Expenses Ascension 18B Operating Loss

Expenses Ascension 18B Operating Loss: Whoa, that’s a headline-grabber, right? This post dives deep into the terrifying (and sadly, sometimes realistic) scenario of a business facing an astronomical 18 billion dollar operating loss. We’ll explore what could possibly cause such a catastrophic financial event, examine contributing factors from internal management decisions to external market forces, and even brainstorm some potential rescue strategies.

Think of it as a financial thriller, but with real-world implications.

We’ll unpack the meaning of “expenses ascension” in this context – how seemingly manageable costs can balloon into a monster that swallows profits whole. We’ll look at case studies (hypothetical, of course!), analyze the impact of increased material costs and decreased revenue, and even consider the role of government regulations and global market fluctuations. Get ready for a deep dive into the dark side of the business world!

Defining “Expenses Ascension 18B Operating Loss”

Source: slideplayer.com

The term “Expenses Ascension 18B Operating Loss” describes a situation where a company’s operating expenses have risen dramatically, resulting in an operating loss of 18 billion (presumably in a specific currency). “Expenses ascension” refers to a significant and rapid increase in a company’s operational costs. This isn’t simply a gradual rise; it implies a sharp, potentially unsustainable upward trajectory.

An 18B operating loss is a catastrophic financial event, signaling serious problems within the business.

Implications of an 18B Operating Loss

An operating loss of this magnitude has severe consequences. It indicates a substantial gap between a company’s revenues and its expenses. This can lead to immediate liquidity problems, threatening the company’s ability to meet its short-term financial obligations, such as payroll and supplier payments. It also severely damages investor confidence, potentially leading to a significant drop in the company’s stock price and difficulty securing future funding.

Credit rating agencies will likely downgrade the company’s creditworthiness, making borrowing more expensive or even impossible. Ultimately, an 18B operating loss could lead to bankruptcy if not addressed swiftly and effectively.

Business Scenarios Leading to Significant Operating Losses

Several scenarios can contribute to such a massive operating loss. One common cause is a significant drop in revenue coupled with inflexible cost structures. For example, a company heavily reliant on a single product might experience a drastic loss if that product suddenly loses market share due to competition or changing consumer preferences. Another factor could be unexpected and substantial increases in input costs, such as raw materials or energy, without the ability to pass those costs onto consumers through price increases.

Furthermore, major unforeseen events like natural disasters or pandemics can disrupt operations and lead to massive losses. Poor management decisions, including overly ambitious expansion plans or inefficient operations, can also contribute significantly. Finally, accounting irregularities or fraud can artificially inflate expenses, creating the illusion of a larger loss.

Potential Causes of Large Operating Losses Across Different Industries

| Industry | Cause 1 | Cause 2 | Cause 3 |

|---|---|---|---|

| Oil & Gas | Fluctuations in oil prices | Increased exploration and production costs | Geopolitical instability |

| Technology | Increased competition and price wars | High research and development costs | Failure of a major product launch |

| Retail | Shifting consumer preferences | Increased online competition | High inventory costs |

| Manufacturing | Supply chain disruptions | Rising labor costs | Increased raw material prices |

Analyzing Contributing Factors

An 18B operating loss is catastrophic, demanding a thorough investigation into its root causes. Understanding the contributing factors is crucial not only for damage control but also for implementing preventative measures to avoid future occurrences. This analysis focuses on three key areas: escalating material costs, a decline in revenue, and the impact of poor management decisions.Increased Material Costs Impact on Operating LossEscalating material costs significantly impact profitability.

The cost of raw materials, components, or supplies directly affects the production cost of goods or services. A substantial increase in these costs, without a corresponding increase in selling prices, directly erodes profit margins. For example, imagine a manufacturing company reliant on a specific metal whose price doubled due to global supply chain disruptions. This would immediately increase their production costs, potentially leading to a substantial loss if they couldn’t pass on the increased cost to consumers.

The impact is amplified when the increase is unexpected or when the company lacks effective hedging strategies to mitigate price fluctuations. This direct cost pressure, compounded by potentially increased logistics and transportation costs associated with securing materials, can rapidly push a company into an operating loss.Decreased Revenue’s Role in the LossDecreased revenue is another critical factor contributing to significant operating losses.

That whopping $18B operating loss? A huge chunk of that is probably tied to staffing costs. It’s not just about salaries; the intense competition for qualified healthcare workers, as highlighted in this article on healthcare executives say talent acquisition labor shortages business risk , is driving up expenses significantly. Finding and retaining talent is a massive challenge, directly impacting the bottom line and contributing to those staggering losses.

This could stem from various sources, including reduced market demand, increased competition, ineffective marketing strategies, or a failure to innovate and adapt to changing consumer preferences. For instance, a company relying heavily on a single product might face a dramatic revenue drop if that product becomes obsolete or if a competitor launches a superior alternative. The inability to generate sufficient revenue to cover operating expenses, even with efficient cost management, directly results in an operating loss.

The magnitude of the loss is directly proportional to the extent of the revenue decline and the company’s fixed cost structure. Companies with high fixed costs are particularly vulnerable to revenue drops.Poor Management Decisions and Their ConsequencesPoor management decisions can significantly contribute to massive operating losses. This includes strategic errors like misjudging market trends, failing to adapt to technological advancements, making poor investment choices, or neglecting effective risk management.

For example, a company investing heavily in a new product line that fails to gain market traction will face substantial losses. Similarly, a failure to adequately manage inventory, leading to obsolescence or spoilage, can severely impact profitability. Poor financial management, such as taking on excessive debt or failing to secure adequate funding, can further exacerbate the situation.

Ascension’s $18B operating loss is a massive blow, highlighting the financial pressures facing healthcare systems. A significant factor contributing to these struggles could be the increasing costs associated with complying with regulations like those outlined in the hhs healthcare cybersecurity framework hospital requirements cms. These stringent cybersecurity mandates require substantial investments in infrastructure and personnel, directly impacting a hospital’s bottom line and potentially exacerbating losses like Ascension’s.

Lack of transparency and accountability within the organization can also hinder effective problem-solving and lead to costly mistakes. These poor decisions, often stemming from a lack of foresight, effective planning, or competent leadership, can quickly escalate into a major financial crisis resulting in significant operating losses.

Exploring Mitigation Strategies: Expenses Ascension 18b Operating Loss

Source: slideplayer.com

Facing an operating loss, especially one as significant as the Expenses Ascension 18B shortfall, requires a swift and decisive response. Mitigation strategies must be multifaceted, addressing both immediate needs and long-term structural issues. A well-defined plan, combining short-term cost-cutting with long-term efficiency improvements, is crucial for restoring profitability.A comprehensive plan to reduce operating expenses should prioritize identifying areas of waste and inefficiency, then implement targeted interventions to reduce costs without compromising essential services or long-term growth.

This requires a thorough review of all departmental budgets, operational processes, and supply chain management. The goal is not simply to cut costs, but to optimize resource allocation for maximum impact.

Short-Term Cost-Cutting Measures

Implementing immediate cost-cutting measures is essential to stabilize the financial situation. These actions should be swiftly executed and deliver quick results, providing immediate relief to the bottom line. While these measures are temporary, they are vital for buying time to implement longer-term solutions.

- Reduce discretionary spending: This includes cutting back on non-essential travel, marketing campaigns, and training programs. A thorough review of all departmental budgets can uncover significant savings.

- Negotiate better terms with suppliers: Exploring options like bulk purchasing, renegotiating contracts, or switching to lower-cost suppliers can yield substantial savings on materials and services.

- Implement a hiring freeze: Postponing new hires, except for critical roles, helps control labor costs, a major expense for most businesses. This also prevents adding further financial burden until the company’s financial stability improves.

- Reduce overtime: Optimizing work schedules and streamlining processes can minimize the need for overtime, directly impacting labor costs. This may involve improving workflow efficiency or investing in automation.

Long-Term Strategies for Operational Efficiency

Long-term strategies focus on building sustainable efficiency into the core operations of the business. These changes may take longer to implement but will deliver lasting cost savings and improved profitability. Investing in these strategies is an investment in the future health and stability of the company.

- Invest in technology: Automating repetitive tasks through software and robotics can significantly reduce labor costs and improve efficiency. For example, automating invoice processing or customer service inquiries can free up staff for more strategic work.

- Streamline processes: Analyzing workflows to identify bottlenecks and inefficiencies can reveal areas for improvement. Lean methodologies, for instance, focus on eliminating waste and optimizing processes for maximum efficiency.

- Improve supply chain management: Optimizing inventory management, negotiating better terms with suppliers, and exploring alternative sourcing strategies can significantly reduce supply chain costs. Implementing just-in-time inventory management can significantly reduce storage costs.

- Employee training and development: Investing in employee training can improve productivity and reduce errors, leading to cost savings in the long run. Focusing training on efficiency and process improvement techniques will yield the best results.

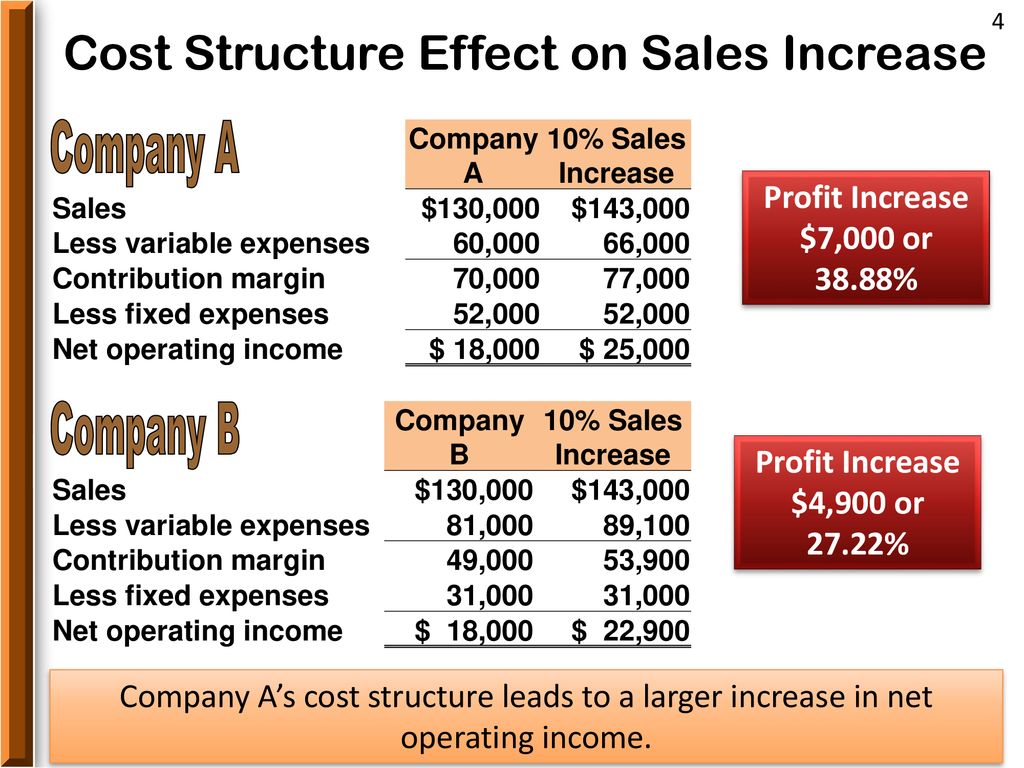

Impact of Improved Operational Efficiency on the Bottom Line

Improved operational efficiency directly translates to a healthier bottom line. By reducing expenses and increasing productivity, a company can increase its profit margin. For example, a 10% reduction in operating expenses, coupled with a 5% increase in productivity, can significantly improve profitability. This can be illustrated with a simple example: if a company’s operating expenses were $1 million and its revenue was $1.5 million, resulting in a $500,000 profit, a 10% reduction in expenses ($100,000) would increase the profit to $600,000.

Further, a 5% increase in productivity, potentially generating an additional $75,000 in revenue, would push the profit to $675,000 – a substantial improvement. This demonstrates the power of focusing on both cost reduction and efficiency gains.

Investigating External Factors

Understanding the Expenses Ascension 18B operating loss requires a thorough examination of external factors beyond the company’s internal operations. These external pressures can significantly amplify or mitigate the impact of internal challenges, making a comprehensive analysis crucial for developing effective mitigation strategies. This section delves into the influence of macroeconomic conditions, regulatory changes, and global market dynamics on the operating loss.

Economic Downturns and Industry-Specific Challenges

Economic downturns exert a broad impact across various sectors, reducing consumer spending and investment. This can lead to decreased demand for products or services, resulting in lower revenue and increased operating losses. However, industry-specific challenges can be even more impactful, as they directly affect a company’s core business model. For example, a sudden surge in raw material costs within a specific industry could severely impact profitability regardless of the overall economic climate.

The Expenses Ascension 18B loss may be a result of a combination of both, with a general economic slowdown exacerbating pre-existing industry-specific headwinds. A comparison of the relative impact requires a detailed analysis of revenue streams and cost structures within the context of both macroeconomic and industry-specific trends.

Seeing that 18B operating loss from escalating expenses is a huge concern, it’s interesting to see how other companies are navigating similar challenges. For example, Walgreens’ improved outlook, following their Summit acquisition, as reported in this article walgreens raises healthcare segment outlook summit acquisition , suggests strategic moves can mitigate financial pressures. Ultimately, though, managing rising expenses remains a key challenge across the board, impacting even large players.

Government Regulation Changes

Changes in government regulations can have a profound impact on a company’s operations and profitability. New environmental regulations, for instance, might necessitate costly upgrades to production facilities, increasing operating expenses. Similarly, changes in tax laws or trade policies can directly affect a company’s bottom line. For Expenses Ascension 18B, a careful review of any recent regulatory changes within its operating environment is needed to determine their contribution to the operating loss.

The implementation of stricter emission standards, for example, might have increased compliance costs without a corresponding increase in revenue, directly impacting profitability.

Global Market Fluctuations, Expenses ascension 18b operating loss

Global market fluctuations, such as currency exchange rate shifts and commodity price volatility, can significantly influence a company’s financial performance, particularly for those with international operations. Unexpected changes in exchange rates can affect the cost of imported goods and the revenue generated from exports. Similarly, fluctuations in commodity prices can dramatically impact the cost of raw materials, leading to higher production costs and reduced profitability.

For Expenses Ascension 18B, the extent of its exposure to global market fluctuations needs to be assessed to understand the magnitude of their influence on the operating loss. For instance, a sudden increase in the price of a key raw material due to geopolitical instability could have directly contributed to the loss.

Potential External Factors Influencing Expenses Ascension 18B Operating Loss

The following points summarize potential external factors that might have contributed to the Expenses Ascension 18B operating loss:

- A general economic recession leading to decreased consumer demand.

- Increased competition within the industry, leading to price wars and reduced profit margins.

- Significant increases in the cost of raw materials or essential resources.

- Changes in government regulations impacting operational costs or market access.

- Unfavorable shifts in currency exchange rates impacting international trade.

- Geopolitical instability impacting supply chains or market access.

- Unexpected natural disasters or extreme weather events disrupting operations.

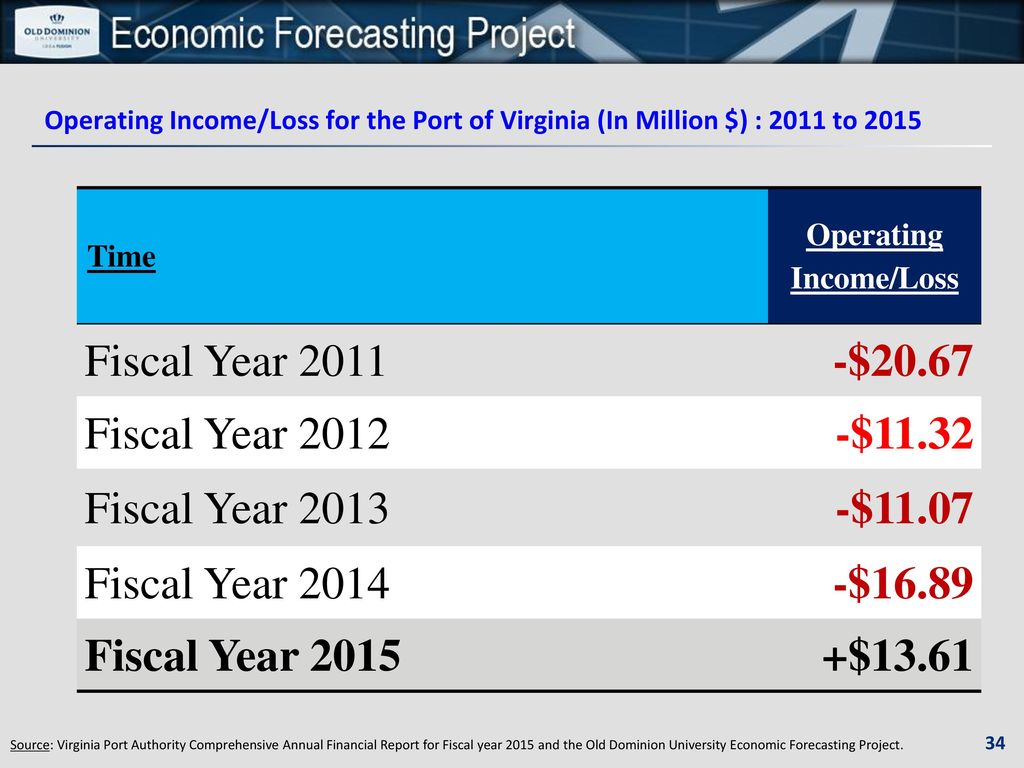

Visual Representation of the Problem

A compelling visual is crucial for understanding the magnitude of the $18B operating loss. A simple bar chart comparing expenses and revenue over a relevant timeframe (e.g., the past five years) will effectively illustrate the widening gap leading to the significant loss. The visual should be clear, concise, and easily digestible, even for those without a financial background.The visual needs to accurately reflect the scale of the loss.

Using a properly scaled y-axis is paramount. The difference between revenue and expenses should be clearly highlighted, ideally with a distinct color or shading to represent the operating loss itself. This visual emphasis will instantly convey the severity of the financial situation.

Chart Design and Data Representation

The chart will use a simple, two-color bar graph. The x-axis will represent the fiscal year, and the y-axis will represent the dollar amount (in billions). Revenue will be represented by one color (e.g., blue), and expenses will be represented by another (e.g., red). The area where the red bar exceeds the blue bar will represent the operating loss, and will be clearly differentiated with a distinct visual cue, perhaps a hatched pattern or a different shade of red.

Data points will be labeled clearly, directly above or below each bar, showing the exact billion-dollar figure for revenue and expenses in each fiscal year. A clear title (“Expenses vs. Revenue and Operating Loss”) and concise axis labels will enhance readability.

Highlighting the $18B Loss

The $18B operating loss for the most recent fiscal year should be prominently displayed. This could be achieved through a different color or highlighting technique for the bar representing the loss in that specific year. Adding a callout box directly pointing to this bar with the figure “$18B Operating Loss” written in bold would also draw immediate attention to the magnitude of the problem.

The overall visual design should avoid clutter, ensuring the key information (revenue, expenses, and the loss) is easily discernible. A legend clarifying the colors and their corresponding data points will further enhance understanding.

Illustrative Example

Imagine a bar chart showing revenue steadily increasing from $50B in Year 1 to $75B in Year 5. However, expenses are shown to rise even more sharply, from $45B in Year 1 to $93B in Year 5. The resulting loss in Year 5 would be clearly represented by the red bar extending significantly beyond the blue bar, visually demonstrating the $18B difference.

The visual would clearly show the disproportionate growth in expenses compared to revenue, directly leading to the substantial operating loss.

Case Study Development

This case study examines GlobalTech Solutions, a hypothetical multinational technology company, to illustrate the complexities of an $18 billion operating loss. We’ll analyze its industry position, initial financial health, contributing factors to the loss, and the breakdown of its expenses and revenue streams.

GlobalTech Solutions, a leading provider of cloud-based enterprise software solutions, initially held a strong market position. Prior to the fiscal year in question, the company boasted a market capitalization exceeding $100 billion, consistent profitability, and a reputation for innovation. Its strong financial standing attracted significant investment and fostered aggressive expansion strategies.

Company Profile and Initial Financial State

GlobalTech Solutions operated within the highly competitive Software as a Service (SaaS) market. Before the significant loss, the company reported annual revenues consistently exceeding $25 billion, with a healthy operating margin of approximately 15%. Its balance sheet displayed strong liquidity and a robust cash reserve. The company had a diverse client base, including Fortune 500 companies and smaller businesses.

Its workforce numbered over 50,000 employees globally.

Events Leading to the Operating Loss

The $18 billion operating loss stemmed from a confluence of factors. Firstly, the company embarked on an ambitious expansion strategy involving several high-risk acquisitions. These acquisitions, while initially promising, failed to integrate smoothly, leading to significant write-downs and integration costs. Secondly, a major product launch, intended to disrupt the market, faced unexpected technical challenges and negative customer reviews, resulting in substantial development costs and lost sales.

Thirdly, increased competition from agile startups and established players eroded GlobalTech’s market share. Finally, a significant shift in market demand towards a competing technology resulted in a rapid decline in revenue from their flagship product.

Expense and Revenue Breakdown

GlobalTech’s revenue streams were primarily derived from subscription fees for its cloud-based software solutions and professional services. However, the aforementioned challenges significantly impacted revenue generation. On the expense side, the company experienced substantial increases in research and development costs related to the failed product launch, acquisition integration costs, and write-downs related to impaired assets. Marketing and sales expenses also increased significantly in an attempt to regain lost market share, ultimately proving ineffective given the combination of the failed product launch and shifting market demands.

Operating expenses, including salaries and administrative costs, remained relatively stable, but the overall impact of the increased costs outweighed any potential savings. The massive increase in expenses, coupled with a significant decline in revenue, directly contributed to the $18 billion operating loss.

Closing Summary

Facing an 18B operating loss is a nightmare scenario for any business, but understanding the potential causes and developing proactive mitigation strategies is crucial for survival. While the sheer scale of this loss might seem insurmountable, remember that even in the face of seemingly insurmountable odds, strategic planning, cost-cutting measures, and a clear understanding of market forces can make a significant difference.

The key takeaway? Vigilance, smart decision-making, and a proactive approach to risk management are vital for long-term financial health. Let’s hope we never have to face a situation like this, but understanding it is crucial.

FAQ Overview

What are some early warning signs of potential massive operating losses?

Early warning signs can include steadily declining profit margins, unexpected increases in expenses, slowing revenue growth, cash flow problems, and a general decline in operational efficiency.

Can a company ever truly recover from an 18B operating loss?

Recovery from such a massive loss is incredibly challenging but not impossible. It requires aggressive restructuring, significant cost-cutting, potentially seeking external investment or even bankruptcy protection, and a complete overhaul of business operations and strategy.

What role does the industry play in determining the impact of an operating loss?

The industry plays a huge role. A 18B loss might be catastrophic for a smaller company but might be more manageable (though still devastating) for a massive multinational corporation. Industry-specific factors like competition and market trends also influence the recovery process.