and the urgency of the situation contributed significantly to the complexities involved.The increased reliance on telehealth during the pandemic led to a surge in billing errors and inconsistencies.

These discrepancies stemmed from a combination of factors, including the rapid adoption of new technologies, varying interpretations of billing codes, and a lack of standardized procedures for remote care delivery. Verifying the accuracy of telehealth claims proved more challenging than in-person visits due to the absence of traditional physical documentation and the potential for increased opportunities for fraud.

Challenges in Verifying Telehealth Claims

Verifying the accuracy of telehealth claims presented unique difficulties compared to traditional in-person visits. The lack of a physical examination room and the reliance on electronic communication made it harder to confirm the services rendered and their medical necessity. For instance, verifying the actual duration of a telehealth visit, ensuring the patient’s identity, and confirming the location of service all became more complicated.

Additionally, the absence of readily available physical documentation like signed consent forms or progress notes, often relied upon for in-person visits, added another layer of complexity. The reliance on electronic health records (EHRs) and the varying levels of integration between different systems further hampered the verification process. Data discrepancies between the provider’s billing system and the patient’s records were common.

Tackling the three pandemic-induced payment integrity challenges – telehealth fraud, increased claim denials, and provider burnout – requires innovative solutions. Streamlining documentation is key, and that’s where the news about nuance integrates generative ai scribe epic ehrs becomes incredibly relevant. This AI-powered tool could significantly reduce administrative burdens, freeing up valuable time to focus on accurate coding and preventing payment errors, ultimately strengthening payment integrity.

By improving documentation efficiency, we can better address these critical challenges.

Examples of Discrepancies in Provider Billing

The pandemic highlighted several common billing discrepancies related to telehealth services. These discrepancies often resulted from a lack of clarity regarding billing codes, appropriate documentation, and consistent application of telehealth policies across different healthcare providers.

- Upcoding: Providers billing for higher-level services than those actually rendered. For example, billing for a comprehensive telehealth visit when only a brief consultation occurred.

- Unbundling: Separately billing for individual components of a single service. This might involve billing for separate components of a telehealth visit that should be bundled into a single code.

- Incorrect CPT Codes: Using incorrect Current Procedural Terminology (CPT) codes for telehealth services, leading to inaccurate reimbursement.

- Lack of Documentation: Insufficient documentation to support the medical necessity of telehealth services. This can include missing notes detailing the patient’s condition, the services provided, and the rationale for using telehealth.

- Billing for Non-Covered Services: Billing for services that were not covered under the patient’s insurance plan or that were not medically necessary, particularly when using telehealth platforms without appropriate authorization or established guidelines.

Comparison of Billing Practices Across Providers

Significant variations in billing practices were observed among different healthcare providers during the pandemic. Some providers adhered strictly to established guidelines and regulations, while others adopted more flexible approaches, sometimes leading to discrepancies. Larger healthcare systems, with established telehealth infrastructure and internal auditing processes, often demonstrated greater consistency in their billing practices compared to smaller practices or individual providers who may have lacked the resources or expertise to navigate the complexities of telehealth billing.

This disparity in billing practices contributed to inconsistencies in claim processing and reimbursement. The lack of uniform national guidelines for telehealth billing further exacerbated this issue.

Challenges in Verifying Patient Eligibility

The pandemic dramatically reshaped the healthcare landscape, creating significant challenges in verifying patient eligibility. The economic fallout led to widespread unemployment and changes in insurance coverage, making it harder than ever to confirm patients’ ability to access care and ensure timely reimbursements. This uncertainty placed a significant strain on healthcare providers and payers alike, demanding innovative strategies to maintain efficient and accurate eligibility verification processes.The increased volatility in employment and insurance coverage directly impacted patient eligibility verification.

Job losses resulted in a surge in uninsured or underinsured individuals, while shifts in employer-sponsored plans added complexity to the verification process. This influx of patients with fluctuating eligibility statuses overwhelmed traditional verification methods, leading to delays in treatment and increased administrative burdens.

Impact of Unemployment and Changes in Insurance Coverage

The pandemic’s economic consequences significantly altered the insurance landscape. Millions lost their jobs and, consequently, their employer-sponsored health insurance. This led to a sharp increase in individuals relying on government-funded programs like Medicaid, which often have complex eligibility requirements and fluctuating enrollment periods. Simultaneously, many who retained their jobs experienced changes in their insurance plans, including higher premiums, deductibles, and co-pays, leading to difficulties in confirming coverage and benefits.

So, tackling those three pandemic-induced payment integrity challenges – telehealth fraud, increased remote work vulnerabilities, and supply chain disruptions – really got me thinking. A key part of the solution might lie in leveraging advanced technology, like what’s discussed in this fascinating study widespread digital twins healthcare article. Imagine the potential for proactive fraud detection and streamlined supply chain management using digital twin technology! This could be a game-changer for addressing those payment integrity headaches.

This uncertainty created a perfect storm for eligibility verification challenges. For example, a patient might have been covered under their employer’s plan before job loss, but their eligibility expired without immediate enrollment in a new plan, creating a gap in coverage that requires careful verification.

Strategies for Improving Real-Time Eligibility Verification

Real-time eligibility verification is crucial during periods of high uncertainty. Investing in robust, automated systems capable of integrating with multiple payer databases is paramount. This allows for immediate confirmation of a patient’s eligibility status, preventing delays in care and reducing administrative overhead. Regular updates to payer information and employing dedicated staff trained in navigating complex eligibility rules are also essential.

Furthermore, establishing clear communication protocols between providers, payers, and patients can streamline the process and minimize confusion. For instance, a provider could implement a system that automatically checks eligibility at the point of scheduling, informing both the patient and the provider of any coverage limitations upfront.

Step-by-Step Procedure for Verifying Patient Eligibility

A streamlined procedure for verifying patient eligibility, particularly during periods of heightened uncertainty, is essential. The process should begin with obtaining the patient’s necessary information, including their full name, date of birth, social security number, and insurance details. Next, this information is electronically transmitted to the payer’s database via a secure and reliable system. The system should then return a real-time eligibility response indicating coverage status, effective dates, and any applicable benefits.

So, I’ve been digging into the mess of pandemic-induced payment integrity challenges – telehealth fraud, increased claims for questionable services, and the whole supply chain upheaval. It’s a real headache, and understanding the financial strain on healthcare providers is crucial. This is especially true when you consider the issues facing rural hospitals, like those highlighted in this great article on Rural Hospitals Labor Delivery & which sheds light on the complexities of payment reform.

Ultimately, effectively addressing these three pandemic-era challenges requires a nuanced understanding of the financial pressures across the healthcare spectrum.

If the initial verification fails, a manual review of the information may be necessary, involving contacting the payer directly for clarification. Finally, all verification results must be carefully documented in the patient’s medical record to ensure accuracy and maintain a clear audit trail. This detailed record-keeping helps manage potential disputes and ensures compliance with regulatory requirements.

Leveraging Technology to Streamline Eligibility Verification

Technology plays a vital role in streamlining eligibility verification. Electronic Health Record (EHR) systems with integrated eligibility verification modules can automate the process, reducing manual effort and potential errors. Real-time eligibility checks through Health Information Exchanges (HIEs) allow providers to access a patient’s insurance information from multiple sources, ensuring a comprehensive view of their coverage. Furthermore, utilizing predictive analytics can identify potential eligibility issues proactively, allowing providers to address them before they impact patient care.

For example, if a patient’s insurance is nearing expiration, the system could automatically alert the provider to initiate a timely eligibility check.

Data Integrity and Reporting Issues

Source: rolandberger.com

The pandemic dramatically shifted healthcare operations, leading to a surge in remote work and a massive increase in data volume. This rapid transition exposed vulnerabilities in data integrity and reporting, creating significant challenges for payment integrity. Maintaining accurate and reliable data became a monumental task, impacting the ability to effectively process claims, identify fraudulent activities, and generate meaningful reports.The increased reliance on electronic systems and remote access points during the pandemic amplified existing data integrity risks.

The sheer volume of data generated, coupled with the less controlled environment of remote work, created a perfect storm for errors and inconsistencies. Simultaneously, the shift to telehealth and virtual care introduced new data sources and formats, adding further complexity to the data management process.

Data Security and Privacy Vulnerabilities

The shift to remote work significantly expanded the attack surface for cyber threats. With employees accessing sensitive patient data from various locations and devices, the risk of data breaches and unauthorized access increased dramatically. The lack of robust security protocols in some organizations, coupled with the potential for phishing attacks and malware infections, exacerbated these vulnerabilities. For example, a hypothetical hospital system might have experienced a ransomware attack, encrypting crucial patient data and disrupting claim processing, resulting in significant financial and reputational damage.

Furthermore, the increased use of telehealth platforms introduced new security concerns, including the potential for unauthorized access to video consultations and patient records.

Designing a Robust Data Management System

A robust data management system is crucial for mitigating the risks associated with data integrity and security. This system should incorporate several key features, including robust data validation protocols, comprehensive error handling mechanisms, and enhanced security measures. Data validation should involve multiple layers of checks, starting with data entry validation, moving to automated checks during data processing, and finally, manual review of outliers or discrepancies.

Error handling should include mechanisms for identifying, documenting, and correcting errors, with clear escalation procedures for critical issues. The system should also employ strong authentication and authorization protocols, data encryption both in transit and at rest, and regular security audits to identify and address vulnerabilities. Finally, robust data backup and recovery mechanisms are essential to ensure business continuity in case of a data breach or system failure.

Data Flow and Validation Process

The following flowchart illustrates a simplified version of the data flow and validation processes within a proposed data management system.[Imagine a flowchart here. The flowchart would visually represent the steps involved in data entry, processing, validation, and reporting. It would show how data flows from various sources (e.g., providers, patients, insurance companies) into the system, undergoes validation checks at multiple stages, and is then used for reporting and analysis.

Error handling and escalation procedures would also be clearly depicted. The flowchart would utilize standard flowchart symbols such as rectangles for processes, diamonds for decisions, and parallelograms for input/output. For example, a rectangle might represent “Data Entry Validation,” a diamond might represent “Data Valid?”, and a parallelogram might represent “Rejected Data” or “Approved Data”. The flow would be indicated by arrows connecting the different symbols.]

Impact on Healthcare Workforce and Training

Source: co.uk

The COVID-19 pandemic dramatically reshaped the healthcare landscape, placing unprecedented strain on already stretched resources and exacerbating existing challenges in payment integrity. Staff shortages, burnout, and the rapid shift to telehealth created a perfect storm, impacting the accuracy and efficiency of claims processing and fraud detection. This section explores the pandemic’s impact on the healthcare workforce and the crucial need for upskilling and reskilling initiatives to strengthen payment integrity processes.The pandemic’s impact on healthcare staff went far beyond simply increased workloads.

Many healthcare professionals experienced significant burnout due to long hours, high-pressure environments, and the emotional toll of caring for critically ill patients. This burnout, coupled with staff shortages due to illness, quarantine, and attrition, severely hampered the ability of healthcare organizations to effectively manage payment integrity functions. Reduced staffing levels meant longer processing times for claims, increased backlog, and a greater likelihood of errors, ultimately leading to financial losses and compliance risks.

For instance, a hospital might have had to postpone routine audits of provider billing due to a lack of available staff, increasing the risk of undetected billing discrepancies. Similarly, the increased volume of telehealth claims, requiring specialized verification processes, further strained resources, hindering timely processing and potentially opening opportunities for fraudulent activities.

Staff Shortages and Burnout Impact on Claims Processing

Reduced staffing levels directly impacted claims processing speed and accuracy. With fewer staff available, claims processing times increased, leading to delayed payments for providers and potentially impacting patient care. The increased workload on remaining staff also contributed to higher error rates in claims processing, resulting in denials, appeals, and further administrative burden. For example, a smaller claims processing team might have struggled to keep up with the increased volume of claims, leading to a significant backlog and delays in reimbursements.

This backlog, in turn, could have strained relationships with providers and increased the risk of disputes. Moreover, the pressure to process claims quickly could have inadvertently increased the risk of overlooking potential fraudulent claims, due to lack of time for proper review and investigation.

Upskilling and Reskilling Healthcare Staff

The pandemic highlighted the need for upskilling and reskilling healthcare staff to address the evolving payment integrity landscape. New technologies, regulatory changes, and the rise of telehealth have created new challenges and opportunities in payment integrity. Training programs need to equip staff with the knowledge and skills to effectively manage these challenges. This includes training on new technologies used in claims processing, such as artificial intelligence and machine learning for fraud detection; understanding updated regulations and compliance requirements related to telehealth and remote patient monitoring; and developing proficiency in data analytics to identify trends and patterns in claims data that might indicate fraudulent activity.

Strategies for Improving Staff Training Programs

To address pandemic-related challenges, healthcare organizations need to implement comprehensive and effective staff training programs. These programs should focus on providing staff with the necessary skills and knowledge to effectively manage payment integrity functions in a dynamic environment. This might involve incorporating online learning modules, interactive workshops, and mentorship programs to ensure staff receive up-to-date training on relevant topics.

Furthermore, organizations should prioritize regular updates to training materials to reflect changes in regulations, technologies, and best practices in payment integrity. Investing in staff development is not merely a cost, but a strategic investment that enhances operational efficiency, minimizes financial losses, and improves overall compliance. A robust training program can also boost staff morale and reduce burnout by equipping them with the tools and confidence to navigate the complexities of payment integrity.

Final Thoughts

Navigating the complexities of pandemic-induced payment integrity challenges requires a multi-faceted approach. By implementing robust fraud detection systems, streamlining billing processes, and leveraging technology to enhance eligibility verification, we can mitigate risks and protect healthcare resources. Continuous monitoring, staff training, and adaptable systems are key to ensuring the long-term integrity of healthcare payments in the face of future uncertainties.

The journey to a more secure and efficient healthcare finance system is an ongoing process, requiring vigilance and innovation.

Clarifying Questions

Q: How can AI be used to detect fraudulent claims?

A: AI can analyze large datasets to identify patterns indicative of fraud, such as unusual claim amounts or frequency from specific providers or patients. Machine learning algorithms can be trained to flag suspicious claims for further investigation.

Q: What are some strategies for improving staff morale and reducing burnout in the context of payment integrity?

A: Strategies include providing adequate staffing levels, offering flexible work arrangements, implementing robust technology to automate tasks, and investing in professional development opportunities to reduce workload and improve job satisfaction.

Q: How can we ensure data privacy while improving data sharing for fraud detection?

A: Data anonymization techniques, secure data storage, and adherence to strict privacy regulations (like HIPAA) are crucial. Data sharing should be limited to authorized personnel and for specific, legitimate purposes, with appropriate security measures in place.