Medicare Shared Savings Losses Traditional vs. JAMA Health Findings

Medicare shared savings losses traditional jama health – Medicare Shared Savings Losses: Traditional vs. JAMA Health Findings – it’s a complex issue impacting healthcare providers and patients alike. The Medicare Shared Savings Program (MSSP), designed to incentivize cost-effective care, hasn’t been without its challenges. Many providers participating in the MSSP have faced unexpected financial losses, raising questions about the program’s structure and effectiveness. This exploration delves into the reasons behind these losses, comparing the MSSP with traditional Medicare and examining insights from the Journal of the American Medical Association (JAMA) to paint a clearer picture of the situation and its implications for the future of healthcare.

We’ll analyze the intricacies of the MSSP, including its participation requirements, financial incentives, and potential pitfalls. We’ll compare and contrast the MSSP with traditional Medicare, looking at cost structures, patient care models, and provider profitability under each system. Crucially, we’ll dissect real-world examples of MSSP financial losses, identifying common contributing factors and exploring strategies to mitigate future risks.

The insights gleaned from relevant JAMA publications will be central to our analysis, offering valuable perspectives on current challenges and potential solutions.

Medicare Shared Savings Program (MSSP) Overview

Source: greenwayhealth.com

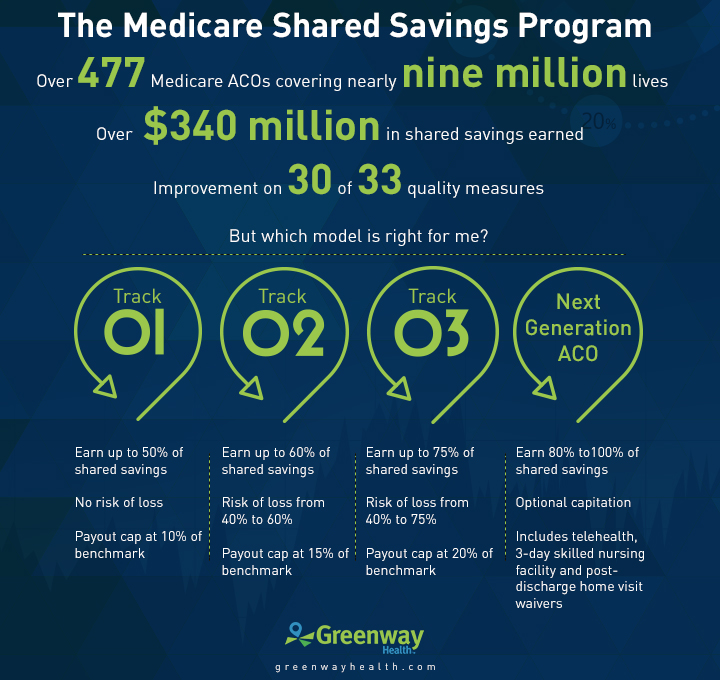

The Medicare Shared Savings Program (MSSP) is a key component of the Affordable Care Act, designed to improve the quality of care for Medicare beneficiaries while simultaneously reducing healthcare spending. It operates on the principle of rewarding accountable care organizations (ACOs) for achieving cost savings and quality improvements. The program encourages a shift from fee-for-service medicine to a value-based care model, where providers are incentivized to keep patients healthy and out of the hospital.The MSSP is structured as a voluntary program where ACOs, typically groups of doctors, hospitals, and other healthcare providers, agree to take responsibility for the care of a defined population of Medicare beneficiaries.

These ACOs work collaboratively to coordinate care, improve efficiency, and prevent unnecessary hospitalizations and readmissions. The program aims to transform healthcare delivery from a volume-based system to one that rewards quality and efficiency.

Participation Requirements for Healthcare Providers

To participate in the MSSP, healthcare providers must meet several requirements. They need to form a legally recognized ACO with a defined governance structure and a comprehensive care management plan. This plan Artikels how the ACO will coordinate care for its assigned beneficiaries, focusing on preventative care, chronic disease management, and patient engagement. Furthermore, the ACO must meet specific requirements related to patient population size and geographic location.

The Centers for Medicare & Medicaid Services (CMS) provides detailed guidelines and application processes for potential participants. The selection process is competitive, emphasizing the ACO’s readiness and capacity to achieve cost savings and quality improvements.

Financial Incentives and Penalties within the MSSP

The MSSP uses a shared savings model to incentivize ACOs. If an ACO generates net savings compared to a benchmark (a projection of their expected spending), it shares a portion of those savings with CMS. The percentage of shared savings varies depending on the ACO’s performance and the specific track it’s participating in. Conversely, if an ACO’s spending exceeds the benchmark, it may face financial penalties.

However, these penalties are typically capped, mitigating extreme risk for the ACOs. The financial structure of the MSSP is designed to encourage cost-effective, high-quality care while protecting ACOs from undue financial risk. The specific shared savings and loss-sharing arrangements are Artikeld in detailed contracts between CMS and participating ACOs. For example, an ACO that significantly reduces hospital readmissions and improves patient outcomes might share a substantial percentage of the savings achieved, while an ACO that performs below the benchmark might experience a smaller financial penalty, proportional to its performance relative to the benchmark.

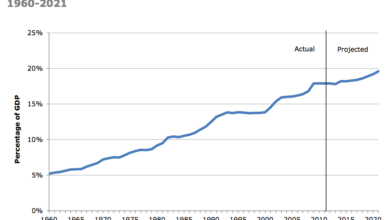

Historical Overview of the MSSP’s Performance

The MSSP has been operating since 2012, and its performance has been mixed. Early years showed modest savings, with some ACOs achieving significant cost reductions while others did not. Over time, CMS has refined the program’s structure and incentives, aiming to improve its effectiveness. Recent years have shown increased participation and a greater number of ACOs achieving shared savings.

However, the program continues to face challenges, including the complexity of coordinating care across multiple providers and the need for robust data infrastructure to track and measure performance. Data from CMS reports show a trend towards improved efficiency and quality metrics within the MSSP over time, although the overall financial impact varies across different ACOs and program tracks.

The ongoing evolution of the MSSP demonstrates a continuous effort to improve its effectiveness in achieving its goals of cost savings and quality improvement within the Medicare system.

Traditional Medicare vs. MSSP

Choosing the right Medicare plan can feel overwhelming, and understanding the differences between traditional Medicare and the Medicare Shared Savings Program (MSSP) is crucial for both beneficiaries and healthcare providers. This comparison highlights the key distinctions in cost structures, care delivery, profitability, and the overall impact on patients.

Cost Structures

Traditional Medicare, encompassing Parts A and B, operates on a fee-for-service model. Providers bill Medicare for each service rendered, leading to potentially unpredictable costs for both the government and beneficiaries. Beneficiaries pay premiums, deductibles, and coinsurance. In contrast, MSSP operates on a value-based care model. Participating providers receive a predetermined payment based on a shared savings arrangement.

If they achieve cost savings below a predetermined benchmark, they share those savings with Medicare. Conversely, if costs exceed the benchmark, they share in the losses. This creates a financial incentive for efficient and high-quality care. The cost structure for beneficiaries under MSSP participating providers can vary depending on the specific arrangements negotiated.

Patient Care Delivery Models

Traditional Medicare supports a largely independent, fee-for-service model. Patients can choose any provider accepting Medicare assignment, leading to fragmented care and potential for unnecessary services. MSSP, however, encourages coordinated care through Accountable Care Organizations (ACOs). ACOs strive to manage the total cost of care for a defined population of beneficiaries, integrating services and promoting preventative care. This leads to a more holistic and potentially more efficient approach to patient care.

The recent JAMA Health article on Medicare shared savings losses and the struggles of traditional healthcare models got me thinking. It highlights the need for innovative solutions, and that’s where advancements like the Google iCAD AI mammography expansion become incredibly relevant. Improving early detection through AI could significantly reduce long-term healthcare costs, potentially addressing some of the issues raised in the JAMA article regarding Medicare’s financial sustainability.

This kind of technological leap could reshape how we approach preventative care and overall healthcare spending.

For example, an ACO might actively manage chronic conditions like diabetes through regular check-ups and proactive interventions, preventing costly hospitalizations down the line.

Impact on Healthcare Provider Profitability

Under traditional Medicare, provider profitability is directly tied to the volume of services provided. This can incentivize performing more procedures, even if not medically necessary. MSSP, however, shifts the focus from volume to value. Providers can increase profitability by improving the efficiency and effectiveness of care, reducing hospital readmissions, and managing chronic conditions effectively. This encourages a more sustainable and patient-centered approach to healthcare delivery.

For example, a successful ACO might reduce hospital readmissions by 15%, resulting in significant cost savings and increased profitability.

Advantages and Disadvantages for Beneficiaries

Traditional Medicare offers beneficiaries broad access to providers. However, it can result in higher out-of-pocket costs due to the fee-for-service structure and lack of coordinated care. MSSP, while potentially offering better care coordination through ACOs, may limit provider choice depending on ACO participation. The cost implications for beneficiaries are less predictable under MSSP, as they depend on the specific arrangements between the ACO and Medicare.

However, improved preventative care and reduced hospital readmissions within an MSSP ACO could ultimately result in lower overall healthcare costs for beneficiaries over time.

The recent JAMA article highlighting Medicare Shared Savings Program losses for traditional health systems got me thinking. It seems the shift towards value-based care is forcing a reevaluation of models, and I wonder if the innovations discussed in this great article on AI, ai most exciting healthcare technology center connected medicine upmc , could offer a path forward.

Perhaps these AI-driven, connected medicine approaches will help traditional systems adapt and ultimately reduce those concerning losses reported in JAMA.

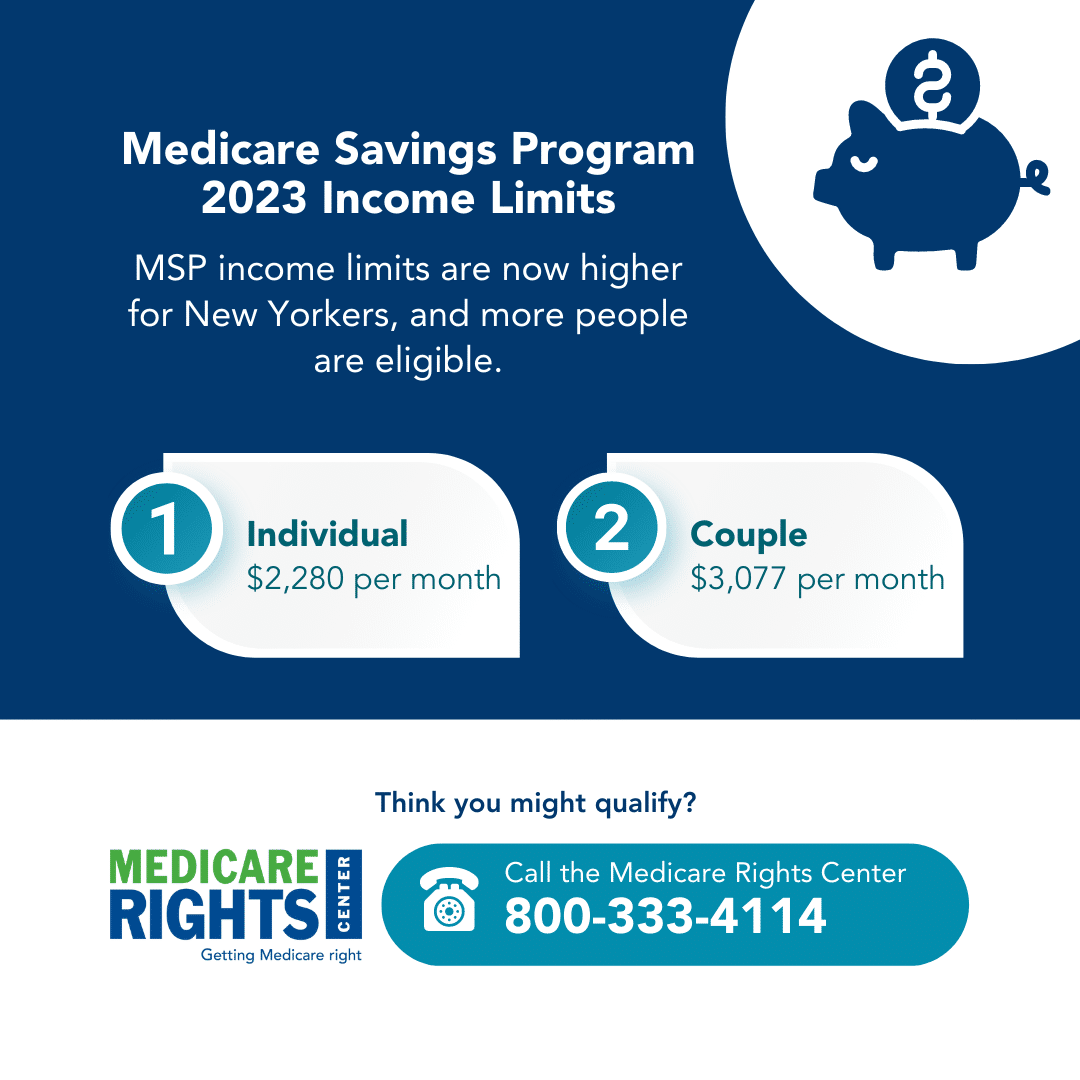

Financial Losses within the MSSP: Medicare Shared Savings Losses Traditional Jama Health

Source: medicarerights.org

Participating in the Medicare Shared Savings Program (MSSP) isn’t a guaranteed path to profit. While many ACOs (Accountable Care Organizations) achieve significant savings and bonuses, a considerable number experience financial losses. Understanding the reasons behind these losses is crucial for ACOs aiming to succeed in this value-based care model.

Examples of Healthcare Organizations Experiencing Financial Losses in the MSSP

Several ACOs have publicly reported, or through analyses of CMS data, experienced financial losses during their participation in the MSSP. While specific financial details are often kept confidential due to competitive reasons, the overall trend indicates that losses are not uncommon, particularly during the initial years of participation. The complexity of managing a large patient population across multiple care settings and the challenges of coordinating care effectively contribute to the financial risks involved.

One can infer from publicly available information that smaller ACOs, those with limited resources or experience in population health management, or those serving particularly complex patient populations are disproportionately affected.

Factors Contributing to Financial Losses in the MSSP

Several factors contribute to financial losses within the MSSP. These include difficulties in accurately predicting and managing total cost of care for a defined population, unexpected increases in the acuity of illness among enrolled beneficiaries, inadequate infrastructure for data analytics and care coordination, and challenges in effectively engaging patients in their own care. Furthermore, insufficient staffing levels, especially in areas such as care management and social work, can also lead to increased costs and reduced efficiency.

Finally, the inability to effectively negotiate lower rates with providers outside the ACO’s network can also negatively impact the bottom line.

Strategies to Mitigate Financial Risk within the MSSP

ACOs employ various strategies to mitigate financial risk. These include robust data analytics to identify high-cost patients and proactively manage their care, investments in care coordination technologies and infrastructure, and strong partnerships with community-based organizations to address social determinants of health. Furthermore, employing effective care management programs, such as disease management and transitional care, can improve patient outcomes and reduce overall costs.

A crucial element is the development of a strong, multidisciplinary team capable of effectively coordinating care and managing the complex needs of a large and diverse patient population. Finally, thorough financial planning and budgeting, considering both expected and potential unexpected costs, are essential for success.

Hypothetical Scenario Illustrating Potential Financial Losses and Their Causes

Let’s consider a hypothetical ACO, “Healthy Horizons,” serving a population of 10,000 Medicare beneficiaries. They projected a 2% reduction in total cost of care, aiming for a shared savings. However, an unexpected influenza epidemic resulted in a significant increase in hospital admissions and emergency room visits. Simultaneously, Healthy Horizons underestimated the prevalence of complex chronic conditions within their population, requiring more intensive care management than anticipated.

Their initial budget didn’t account for the added costs of managing these unexpected surges. The increased utilization of high-cost services, coupled with the underestimation of the complexity of their patient population, resulted in a significant financial loss for Healthy Horizons, exceeding their projected savings and ultimately leading to a net loss for the year. This scenario underscores the importance of thorough risk assessment, comprehensive data analysis, and flexible financial planning in mitigating financial risks within the MSSP.

Impact of Healthcare System Factors on MSSP Success

The Medicare Shared Savings Program (MSSP) success hinges not only on the ACO’s internal strategies but also on broader healthcare system factors. These external forces significantly influence an ACO’s ability to achieve cost savings and improve quality, impacting their financial outcomes within the program. Understanding these factors is crucial for both ACOs and policymakers seeking to optimize the MSSP’s effectiveness.

Population Health Influence on MSSP Financial Outcomes

The health status and demographics of the patient population served by an ACO are paramount to its success within the MSSP. ACOs responsible for sicker, more complex populations face inherently higher costs and greater challenges in achieving savings. For example, an ACO managing a large proportion of patients with chronic conditions like diabetes or heart disease will require more intensive interventions and resources, potentially hindering their ability to meet the benchmark targets set by the program.

Conversely, an ACO with a healthier population, requiring less intervention, has a greater chance of exceeding benchmarks and earning shared savings. This highlights the importance of risk adjustment methodologies within the MSSP, which attempt to account for these inherent differences in patient populations.

Technology and Data Analytics in MSSP Success, Medicare shared savings losses traditional jama health

Effective utilization of technology and data analytics is no longer optional, but rather essential for MSSP success. Sophisticated data analytics platforms allow ACOs to identify high-risk patients, track their care journeys, and proactively manage their conditions. This proactive approach, facilitated by technology, allows for early intervention and prevention of costly hospitalizations and emergency room visits. For example, predictive modeling can identify patients at high risk of readmission after a hospital stay, enabling the ACO to implement targeted interventions to reduce that risk.

Furthermore, telehealth technologies can enhance access to care, especially for patients in remote areas, improving care coordination and potentially lowering costs. The lack of adequate technology and data analytics capabilities can severely limit an ACO’s ability to effectively manage its population and achieve its financial goals.

Healthcare Workforce Shortages and MSSP Performance

The ongoing shortage of healthcare professionals, including physicians, nurses, and other specialists, significantly impacts ACO performance within the MSSP. Staffing shortages can lead to increased workloads, reduced care quality, and potentially higher costs. For example, a shortage of primary care physicians can result in delayed or inadequate care, leading to more expensive hospitalizations later. Similarly, a lack of sufficient nursing staff can impact the quality of care provided in hospitals and skilled nursing facilities, potentially increasing the risk of readmissions and complications.

ACOs operating in areas with significant workforce shortages may need to implement creative staffing strategies, such as leveraging telehealth or employing advanced practice providers, to mitigate these challenges.

Impact of Regulatory Changes on MSSP Participation and Profitability

Regulatory changes at both the federal and state levels directly influence MSSP participation and profitability. Changes to payment models, quality reporting requirements, or risk adjustment methodologies can significantly impact an ACO’s ability to succeed within the program. For instance, a change in the benchmark calculation methodology could drastically alter an ACO’s financial performance. Similarly, stricter quality reporting requirements could increase the administrative burden on ACOs, potentially impacting their efficiency and profitability.

Uncertainty surrounding future regulatory changes can also discourage ACO participation, as organizations may hesitate to commit to the program if they anticipate significant changes that could negatively impact their performance.

Future Directions and Potential Improvements for the MSSP

Source: kc-usercontent.com

The Medicare Shared Savings Program (MSSP) holds immense potential for improving healthcare quality and efficiency, but its current structure presents challenges, notably financial losses for some participating providers. Addressing these issues requires a multi-pronged approach focusing on program design, risk-sharing mechanisms, and provider engagement. The following sections Artikel potential improvements to enhance the MSSP’s effectiveness and long-term sustainability.

Improved Risk Adjustment and Benchmarking

Accurate risk adjustment is crucial to fairly assess performance and avoid penalizing providers caring for sicker populations. Current methodologies may not fully capture the complexity of patient needs, leading to unfair financial penalties for providers who accept a higher proportion of high-risk patients. Improvements could involve incorporating more granular patient data, such as social determinants of health, into the risk adjustment models.

This would ensure that providers aren’t unfairly disadvantaged due to factors beyond their control. For example, incorporating data on housing stability and food security could significantly improve the accuracy of risk stratification. Furthermore, more frequent benchmarking and adjustments to benchmarks could better reflect evolving healthcare trends and ensure fairness across different geographic regions and provider types.

The recent JAMA Health article highlighting Medicare Shared Savings Program losses for traditional Medicare beneficiaries got me thinking. We need better ways to coordinate care, and that’s where a technology-driven approach comes in, like the one discussed in this insightful piece on reimagining collaboration in senior care a technology driven approach. Ultimately, improved care coordination could significantly impact those Medicare savings losses, offering a potential solution to the challenges outlined in the JAMA study.

Innovative Risk-Sharing Models

The current MSSP model primarily focuses on downside risk sharing, which can deter participation from providers concerned about potential financial losses. Innovative approaches could include a greater emphasis on upside risk sharing, rewarding providers who exceed performance benchmarks significantly. This could incentivize providers to adopt innovative care models and invest in quality improvement initiatives. A hybrid model, combining both upside and downside risk sharing, could provide a balanced approach, rewarding success while mitigating significant financial losses.

For instance, a tiered system could offer increasing levels of upside potential with higher levels of downside risk, encouraging continuous improvement.

Strengthening Provider Participation and Support

Enhancing provider participation requires addressing the barriers to entry and providing robust support throughout the program. This involves simplifying the enrollment process, offering more technical assistance and training, and creating more flexible participation options to accommodate diverse practice settings. Furthermore, promoting successful MSSP participation stories and fostering a community of practice amongst participants can significantly increase engagement and encourage knowledge sharing.

Dedicated mentorship programs, pairing experienced participants with newer ones, could offer invaluable guidance and support. This would lead to greater success rates and increased confidence in the program.

Framework for Evaluating Long-Term Sustainability

Evaluating the long-term sustainability of the MSSP requires a comprehensive framework that considers financial viability, provider satisfaction, and program impact on healthcare quality and costs. This framework should incorporate both quantitative and qualitative data, including financial performance metrics, provider surveys, and measures of patient outcomes. Regular assessments and adjustments based on the data collected will ensure the program’s continued relevance and effectiveness.

A key element of this framework should be a robust feedback mechanism allowing for continuous improvement and adaptation based on real-world experiences and evolving healthcare landscape. This could include annual reports incorporating detailed analysis of program performance and recommendations for future improvements.

Closing Notes

The journey through Medicare Shared Savings Program losses, contrasting it with traditional Medicare and incorporating the valuable research published in JAMA, reveals a complex system with both significant potential and inherent risks. While the MSSP aims to improve efficiency and lower costs, its success hinges on careful planning, risk management, and a deep understanding of the factors that can lead to financial setbacks.

The insights from JAMA studies highlight the need for ongoing adjustments and innovation within the program, emphasizing the importance of data-driven decision-making and proactive strategies to ensure the long-term viability and effectiveness of the MSSP for both providers and patients.

Question Bank

What are the most common reasons for MSSP financial losses?

Common reasons include inaccurate risk adjustment, unexpected increases in patient acuity, difficulties in managing complex patient populations, and insufficient data analytics capabilities.

How does the MSSP differ from capitation models?

While both involve risk-sharing, capitation involves a fixed payment per patient, while the MSSP uses a benchmark and shared savings/losses based on performance relative to that benchmark.

What role does technology play in MSSP success?

Technology, particularly data analytics and telehealth, is crucial for accurate risk stratification, efficient care coordination, and better population health management, all of which can impact financial outcomes.

Are there any resources available to help providers avoid MSSP losses?

CMS provides resources and training, and many consulting firms specialize in helping providers optimize their MSSP participation.