Cigna Sues CVS, Amy Bricker, Express Scripts, Caremark

Cigna sues cvs amy bricker express scripts caremark – Cigna sues CVS, Amy Bricker, Express Scripts, and Caremark – the headline alone screams major drama in the pharmaceutical world! This massive lawsuit isn’t just about money; it’s a clash of titans shaking up the healthcare industry. We’re diving deep into the allegations, exploring the roles of each player, and uncovering the potential impact on patients and the future of prescription drug access.

Get ready for a rollercoaster ride through corporate intrigue and legal battles!

At the heart of the storm is Cigna’s claim against CVS, Express Scripts, and Caremark, with Amy Bricker, a key figure, caught in the crossfire. The lawsuit alleges anti-competitive practices, potentially manipulating drug prices and limiting patient choices. We’ll dissect the legal arguments, examine the evidence, and consider the potential consequences – from hefty fines to sweeping industry reforms.

This isn’t just a legal battle; it’s a fight for fair pricing and accessible healthcare.

The Cigna Lawsuit

Source: statnews.com

Cigna’s lawsuit against CVS Health, Amy Bricker (a former Cigna executive), Express Scripts, and Caremark (all subsidiaries of CVS Health) is a complex legal battle centered around allegations of anti-competitive practices and breaches of fiduciary duty. The core of the dispute lies in Cigna’s claim that CVS manipulated its pharmacy benefit management (PBM) practices to steer patients towards CVS pharmacies and its own preferred drugs, ultimately harming Cigna and its customers.

Core Allegations of the Lawsuit

Cigna alleges that CVS, through its subsidiaries Express Scripts and Caremark, engaged in a series of actions designed to benefit CVS financially at the expense of Cigna and its members. These actions include manipulating drug formularies to favor CVS-owned pharmacies and higher-priced drugs, using opaque pricing structures to obscure the true cost of medications, and retaliating against Cigna for attempting to negotiate more favorable terms.

The lawsuit also names Amy Bricker, a former Cigna executive, alleging she shared confidential Cigna information with CVS while employed by Cigna, providing CVS with an unfair competitive advantage.

Legal Basis for Cigna’s Claims

Cigna’s lawsuit rests on several legal grounds, including violations of antitrust laws, breach of contract, and breach of fiduciary duty. The antitrust claims center on allegations of anti-competitive conduct designed to stifle competition and harm consumers. The breach of contract claims stem from Cigna’s assertion that CVS violated the terms of their existing agreements. The breach of fiduciary duty claim focuses on Bricker’s alleged actions, claiming she violated her duty of loyalty to Cigna by sharing confidential information.

Damages Sought by Cigna

The specific monetary damages Cigna seeks are not publicly disclosed in detail, but the lawsuit seeks compensation for the financial losses incurred as a result of CVS’s alleged actions. This likely includes the overpayment for drugs and pharmacy services, lost profits due to market share loss, and other consequential damages. The amount is expected to be substantial, given the scale of the alleged misconduct and the size of the companies involved.

Timeline of Key Events

While precise dates aren’t always publicly available, a general timeline might include: (1) Cigna and CVS Health had a pre-existing business relationship involving pharmacy benefit management services. (2) Alleged anti-competitive actions by CVS began, including formulary manipulation and opaque pricing. (3) Cigna attempted to negotiate more favorable terms with CVS, but faced alleged retaliation. (4) Amy Bricker’s alleged actions of sharing confidential information occurred.

(5) Cigna filed the lawsuit against CVS, Bricker, Express Scripts, and Caremark. The exact timing of these events would be revealed through the discovery process in the lawsuit.

Roles of the Defendants

| Defendant | Role | Alleged Actions | Cigna’s Claim Against Each |

|---|---|---|---|

| CVS Health | Parent company | Orchestrating anti-competitive practices through subsidiaries | Antitrust violations, breach of contract |

| Amy Bricker | Former Cigna executive | Sharing confidential Cigna information with CVS | Breach of fiduciary duty |

| Express Scripts | PBM subsidiary of CVS | Manipulating drug formularies, opaque pricing | Antitrust violations, breach of contract |

| Caremark | Pharmacy services subsidiary of CVS | Steering patients to CVS pharmacies, facilitating higher drug costs | Antitrust violations, breach of contract |

Amy Bricker’s Role in the Dispute

Source: slideplayer.com

The Cigna lawsuit against CVS, specifically targeting Express Scripts and Caremark, involved a complex web of pharmaceutical benefit management (PBM) practices. Understanding Amy Bricker’s role requires examining her position within this intricate system and the allegations leveled against her in the context of these practices. While specifics regarding her individual actions remain largely undisclosed due to the ongoing legal proceedings, piecing together publicly available information allows for a clearer picture of her potential involvement.Amy Bricker held a senior leadership position within Express Scripts, a subsidiary of Cigna’s competitor, CVS Health.

Her exact title and responsibilities aren’t consistently reported across all news sources, but reports suggest she was deeply involved in strategic decision-making concerning drug pricing, formulary management, and potentially, negotiations with pharmaceutical companies. This places her directly within the sphere of the alleged practices that led to Cigna’s legal action.

Allegations Against Amy Bricker

The lawsuit filed by Cigna doesn’t explicitly name Amy Bricker as an individual defendant. However, the allegations of anti-competitive practices and the manipulation of drug pricing, as Artikeld in the complaint, implicate individuals within Express Scripts who held positions of significant influence over these processes. Given Bricker’s senior role, it’s reasonable to infer that she was either directly involved in, or at least aware of, the practices under scrutiny.

So, Cigna’s suing CVS, Amy Bricker, Express Scripts, and Caremark – a massive legal battle brewing in the healthcare world. It makes you wonder about the future of personalized medicine, especially considering what I read in this fascinating study on study widespread digital twins healthcare ; it could revolutionize how we approach these kinds of disputes by allowing for more accurate predictions of patient needs and treatment costs.

Ultimately, though, the Cigna lawsuit highlights just how complex and fragmented the current system remains.

The lawsuit focuses on the overarching system, and further details about specific individual actions may emerge during the discovery phase of the litigation.

Bricker’s Response to the Lawsuit

Publicly available information regarding Amy Bricker’s direct response to the lawsuit is limited. Given the ongoing nature of the legal proceedings, it’s highly likely that her legal team is advising her to refrain from public comment. Any statements released would be carefully considered to avoid prejudicing the case. It’s important to remember that the allegations against her are just that – allegations – and she is presumed innocent until proven otherwise.

Narrative of Bricker’s Potential Involvement

A plausible narrative outlining Bricker’s potential involvement could depict her as a key decision-maker within Express Scripts, responsible for implementing strategies that allegedly favored CVS Health’s financial interests over those of its clients. This could involve participating in negotiations with pharmaceutical companies, influencing the formulary (the list of covered drugs), or contributing to the pricing algorithms used to determine reimbursement rates.

The Cigna lawsuit against CVS, Amy Bricker, Express Scripts, and Caremark is a huge deal, highlighting the complexities of the healthcare industry. It got me thinking about how technology could streamline things, and I stumbled upon this amazing article about how nuance integrates generative AI scribe with Epic EHRs , potentially reducing administrative burdens and improving efficiency. This kind of innovation could help prevent future conflicts like the Cigna lawsuit, hopefully making healthcare more transparent and less prone to disputes.

The resulting actions, if proven to be anti-competitive, could have directly contributed to the financial losses claimed by Cigna in their lawsuit. It’s crucial to emphasize that this is a hypothetical narrative based on the publicly available information; the actual details of her involvement, if any, will only emerge through the legal process.

The Pharmaceutical Industry Context

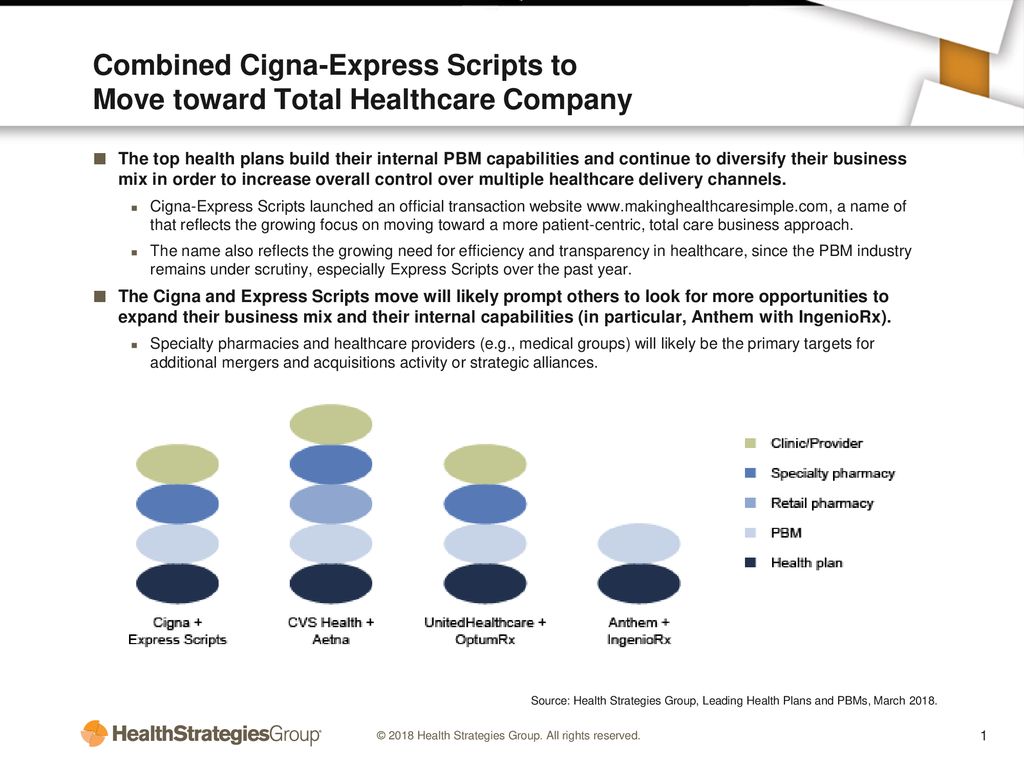

The Cigna lawsuit against CVS, Express Scripts, and Caremark highlights complex dynamics within the pharmaceutical industry, specifically the intricate relationships between insurers, pharmacy benefit managers (PBMs), and pharmacies. Understanding the business models of each player is crucial to grasping the implications of this legal battle. The core issue revolves around pricing, rebates, and the overall management of prescription drug costs, a significant burden on both individuals and the healthcare system.The business models of these companies differ significantly.

Cigna operates as a health insurer, primarily focused on managing risk and providing health coverage to individuals and employers. CVS, a pharmacy retailer, also operates a PBM, CVS Caremark, which negotiates drug prices with pharmaceutical manufacturers and manages prescription drug benefits for health plans. Express Scripts and Caremark are both standalone PBMs, specializing in negotiating drug prices, managing formularies, and processing prescription claims.

Essentially, Cigna pays PBMs to manage drug costs, creating a potential conflict of interest if PBMs prioritize their own profits over the best interests of the insurer and its members.

Business Model Comparisons

Cigna’s business model centers around managing risk and providing comprehensive health insurance plans. Their revenue is derived from premiums paid by members and employers. CVS Health, on the other hand, operates a diversified business model encompassing retail pharmacies, a PBM (Caremark), and health services. Their revenue streams are diverse, including retail sales, PBM fees, and health services revenue. Express Scripts and Caremark, as dedicated PBMs, generate revenue primarily through fees from health plans and rebates from pharmaceutical manufacturers.

So, Cigna’s suing CVS, Amy Bricker, Express Scripts, and Caremark – a massive legal battle brewing in the healthcare world. It makes you think about the bigger picture of access, especially when you consider the challenges faced by rural hospitals, like those discussed in this insightful article on Rural Hospitals Labor Delivery & – the struggles they face directly impact patient care, which is ultimately what these big pharma fights are supposedly about.

Ultimately, the Cigna lawsuit highlights the complexities of the system impacting everyone, from major players to rural communities.

This creates a complex interplay where their profit maximization might not always align with lowering drug costs for patients. The differing revenue streams and profit structures are central to understanding the conflicts that arise.

Competitive Dynamics in the PBM Industry

The PBM industry is characterized by high consolidation, with a few large players dominating the market. This lack of competition can lead to higher drug prices for consumers, as PBMs have significant leverage in negotiations with pharmaceutical manufacturers. The industry’s opaque pricing structures and spread pricing practices (where PBMs keep the difference between what they pay manufacturers and what they charge insurers) have also drawn considerable scrutiny.

The lawsuit highlights the potential for anti-competitive behavior, such as steering patients toward specific pharmacies or drugs to maximize profits.

Implications of the Lawsuit on the Healthcare Landscape

The outcome of the Cigna lawsuit could significantly impact the healthcare landscape. A ruling in Cigna’s favor could lead to increased transparency in PBM pricing and operations, potentially lowering drug costs for consumers. It could also encourage greater competition within the PBM industry, potentially leading to more favorable contracts for insurers and better value for patients. Conversely, a ruling against Cigna could solidify the current power dynamics, maintaining the status quo of high drug prices and limited transparency.

This case sets a precedent for future legal challenges to PBM practices. The potential for increased regulatory scrutiny and legislative action is also significant.

Examples of Similar Legal Disputes, Cigna sues cvs amy bricker express scripts caremark

Several similar legal disputes have occurred within the PBM sector. These often involve allegations of anti-competitive behavior, unfair pricing practices, and conflicts of interest. For example, numerous lawsuits have been filed against PBMs alleging they manipulate rebates and spread pricing to inflate their profits at the expense of payers and patients. These cases underscore the ongoing concerns about transparency and fair competition within this critical sector of the healthcare system.

The Cigna lawsuit is one of the most high-profile examples of this ongoing trend, signaling a growing push for greater accountability and reform within the PBM industry.

Potential Outcomes and Impacts

The Cigna lawsuit against CVS, Amy Bricker (former Cigna executive), and Express Scripts/Caremark carries significant weight, potentially reshaping the pharmaceutical benefit management (PBM) landscape and impacting healthcare costs and patient access to medications. The outcome will depend on the court’s interpretation of the contracts, evidence presented, and legal arguments made. Several scenarios are possible, each with far-reaching consequences.The potential outcomes are multifaceted and could involve financial settlements, injunctions altering business practices, or even criminal charges, depending on the evidence presented and the court’s findings.

The impact extends beyond the immediate parties involved, affecting the broader healthcare system and influencing future PBM industry practices.

Outcomes for Each Party Involved

Cigna aims to recover damages it alleges resulted from anti-competitive practices. A favorable ruling could significantly impact Cigna’s financial position, potentially leading to increased profits and a stronger negotiating position in future contracts with PBMs. Conversely, an unfavorable outcome could result in substantial financial losses and reputational damage. CVS, Express Scripts/Caremark, and Amy Bricker, if found liable, face potential financial penalties, including substantial fines and compensation payments to Cigna.

They could also experience reputational harm, potentially impacting investor confidence and future business dealings. A complete dismissal of the case would be a significant victory for the defendants, but it would likely lead to further scrutiny of their business practices.

Impact on Healthcare Costs and Patient Access to Medications

The lawsuit’s outcome could significantly influence healthcare costs. If Cigna prevails and demonstrates anti-competitive practices, it could lead to increased transparency and competition within the PBM industry, potentially driving down drug prices. This could benefit patients by improving medication affordability and accessibility. Conversely, a loss for Cigna could reinforce the existing PBM structure, potentially maintaining or even increasing drug costs and limiting patient access.

The potential for increased legal challenges against PBMs might also lead to increased administrative costs for both PBMs and insurers, potentially indirectly impacting patient costs. For example, if increased regulatory oversight is a result of the lawsuit, the administrative burden on PBMs could translate to higher prescription drug prices.

Ramifications for Future Business Practices within the PBM Industry

Regardless of the outcome, this lawsuit is likely to prompt a reassessment of PBM business practices. Increased scrutiny of rebate structures, spread pricing, and other potentially anti-competitive practices is almost certain. The legal arguments presented will likely serve as a precedent for future litigation, influencing how PBMs negotiate with pharmaceutical manufacturers and insurers. We might see a shift towards greater transparency in PBM operations and more stringent regulatory oversight to prevent similar conflicts in the future.

This could involve changes to legislation, influencing the way PBMs operate and are held accountable.

Potential Short-Term and Long-Term Consequences

The following points Artikel potential short-term and long-term consequences of the legal decision:

The potential ramifications are extensive and will unfold over time. Immediate impacts will be felt by the involved companies, while long-term effects will ripple through the healthcare system and the PBM industry.

- Short-Term Consequences:

- Fluctuations in stock prices for Cigna, CVS, and Express Scripts/Caremark.

- Increased media scrutiny and public debate regarding PBM practices.

- Potential changes in business strategies by PBMs to mitigate future legal risks.

- Increased legal costs for all parties involved.

- Long-Term Consequences:

- Changes in PBM regulations and oversight.

- Increased transparency in PBM pricing and rebate structures.

- Potential shifts in market share among PBMs and health insurers.

- Significant impact on drug pricing and patient access to medications.

- The creation of legal precedents that will shape future litigation involving PBMs.

Illustrative Examples (No image links needed)

The Cigna lawsuit against CVS, Amy Bricker, and Express Scripts/Caremark offers a complex scenario with far-reaching consequences. Understanding its potential impact requires looking at specific examples illustrating its effects on patients, internal company communications, and future industry negotiations.

A Patient’s Struggle with Medication Access

Imagine Sarah, a diabetic patient whose insulin requires a prior authorization through Cigna. Before the lawsuit, her prescription was routinely approved. However, post-lawsuit, Express Scripts, facing increased scrutiny and potentially altered reimbursement rates from Cigna, implements stricter prior authorization protocols. Sarah’s prescription is now repeatedly delayed, requiring multiple calls and doctor’s notes. Her insulin supply runs low, leading to health complications requiring emergency room care, costing her thousands of dollars in unexpected medical expenses.

This scenario highlights how even seemingly minor changes in prescription drug access can have significant, and costly, consequences for patients. The cost of her emergency room visit far outweighs the cost of the insulin itself, demonstrating the ripple effect of disputes between insurance providers and PBMs.

Internal Communication at Express Scripts

An internal email chain between Express Scripts’ legal team and its pharmacy benefits management division reveals growing concerns regarding the Cigna lawsuit. The subject line reads: “Cigna Litigation – Potential Impact on Prior Authorization Protocols.” The email chain begins with a legal update summarizing Cigna’s allegations regarding anti-competitive practices and the potential for significant financial penalties. A subsequent email from the PBM division expresses concern about the potential need to revise prior authorization criteria to reduce the risk of further legal action.

The discussion focuses on strategies to minimize financial exposure, including potentially relaxing some authorization requirements, while simultaneously attempting to maintain profitability. This internal communication reflects the pressure and strategic decision-making processes occurring within the company as a direct result of the lawsuit. The tone is cautious, emphasizing risk mitigation and potential financial ramifications.

Influence on Future Negotiations

The Cigna lawsuit will likely force a reevaluation of negotiation strategies between insurance providers and PBMs. Future contracts might include more stringent transparency clauses regarding pricing and rebate structures. Negotiations will likely focus more on value-based care models, incentivizing PBMs to prioritize patient outcomes over pure cost minimization. This shift could lead to a more collaborative approach, with greater emphasis on data sharing and joint efforts to manage prescription drug costs.

The outcome of the lawsuit, regardless of the verdict, will serve as a precedent, influencing future contract negotiations and potentially leading to increased regulatory oversight of PBM practices. This could involve greater transparency in drug pricing and rebate arrangements, potentially shifting the balance of power in the pharmaceutical industry.

Conclusive Thoughts

The Cigna lawsuit against CVS, Amy Bricker, Express Scripts, and Caremark is far more than just a corporate spat; it’s a pivotal moment in the ongoing debate about pharmaceutical pricing and patient access. The outcome will undoubtedly reshape the landscape of the PBM industry, influencing future negotiations and potentially altering how millions access essential medications. The long-term consequences remain uncertain, but one thing is clear: this case will be studied and debated for years to come, shaping the future of healthcare for all of us.

Questions Often Asked: Cigna Sues Cvs Amy Bricker Express Scripts Caremark

What is a PBM?

A Pharmacy Benefit Manager (PBM) is a third-party administrator of prescription drug programs for insurance companies and employers. They negotiate drug prices with pharmaceutical companies and manage prescription drug formularies.

What are the potential penalties for CVS, Express Scripts, and Caremark if found guilty?

Potential penalties could include substantial fines, mandated changes to business practices, and even potential criminal charges depending on the specifics of the alleged wrongdoing.

How might this affect my prescription drug costs?

The outcome could significantly impact prescription drug pricing, potentially leading to either higher or lower costs depending on the court’s decision and subsequent market adjustments. It’s difficult to predict the exact effect on individual patients.

What is Amy Bricker’s current status?

Further research is needed to determine Amy Bricker’s current status and any public statements she has made regarding the lawsuit.