Hospital Health System M&A Returns Pre-Pandemic Levels, Kaufman Hall Reports

Hospital health system M A returns pre pandemic levels Kaufman Hall – Hospital Health System M&A Returns Pre-Pandemic Levels, Kaufman Hall Reports: Wow, the healthcare landscape is shifting! After the whirlwind of the pandemic, it’s fascinating to see hospital mergers and acquisitions (M&A) activity bouncing back to pre-COVID levels. This isn’t just a number on a spreadsheet; it’s a reflection of significant changes in the industry, driven by everything from financial pressures to evolving patient needs.

Let’s dive into what’s fueling this resurgence and what it means for the future of healthcare.

This post will explore the key financial indicators that reveal this comeback, analyzing data from Kaufman Hall’s reports to paint a clearer picture. We’ll unpack the impact on different hospital specialties, examining the role of government policies, and exploring the strategies hospitals are employing to navigate this new normal. It’s a complex story, but one that holds significant implications for both healthcare providers and patients alike.

Hospital Health System Financial Performance Pre- and Post-Pandemic

Source: mdpi.com

The COVID-19 pandemic dramatically reshaped the financial landscape of hospital health systems, initially causing significant disruptions followed by a complex recovery process. While the initial impact was overwhelmingly negative, a return to pre-pandemic levels of activity, including mergers and acquisitions (M&A), is now being observed. Analyzing the key financial indicators before and after the pandemic reveals a nuanced picture of resilience and adaptation within the healthcare sector.

Key Financial Indicators: Pre- and Post-Pandemic Comparison

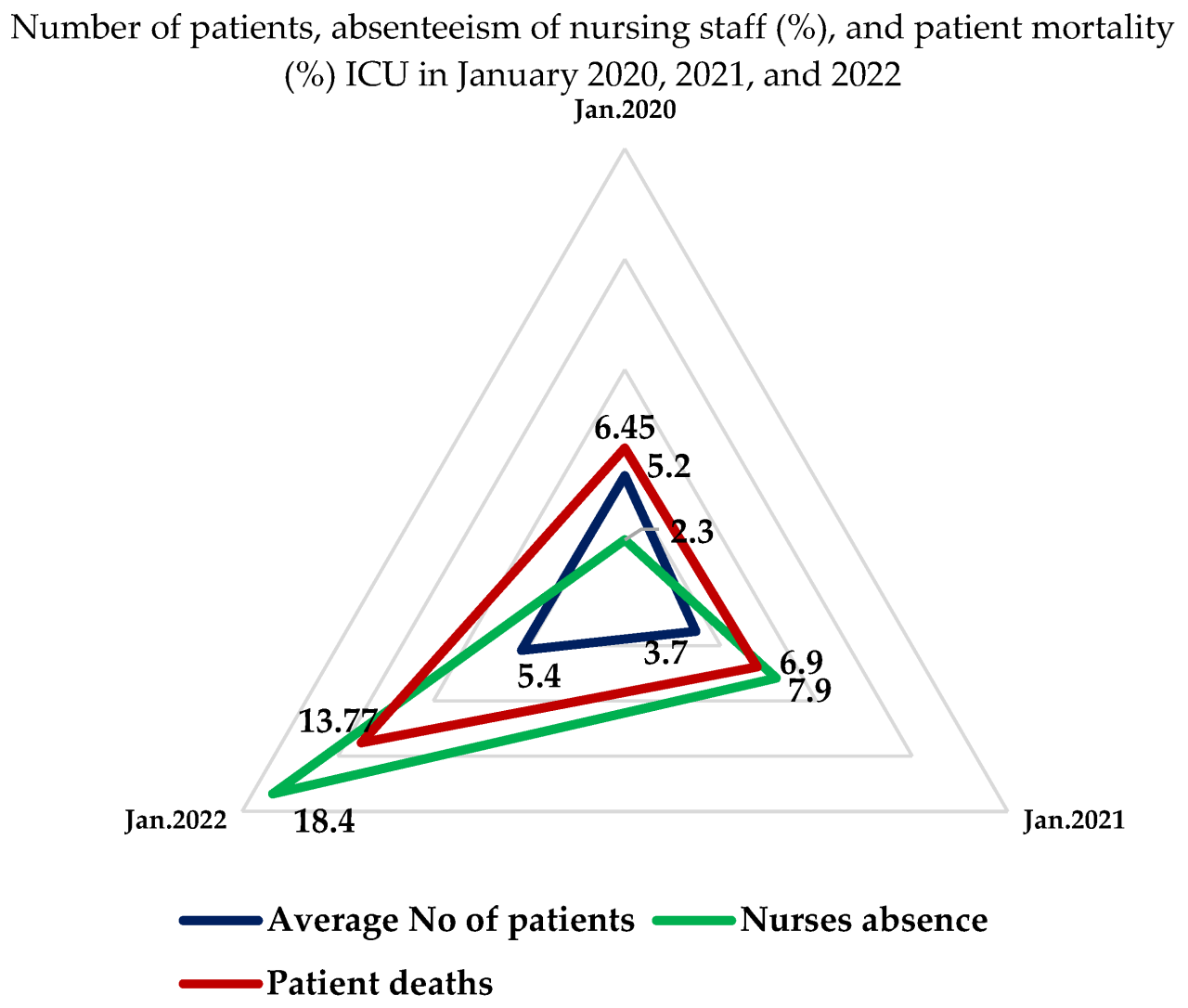

Kaufman Hall reports consistently highlighted a sharp decline in hospital revenue during the initial phases of the pandemic. This was largely due to a decrease in elective procedures, the postponement of non-urgent care, and the increased costs associated with managing COVID-19 patients. Expenses, on the other hand, surged due to increased staffing needs (including personal protective equipment and hazard pay), the acquisition of additional medical equipment, and the need for expanded intensive care unit capacity.

Profitability, consequently, took a substantial hit, with many hospitals experiencing significant operating losses. As the pandemic progressed, a partial recovery occurred, driven by the resumption of elective procedures and a gradual increase in patient volume. However, inflationary pressures and ongoing staffing shortages continue to challenge the financial stability of many health systems, preventing a complete return to pre-pandemic profitability for some.

While precise figures vary depending on the specific health system and its geographic location, the general trend reflects a period of significant financial strain followed by a partial, but not complete, recovery.

So, Kaufman Hall reports that hospital M&A activity is back to pre-pandemic levels – a huge shift! This resurgence highlights the need for robust cybersecurity, especially given the increased data handling. Understanding the implications of the hhs healthcare cybersecurity framework hospital requirements cms is crucial for these merging systems, ensuring patient data remains protected as these organizations integrate.

Successfully navigating this regulatory landscape is vital for continued growth in the post-pandemic hospital market.

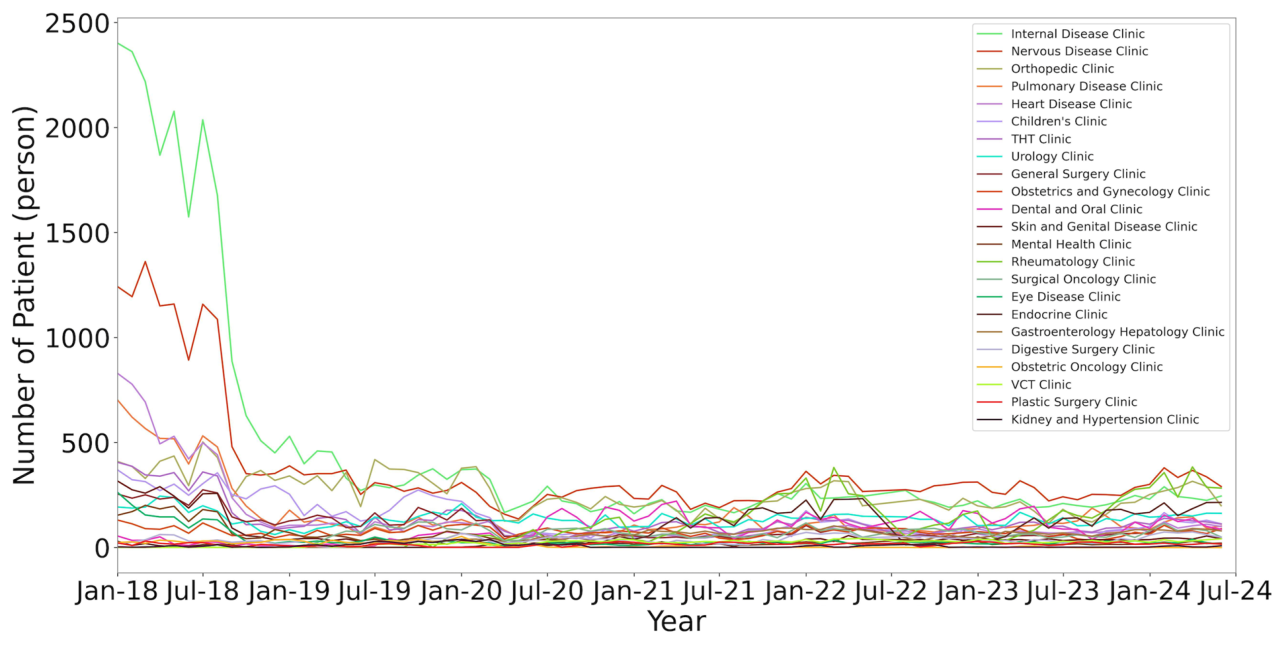

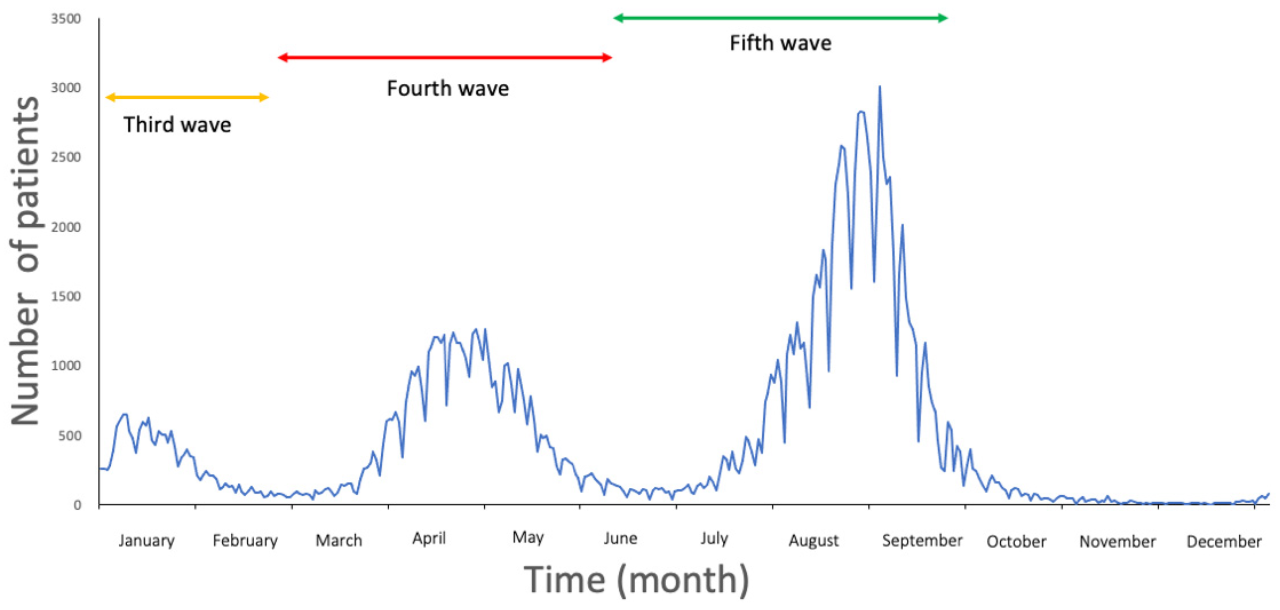

Impact of the Pandemic on Patient Volume and Revenue Streams

The pandemic’s impact on patient volume and revenue varied significantly across different hospital specialties. Emergency departments and intensive care units experienced an initial surge in patient volume, leading to increased revenue in those areas, albeit often at a higher cost. Conversely, elective procedures such as orthopedic surgeries, cardiovascular interventions, and oncology treatments saw a dramatic decline, leading to significant revenue losses in these specialties.

Outpatient clinics also experienced reduced patient volume, as many patients delayed non-urgent care. The recovery has been uneven; some specialties have largely recovered to pre-pandemic levels, while others continue to lag. For instance, mental health services have seen a sustained increase in demand, potentially offsetting some losses in other areas. The financial implications of these shifts underscore the need for hospitals to adapt their operational models and resource allocation strategies.

Factors Contributing to the Return of M&A Activity

The resurgence of M&A activity in the hospital sector to pre-pandemic levels is a complex phenomenon influenced by both internal and external factors.

| Factor | Category | Description | Example |

|---|---|---|---|

| Financial pressures and need for economies of scale | Internal | Hospitals facing financial challenges seek mergers to improve efficiency and reduce costs. | A struggling rural hospital merges with a larger urban system to access resources and improve financial stability. |

| Need to expand service offerings and market share | Internal | Hospitals seek to expand their service lines and geographic reach through acquisitions. | A hospital system acquires a smaller hospital specializing in oncology to expand its cancer care services. |

| Increased competition and market consolidation | External | The increasing pressure of competition drives hospitals to merge to gain a stronger market position. | Two competing hospital systems in a region merge to create a larger, more dominant player. |

| Government regulations and payment models | External | Changes in healthcare regulations and payment models can influence M&A activity. | Changes in Medicare reimbursement policies incentivize mergers to improve efficiency and reduce costs. |

Market Dynamics and M&A Activity

The post-pandemic healthcare landscape has witnessed a dramatic reshaping of the competitive landscape, significantly influencing the frequency and nature of mergers and acquisitions (M&A) activity within the hospital industry. Factors like financial pressures, shifting patient demographics, and technological advancements have converged to create a dynamic environment where consolidation is often viewed as a strategic necessity for survival and growth.The competitive intensity within the hospital industry is substantial, driven by factors such as increasing numbers of patients needing care, limited resources, and the constant pressure to improve efficiency and quality while managing costs.

This competition has intensified the need for hospitals to expand their reach, diversify their service offerings, and achieve economies of scale, all of which are often facilitated through mergers and acquisitions.

Drivers of Hospital Mergers and Acquisitions

Financial stability and market share are two primary drivers behind the surge in hospital M&A activity. Hospitals facing financial difficulties, often stemming from decreased reimbursements, rising operating costs, and increased bad debt, may seek mergers to improve their financial position through cost-cutting measures and increased bargaining power with insurers. Simultaneously, expanding market share allows hospitals to increase their patient volume, enhance their brand recognition, and improve their negotiating leverage with payers.

For example, a smaller rural hospital might merge with a larger urban system to gain access to specialized services and a wider patient base, thus improving its financial outlook and market competitiveness. Conversely, a financially robust system might acquire a struggling hospital to consolidate its market dominance and prevent the loss of a vital healthcare resource within its service area.

Strategic Goals of Hospital Mergers and Acquisitions in the Post-Pandemic Era

Mergers and acquisitions are no longer simply about survival; they are increasingly strategic moves to achieve specific goals in the post-pandemic environment. Hospitals are utilizing M&A activity to pursue a range of objectives.

- Enhanced Financial Stability: Combining resources and eliminating redundancies leads to improved cost efficiencies and better financial performance, mitigating the risks associated with fluctuating reimbursements and rising operating costs.

- Increased Market Share and Geographic Reach: Expanding into new geographic areas or consolidating market presence allows for increased patient volume, stronger bargaining power with payers, and enhanced brand recognition.

- Access to Specialized Services and Expertise: Mergers enable hospitals to offer a wider range of services, attracting more patients and improving the quality of care. This is particularly important in areas with limited access to specialized care.

- Improved Technology and Infrastructure: Acquiring hospitals with advanced technology or better infrastructure can significantly enhance a system’s capabilities and competitiveness. This includes access to advanced medical equipment, electronic health records (EHR) systems, and telehealth platforms.

- Talent Acquisition and Retention: M&A activity can facilitate the recruitment and retention of skilled healthcare professionals, addressing workforce shortages and ensuring the delivery of high-quality care.

Impact of Government Policies and Regulations: Hospital Health System M A Returns Pre Pandemic Levels Kaufman Hall

Government policies and regulations significantly influence hospital financial health and the landscape of mergers and acquisitions (M&A) within the healthcare industry. Reimbursement rates, regulatory changes, and compliance requirements all play a crucial role in shaping hospital strategies and their overall financial stability. Understanding these dynamics is critical for navigating the complexities of the healthcare market.The intricate relationship between government intervention and hospital finances is multifaceted.

Reimbursement rates set by programs like Medicare and Medicaid directly impact a hospital’s revenue stream. Changes to these rates, whether increases or decreases, have a cascading effect on profitability, investment capabilities, and ultimately, decisions about mergers and acquisitions. Simultaneously, regulatory changes affecting hospital operations, such as those related to patient safety, data privacy (HIPAA), and quality of care, introduce both costs and complexities that influence financial performance and the attractiveness of potential M&A targets.

Medicare and Medicaid Reimbursement Rates

Medicare and Medicaid reimbursement rates are a major determinant of hospital revenue. Reductions in these rates, often implemented to control healthcare spending, can significantly strain hospital budgets, leading to decreased profitability and potentially impacting their ability to invest in infrastructure upgrades or new technologies. Conversely, increases in reimbursement rates can improve financial stability, enabling hospitals to expand services, recruit top talent, and potentially pursue acquisitions.

For example, the 2010 Affordable Care Act (ACA) expanded Medicaid coverage, initially leading to increased patient volume and revenue for some hospitals, but subsequent reimbursement rate adjustments altered this impact. Hospitals in areas with high Medicaid populations experienced varying financial outcomes depending on their ability to effectively manage the increased patient load and navigate the complexities of the expanded program.

Regulatory Changes and Compliance Costs

Compliance with numerous federal and state regulations places a substantial burden on hospitals. Regulations concerning patient safety (e.g., infection control protocols), data privacy (HIPAA), and quality of care (e.g., reporting requirements for patient outcomes) all necessitate significant investments in infrastructure, personnel, and technology. These compliance costs can impact a hospital’s bottom line and influence its decision-making regarding mergers and acquisitions.

Hospitals facing substantial regulatory pressures might seek partners to share the burden of compliance or to gain access to resources that improve their ability to meet regulatory requirements. For instance, the implementation of the Protecting Access to Medicare Act of 2014 (PAMA) introduced new requirements for physician payment, impacting hospitals’ ability to negotiate rates with physician groups and potentially influencing M&A activity related to physician practices.

Examples of Government Regulations Affecting Hospital Financial Stability and M&A Activity

The impact of government regulations on hospital finances and M&A activity is observable through various examples. The implementation of the ACA, while aiming to expand health insurance coverage, also introduced significant changes to reimbursement methodologies, impacting hospital revenue streams and influencing M&A decisions. Hospitals in different geographic locations and with different patient demographics experienced diverse financial consequences, leading to varying strategies regarding mergers and acquisitions.

Similarly, the ongoing debate surrounding drug pricing and the implementation of various cost-containment measures have influenced hospital financial stability and prompted strategic alliances and mergers to improve bargaining power with pharmaceutical companies. Hospitals facing significant financial challenges due to regulatory changes have often sought mergers or acquisitions to achieve economies of scale and improve their financial resilience.

So, Kaufman Hall reports that many hospital systems in MA are back to pre-pandemic patient levels, which is great news, right? But the recent new york state nurse strike NYSNA Montefiore Mount Sinai highlights the ongoing staffing challenges impacting hospital recovery nationwide. These staffing issues, of course, directly impact a hospital’s ability to reach and maintain those pre-pandemic levels of care.

Hopefully, MA hospitals can avoid similar situations.

Operational Efficiency and Cost Reduction Strategies

Source: mdpi.com

The post-pandemic landscape has forced hospital systems to re-evaluate their operational models, focusing intensely on efficiency and cost reduction to maintain financial stability and ensure the delivery of high-quality care. This requires a multi-pronged approach, incorporating technological advancements, streamlined workflows, and strategic resource allocation. The strategies employed vary considerably depending on the specific challenges faced by each system, but common threads of data-driven decision-making and a commitment to continuous improvement are readily apparent.

Successful cost reduction and efficiency improvements often involve a combination of strategies targeting both operational processes and strategic resource management. Many hospitals are finding that a holistic approach, encompassing everything from supply chain optimization to workforce management, yields the most significant and sustainable results. This shift requires a cultural change, moving away from siloed departments towards a collaborative, system-wide focus on efficiency.

Supply Chain Optimization and Inventory Management

Effective supply chain management is crucial for cost reduction. Hospitals can implement strategies such as group purchasing organizations (GPOs) to leverage bulk buying power and negotiate better prices with vendors. Implementing just-in-time inventory management systems minimizes storage costs and reduces waste from expired or obsolete supplies. For example, a large hospital system might use data analytics to predict consumption patterns and optimize ordering, reducing inventory holding costs by 15% within a year.

This also reduces the risk of stockouts, ensuring uninterrupted care delivery. Real-time inventory tracking systems allow for precise monitoring of supply levels, preventing unnecessary overstocking and facilitating efficient procurement.

Streamlining Clinical Workflows and Reducing Administrative Burden

Improving clinical workflows can significantly reduce operational costs. This involves analyzing processes to identify bottlenecks and inefficiencies. Implementing electronic health records (EHRs) and integrating data systems can automate tasks, reduce paperwork, and improve communication between departments. For instance, a hospital system could implement a standardized order entry system to minimize errors and reduce the time spent on manual data entry.

So, Kaufman Hall reports that hospital health system M&A activity is back to pre-pandemic levels, which is pretty wild considering everything. This resurgence makes sense when you consider the end of the official COVID-19 public health emergency, as detailed in this article: covid 19 public health emergency ends. The lifting of those restrictions likely opened the door for more mergers and acquisitions in the healthcare sector, allowing hospital systems to refocus on growth strategies.

Furthermore, the adoption of telehealth services can reduce the need for in-person visits, lowering overhead costs and improving access to care for patients in remote areas. This reduction in administrative burden allows clinicians to focus more on patient care.

Workforce Optimization and Talent Management

Optimizing staffing levels and improving workforce productivity are critical for cost control. This might involve cross-training staff to increase flexibility and reduce reliance on expensive temporary staff. Investing in employee training and development can improve skills and job satisfaction, leading to reduced turnover and improved efficiency. A hospital system could implement a predictive modeling tool to forecast staffing needs based on patient volume and acuity, optimizing scheduling and minimizing overtime costs.

Furthermore, strategies like improved scheduling and shift patterns can enhance staff morale and productivity, leading to fewer sick days and improved patient outcomes.

Hypothetical Cost-Reduction Plan for a Hospital System, Hospital health system M A returns pre pandemic levels Kaufman Hall

This hypothetical plan focuses on a medium-sized hospital system with annual operating expenses of $500 million. The goal is to achieve a 5% reduction in operating expenses within two years.

| Strategy | Specific Measures | Projected Savings (Year 1) | Projected Savings (Year 2) |

|---|---|---|---|

| Supply Chain Optimization | Implement GPO, implement just-in-time inventory, utilize data analytics for demand forecasting | $5 million | $10 million |

| Workflow Streamlining | Implement standardized order entry system, optimize scheduling algorithms, expand telehealth services | $7.5 million | $15 million |

| Workforce Optimization | Cross-training initiatives, improved scheduling, employee retention programs | $5 million | $10 million |

| Energy Efficiency | Upgrade to energy-efficient equipment, implement energy management system | $2.5 million | $2.5 million |

| Total Projected Savings | $20 million | $37.5 million |

Future Outlook and Trends

The healthcare landscape is in constant flux, driven by evolving demographics, technological advancements, and shifting regulatory environments. Predicting the future of hospital mergers and acquisitions (M&A) requires considering these interwoven factors and their potential impact on the industry’s consolidation trajectory. While the post-pandemic recovery has seen a resurgence in M&A activity, the coming years will present both significant opportunities and considerable challenges for hospital systems.The next five years will likely witness continued, albeit perhaps slower, growth in hospital M&A activity.

Several factors will shape this trend. Aging populations, particularly in developed nations, will increase demand for healthcare services, prompting larger systems to acquire smaller, more specialized facilities to expand their reach and service capabilities. Simultaneously, the increasing complexity and cost of healthcare will incentivize consolidation, enabling systems to negotiate better rates with insurers and achieve economies of scale.

However, regulatory scrutiny and antitrust concerns could act as a brake on aggressive consolidation.

Projected M&A Activity in the Hospital Sector

A visual representation of projected M&A activity over the next five years would show a moderately upward-sloping line. The initial years (years 1-2) might depict a relatively steep incline, reflecting the continuation of the post-pandemic recovery and a rush to consolidate. However, the growth rate would likely plateau in years 3-5, reflecting increased regulatory scrutiny and potential market saturation in certain regions.

The line would not be perfectly smooth, with potential dips representing periods of economic uncertainty or increased regulatory hurdles. Key contributing factors, depicted as annotations on the graph, would include population aging (positive influence), technological advancements (positive, particularly for telehealth and data analytics acquisitions), increasing healthcare costs (positive influence on consolidation), and regulatory pressures (negative influence). The graph would also likely show variations across different geographical regions, with areas experiencing rapid population growth showing higher M&A activity than those with stagnant or declining populations.

For example, regions with a high concentration of aging Baby Boomers would likely show stronger M&A activity compared to areas with a younger population. This reflects the increasing demand for geriatric care and the need for larger systems to manage this expanding need effectively.

Challenges Facing Hospital Systems

Hospital systems face a multifaceted set of challenges. Maintaining profitability in the face of rising operational costs and reimbursement pressures remains a significant concern. The increasing complexity of healthcare regulations adds another layer of difficulty, requiring substantial investment in compliance and administrative functions. Furthermore, attracting and retaining qualified healthcare professionals, especially in rural or underserved areas, is a persistent challenge.

Finally, the need to adapt to rapid technological advancements, including the adoption of telehealth and data analytics, requires significant investment and a change in operational models. For example, the successful implementation of telehealth requires significant investment in technology infrastructure and staff training, representing a substantial challenge for smaller, resource-constrained hospitals. This is further complicated by the need to ensure equitable access to telehealth services across different demographics and geographical locations.

Opportunities for Hospital Systems

Despite the challenges, several opportunities exist for forward-thinking hospital systems. Expanding into value-based care models, focusing on preventative care and population health management, can improve both patient outcomes and financial performance. Leveraging technological advancements, such as AI-powered diagnostics and robotic surgery, can enhance efficiency and improve the quality of care. Strategic partnerships with other healthcare providers, such as physician groups and home health agencies, can create integrated delivery networks that provide more comprehensive and coordinated care.

For instance, partnerships with home health agencies can allow for more efficient post-discharge care, reducing hospital readmission rates and improving patient outcomes. This also helps hospitals to better manage the costs associated with hospital readmissions. The expansion into underserved markets offers another avenue for growth, particularly in areas with aging populations or a shortage of healthcare professionals.

Wrap-Up

Source: mdpi.com

The return of hospital M&A activity to pre-pandemic levels, as highlighted by Kaufman Hall’s findings, signifies a pivotal moment in the healthcare industry. While the pandemic undeniably reshaped the sector, the resurgence of mergers and acquisitions demonstrates a remarkable resilience and strategic adaptation. Understanding the underlying factors—from financial pressures to evolving market dynamics—is crucial for navigating the future of healthcare.

This period of consolidation will likely continue to shape the landscape, impacting patient care, access, and the overall financial health of hospital systems. It’s a dynamic situation, and staying informed is key.

Questions and Answers

What specific financial indicators show the return to pre-pandemic M&A levels?

Kaufman Hall’s reports likely track metrics like deal volume, total transaction value, and the number of hospitals involved in mergers and acquisitions. A comparison of these figures pre- and post-pandemic would demonstrate the return to previous activity levels.

How are smaller hospitals impacted by this increased M&A activity?

Smaller hospitals may face increased pressure to merge or be acquired to remain financially viable in a consolidating market. This could lead to both benefits (access to resources, improved technology) and drawbacks (loss of local control, potential service reductions).

What are the ethical considerations surrounding hospital mergers and acquisitions?

Ethical concerns include ensuring continued access to care for vulnerable populations, preventing price gouging, and maintaining high quality standards across merged systems. Regulatory oversight plays a crucial role in mitigating these risks.