Must-Have Things for Diabetes Patients

Must have things for diabetes patients – Must-have things for diabetes patients go far beyond just medication. Living well with diabetes requires a holistic approach encompassing careful monitoring, smart dietary choices, regular exercise, and proactive management of emotional wellbeing. This isn’t just about surviving; it’s about thriving, and understanding the tools and strategies available is the first step toward a healthier, happier life. This guide will equip you with the knowledge and resources to navigate your diabetes journey with confidence.

We’ll explore essential tools like blood glucose meters and the importance of consistent monitoring. We’ll delve into medication and insulin management, offering clarity on different types and administration methods. Nutrition plays a crucial role, and we’ll examine creating balanced meal plans and understanding carbohydrate counting. Furthermore, we’ll discuss the significance of regular physical activity and strategies for managing potential complications, both physical and emotional.

By the end, you’ll have a comprehensive understanding of the essential elements for managing diabetes effectively.

Blood Glucose Monitoring

Managing diabetes effectively relies heavily on understanding and controlling your blood glucose levels. Regular monitoring is crucial for making informed decisions about your diet, medication, and overall lifestyle. This allows you to prevent both short-term complications like hypoglycemia (low blood sugar) and long-term complications such as eye damage, nerve damage, and kidney disease.

Managing diabetes means prioritizing blood glucose monitoring and healthy eating, but it’s also crucial to consider long-term health. Did you know that regular eye exams are important, and research suggests that, as discussed in this fascinating article, can eye test detect dementia risk in older adults ? This highlights the importance of proactive healthcare, just as consistently checking your blood sugar is vital for diabetes management.

Types of Blood Glucose Meters and Their Features

Several types of blood glucose meters are available, each with its own set of advantages and disadvantages. The choice often depends on individual needs, preferences, and budget.

| Meter Type | Accuracy | Cost | Ease of Use |

|---|---|---|---|

| Standard Blood Glucose Meter | Generally accurate within ±15 mg/dL or 15% of the reading (depending on the specific model). Regular calibration is important. | Varies widely depending on brand and features. Generally affordable, with many options available at reasonable prices. Test strips are an ongoing cost. | Relatively easy to use. Most meters have large displays and simple button interfaces. Requires a finger prick for blood sample. |

| Flash Glucose Monitoring Systems (CGM) | Provides continuous glucose readings throughout the day and night. Accuracy varies depending on the system. Usually more accurate than standard meters, but still subject to error. | Generally more expensive than standard meters, with significant ongoing costs for sensors and transmitters. | Relatively easy to use, with less frequent finger prick testing needed. Data is usually available via a smartphone app. |

| Smartphone-Connected Meters | Accuracy is comparable to standard meters. | Cost varies. Usually more expensive than basic meters but often cheaper than CGMs. | Easy to use; data is automatically transferred to a smartphone app for tracking and analysis. |

Performing a Blood Glucose Test

Accurate blood glucose testing involves careful attention to detail. Here’s a step-by-step guide for using a standard blood glucose meter:

Before starting, ensure you have everything you need: your meter, lancet, lancing device, test strips, alcohol swabs, and a clean, dry surface.

- Wash your hands thoroughly with soap and water.

- Insert a new test strip into the meter.

- Use an alcohol swab to clean the area you will be pricking (typically a fingertip).

- Use the lancing device to prick your fingertip. Gently squeeze your finger to obtain a drop of blood.

- Apply the blood to the test strip. Ensure the blood completely covers the designated area.

- Wait for the meter to display your blood glucose reading.

- Record your reading in your logbook or diabetes management app.

- Dispose of the used lancet and test strip properly.

The Importance of Recording and Tracking Blood Glucose Levels

Recording and tracking your blood glucose levels is essential for effective diabetes management. This data provides valuable insights into how your body responds to different foods, medications, and activities. By analyzing trends and patterns, you and your healthcare provider can adjust your treatment plan to better control your blood sugar and reduce the risk of complications. For example, consistently high readings might indicate a need for medication adjustment, while consistently low readings could suggest a need to adjust meal timing or carbohydrate intake.

Regular monitoring empowers you to take an active role in your health.

Medication and Insulin Management

Source: buycanadianinsulin.com

Managing diabetes effectively often involves medication and/or insulin therapy. Understanding your prescribed medications and how to manage your insulin is crucial for maintaining good blood sugar control and preventing long-term complications. This section will delve into the different types of medications, insulin options, and best practices for their use.

Common Diabetes Medications

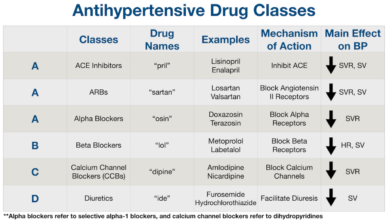

Many medications are used to manage diabetes, each working through different mechanisms. Choosing the right medication depends on several factors, including your type of diabetes, overall health, and individual needs. It’s crucial to discuss medication options with your doctor to determine the best approach for you.

- Metformin: This is a first-line medication for type 2 diabetes. It works by decreasing glucose production in the liver and improving insulin sensitivity in muscle cells. Potential side effects include nausea, diarrhea, and stomach upset. These side effects often lessen over time.

- Sulfonylureas (e.g., Glipizide, Glyburide): These medications stimulate the pancreas to release more insulin. They are often used in combination with metformin. Side effects can include weight gain and hypoglycemia (low blood sugar).

- Meglitinides (e.g., Repaglinide, Nateglinide): Similar to sulfonylureas, these stimulate insulin release but have a shorter duration of action. They are often taken before meals. Side effects are similar to sulfonylureas, including hypoglycemia.

- DPP-4 Inhibitors (e.g., Sitagliptin, Saxagliptin): These medications increase the levels of incretin hormones, which stimulate insulin release and suppress glucagon (a hormone that raises blood sugar). Side effects are generally mild, but some individuals may experience upper respiratory infections or headaches.

- SGLT2 Inhibitors (e.g., Canagliflozin, Dapagliflozin): These medications work by blocking the reabsorption of glucose in the kidneys, increasing glucose excretion in the urine. Side effects can include urinary tract infections and genital yeast infections.

- GLP-1 Receptor Agonists (e.g., Semaglutide, Liraglutide): These medications mimic the effects of incretin hormones, promoting insulin release and suppressing glucagon. They can also lead to weight loss. Side effects can include nausea and vomiting.

Insulin Types and Administration

Insulin is a hormone that helps glucose enter cells for energy. People with type 1 diabetes and some with type 2 diabetes require insulin therapy. Several types of insulin are available, each with a different onset, peak, and duration of action. Understanding these differences is essential for effective blood sugar control.

- Rapid-acting insulin (e.g., Lispro, Aspart, Glulisine): Starts working within 15 minutes, peaks in 1-2 hours, and lasts for 3-4 hours. Often taken right before meals.

- Short-acting insulin (Regular): Starts working within 30 minutes, peaks in 2-3 hours, and lasts for 5-7 hours. Can be taken before meals or as a basal insulin.

- Intermediate-acting insulin (NPH): Starts working within 2-4 hours, peaks in 4-12 hours, and lasts for 12-18 hours. Often used twice daily.

- Long-acting insulin (e.g., Glargine, Detemir): Starts working within 1-2 hours, has no significant peak, and lasts for 20-24 hours. Provides a basal level of insulin.

Insulin Injection Process

Here’s a description of the insulin injection process:Imagine a person holding a pre-filled insulin pen. The pen is held like a pen, with the needle pointing downward. The person cleans the injection site (typically the abdomen, thigh, or upper arm) with an alcohol swab. They pinch a small area of skin to create a layer of fat. The needle is inserted at a 90-degree angle, pushing the plunger down until the dose is delivered.

The needle is then removed, and the injection site is gently pressed. The process is quick and relatively painless with proper technique.

Managing diabetes effectively means having the right tools, like a reliable glucose meter and a stash of healthy snacks. It’s all about proactive health management, much like the approaches needed for other conditions; for example, learning about effective strategies to manage Tourette syndrome in children highlights the importance of understanding and adapting to individual needs. Similarly, for diabetes, having a well-stocked first-aid kit with essential supplies is crucial for managing unexpected situations.

Insulin Storage and Handling

Proper storage and handling of insulin are crucial to maintain its potency and effectiveness. Unopened insulin vials and pens should be refrigerated, but never frozen. Opened insulin pens can be stored at room temperature for up to 28 days. Always check the expiration date and inspect insulin for any signs of cloudiness or discoloration before use. Dispose of insulin properly according to your healthcare provider’s instructions.

Insulin Delivery Methods Comparison

| Method | Cost | Convenience | Flexibility |

|---|---|---|---|

| Syringes | Low | Moderate | Low (requires multiple daily injections) |

| Insulin Pens | Moderate | High | Moderate (allows for dose adjustments) |

| Insulin Pumps | High | High | High (provides continuous insulin delivery and allows for precise dose adjustments) |

Healthy Diet and Nutrition

Managing diabetes effectively involves a significant focus on diet and nutrition. What you eat directly impacts your blood sugar levels, energy levels, and overall health. A well-planned diabetic diet isn’t about restriction; it’s about making informed choices to maintain stable blood sugar and support your well-being. This section will explore key aspects of creating a healthy eating plan for managing diabetes.

Sample Meal Plan for a Diabetic Individual

A balanced meal plan for someone with diabetes should include a variety of foods from all food groups, focusing on portion control and carbohydrate intake. The following is a sample meal plan; individual needs may vary, and consulting a registered dietitian or certified diabetes educator is crucial for personalized guidance. Remember, this is just an example, and calorie and carbohydrate counts will depend on the specific ingredients and preparation methods.

| Meal | Food | Portion Size | Approximate Nutritional Information (per serving, may vary) |

|---|---|---|---|

| Breakfast | 1/2 cup Oatmeal with 1/4 cup berries and 1/4 cup chopped nuts | 1 cup | Approx. 250 calories, 45g carbohydrates, 5g fiber |

| Lunch | 4oz Grilled Chicken Salad with 2 cups mixed greens, 1/2 cup chopped vegetables, and 2 tablespoons light vinaigrette | 1.5 cups | Approx. 300 calories, 20g carbohydrates, 8g fiber |

| Dinner | 4oz Baked Salmon with 1/2 cup brown rice and 1 cup steamed broccoli | 1.5 cups | Approx. 400 calories, 40g carbohydrates, 10g fiber |

| Snack | 1 small apple with 1 ounce of almonds | 1 apple and 1 oz almonds | Approx. 200 calories, 20g carbohydrates, 5g fiber |

Carbohydrate Counting and Blood Glucose Control

Carbohydrate counting is a crucial tool for managing blood sugar levels. It involves tracking the amount of carbohydrates you consume at each meal and snack. This helps you predict how your blood sugar will respond and allows you to adjust your insulin dose or medication accordingly, preventing blood sugar spikes or drops. Accurate carbohydrate counting requires understanding the carbohydrate content of various foods and using portion control to manage intake.

For example, a person might use a food scale and a carbohydrate counting app to carefully track the carbs in each meal. Consistent monitoring and adjustment based on blood glucose readings are essential for effective carbohydrate counting.

Benefits of Fiber-Rich Foods in a Diabetic Diet

Fiber, a type of carbohydrate the body can’t digest, plays a vital role in managing diabetes. High-fiber foods slow down the absorption of sugar into the bloodstream, preventing rapid spikes in blood glucose levels. Fiber also promotes feelings of fullness, aiding in weight management, which is often beneficial for individuals with diabetes. Good sources of fiber include whole grains, fruits, vegetables, and legumes.

Including these foods in your diet contributes to better blood sugar control and overall health. For example, a diet rich in soluble fiber, found in oats and beans, can help lower cholesterol levels.

Foods to Limit or Avoid in a Diabetic Diet

Certain foods should be limited or avoided in a diabetic diet due to their high sugar or refined carbohydrate content. Sugary drinks, processed foods, and white bread are examples of foods that can cause rapid blood sugar increases. These foods offer minimal nutritional value and contribute to weight gain. Limiting saturated and trans fats is also important to manage cholesterol levels and cardiovascular health, often compromised in individuals with diabetes.

For instance, choosing lean protein sources over fatty meats can significantly improve overall health outcomes. Replacing refined carbohydrates with whole grains is a beneficial dietary change.

Physical Activity and Exercise

Managing diabetes effectively isn’t just about what you eat and the medications you take; it’s also significantly about incorporating regular physical activity into your daily routine. Exercise plays a crucial role in improving insulin sensitivity, managing weight, and boosting overall well-being for individuals with diabetes. It’s a powerful tool in your diabetes management arsenal, complementing other strategies for better blood sugar control.

Managing diabetes means having the right tools – a reliable glucose meter, test strips, and insulin (if needed) are absolute essentials. It’s all about proactive health management, much like the choices Karishma Mehta made when she decided to freeze her eggs, as detailed in this article karishma mehta gets her eggs frozen know risks associated with egg freezing ; planning for the future is key, whether it’s fertility or blood sugar control.

Don’t forget to keep a healthy snack readily available to manage those blood sugar dips!

Regular exercise helps your body use insulin more effectively, meaning your cells can better absorb glucose from your bloodstream. This, in turn, helps to keep your blood sugar levels within a healthy range. Beyond blood sugar control, exercise offers a multitude of other health benefits, including improved cardiovascular health, weight management, reduced stress levels, and enhanced mood. Finding the right type and intensity of exercise is key to maximizing these benefits while minimizing the risk of complications.

Sample Weekly Exercise Plan for Diabetics

This plan offers a variety of activities to suit different fitness levels. Remember to consult your doctor or a certified diabetes educator before starting any new exercise program, especially if you have any underlying health conditions.

- Beginner (Low-Impact):

- Monday: 30-minute brisk walk

- Tuesday: Rest or gentle stretching

- Wednesday: 30-minute water aerobics

- Thursday: Rest or gentle stretching

- Friday: 30-minute chair yoga

- Weekend: Rest or light activity like gardening.

- Intermediate (Moderate-Impact):

- Monday: 45-minute brisk walk or cycling

- Tuesday: Strength training (bodyweight exercises or light weights), 30 minutes

- Wednesday: 45-minute swimming

- Thursday: Rest or gentle stretching

- Friday: 45-minute brisk walk or jogging

- Weekend: Hiking or a longer walk.

- Advanced (High-Impact):

- Monday: 60-minute run or interval training

- Tuesday: Strength training (weights), 45 minutes

- Wednesday: 60-minute swimming or cycling

- Thursday: Rest or active recovery (yoga or stretching)

- Friday: 60-minute run or HIIT workout

- Weekend: Longer distance run or cycling, participating in a team sport.

Benefits of Regular Physical Activity in Diabetes Management

Regular physical activity offers a wide range of benefits for individuals with diabetes. These benefits extend beyond blood sugar control and encompass various aspects of overall health and well-being.

- Improved Insulin Sensitivity: Exercise enhances the body’s ability to use insulin effectively, leading to better glucose uptake by cells.

- Weight Management: Physical activity helps burn calories and maintain a healthy weight, which is crucial for diabetes management.

- Reduced Cardiovascular Risk: Exercise strengthens the heart and improves cardiovascular health, reducing the risk of heart disease and stroke.

- Improved Blood Pressure and Cholesterol Levels: Regular physical activity contributes to healthier blood pressure and cholesterol levels.

- Enhanced Mood and Reduced Stress: Exercise releases endorphins, which have mood-boosting and stress-reducing effects.

- Improved Sleep Quality: Regular physical activity can improve sleep quality, which is often disrupted in individuals with diabetes.

Appropriate Exercise Intensity and Duration

Choosing the right intensity and duration of exercise is vital for maximizing benefits and minimizing risks. Overexertion can lead to hypoglycemia (low blood sugar), while insufficient exercise may not provide optimal benefits.

Intensity should be tailored to individual fitness levels. A good starting point is moderate-intensity exercise, such as a brisk walk where you can talk but not sing. Gradually increase intensity and duration as your fitness improves. Duration should ideally be at least 150 minutes of moderate-intensity aerobic activity per week, spread across several days.

Impact of Exercise on Blood Glucose Levels and Overall Health

Exercise directly impacts blood glucose levels by increasing glucose uptake by muscles. The effect varies depending on the type, intensity, and duration of exercise, as well as individual factors such as insulin sensitivity and medication. For example, a short burst of high-intensity exercise might lead to a temporary decrease in blood glucose, while longer, moderate-intensity exercise might have a more sustained effect.

In the long term, regular exercise improves insulin sensitivity, leading to better blood sugar control and reduced risk of long-term complications such as heart disease, nerve damage, and kidney disease. It also contributes to weight management, improved cardiovascular health, and enhanced overall well-being.

Managing Complications

Source: blogspot.com

Living with diabetes means being proactive about your health. While diligent management of blood sugar, diet, and exercise significantly reduces the risk, it’s crucial to understand the potential long-term complications and how to mitigate them. These complications arise from the damaging effects of high blood sugar levels on various organs and systems over time. Early detection and management are key to preventing or slowing their progression.Diabetic complications are serious, but with proper care and monitoring, many can be managed effectively.

Understanding these potential issues empowers you to take control of your health and improve your quality of life.

Diabetic Neuropathy

Diabetic neuropathy refers to nerve damage caused by persistently high blood sugar. This damage can affect various parts of the body, leading to a range of symptoms depending on the nerves affected. Peripheral neuropathy, affecting the nerves in the hands and feet, is the most common type.Symptoms of peripheral diabetic neuropathy can include numbness, tingling, burning, or pain in the extremities.

These sensations can be mild or severe, and may worsen at night. In some cases, individuals may experience loss of feeling, making them more susceptible to injuries that go unnoticed and can lead to infections. Another type, autonomic neuropathy, affects the nerves controlling involuntary functions like digestion, heart rate, and bladder control, potentially resulting in digestive issues, irregular heartbeat, or urinary problems.Treatment for diabetic neuropathy focuses on managing blood sugar levels and alleviating symptoms.

Medications, including pain relievers and antidepressants, may be prescribed to manage pain and discomfort. Physical therapy can help improve mobility and function, while supportive devices, like special shoes or inserts, can protect against foot injuries. Maintaining good blood sugar control remains the most crucial aspect of preventing further nerve damage.

Regular Check-ups for Early Detection, Must have things for diabetes patients

Regular check-ups with your healthcare team are vital for managing diabetes and preventing complications. These appointments allow for monitoring of blood sugar levels, blood pressure, cholesterol, and kidney function. Additionally, your doctor may recommend specific tests to screen for early signs of retinopathy (eye damage), nephropathy (kidney damage), and neuropathy. Early detection allows for timely intervention, which can significantly improve outcomes and slow or prevent the progression of these complications.

For example, regular eye exams can detect retinopathy early, allowing for treatment with laser therapy or other interventions to preserve vision. Similarly, early detection of nephropathy can help prevent kidney failure through lifestyle changes and medication.

Preventing and Delaying Complications

The most effective way to prevent or delay the onset of diabetes-related complications is through rigorous management of blood sugar levels. Maintaining blood sugar within the target range recommended by your doctor is crucial. This requires careful adherence to your diabetes treatment plan, which includes medication, insulin management (if necessary), a healthy diet, and regular physical activity. Beyond blood sugar control, other lifestyle factors also play a role.

These include maintaining a healthy weight, managing blood pressure and cholesterol levels, and not smoking. These steps significantly reduce the risk of developing or worsening diabetic complications. For example, individuals who maintain healthy blood pressure are less likely to experience cardiovascular complications associated with diabetes. Similarly, a healthy diet rich in fruits, vegetables, and whole grains can contribute to better overall health and reduced risk of complications.

Emotional and Mental Wellbeing

Living with diabetes isn’t just about managing blood sugar; it’s also about nurturing your emotional and mental health. The daily demands of managing your condition can take a toll, leading to stress, anxiety, and even depression. Understanding and addressing these emotional challenges is crucial for overall well-being and effective diabetes management. Prioritizing mental health is as important as managing blood glucose levels.

Coping Mechanisms for Emotional Challenges

Diabetes can bring unexpected emotional highs and lows. Feeling overwhelmed, frustrated, or even angry is completely understandable. Developing healthy coping mechanisms is key to navigating these feelings. These strategies can help you manage the emotional rollercoaster that sometimes accompanies diabetes.

- Mindfulness and Meditation: Practicing mindfulness techniques, such as meditation or deep breathing exercises, can help center you in the present moment and reduce feelings of anxiety or overwhelm. Even a few minutes a day can make a difference.

- Journaling: Writing down your thoughts and feelings can be a powerful way to process emotions and identify triggers. This can help you understand your emotional patterns and develop strategies for coping.

- Seeking Professional Support: Don’t hesitate to reach out to a therapist or counselor specializing in diabetes-related emotional challenges. They can provide guidance and support in developing effective coping strategies.

- Connecting with Others: Sharing your experiences with others who understand what you’re going through can be incredibly helpful. Support groups or online communities offer a safe space to connect and share feelings.

Stress Management in Diabetes Care

Stress significantly impacts blood sugar levels. When stressed, the body releases hormones that can raise blood glucose. Effective stress management is therefore a vital component of diabetes self-management.

- Identify Stressors: Pinpoint the situations or events that trigger your stress response. This awareness is the first step toward managing them effectively.

- Relaxation Techniques: Incorporate relaxation techniques into your daily routine. This could include yoga, tai chi, progressive muscle relaxation, or listening to calming music.

- Time Management: Effective time management can reduce feelings of being overwhelmed. Prioritize tasks, break down large projects into smaller, manageable steps, and learn to say no to commitments that add unnecessary stress.

- Healthy Lifestyle Choices: Prioritizing a healthy diet, regular exercise, and sufficient sleep can significantly reduce stress levels and improve overall well-being.

Building a Strong Support System

Having a strong support system is invaluable in managing diabetes. Surrounding yourself with understanding and supportive individuals can make a world of difference.

A strong support system can involve family, friends, healthcare professionals, and support groups. Open communication with loved ones about your diabetes and your needs is crucial. Joining a diabetes support group allows you to connect with others who share similar experiences and challenges. Your healthcare team – including your doctor, diabetes educator, and registered dietitian – provides medical expertise and guidance.

Maintaining a Positive Outlook

Maintaining a positive outlook is essential for managing diabetes effectively. While it’s important to acknowledge the challenges, focusing on your strengths and celebrating small victories can significantly boost your overall well-being.

- Focus on Self-Care: Prioritize activities that bring you joy and relaxation. This could be anything from spending time in nature to pursuing hobbies or spending quality time with loved ones.

- Set Realistic Goals: Set achievable goals for your diabetes management. Celebrating small successes along the way can build confidence and motivation.

- Practice Self-Compassion: Be kind to yourself. Don’t beat yourself up over setbacks. Remember that everyone makes mistakes, and learning from them is part of the process.

- Celebrate Milestones: Acknowledge and celebrate your achievements in managing your diabetes. This can be a significant motivator in maintaining a positive outlook.

Closing Summary: Must Have Things For Diabetes Patients

Managing diabetes effectively is a journey, not a destination. It requires dedication, understanding, and the right tools. Remember, consistent blood glucose monitoring, a balanced diet, regular exercise, and proactive management of potential complications are key. Don’t hesitate to reach out to your healthcare provider for personalized guidance and support. By embracing a holistic approach and utilizing the resources available, you can take control of your diabetes and live a full, vibrant life.

FAQ Section

What’s the best way to store insulin?

Generally, insulin should be refrigerated, but never frozen. Check the specific storage instructions on your insulin packaging.

How often should I check my blood sugar?

The frequency depends on your individual needs and treatment plan. Your doctor will provide guidance on how often you should test.

What are some signs of low blood sugar (hypoglycemia)?

Symptoms can include shakiness, sweating, dizziness, confusion, and rapid heartbeat. If you experience these, check your blood sugar and treat accordingly.

Can I exercise if my blood sugar is high?

Generally yes, but it’s important to monitor your blood sugar levels before, during, and after exercise. Consult your doctor for personalized advice.