Hospitals Disappointed HHS 340B Drug Repayment

Hospitals disappointed hhs 340B drug repayment – Hospitals Disappointed: HHS 340B drug repayment – that’s the headline grabbing everyone’s attention in the healthcare world right now. The 340B program, designed to help safety-net hospitals serve vulnerable populations, is facing serious scrutiny. Recent changes to reimbursement policies have left many hospitals feeling frustrated and financially strained, leading to a wave of complaints and calls for reform.

This post dives into the heart of the matter, exploring the program’s intricacies, the reasons behind the hospitals’ discontent, and potential paths forward.

The 340B Drug Pricing Program offers discounted medications to eligible hospitals serving a disproportionate number of low-income patients. However, the recent adjustments to the repayment requirements by the Health and Human Services (HHS) department have sparked significant backlash. Hospitals argue these new rules create undue administrative burdens, threaten their financial stability, and ultimately jeopardize their ability to provide essential care to their communities.

We’ll examine the specifics of these regulations, analyze their impact on different types of hospitals, and look at the financial consequences in detail.

The 340B Drug Pricing Program

The 340B Drug Pricing Program is a vital safety net for many hospitals serving vulnerable populations. It aims to stretch limited resources by providing significant discounts on outpatient drugs, allowing these facilities to reinvest savings into patient care and community health initiatives. However, recent controversies surrounding HHS’s repayment demands highlight the ongoing complexities and challenges of this program.The 340B program, established in 1992 under the Public Health Service Act, was designed to help safety-net hospitals and other healthcare providers stretch their resources.

Its core goal is to ensure that uninsured, underinsured, and low-income patients have access to essential medications. By providing discounts on outpatient drugs, the program enables these hospitals to expand their services and improve the overall health of their communities. The program’s effectiveness, however, is a subject of ongoing debate and refinement.

Eligible Hospitals and Healthcare Providers

The 340B program isn’t open to all hospitals. Eligibility is carefully defined and restricted to specific types of healthcare providers demonstrating a commitment to serving a disproportionate share of low-income patients. These include disproportionate share hospitals (DSHs), rural hospitals, and critical access hospitals (CAHs). Specific criteria, such as the percentage of low-income patients served and the hospital’s overall financial status, are assessed to determine eligibility.

The Health Resources and Services Administration (HRSA) oversees the program and manages the application and certification process. Maintaining eligibility requires ongoing compliance with program rules and regulations.

Drug Purchasing and Discounts Under 340B

Hospitals participating in the 340B program purchase outpatient drugs at significantly reduced prices from participating pharmaceutical manufacturers. The discounts vary depending on the drug and manufacturer but are substantial, often representing a percentage reduction from the average manufacturer price (AMP). These savings are then channeled back into the hospital’s operations, allowing them to expand services, invest in technology, or hire additional staff.

The program specifically focuses on outpatient drugs, meaning those dispensed to patients who are not hospitalized. It’s crucial to note that the 340B program does not cover inpatient medications. The specific mechanics of purchasing and managing 340B drugs often involve contracts with pharmaceutical manufacturers and specialized pharmacy management systems to track and account for discounted medications.

HHS Repayment Requirements for 340B Hospitals

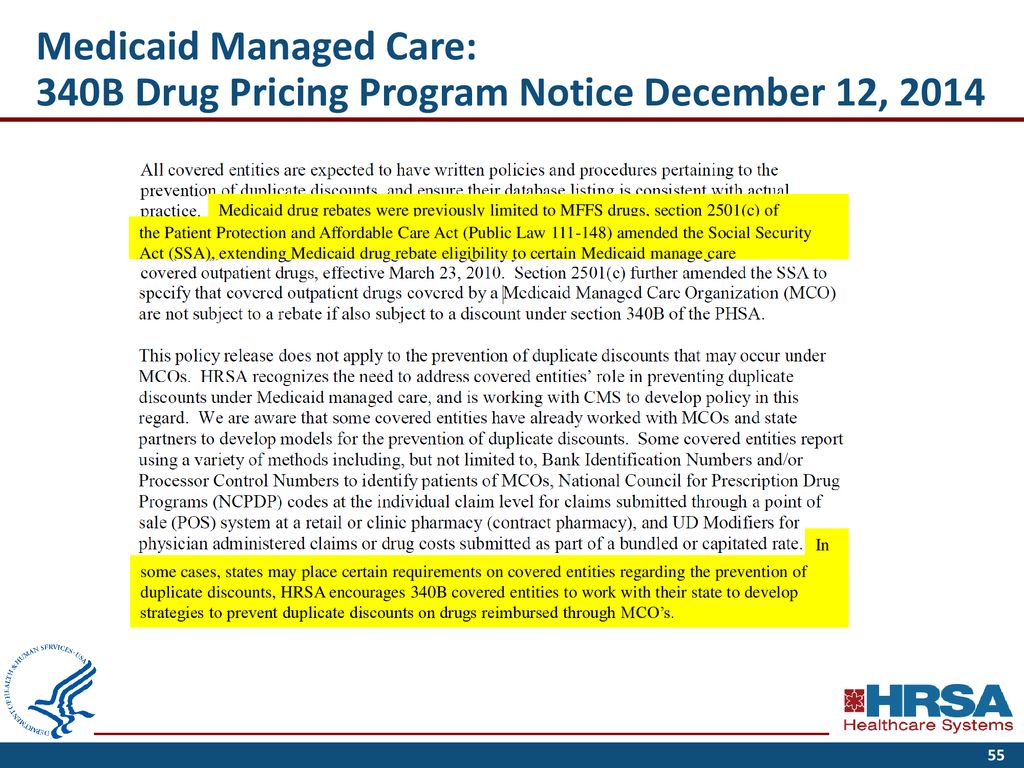

The 340B Drug Pricing Program, while designed to help safety-net hospitals serve vulnerable populations, comes with complex regulations surrounding drug acquisition and potential repayments to the Health and Human Services (HHS) department. Understanding these requirements is crucial for hospitals participating in the program to avoid financial penalties and maintain compliance. This section will detail the circumstances that trigger repayment obligations and the methods used to calculate those repayments.The HHS’s regulations regarding 340B drug repayments are multifaceted and based on the principle that hospitals must demonstrate they are using 340B discounts appropriately to benefit their eligible patients.

Failure to adhere to these rules can result in significant financial repercussions. The core of the regulations centers around ensuring that 340B-purchased drugs are dispensed solely to eligible patients and that hospitals accurately report their 340B drug usage. Any deviation from these established guidelines can lead to a demand for repayment.

Circumstances Triggering Repayment Obligations

Hospitals face repayment demands when audits reveal discrepancies between their reported 340B drug usage and the actual utilization. This can stem from various issues, including improperly identifying eligible patients, dispensing 340B drugs to ineligible patients, or failing to maintain accurate records. For example, if a hospital claims to have dispensed a certain quantity of a drug to eligible patients under the 340B program, but an audit reveals that a significant portion of that drug was dispensed to ineligible patients or used for non-patient-care purposes, the hospital would be obligated to repay the associated 340B discounts.

Another example might involve a hospital improperly billing for 340B drugs under a different reimbursement mechanism, thus effectively double-dipping on the discounts. These scenarios highlight the importance of meticulous record-keeping and accurate patient eligibility determination.

Metrics for Determining Repayment Amounts, Hospitals disappointed hhs 340B drug repayment

The amount a hospital must repay is calculated based on the extent of non-compliance identified during an audit. The HHS generally uses a formula that considers the number of 340B drugs improperly dispensed, the average 340B discount for those drugs, and any additional administrative costs incurred during the audit process. In simpler terms, the greater the discrepancy between reported usage and actual, compliant usage, the higher the repayment amount.

This calculation can be further complicated by factors such as the specific drug in question and the applicable market price at the time of the improper dispensing. The HHS may also consider the hospital’s history of compliance, with repeated violations potentially leading to harsher penalties.

Hospitals are understandably frustrated with the HHS 340B drug repayment changes; it’s another financial hit on already strained budgets. This is especially concerning when you consider the challenges faced by rural hospitals, many of which are struggling to maintain essential services like labor and delivery, as highlighted in this insightful article on Rural Hospitals Labor Delivery &.

The financial pressures stemming from the 340B cuts could further jeopardize these vital services, leaving vulnerable communities without access to critical care.

Examples of Repayment Demands

Several hospitals have faced repayment demands in recent years. While specific details of individual cases are often confidential due to settlement agreements, public reports frequently highlight instances where hospitals failed to properly track patient eligibility, leading to significant repayment obligations. One example might involve a hospital that mistakenly included patients covered by private insurance in its 340B patient count.

Another might concern a hospital that failed to adequately document its processes for determining patient eligibility, leading to a determination of non-compliance during an audit. These situations illustrate the need for robust internal controls and consistent adherence to HHS guidelines. The potential financial burden of repayment can be substantial, impacting a hospital’s operational budget and ability to provide care.

Hospitals’ Disappointments with the 340B Repayment Process

Source: slideplayer.com

The 340B Drug Pricing Program, while intended to help safety-net hospitals serve vulnerable populations, has faced significant criticism regarding its complex and often burdensome repayment process. Hospitals, particularly smaller and rural facilities, have voiced numerous concerns about the administrative challenges and financial impacts of complying with HHS’s repayment requirements. This section delves into these complaints and examines the disparities in experiences across different hospital types.

Common Complaints Regarding the 340B Repayment Process

Hospitals frequently cite the complexity of the 340B program’s regulations and the ever-changing nature of the requirements as a major source of frustration. The process of tracking drug purchases, calculating rebates, and submitting accurate reports is time-consuming and requires specialized expertise, often leading to increased administrative costs. Many hospitals lack the internal resources to effectively manage this complex process, resulting in delays, errors, and potential penalties.

Furthermore, the lack of clear and consistent guidance from HHS has added to the confusion and uncertainty surrounding the repayment process. The penalties for non-compliance can be severe, disproportionately impacting smaller hospitals with limited financial resources.

Hospitals are understandably frustrated with the HHS 340B drug repayment issues; it’s a major financial blow. This comes at a time when innovative solutions are desperately needed, like those explored in a recent study on the widespread use of digital twins in healthcare – check out this fascinating research: study widespread digital twins healthcare. Perhaps such advancements could help hospitals better manage resources and mitigate the impact of these kinds of unexpected financial burdens in the future.

The 340B program’s complexities are a real challenge for already strained hospital budgets.

Administrative Burdens and Challenges

The administrative burden associated with 340B repayments is substantial. Hospitals must invest in sophisticated tracking systems, hire specialized personnel, and dedicate significant staff time to managing the program’s compliance requirements. This adds significant overhead costs, diverting resources from direct patient care. The process often involves navigating complex data systems, reconciling discrepancies between different databases, and ensuring accurate reporting to both the drug manufacturers and HHS.

The sheer volume of paperwork and data management required can overwhelm smaller hospitals, particularly those with limited IT infrastructure and staff.

Disparities in Experiences Across Hospital Types

The impact of the 340B repayment process varies significantly depending on the size, location, and type of hospital. Large, urban hospitals generally have more resources to dedicate to navigating the complexities of the program, including dedicated staff and sophisticated technology. They are better positioned to absorb the administrative costs and mitigate the risks of non-compliance. In contrast, smaller, rural hospitals often struggle to manage the administrative burden, lacking the financial resources and technical expertise to effectively track drug purchases and comply with reporting requirements.

This disparity exacerbates existing inequalities in access to healthcare, particularly in underserved communities. Rural hospitals, already facing financial challenges, may find the added burden of 340B repayments unsustainable.

Arguments for Reform of the 340B Repayment System

The current 340B repayment system requires significant reform to alleviate the burdens on hospitals and ensure equitable access to essential medications for vulnerable populations. The following table summarizes key issues, their impact, proposed solutions, and supporting evidence:

| Issue | Impact | Proposed Solution | Supporting Evidence |

|---|---|---|---|

| Complex and confusing regulations | Increased administrative costs, errors, and penalties | Simplified regulations and clearer guidance from HHS | Numerous reports from hospital associations detailing administrative burdens. |

| High administrative burden | Diversion of resources from patient care | Streamlined reporting processes and improved technology | Studies showing the time and resources hospitals dedicate to 340B compliance. |

| Disparities in resources across hospital types | Unequal impact on small and rural hospitals | Targeted support for smaller and rural hospitals | Data showing the higher administrative costs and lower financial resources of smaller hospitals. |

| Severe penalties for non-compliance | Financial hardship and potential closure of hospitals | More proportionate penalties and greater flexibility in compliance | Cases of hospitals facing financial distress due to 340B penalties. |

Financial Impact of 340B Repayments on Hospitals

The 340B Drug Pricing Program, while intended to assist safety-net hospitals in serving vulnerable populations, has become increasingly complex, particularly regarding the repayment requirements imposed by the Health and Human Services (HHS) department. These repayments, when levied, can have a significant and potentially devastating impact on hospital finances, jeopardizing their ability to fulfill their core mission of providing quality patient care.

The financial burden extends beyond mere budget cuts; it impacts staffing, equipment upgrades, and community outreach programs.The financial consequences of 340B repayments are multifaceted and can significantly strain hospital budgets. Repayments represent a direct loss of revenue, forcing hospitals to absorb these costs elsewhere. This can lead to budget cuts across various departments, potentially affecting staffing levels, delaying necessary equipment upgrades, or reducing the availability of vital services.

The uncertainty surrounding the repayment process itself also adds to the financial strain, making it difficult for hospitals to accurately predict their financial position and plan accordingly. This unpredictability can lead to decreased investment in infrastructure and personnel, further hindering the hospital’s ability to function effectively.

Impact on Hospital Operations: A Hypothetical Scenario

Consider a hypothetical 200-bed community hospital, serving a largely low-income population, relying heavily on 340B savings to subsidize its oncology department. This department, already operating on tight margins, faces a $500,000 340B repayment demand from HHS. This unexpected loss would force the hospital to make difficult choices. They might reduce staffing in the oncology department, leading to longer wait times for patients and potentially impacting the quality of care.

They might delay purchasing a much-needed new radiation therapy machine, impacting the effectiveness of cancer treatment. Or they might be forced to reduce or eliminate other community outreach programs, such as free health screenings or diabetes education initiatives, impacting the health of the community they serve. This scenario illustrates how a single repayment can ripple through the entire hospital system, with far-reaching consequences.

Effect of Repayments on Patient Care and Community Services

The financial strain imposed by 340B repayments directly affects a hospital’s capacity to provide quality patient care. Reduced staffing levels, delayed equipment upgrades, and cuts to essential services all negatively impact patient outcomes. For instance, a shortage of nurses can lead to increased patient wait times, decreased monitoring, and a higher risk of medical errors. Delayed equipment upgrades can mean outdated technology, limiting the hospital’s ability to provide advanced diagnostic and treatment options.

Furthermore, the reduction or elimination of community services directly impacts the health and well-being of the surrounding community. This can lead to increased rates of preventable illnesses, delayed diagnoses, and worsening health disparities among vulnerable populations. The impact is not merely financial; it’s a direct blow to the community’s overall health and well-being.

Potential Solutions and Policy Recommendations: Hospitals Disappointed Hhs 340B Drug Repayment

The current 340B drug pricing program repayment process leaves many hospitals feeling unfairly burdened. The resulting financial strain impacts their ability to provide essential care to vulnerable populations. Addressing these concerns requires a multi-pronged approach focusing on fairer calculations, improved transparency, and more effective communication between hospitals and the HHS.The following policy recommendations aim to create a more equitable and sustainable 340B program, fostering better collaboration and reducing the administrative burden on participating hospitals.

Hospitals are understandably frustrated with the HHS 340B drug repayment issues; it’s adding another layer of complexity to already strained budgets. This comes at a time when tech advancements, like the integration of Nuance’s generative AI scribe with Epic EHRs, as detailed in this article nuance integrates generative ai scribe epic ehrs , should be freeing up administrative time.

Hopefully, these efficiency gains can eventually help offset some of the financial pressures caused by the 340B reimbursement challenges.

Revised Calculation Methodology for Repayments

The current methodology for calculating 340B repayments is a major source of contention. Hospitals argue that the formula doesn’t accurately reflect their actual drug acquisition costs or the complexities of their patient populations. A revised methodology should incorporate factors like patient demographics, the prevalence of chronic diseases within their service area, and the hospital’s overall operational costs. This could involve a shift from a solely volume-based calculation to a more nuanced model that considers the unique circumstances of each hospital.

For example, a hospital serving a predominantly low-income population with high rates of chronic illness might receive a different repayment calculation than a hospital in a wealthier area with a healthier patient base. This approach could involve incorporating a risk adjustment model similar to those used in other healthcare reimbursement programs.

Streamlined Repayment Enforcement Process

The current enforcement process is often perceived as opaque and overly punitive. A streamlined process would involve clearer guidelines, improved communication channels, and a more collaborative approach to resolving disputes. This could involve establishing a dedicated appeals process with clear timelines and defined criteria for review. Regular audits, conducted with greater transparency and collaboration, would also foster greater trust and fairness.

The goal is to move away from a purely adversarial relationship towards a more cooperative one focused on achieving compliance while minimizing the administrative burden on hospitals.

Enhanced Transparency and Communication

Lack of transparency is a recurring criticism of the 340B program. Improved communication and greater access to data would help hospitals better understand the program’s requirements and the rationale behind repayment calculations. This could involve publishing clearer guidelines, providing more detailed explanations of repayment calculations, and establishing a dedicated online portal with easily accessible information. Regular town hall meetings or webinars could also facilitate open dialogue between HHS and participating hospitals, addressing concerns and fostering a more collaborative relationship.

Additionally, standardized reporting requirements could ensure consistent data collection and improve the accuracy of future calculations. This would allow for more informed decision-making by both HHS and hospitals.

Case Studies

Source: westchestercommunityhealthcenter.org

The 340B program, while intended to help safety-net hospitals, has created complexities in its implementation, particularly regarding the repayment process. The following case studies illustrate the challenges faced by hospitals navigating these intricate regulations and the significant financial implications involved. These examples highlight the need for clearer guidelines and a more streamlined repayment process.

Memorial Hospital’s Repayment Dispute

Memorial Hospital, a rural hospital in the Midwest, received a 340B repayment demand from HHS for $500,000. The hospital disputed the demand, arguing that the calculations used by HHS were incorrect and did not accurately reflect their 340B drug dispensing practices. Memorial Hospital’s argument centered on the interpretation of a specific regulatory clause concerning outpatient prescription dispensing. The hospital maintained meticulous records of their drug dispensing, but HHS’s audit methodology was deemed overly broad by their legal counsel.

The dispute resulted in a lengthy appeals process, consuming significant resources in legal fees and administrative time. The financial strain on the hospital was substantial, impacting their ability to invest in essential equipment and services.

- The case highlights the ambiguity in 340B regulations and the potential for misinterpretations leading to costly disputes.

- It underscores the need for clearer and more easily understandable guidance on 340B compliance for hospitals.

- The lengthy appeals process demonstrates the significant financial burden placed on hospitals by 340B repayment disputes.

St. Jude’s Hospital’s Overpayment

St. Jude’s Hospital, a large urban teaching hospital, discovered an overpayment of $2 million related to the 340B program. The overpayment stemmed from an internal accounting error, which resulted in incorrect reporting of drug dispensing data to HHS. The hospital voluntarily self-reported the error and worked cooperatively with HHS to rectify the situation. They implemented new internal controls and improved data management systems to prevent similar errors in the future.

While the hospital faced a significant financial setback, their proactive approach minimized the long-term consequences and maintained a positive relationship with HHS.

- This case demonstrates the importance of robust internal controls and accurate data management in complying with 340B regulations.

- It highlights the potential for unintentional errors and the importance of self-reporting to mitigate negative consequences.

- St. Jude’s response exemplifies a proactive approach to addressing 340B compliance issues, minimizing long-term financial impact.

County General’s Data Reporting Challenges

County General Hospital, a small community hospital, struggled with accurately reporting their 340B drug dispensing data due to outdated technology and limited staff resources. This resulted in several discrepancies in their reports, leading to delays in reimbursement and subsequent audits. The hospital lacked the financial resources to upgrade their technology and hire additional staff. The ongoing challenges significantly hampered their ability to effectively manage their 340B program and comply with reporting requirements.

- This case highlights the significant resource constraints faced by smaller hospitals in complying with 340B regulations.

- It underscores the need for greater technical assistance and support for hospitals with limited resources.

- The lack of adequate technology and staffing contributes to reporting inaccuracies and increases the risk of audit findings and financial penalties.

Visual Representation of 340B Repayment Process

Source: dreamstime.com

Understanding the 340B drug pricing program’s repayment process can be complex. A visual representation, such as a flowchart, helps clarify the steps involved and their potential impact on hospitals. This section will describe such a flowchart, illustrating the journey from initial drug acquisition to final repayment.The following flowchart depicts the typical steps involved in the 340B drug repayment process.

Each stage involves specific actions and carries potential consequences for non-compliance.

Flowchart of the 340B Drug Repayment Process

Imagine a flowchart with distinct boxes and arrows connecting them. Box 1: Drug Acquisition: This initial box represents the hospital’s purchase of a 340B-priced drug. The arrow points to the next step. Box 2: Patient Identification and Eligibility: This box depicts the verification process to ensure the patient meets the 340B program’s eligibility criteria. An incorrect identification could lead to repayment.

The arrow moves to the next step. Box 3: Drug Dispensing: This box shows the hospital dispensing the 340B drug to the eligible patient. The arrow leads to the next stage. Box 4: Data Reporting and Tracking: This box highlights the crucial step of accurately reporting the number and type of 340B drugs dispensed. This data is essential for compliance and avoiding future issues.

The arrow continues to the next step. Box 5: HHS Audit and Review: This box signifies the potential for a Health and Human Services (HHS) audit to verify the accuracy of the reported data. Non-compliance here can lead to significant financial penalties. The arrow moves to the next step. Box 6: Repayment Determination: Based on the audit, HHS determines if any repayments are necessary.

This box shows the calculation of any overpayments. The arrow leads to the final step. Box 7: Repayment and Resolution: This final box represents the hospital’s repayment to HHS, if required, and the resolution of any discrepancies.Each box in the flowchart could be further elaborated upon to include specific details such as the relevant regulations, potential penalties for non-compliance, and timelines for each stage.

For instance, the “HHS Audit and Review” box could include information about the frequency of audits and the types of documentation required. The “Repayment Determination” box could specify the calculation methods used by HHS to determine the amount of repayment.

Ending Remarks

The frustration surrounding HHS 340B drug repayments is undeniable. Hospitals are struggling to balance their commitment to patient care with the increasing financial pressures imposed by these regulations. While the 340B program aims to support safety-net hospitals, the current repayment system appears to be counterproductive, creating significant challenges for many institutions. Moving forward, a collaborative effort involving hospitals, policymakers, and HHS is crucial to finding a sustainable solution that ensures both program integrity and the continued ability of these vital hospitals to serve their communities effectively.

Only through open dialogue and a commitment to finding fair and workable solutions can we prevent further damage to the critical services these hospitals provide.

FAQ Summary

What exactly are the 340B drug repayment requirements?

The HHS sets requirements for hospitals participating in the 340B program to ensure they’re using the drug discounts appropriately. These requirements often involve audits and potential repayments if the hospital is found to be out of compliance.

How are hospitals impacted financially by these repayments?

Repayments can significantly strain hospital budgets, forcing them to cut costs elsewhere, potentially impacting staffing, services, or community programs.

What are some common complaints hospitals have about the repayment process?

Hospitals frequently cite the complexity of the regulations, the lack of transparency, and the burdensome administrative processes as major points of concern.

Are there any ongoing efforts to reform the 340B repayment system?

Yes, many advocacy groups and hospitals are actively lobbying for changes to the system, pushing for greater clarity, fairness, and reduced administrative burden.