Friday Health Plans shuts down The Fallout

Friday Health Plans shuts down – the news hit hard. Suddenly, thousands of employees are facing unemployment, investors are counting losses, and consumers are scrambling to find new healthcare providers. This unexpected collapse leaves a trail of questions and uncertainty, impacting not only those directly involved but also highlighting vulnerabilities within the healthcare industry. This post dives into the aftermath, exploring the impact on employees, investors, and consumers, and examining the lessons we can learn from this significant event.

The abrupt closure of Friday Health Plans raises serious concerns about the stability of the healthcare market and the potential for similar disruptions. We’ll analyze the financial factors that contributed to the company’s downfall, explore the regulatory implications, and consider the long-term consequences for patients and the broader healthcare ecosystem. We’ll also look at what steps could have been taken to prevent this situation and how we can improve the resilience of healthcare providers in the future.

Impact on Employees

Source: amazonaws.com

The sudden shutdown of Friday Health Plans has undoubtedly left a significant mark on its employees, raising concerns about job security, financial stability, and future career prospects. The scale of job losses and the support offered to those affected are key indicators of the company’s handling of this difficult situation and its overall approach to employee welfare.The number of employees affected by Friday Health Plans’ closure remains to be precisely determined, but reports suggest a substantial loss of jobs across various departments.

This includes not only the roles directly involved in healthcare operations but also supporting functions like IT, administration, and marketing. The exact figure will likely emerge as official statements are released and severance packages are processed.

Severance Packages Offered

The details surrounding severance packages offered to laid-off employees are crucial for assessing the level of support provided. While the specifics haven’t been publicly released in their entirety, initial reports suggest variations based on tenure and position. Some reports indicate that employees received severance pay equivalent to a few weeks or months of their salary, potentially coupled with benefits continuation for a limited period.

However, without official confirmation from the company or reliable third-party sources, it’s difficult to provide a comprehensive overview. The absence of transparent communication on this matter contributes to the uncertainty and anxiety experienced by former employees.

Comparison to Industry Standards

Comparing Friday Health Plans’ employee support to industry standards requires a nuanced approach. Severance packages in the tech and healthcare sectors, particularly in instances of company closure, can vary widely. Factors like company size, financial health prior to closure, and prevailing labor laws all play a significant role. While some companies offer generous severance packages extending several months of salary, along with extended healthcare benefits and outplacement services, others provide minimum legal requirements.

Without detailed information on Friday Health Plans’ offerings, a direct comparison remains challenging. However, it is important to note that the absence of transparent communication around severance packages may lead to perceptions of inadequate support compared to industry best practices, especially when contrasted with companies known for prioritizing employee well-being even during restructuring.

Hypothetical Employee Support Program

A robust employee support program for future similar situations should prioritize transparency and proactive communication. It should include a clearly defined severance package structure, readily accessible to all employees, irrespective of their role or tenure. This package should ideally exceed minimum legal requirements and offer extended health insurance coverage, outplacement services (including resume assistance and job search support), and financial counseling.

Furthermore, a dedicated support team should be available to address employee concerns and provide guidance during the transition. For instance, a program could include:

- Severance pay equivalent to at least two months’ salary, plus one additional week for every year of service.

- Extended health insurance coverage for at least six months.

- Access to career counseling and outplacement services, including resume writing workshops and interview preparation sessions.

- Financial counseling services to assist with budgeting and debt management.

- Regular communication updates from company leadership throughout the transition period.

This hypothetical program emphasizes a proactive and empathetic approach, minimizing the uncertainty and hardship faced by employees during a challenging time. It prioritizes not only financial support but also the emotional and career well-being of affected individuals. Learning from past experiences, particularly those involving large-scale layoffs, is crucial in developing effective and compassionate employee support programs.

Financial Implications for Investors

The abrupt shutdown of Friday Health Plans sent shockwaves through the investment community, leaving many investors facing significant financial losses. The company’s failure highlights the inherent risks associated with investing in the volatile healthcare sector, particularly in startups operating within a complex regulatory environment. Understanding the reasons behind Friday Health Plans’ downfall is crucial for assessing the extent of investor losses and learning valuable lessons for future investments.The primary reasons for Friday Health Plans’ financial difficulties appear to be a combination of factors.

Aggressive expansion strategies, coupled with intense competition in the healthcare marketplace, strained the company’s resources. Difficulties in securing sufficient funding and maintaining profitability in a highly regulated industry also contributed to the company’s ultimate demise. Furthermore, challenges in managing operational costs and achieving sufficient customer acquisition likely played a role in the company’s financial struggles. These factors ultimately led to the company’s inability to meet its financial obligations, resulting in its closure.

So Friday Health Plans shutting down is a bummer, especially considering the complexities of healthcare access. It makes you wonder if more robust digital solutions could prevent similar situations, like those explored in this fascinating study on the widespread use of digital twins in healthcare: study widespread digital twins healthcare. Perhaps a more proactive, data-driven approach, like what digital twins offer, could help identify and address potential vulnerabilities before they lead to a company collapse.

The Friday Health Plans situation highlights the need for innovation in healthcare management.

Comparison to Similar Healthcare Company Failures

The financial repercussions for investors in Friday Health Plans are unfortunately not unique in the healthcare industry. Several other healthcare startups have experienced similar fates, resulting in substantial losses for investors. For instance, the collapse of Theranos, a blood-testing company, resulted in billions of dollars in losses for investors who had initially poured significant sums into the company based on overly optimistic projections.

Similarly, the failure of several telehealth companies during the post-pandemic downturn underscores the risks involved in this rapidly evolving sector. The common thread in these failures often involves overvaluation, unrealistic growth projections, and insufficient operational planning.

So, Friday Health Plans shutting down is a bummer, especially considering the complexities of healthcare tech. It makes you think about the future of streamlined systems, and how advancements like the integration of Nuance’s generative AI scribe with Epic EHRs, as detailed in this article nuance integrates generative ai scribe epic ehrs , could potentially improve efficiency and reduce administrative burdens for surviving companies.

Ultimately, though, Friday Health’s closure highlights the ongoing challenges in navigating the healthcare landscape.

Potential Investor Losses

The actual losses experienced by investors in Friday Health Plans will vary depending on several factors, including the amount invested, the timing of the investment, and the type of investment (e.g., equity, debt). However, we can illustrate potential losses using a hypothetical scenario. The table below shows potential losses based on different investment sizes and holding periods. These are estimations and do not reflect actual losses experienced by individual investors.

The actual losses could be higher or lower depending on the specific circumstances.

| Investment Size | Holding Period (Years) | Estimated Loss (Percentage) | Example Loss ($) |

|---|---|---|---|

| $10,000 | 1 | 75% | $7,500 |

| $50,000 | 2 | 90% | $45,000 |

| $100,000 | 3 | 80% | $80,000 |

| $500,000 | 1 | 60% | $300,000 |

Effect on Healthcare Consumers

The sudden closure of Friday Health Plans leaves thousands of consumers scrambling to find new healthcare coverage. This disruption can be stressful and confusing, particularly for those who rely on the specific network of doctors and hospitals provided by Friday Health Plans. Understanding the options available and taking proactive steps to secure new coverage is crucial to maintaining uninterrupted access to healthcare services.The immediate impact includes loss of existing coverage, potentially resulting in gaps in healthcare access.

Patients may face difficulties scheduling appointments, filling prescriptions, or accessing necessary medical care. The transition to a new plan may also involve navigating complex paperwork, understanding new benefits and cost-sharing structures, and potentially facing higher premiums or deductibles.

Alternative Healthcare Providers for Affected Individuals

Finding a suitable replacement health insurance plan requires careful consideration of individual needs and circumstances. Several major insurers operate in the areas previously served by Friday Health Plans. These companies offer a range of plans with varying levels of coverage and cost. It’s essential to compare plans based on factors like your doctor’s network participation, prescription drug coverage, and overall out-of-pocket expenses.

State insurance marketplaces, such as those run by the Affordable Care Act (ACA), can be invaluable resources in this process. Many independent insurance brokers also offer assistance in navigating the options and selecting the most appropriate plan.

Step-by-Step Guide to Transitioning to New Healthcare Plans

1. Gather Information Collect your Friday Health Plans policy information, including member ID, group number, and covered dependents. Note any existing medical conditions and current prescriptions.

2. Research Alternative Plans Explore plans offered by competing insurance providers in your area. Utilize online comparison tools provided by your state’s insurance marketplace or consult with an independent insurance broker.

3. Compare Plans Carefully review the details of each plan, focusing on network coverage, prescription drug formularies, and out-of-pocket costs. Consider your personal healthcare needs and preferences when making your selection.

4. Enroll in a New Plan Once you’ve selected a plan, complete the enrollment process through the insurer’s website or via a broker. Meet any deadlines for enrollment to avoid gaps in coverage.

5. Inform Your Providers Notify your doctors and other healthcare providers about your change in insurance coverage. Provide them with your new insurance information to ensure seamless continuity of care.

6. Update Prescriptions Contact your pharmacy and your doctor to update your prescription information with your new insurance provider.

Comparison of Coverage and Costs Offered by Competing Health Insurance Providers

| Insurer | Plan Type | Monthly Premium (Example) | Annual Deductible (Example) |

|---|---|---|---|

| UnitedHealthcare | Bronze | $300 | $6,000 |

| Anthem Blue Cross | Silver | $450 | $4,000 |

| Blue Shield of California | Gold | $600 | $2,000 |

| Kaiser Permanente | HMO | $550 | $1,500 |

*Note: Premium and deductible amounts are illustrative examples and will vary based on plan specifics, location, age, and health status. Contact individual insurers for accurate and up-to-date pricing.*

Regulatory and Legal Ramifications

Source: prnewswire.com

The abrupt shutdown of Friday Health Plans will undoubtedly trigger a cascade of regulatory scrutiny and potential legal actions. The company’s failure to adequately manage its financial resources and provide consistent service to its policyholders raises serious questions about its compliance with state and federal regulations governing health insurance providers. This situation necessitates a thorough examination of the company’s practices and a potential reassessment of regulatory frameworks to prevent similar occurrences.The potential legal and regulatory ramifications are far-reaching and could involve multiple agencies at both the state and federal levels.

So Friday Health Plans shutting down is a big deal, right? It makes you think about access to healthcare, especially in underserved areas. This directly impacts the already strained resources of rural hospitals, many of which are struggling to maintain essential services like labor and delivery, as highlighted in this insightful article on Rural Hospitals Labor Delivery &.

The closure of Friday Health Plans further underscores the fragility of our healthcare system, particularly in rural communities.

Investigations will likely focus on whether Friday Health Plans adhered to all applicable insurance regulations, including those related to solvency, reserve requirements, and consumer protection. The Department of Insurance in each state where Friday Health Plans operated will play a key role, along with federal agencies like the Centers for Medicare & Medicaid Services (CMS) if any federal programs were involved.

Anticipated Regulatory Investigations and Lawsuits

State insurance departments will likely initiate investigations into Friday Health Plans’ financial practices, focusing on whether the company accurately reported its financial condition and met minimum capital requirements. Lawsuits from consumers who experienced disruptions in coverage or access to care are highly probable. These lawsuits could allege breach of contract, negligence, and violations of state consumer protection laws.

Furthermore, investigations might uncover potential violations of anti-fraud statutes if irregularities are found in the company’s financial reporting or operational practices. For example, if it’s discovered that Friday Health Plans knowingly misrepresented its financial stability to secure funding or attract customers, criminal charges could be filed against responsible individuals. The investigation process would involve reviewing financial records, interviewing employees and executives, and potentially employing forensic accounting techniques to identify any fraudulent activities.

The outcome could lead to significant fines, restitution for affected consumers, and even criminal prosecution.

Potential Legal Implications for Executives and Board Members

Executives and board members of Friday Health Plans face potential legal liabilities, particularly if investigations reveal negligence, mismanagement, or fraudulent activities. They could be personally held accountable for any losses suffered by policyholders or investors. This could include civil lawsuits alleging breach of fiduciary duty, where directors and officers failed to act in the best interests of the company and its stakeholders.

Furthermore, if intentional wrongdoing is proven, such as knowingly misleading investors or regulators, criminal charges could be filed. The severity of the penalties will depend on the findings of the investigations and the specific actions taken by the individuals involved. Past cases involving similar corporate failures have resulted in significant fines, bans from serving as corporate officers, and even imprisonment for executives and board members.

Comparison to Past Regulatory Actions Against Similar Companies

The situation surrounding Friday Health Plans’ collapse bears similarities to past failures of health insurance companies, such as the collapse of several smaller health insurers during the Affordable Care Act’s initial rollout. In those instances, regulatory actions focused on ensuring the solvency of remaining insurers and protecting consumers who lost coverage. This often involved increased scrutiny of financial reporting, stricter reserve requirements, and heightened oversight of the insurance market.

The regulatory response to Friday Health Plans’ failure will likely follow a similar pattern, potentially leading to increased regulatory oversight of the health insurance industry, particularly for smaller, rapidly growing companies. For instance, the state insurance departments might implement more stringent financial reporting requirements, more frequent audits, and stricter capital reserve requirements to prevent a recurrence of similar situations.

Hypothetical Regulatory Response to Mitigate Future Failures

A hypothetical regulatory response to prevent future failures could involve several key components. First, enhanced financial reporting and auditing requirements could provide regulators with a more comprehensive view of the financial health of health insurance companies. This would include more frequent audits, stricter scrutiny of actuarial models, and increased transparency in financial reporting. Second, stricter capital reserve requirements would ensure that companies have sufficient funds to cover unexpected losses and maintain solvency.

This could involve a tiered system based on company size and risk profile. Third, improved consumer protection measures could provide better safeguards for policyholders in the event of insurer failure. This might include a more streamlined process for transferring coverage to another insurer, and increased access to dispute resolution mechanisms. Finally, increased collaboration between state and federal regulators would improve coordination and oversight of the health insurance industry, ensuring that all companies are complying with regulations and maintaining financial stability.

Lessons Learned from the Shutdown

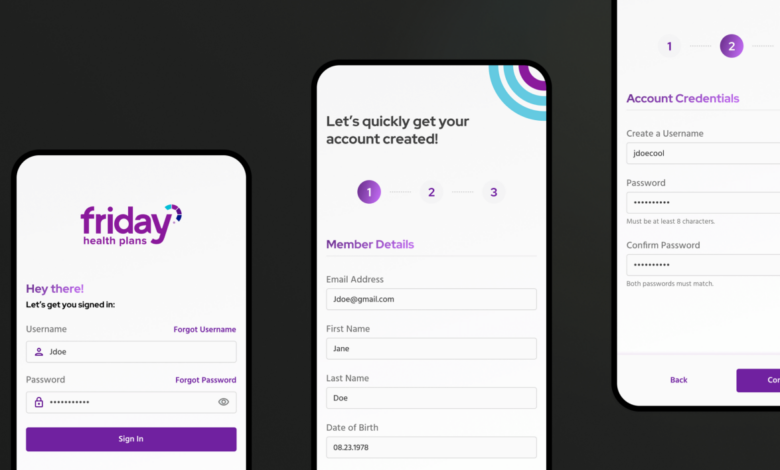

Source: deptagency.com

Friday Health Plans’ abrupt shutdown serves as a stark reminder of the challenges inherent in disrupting the healthcare industry. While the company aimed to offer affordable and accessible healthcare, several factors contributed to its downfall, offering valuable lessons for future ventures in this complex market. Analyzing these factors can help prevent similar failures and foster a more sustainable approach to healthcare innovation.The demise of Friday Health Plans highlights the crucial interplay between operational efficiency, market dynamics, and regulatory compliance in the healthcare sector.

A thorough examination of these aspects, coupled with a comparison to successful models, reveals key areas where improvements could have been implemented.

Key Factors Contributing to Friday Health Plans’ Failure

Several interconnected factors contributed to Friday Health Plans’ failure. Insufficient capital, coupled with rapid expansion into new markets before achieving profitability in existing ones, proved unsustainable. Aggressive pricing strategies, while attractive to consumers, likely squeezed profit margins to dangerously low levels. Furthermore, challenges in managing operational costs and efficiently handling claims processing likely exacerbated the financial strain.

The company’s reliance on a primarily digital platform, while innovative, may have hindered personalized customer service and effective communication, potentially leading to increased customer churn and dissatisfaction. Finally, navigating the complex regulatory landscape of healthcare proved challenging, potentially resulting in penalties or fines that further strained the company’s finances.

Strategies That Could Have Prevented the Shutdown

A more measured approach to expansion, prioritizing profitability over rapid market penetration, could have significantly improved Friday Health Plans’ prospects. Focusing on a smaller, more manageable geographic area initially, allowing for the development of robust operational processes and customer service infrastructure, would have provided a stronger foundation for growth. A more diversified revenue model, perhaps incorporating value-added services or partnerships with other healthcare providers, could have mitigated reliance on narrow margins.

Additionally, a stronger emphasis on data analytics to optimize operational efficiency and accurately predict future costs would have provided valuable insights for strategic decision-making. Proactive engagement with regulatory bodies to ensure full compliance and mitigate potential penalties would have reduced financial risk.

Comparison to Successful Healthcare Companies

Unlike Friday Health Plans, successful healthcare companies often prioritize a phased approach to expansion, ensuring profitability in each market before moving to the next. Companies like Kaiser Permanente, with their integrated delivery system, demonstrate the benefits of vertical integration, controlling various aspects of healthcare delivery to improve efficiency and coordination. Other successful models, like the large, established insurance providers, emphasize strong risk management and careful financial planning.

These companies typically have more diversified revenue streams and extensive experience navigating the regulatory environment. They also prioritize customer retention through excellent customer service and proactive communication.

Informing Future Healthcare Business Strategies, Friday Health Plans shuts down

The experience of Friday Health Plans underscores the need for a pragmatic approach to healthcare innovation. Future ventures should prioritize financial sustainability, robust operational efficiency, and thorough regulatory compliance from the outset. A measured growth strategy, coupled with a diverse revenue model and a strong focus on customer service, are crucial for long-term success. Furthermore, leveraging data analytics and technological advancements to improve operational efficiency and personalize customer experiences is vital.

Understanding the intricacies of the healthcare market and the regulatory landscape is paramount, requiring significant expertise and proactive engagement with regulatory bodies. Ultimately, a sustainable healthcare business model requires a balance between innovation, efficiency, and responsible financial management.

Visual Representation of the Impact: Friday Health Plans Shuts Down

Visualizing the multifaceted impact of Friday Health Plans’ shutdown requires a strategic approach using different types of charts and infographics. A well-designed visual representation can effectively communicate the complex interplay between the effects on employees, investors, and consumers, highlighting the severity and scope of the situation. This would be far more impactful than simply presenting raw data.The most effective way to show this would be through a combination of visuals.

One infographic would focus on the human cost and financial fallout, while a separate timeline chart would illustrate the sequence of events leading to the closure.

Infographic: The Human and Financial Cost

This infographic would utilize a circular design, with three main sections representing employees, investors, and consumers. Each section would be color-coded for easy identification: employees in a muted blue representing stability and trust, investors in a deep red highlighting risk and loss, and consumers in a calming green symbolizing healthcare access. Within each section, data visualization would use a combination of icons (e.g., a person for employees, a dollar sign for investors, a medical cross for consumers), bar graphs showing job losses, investment losses, and the number of consumers affected respectively, and short, impactful text summarizing the key consequences.

For example, the employee section might show the number of job losses and the average salary lost, while the investor section could display the percentage drop in stock value and the overall financial impact. The consumer section would show the number of people losing coverage and the potential difficulties in finding alternative plans. The overall design would be clean and minimalist, using a sans-serif font for readability and a consistent color palette to maintain a cohesive look.

Timeline Chart: Events Leading to Shutdown

A horizontal bar chart would be ideal for displaying the timeline. The x-axis would represent time, marked with key dates and events. The y-axis would list the significant events leading to the shutdown, such as funding rounds, regulatory actions, significant financial losses, and ultimately, the announcement of the closure. Each event would be represented by a colored bar extending from its start date to its end date (or projected end date, if applicable).

The color scheme could use a gradient from light grey (early stages) to dark grey (later stages, culminating in black for the shutdown announcement). This visual representation would clearly illustrate the progression of events and highlight critical turning points contributing to the company’s demise. Data points would include specific dates, financial figures (e.g., amount of funding received or lost), and concise descriptions of each event.

Clear axis labels and a concise title would enhance readability and understanding. For example, a bar might show “Series B Funding – $50M” with the dates of the funding round. Another might show “Regulatory Fine – $10M” with the corresponding date. The final bar would be “Shutdown Announcement” in black.

Closing Notes

The shutdown of Friday Health Plans serves as a stark reminder of the inherent risks within the healthcare industry. The ripple effects – impacting employees, investors, and consumers alike – underscore the need for greater transparency, robust financial planning, and proactive regulatory oversight. While the immediate aftermath is filled with uncertainty and hardship, the lessons learned from this event can inform future strategies and help prevent similar crises from unfolding.

The focus now shifts towards supporting those affected and ensuring the stability of the healthcare system for everyone.

Essential FAQs

What severance packages were offered to Friday Health Plans employees?

Details on severance packages haven’t been publicly released yet, but it’s expected that information will become available as legal processes unfold.

Can I still access my medical records from Friday Health Plans?

Contact the state insurance commissioner’s office or the relevant regulatory body for guidance on accessing your records. They should be able to direct you to the appropriate channels.

What are my options if I was mid-treatment with a Friday Health Plans doctor?

You’ll need to find a new provider and potentially request your medical records from Friday Health Plans or their designated record custodian to ensure a smooth transition of care.

Will Friday Health Plans be investigated by regulators?

It’s highly likely that regulatory investigations will occur, given the scale of the company’s collapse and its impact on patients and investors. The nature and extent of these investigations will become clearer in time.