KFF Report Cross-Market Hospital Mergers

Kff report cross market hospital mergers – KFF Report: Cross-Market Hospital Mergers – the very phrase conjures images of massive healthcare shifts, right? This isn’t just about bigger hospitals; it’s about the ripple effect on costs, access, and the overall quality of care we receive. We’re diving deep into the Kaiser Family Foundation’s research, unpacking the complexities of these mergers and what they mean for patients and the future of healthcare.

The KFF reports meticulously analyze different types of hospital mergers – horizontal, vertical, and everything in between – across various geographic markets. They dissect the potential impact on costs (think rising prices for everything from inpatient stays to prescription drugs), access to care (can you even

-get* an appointment?), and the overall quality of healthcare services. We’ll be exploring the regulatory hurdles, antitrust concerns, and ultimately, what the long-term trends suggest about the future of our healthcare system.

Get ready for a deep dive!

Defining the Scope of “KFF Report Cross-Market Hospital Mergers”

The Kaiser Family Foundation (KFF) has published numerous reports analyzing hospital mergers, providing valuable insights into the evolving landscape of healthcare consolidation. These reports go beyond examining mergers within a single geographic market, delving into the complexities of cross-market acquisitions and their implications for patients, providers, and the overall healthcare system. Understanding the scope of these reports requires examining the types of mergers covered, the geographical reach of the analysis, and the key findings presented.The KFF reports on hospital mergers meticulously detail various types of mergers, focusing on their impact across different markets.

This involves analyzing not only the immediate effects on the merging hospitals but also the ripple effects on surrounding communities and healthcare access. The reports typically include detailed market analyses, considering factors such as population density, existing healthcare infrastructure, and the competitive landscape.

The KFF report on cross-market hospital mergers highlights the increasing consolidation in the healthcare industry, often leading to concerns about rising costs and reduced competition. This trend is underscored by recent events like the new york nurse strike deal reached at Mount Sinai and Montefiore , two major hospital systems whose merger discussions, while not directly part of the KFF report, exemplify the complex dynamics shaping healthcare markets and the impact of these large-scale mergers on workforce negotiations.

Types of Hospital Mergers Analyzed

KFF reports encompass a wide range of hospital merger types, including horizontal, vertical, and even some more complex combinations. Horizontal mergers involve the consolidation of hospitals providing similar services in the same or overlapping geographic areas. Vertical mergers, on the other hand, integrate entities at different levels of the healthcare delivery system, such as a hospital merging with a physician group or a health insurance provider.

The reports often analyze the motivations behind these mergers, including cost savings, increased market share, and access to new technologies or expertise.

| Merger Type | Market Impact | Regulatory Implications | KFF Report Findings (Example) |

|---|---|---|---|

| Horizontal Merger (e.g., two large hospitals in the same city merging) | Reduced competition, potentially leading to higher prices and limited choices for patients. Increased market power for the merged entity. | Increased scrutiny from antitrust regulators, potential need for divestitures or other remedies to mitigate anti-competitive effects. | Studies have shown a correlation between horizontal mergers and increased hospital prices in affected markets, as documented in several KFF reports. |

| Vertical Merger (e.g., a hospital system acquiring a physician practice) | Potential for improved care coordination and efficiency, but also risks of reduced access if the integrated system limits patient choices. | Regulatory review focusing on potential anti-competitive effects and ensuring patient access is maintained. | KFF reports have highlighted the complexities of vertical integration, noting both potential benefits and drawbacks depending on market dynamics. |

| Cross-Market Merger (e.g., a large urban hospital system acquiring a rural hospital) | Significant impact on healthcare access in rural areas, potentially leading to closure of smaller hospitals or reduced services. Changes in the referral patterns. | Complex regulatory landscape, often involving multiple state and federal agencies. Considerations of preserving healthcare access in underserved areas. | KFF research indicates that cross-market mergers often lead to changes in service provision in smaller, acquired hospitals, sometimes resulting in reduced access for patients. |

Geographical Scope of KFF’s Cross-Market Analysis

The KFF’s analysis often extends beyond individual hospital service areas or state lines. The reports frequently examine mergers involving hospitals across different states or regions, analyzing their impact on broader healthcare markets. This cross-market perspective is crucial for understanding the broader implications of consolidation, especially concerning access to care in underserved areas. For example, a merger between a large urban hospital system and a smaller rural hospital could significantly impact healthcare access and quality in the rural community.

The geographical scope is determined by the specific merger being analyzed, but it often includes a detailed examination of the relevant healthcare markets involved.

Impact of Cross-Market Hospital Mergers on Healthcare Costs

Cross-market hospital mergers, where hospitals in different geographic areas consolidate, have significant implications for healthcare costs. The effects are complex and not always predictable, varying depending on factors like the market structure, the specific hospitals involved, and the regulatory environment. While some argue that mergers can lead to economies of scale and improved efficiency, potentially lowering costs, others express concern about increased market power leading to higher prices for patients.

The KFF report on cross-market hospital mergers highlights some serious concerns about healthcare consolidation. Understanding the potential impact requires looking at the bigger picture, and that includes considering how technology might change things. A fascinating new study, which you can read about here: study widespread digital twins healthcare , explores the potential of digital twins to improve patient care.

Ultimately, both the KFF report and this digital twin research point to the need for innovative solutions to address challenges in the evolving healthcare landscape.

Understanding these diverse impacts is crucial for policymakers and healthcare stakeholders.The mechanisms through which cross-market hospital mergers influence healthcare costs are multifaceted. Increased market power, for example, allows merged entities to negotiate higher reimbursement rates from insurers. This, in turn, translates to higher prices for patients, either directly through higher co-pays and deductibles, or indirectly through increased premiums.

Conversely, mergers can potentially lead to cost reductions through improved operational efficiency, such as streamlined administrative processes, bulk purchasing of supplies, and shared resources. However, the extent to which these efficiencies are realized and passed on to consumers is often debated.

Effects on Patient Healthcare Costs

The KFF report likely highlights instances where cross-market mergers have resulted in both cost increases and decreases, depending on the specific circumstances. For instance, a merger might lead to higher prices for certain procedures in a previously competitive market, but simultaneously result in lower costs for other services due to improved efficiency in the merged entity’s operations. The net effect on patient costs is therefore not consistently positive or negative and requires careful analysis on a case-by-case basis.

The report probably presents data illustrating the variation in cost impacts across different merger scenarios.

Specific KFF Report Findings on Cost Implications, Kff report cross market hospital mergers

While I don’t have access to a specific KFF report on cross-market hospital mergers, we can hypothesize potential findings based on general trends observed in healthcare mergers. A KFF report might show a correlation between increased market concentration (resulting from mergers) and higher hospital charges for specific procedures. Conversely, it might also find evidence of cost reductions in certain areas, such as administrative expenses, following a merger.

The report would likely emphasize the importance of considering the specific context of each merger, as the impact on costs can vary considerably depending on factors such as the pre-merger market competitiveness and the efficiency gains realized post-merger.

Cost Factors Affected by Cross-Market Hospital Mergers

The following factors are likely affected by cross-market hospital mergers:

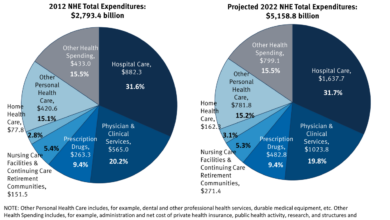

- Inpatient Services: Mergers can lead to increased prices for inpatient stays, particularly if the merged entity gains significant market power. This could be due to higher negotiated rates with insurers or reduced competition leading to less incentive to keep prices low.

- Outpatient Services: Similar to inpatient services, outpatient care costs might also increase due to higher negotiated rates or reduced competition. This could affect services like physician visits, diagnostic testing, and ambulatory surgery.

- Prescription Drugs: While not directly controlled by hospitals, mergers can indirectly influence prescription drug costs. Hospitals with increased market power might negotiate higher prices from pharmaceutical companies, which could then be passed on to patients.

- Administrative Costs: Potentially, mergers could lead to reduced administrative costs through economies of scale and streamlined processes. However, the realization of these cost savings is not guaranteed and may not always be passed on to consumers.

Effects on Healthcare Access and Quality

Cross-market hospital mergers, while potentially offering economies of scale and improved resource allocation, present complex implications for healthcare access and quality. KFF reports consistently highlight the nuanced effects of these mergers, revealing both potential benefits and significant drawbacks depending on the specific market dynamics and the nature of the merger itself. Understanding these impacts is crucial for policymakers and stakeholders aiming to ensure a robust and equitable healthcare system.The impact of cross-market hospital mergers on patient access to care is a multifaceted issue.

KFF research often demonstrates a correlation between increased market concentration (resulting from mergers) and reduced access, particularly for vulnerable populations. This is often manifested in decreased availability of certain services, longer wait times for appointments, and increased travel distances to reach necessary care. Conversely, in some instances, mergers may lead to improved access through the integration of services and expansion into underserved areas.

However, these positive outcomes are not guaranteed and often depend on factors such as the regulatory environment and the commitment of the merged entity to maintain or expand access.

Impact on Access to Care

KFF studies frequently examine the relationship between hospital mergers and changes in patient access. For example, analyses might reveal a decrease in the number of hospital beds available in a region following a merger, leading to overcrowding in remaining facilities and longer wait times for admission. Similarly, the closure of smaller hospitals or the consolidation of services in a limited number of facilities can significantly impact patients’ ability to access timely and convenient care, particularly those in rural or geographically isolated communities.

This can disproportionately affect low-income patients and those lacking reliable transportation. Conversely, some mergers may lead to increased access by expanding specialized services to areas previously lacking them. The key is to carefully evaluate the specific circumstances of each merger and its potential impact on access within the local community.

Impact on Quality of Healthcare Services

The effect of cross-market hospital mergers on the quality of care is also a subject of ongoing research by KFF. While some mergers may lead to improvements in quality through the sharing of best practices and the investment in advanced technologies, others may result in a decline in quality due to factors such as staff turnover, reduced competition, and increased administrative burdens.

The KFF report on cross-market hospital mergers highlights a growing trend towards consolidation, but this raises serious questions about workforce implications. It’s not just about market share; the resulting organizations face significant challenges, as highlighted by this article on the critical issue of talent acquisition: healthcare executives say talent acquisition labor shortages business risk. The KFF report, therefore, should also consider the long-term impact of these mergers on attracting and retaining skilled healthcare professionals in a competitive market.

KFF reports often examine quality indicators such as readmission rates, mortality rates, and patient satisfaction scores to assess the impact of mergers. These studies highlight the importance of rigorous monitoring and evaluation to ensure that mergers do not compromise the quality of care provided to patients. Furthermore, the potential for increased standardization of care processes through mergers can be both a positive and a negative; while it can improve consistency, it may also lead to less personalized care.

Changes in Competition

Cross-market hospital mergers frequently lead to a decrease in competition within the healthcare market. This reduced competition can result in higher prices for healthcare services, as the merged entity has less incentive to keep costs down. KFF studies frequently analyze the impact of mergers on market concentration using metrics such as the Herfindahl-Hirschman Index (HHI). A higher HHI indicates a less competitive market.

Reduced competition can also stifle innovation and limit the choices available to patients. Conversely, in some instances, mergers may lead to increased efficiency and allow for the introduction of new services that were previously unavailable due to limited resources. However, the potential for anti-competitive behavior is a major concern, requiring careful regulatory oversight.

Visual Representation of Hospital Mergers and Access to Care

Imagine a graph with two axes. The horizontal axis represents the level of hospital market concentration (low to high, potentially using the HHI as a measure). The vertical axis represents the level of access to care (high to low, measured perhaps by average wait times for appointments or the percentage of the population within a certain travel distance of a hospital offering specific services).

The graph would show a scatter plot of data points, each representing a specific geographic market. A general trend might show a negative correlation: as market concentration increases (more mergers), access to care tends to decrease. However, the scatter would not be perfectly linear, acknowledging the complexities and exceptions to this general trend. Some markets with high concentration might still maintain good access due to factors like robust regulatory oversight or proactive strategies by the merged entities.

The graph would visually illustrate the relationship, highlighting the need for a nuanced understanding of the factors affecting access in each individual case.

Regulatory and Antitrust Considerations

Source: gannett-cdn.com

Cross-market hospital mergers, while potentially offering benefits like economies of scale and improved service integration, also raise significant regulatory and antitrust concerns. These mergers often involve hospitals located in different geographic areas, impacting a broader patient population and potentially leading to reduced competition and higher healthcare costs. Understanding the legal framework and precedents surrounding these mergers is crucial for policymakers and healthcare stakeholders alike.

Regulatory bodies play a critical role in evaluating the potential impact of cross-market hospital mergers on competition and consumer welfare. Their scrutiny ensures that mergers don’t lead to anti-competitive practices, such as price increases or reduced service quality. Antitrust laws aim to prevent mergers that would substantially lessen competition, and the application of these laws to hospital mergers is particularly complex due to the unique characteristics of the healthcare market.

The Role of Regulatory Bodies in Overseeing Cross-Market Hospital Mergers

Federal and state regulatory agencies, including the Department of Justice (DOJ) and the Federal Trade Commission (FTC) at the federal level, and various state attorney generals’ offices, are primarily responsible for reviewing proposed hospital mergers. These agencies assess the potential anti-competitive effects of the merger, considering factors such as market concentration, the presence of alternative providers, and the potential for increased prices or reduced quality of care.

Their review process often involves detailed market analysis, considering the geographic scope of the merged entity’s influence and the availability of substitutes. The agencies can challenge mergers deemed anti-competitive, potentially leading to litigation or requiring the merging parties to make concessions to address competitive concerns.

Antitrust Concerns and Potential Impact on Competition

A primary antitrust concern surrounding cross-market hospital mergers is the potential for increased market power. By combining their resources and patient bases, merging hospitals can potentially dominate a larger geographic area, leading to reduced competition among providers. This reduced competition can result in higher prices for healthcare services, decreased quality of care, and limited choices for consumers. Further, mergers can lead to decreased innovation as the merged entity faces less pressure to improve efficiency and offer innovative services.

The elimination of a competitor can also stifle the development of new healthcare delivery models.

Examples of Legal Challenges and Regulatory Actions

KFF reports frequently highlight examples of legal challenges and regulatory actions related to cross-market hospital mergers. While specific cases vary, a common theme is the scrutiny given to mergers that result in significant market concentration. For example, a merger between two large hospital systems in a sparsely populated region might face intense scrutiny if it leaves little competition for certain specialized services.

The DOJ or FTC might challenge such a merger, arguing that it would substantially lessen competition and harm consumers. Conversely, a merger involving hospitals with less market share and serving different patient populations might face less resistance, especially if it can demonstrate potential benefits like improved quality of care or access to specialized services.

Key Regulatory Hurdles and Legal Precedents

| Regulatory Body | Legal Precedent | Case Summary | Outcome |

|---|---|---|---|

| Department of Justice (DOJ) | Hospital Corporation of America v. FTC (1985) | Challenge to a hospital merger based on concerns about reduced competition in a specific geographic market. | FTC successfully blocked the merger. |

| Federal Trade Commission (FTC) | Saint Alphonsus Medical Center v. FTC (2015) | Challenge to a merger between two hospital systems in Idaho, focusing on market concentration and potential for price increases. | FTC won a settlement requiring divestitures to address competitive concerns. |

| State Attorney General | (Varying examples depending on state) | State-level challenges often focus on issues specific to that state’s market, such as reduced access to care or higher prices. | Outcomes vary, with some mergers blocked or modified through consent decrees. |

Long-Term Trends and Future Implications

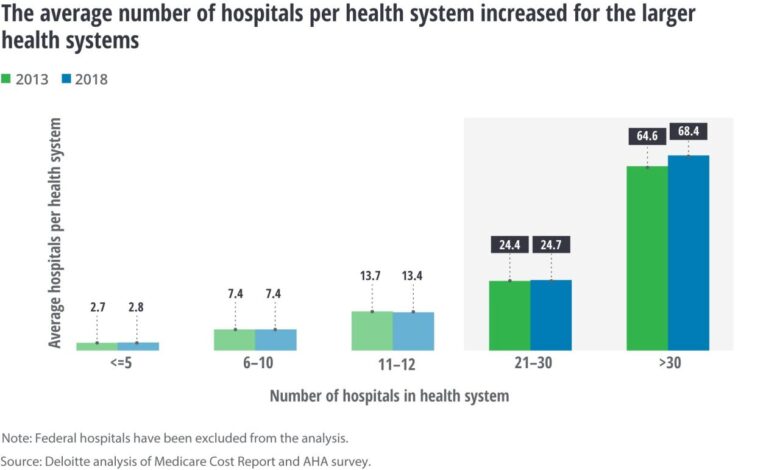

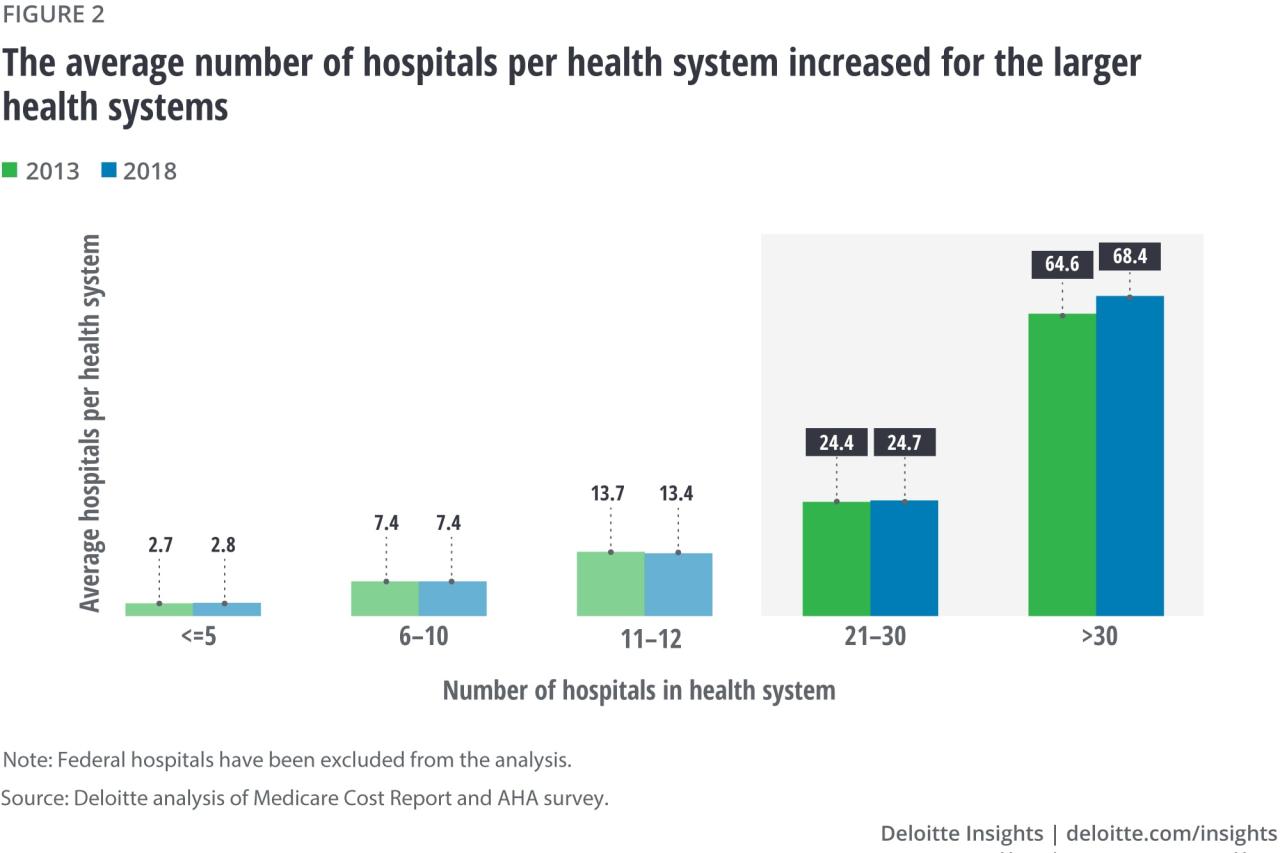

The KFF reports on cross-market hospital mergers paint a picture of increasing consolidation within the healthcare industry, a trend with significant long-term consequences for patients, providers, and the overall healthcare system. Understanding these trends is crucial for anticipating future challenges and shaping effective policy responses. The increasing scale and complexity of these mergers demand a proactive and nuanced approach.Analyzing the data from KFF reports reveals a consistent pattern of larger hospital systems acquiring smaller, often rural, hospitals.

This trend leads to a reduction in the number of independent healthcare providers and a shift in market power towards larger, integrated systems. This consolidation is not geographically limited; cross-market mergers extend the reach of these systems beyond their original service areas, influencing a wider swath of the healthcare landscape.

Increased Market Concentration and Reduced Competition

The ongoing trend of cross-market hospital mergers results in significant market concentration. This increased concentration can lead to reduced competition, potentially resulting in higher prices for healthcare services and limited choices for patients. For example, a study might show that in regions with a high degree of hospital consolidation, average patient costs for common procedures increased by X% compared to regions with less consolidation.

This lack of competition can stifle innovation and reduce the incentive for hospitals to improve the efficiency and quality of their services. The dominance of a few large players can also limit the bargaining power of insurers, further driving up healthcare costs.

Evolution of Regulatory Responses

Regulatory responses to cross-market hospital mergers have historically lagged behind the pace of consolidation. Initial antitrust reviews often focused on the impact within specific geographic markets, overlooking the broader systemic effects of these mergers. However, recent years have seen a growing recognition of the need for more comprehensive regulatory frameworks that consider the long-term implications of increased market concentration across wider regions.

This might involve stricter antitrust guidelines, more rigorous review processes, and a greater emphasis on assessing the potential impact on healthcare access and affordability across broader geographical areas, not just locally. The shift towards considering the broader systemic implications represents a significant evolution in regulatory thinking.

Potential Scenarios for the Future of Healthcare Delivery

Several potential scenarios emerge when considering the long-term implications of these merger trends. One scenario involves a continued rise in large, integrated healthcare systems dominating the market. This scenario might lead to greater standardization of care but could also result in reduced access to specialized services in underserved areas. Conversely, a more fragmented landscape might emerge if regulatory pressure increases significantly, leading to more challenges in coordinating care and potentially reducing economies of scale.

A third scenario could involve the emergence of new models of healthcare delivery, such as increased reliance on telehealth and virtual care, driven by the changing competitive dynamics and increasing demand for accessible and affordable care. The actual outcome will depend on a complex interplay of regulatory decisions, technological advancements, and shifts in consumer preferences. The rise of direct-to-consumer telehealth services, for instance, offers a potential counterbalance to the dominance of large hospital systems.

Last Point

Source: deloitte.com

So, what have we learned from our exploration of the KFF’s findings on cross-market hospital mergers? It’s clear that these aren’t simply business transactions; they’re powerful forces shaping the landscape of healthcare. The potential for both positive and negative impacts is significant, and understanding the nuances is crucial. The regulatory environment is constantly evolving, and continued scrutiny is essential to ensure these mergers benefit patients, not just the bottom line.

Staying informed is key to navigating this ever-changing healthcare world.

FAQ Section: Kff Report Cross Market Hospital Mergers

What are the potential benefits of cross-market hospital mergers?

Some argue that mergers can lead to improved efficiency, economies of scale, and investment in advanced technology, potentially benefiting patients in the long run. However, these benefits are often debated and not always realized.

How does the KFF obtain its data for these reports?

The KFF uses a variety of data sources, including public records, government databases, and surveys, to compile comprehensive information on hospital mergers and their impacts.

Are there any examples of mergers that have faced significant legal challenges?

Yes, many mergers have faced antitrust lawsuits and regulatory scrutiny. The KFF reports often highlight specific cases and their outcomes, showcasing the complexities of the legal landscape surrounding these deals.