How to Differentiate Sores on Roof of Mouth

How to differentiate sores on roof of mouth – How to differentiate sores on the roof of your mouth? It’s a question many of us have faced, staring at that unwelcome blemish and wondering, “What is this thing?” Mouth sores are common, but figuring out if it’s a simple canker sore, a pesky cold sore, or something else entirely can be tricky. This post dives into the world of mouth sores, helping you identify the culprit and find the right path to relief.

We’ll explore different types of sores, their causes, symptoms, and when you should seek professional help. Get ready to become a mouth-sore detective!

We’ll cover everything from the visual differences between canker sores and cold sores to the less common causes like infections and allergies. We’ll also look at how symptoms can vary depending on the type of sore and what home remedies might help ease the discomfort. Remember, while this information is helpful, it’s not a substitute for professional medical advice.

If you’re concerned about a mouth sore, always consult a doctor or dentist.

Types of Mouth Sores

Source: pinimg.com

Mouth sores are a common ailment, but identifying the specific type is crucial for effective treatment. Different sores have distinct appearances, locations, and underlying causes, ranging from minor irritations to viral infections. Understanding these differences can help you seek appropriate care and alleviate discomfort.

Canker Sores

Canker sores, also known as aphthous ulcers, are small, shallow lesions that typically appear on the soft tissues of the mouth, including the inside of the cheeks, lips, and, importantly for this discussion, the roof of the mouth (palate). They are usually round or oval, with a yellowish-white center and a reddish border. Their size varies; some are tiny, while others can reach up to a centimeter in diameter.

Canker sores are usually quite painful and can last for a week or two. Their location on the palate can make eating and drinking uncomfortable.

Cold Sores (Fever Blisters)

Unlike canker sores, cold sores are caused by the herpes simplex virus (HSV) and are characterized by small, fluid-filled blisters that typically appear on the outer edges of the lips, but can sometimes occur on the border of the mouth or even rarely, on the palate. These blisters initially appear as small red bumps, which then develop into fluid-filled vesicles.

These vesicles eventually break, forming painful, crusting sores. Cold sores usually progress through several stages before healing, and they are highly contagious. Their location and contagious nature distinguish them from canker sores.

Mouth Sores Caused by Trauma

Trauma to the mouth, such as biting your cheek or palate accidentally, can result in sores. These sores typically present as a single lesion, located precisely at the site of injury. Their appearance depends on the severity of the trauma; they might be superficial abrasions, slightly raised and red, or deeper, more painful lesions. Unlike canker sores or cold sores, they are usually not accompanied by systemic symptoms and heal quickly with basic care, avoiding further irritation.

Infection can complicate trauma-induced sores, leading to a more severe presentation.

Mouth Sores Caused by Infection

Infections, such as those caused by bacteria or fungi, can also cause mouth sores. These sores can vary significantly in appearance, depending on the type of infection. They might be red, swollen, and painful, and could be accompanied by other symptoms such as fever or swollen lymph nodes. The location can also vary depending on the infection. For example, a fungal infection like oral thrush often presents as white patches on the tongue and inner cheeks, but it can also affect the palate.

These infections often require specific antifungal or antibacterial treatments.

Comparison of Common Mouth Sore Types

| Cause | Appearance | Symptoms | Treatment |

|---|---|---|---|

| Unknown (likely immune system related) | Small, round or oval, yellowish-white center, red border | Pain, burning sensation | Over-the-counter pain relievers, mouthwashes |

| Herpes simplex virus (HSV) | Fluid-filled blisters that crust over | Pain, tingling, burning sensation, fever | Antiviral medications, pain relievers |

| Trauma (e.g., biting) | Abrasion or lesion at the site of injury | Pain, bleeding (initially) | Gentle cleaning, avoiding irritation |

| Bacterial or fungal infection | Variable; red, swollen, painful; may have white patches | Pain, swelling, fever, possibly other systemic symptoms | Antibiotics or antifungals, depending on the infection |

Causes of Mouth Sores on the Roof of the Mouth

Developing a sore on the roof of your mouth can be uncomfortable and inconvenient. Understanding the underlying causes is crucial for effective treatment and prevention. Several factors, ranging from infections to nutritional deficiencies and environmental irritants, can contribute to these painful lesions.

Viral, Bacterial, and Fungal Infections

Viral, bacterial, and fungal infections are common culprits behind mouth sores. Herpes simplex virus (HSV), for instance, is responsible for cold sores, which can sometimes appear on the palate. These sores typically present as small, fluid-filled blisters that eventually crust over. Bacterial infections, often stemming from poor oral hygiene, can lead to more generalized inflammation and ulceration. Finally, fungal infections, such as oral thrush (candidiasis), caused byCandida albicans*, frequently manifest as creamy white patches or sores, particularly in individuals with weakened immune systems or those taking antibiotics.

These infections can spread easily and cause significant discomfort.

Nutritional Deficiencies

Certain nutritional deficiencies can significantly increase your susceptibility to mouth sores. A deficiency in vitamin B12, crucial for red blood cell production and nerve function, is often associated with glossitis (inflammation of the tongue) but can also manifest as sores on the palate. Similarly, iron deficiency anemia, characterized by low levels of iron in the blood, can weaken the body’s ability to repair tissues, leading to increased vulnerability to mouth sores and slower healing times.

Maintaining a balanced diet rich in these essential nutrients is vital for oral health.

Allergens and Irritants

Exposure to certain allergens and irritants can trigger an inflammatory response in the mouth, resulting in the formation of sores. Common food allergens, such as nuts, dairy, or certain fruits, can cause localized reactions on the palate. Similarly, irritants like acidic foods (citrus fruits, tomatoes), spicy foods, or even poorly fitting dentures can cause mechanical trauma and inflammation, leading to sore development.

Identifying and avoiding these triggers is crucial for preventing recurring sores.

Stress and Weakened Immune System

Stress and a weakened immune system are often overlooked factors contributing to mouth sores. Chronic stress can suppress the immune system, making the body more vulnerable to infections and slowing down the healing process. A compromised immune system, whether due to illness, medication, or other factors, leaves individuals more susceptible to various infections, including those that cause mouth sores.

Managing stress levels through techniques like exercise, meditation, or sufficient sleep, and maintaining a healthy immune system through proper nutrition and rest, are vital for preventing mouth sores.

Symptoms Associated with Different Mouth Sores: How To Differentiate Sores On Roof Of Mouth

Understanding the symptoms of different mouth sores is crucial for proper diagnosis and treatment. The pain level, accompanying symptoms, and duration can vary significantly depending on the type of sore. This information can help you determine whether a visit to the doctor is necessary.

Canker Sore Symptoms

Canker sores, also known as aphthous ulcers, are small, shallow ulcers that typically appear inside the mouth. They are usually quite painful, especially when eating or drinking acidic or spicy foods. The pain level can vary from mild discomfort to significant pain depending on the size and location of the sore.

- Pain: Ranges from mild to severe, often exacerbated by acidic or spicy foods.

- Appearance: Small, round or oval, shallow ulcers with a yellowish-white center and a red border.

- Other Symptoms: Usually no other symptoms, though some individuals might experience mild swelling in the surrounding area.

- Duration: Typically heal within 1-3 weeks, although larger sores may take longer.

Cold Sore Symptoms

Cold sores, or fever blisters, are caused by the herpes simplex virus (HSV) and usually appear on the lips or around the mouth, but can sometimes occur on the roof of the mouth. These sores are often preceded by tingling or burning sensations.

- Pain: Can range from mild to moderate discomfort.

- Appearance: Small, fluid-filled blisters that eventually crust over.

- Other Symptoms: May be accompanied by fever, swollen lymph nodes (glands), headache, and general malaise (a feeling of discomfort, illness, or unease).

- Duration: Typically last 7-10 days, though the healing process can be longer.

Mouth Ulcers (Other Types) Symptoms

There are various other types of mouth ulcers, each with its own characteristics. For example, traumatic ulcers result from injury, and their symptoms are directly related to the injury itself. These ulcers may be painful depending on the severity of the trauma. Some fungal infections can also cause mouth sores, and these often present with a white or yellowish coating.

- Pain: Varies depending on the underlying cause, ranging from mild to severe.

- Appearance: Highly variable depending on the cause; may be red, white, yellow, or a combination.

- Other Symptoms: Can include fever, difficulty swallowing, or other symptoms related to the underlying cause (e.g., thrush may present with a white coating on the tongue and mouth).

- Duration: Varies greatly depending on the cause and treatment. Some heal quickly, while others may persist for weeks or months.

Home Remedies and Treatment Options

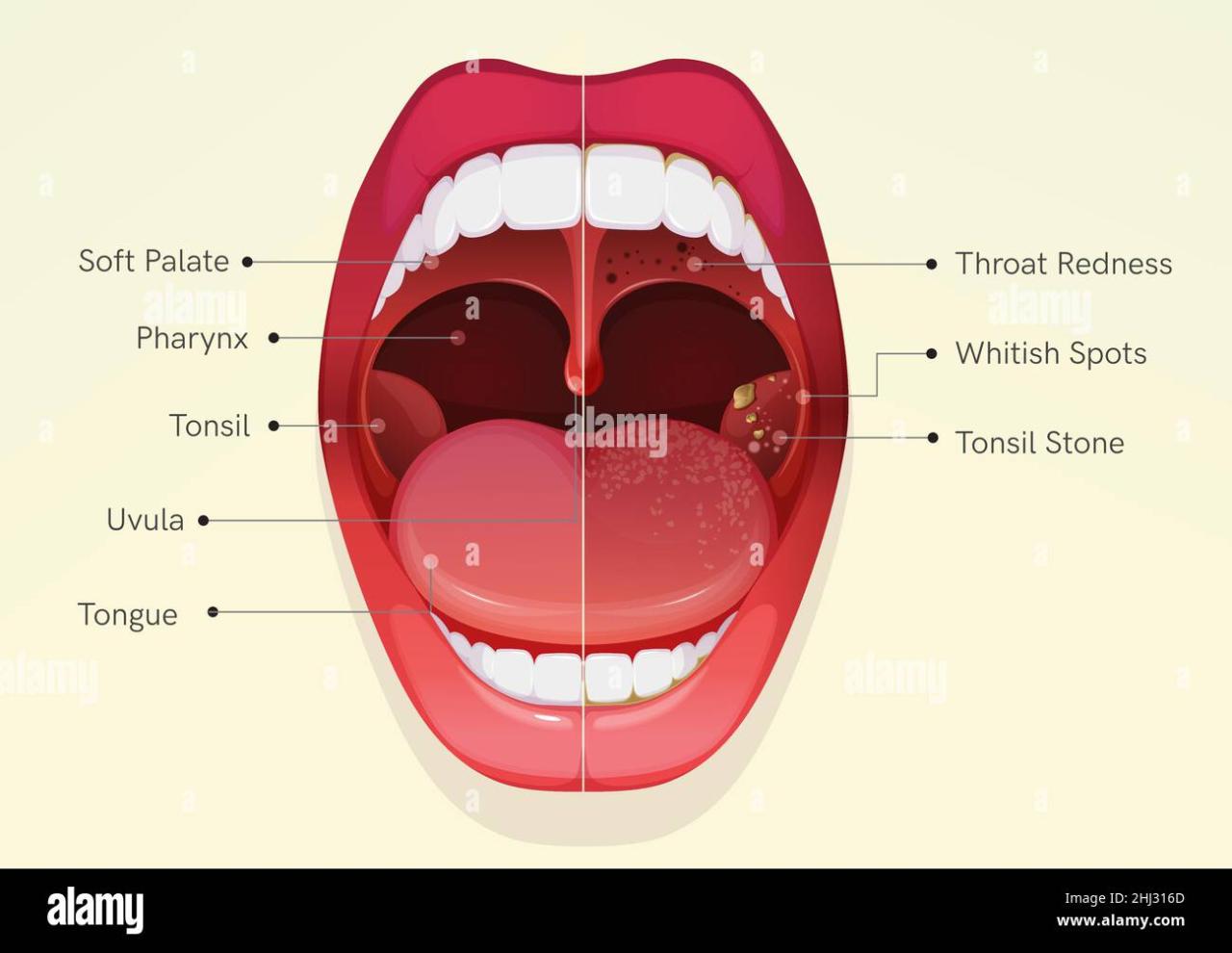

Source: alamy.com

Dealing with a painful sore on the roof of your mouth can be incredibly frustrating. Luckily, there are several things you can do at home to ease the discomfort and promote healing. While over-the-counter medications can also be helpful, understanding when to seek professional medical advice is crucial.

Figuring out if that mouth sore is just a canker sore or something more serious can be tricky! Sometimes, even minor mouth irritations can impact breathing, reminding me of the recent news about Monali Thakur being hospitalized after struggling to breathe – you can read more about it and respiratory disease prevention here: monali thakur hospitalised after struggling to breathe how to prevent respiratory diseases.

It highlights how important it is to pay attention to any changes in your body, even seemingly small ones like mouth sores, and seek medical advice if needed.

Home Remedies for Mouth Sore Relief

Many simple home remedies can soothe the pain and irritation of mouth sores. These remedies often work by cleaning the area, reducing inflammation, or providing a protective barrier. Consistent application is key to seeing improvement.

- Salt Water Rinse: Dissolving ½ to ¾ teaspoon of salt in 8 ounces of warm water creates a simple yet effective rinse. The salt helps draw out fluid from the sore, reducing swelling and potentially killing bacteria. Gently swish the solution around your mouth for 30-60 seconds, then spit it out. Repeat several times a day.

- Ice: Applying a small ice cube wrapped in a thin cloth to the affected area can numb the pain and reduce inflammation. Do this for short intervals (1-2 minutes at a time) to avoid tissue damage from the cold.

- Aloe Vera: The soothing properties of aloe vera gel can help reduce pain and inflammation. Apply a small amount directly to the sore using a clean finger or cotton swab.

Over-the-Counter Medications

Several over-the-counter medications can provide relief from mouth sore pain and accelerate healing. It’s always best to read and follow the product instructions carefully.

- Orabase or similar topical anesthetics: These create a protective barrier over the sore, reducing pain and irritation. They often contain benzocaine or lidocaine.

- Antiseptic mouthwashes: These can help kill bacteria and reduce inflammation, but avoid those containing alcohol, as it can further irritate the sore.

- Pain relievers: Over-the-counter pain relievers like ibuprofen or acetaminophen can help manage pain associated with mouth sores, especially if they’re particularly severe.

When to Seek Professional Medical Attention

While many mouth sores heal on their own with home care, some warrant a visit to the dentist or doctor. It’s crucial to seek professional help if:

- The sore is extremely painful and doesn’t improve after a week of home treatment.

- The sore is unusually large or deep.

- You experience difficulty swallowing or breathing.

- The sore bleeds excessively.

- You develop a fever or other systemic symptoms.

- The sore doesn’t heal within two weeks.

Decision-Making Flowchart for Mouth Sore Treatment

The appropriate treatment for a mouth sore depends heavily on its type and severity. This flowchart can help guide your decision-making process.

Note: This flowchart is a simplified guide. Always consult a healthcare professional for diagnosis and treatment.

(Imagine a flowchart here: A box at the top: “Mouth Sore?”. Branching down: “Mild, heals within a week?” Yes: “Home remedies (salt water rinse, ice, aloe vera)”. No: “Severe, persistent, or concerning symptoms?” Yes: “Seek medical attention”. No: “Over-the-counter medication (topical anesthetics, antiseptic mouthwash, pain relievers). Consider follow-up if no improvement.)

When to See a Doctor

Knowing when a mouth sore warrants medical attention is crucial for preventing complications and ensuring proper treatment. While many mouth sores heal on their own within a week or two, certain signs indicate the need for professional evaluation. Ignoring these warning signs could lead to delayed treatment and potentially more severe health issues.Persistent symptoms and unusual characteristics should always prompt a visit to the doctor.

Early diagnosis can help prevent more serious problems, especially if the underlying cause is an infection or a more serious medical condition.

Warning Signs Requiring Medical Attention

Several warning signs suggest that a mouth sore requires immediate medical attention. These include persistent bleeding that doesn’t stop with pressure, rapid enlargement or spread of the sore, unusually large size (larger than a typical canker sore), and the development of a high fever, especially if accompanied by other symptoms like fatigue or swollen lymph nodes. These could indicate an infection, an autoimmune disorder, or other serious health concerns.

For example, a rapidly spreading sore might signify a bacterial or viral infection that needs antibiotic or antiviral treatment. A high fever coupled with a mouth sore could suggest a more systemic infection requiring immediate medical care.

Figuring out what’s causing that sore on the roof of your mouth can be tricky! Is it a canker sore, a symptom of something more serious, or just irritation? It’s amazing to think about how far medicine has come, like with the recent news that the fda approves clinical trials for pig kidney transplants in humans , a huge leap forward in organ transplantation.

But back to that mouth sore – paying attention to its size, color, and how long it’s been there is key to figuring out what’s going on.

Importance of Professional Diagnosis for Recurring or Unusual Mouth Sores, How to differentiate sores on roof of mouth

Recurring mouth sores, particularly those that are unusually painful, persistent, or change in appearance, require professional evaluation. These could indicate an underlying medical condition such as an autoimmune disease (like Behçet’s disease) or a nutritional deficiency. Similarly, mouth sores that are atypical in appearance – such as those that are unusually large, deeply ulcerated, or have irregular borders – should be examined by a doctor to rule out more serious conditions.

A professional diagnosis can help determine the underlying cause and provide appropriate treatment to prevent recurrence. For instance, a persistent mouth sore might be indicative of a vitamin deficiency, which can be addressed through dietary changes or supplementation.

Diagnostic Procedures for Mouth Sores

A doctor will typically begin by taking a detailed medical history, including information about the sore’s onset, duration, symptoms, and any relevant medical conditions. A visual examination of the mouth is usually the first step. Depending on the suspected cause, further diagnostic tests may be necessary. These could include a blood test to check for infections, nutritional deficiencies, or autoimmune disorders; a biopsy to examine a tissue sample under a microscope; or a swab test to identify bacteria or viruses.

In some cases, imaging tests like X-rays might be necessary if a deeper underlying problem is suspected. For example, a biopsy might be performed if the doctor suspects oral cancer.

Symptom Severity and When to Seek Medical Attention

| Symptom | Severity | When to See a Doctor | Possible Diagnosis |

|---|---|---|---|

| Persistent bleeding | Doesn’t stop with pressure, excessive bleeding | Immediately | Underlying medical condition, infection |

| Rapid spread of sore | Sore significantly increases in size within hours or days | Within 24-48 hours | Infectious disease, potentially serious infection |

| Unusually large sore | Larger than a typical canker sore, deeply ulcerated | Within a week | Oral cancer, other serious conditions |

| High fever | Fever above 101°F (38.3°C), accompanied by other symptoms | Immediately | Systemic infection, potentially serious illness |

Illustrative Examples of Mouth Sores

Understanding the visual characteristics of different mouth sores is crucial for proper diagnosis and treatment. While self-diagnosis should always be followed by a professional consultation, recognizing key features can help you communicate effectively with your doctor. Below are detailed descriptions of three common types of mouth sores.

Canker Sore Appearance

A typical canker sore, or aphthous ulcer, usually presents as a small, shallow crater-like lesion. Its texture is typically smooth and often slightly raised above the surrounding tissue. The color can vary; they often start as a reddish or yellowish-white spot before developing a grayish-white or yellowish base. A noticeable red halo of inflammation typically surrounds the sore, indicating the body’s immune response.

The size can range from a few millimeters to a centimeter or more, depending on the severity. Canker sores are usually painful, especially when touched or exposed to acidic or spicy foods.

Cold Sore Development Stages

Cold sores, or fever blisters, are caused by the herpes simplex virus (HSV). Their appearance changes dramatically throughout their lifecycle. The initial stage often begins with a tingling or burning sensation on the lip or surrounding area. This prodromal phase can last a few hours to a day before the next stage begins. Then, small, fluid-filled blisters develop, clustered together.

These blisters are typically clear or slightly yellowish. Over the next few days, the blisters break open, releasing the fluid and forming a shallow ulcer. This ulcer then develops a yellowish crust that eventually scabs over, before healing completely within a week or two.

Figuring out what’s causing that painful sore on the roof of your mouth can be tricky! Is it a canker sore, a cold sore, or something else? Proper identification is key to treatment, and your diet plays a surprisingly big role. Learning about nutritional needs, like in this article on are women and men receptive of different types of food and game changing superfoods for women , can help you understand how food choices impact oral health and healing.

So, pay attention to what you eat – it could be the key to soothing that sore spot.

Mouth Sore from Physical Injury

A mouth sore resulting from a physical injury, such as biting your cheek or accidentally scraping the roof of your mouth, typically presents as a clearly defined abrasion or laceration. Depending on the severity of the injury, bleeding may occur, ranging from minor oozing to more significant bleeding. The appearance will depend on the type of injury. A scrape might look like a raw, red area, while a more significant injury might appear as a deeper, irregular wound.

The healing process usually involves the formation of a protective fibrin clot, which stops the bleeding and allows the underlying tissues to regenerate. This process typically takes several days to a week, with the sore gradually becoming less red and inflamed as it heals. The healing may result in a slightly discolored area for a short period after complete healing.

Final Thoughts

So, next time you find yourself staring at a mysterious sore on the roof of your mouth, you’ll be better equipped to identify it. Remember that while many mouth sores resolve on their own, persistent, painful, or unusual sores warrant a visit to the doctor. Armed with the knowledge from this post, you can confidently navigate the world of mouth sores, knowing when to treat at home and when to seek professional care.

Stay healthy, and happy smiling!

User Queries

What if my mouth sore bleeds easily?

Persistent bleeding from a mouth sore could indicate a more serious issue and warrants a doctor’s visit.

How long should I expect a mouth sore to last?

This varies greatly depending on the type of sore. Canker sores usually heal within 1-2 weeks, while cold sores may take longer.

Are mouth sores contagious?

Cold sores are contagious, spread through direct contact. Canker sores are generally not contagious.

Can stress cause mouth sores?

Yes, stress can weaken the immune system, making you more susceptible to developing mouth sores.