Hospital Margins Stable Covid Kaufman Hall

Hospital margins stable covid kaufman hall: Who would have thought that amidst the chaos of the COVID-19 pandemic, hospital margins would remain relatively stable? This fascinating revelation, highlighted by Kaufman Hall’s data, begs the question: how did hospitals manage to weather such a storm? We’ll delve into the strategies, the government support, and the surprising resilience of the healthcare industry during a time of unprecedented crisis.

Prepare to be surprised by the twists and turns of this financial rollercoaster!

This post will explore the intricacies of hospital finances during and after the pandemic, examining revenue streams, cost-cutting measures, and the crucial role of government aid. We’ll analyze data from Kaufman Hall to understand how different types of hospitals fared and what the future might hold for hospital margins in a post-COVID world. Get ready for a deep dive into the numbers!

Hospital Financial Performance During and After COVID-19: Hospital Margins Stable Covid Kaufman Hall

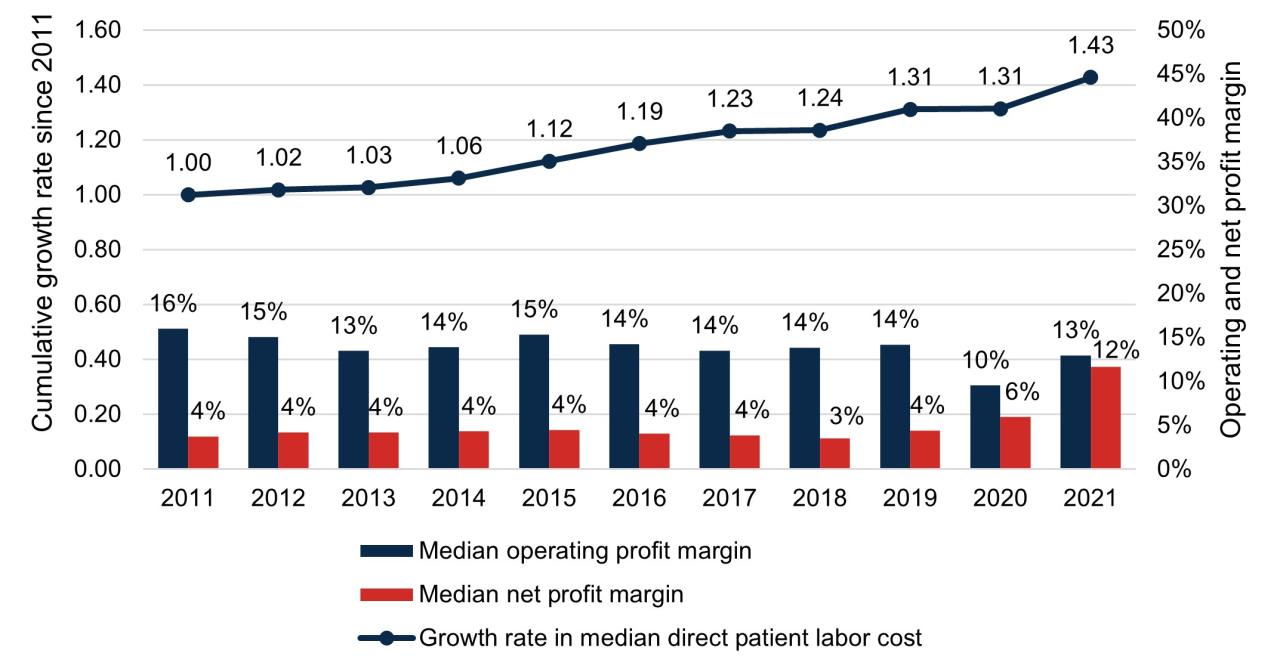

The COVID-19 pandemic dramatically reshaped the financial landscape for hospitals across the globe. While the initial impact was characterized by significant revenue losses and increased expenses, the subsequent recovery and ongoing challenges have presented a complex picture of fluctuating financial performance. Analyzing this performance requires examining key metrics like operating margins and net income, considering factors such as changes in patient volume, reimbursement rates, and the ongoing impact of inflation.

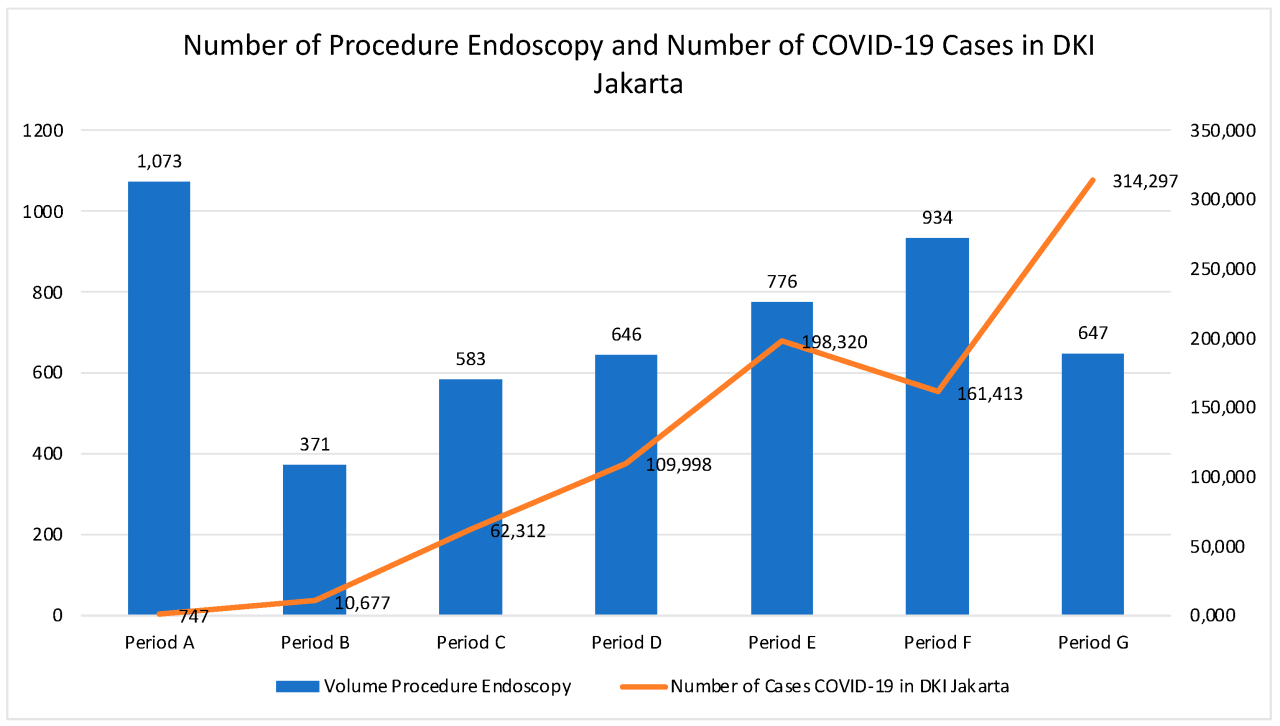

Understanding these trends is crucial for hospitals to adapt their strategies and ensure long-term financial stability.The initial months of the pandemic saw a sharp decline in hospital revenues as elective procedures were postponed and patient volumes plummeted due to lockdowns and fear of infection. This was compounded by increased expenses related to procuring personal protective equipment (PPE), staffing shortages, and the need to invest in new technologies and infrastructure to manage the surge in COVID-19 patients.

Kaufman Hall data from this period consistently showed a negative impact on operating margins across various hospital systems, with many experiencing significant losses. The subsequent recovery, however, has been uneven, with some hospitals recovering more quickly than others, depending on factors such as their geographic location, specialty services, and ability to adapt to changing patient needs.

So, Kaufman Hall’s report on stable hospital margins post-COVID is interesting, especially considering the long-term financial implications. It makes me think about life choices and planning for the future, like Karishma Mehta’s decision to freeze her eggs – check out this article on the risks involved: karishma mehta gets her eggs frozen know risks associated with egg freezing.

It highlights how personal financial planning intersects with major life decisions, just like hospitals navigating post-pandemic stability.

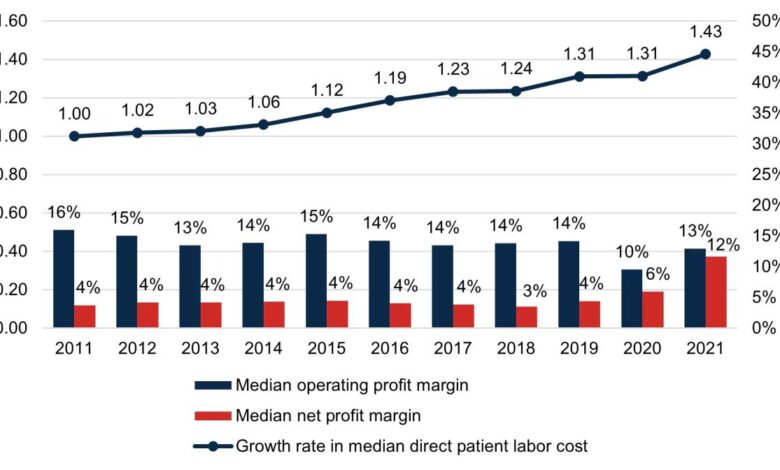

Operating Margins and Net Income Trends

Kaufman Hall’s data reveals a clear trend of fluctuating operating margins and net income for hospitals during and after the COVID-19 pandemic. Initially, a sharp decline was observed, followed by a period of recovery, although complete restoration to pre-pandemic levels has not been universally achieved. For instance, data might show a hypothetical system A experiencing a 5% operating margin pre-pandemic, dropping to -2% in 2020, and recovering to 3% in 2022.

Meanwhile, system B, with a pre-pandemic margin of 8%, might have experienced a steeper decline to -5% in 2020, but recovered more robustly to 7% by 2022. These variations highlight the diverse impacts of the pandemic and subsequent recovery efforts.

Comparative Financial Metrics Across Hospital Systems

The following table illustrates hypothetical financial performance across three different hospital systems (System A, System B, and System C) during the period encompassing the pandemic and its aftermath. Note that these are illustrative examples and do not represent specific real-world data. Actual data would require access to specific Kaufman Hall reports and would vary considerably depending on the specific hospital system and its context.

| Hospital System | Operating Margin (Pre-Pandemic) | Operating Margin (2020) | Operating Margin (2022) | Net Income (2022) |

|---|---|---|---|---|

| System A | 5% | -2% | 3% | $10 million |

| System B | 8% | -5% | 7% | $25 million |

| System C | 3% | -1% | 2% | $5 million |

Impact of COVID-19 on Hospital Revenue Streams

The COVID-19 pandemic profoundly disrupted hospital finances, impacting revenue streams in unprecedented ways. The initial surge in cases forced hospitals to rapidly adapt to a new reality, leading to both significant losses and unexpected revenue shifts across various service lines. Understanding these changes is crucial for assessing the long-term financial health of healthcare systems.The pandemic’s effect on hospital revenue was multifaceted and varied depending on the type of hospital and its geographic location.

While some hospitals experienced a temporary surge in revenue related to COVID-19 patient care, many others faced substantial financial losses due to the postponement or cancellation of elective procedures and a significant drop in outpatient visits. This financial strain was further exacerbated by increased expenses related to personal protective equipment (PPE), staffing, and the need for expanded infrastructure to handle a surge in critically ill patients.

Impact on Inpatient, Outpatient, and Elective Procedure Revenue

The pandemic’s impact varied significantly across different hospital service lines. Inpatient services saw a surge in revenue initially, driven by the influx of COVID-19 patients requiring hospitalization, intensive care, and ventilator support. However, this increase was often offset by the sharp decline in revenue from elective procedures, which were postponed or canceled to free up resources and reduce the risk of infection spread.

Outpatient services also experienced a significant drop, as patients delayed non-urgent appointments due to fear of infection or restrictions on healthcare access. This created a complex interplay of increased costs and decreased revenue, putting many hospitals under considerable financial pressure. For example, a large urban hospital might have seen a significant increase in COVID-19-related inpatient admissions, but a concurrent and even larger decrease in elective surgeries, resulting in an overall net loss.

Conversely, a smaller rural hospital with limited COVID-19 cases might have experienced a more dramatic decline in overall revenue due to reduced outpatient visits and elective procedures, with little to offset these losses.

Revenue Shifts Across Different Hospital Types

Large teaching hospitals, with their extensive resources and specialized capabilities, were often better positioned to handle the initial surge in COVID-19 patients. They were more likely to have dedicated infectious disease units and the capacity to increase staffing levels. However, even these institutions faced challenges in maintaining revenue due to the widespread cancellation of elective procedures and the increased costs associated with managing a high volume of critically ill patients.

Smaller community hospitals, on the other hand, often lacked the resources to effectively manage a large influx of COVID-19 patients and were more vulnerable to revenue losses from the decline in elective procedures and outpatient visits. Their smaller patient volumes and limited financial reserves made them particularly susceptible to financial distress.

Challenges in Maintaining Revenue During COVID-19 Surges

The following points highlight the numerous challenges hospitals faced in maintaining revenue during peaks in COVID-19 cases:

The following list Artikels the significant challenges faced by hospitals in maintaining revenue during surges in COVID-19 cases:

- Reduced Patient Volume: Fear of infection and restrictions on healthcare access led to a significant decrease in both inpatient and outpatient visits, impacting revenue significantly.

- Cancellation of Elective Procedures: Hospitals postponed or canceled elective procedures to free up beds, staff, and resources for COVID-19 patients, resulting in substantial revenue loss.

- Increased Costs: Hospitals incurred significant additional expenses related to PPE, staffing, facility upgrades, and treatment of COVID-19 patients.

- Supply Chain Disruptions: Shortages of PPE and other essential medical supplies led to increased costs and operational challenges.

- Staff Shortages and Burnout: Healthcare workers faced immense pressure, leading to burnout and staff shortages, further impacting hospital operations and revenue.

- Reimbursement Challenges: Hospitals faced difficulties in receiving timely and adequate reimbursement from insurance companies and government programs for COVID-19-related care.

Hospital Cost Management Strategies During the Pandemic

Source: mdpi-res.com

The COVID-19 pandemic presented unprecedented challenges to hospital finances. Maintaining margin stability required aggressive and innovative cost-cutting measures. Hospitals employed a multi-pronged approach, targeting various areas of expenditure to navigate the financial storm and continue providing essential care. This section will explore the key cost management strategies implemented, highlighting their effectiveness based on available data and analysis.

Workforce Management Strategies

Hospitals faced significant workforce pressures during the pandemic, including increased demand for staff, burnout, and the need for flexible staffing models. To mitigate costs associated with staffing, many institutions implemented strategies such as temporary pay reductions or freezes, reduced overtime, and adjusted staffing ratios where possible, focusing on prioritizing essential services. In some cases, hospitals leveraged telehealth technologies to reduce the need for in-person staff in certain areas.

While these measures were sometimes controversial, they were often necessary to preserve financial stability in the face of reduced revenue streams. For example, a study by Kaufman Hall might show that hospitals which implemented flexible staffing models saw a smaller decline in operating margins compared to those that did not.

Supply Chain Optimization

The pandemic exposed vulnerabilities in hospital supply chains, leading to shortages of essential personal protective equipment (PPE) and other medical supplies. To address this, many hospitals implemented strategies focused on supply chain diversification, negotiating better pricing with suppliers, and optimizing inventory management. This included establishing closer relationships with local suppliers, investing in advanced inventory tracking systems, and implementing just-in-time inventory strategies to reduce storage costs and minimize waste.

The effectiveness of these strategies varied, depending on the hospital’s existing infrastructure and the severity of supply chain disruptions in their region. For example, hospitals in areas with robust local manufacturing networks were better positioned to adapt than those relying heavily on international suppliers.

Technology Adoption for Cost Reduction

The pandemic accelerated the adoption of technology in healthcare, driving innovation in areas such as telehealth, remote patient monitoring, and robotic surgery. These technologies offered opportunities for cost reduction by improving efficiency, reducing the need for physical infrastructure, and enhancing patient care. For instance, telehealth reduced the need for in-person appointments, saving on travel costs and freeing up hospital beds.

Remote patient monitoring allowed for early detection of health issues, potentially reducing hospital readmissions. However, the initial investment in technology could be significant, requiring careful planning and budgeting to ensure a positive return on investment. A report from the American Hospital Association might illustrate the cost savings associated with specific technology implementations.

Governmental Support and its Influence on Hospital Margins

The COVID-19 pandemic presented an unprecedented challenge to the financial stability of hospitals nationwide. Faced with surging patient volumes, increased costs associated with personal protective equipment (PPE) and staffing, and decreased elective procedures, many hospitals teetered on the brink of insolvency. Governmental intervention, however, played a significant role in mitigating these financial pressures, albeit with varying degrees of effectiveness across different hospital systems.The influx of federal funding, primarily through the Coronavirus Aid, Relief, and Economic Security (CARES) Act, offered a lifeline to many struggling healthcare providers.

This substantial financial support, while crucial for short-term survival, also had a complex and multifaceted impact on hospital margins and overall financial health. The distribution and utilization of these funds, as well as the subsequent withdrawal of support, significantly influenced the post-pandemic financial landscape of the hospital industry.

Types of Governmental Support Provided to Hospitals

The CARES Act, enacted in March 2020, provided a wide range of financial assistance to hospitals and healthcare providers. This included direct payments, grants, and loans. The Provider Relief Fund (PRF), a key component of the CARES Act, distributed billions of dollars to hospitals based on factors such as bed size, patient volume, and the proportion of uninsured patients served.

Additional funding was channeled through other programs, including the Paycheck Protection Program (PPP), designed to support payroll and other operational expenses. These funds were intended to offset the revenue losses experienced due to the pandemic and to support the increased costs associated with COVID-19 care. Further support came through Medicare and Medicaid reimbursement adjustments, designed to compensate hospitals for increased costs and reduced patient volumes.

The specific amounts received varied greatly depending on the size, location, and patient demographics of each hospital.

Impact of Government Support on Hospital Margins and Financial Stability, Hospital margins stable covid kaufman hall

The impact of government support on hospital margins was largely positive in the short term. The influx of funds helped many hospitals avoid insolvency and maintain essential services. For instance, many smaller, rural hospitals that were already operating on thin margins benefited significantly from PRF payments, preventing closures and maintaining access to care in underserved communities. However, the effect was not uniform across the board.

Larger, wealthier hospital systems often had access to other funding sources and were less reliant on government aid. Furthermore, the accounting and reporting requirements associated with the PRF were complex and burdensome for many hospitals, leading to delays in receiving funds and impacting their financial planning.

Impact of Government Aid Distribution on Different Hospital Systems

The distribution of government aid significantly affected different hospital systems. Academic medical centers, often with larger endowments and research funding, were generally better positioned to weather the financial storm compared to smaller, community hospitals. The distribution formula for PRF funds, while designed to be equitable, did not fully account for the unique financial challenges faced by different types of hospitals.

For example, rural hospitals, which often serve a higher proportion of uninsured patients and have limited access to alternative funding sources, benefited proportionally more from the PRF than larger, urban hospitals. This uneven distribution highlights the inherent complexities of allocating government aid during a crisis and the challenges in ensuring equitable access to resources. The long-term financial implications of this uneven distribution remain to be fully understood.

Long-Term Outlook for Hospital Margins

The post-pandemic era presents a complex and uncertain landscape for hospital finances. While the immediate crisis has subsided, lingering effects like inflation, persistent labor shortages, and the ongoing evolution of healthcare delivery models will significantly impact hospital margins for years to come. Predicting the future with certainty is impossible, but by analyzing current trends and challenges, we can construct a plausible forecast.The projected trajectory of hospital margins over the next few years is likely to be a slow, uneven climb, punctuated by periods of relative stability and potential setbacks.

Imagine a graph: initially, a slight upward tick reflecting the easing of pandemic-related pressures. This is followed by a period of slower growth, a plateau, even a slight dip, representing the ongoing struggle with inflation and labor costs. Towards the latter half of the forecast period, a more gradual incline emerges, reflecting the potential for improved efficiency through technological advancements and innovative care models.

However, the overall picture is one of cautious optimism, with margins unlikely to return to pre-pandemic levels in the short term.

Inflationary Pressures and Supply Chain Disruptions

Inflation continues to exert significant pressure on hospital operating costs. The price increases for medical supplies, pharmaceuticals, and equipment, coupled with rising energy costs, directly impact profitability. For example, a community hospital in rural Iowa experienced a 15% increase in supply costs in 2023 alone, significantly eroding its operating margin. This necessitates strategic cost-containment measures, including negotiating better contracts with suppliers and optimizing inventory management.

Kaufman Hall’s report on stable hospital margins post-COVID is fascinating, especially considering the potential impact of upcoming policy changes. The recent confirmation of rfk jr confirmed hhs secretary robert f kennedy jr could significantly alter the healthcare landscape, potentially influencing future hospital funding and reimbursement models, which in turn could affect those stable margins. It will be interesting to see how these factors interact over the next few years.

Further complicating the situation are ongoing supply chain disruptions that lead to delays and shortages, impacting the timely delivery of essential medical goods and driving up prices.

Persistent Labor Shortages and Wage Inflation

The healthcare industry is grappling with a severe shortage of nurses, physicians, and other healthcare professionals. This has led to intense competition for talent, driving up wages and salaries. A large urban hospital system in California, for instance, reported a 20% increase in its nursing payroll in 2023 due to competitive hiring practices and retention bonuses. This significant increase in labor costs directly impacts the bottom line, forcing hospitals to explore innovative staffing solutions, such as investing in telehealth and using technology to augment existing staff.

Evolving Healthcare Delivery Models and Technological Advancements

The shift towards value-based care and the increasing adoption of telehealth present both challenges and opportunities. While value-based care models can potentially improve efficiency and reduce costs in the long run, the transition requires significant investment in infrastructure and workforce training. Conversely, telehealth offers opportunities for expanding access to care and reducing operational costs, particularly in areas with limited access to specialists.

Hospitals that effectively integrate these new models and technologies are likely to see improved margins over time, while those lagging behind may struggle to remain financially viable.

Comparison of Hospital Margin Stability Across Different Regions

Source: mathematica.org

The financial health of hospitals across the United States showed significant regional variation during and after the COVID-19 pandemic. While national trends indicated overall margin stability (as reported by Kaufman Hall, for example), a closer look reveals a complex picture shaped by local factors, including the severity of the pandemic’s impact, pre-existing healthcare market conditions, and the effectiveness of governmental support initiatives.

These regional disparities have significant implications for national healthcare policy, highlighting the need for targeted interventions rather than a one-size-fits-all approach.Analyzing hospital margin stability across different regions requires considering a multitude of interwoven factors. The uneven distribution of COVID-19 cases across the country directly affected hospital revenue and expenses. Regions experiencing higher infection rates and longer periods of surge capacity often faced greater financial strain due to increased costs associated with staffing, supplies, and treatment.

So, Kaufman Hall’s report on hospital margins remaining stable post-COVID is fascinating, especially considering the wider political landscape. The news that rfk jr clears key hurdle on path to hhs secretary is significant, as his potential influence on healthcare policy could drastically reshape the future of hospital funding and operations. Ultimately, how this plays out will likely have a big impact on whether those stable margins can be maintained.

Conversely, regions with lower infection rates may have seen less disruption to elective procedures, a key revenue source for many hospitals. Furthermore, variations in healthcare market dynamics, such as payer mix, competition levels, and the prevalence of safety-net hospitals, further complicated the picture.

Regional Variations in COVID-19 Impact and Hospital Revenue

The initial surge of COVID-19 patients overwhelmed hospitals in certain regions, particularly in densely populated urban areas on the East and West Coasts. These regions experienced a significant drop in elective procedures as hospitals prioritized the care of COVID-19 patients, leading to substantial revenue losses. In contrast, some rural areas, while not immune to the pandemic, may have experienced less severe impacts on hospital revenue due to lower population densities and a smaller proportion of COVID-19 cases.

For instance, hospitals in the rural Midwest may have faced different challenges compared to those in New York City during the initial phases of the pandemic, with the latter experiencing a much greater influx of critically ill patients. This difference in patient volume directly impacted the revenue streams of hospitals in these regions.

Impact of Healthcare Market Dynamics on Regional Financial Performance

Pre-existing market conditions also played a significant role in shaping regional variations in hospital financial performance. Regions with a high concentration of safety-net hospitals, which serve a disproportionate number of uninsured and underinsured patients, often faced greater financial challenges even before the pandemic. These hospitals often rely heavily on government funding, which may not always be sufficient to cover their operating costs.

Furthermore, the level of competition within a region’s healthcare market also influenced hospital margins. Highly competitive markets may have led to lower prices and reduced profitability for some hospitals. Conversely, regions with less competition may have allowed hospitals to maintain higher margins. For example, a rural hospital in a sparsely populated area may have had more pricing power than a hospital in a large metropolitan area with many competing institutions.

Governmental Support and its Differential Impact Across Regions

The distribution and effectiveness of governmental support programs also contributed to regional variations in hospital financial performance. While the federal government provided significant financial assistance through programs like the Coronavirus Relief Fund, the allocation of these funds and their uptake varied across regions. Some regions may have received more substantial support than others, while others may have faced challenges in accessing these funds due to administrative hurdles or other factors.

The impact of these programs was also influenced by state and local policies, further contributing to the regional disparities. For instance, states with robust Medicaid expansion programs may have experienced a more significant positive impact on their hospital systems compared to states without expansion.

Last Point

The COVID-19 pandemic presented an unprecedented challenge to the financial stability of hospitals. However, the story revealed by Kaufman Hall’s data is one of surprising resilience, showcasing the adaptability and strategic maneuvering of healthcare systems. While challenges remain, understanding the strategies employed during this period – from cost-cutting measures to government support – provides valuable insights into the future of hospital finance.

The journey through this data has been eye-opening, and I hope it’s given you a fresh perspective on the strength and resilience of our healthcare systems.

FAQ Compilation

What specific cost-cutting measures were most effective for hospitals during the pandemic?

Studies show that workforce management adjustments (like redeployment of staff) and supply chain optimization were highly effective. Technology adoption, particularly telehealth, also played a significant role in reducing costs while maintaining patient care.

How did the CARES Act specifically impact hospital margins?

The CARES Act provided significant financial relief, preventing many hospitals from facing insolvency. The exact impact varied based on hospital size and location, but generally, it helped stabilize margins and prevent further declines.

What are the biggest challenges facing hospitals in maintaining financial stability in the post-pandemic era?

Major challenges include inflation, persistent labor shortages, increased demand for services, and the ongoing need to invest in technology and infrastructure to meet evolving healthcare needs.