Can Mewing Define Your Jawline? Risks & Effectiveness

Can mewing define your jawline its risks and effectiveness – Can mewing define your jawline? Its risks and effectiveness are hot topics in the world of facial aesthetics. This natural, non-surgical method promises jawline improvement through conscious tongue posture, but does it really work? We’ll delve into the science behind mewing, exploring its potential benefits, drawbacks, and whether it lives up to the hype. Get ready to uncover the truth about this increasingly popular technique!

Mewing, simply put, involves resting your tongue against the roof of your mouth. Proponents claim this simple change can reshape your face over time by influencing bone growth and muscle development. But is it a miracle cure or just another internet trend? We’ll examine the anatomical changes supposedly caused by mewing, comparing it to other jawline enhancement methods to help you make informed decisions about your facial structure.

Introduction to Mewing

Source: shopify.com

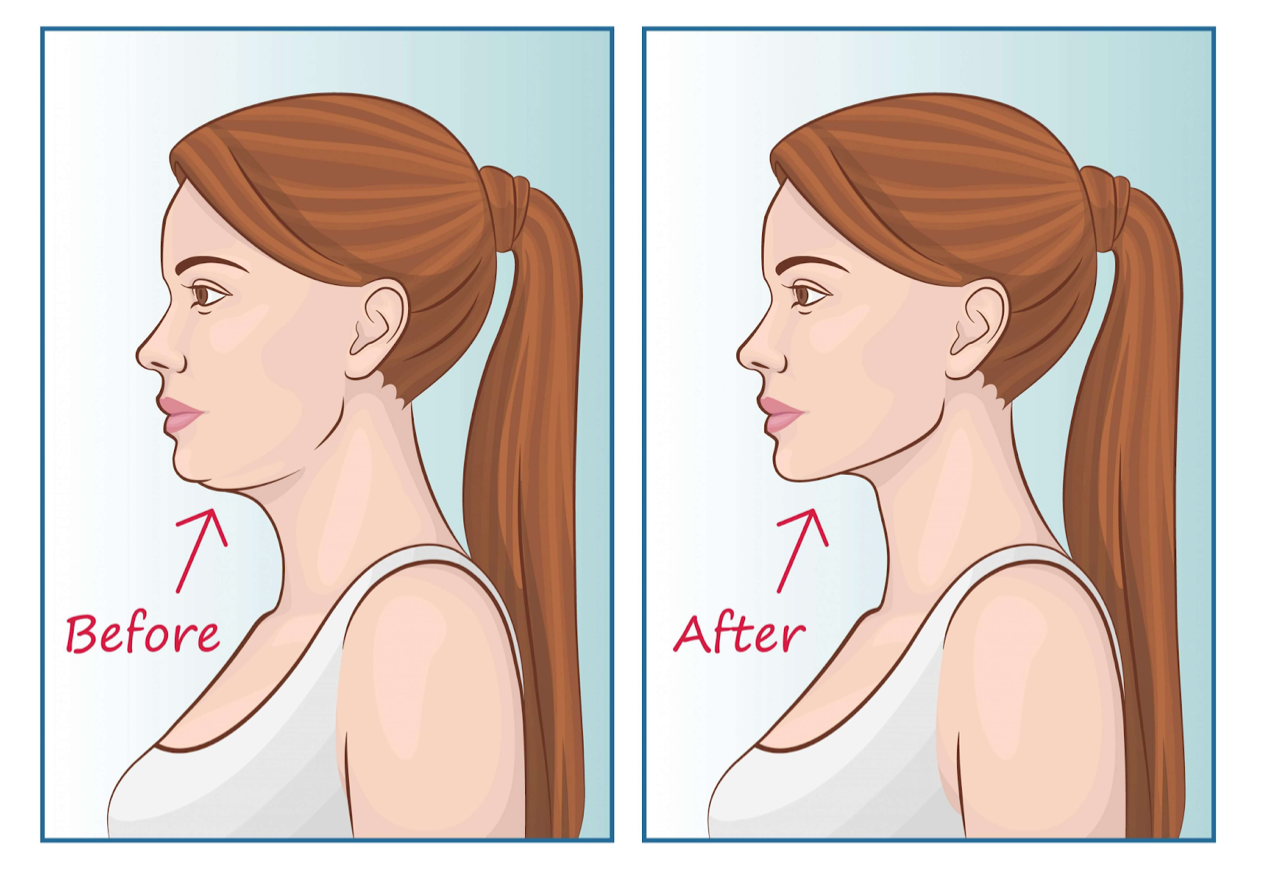

Mewing, a controversial yet increasingly popular technique, centers around the proper positioning of the tongue against the roof of the mouth. Proponents claim it can improve facial aesthetics, particularly the jawline, by influencing the growth and development of the maxilla (upper jaw) and mandible (lower jaw). While scientific evidence supporting these claims remains limited, the technique’s growing popularity warrants a closer examination of its mechanics and origins.The core principle of mewing involves consciously resting the tongue on the roof of the mouth, specifically against the palate, with the tip of the tongue just behind the upper incisors.

This, according to mewing advocates, creates optimal pressure and encourages proper facial bone development. This constant pressure is believed to stimulate bone growth in the jaw and face, leading to a more defined jawline, improved facial symmetry, and a more aesthetically pleasing profile. The purported effects range from subtle improvements in facial structure to more dramatic changes, depending on individual factors and the duration of practice.

The Mechanics of Mewing

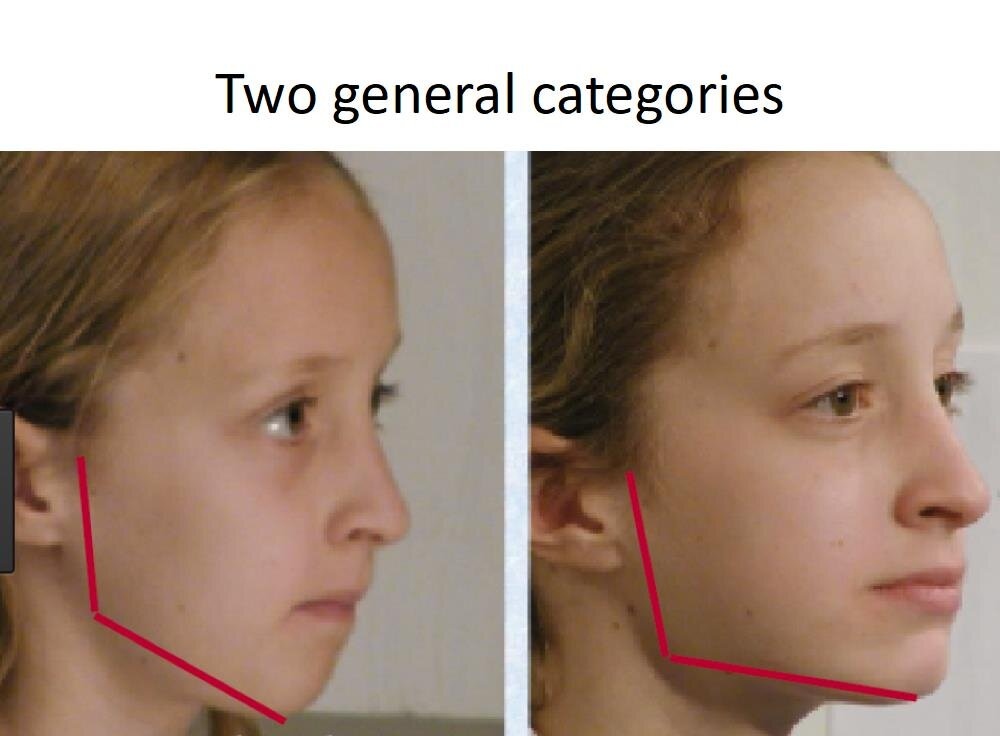

Mewing’s purported effectiveness relies on the idea of myofunctional therapy, which emphasizes the role of oral posture and muscle function in influencing craniofacial development. Correct tongue posture, according to this theory, is crucial for optimal growth and development of the maxillofacial complex. Incorrect tongue posture, such as resting the tongue low in the mouth or between the teeth, is thought to contribute to underdeveloped jaws and a less defined facial structure.

The act of mewing aims to counteract these negative effects by actively promoting proper tongue placement and encouraging the natural growth of facial bones. Visualizing the tongue as a “shelf” supporting the palate might help in understanding the concept of consistent, correct tongue posture.

So, you’re wondering about mewing and jawlines – the potential benefits, risks, and whether it actually works? It’s a popular topic, but sometimes we need to step back and consider other things impacting facial structure. For example, managing underlying health conditions can be just as crucial, and for children, this might include focusing on things like effective strategies for managing conditions like Tourette Syndrome, which you can learn more about here: strategies to manage Tourette syndrome in children.

Understanding the holistic picture is key before jumping into any facial reshaping techniques like mewing. Ultimately, responsible self-care involves considering your overall well-being.

The Origins and History of Mewing, Can mewing define your jawline its risks and effectiveness

The mewing technique’s origins are attributed to Dr. John Mew and his son, Mike Mew, British orthodontists. Their theories, largely disseminated through online platforms and videos, emphasize the importance of proper oral posture and tongue placement in influencing facial structure. While the Mews’ work has not been subject to rigorous scientific peer review on the scale of traditional orthodontic treatments, their ideas gained traction through online communities, sparking significant discussion and experimentation among individuals seeking to improve their facial aesthetics.

The technique’s relative simplicity and the potential for natural facial improvement have contributed to its widespread popularity. However, it’s crucial to remember that the scientific evidence supporting the effectiveness of mewing is still limited and requires further research.

So, I’ve been researching mewing – can it really reshape your jawline? The potential benefits are tempting, but like any technique, there are risks. It’s all about understanding the long-term effects, much like the considerations Karishma Mehta faced when deciding to freeze her eggs, as detailed in this article: karishma mehta gets her eggs frozen know risks associated with egg freezing.

Both decisions require careful research and understanding of potential downsides before committing. Ultimately, responsible self-improvement means weighing the pros and cons of any approach to physical change.

Mewing and Jawline Definition: Can Mewing Define Your Jawline Its Risks And Effectiveness

Source: redd.it

So, you’re wondering about mewing and its effect on your jawline? It’s a popular topic, but the effectiveness is debated, and honestly, there’s a lack of solid scientific backing. It’s important to remember that focusing too much on any single facial feature can lead to unhealthy habits. For example, straining your facial muscles excessively could increase tension, potentially raising your risk of conditions like high blood pressure, a major risk factor listed in this article on risk factors that make stroke more dangerous.

Ultimately, a holistic approach to health, including balanced posture and stress management, is key – much more important than a perfectly sculpted jawline.

Mewing, the practice of maintaining proper tongue posture, claims to improve jawline definition and overall facial aesthetics. This isn’t a quick fix, however; it relies on the body’s natural bone remodeling processes, making results gradual and dependent on individual factors. Understanding the mechanisms behind these potential changes is crucial for managing expectations and assessing the validity of mewing’s claims.

The purported jawline improvement from mewing stems from the belief that consistent correct tongue posture can influence the growth and development of the maxilla (upper jaw) and mandible (lower jaw). Proponents suggest that proper tongue placement against the roof of the mouth stimulates bone growth in these areas, leading to a more defined jawline. This process is hypothesized to be a consequence of increased pressure and stimulation of the underlying bone tissue.

The changes are not immediate and require consistent effort over extended periods.

Tongue Posture’s Influence on Bone Development and Facial Structure

The theory behind mewing’s effectiveness centers on the idea that the tongue, as a significant muscle in the oral cavity, exerts considerable force. When the tongue rests correctly against the palate, this force is distributed evenly across the alveolar ridge and palate, stimulating osteoblasts (bone-forming cells). Conversely, incorrect tongue posture, such as resting the tongue on the lower teeth or letting it fall to the bottom of the mouth, may lead to uneven pressure distribution, potentially hindering optimal bone growth and contributing to a less defined jawline.

This altered pressure distribution can, over time, influence the shape and development of the jaw and surrounding facial structures. The degree of influence, however, is subject to ongoing research and individual variation.

Comparison of Mewing with Other Jawline Enhancement Methods

Mewing is often compared to other methods aimed at improving jawline definition, such as surgery and orthodontic treatments. Surgical procedures like jaw surgery (orthognathic surgery) offer immediate and significant changes to jaw structure and alignment, but carry risks and high costs. Orthodontic treatments, such as braces or Invisalign, gradually reposition teeth and can indirectly influence jaw alignment. However, these methods are primarily focused on dental alignment, not necessarily on direct bone growth stimulation like mewing.

Compared to these more invasive and expensive methods, mewing is presented as a non-invasive, cost-effective approach, but its effectiveness remains a topic of ongoing debate and research. The results are significantly slower and less predictable than surgical or orthodontic methods.

Closing Notes

Source: emmamews.com

So, can mewing truly redefine your jawline? The answer, as with most things, is nuanced. While some anecdotal evidence and theoretical mechanisms suggest potential benefits, scientific backing remains limited. The effectiveness of mewing likely varies greatly depending on individual factors like age, genetics, and consistency. Ultimately, managing expectations is key.

If you’re considering mewing, approach it with a realistic perspective, understanding that it’s not a guaranteed solution but rather a potentially helpful technique to incorporate into a holistic approach to facial aesthetics and overall health. Remember to consult a healthcare professional before making any significant changes to your daily habits.

Question Bank

How long does it take to see results from mewing?

Results vary greatly, and some individuals may see changes within months, while others may not see significant differences for years, or at all. Consistency is key.

Is mewing painful?

Generally, mewing itself shouldn’t be painful. However, initially, you might experience some muscle soreness as you adjust to the new tongue position. This should subside.

Can mewing worsen an existing overbite or underbite?

It’s possible. If you have a pre-existing bite issue, consult an orthodontist or dentist before starting mewing to avoid potentially worsening the condition.

Are there any other side effects associated with mewing?

Some people report temporary discomfort like jaw pain or headaches, especially in the beginning. If you experience persistent pain, stop and consult a healthcare professional.