Why Do Some People Cry So Easily? Possible Causes

Why do some people cry so easily possible causes – Why do some people cry so easily? Possible causes are surprisingly multifaceted, weaving together threads of genetics, neurology, psychology, hormones, and even societal influences. Understanding why some individuals experience heightened emotional responses, manifested in easy crying, requires a nuanced look at the interplay of these factors. This exploration delves into the biological mechanisms, psychological processes, and social contexts that contribute to this common human experience.

From the inherited temperament that makes some more sensitive to the impact of hormonal fluctuations, from the role of neurotransmitters to the influence of past trauma, we’ll examine the complex tapestry of factors that determine individual emotional reactivity. We’ll also explore how cultural norms and social pressures can shape the expression of emotions, influencing when and how tears might flow.

This isn’t about judging emotional responses; it’s about understanding the diverse pathways that lead to them.

Emotional Sensitivity and Temperament

Understanding why some individuals cry more easily than others often involves exploring the complex interplay of genetics, personality, and learned behaviors. While environmental factors undoubtedly play a role, a significant portion of our emotional reactivity is rooted in our inherent temperament and genetic predispositions. This section delves into the fascinating relationship between our inborn traits and our propensity for emotional displays.

Our emotional responses, including our tendency to cry, are significantly influenced by our genetic makeup. Genes don’t directly dictate whether we’ll cry easily, but they influence the development of our nervous system and brain chemistry, which, in turn, affects our emotional regulation and reactivity. For instance, variations in genes related to neurotransmitter production (like serotonin and dopamine) can impact how we process and experience emotions.

Individuals with certain genetic variations might have a lower threshold for emotional overwhelm, leading to more frequent tears. This isn’t a simple “cry gene,” but rather a complex interplay of multiple genes affecting multiple pathways within the brain.

Genetic Influence on Emotional Reactivity

Research in behavioral genetics highlights the heritability of emotional traits. Twin studies, comparing identical (monozygotic) and fraternal (dizygotic) twins, consistently demonstrate a significant genetic component to emotional stability and reactivity. Identical twins, sharing nearly identical genes, tend to exhibit more similar levels of emotional expressiveness than fraternal twins, suggesting a strong genetic influence. While environmental factors shape individual experiences, the foundation of our emotional landscape is laid down through our genes.

Personality Traits Associated with Easy Crying

Certain personality traits are often associated with a greater tendency towards emotional displays, including crying. These traits aren’t inherently negative; they simply reflect different ways of processing and expressing emotions.

- High neuroticism: Individuals high in neuroticism tend to experience more negative emotions, including anxiety and sadness, which can manifest as frequent crying.

- High empathy: People with high levels of empathy are deeply affected by the emotions of others, and this sensitivity can easily lead to tears, especially when witnessing suffering or injustice.

- High emotional expressiveness: Some individuals are simply more comfortable and open about expressing their emotions, including sadness, through crying. This isn’t necessarily a sign of weakness but rather a reflection of their personality style.

Emotional Sensitivity versus Emotional Instability

It’s crucial to distinguish between emotional sensitivity and emotional instability. While both can involve readily expressing emotions, they represent different underlying mechanisms.

Emotional sensitivity refers to a heightened awareness and responsiveness to emotions, both one’s own and others’. Highly sensitive individuals may cry easily because they deeply feel and experience emotions. This is not necessarily indicative of a lack of control or instability. Emotional instability, on the other hand, often involves unpredictable mood swings, difficulty regulating emotions, and impulsive reactions.

While someone with emotional instability might cry easily, their crying is often part of a broader pattern of emotional dysregulation.

Hypothetical Study Comparing Emotional Responses

A hypothetical study could compare emotional responses in individuals with varying temperaments, categorized perhaps using established temperament scales like the EAS Temperament Survey. Participants would be exposed to standardized emotional stimuli (e.g., sad movies, emotionally evocative stories) while their physiological responses (heart rate, skin conductance) and self-reported emotional experience are measured. The study would compare individuals classified as having high versus low emotional reactivity, exploring differences in their physiological and subjective responses to the stimuli.

This could reveal whether differences in temperament are correlated with differences in the intensity and frequency of emotional responses, including crying.

Neurological Factors

We’ve explored emotional sensitivity and temperament as contributing factors to easy crying, but the underlying neurological mechanisms play a crucial role. Understanding the brain’s involvement provides a deeper insight into why some individuals are more prone to tears than others. This section delves into the neurological aspects influencing emotional responses and tear production.

The Amygdala’s Role in Fear and Emotional Responses

The amygdala, a small almond-shaped structure deep within the brain, is a key player in processing emotions, particularly fear. It acts as an emotional alarm system, rapidly evaluating sensory information and triggering a response. In individuals who cry easily, the amygdala might be hyperactive, leading to an exaggerated fear response or heightened emotional sensitivity to even mildly stressful situations.

This overreaction could manifest as tears. Research suggests that individuals with anxiety disorders, often characterized by heightened fear responses, may exhibit increased amygdala activity. This heightened activity can lead to an amplified emotional response to stimuli, which could include crying.

Neurotransmitters and Mood Regulation

Neurotransmitters are chemical messengers that transmit signals between nerve cells. Several neurotransmitters, particularly serotonin, play a significant role in mood regulation. Serotonin is associated with feelings of well-being and happiness. Imbalances in serotonin levels, either due to genetic predisposition or environmental factors, can disrupt mood regulation and potentially lead to increased emotional reactivity, including easy crying. For example, individuals with depression often experience low serotonin levels, and one of the symptoms of depression is increased tearfulness.

Antidepressant medications, which often aim to increase serotonin levels, can sometimes reduce tearfulness as a side effect.

Impact of Brain Injuries and Neurological Conditions on Emotional Control

Brain injuries or neurological conditions can significantly disrupt the brain’s intricate network responsible for emotional regulation. Damage to areas like the prefrontal cortex, which plays a vital role in emotional control and decision-making, can lead to emotional lability – a condition characterized by rapid and unpredictable shifts in mood and emotional expression, including increased crying. Similarly, conditions like stroke, traumatic brain injury, or neurodegenerative diseases can affect emotional control and result in heightened emotional responses.

These injuries may disrupt the complex interplay between different brain regions involved in emotional processing, leading to an increased propensity for tears.

Neurological Conditions and Emotional Expression

| Neurological Condition | Effect on Emotional Expression | Example | Mechanism |

|---|---|---|---|

| Stroke | Emotional lability, increased crying, difficulty controlling emotions | A person experiencing a stroke might cry uncontrollably at seemingly insignificant events. | Damage to brain regions involved in emotional regulation (e.g., prefrontal cortex). |

| Traumatic Brain Injury (TBI) | Emotional dysregulation, irritability, increased tearfulness | An individual with TBI might cry easily after experiencing frustration or minor setbacks. | Disruption of neural pathways involved in emotional processing. |

| Alzheimer’s Disease | Emotional lability, apathy, inappropriate emotional responses | A person with Alzheimer’s might cry unexpectedly, even in the absence of any apparent trigger. | Neurodegeneration affecting various brain regions, including those responsible for emotional regulation. |

| Multiple Sclerosis (MS) | Emotional lability, depression, anxiety | Someone with MS might experience frequent tearfulness alongside other mood disturbances. | Inflammation and demyelination affecting the brain and spinal cord, disrupting neural communication. |

Psychological Factors

Source: highlysensitiverefuge.com

Understanding why some individuals cry more easily than others requires exploring the intricate interplay of psychological factors. While biological predispositions certainly play a role, the mind’s interpretation and processing of emotions significantly influence our outward expression of sadness or distress. Pre-existing mental health conditions, past traumas, and learned coping mechanisms all contribute to an individual’s emotional regulation and tearfulness.

Several psychological conditions are strongly associated with increased tearfulness. Anxiety disorders, for instance, often manifest with heightened emotional reactivity, making individuals more prone to crying during moments of stress or even seemingly minor upsets. The constant state of hypervigilance and worry characteristic of anxiety can lower the threshold for emotional overflow. Similarly, depression is frequently accompanied by tearfulness, reflecting the pervasive sadness and hopelessness that define the condition.

The emotional numbness often associated with depression can paradoxically be punctuated by intense bouts of crying, representing a release of pent-up emotional pressure.

Emotional Responses Across Psychological Diagnoses

The emotional responses in individuals with different psychological diagnoses vary considerably. While both anxiety and depression may involve tearfulness, the context and nature of the crying differ. Anxiety-related crying often occurs in response to specific triggers or anticipatory worry, reflecting a feeling of being overwhelmed. In contrast, depression-related crying may be more spontaneous, reflecting a general sense of sadness and despair, and may not be directly tied to a specific event.

Other conditions, such as post-traumatic stress disorder (PTSD), can lead to tearfulness as a manifestation of intrusive memories or flashbacks, highlighting the complex relationship between psychological state and emotional expression. It’s crucial to remember that these are general tendencies; individual experiences can vary greatly.

Impact of Past Trauma and Adverse Childhood Experiences

Past trauma and adverse childhood experiences (ACEs) significantly impact an individual’s capacity for emotional regulation. Experiences such as abuse, neglect, or significant loss can lead to the development of maladaptive coping mechanisms, including emotional suppression or over-expression. Individuals who have experienced trauma may exhibit heightened sensitivity to emotional triggers and struggle to manage their emotional responses effectively. This can manifest as increased tearfulness, but also as emotional numbness or difficulty identifying and expressing feelings appropriately.

The brain’s stress response system may become dysregulated, leading to a lower threshold for emotional overwhelm and an increased likelihood of emotional outbursts, including crying.

So, why do some people cry so easily? Hormonal imbalances are a big factor, but it’s also linked to personality and even past trauma. Interestingly, diet plays a role too; I was reading this fascinating article about how nutritional needs differ between the sexes, check it out: are women and men receptive of different types of food and game changing superfoods for women.

Understanding these nutritional differences might even impact emotional regulation and, therefore, how easily someone cries. It’s all interconnected, right?

Coping Mechanisms for Managing Emotional Responses

Developing effective coping mechanisms is crucial for individuals who experience excessive tearfulness. These strategies aim to improve emotional regulation and reduce the frequency and intensity of emotional outbursts.

A range of approaches can be beneficial. Mindfulness practices, such as meditation and deep breathing exercises, can help individuals become more aware of their emotional state and develop skills to manage overwhelming feelings. Cognitive behavioral therapy (CBT) provides tools to identify and challenge negative thought patterns that contribute to emotional distress. Regular physical activity releases endorphins, which have mood-boosting effects.

Social support from friends, family, or support groups can provide a sense of connection and reduce feelings of isolation. Journaling can help individuals process their emotions and gain insights into their triggers. In some cases, professional help from a therapist or counselor is essential to address underlying psychological conditions and develop personalized coping strategies. It’s important to find what works best for each individual, as coping mechanisms are highly personalized.

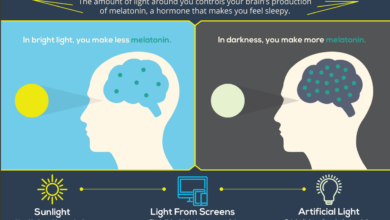

Hormonal Influences

Source: pinimg.com

Hormones play a significant role in regulating our mood and emotional responses. Fluctuations in hormone levels can trigger a wide range of emotional changes, including increased tearfulness and heightened sensitivity. While many factors contribute to emotional responses, understanding the impact of hormonal shifts is crucial for a complete picture.Hormonal changes throughout a woman’s life, particularly those involving estrogen and progesterone, are strongly linked to emotional lability.

These hormones influence neurotransmitter activity in the brain, impacting areas responsible for mood regulation. The complex interplay between these hormones and the brain’s neurochemical pathways explains why some individuals experience heightened emotional sensitivity during specific hormonal phases.

Estrogen and Progesterone’s Influence on Mood

Estrogen and progesterone, the primary female sex hormones, exhibit cyclical fluctuations throughout the menstrual cycle and during pregnancy. These fluctuations directly affect the levels of neurotransmitters like serotonin and dopamine, which are key players in mood regulation. Low levels of estrogen, for example, have been associated with increased irritability, anxiety, and depression, potentially leading to increased tearfulness. Conversely, progesterone’s influence is more complex, with both calming and potentially anxiety-inducing effects depending on individual factors and the balance with other hormones.

The interaction between estrogen and progesterone, and their interplay with other hormones, creates a dynamic system influencing emotional responses.

Menstruation and Tearfulness

The week leading up to menstruation (premenstrual syndrome or PMS) is often characterized by emotional changes, including increased tearfulness, irritability, and mood swings. This is largely attributed to the significant drop in estrogen and progesterone levels that occurs just before menstruation begins. This hormonal shift can disrupt neurotransmitter balance, resulting in heightened emotional sensitivity and making individuals more prone to crying.

The severity of these symptoms varies widely depending on individual hormonal profiles and other factors. For some, PMS symptoms are mild, while others experience significantly debilitating effects.

Pregnancy and Hormonal Shifts

Pregnancy involves dramatic hormonal changes, with significant increases in estrogen and progesterone. While these hormones often contribute to feelings of well-being, they can also lead to increased emotional lability and tearfulness. The fluctuating levels of these hormones, coupled with the physiological and psychological stresses of pregnancy, can make pregnant individuals more susceptible to emotional fluctuations. Postpartum, hormonal levels rapidly decrease, leading to another period of significant hormonal shifts, often linked to postpartum depression or anxiety, further highlighting the strong connection between hormonal changes and emotional responses.

Hormonal Imbalances and Emotional Regulation

Beyond the cyclical fluctuations associated with menstruation and pregnancy, hormonal imbalances stemming from conditions such as thyroid disorders, menopause, or polycystic ovary syndrome (PCOS) can significantly impact emotional regulation. These imbalances disrupt the delicate balance of hormones influencing mood, potentially leading to increased irritability, anxiety, depression, and tearfulness. Effective management of these conditions, often involving hormone replacement therapy or other treatments, can help alleviate these emotional symptoms and improve emotional regulation.

Timeline of Hormonal Changes and Emotional Responses

| Stage | Hormonal Changes | Potential Emotional Effects |

|---|---|---|

| Menstrual Cycle (Premenstrual Phase) | Drop in estrogen and progesterone | Increased irritability, anxiety, tearfulness, mood swings |

| Menstruation | Low estrogen and progesterone | Emotional sensitivity may persist or lessen |

| Pregnancy (First Trimester) | Rapid increase in estrogen and progesterone | Mood swings, emotional lability, increased tearfulness |

| Pregnancy (Second & Third Trimester) | Continued high levels of estrogen and progesterone | Emotional fluctuations may continue or stabilize |

| Postpartum | Rapid decrease in estrogen and progesterone | Postpartum depression, anxiety, tearfulness, mood swings |

| Menopause | Significant decrease in estrogen | Mood swings, irritability, anxiety, depression |

Social and Cultural Factors

Source: choosingtherapy.com

The way we express emotions, including crying, isn’t solely determined by internal processes; societal and cultural norms play a significant role in shaping our emotional responses and how we choose to outwardly display them. Understanding these external influences is crucial to comprehending the diverse ways individuals experience and express sadness or distress.Societal norms and expectations significantly influence the expression of emotions, particularly in public settings.

Cultures vary widely in their acceptance of emotional displays, impacting how individuals regulate their feelings and whether or not they feel comfortable expressing sadness openly. These differences often stem from deeply ingrained cultural values and beliefs about emotional appropriateness and self-control.

Cultural Differences in the Acceptability of Crying

The acceptability of crying differs dramatically across cultures. In some cultures, open displays of emotion, including crying, are considered acceptable and even encouraged, particularly in situations of grief or loss. These cultures may view emotional expression as a healthy and necessary way to process difficult experiences. Conversely, other cultures may place a higher value on emotional restraint and self-control, viewing open displays of crying as a sign of weakness or immaturity.

These cultural norms can profoundly impact an individual’s emotional development and their ability to manage their emotions effectively. For instance, in many East Asian cultures, emotional restraint is highly valued, and public displays of sadness may be discouraged. In contrast, in some Latin American cultures, expressing sadness openly is more common and considered a natural response to difficult circumstances.

Emotional Expression in Different Cultures Compared

Comparing emotional expression across cultures reveals fascinating insights into the complex interplay between individual temperament and cultural norms. Consider the difference between cultures that emphasize stoicism and those that encourage emotional expressiveness. In stoic cultures, individuals may learn to suppress their emotions, potentially leading to difficulties in emotional processing. In contrast, in emotionally expressive cultures, individuals may be more likely to openly express their emotions, which can facilitate emotional release and processing.

These contrasting approaches highlight how cultural norms can shape not only how emotions are expressed but also how they are experienced internally. The perceived social consequences of crying can vary significantly, influencing an individual’s likelihood of expressing sadness openly.

Impact of Social Pressure on Emotional Regulation

Social pressure can significantly impact emotional regulation. The fear of judgment or negative social consequences can lead individuals to suppress their emotions, even if doing so is detrimental to their emotional well-being. For example, men in many Western cultures may feel societal pressure to suppress their tears, leading to difficulties in processing grief or other negative emotions. This pressure to conform to gender norms can have significant consequences for mental health and emotional well-being.

Similarly, individuals in high-pressure work environments may feel compelled to suppress their emotions to maintain a professional image, potentially leading to burnout and other stress-related issues. The internalization of these societal expectations can create a complex dynamic where emotional expression is carefully managed to align with perceived social norms.

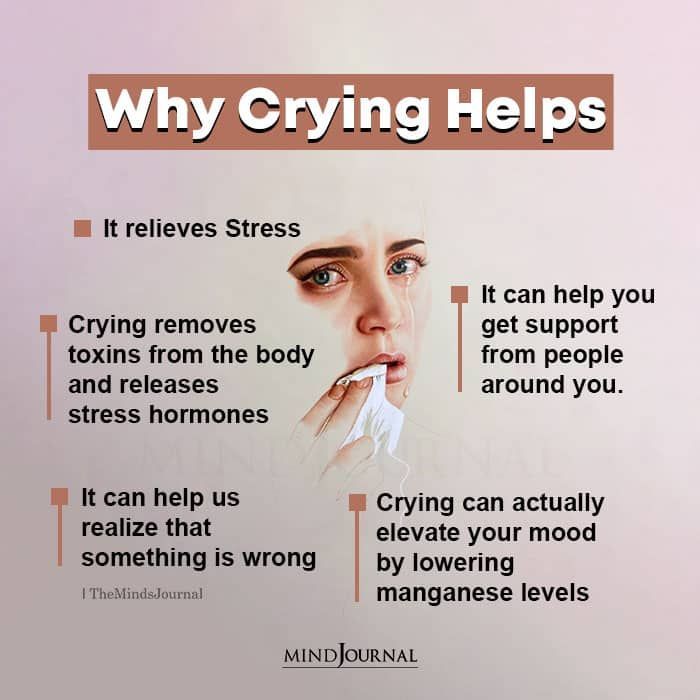

Environmental Factors

Our emotional landscape isn’t solely shaped by internal factors; the world around us plays a significant role in how we feel and react. Environmental factors, encompassing everything from our physical surroundings to major life events, can profoundly influence our emotional responses, including our propensity to cry. Understanding these external pressures is crucial to managing emotional wellbeing.Environmental stressors significantly impact our emotional regulation.

Stress, in its various forms, disrupts our internal balance, making us more vulnerable to emotional outbursts, including tears. The body’s stress response, involving the release of cortisol and other hormones, can directly affect mood and emotional control. This doesn’t mean that crying under stress is inherently negative; it can be a healthy release of pent-up emotions. However, chronically stressful environments can exacerbate emotional fragility.

Stressful Situations and Increased Tearfulness

A range of stressful situations can trigger increased tearfulness. These situations vary in intensity and impact depending on individual experiences and coping mechanisms. For example, experiencing a significant loss, such as the death of a loved one or the end of a relationship, often leads to intense sadness and frequent crying. Similarly, financial difficulties, job insecurity, or health problems can create chronic stress, leading to increased emotional vulnerability and tearfulness.

Major life transitions, such as moving to a new city, starting a new job, or getting married, can also be emotionally taxing, potentially resulting in heightened sensitivity and increased crying. Even seemingly minor daily stressors, such as traffic jams or arguments, can accumulate and contribute to overall emotional strain, potentially manifesting as tearfulness.

Interaction of Environmental Factors and Predispositions

Environmental factors don’t act in isolation; they interact intricately with individual predispositions. Someone genetically predisposed to higher emotional sensitivity might experience significantly more intense emotional reactions to environmental stressors compared to someone less sensitive. For instance, a person with a history of anxiety might find themselves crying more easily in response to stressful situations at work, while someone with a more resilient temperament might manage the same situation with less visible emotional distress.

This interaction highlights the complex interplay between nature and nurture in shaping emotional responses. Understanding one’s own vulnerabilities and how environmental factors trigger them is key to developing effective coping strategies.

Creating Supportive and Calming Environments

Creating a supportive and calming environment can significantly contribute to emotional regulation. This involves consciously minimizing exposure to stressors and maximizing access to resources that promote emotional well-being. Strategies include practicing mindfulness and relaxation techniques, engaging in regular exercise, maintaining a healthy diet, ensuring sufficient sleep, and cultivating strong social support networks. Creating a physically calming space, such as a quiet room for relaxation or a comfortable outdoor area, can also help reduce stress and improve emotional stability.

Emotional sensitivity varies wildly; some people cry easily due to hormonal fluctuations, others because of heightened empathy. It’s a complex issue, and understanding the underlying reasons is crucial. Learning about the physical and emotional challenges women face, like those detailed in this article about Karishma Mehta’s egg freezing decision, karishma mehta gets her eggs frozen know risks associated with egg freezing , highlights how significant life events can trigger intense emotional responses, affecting tear production and our overall emotional well-being.

Ultimately, crying easily is often a symptom, not a problem in itself, and deserves understanding, not judgment.

Similarly, establishing healthy boundaries to limit exposure to toxic relationships or overwhelming situations can significantly reduce emotional strain and promote a sense of control, potentially leading to decreased tearfulness.

Medical Conditions: Why Do Some People Cry So Easily Possible Causes

Increased tearfulness isn’t always simply a matter of emotion; sometimes, underlying medical conditions play a significant role. These conditions can disrupt hormonal balance, alter neurological pathways, or directly impact emotional regulation centers in the brain, leading to heightened sensitivity and increased crying. Understanding these connections is crucial for appropriate diagnosis and management.Certain medical conditions can significantly influence emotional responses, often manifesting as increased tearfulness.

So, why do some people cry so easily? It’s a complex issue, often tied to hormonal fluctuations or past trauma. But sometimes, underlying health conditions play a role; for example, understanding the risk factors that make stroke more dangerous can highlight how even seemingly unrelated physical issues can impact emotional responses. Similarly, certain neurological conditions might also affect emotional regulation and increase tearfulness.

It’s definitely something worth exploring if it’s significantly impacting your life.

These conditions frequently involve hormonal imbalances or neurological changes that affect the brain’s emotional processing areas. It’s vital to remember that this isn’t about “weakness” but about understanding the complex interplay between physical health and emotional well-being.

Medical Conditions Causing Hormonal Imbalances

Hormonal fluctuations are strongly linked to mood changes, and several medical conditions can disrupt this delicate balance, resulting in increased tearfulness. For example, hypothyroidism, a condition where the thyroid gland doesn’t produce enough thyroid hormone, can lead to fatigue, depression, and increased sensitivity to emotional stimuli. Similarly, conditions affecting the adrenal glands, such as Addison’s disease, can cause hormonal imbalances that impact mood regulation.

Menopause, a natural transition in women’s lives, also involves significant hormonal shifts that frequently trigger emotional lability, including increased crying. Premenstrual syndrome (PMS) is another common example, where fluctuating hormone levels during the menstrual cycle can lead to heightened emotional sensitivity.

Medical Conditions Affecting Emotional Regulation

Beyond hormonal imbalances, several neurological and other medical conditions directly affect emotional regulation. For example, brain tumors, strokes, and traumatic brain injuries can damage areas of the brain responsible for emotional processing, leading to significant changes in emotional responses, including increased tearfulness. Neurodegenerative diseases like Alzheimer’s disease and Parkinson’s disease can also affect emotional regulation, resulting in emotional lability and uncontrolled crying.

Multiple sclerosis (MS) can similarly impact emotional control due to its effects on the central nervous system.

Medications and Emotional Responses, Why do some people cry so easily possible causes

Many medications, while beneficial for treating other conditions, can have side effects that affect emotional responses. Some antidepressants, while generally improving mood, can initially increase tearfulness or emotional sensitivity. Certain medications used to treat high blood pressure, hormonal imbalances, or pain can also have mood-altering side effects, including increased crying. It is crucial to discuss any unexpected emotional changes with a healthcare professional to assess whether medication adjustments are necessary.

It’s important to remember that this doesn’t diminish the value of the medication; rather, it highlights the need for careful monitoring and communication with your doctor.

Relationship Between Medical Conditions, Hormonal Changes, and Emotional Expression

The following flowchart illustrates the interconnectedness of medical conditions, hormonal changes, and emotional expression, specifically tearfulness.[Diagram Description: A flowchart would be presented here. It would begin with a central box labeled “Medical Condition” (e.g., Hypothyroidism, Menopause, Brain Tumor). Arrows would branch out to boxes labeled “Hormonal Imbalance” (e.g., Low Thyroid Hormone, Estrogen Fluctuation, etc.) and “Neurological Changes” (e.g., Impaired Brain Function, Nerve Damage, etc.).

From these boxes, arrows would lead to a final box labeled “Increased Tearfulness/Emotional Lability”. The flowchart visually demonstrates how a medical condition can lead to hormonal changes or neurological alterations, ultimately resulting in increased emotional sensitivity and tearfulness.]

Illustrative Examples

Understanding the complexities of easy crying requires looking at how different factors can interact. It’s rarely a single cause, but rather a confluence of biological, psychological, and environmental influences. The following examples illustrate this interplay.

Hypothetical Scenario 1: The Overwhelmed Graduate Student

Imagine Sarah, a 28-year-old graduate student nearing the completion of her dissertation. She’s always been emotionally sensitive, a trait she inherited from her mother. Recently, she’s been experiencing increased stress due to a demanding workload, mounting financial pressures, and a strained relationship with her advisor. Her sleep has suffered, exacerbating her already low serotonin levels (a neurotransmitter linked to mood regulation).

The combination of her inherent temperament, the intense pressure of her studies (environmental factor), sleep deprivation (environmental and impacting neurological factors), and relationship difficulties (social and psychological factors) leaves her feeling constantly on edge. A seemingly minor setback, like receiving a critical comment on her work, can trigger a cascade of overwhelming emotions, resulting in a prolonged crying episode.

She feels a tightness in her chest, a lump in her throat, and her vision blurs as tears stream down her face. The crying isn’t just about the comment itself; it’s a release of pent-up stress and frustration stemming from various aspects of her life. Physically, she experiences rapid heart rate and shallow breathing, further intensifying her emotional distress.

Hypothetical Scenario 2: The Postpartum Mother

Consider Maria, a 32-year-old mother who gave birth to her first child three months ago. The hormonal shifts after childbirth significantly impacted her emotional state. She’s experiencing postpartum depression, characterized by intense sadness, anxiety, and irritability. She also has a history of anxiety, a pre-existing psychological vulnerability that is now amplified by the challenges of motherhood. The constant demands of caring for a newborn, coupled with sleep deprivation and a lack of social support (environmental and social factors), further exacerbate her emotional fragility.

The simple act of her baby crying can trigger a wave of overwhelming feelings, including guilt, inadequacy, and fear. She feels a sense of helplessness and despair, accompanied by physical sensations like fatigue, nausea, and a general feeling of being overwhelmed. Tears come easily, sometimes triggered by seemingly insignificant events or even just the weight of her emotions.

The crying represents a complex interaction of hormonal changes, pre-existing psychological vulnerabilities, and significant environmental stressors. Unlike Sarah’s situation, Maria’s experience is heavily influenced by hormonal fluctuations and the unique challenges of postpartum life.

Ultimate Conclusion

Ultimately, the answer to “Why do some people cry so easily?” isn’t a simple one. It’s a complex interplay of nature and nurture, biology and experience. Understanding the potential underlying causes, whether genetic predisposition, hormonal imbalances, psychological factors, or social influences, allows for greater empathy and potentially, more effective coping strategies. Recognizing the diverse factors at play helps us appreciate the wide spectrum of human emotional expression and the many paths to emotional well-being.

User Queries

Is crying easily a sign of weakness?

Absolutely not! Crying is a natural human response to a wide range of emotions, both positive and negative. It’s a release of emotion, not an indicator of strength or weakness.

Can medication affect how easily I cry?

Yes, certain medications can impact emotional regulation and may lead to increased tearfulness as a side effect. If you’re concerned, talk to your doctor.

How can I control my crying?

Developing coping mechanisms like mindfulness, deep breathing exercises, and seeking support from therapists or support groups can help manage emotional responses.

Is it normal to cry easily during pregnancy or menopause?

Yes, hormonal changes during these life stages can significantly impact emotional regulation and increase tearfulness. It’s a common experience.