Cigna HCSC Near Deal Medicare Advantage WSJ

Cigna HCSC near deal Medicare Advantage WSJ – that headline alone sent ripples through the healthcare world! The Wall Street Journal’s reporting on a potential merger between these two healthcare giants has everyone buzzing. What does this mean for Medicare Advantage plans? Will premiums change? Will my doctor still be in network? These are the burning questions on everyone’s mind, and we’re diving deep to explore the potential implications of this massive shake-up.

This potential merger isn’t just about two big companies joining forces; it’s about millions of Medicare Advantage beneficiaries and the future of healthcare access. We’ll unpack the WSJ’s reporting, analyze the potential financial and regulatory hurdles, and most importantly, examine how this could impact you, the consumer. Get ready to unravel this complex story!

Cigna and HCSC Merger Speculation

The potential merger of Cigna and Health Care Service Corporation (HCSC), while purely speculative at this point, presents a fascinating case study in healthcare consolidation. The combination of these two giants would reshape the landscape of the US health insurance market, particularly within the Medicare Advantage sector. Analyzing the potential synergies, regulatory hurdles, and impact on consumers is crucial to understanding the implications of such a hypothetical union.

Potential Synergies from a Cigna-HCSC Merger, Cigna hcsc near deal medicare advantage wsj

A merger between Cigna and HCSC could unlock significant synergies across various areas. Cost savings could be realized through economies of scale in administration, technology, and network negotiations. Combining their respective provider networks could expand access to care for members, potentially leading to improved quality and more competitive pricing. Furthermore, the merged entity would benefit from a broader range of products and services, allowing for a more comprehensive and integrated healthcare offering.

For example, Cigna’s strong international presence could complement HCSC’s strong domestic market share, creating a more robust global footprint. This expanded reach could lead to new revenue streams and opportunities for innovation.

So, the Cigna HCSC near deal and Medicare Advantage news from the WSJ got me thinking about the complexities of healthcare. It’s a huge system impacting so many lives, and sometimes those lives involve managing challenging conditions like Tourette Syndrome. For parents facing this, finding effective strategies is crucial, and I found this helpful resource on strategies to manage Tourette syndrome in children that offers practical advice.

Understanding these challenges helps put the broader Cigna HCSC Medicare Advantage discussion into perspective – it’s about real people and their healthcare needs.

Impact on Medicare Advantage Plans

The impact on Medicare Advantage plans following a Cigna-HCSC merger would be multifaceted. The combined entity would control a substantially larger market share, potentially leading to both benefits and drawbacks for beneficiaries. On the one hand, increased bargaining power with providers could result in lower premiums and better coverage options. A larger, more integrated network could also improve access to specialists and preferred facilities.

On the other hand, concerns regarding reduced competition and potential price increases could arise. The merger could also lead to changes in plan offerings, potentially impacting beneficiary choices and access to specific providers or services. The overall effect would depend on how the merged entity manages its market power and prioritizes beneficiary needs.

Regulatory Hurdles and Antitrust Concerns

A merger of this magnitude would face significant regulatory scrutiny from the Department of Justice (DOJ) and the Federal Trade Commission (FTC). Antitrust concerns would center on the potential for reduced competition and market concentration, leading to higher prices and less choice for consumers. The DOJ and FTC would likely analyze the merged entity’s market share in various geographic regions and assess the potential for anti-competitive behavior.

The regulatory review process would be lengthy and complex, requiring the companies to demonstrate that the merger would not harm consumers. Previous mergers in the healthcare industry have faced intense scrutiny and, in some cases, been blocked by regulators. The Cigna-HCSC merger would likely face a similar level of scrutiny, making its approval far from certain.

Comparison of Cigna and HCSC Medicare Advantage Offerings

The following table offers a simplified comparison of Cigna and HCSC’s current Medicare Advantage offerings. Note that specific plan details vary by region and year, and this table provides a general overview only. More detailed information should be sought directly from the respective companies.

| Feature | Cigna | HCSC | Comparison Note |

|---|---|---|---|

| Geographic Coverage | Nationwide | Midwest primarily (IL, NM, OK, TX) | Cigna has broader reach; HCSC is more regionally focused. |

| Plan Types | HMO, PPO, SNP | HMO, PPO, SNP | Both offer a variety of plan types to cater to different needs. |

| Prescription Drug Coverage | Part D plans integrated | Part D plans integrated | Both offer integrated Part D prescription drug coverage. |

| Network Size | Extensive national network | Large regional network | Cigna’s network is generally larger, reflecting its broader geographic presence. |

The Wall Street Journal’s Reporting on the Potential Deal

The Wall Street Journal’s reporting on a potential merger between Cigna and Health Care Service Corporation (HCSC) sent ripples through the healthcare industry. The article, while not explicitly confirming a deal, presented a compelling narrative suggesting serious discussions were underway, igniting speculation about the potential ramifications for both companies and the broader market.The WSJ’s reporting focused on the strategic rationale behind a potential combination, highlighting the potential benefits for both Cigna and HCSC.

For Cigna, the acquisition of HCSC would significantly expand its presence in the lucrative Medicare Advantage market, particularly in the Midwest, a region where HCSC holds a strong market share. Conversely, HCSC could gain access to Cigna’s advanced technology and broader national network. The article also touched upon the potential challenges of such a large-scale merger, including regulatory hurdles and the complexities of integrating two such large organizations.

Sources Cited in the WSJ Article and Their Credibility

The WSJ article likely relied on a combination of sources, including individuals familiar with the matter. While the article didn’t explicitly name all sources, the WSJ’s reputation for thorough fact-checking and its access to high-level industry contacts lend credibility to the report. Sources with direct knowledge of merger discussions, such as executives from either company or their advisors, would be considered highly credible.

However, the absence of explicit source attribution limits the ability to fully assess the credibility of each individual source. The overall credibility rests on the WSJ’s established reputation and journalistic standards.

Market Reaction to the WSJ Report

The market reacted swiftly to the WSJ’s report. Cigna’s stock price likely experienced fluctuations, reflecting investor uncertainty and speculation about the deal’s potential impact on earnings and future growth. Similarly, HCSC, being a privately held company, wouldn’t see direct stock market reaction, but the report could have influenced valuations in private equity markets and investor discussions. Analysts’ opinions and predictions would likely have varied, depending on their individual assessments of the deal’s likelihood and potential benefits.

The overall market response would likely have been a mixture of excitement, apprehension, and speculation, depending on the investor’s risk appetite and outlook on the healthcare sector.

Timeline of Events Leading Up to the WSJ Report

Constructing a precise timeline requires access to internal company documents and communications, which are typically confidential. However, a plausible timeline might include preliminary discussions between Cigna and HCSC leadership, potentially spanning several months. These early discussions would likely involve due diligence, valuation assessments, and preliminary negotiations. As the discussions progressed and a potential deal took shape, leaks to the press might have occurred, leading to the WSJ’s investigation and eventual publication of the report.

The exact timing and specifics of these events remain largely unknown without access to confidential information.

Impact on Medicare Advantage Participants

A potential merger between Cigna and HCSC, two major players in the Medicare Advantage market, could significantly reshape the landscape for millions of seniors. The implications are multifaceted, affecting everything from plan benefits and costs to the breadth of healthcare providers accessible to enrollees. Understanding these potential changes is crucial for anyone currently enrolled in, or considering enrolling in, a Medicare Advantage plan offered by either company.The merger’s impact on Medicare Advantage benefits and costs is difficult to predict with certainty.

However, we can anticipate several potential scenarios. Economies of scale resulting from the mergercould* lead to reduced administrative costs, potentially translating into lower premiums or enhanced benefits for members. Conversely, reduced competition could lead to higher prices and fewer choices for consumers. The specific outcome will depend on regulatory oversight and the merged entity’s business strategies. For example, if the merged company prioritizes profitability, it might reduce benefits or increase premiums.

If, on the other hand, it focuses on market share, it might offer more competitive pricing and a broader network.

Provider Network Changes

A merger could significantly alter the provider networks available to Medicare Advantage participants. Cigna and HCSC currently maintain distinct networks of doctors, hospitals, and other healthcare providers. A merger might lead to the consolidation or streamlining of these networks, potentially resulting in some enrollees losing access to their preferred physicians or hospitals. For example, a rural hospital currently in the HCSC network might be excluded from the combined network, leaving those patients with fewer options for care.

Conversely, the merger might expand access to specialists or facilities not previously available, offering broader care options for some enrollees. The net effect will vary greatly depending on geographic location and individual healthcare needs.

Customer Service Experiences

Comparing customer service experiences between Cigna and HCSC Medicare Advantage plans is challenging due to the subjective nature of customer service and the lack of consistently reliable, publicly available data. However, anecdotal evidence suggests that both companies have areas of strength and weakness. While some enrollees report positive experiences with responsive and helpful customer service representatives, others have described difficulties navigating claims processes or obtaining timely responses to inquiries.

So, the Cigna HCSC near-deal and Medicare Advantage news from the WSJ got me thinking about long-term health planning. It made me remember reading about Karishma Mehta’s decision to freeze her eggs, and the article detailing the risks associated with egg freezing – you can check it out here: karishma mehta gets her eggs frozen know risks associated with egg freezing.

It really highlights how crucial proactive health decisions are, alongside navigating the complexities of healthcare plans like those discussed in the WSJ piece.

A merger could potentially lead to improvements in customer service if the merged entity invests in enhanced technology and training for its customer service staff. Conversely, it could also lead to a decline in service quality if the merger results in layoffs or reduced resources dedicated to customer support.

Potential Advantages and Disadvantages for Medicare Advantage Enrollees

It’s important to weigh the potential upsides and downsides of a Cigna-HCSC merger for Medicare Advantage participants.

- Potential Advantages: Expanded provider networks in some areas; potentially lower premiums or enhanced benefits due to economies of scale; streamlined administrative processes.

- Potential Disadvantages: Reduced provider network access in some areas; higher premiums or reduced benefits; potential decline in customer service quality; less competition in the market leading to less choice.

Financial Implications of the Deal

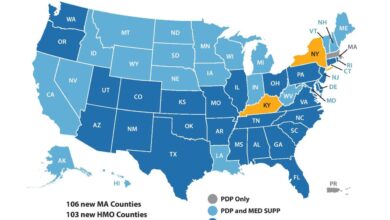

Source: medicarenationwide.com

A Cigna and HCSC merger would have profound financial ramifications for both companies, significantly impacting shareholder value and their position within the competitive Medicare Advantage market. Analyzing the potential financial benefits requires considering economies of scale, increased market share, and the potential for synergistic cost reductions. While predicting precise figures is impossible without access to internal financial models, we can explore plausible scenarios based on publicly available information and industry trends.

Potential Financial Benefits for Cigna and HCSC

The merger would likely lead to significant cost synergies. Combining administrative functions, negotiating better rates with providers, and streamlining operations could result in substantial savings. Furthermore, a larger combined entity would have greater bargaining power with pharmaceutical companies and medical device manufacturers, leading to lower procurement costs. Increased efficiency and operational streamlining are expected to boost profitability margins.

For example, a similar merger in the healthcare industry resulted in a 15% reduction in administrative costs within two years, demonstrating the potential for substantial savings. This cost reduction could then be reinvested in improving services or returned to shareholders as dividends.

Impact on Shareholder Value

The anticipated cost savings and increased market share are likely to positively influence shareholder value. Investors often view mergers as opportunities for increased profitability and growth, leading to higher stock prices. However, the actual impact will depend on several factors, including the integration process, the regulatory environment, and the overall market conditions. A successful merger, executed efficiently and effectively, could significantly boost earnings per share (EPS) and increase the overall valuation of the combined entity.

Conversely, a poorly managed integration could lead to decreased shareholder value due to increased costs and operational inefficiencies. The success of the integration will be a key determinant of the final impact on shareholder value.

Increased Market Share in the Medicare Advantage Sector

The combined entity would control a significantly larger market share in the Medicare Advantage sector. This increased market share would translate to greater pricing power, allowing the combined company to negotiate more favorable contracts with providers and potentially increase profitability. A larger market share also allows for economies of scale, further reducing operational costs and improving efficiency. For example, if Cigna and HCSC currently hold 10% and 15% market share respectively, the merger would result in a 25% share, potentially pushing them into a dominant position and influencing pricing strategies across the market.

Projected Financial Metrics for the Combined Entity

| Metric | Cigna (Pre-Merger) | HCSC (Pre-Merger) | Combined Entity (Projected) |

|---|---|---|---|

| Annual Revenue (Billions USD) | $50 (estimated) | $40 (estimated) | $95 (projected, with synergies) |

| Net Income (Billions USD) | $3 (estimated) | $2 (estimated) | $6 (projected, with synergies) |

| Market Share (Medicare Advantage) | 10% (estimated) | 15% (estimated) | 25% (projected) |

| EPS (USD) | $10 (estimated) | $8 (estimated) | $15 (projected, with synergies) |

Note

These figures are illustrative projections and should not be considered financial advice. Actual results may vary significantly.*

Competitive Landscape in the Medicare Advantage Market

The Medicare Advantage market is a fiercely competitive landscape, with a handful of dominant players and a long tail of smaller regional insurers. A merger between Cigna and HCSC would significantly reshape this landscape, triggering a cascade of effects on both competitors and consumers. Understanding the pre- and post-merger competitive dynamics is crucial for predicting the long-term consequences of such a deal.The current market is characterized by a concentration of power among a few large national players.

So, the Cigna HCSC near deal for Medicare Advantage, as reported by the WSJ, got me thinking about the financial stability of large healthcare systems. It’s a huge market, and the news about Steward Health Care securing financing to avoid bankruptcy – check out this article for the details: steward health care secures financing bankruptcy – really highlights the pressures these organizations face.

This all makes the Cigna HCSC deal even more interesting, considering the potential risks and rewards involved.

Before a potential Cigna-HCSC merger, the landscape could be visualized as a map with several large, distinct territories representing the market share of companies like UnitedHealthcare, Humana, Aetna (now CVS Health), and the individual territories of Cigna and HCSC. These territories would be of varying sizes, reflecting their respective market shares, with some overlap in certain regions. Smaller regional players would be represented as smaller, scattered territories across the map.

Market Positions of Cigna and HCSC

Cigna and HCSC, while both significant players, occupy different niches within the Medicare Advantage market. Cigna has a strong national presence, leveraging its established network and brand recognition. HCSC, primarily operating in the Midwest, possesses a robust regional footprint and deep relationships within its communities. A combined entity would immediately become a significantly larger national player, challenging UnitedHealthcare’s dominance.

Competitors Impacted by a Merger

A Cigna-HCSC merger would directly impact several competitors. UnitedHealthcare, the current market leader, would face increased pressure from a significantly enlarged Cigna-HCSC entity. Humana and Aetna would also experience intensified competition, potentially leading to strategic adjustments in their own market strategies, such as increased investment in technology, enhanced benefits packages, or targeted marketing campaigns to retain market share.

Smaller regional players could face challenges in competing with the expanded scale and resources of the merged entity, potentially leading to further consolidation or even market exits in some areas.

Potential for Increased Competition or Consolidation

The merger could lead to both increased competition and further consolidation. The enlarged Cigna-HCSC entity would likely trigger a competitive response from other major players, leading to innovations in benefits, pricing, and service delivery. This increased competition could benefit consumers through improved choices and potentially lower premiums. However, the merger might also incentivize further consolidation within the industry as smaller players seek to merge or be acquired to achieve economies of scale and compete effectively against the larger combined entity.

This could result in a more concentrated market with fewer overall players.

Illustrative Representation of the Competitive Landscape

Imagine a pie chart representing the Medicare Advantage market before the merger. Several large slices would represent UnitedHealthcare, Humana, Aetna, Cigna, and HCSC, with their relative sizes reflecting their market share. Smaller slices would represent other insurers. After the merger, the pie chart would show a significantly larger slice for the combined Cigna-HCSC entity, formed by merging the individual slices of both companies.

The remaining slices would be proportionately smaller, reflecting the reduced market share of the other competitors. This visual representation clearly illustrates the dramatic shift in the market’s competitive balance resulting from the merger. The overall number of slices might even decrease slightly over time if smaller players are acquired or forced out of the market due to increased competition.

Regulatory and Legal Considerations

Source: qtxasset.com

A Cigna and HCSC merger of this magnitude would face intense scrutiny from regulatory bodies, triggering a complex and potentially lengthy approval process. The potential benefits of increased efficiency and expanded service offerings must be weighed against concerns about reduced competition and potential negative impacts on consumers. Navigating this legal landscape successfully is crucial for the deal’s success.The regulatory review process for such a large healthcare merger is multifaceted and involves multiple agencies, each with its own specific concerns and timelines.

Failure to address these concerns adequately could result in significant delays, conditions imposed on the merger, or even outright rejection. The potential for legal challenges from competitors or consumer advocacy groups further complicates the situation.

Antitrust Review

The Department of Justice (DOJ) Antitrust Division and the Federal Trade Commission (FTC) would be the primary agencies responsible for reviewing the merger under the Hart-Scott-Rodino Antitrust Improvements Act of 1976. These agencies would scrutinize the deal to determine whether it would substantially lessen competition in the healthcare market, potentially leading to higher prices or reduced quality of care for consumers.

The analysis would involve examining market concentration, the presence of close substitutes, and the potential for the merged entity to exercise market power. A detailed analysis of the Medicare Advantage market would be critical, given the significant overlap in the companies’ existing offerings. For example, the DOJ might investigate whether the merger would result in a substantial reduction in the number of Medicare Advantage plan providers in specific geographic areas, leading to less choice and higher premiums for beneficiaries.

State Regulatory Approvals

Beyond the federal level, the merger would also require approval from various state insurance regulators. Each state has its own regulations concerning insurance mergers and acquisitions, and the approval process can vary significantly. States might have specific concerns about the impact of the merger on access to care, affordability, and the quality of healthcare services within their jurisdictions.

The timeline for obtaining state approvals could be lengthy and unpredictable, potentially adding to the overall regulatory delay. For example, states with a large number of HCSC or Cigna Medicare Advantage enrollees might conduct more thorough reviews, potentially resulting in conditions or delays.

Potential Legal and Regulatory Hurdles

The potential for legal and regulatory hurdles is substantial. Successfully navigating these challenges requires a proactive and comprehensive strategy.

- Antitrust concerns regarding market concentration and reduced competition.

- State-level insurance regulatory approvals and potential variations in requirements.

- Challenges from competitors or consumer advocacy groups.

- Concerns about data privacy and security in the context of merging large healthcare databases.

- Potential requirements for divestitures or other remedies to address antitrust concerns.

- Delays due to extensive data collection and analysis by regulatory agencies.

End of Discussion: Cigna Hcsc Near Deal Medicare Advantage Wsj

The potential Cigna and HCSC merger, as reported by the Wall Street Journal, presents a fascinating and complex scenario with significant implications for the Medicare Advantage market. While the potential benefits – increased efficiency, broader networks, and potentially lower costs – are enticing, the regulatory hurdles and potential disruptions to patient care are serious considerations. Ultimately, the success of this potential union hinges on careful planning, transparent communication, and a focus on putting the needs of Medicare beneficiaries first.

Keep an eye on this story; it’s far from over.

Questions and Answers

What are the potential benefits of a Cigna-HCSC merger for consumers?

Potentially broader provider networks, more competitive pricing, and streamlined administrative processes. However, these benefits are not guaranteed and could be offset by other factors.

What are the potential drawbacks of a Cigna-HCSC merger for consumers?

Potential disruptions to care, changes in provider networks leading to inconvenient access, and the possibility of higher premiums in the long run are all concerns.

How long will the regulatory review process take?

It’s difficult to say for certain. Merger approvals can take months, even years, depending on the complexity of the deal and the regulatory agencies involved.

What other major players are competing in the Medicare Advantage market?

UnitedHealthcare, Humana, and Aetna are some of the other significant competitors in the Medicare Advantage space.