Surprise Billing Law In-Network Claims & Fair Health

Surprise billing law in network claims fair health – it sounds complicated, right? But it’s actually a huge deal for anyone with health insurance. We’ve all heard horror stories about unexpected medical bills, even when we think we’re covered. This post dives into the No Surprises Act, exploring how it aims to protect patients from these unexpected costs, even when seeing in-network providers.

We’ll examine Fair Health’s role in setting fair prices and look at real-life examples of how this law impacts both patients and healthcare providers. Get ready to understand your rights and how to navigate this tricky system!

The No Surprises Act was designed to protect patients from unexpected medical bills, but the reality is more nuanced. While it aims to prevent surprise billing from out-of-network providers, it also tackles situations where in-network providers might still try to charge more than agreed upon. We’ll explore how Fair Health’s data plays a critical role in determining what constitutes a “fair” price, the challenges in using this data, and what you can do if you still end up with a surprise bill despite having in-network coverage.

It’s a complex issue, but understanding the key players and processes is crucial for protecting your financial well-being.

The Surprise Billing Law

The No Surprises Act, enacted in 2020, aims to protect patients from unexpected medical bills. While primarily focused on out-of-network charges, it also significantly impacts in-network claims by establishing clearer expectations and dispute resolution processes. This law aims to make healthcare costs more predictable and transparent, especially for those with employer-sponsored insurance plans.

Key Provisions of the No Surprises Act Regarding In-Network Claims

The No Surprises Act’s impact on in-network claims is less direct than its impact on out-of-network charges. However, it still plays a crucial role in preventing unexpected bills by establishing clear guidelines for provider payments and dispute resolution. The Act doesn’t directly regulate what in-network providers can charge, but it sets a framework to ensure that patients are not held responsible for charges outside their expected cost-sharing based on their insurance plan.

This involves defining a process for resolving disputes when the provider’s billed amount exceeds the allowed amount under the patient’s insurance plan. The law also provides avenues for patients to appeal unexpected charges.

Circumstances Where Surprise Billing Can Still Occur Despite In-Network Coverage

Even with in-network coverage, surprise billing can still occur in certain limited circumstances. One common scenario involves balance billing by an in-network provider when the provider’s charges exceed the allowed amount under the patient’s insurance plan. This can happen if the provider hasn’t properly negotiated rates with the insurance company or if there’s a discrepancy in coding or billing practices.

Another situation might arise when a patient receives services from an out-of-network provider within an in-network facility (e.g., anesthesiologist at an in-network hospital). While the hospital itself might be in-network, the individual provider may not be, leading to a potential surprise bill. Finally, errors in pre-authorization or claims processing can also result in unexpected charges, despite the patient having in-network coverage.

Impact of the No Surprises Act on Various Healthcare Settings

The No Surprises Act affects various healthcare settings differently. Hospitals, as larger entities, generally have more robust contracts with insurance companies, minimizing the potential for surprise billing. However, they still need to ensure that all providers within their network adhere to the Act’s guidelines. Physician offices, particularly those with smaller practices, might face greater challenges in navigating the complexities of the Act’s regulations, especially regarding provider payment and dispute resolution.

Ambulatory surgical centers and other specialized facilities also fall under the Act’s purview, requiring them to comply with the regulations regarding patient cost-sharing and dispute resolution.

Comparison of Pre- and Post-No Surprises Act Scenarios for In-Network Patient Cost Responsibility

The following table compares patient cost responsibility before and after the implementation of the No Surprises Act for in-network claims. Note that this is a simplified representation, and actual costs can vary based on individual insurance plans and specific provider agreements.

| Scenario | Patient Cost (Pre-Act) | Patient Cost (Post-Act) | Provider Payment (Pre-Act) | Provider Payment (Post-Act) | Dispute Resolution Process (Pre-Act) | Dispute Resolution Process (Post-Act) |

|---|---|---|---|---|---|---|

| In-Network Service, Provider Bills Above Allowed Amount | Potentially significant balance billing | Limited to negotiated in-network rate; balance billing prohibited | Negotiated rate, potentially less than billed amount | Negotiated rate, potentially less than billed amount, but patient protected from balance billing | Limited or inconsistent processes; patient often bears the burden | Independent Dispute Resolution (IDR) process established; patient can appeal |

| In-Network Service, No Billing Discrepancies | Copay/coinsurance as per plan | Copay/coinsurance as per plan | Negotiated rate | Negotiated rate | Generally straightforward | Generally straightforward |

Fair Health’s Role in Addressing Surprise Billing

Source: ytimg.com

Fair Health plays a crucial role in mitigating surprise medical bills by providing a massive database of healthcare claims data used to determine appropriate in-network rates. This data is instrumental in the implementation of surprise billing laws, helping to establish a fair and transparent system for resolving payment disputes between insurers and out-of-network providers. Its influence extends to both patients and providers, impacting how much patients ultimately pay out-of-pocket and how providers are reimbursed for their services.

The surprise billing law and in-network claims are a huge deal for Fair Health, and honestly, it’s all making me a little anxious. The whole system needs a serious overhaul, and that’s why news like Robert F. Kennedy Jr. clearing a key hurdle on his path to becoming HHS Secretary, as reported in this article , is so significant.

His stance on healthcare access could drastically impact how effective the surprise billing law becomes, ultimately influencing the future of Fair Health’s data and advocacy efforts.

Fair Health’s Database and In-Network Rate Determination

Fair Health’s database comprises millions of privately insured claims, offering a comprehensive picture of healthcare costs across the United States. This data is anonymized and aggregated to protect patient privacy while maintaining the statistical power necessary for accurate analysis. The database includes information on various procedures, services, and geographic locations, allowing for a granular understanding of market-based pricing.

Using this data, Fair Health calculates median in-network rates for specific services in specific geographic areas, providing a benchmark for negotiations and dispute resolution in surprise billing cases. These median rates are intended to reflect the typical payment made by insurers to in-network providers for similar services, offering a fairer alternative to the often-inflated charges of out-of-network providers.

Fair Health’s Methodology for Calculating Median In-Network Charges

Fair Health’s methodology focuses on identifying the median in-network charge for a given procedure or service within a specific geographic area. This means they identify the middle value in a dataset of in-network payments after excluding outliers to reduce the impact of unusually high or low payments. This median is calculated using a sophisticated algorithm that accounts for various factors, including the specific procedure code, the location of the service, and the payer involved.

The algorithm filters the data to include only in-network claims, ensuring that the calculated median accurately reflects the typical in-network reimbursement rate. The use of the median, rather than the average (mean), is crucial because it’s less susceptible to distortion by extreme values. For instance, if a few insurers paid significantly higher than the norm, the average would be skewed upwards, while the median would remain a more stable and representative figure.

Limitations and Potential Biases in Fair Health’s Data

While Fair Health’s database is extensive, it’s essential to acknowledge its limitations. The data primarily reflects privately insured claims, potentially underrepresenting the experiences of patients with Medicare, Medicaid, or other government-sponsored insurance. Furthermore, the data may not fully capture the complexities of certain medical procedures or the nuances of specific geographic markets. For example, a high concentration of specialists in a particular area might skew the median rate higher than in a less specialized region.

Another potential bias stems from the fact that the data represents past payments; it might not always perfectly predict future rates or reflect the dynamic nature of healthcare costs. Finally, the selection criteria used for outlier removal could influence the calculated median, and the specific algorithm used is proprietary, limiting full transparency.

Comparison with Other Methods for Determining In-Network Rates

Several alternative methods exist for determining in-network rates. Some insurers use their own internal data, which might reflect their specific contracting practices and may not be representative of the broader market. Other methods involve negotiations between insurers and provider networks, potentially leading to inconsistent pricing across different regions or payers. Fair Health’s methodology aims to provide a more objective and standardized approach, leveraging a large, independent dataset to establish a market-based benchmark.

However, the reliance on historical data and potential biases inherent in any large dataset necessitates ongoing refinement and transparency in the methodology. Comparing Fair Health’s data to other methods reveals both its strengths – namely its scale and independence – and its weaknesses, which include the potential for biases and limitations in data representation.

Patient Experiences with In-Network Surprise Billing

In-network surprise billing is a frustrating and often financially devastating experience for patients who believe they’ve protected themselves by choosing in-network providers. Despite the best intentions and careful planning, unexpected bills can still appear, leaving individuals struggling to understand why and how to address the issue. This section will explore real-world examples of in-network surprise billing, common causes, and the significant financial burden it places on patients.

Examples of In-Network Surprise Billing

Patients frequently encounter surprise bills even when seeing in-network doctors. One common scenario involves out-of-network anesthesiologists or radiologists working within an in-network hospital. The patient, believing their care is fully covered, receives a bill from a provider outside their insurance network for services rendered during their procedure. Another example is when a specialist, who is technically in-network, performs a procedure not covered under the patient’s specific plan or uses a non-covered facility.

Even seemingly simple procedures can lead to surprise bills if the provider is out-of-network or uses an out-of-network facility for testing or diagnostics.

Reasons for In-Network Surprise Billing

Several factors contribute to in-network surprise billing. One key reason is the complex web of healthcare providers and facilities. A patient might see an in-network physician but that physician might use an out-of-network lab or imaging center, resulting in a surprise bill from the ancillary provider. Another factor is the lack of transparency in provider networks. Insurance plans don’t always clearly define which specific doctors, specialists, and facilities within a hospital are truly “in-network” for all services.

This ambiguity leaves patients vulnerable to unexpected charges. Finally, some providers might bill out-of-network intentionally, attempting to maximize their revenue, regardless of the patient’s insurance coverage.

Case Studies: The Financial Impact of Surprise Billing

Consider the case of Sarah, who underwent a routine knee surgery at an in-network hospital with an in-network surgeon. However, she received a $5,000 bill from an out-of-network anesthesiologist. This unexpected expense, despite having insurance, caused significant financial hardship, forcing her to delay other necessary medical treatments. Another example is John, who received a surprise bill of $2,000 for a diagnostic test performed at an out-of-network facility, even though his physician was in-network.

These cases highlight the substantial financial burden that in-network surprise billing can impose on patients, often resulting in medical debt and compromised financial stability.

Steps to Take When Encountering a Surprise Bill

The following flowchart illustrates the steps a patient should take upon receiving a surprise bill despite having in-network coverage:

Step 1: Review the bill carefully to identify the provider and service.Step 2: Contact your insurance company to verify the provider’s in-network status and the coverage for the service.Step 3: If the bill is deemed incorrect, dispute the charges with your insurance company and the provider.Step 4: Gather documentation, such as your Explanation of Benefits (EOB) and the bill itself.Step 5: If the issue remains unresolved, consider seeking assistance from a patient advocate or consumer protection agency.Step 6: Explore options for payment plans or financial assistance programs.

The Role of Insurance Providers in Preventing Surprise Billing

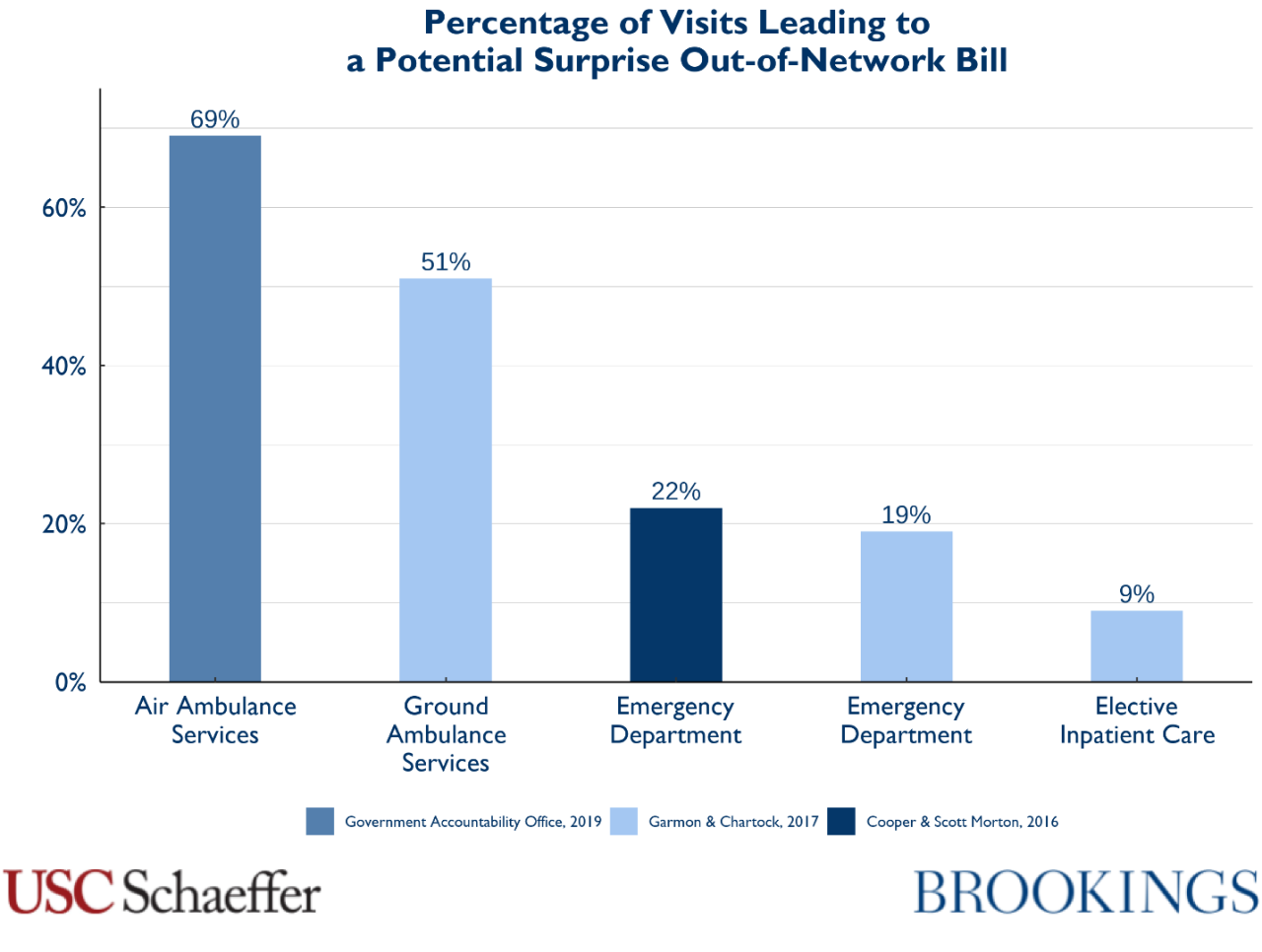

Source: brookings.edu

Insurance providers play a crucial role in preventing surprise medical bills, particularly those arising within the in-network context. Their responsibilities extend beyond simply processing claims; they involve proactive measures to ensure transparency and fair pricing for their members. Failure to effectively manage these responsibilities can lead to significant financial burdens for patients and erode trust in the healthcare system.The prevention of in-network surprise billing relies heavily on the insurance provider’s ability to effectively negotiate rates with healthcare providers.

This negotiation process, often complex and involving extensive data analysis, aims to establish predetermined prices for various medical services. The resulting negotiated rates form the foundation of the provider’s participation in the insurance network. Stronger negotiation power, often wielded by larger insurance companies, can result in lower costs for patients, while weaker negotiation positions may leave patients more vulnerable to higher costs even within the in-network setting.

Negotiation of Rates with Healthcare Providers

Insurance providers employ various strategies to negotiate rates with healthcare providers. These strategies often involve analyzing historical claims data, benchmarking against similar providers in the area, and leveraging their market power to secure favorable pricing. The negotiation process can be protracted, involving multiple rounds of discussions and often requiring sophisticated actuarial modeling to project costs and utilization. Successful negotiations lead to contracts that define the reimbursement rates for specific procedures and services.

These contracts are crucial in preventing surprise bills because they establish a pre-agreed-upon price that the patient’s insurance will cover. Failure to negotiate effective rates can lead to higher costs passed on to the patient, even if the provider is in-network. For example, a poorly negotiated contract might result in a higher rate for a common procedure, such as a routine blood test, leading to increased out-of-pocket costs for the patient.

Influence of Provider Networks on Patient Access and Cost Transparency, Surprise billing law in network claims fair health

The network of healthcare providers contracted by an insurance company significantly impacts patient access to care and cost transparency. A broad network offers patients greater choice in selecting their healthcare providers, but it might also result in higher premiums due to the increased costs associated with contracting with a wider range of providers. Conversely, a narrower network might lead to lower premiums but limit the patient’s choice of doctors and hospitals.

Navigating healthcare costs can be a real headache, especially with surprise billing. The new laws around in-network claims and Fair Health are a step in the right direction, but unexpected illnesses still hit hard. Reading about Monali Thakur’s hospitalization after struggling to breathe, as detailed in this article monali thakur hospitalised after struggling to breathe how to prevent respiratory diseases , really highlights the importance of preventative care and understanding your insurance coverage.

Ultimately, clear billing practices and affordable healthcare remain crucial goals, even with these new protections in place.

Cost transparency is also influenced by the network; insurers with comprehensive online tools and clear explanations of in-network costs empower patients to make informed decisions about their care. Conversely, a lack of transparency can leave patients vulnerable to unexpected costs, even when choosing an in-network provider. For example, a patient might unknowingly select a provider within the network but be surprised by additional charges not clearly Artikeld in the provider’s contract with the insurer.

Best Practices for Insurance Providers to Minimize In-Network Surprise Billing

Effective strategies for minimizing in-network surprise billing require a multifaceted approach. Below are some best practices:

- Proactive Network Management: Regularly review and update provider contracts to ensure accuracy and alignment with current market rates.

- Enhanced Transparency: Provide clear and easily accessible information to patients regarding in-network provider costs and coverage details.

- Strengthened Negotiation Strategies: Invest in data analytics and negotiation expertise to secure favorable rates with healthcare providers.

- Robust Claims Auditing: Implement rigorous processes to detect and address potential billing discrepancies before they reach the patient.

- Patient Education Initiatives: Educate members about their rights and responsibilities regarding in-network billing and how to identify potential issues.

The Impact of the Surprise Billing Law on Healthcare Providers: Surprise Billing Law In Network Claims Fair Health

The No Surprises Act, while designed to protect patients from unexpected medical bills, has had a complex and multifaceted impact on healthcare providers. The law’s effects on provider finances, reimbursement practices, and network participation are still unfolding, revealing both challenges and potential benefits depending on the specific provider type and their business model. Understanding these impacts is crucial for navigating the evolving landscape of healthcare billing and payment.The No Surprises Act significantly altered the financial landscape for many healthcare providers, particularly those who frequently treat out-of-network patients or rely heavily on balance billing.

Navigating surprise billing and in-network claims under the new Fair Health regulations can be tricky, especially when you’re already juggling a million things. Maintaining good health is key, and that includes proper nutrition. I was reading this fascinating article on are women and men receptive of different types of food and game changing superfoods for women , which made me realize how important fueling your body correctly is for managing stress – something crucial when dealing with unexpected medical bills.

Understanding your healthcare costs and eating well go hand-in-hand for overall well-being.

The law’s arbitration process, designed to determine a fair price when an out-of-network provider delivers care to an in-network patient, has resulted in payments that are often lower than what providers would have traditionally billed. This has led to concerns about reduced revenue and potential financial instability for some practices, especially smaller independent physician groups. Larger hospital systems, with greater financial resources and negotiating power, may have experienced a less dramatic impact.

Provider Reimbursement Practices Under the No Surprises Act

The No Surprises Act’s influence on provider reimbursement is substantial. The independent dispute resolution (IDR) process, while intended to be fair, has introduced an element of uncertainty into the billing process. Providers must now factor in the potential for their claims to be reduced through arbitration, impacting their revenue projections and potentially leading to adjustments in billing strategies.

Some providers have reported negotiating higher in-network rates to compensate for potential losses from out-of-network cases resolved through arbitration. This shift toward a greater emphasis on in-network participation is a significant change in reimbursement practices.

Comparative Impact on Different Provider Types

The impact of the No Surprises Act varies significantly across different types of healthcare providers. Large hospital systems, with their established billing departments and robust negotiating power, have generally been better positioned to navigate the complexities of the law and its arbitration process. In contrast, smaller physician practices and independent anesthesiologists, for example, may find it more challenging to absorb revenue reductions resulting from the arbitration process.

This disparity in impact highlights the law’s potential to exacerbate existing inequalities within the healthcare system. For example, a large hospital system might have the resources to hire specialized personnel to manage the complexities of the IDR process, while a small practice may struggle to dedicate the necessary time and resources.

Provider Participation in Insurance Networks

The No Surprises Act has influenced provider participation in insurance networks in several ways. Some providers have chosen to increase their in-network participation to avoid the complexities and potential revenue losses associated with the arbitration process for out-of-network claims. This is especially true for providers who see a significant number of patients with in-network coverage. Others, particularly those with specialized services or high demand, may maintain out-of-network status, accepting the risk of lower reimbursement through arbitration in exchange for potentially higher fees from patients.

The law’s impact on network participation is an ongoing dynamic, influenced by factors such as provider specialty, practice size, and the local market dynamics of insurance coverage. The long-term consequences of these shifts in network participation are yet to be fully understood.

Conclusive Thoughts

Navigating the world of surprise medical billing can feel like a minefield, but understanding the No Surprises Act and Fair Health’s role is the first step towards protecting yourself. Remember, even with in-network coverage, unexpected bills can still pop up. By being informed about your rights and the processes involved in resolving billing disputes, you can take control of your healthcare costs and avoid financial hardship.

Keep an eye on your Explanation of Benefits (EOB) statements, ask questions if something seems off, and don’t hesitate to advocate for yourself. Your financial health is worth it!

Questions and Answers

What if my in-network provider still bills me more than expected?

Contact your insurance provider immediately. They should be able to help resolve the discrepancy and potentially negotiate a lower payment. You can also file an appeal if necessary.

How does Fair Health’s data influence my out-of-pocket costs?

Fair Health’s database of in-network rates helps determine a median price for services. This median is often used as a benchmark in arbitration to settle disputes between patients, providers, and insurers when surprise billing occurs.

Can I be billed for services outside my insurance network even if I’m seeing an in-network doctor?

Yes, this can happen if your in-network doctor uses out-of-network anesthesiologists, radiologists, or other specialists without proper notification. The No Surprises Act aims to prevent this, but it’s still possible. Always clarify beforehand.

What’s the difference between “in-network” and “out-of-network” providers?

In-network providers have negotiated rates with your insurance company, meaning your out-of-pocket costs will be lower. Out-of-network providers haven’t, leading to potentially higher costs.