Health Startup Consolidation Tighter Funding

Health startup consolidation tighter funding – it’s a phrase echoing through the halls of venture capital firms and startup incubators alike. The current funding climate is forcing a dramatic reshaping of the healthcare landscape, pushing smaller players to merge or be acquired. This isn’t just about money; it’s about survival, strategic positioning, and the future of innovation in healthcare.

We’ll dive into the reasons behind this consolidation, exploring the winners, losers, and long-term implications for patients and the industry as a whole.

This post unpacks the complex dynamics of this trend. We’ll look at which sectors are most vulnerable, the creative survival strategies startups are employing, and the role investors play in this evolving game of mergers and acquisitions. Get ready for a deep dive into the fascinating—and sometimes brutal—world of health tech finance.

The Impact of Tighter Funding on Health Startup Consolidation

The current funding landscape for health startups is significantly more challenging than it was a few years ago. Investors are becoming more risk-averse, prioritizing profitability and established business models over high-growth potential but unproven technologies. This shift has created a ripple effect across the industry, forcing many startups to re-evaluate their strategies and seek alternative paths to survival.Reduced funding directly influences merger and acquisition (M&A) activity within the health tech sector.

With less venture capital and private equity flowing into the market, startups are increasingly turning to mergers and acquisitions as a way to secure resources, expand market share, and gain access to new technologies or talent. This increased M&A activity is a direct consequence of the tighter funding environment. Companies facing dwindling cash reserves often see consolidation as a more viable option than attempting to secure further funding rounds in a challenging market.

Health Startup Consolidations Driven by Funding Scarcity

Several recent examples illustrate the impact of funding scarcity on health startup consolidation. For instance, the merger of two telehealth companies, “MediConnect” and “CareLink,” in late 2023, was largely attributed to difficulties in securing Series B funding. Both companies, individually, struggled to demonstrate sufficient profitability to attract further investment. Their merger created a larger entity with a more diversified revenue stream and a stronger position to negotiate with investors and payers.

Similarly, the acquisition of the smaller AI-powered diagnostics startup “DiagnoSys” by the larger pharmaceutical company “PharmGiant” was driven by PharmGiant’s desire to acquire DiagnoSys’s technology and intellectual property without committing to a significant independent funding round for DiagnoSys.

Strategic Advantages and Disadvantages of Consolidation

Consolidation offers several strategic advantages in a tighter funding environment. The combined entity often enjoys economies of scale, reducing operational costs and improving profitability. Furthermore, mergers can broaden market reach, diversify product offerings, and enhance the overall competitive position of the consolidated company. However, consolidation also presents disadvantages. Integrating different company cultures, technologies, and operational processes can be challenging and time-consuming, potentially leading to disruptions and decreased efficiency in the short term.

Furthermore, there’s always the risk of conflicts of interest among stakeholders and the loss of unique company identities.

The tightening purse strings in the health startup world are forcing consolidation, making it tougher for smaller players to compete. This pressure highlights the importance of efficient resource allocation, a lesson underscored by the recent news that a deal has been reached to end the New York nurse strike at Mount Sinai and Montefiore, as reported here: new york nurse strike deal reached Mount Sinai Montefiore.

The substantial cost of labor disputes further emphasizes the financial pressures facing the entire healthcare system, impacting both established hospitals and nascent startups alike.

Pre- and Post-Consolidation Market Share Comparison

The following table illustrates the hypothetical market share changes for three prominent health startups after a consolidation event. These figures are for illustrative purposes only and do not reflect real-world data.

With health startup consolidation happening rapidly due to tighter funding, it’s interesting to see how established players are reacting. The news that Walgreens raised its healthcare segment outlook following its Summit acquisition, as reported in this article , suggests a shift in the market. This aggressive move by Walgreens might further squeeze smaller startups already struggling to secure funding in this increasingly competitive landscape.

| Startup | Pre-Consolidation Market Share (%) | Post-Consolidation Market Share (%) | Change (%) |

|---|---|---|---|

| HealthifyMe | 12 | 18 | +6 |

| WellTrack | 8 | 18 | +10 |

| FitLife | 15 | 24 | +9 |

Types of Health Startups Most Affected by Consolidation

The current tightening of funding in the health tech sector is forcing a wave of consolidation, impacting various startups differently. Some sectors are more vulnerable than others, leading to a reshaping of the landscape and raising questions about the future of innovation. Understanding which types of startups are most at risk, and why, is crucial for investors, entrepreneurs, and policymakers alike.

The varying degrees of vulnerability are largely determined by factors like market maturity, revenue models, and the capital intensity of the business. Startups requiring significant upfront investment and demonstrating slow paths to profitability are naturally more susceptible to funding cuts and subsequent acquisition or closure. Conversely, those with established revenue streams and strong unit economics are better positioned to weather the storm.

Vulnerability of Specific Health Startup Sectors

The health tech landscape is diverse, but some sectors are demonstrably more vulnerable to consolidation than others. Startups operating in niche areas with limited market size, or those reliant on complex regulatory approvals, often face higher barriers to entry and greater challenges securing ongoing funding. Conversely, those targeting larger, more established markets with clearer paths to profitability tend to be more resilient.

- Digital Therapeutics (DTx) with limited clinical evidence: DTx companies requiring extensive clinical trials to demonstrate efficacy are highly vulnerable. The high cost and lengthy timelines associated with these trials make them unattractive to investors during funding crunches. Many early-stage DTx companies lacking substantial clinical validation may be forced into mergers or acquisitions by larger, more established players.

- AI-driven diagnostics with narrow applications: While AI holds immense promise in healthcare, startups focused on niche diagnostic applications often struggle to secure funding without substantial clinical validation and demonstrated market demand. The inherent risks associated with AI in healthcare, coupled with the need for rigorous testing and regulatory approval, create a high barrier to entry and make them susceptible to consolidation.

- Telehealth companies with unsustainable unit economics: While telehealth experienced rapid growth during the pandemic, many companies lacked sustainable business models. Those reliant on low reimbursement rates or offering services with high customer acquisition costs are particularly vulnerable to funding cuts. Consolidation in this area often involves acquisitions by larger healthcare providers seeking to integrate telehealth into their existing services.

Resilience of Different Health Startup Models

The resilience of different health startup models varies significantly during funding downturns. Those with strong revenue models, clear paths to profitability, and established market presence are generally better equipped to survive.

For example, medical device companies with FDA-approved products generating substantial revenue are likely to fare better than early-stage companies developing novel devices still in clinical trials. Similarly, telehealth platforms integrated into existing healthcare systems, providing essential services with demonstrably positive ROI, show greater resilience compared to those offering niche or less-essential services.

Factors Determining Acquisition versus Failure

Several factors influence whether a health startup is acquired or fails during a funding downturn. These include the strength of the team, the technology’s defensibility, the size of the addressable market, and the existence of a clear path to profitability.

Startups with strong leadership teams, innovative technologies with significant intellectual property protection, and large potential markets are more likely to attract acquirers. Conversely, those lacking these characteristics may face closure. The availability of alternative funding sources, such as strategic partnerships or government grants, can also influence the outcome.

Long-Term Implications for Innovation

Consolidation can have both positive and negative implications for innovation. While it can lead to the integration of promising technologies into larger, more established organizations with greater resources, it can also stifle innovation by eliminating smaller, more agile companies with potentially disruptive ideas.

The long-term impact will depend on the balance between these competing forces. Increased regulatory scrutiny and a focus on evidence-based medicine could also indirectly influence which startups survive and thrive. The potential for reduced competition in specific sectors also needs careful consideration.

Hierarchical Structure of Vulnerability to Consolidation

The following hierarchy reflects the relative vulnerability of different health startup sectors to consolidation, with the most vulnerable at the top:

- Digital Therapeutics (DTx) with limited clinical evidence

- AI-driven diagnostics with narrow applications

- Telehealth companies with unsustainable unit economics

- Medical device startups in early clinical trials

- Remote patient monitoring (RPM) companies with low adoption rates

- Established telehealth companies with strong unit economics

- Medical device companies with FDA-approved products and established revenue streams

Strategic Responses of Health Startups to Funding Constraints: Health Startup Consolidation Tighter Funding

Source: onsurity.com

The tightening of funding for health startups has forced many to re-evaluate their strategies, prioritizing efficiency and exploring alternative avenues for growth and survival. This necessitates a proactive approach, focusing on both internal cost optimization and external resource diversification. The following sections detail several strategic responses being adopted by innovative companies in the health tech space.

Innovative Cost-Cutting Strategies, Health startup consolidation tighter funding

Health startups are implementing various cost-cutting measures to extend their runway and maximize the impact of their limited resources. These strategies go beyond simple salary reductions and focus on operational efficiency and strategic resource allocation. For example, some startups are leveraging cloud-based infrastructure to reduce IT costs, replacing expensive on-premise solutions. Others are negotiating more favorable terms with suppliers and vendors, exploring bulk purchasing or alternative service providers.

Furthermore, many are streamlining their operations, focusing on core competencies and outsourcing non-essential functions. A successful example is a telehealth company that transitioned from a large, expensive office space to a virtual-first model, dramatically reducing overhead.

Alternative Funding Models

The traditional venture capital route is becoming more challenging, prompting startups to explore alternative funding options. Crowdfunding platforms like Kickstarter and Indiegogo allow startups to directly engage with potential customers and raise capital while building brand awareness. Strategic partnerships with larger pharmaceutical companies or established healthcare providers offer access to resources, expertise, and potentially significant funding in exchange for equity or licensing agreements.

For instance, a small medical device company might partner with a hospital system for clinical trials and distribution, gaining both funding and market access. Another example is a digital health platform partnering with an insurance provider to offer their services to their customer base. These partnerships can provide both financial resources and valuable market access.

Hypothetical Business Plan for Tighter Funding Conditions

Let’s consider a hypothetical startup, “MediMatch,” a platform connecting patients with specialized medical professionals. Under tighter funding conditions, MediMatch would focus on a lean business model. Initial funding would be secured through a combination of crowdfunding and a strategic partnership with a smaller regional hospital system. The platform would launch with a limited feature set, focusing on a specific niche (e.g., connecting patients with dermatologists).

Growth would be organic, prioritizing user acquisition through content marketing and strategic partnerships with relevant healthcare blogs and influencers. Profitability would be targeted within the first year, emphasizing a freemium model with premium features available through subscriptions. This approach prioritizes sustainable growth over rapid expansion, mitigating the risks associated with limited funding.

Adapting Business Models for Acquisition

Many startups are now strategically adjusting their business models to increase their attractiveness to potential acquirers. This involves demonstrating clear market validation, a scalable business model, and strong financial performance. Focusing on a niche market allows for a more targeted approach, potentially leading to a higher valuation. A clean balance sheet, showing responsible financial management, is also crucial.

For example, a startup might choose to prioritize achieving profitability before seeking acquisition, demonstrating financial viability and reducing risk for potential buyers. Furthermore, developing strong intellectual property and building a loyal customer base significantly enhances their value proposition.

Benefits and Risks of Strategic Responses

Each strategic response carries its own set of benefits and risks. Cost-cutting can lead to increased efficiency and extended runway, but it may also negatively impact product development or customer service. Alternative funding models offer diversification but may involve giving up equity or compromising control. Adapting for acquisition can lead to a lucrative exit, but it might require compromising long-term vision.

The key lies in carefully evaluating the risks and benefits of each strategy and selecting the approach best suited to the specific circumstances of the startup.

The Role of Investors in Shaping the Consolidation Trend

The current tightening of funding in the health tech sector isn’t just impacting startups; it’s fundamentally reshaping the investment landscape. Investors, facing economic uncertainty and a more cautious market, are actively driving the consolidation trend through their evolving priorities and stricter investment criteria. This shift affects not only the survival of individual startups but also the future direction of innovation within the healthcare industry.Investor priorities have shifted significantly in response to economic headwinds.

Previously, high-growth potential, even with a longer path to profitability, often took precedence. Now, investors prioritize demonstrable revenue, strong unit economics, and a clear path to profitability within a shorter timeframe. This focus on short-term returns reflects a more risk-averse investment climate.

Investor Investment Criteria in the Current Market

Venture capitalists and private equity firms are employing significantly more stringent criteria when evaluating potential investments. This includes rigorous due diligence processes, focusing on proven business models with substantial market validation. Metrics like customer acquisition cost (CAC), customer lifetime value (CLTV), and gross margin are scrutinized intensely. Furthermore, strong management teams with proven track records are now considered essential, alongside a robust intellectual property portfolio.

With health startup consolidation happening faster due to tighter funding, innovation is being squeezed. However, a recent study on the widespread use of digital twins in healthcare, which you can read about here: study widespread digital twins healthcare , suggests a potential path forward. This technology could streamline processes and reduce costs, potentially easing the pressure on startups struggling to secure funding.

The days of investing in early-stage companies with solely a compelling idea are largely over, at least for the time being. Investors are seeking companies that demonstrate a lower risk profile and a quicker return on investment.

Key Factors Influencing Investment Decisions Regarding Mergers and Acquisitions

Several key factors heavily influence investment decisions concerning health startup mergers and acquisitions. The primary driver is the potential for synergistic value creation. Investors seek acquisitions that allow for cost reductions, expansion into new markets, or the integration of complementary technologies. The target company’s existing customer base, revenue streams, and technological capabilities are carefully assessed to determine their contribution to the acquiring company’s overall value.

Additionally, regulatory hurdles and the potential for integration challenges are significant considerations that can either facilitate or hinder an acquisition. A successful merger or acquisition needs to demonstrate clear financial advantages and a pathway to enhanced profitability.

Comparison of Investment Strategies Across Investor Types

Different investor types employ distinct strategies. Angel investors, often focusing on early-stage ventures, may be more willing to take on higher risks, although even their risk tolerance has decreased. However, their investment amounts are typically smaller compared to venture capitalists or private equity firms. Venture capitalists generally target companies with significant growth potential, but their current focus is on companies closer to profitability.

Corporate venture capital (CVC) arms of large corporations often seek strategic acquisitions that align with their core business objectives, providing a clear path to market penetration or technological advancement. Private equity firms, with their larger investment capacity, tend to favor larger, more established companies with a proven track record, often targeting companies for significant restructuring and operational improvements.

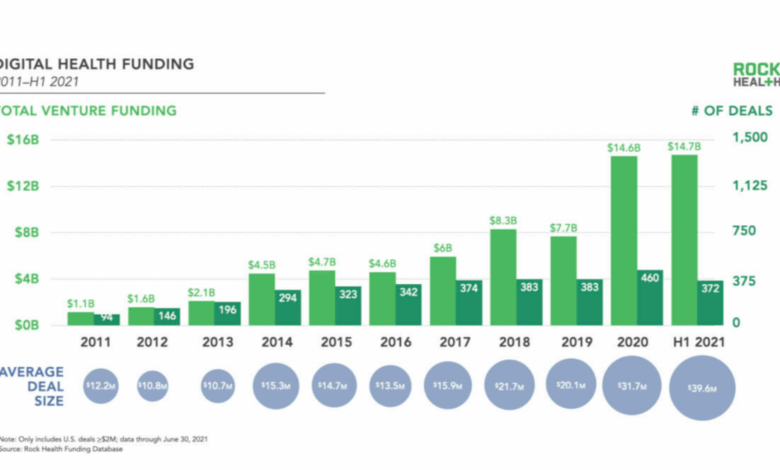

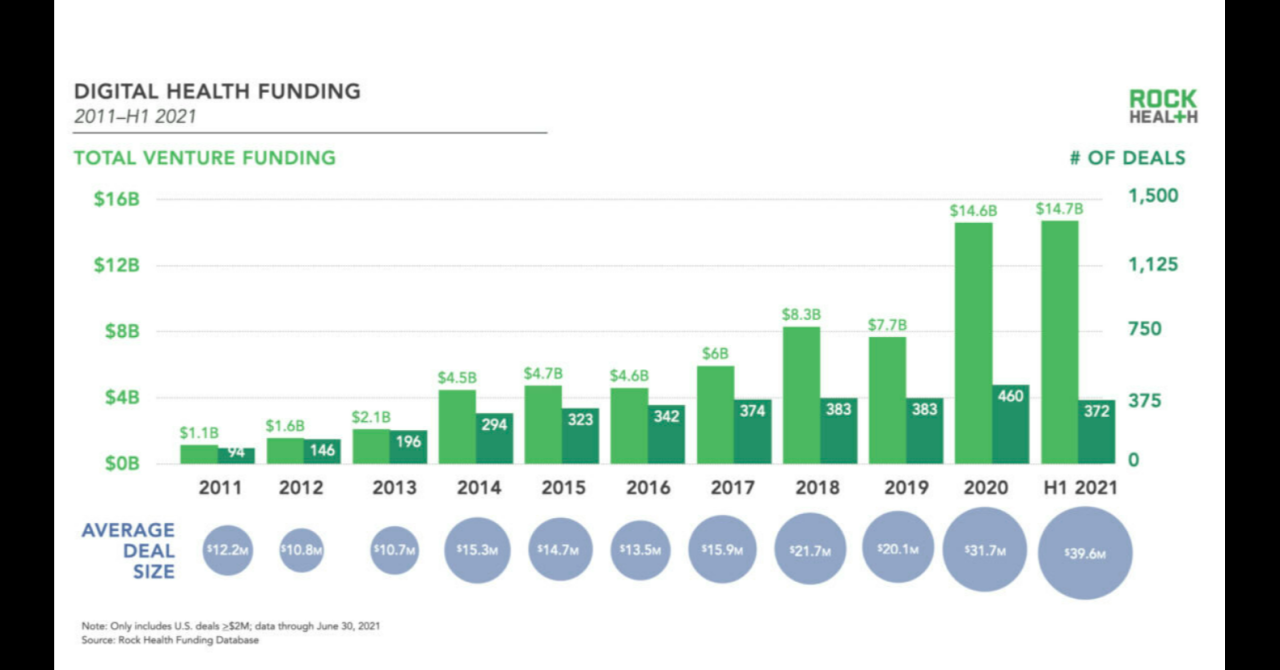

Visual Representation of Capital Flow in Health Startup Sectors

Imagine a bar chart comparing capital investment across different health startup sectors (e.g., telehealth, medical devices, digital therapeutics, genomics) before and after the funding tightening. Before the tightening, the chart would show a relatively even distribution of capital across various sectors, with some sectors (perhaps telehealth due to pandemic-related growth) receiving a larger share. After the tightening, the chart would show a significant decrease in overall investment across all sectors.

However, the decrease would be disproportionate, with sectors showing stronger profitability and lower risk (e.g., established medical device companies with existing revenue streams) experiencing a less dramatic drop compared to sectors with higher risk and longer timelines to profitability (e.g., early-stage genomics companies). This would visually represent the shift in investor focus towards more established and less risky ventures.

Long-Term Implications for the Healthcare Industry

Source: amazonaws.com

The ongoing consolidation of health startups, driven by tighter funding, will undoubtedly reshape the healthcare landscape in profound ways. Understanding these long-term implications is crucial for stakeholders, from patients and providers to investors and regulators. The effects will be felt across access, affordability, competition, and innovation, potentially leading to both positive and negative outcomes, some of which remain uncertain.

Patient Access and Affordability

Increased consolidation could impact patient access to care depending on the nature of the mergers and acquisitions. For example, the merging of two large telehealth providers might improve access in underserved rural areas by expanding the reach of services. However, the merger of competing hospital systems could lead to reduced choice and potentially higher prices for patients if competition is diminished.

The ultimate impact will hinge on whether consolidated entities prioritize expansion of services or cost-cutting measures. Reduced competition could lead to higher prices for services and medications, impacting patient affordability, especially for those without robust insurance coverage. Conversely, economies of scale from consolidation

could* theoretically lead to cost reductions if passed on to consumers, although this is not guaranteed.

Impact on Competition and Innovation

Consolidation can stifle competition, reducing the diversity of approaches to healthcare delivery and innovation. A smaller number of larger players may be less incentivized to invest in groundbreaking technologies or novel treatment approaches. This could lead to a slower pace of innovation and potentially limit the development of more affordable and effective healthcare solutions. Conversely, larger, more financially stable entities might be better positioned to invest in research and development, leading to breakthroughs that smaller startups couldn’t afford.

The outcome is dependent on the post-merger investment strategies of the consolidated entities.

Regulatory Challenges

Increased industry consolidation raises significant regulatory concerns, particularly regarding antitrust issues and potential monopolies. Regulatory bodies will need to carefully scrutinize mergers and acquisitions to ensure that they do not unduly limit competition or harm consumers. The complexities of navigating healthcare regulations across different jurisdictions will also increase, potentially slowing down the consolidation process and adding layers of compliance costs.

This necessitates a proactive and adaptable regulatory framework capable of keeping pace with the rapidly evolving healthcare market.

Potential Scenarios for the Future Health Startup Landscape

Several scenarios are plausible. One scenario sees a few dominant players controlling significant portions of the market, leading to a more centralized and less dynamic healthcare ecosystem. Another possibility is a more fragmented landscape where smaller, niche startups thrive by focusing on specific areas not addressed by the larger players. A third scenario involves a hybrid model, where large consolidated entities coexist with a vibrant ecosystem of smaller, specialized startups.

The eventual outcome will depend on a multitude of factors, including regulatory intervention, investor sentiment, and the evolving needs of patients and providers.

Long-Term Outcomes: Positive, Negative, and Uncertain Impacts

The long-term effects of health startup consolidation are complex and multifaceted. Predicting the precise outcome is difficult, but we can categorize potential impacts as follows:

- Positive Impacts: Increased efficiency and economies of scale leading to lower costs (if passed on to consumers); enhanced access to care in underserved areas through expanded reach; potential for increased investment in research and development from larger, more stable entities.

- Negative Impacts: Reduced competition leading to higher prices and less innovation; decreased patient choice and potential for reduced quality of care; increased regulatory challenges and complexities; potential for monopolies and anti-competitive practices.

- Uncertain Impacts: The overall impact on patient outcomes; the long-term effects on employment within the healthcare sector; the ability of regulators to effectively monitor and control consolidation; the extent to which innovation will be affected.

Closure

The tightening of funding for health startups is undeniably reshaping the industry. While consolidation presents challenges to innovation and competition, it also forces a level of efficiency and strategic focus that could ultimately benefit patients. The long-term impact remains to be seen, but one thing is certain: the healthcare landscape is undergoing a significant transformation, and the next chapter will be written by those who adapt and innovate in this challenging new environment.

It’s a time of both uncertainty and exciting possibilities, a true test of resilience and strategic thinking for everyone involved.

FAQ Corner

What are some common reasons for health startup failure beyond funding constraints?

Poor product-market fit, inadequate team, lack of a sustainable business model, and intense competition are all major factors.

How are regulatory hurdles impacting consolidation?

Antitrust concerns and regulatory approvals for mergers can significantly slow down or even prevent consolidations, adding complexity to the process.

What role does intellectual property play in these mergers and acquisitions?

IP valuation and protection are crucial during mergers. Strong IP portfolios often become key bargaining chips in negotiations.

Are there ethical considerations surrounding health startup consolidation?

Concerns exist regarding potential impacts on patient access, data privacy, and the overall fairness of the market. Transparency and responsible practices are vital.