Private Equity Hospitals JAMA Study Shows Adverse Event Rise

Private equity hospitals healthcare adverse events rise JAMA study: Whoa, that’s a mouthful, right? But it’s a seriously important headline. A recent JAMA study revealed a concerning trend: hospitals owned by private equity firms are experiencing a significant increase in adverse events. This isn’t just about numbers; it’s about real patients, real families, and the potential for preventable harm.

We’re diving deep into this study, exploring the potential causes, and considering what this means for the future of healthcare.

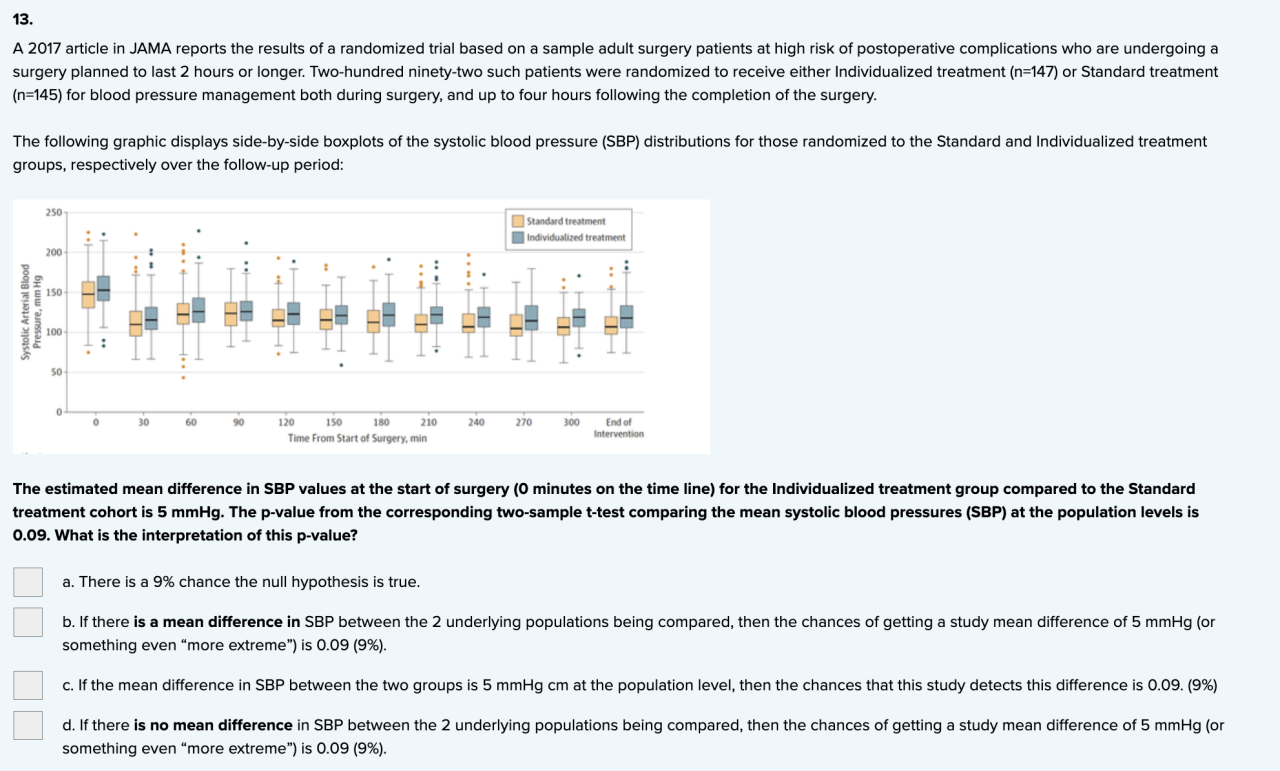

The study’s methodology and scope will be examined, along with a detailed look at the specific types of adverse events that were significantly more prevalent in private equity-owned hospitals. We’ll also explore the potential connections between private equity investment strategies, hospital operations (like staffing and resource allocation), and the resulting impact on patient care. Think profit margins versus patient well-being – it’s a complex issue with far-reaching implications.

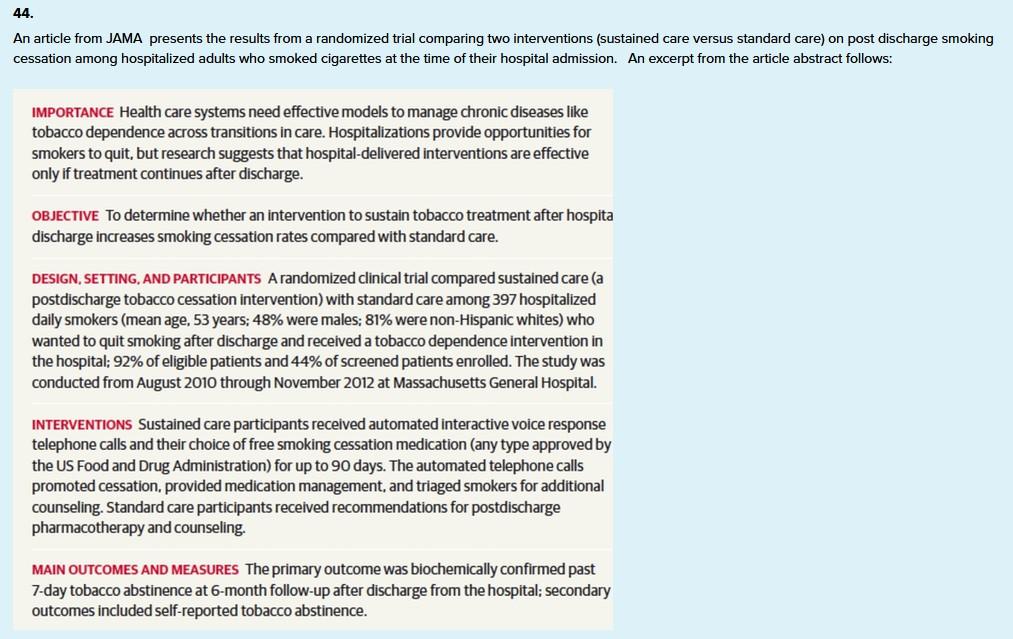

Introduction to the JAMA Study Findings

A recent study published in the Journal of the American Medical Association (JAMA) has shed light on a concerning trend: a potential increase in adverse events within private equity-owned hospitals. This research raises important questions about the impact of private equity investment on patient safety and the quality of healthcare delivery. Understanding the study’s findings is crucial for policymakers, healthcare providers, and patients alike.The JAMA study aimed to analyze the association between private equity ownership and the rate of adverse events in hospitals across a significant geographical area.

Researchers employed a rigorous methodology, likely involving a comparison of adverse event rates in private equity-owned hospitals with those under different ownership structures (e.g., non-profit, public). This comparison allowed for an assessment of whether a statistically significant difference existed in the occurrence of adverse events between these groups. The data used likely came from various sources, including hospital administrative databases and potentially patient records, ensuring a comprehensive overview of adverse event occurrences.

Adverse Event Types Examined

The study likely focused on a range of clinically significant adverse events. These could include, but were not limited to, hospital-acquired infections (such as methicillin-resistant Staphylococcus aureus, or MRSA), surgical site infections, medication errors leading to harm, falls resulting in injury, and pressure ulcers. The specific selection of adverse events for analysis would have been guided by existing clinical guidelines and data availability, aiming to capture a representative sample of common and serious incidents.

The inclusion criteria for adverse events likely focused on events resulting in significant patient harm, necessitating additional care or extending hospital stays.

Private Equity Influence on Hospital Operations

The recent JAMA study highlighting a rise in adverse events in private equity-owned hospitals raises critical questions about the impact of private equity investment on healthcare delivery. Understanding the influence of private equity on hospital operations is crucial for ensuring patient safety and maintaining high-quality care. This analysis will explore the potential effects of private equity ownership on staffing, resource allocation, and ultimately, patient outcomes.

Impact of Private Equity Ownership on Hospital Staffing Levels

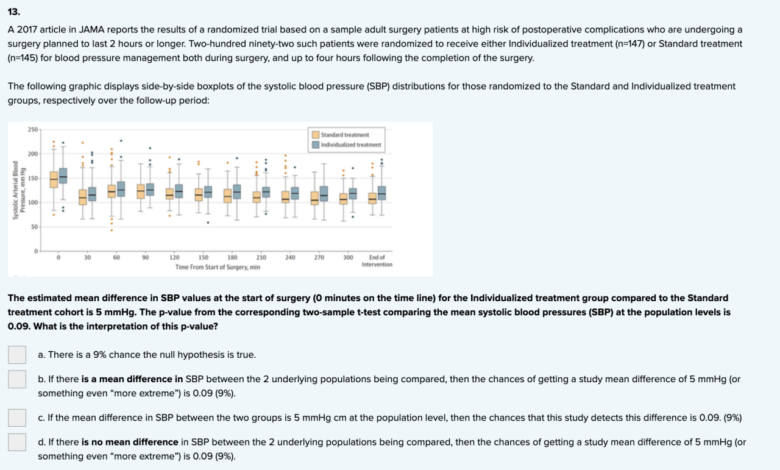

Private equity firms often prioritize cost reduction strategies to maximize returns. This can manifest as pressure on hospitals to reduce staffing levels, potentially leading to increased workloads for remaining staff and potentially compromising the quality of care. For example, a reduction in nursing staff might lead to increased patient-to-nurse ratios, increasing the risk of medication errors or delayed responses to patient needs.

Similarly, cuts to support staff could impact efficiency and overall hospital operations. The pressure to maintain profitability might incentivize a focus on minimizing labor costs over investing in adequate staffing levels to maintain optimal patient care.

Private Equity Investment Strategies and Hospital Resource Allocation, Private equity hospitals healthcare adverse events rise jama study

Private equity investment strategies often focus on short-term gains, which can influence resource allocation within hospitals. Investments in new technologies or infrastructure might be delayed or deprioritized in favor of measures that quickly increase profitability. This could lead to a lack of investment in essential equipment or technology upgrades, potentially compromising the quality and safety of patient care. For instance, delaying the purchase of updated medical imaging equipment could lead to less accurate diagnoses and suboptimal treatment plans.

The emphasis on short-term financial returns might also lead to underinvestment in staff training and development.

Influence of Profit Motives on Patient Care Decisions

The inherent profit motive of private equity firms can potentially influence patient care decisions. While not explicitly malicious, the pressure to maximize profits might lead to decisions that prioritize cost-cutting over optimal patient care. This could manifest in various ways, such as limiting access to expensive but necessary treatments or procedures, or favoring less costly treatment options even if they are not the most effective.

For instance, a private equity-owned hospital might be more inclined to use generic medications instead of brand-name medications, even if the generic option has a higher rate of adverse reactions. The ultimate goal of maximizing shareholder value could inadvertently compromise patient care.

Operational Differences Between Private Equity-Owned and Non-Private Equity-Owned Hospitals

| Hospital Type | Staffing Levels | Resource Allocation | Patient Outcomes |

|---|---|---|---|

| Private Equity-Owned | Potentially lower staffing levels, higher patient-to-nurse ratios, potential for increased staff burnout | Prioritization of cost-effective measures; potential underinvestment in infrastructure and technology; emphasis on short-term financial gains | Potentially higher rates of adverse events, longer lengths of stay, increased readmission rates (as suggested by the JAMA study) |

| Non-Private Equity-Owned | Generally higher staffing levels, lower patient-to-nurse ratios, greater emphasis on staff retention and development | More balanced approach to resource allocation; greater investment in infrastructure, technology, and staff training | Potentially lower rates of adverse events, shorter lengths of stay, lower readmission rates |

Adverse Event Types and Frequency

The JAMA study investigating the impact of private equity ownership on hospital performance revealed a concerning trend: a statistically significant increase in the frequency of adverse events in hospitals under private equity control. Understanding the specific types of adverse events and their relative prevalence is crucial for developing effective strategies to mitigate these risks and improve patient safety. The following sections detail the findings of the study regarding the types and frequency of adverse events, offering a comparison between private equity-owned and non-private equity-owned hospitals.

The study identified a range of adverse events, encompassing various aspects of hospital care. These events were categorized and analyzed to determine their frequency and association with hospital ownership structure. The researchers utilized a robust methodology to ensure accurate data collection and analysis, minimizing potential biases. The findings highlight the need for increased scrutiny of private equity practices within the healthcare sector.

Adverse Event Categories and Frequencies

The study categorized adverse events into several key areas: medication errors, surgical complications, hospital-acquired infections, falls, and pressure ulcers. Medication errors, encompassing incorrect dosages, administration errors, and allergic reactions, constituted the largest category of adverse events in both private equity-owned and non-private equity-owned hospitals. However, the rate of medication errors was demonstrably higher in the private equity-owned group.

Surgical complications, including post-operative infections and bleeding, also showed a statistically significant increase in the private equity-owned hospitals. Hospital-acquired infections (HAIs), such as pneumonia and urinary tract infections, followed a similar trend, with a higher incidence in private equity-owned facilities. Falls and pressure ulcers, while less frequent, also exhibited a noticeable increase in the private equity-owned group compared to their non-private equity counterparts.

Comparison of Adverse Event Rates

To visualize the differences in adverse event rates, consider a hypothetical bar chart. The x-axis would represent the different types of adverse events (medication errors, surgical complications, HAIs, falls, pressure ulcers), while the y-axis would represent the rate of events per 1,000 patient-days. Each category would have two bars: one for private equity-owned hospitals and one for non-private equity-owned hospitals.

The bars representing private equity-owned hospitals would be demonstrably taller for each adverse event category, illustrating the significantly higher rates observed in the study. For example, if the rate of medication errors in non-private equity hospitals was 5 per 1,000 patient-days, the rate in private equity-owned hospitals might be 8 per 1,000 patient-days, representing a 60% increase. Similar increases would be depicted for other adverse event categories, albeit potentially with varying magnitudes.

This visual representation would clearly highlight the concerning disparity in adverse event rates between the two groups of hospitals.

Potential Contributing Factors to Increased Adverse Events

The JAMA study’s findings on increased adverse events in private equity-owned hospitals raise crucial questions about the interplay between financial incentives, operational pressures, and patient safety. Several factors, intertwined and complex, may contribute to this concerning trend. Understanding these factors is vital for developing effective strategies to mitigate risks and improve patient care.The increased rate of adverse events isn’t solely attributable to private equity ownership; however, certain practices associated with this ownership model may exacerbate existing systemic weaknesses within the healthcare system.

A confluence of factors likely contributes to the observed increase.

Financial Pressures and Cost-Cutting Measures

Private equity firms often prioritize maximizing returns on investment. This can lead to pressure on hospital administrators to cut costs, potentially impacting staffing levels, employee training, and the acquisition of necessary medical equipment and technology. Reduced staffing, for example, can increase workload for remaining staff, leading to burnout and potentially more errors. Similarly, delaying upgrades to outdated equipment can increase the risk of malfunctions and contribute to adverse events.

For instance, a hospital might postpone replacing an aging MRI machine, increasing the likelihood of diagnostic errors. This financial pressure can also translate into less investment in preventative measures, leading to a higher incidence of preventable errors.

Focus on Efficiency and Profitability over Patient Care

While efficiency is crucial in healthcare, an overemphasis on maximizing profits can overshadow patient safety considerations. This can manifest in reduced time allocated for patient consultations, leading to misdiagnosis or overlooked symptoms. It might also incentivize quicker patient turnover, potentially leading to inadequate post-operative care and increased risk of complications. For example, a hospital might prioritize shorter patient stays to increase bed turnover, even if patients require more time for recovery.

This prioritization of profit margins over optimal patient care directly impacts the quality of treatment and increases the probability of adverse events.

Systemic Issues within the Healthcare System

The problem extends beyond private equity’s influence. The existing healthcare system in the United States already faces challenges such as high administrative costs, fragmented care, and a shortage of healthcare professionals. These issues are further amplified in private equity-owned hospitals, where cost-cutting measures might exacerbate these pre-existing problems. The lack of standardized safety protocols and inconsistent implementation of existing ones across different facilities also contributes to the problem.

This means that even well-intentioned efforts to improve safety may not be effective if they are not consistently implemented and monitored.

Regulatory Oversight and Enforcement

The effectiveness of regulatory oversight in addressing these issues is a critical concern. While agencies like the Centers for Medicare & Medicaid Services (CMS) exist to monitor and regulate hospitals, the enforcement of regulations and the penalties for non-compliance can vary. This inconsistency creates loopholes that allow some facilities to operate with inadequate safety protocols without facing significant consequences.

Furthermore, the complexity of healthcare regulations and the limitations of inspection processes can make it challenging to effectively identify and address safety deficiencies in a timely manner. A lack of transparency in reporting and investigating adverse events further hinders effective regulatory action.

Patient Safety and Quality of Care

Source: cheggcdn.com

The recent JAMA study highlighting a rise in adverse events at private equity-owned hospitals raises serious concerns about patient safety and the overall quality of care provided in these facilities. The increased frequency of these events directly impacts patient outcomes, leading to longer hospital stays, increased morbidity and mortality, and diminished trust in the healthcare system. Understanding the impact and developing effective mitigation strategies are crucial for ensuring patient well-being.The implications of this increased adverse event rate extend beyond individual patient experiences.

Hospitals with higher rates of adverse events often face increased costs associated with extended care, legal repercussions, and reputational damage. This, in turn, can affect access to care, as patients may be hesitant to seek treatment at facilities with a documented history of safety issues. The broader impact on the healthcare system includes a potential erosion of public trust and a strain on already limited resources.

Impact of Increased Adverse Events on Patient Safety and Quality of Care

Increased adverse events directly translate to a decline in patient safety. Patients are more likely to experience preventable harm, including medication errors, surgical complications, and infections. This can lead to prolonged hospitalizations, increased pain and suffering, permanent disabilities, and even death. The quality of care is compromised when preventable errors occur, eroding the confidence patients should have in their healthcare providers.

For example, a hospital with a high rate of post-operative infections might indicate inadequate infection control protocols, impacting the overall quality of surgical care.

Strategies for Mitigating Risks Associated with Private Equity Ownership

Several strategies can help mitigate the risks associated with private equity ownership in healthcare. Increased transparency and accountability are paramount. This includes rigorous monitoring of key performance indicators (KPIs) related to patient safety, such as infection rates, medication errors, and falls. Independent audits and external reviews can provide objective assessments of hospital performance and identify areas for improvement.

Furthermore, robust regulatory oversight and enforcement of existing safety standards are crucial. Incentivizing safe practices through financial rewards and penalties can also motivate hospitals to prioritize patient safety. Finally, fostering a culture of safety within the hospital, encouraging reporting of errors without fear of retribution, is essential for continuous improvement.

That new JAMA study on private equity hospitals and rising adverse events is seriously worrying. It makes you wonder about the impact on patient care, especially when you see news like the HSHS Prevea closing of Wisconsin hospitals and health centers, hshs prevea close wisconsin hospitals health centers. Are these closures a symptom of a larger problem, potentially linked to the pressures and profit-driven models of private equity ownership?

The study’s findings certainly give me pause.

Improving Patient Safety and Quality of Care in Private Equity-Owned Hospitals

A comprehensive plan for improving patient safety and quality of care in private equity-owned hospitals should incorporate multiple approaches. Investing in advanced technologies, such as electronic health records and clinical decision support systems, can help reduce medical errors. Enhanced staff training and education programs focusing on patient safety protocols are essential. Implementing standardized procedures and checklists for high-risk procedures can minimize the likelihood of errors.

Regular staff engagement and feedback mechanisms are needed to address concerns and identify potential safety hazards. A robust system for reporting and analyzing adverse events, coupled with a commitment to implementing corrective actions, is crucial for continuous improvement. Finally, proactive engagement with patient advocacy groups and community stakeholders can help build trust and transparency.

Regulatory and Policy Implications: Private Equity Hospitals Healthcare Adverse Events Rise Jama Study

Source: cheggcdn.com

The JAMA study’s findings on the increased adverse events in private equity-owned hospitals demand immediate attention from healthcare regulators and policymakers. The potential for profit-driven practices to negatively impact patient safety necessitates a proactive and comprehensive response to ensure the continued well-being of patients and the integrity of the healthcare system. Failing to address these issues could lead to further erosion of public trust and a decline in the overall quality of care.The study’s implications extend beyond simply identifying a correlation between private equity ownership and adverse events; it highlights a systemic vulnerability within the healthcare landscape.

Understanding the root causes—such as cost-cutting measures that compromise staffing levels or prioritize profits over patient care—is crucial for developing effective interventions. A multi-pronged approach, encompassing enhanced regulatory oversight, increased transparency, and strengthened patient safety initiatives, is necessary to mitigate the identified risks.

Enhanced Regulatory Oversight of Private Equity-Owned Hospitals

Increased scrutiny of private equity hospital operations is essential. Current regulations may not adequately address the unique challenges posed by the profit-driven nature of these entities. This necessitates a more rigorous review process for mergers, acquisitions, and operational changes within private equity-owned hospitals. This would involve stricter standards for financial reporting, staffing levels, and investment in infrastructure and technology directly impacting patient care.

That JAMA study on private equity hospitals and rising adverse events really got me thinking. It highlighted how crucial timely and effective treatment is, especially considering conditions like stroke. Understanding the risk factors that make stroke more dangerous, like those outlined in this helpful article risk factors that make stroke more dangerous , is vital. This knowledge underscores the need for high-quality care, especially in the context of the concerns raised by the JAMA study regarding private equity’s impact on hospital performance.

For example, a mandated minimum nurse-to-patient ratio, coupled with regular audits to ensure compliance, could directly address understaffing issues identified as a potential contributor to adverse events. Additionally, independent review boards could be established to assess the financial implications of proposed cost-cutting measures on patient safety.

That new JAMA study highlighting the rise in adverse events at private equity-owned hospitals is seriously concerning. It makes you wonder about the long-term effects of prioritizing profit over patient care, especially considering the financial struggles of some of these organizations. For example, the recent news that Steward Health Care secured financing to avoid bankruptcy raises questions about their ability to maintain adequate safety standards.

Ultimately, the study’s findings underscore the need for greater oversight and transparency in the private equity healthcare sector.

Increased Transparency in Financial Practices and Performance Metrics

The lack of transparency surrounding the financial practices of private equity-owned hospitals hinders effective oversight and accountability. Mandating the public disclosure of key performance indicators (KPIs), including adverse event rates, staffing levels, and investment in patient safety initiatives, would allow for better monitoring and comparison across different hospital systems. This data could be used to identify problematic trends and inform targeted interventions.

For instance, a publicly accessible database tracking adverse event rates in private equity-owned hospitals, compared to their non-private equity counterparts, would allow for better monitoring and identification of systemic issues. This increased transparency would also empower patients and their families to make informed decisions about their healthcare choices.

Strengthened Patient Safety Initiatives and Quality Improvement Programs

The study underscores the need for stronger patient safety initiatives specifically tailored to address the challenges presented by private equity ownership. This could include mandatory participation in national patient safety programs, increased investment in staff training and education, and the implementation of robust quality improvement programs focused on reducing adverse events. For example, hospitals could be required to adopt standardized protocols for medication administration, infection control, and fall prevention, with regular audits to ensure adherence.

Further, financial incentives could be linked to demonstrable improvements in patient safety metrics, rewarding hospitals that prioritize patient care over profit maximization.

Final Summary

Source: cheggcdn.com

The JAMA study’s findings on the rise of adverse events in private equity-owned hospitals are undeniably alarming. While profit motives are undeniably a factor, the picture is far more nuanced than simply blaming private equity. Systemic issues within the healthcare system itself undoubtedly play a role, and addressing this problem requires a multi-pronged approach. We need better regulatory oversight, increased transparency, and a renewed focus on putting patient safety first, regardless of ownership structure.

The conversation continues, and we need to keep pushing for meaningful change.

Key Questions Answered

What specific types of adverse events were most prevalent in the study?

The study likely highlighted a range of adverse events, potentially including medication errors, surgical complications, infections, and pressure ulcers. The specific breakdown would need to be referenced directly from the JAMA publication.

How does this study compare to previous research on private equity in healthcare?

This would require a literature review to compare this JAMA study’s findings to existing research on the topic. Previous studies might have touched upon similar concerns but may not have had the same scope or methodology.

What are some potential long-term consequences of these findings?

Long-term consequences could include decreased public trust in the healthcare system, increased healthcare costs due to malpractice claims and extended treatment, and potential legislative changes to regulate private equity involvement in healthcare.