Members Dissatisfied Commercial Health Plans

Members dissatisfied commercial health plans? It’s a topic hitting close to home for many. We’ve all been there – the frustrating phone calls, the confusing bills, the feeling that your health insurance isn’t really working for you. This post dives into the common gripes, explores why so many are unhappy with their commercial health plans, and offers some potential solutions.

We’ll look at everything from high out-of-pocket costs and poor communication to inadequate provider networks and cumbersome claims processing. Get ready to vent (and maybe find some answers!).

The dissatisfaction isn’t just about dollars and cents; it’s about feeling valued as a patient and having confidence in your healthcare system. This isn’t just a rant; it’s a call for better transparency, better communication, and a more patient-centric approach to commercial health insurance. We’ll explore the different types of plans, the reasons behind the frustration, and some ideas on how things can improve.

Let’s get started!

Reasons for Dissatisfaction

Member dissatisfaction with commercial health plans is a significant concern, impacting both individual well-being and the overall healthcare system. Understanding the root causes is crucial for improving plan design and member experience. This section delves into the top reasons members express dissatisfaction, exploring their impact and potential solutions.

High Out-of-Pocket Costs

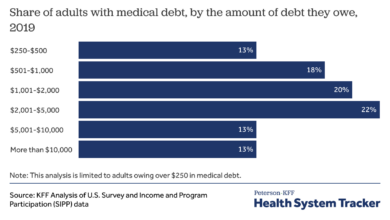

High out-of-pocket costs consistently rank among the top reasons for member dissatisfaction. These costs, including deductibles, co-pays, and coinsurance, can create significant financial burdens, particularly for individuals with chronic conditions or unexpected illnesses.

| Reason | Frequency | Impact | Proposed Solutions |

|---|---|---|---|

| High Deductibles and Co-pays | Very High | Reduced healthcare access and utilization; delayed or forgone necessary care; financial strain; increased stress levels. For example, a family facing a $10,000 deductible may delay seeking care for a child’s illness, potentially leading to more serious health problems and higher costs in the long run. | Transparent cost estimates; tiered plans with varying deductible levels; financial assistance programs; increased emphasis on preventative care to reduce future costs. |

| Lack of Network Coverage | High | Limited choice of providers; difficulty accessing specialized care; increased out-of-pocket expenses when using out-of-network providers. For instance, a member needing a specialist might find that only out-of-network specialists are available in their area, leading to significantly higher costs. | Expanding provider networks; negotiating better rates with providers; providing clear and readily accessible information about network providers. |

| Poor Claims Processing and Reimbursement | High | Financial uncertainty; delays in receiving reimbursements; frustration and administrative burden; potential disputes and appeals. An example would be a member receiving an unexpected denial of a claim, with the appeals process being long and confusing, causing undue stress and financial hardship. | Streamlining claims processing; improving online tools for tracking claims; providing clear and concise explanations of denials; establishing a user-friendly appeals process. |

Impact of High Out-of-Pocket Costs on Member Satisfaction

High deductibles and co-pays significantly impact healthcare access and utilization. Many individuals delay or forgo necessary care due to cost concerns, leading to worse health outcomes and potentially higher long-term costs. For example, someone with a high deductible might postpone a routine checkup or necessary medication, resulting in the condition worsening and requiring more expensive treatment later. This directly affects member satisfaction, creating frustration and distrust in the health plan.

Poor Communication and Customer Service, Members dissatisfied commercial health plans

Ineffective communication and poor customer service are major contributors to member dissatisfaction. A lack of clear and timely information about benefits, coverage, and claims processing creates confusion and frustration. Examples include confusing plan documents, long wait times for customer service calls, and unhelpful or unresponsive representatives.Effective communication strategies employed by successful health plans include: proactive communication about benefits and coverage; user-friendly online portals for managing accounts and accessing information; multiple communication channels (phone, email, chat); personalized communication tailored to individual needs; and responsive and empathetic customer service representatives.

Network Adequacy and Access

Choosing a health insurance plan often feels like navigating a maze. One of the most crucial factors, often overlooked until it’s too late, is the adequacy of the provider network. A seemingly small difference in network size or specialist availability can significantly impact your healthcare experience and access to timely, quality care. This section will delve into the network adequacy and access issues faced by members of two major commercial health plans, highlighting the strengths and weaknesses of each.

Understanding the intricacies of provider networks is essential for making informed decisions about your health insurance. A robust network provides peace of mind, knowing that you have access to a wide range of healthcare professionals when you need them. Conversely, a limited network can lead to frustration, delays, and ultimately, compromised care.

Comparison of Provider Networks: Plan A vs. Plan B

Let’s compare the provider networks of two hypothetical major commercial health plans, Plan A and Plan B, focusing on access to specialists and preferred providers. Both plans have extensive networks, but their strengths and weaknesses differ significantly based on geographic location and specialty type.

The following bullet points summarize the key aspects of each plan’s network:

- Plan A Strengths:

- Strong presence in urban areas, with excellent access to specialists in cardiology and oncology.

- Large network of preferred providers, resulting in lower out-of-pocket costs for many services.

- Relatively easy online provider search tool.

- Plan A Weaknesses:

- Limited network in rural areas, making access to specialists challenging for those living outside major cities.

- Fewer specialists in areas like neurology and dermatology compared to Plan B.

- Long wait times for appointments with some preferred providers.

- Plan B Strengths:

- Broad geographic coverage, including strong representation in both urban and rural areas.

- Larger network of specialists across various medical fields, including neurology and dermatology.

- Generally shorter wait times for appointments.

- Plan B Weaknesses:

- Smaller network of preferred providers compared to Plan A, potentially leading to higher out-of-pocket costs.

- Provider search tool less user-friendly than Plan A’s.

- Some areas within the network have a higher concentration of out-of-network providers.

Impact of Limited Network Access on Patient Care and Satisfaction

Limited network access can significantly impact patient care and satisfaction. Delayed or inaccessible care can lead to worsening health conditions, increased hospitalizations, and higher overall healthcare costs. Patient satisfaction suffers due to frustration with navigating the network, difficulty finding in-network specialists, and longer wait times for appointments.

For example, imagine Sarah, a patient with a rare neurological condition requiring specialized care. If her health plan (Plan A) has a limited network of neurologists, especially in her rural area, she might face significant challenges accessing timely treatment. This delay could lead to a worsening of her condition, requiring more extensive and costly interventions later. The frustration of searching for an in-network specialist and dealing with long wait times further diminishes her overall healthcare experience and satisfaction.

Hypothetical Improved Provider Network Strategy

To enhance network adequacy and improve member access, a commercial health plan could implement the following strategy:

This strategy focuses on expanding access to specialists and improving geographic coverage while maintaining cost-effectiveness.

- Expand Specialist Networks: Prioritize recruiting specialists in underserved areas and specialties with limited provider availability. This could involve offering competitive compensation packages and providing resources for recruitment.

- Enhance Geographic Coverage: Strategically expand the network into rural and underserved areas by partnering with local hospitals and clinics. This might involve negotiating favorable contracts to ensure affordability.

- Improve Network Transparency: Develop a user-friendly online provider search tool with advanced search filters (specialty, location, language, etc.) and real-time appointment availability information. This empowers members to make informed choices.

- Implement Telehealth Integration: Expand telehealth services to improve access to specialists, especially for those in remote areas. This requires investing in robust telehealth infrastructure and training providers on its effective use.

- Negotiate Favorable Contracts: Negotiate favorable contracts with providers to ensure affordability and maintain a balance between network size and cost-effectiveness.

Claims Processing and Reimbursement: Members Dissatisfied Commercial Health Plans

Navigating the claims process with commercial health plans can often feel like traversing a minefield. Many members experience frustration and financial hardship due to delays, denials, and billing inaccuracies. Understanding the common pitfalls and advocating for efficient, transparent processing is crucial for a positive healthcare experience.

Common issues members encounter include lengthy processing times, leading to delayed payments for medical services. Denials, often due to unclear pre-authorization requirements or coding errors, leave patients responsible for unexpected out-of-pocket costs. Billing errors, such as incorrect charges or duplicate billings, add further complexity and financial strain. For example, a patient might receive a bill for a procedure they never had, or a bill that significantly exceeds the expected cost based on their plan’s coverage.

Another common issue is a lack of clear communication from the insurance company throughout the claims process, leaving patients unsure of the status of their claims and unable to proactively address potential problems.

Delays in Claims Processing

Delays in claims processing stem from various factors, including inefficient manual processes, inadequate staffing, and complex claim adjudication systems. These delays can significantly impact patients’ financial stability, especially for those with high deductibles or limited savings. Imagine a patient who has undergone a major surgery and is already facing significant medical expenses. A delay in processing their claim can lead to mounting debt and increased financial stress.

Furthermore, delays often necessitate multiple calls and emails to the insurance company, adding to the patient’s frustration and burden.

Claims Denials and Appeals

Claims denials are frequently caused by issues such as missing or incomplete documentation, incorrect coding, or services not covered under the plan. The denial process itself can be opaque and difficult to navigate, often requiring patients to spend significant time and effort gathering additional information and appealing the decision. For instance, a patient might receive a denial for a medically necessary procedure because the physician didn’t properly document the medical necessity.

Appealing a denial often involves filling out complex forms, submitting supporting documentation, and waiting for a decision, which can be both time-consuming and stressful.

Billing Errors and Discrepancies

Billing errors, including duplicate charges, incorrect amounts, and misapplied payments, are another major source of frustration for members. These errors can lead to unnecessary financial burdens and negatively impact patient-provider relationships. For example, a patient might receive multiple bills for the same service, leading to confusion and extra expenses. This lack of accuracy adds an extra layer of complexity to an already challenging situation.

Improving Claims Processing Efficiency and Transparency

Implementing technological solutions, such as automated claims processing systems and online portals, can significantly streamline the process. These systems can reduce manual data entry, improve accuracy, and provide real-time updates to patients on the status of their claims. Improved communication protocols, such as automated email and text message updates, can keep patients informed and reduce the need for phone calls.

So many members are dissatisfied with their commercial health plans, citing issues with access to care and rising costs. This dissatisfaction is only exacerbated by the current healthcare crisis, as highlighted in this article about healthcare executives saying talent acquisition and labor shortages are a major business risk. Ultimately, fewer healthcare professionals means longer wait times and potentially less comprehensive care, further fueling member frustration.

A Streamlined Claims Process: A Step-by-Step Guide

A well-designed claims process should prioritize simplicity and transparency. Here’s a step-by-step example of an improved process:

- Provider submits claim electronically: The provider submits the claim electronically, including all necessary documentation, directly to the insurance company’s system.

- Automated claim verification: The system automatically verifies the claim against the patient’s policy information and pre-authorization requirements.

- Real-time claim status updates: The patient receives real-time updates on the status of their claim via email or text message.

- Automated payment processing: Upon claim approval, the payment is automatically processed and sent to the provider.

- Transparent denial process: In case of a denial, the patient receives a clear explanation of the reason for denial and instructions on how to appeal the decision.

- Easy access to claim details: Patients can easily access their claim details and history through a secure online portal.

Member Experience and Engagement

Source: policyensure.com

Positive member experiences are crucial for the success of any commercial health plan. A strong focus on member engagement fosters loyalty, reduces churn, and ultimately improves the overall health outcomes of the plan’s members. This section will delve into the key elements of a positive member experience and effective engagement strategies.

A positive member experience is built on several key pillars: easy access to care, efficient claims processing, clear and concise communication, and a feeling of being valued and understood. It’s about providing a seamless and supportive journey for members navigating the complexities of healthcare. This extends beyond just efficient administrative processes; it encompasses the emotional and relational aspects of healthcare as well.

Elements of a Positive Member Experience

An ideal interaction with a health plan representative should be efficient, empathetic, and problem-solving oriented. Imagine a scenario where a member calls to inquire about a denied claim. The representative answers promptly, listens attentively to the member’s concerns, clearly explains the reason for the denial in simple terms, and Artikels the steps the member can take to appeal the decision.

The representative remains calm and professional throughout the interaction, ensuring the member feels heard and understood. The entire process is streamlined, with minimal hold times and easy-to-follow instructions. The representative also proactively offers additional resources or support if needed, leaving the member feeling confident and satisfied.

Successful Member Engagement Strategies

Several strategies can significantly improve member satisfaction and loyalty. These strategies go beyond simply providing good customer service; they aim to build genuine relationships and foster a sense of community among members.

So many people are voicing their frustrations with commercial health plans lately – high premiums, limited choices, you name it. It makes you wonder about the bigger picture, like how secure their data really is. I was reading this article on the hhs healthcare cybersecurity framework hospital requirements cms and it highlighted just how crucial robust systems are.

If hospitals are struggling to meet these standards, it’s easy to imagine the vulnerabilities in smaller commercial plans, which only adds to members’ dissatisfaction.

- Personalized Communication: Tailoring communication to individual member needs and preferences, using their preferred channels (email, text, mail).

- Proactive Outreach: Reaching out to members with relevant health information, reminders for preventive care, and personalized wellness programs.

- Member Portals and Mobile Apps: Providing convenient online access to account information, claims status, doctor directories, and telehealth services.

- Educational Resources: Offering webinars, workshops, and online resources to help members understand their health benefits and make informed decisions.

- Rewards and Incentives: Implementing programs that reward members for healthy behaviors, such as completing wellness assessments or participating in preventive screenings.

- Community Building: Creating opportunities for members to connect with each other and share experiences, such as support groups or online forums.

Improving Member Engagement with Digital Tools and Personalized Communication

A strategic plan leveraging digital tools and personalized communication can dramatically improve member engagement. The table below Artikels a sample plan:

| Method | Target Audience | Goal | Expected Outcome |

|---|---|---|---|

| Personalized email campaigns promoting preventative care based on age and health history | Members aged 40-65 with no recent colonoscopies | Increase colonoscopy screening rates | 15% increase in colonoscopy screenings within 6 months |

| Mobile app with medication reminders and adherence tracking | Members with chronic conditions requiring medication adherence | Improve medication adherence | 10% increase in medication adherence rates within 3 months |

| Interactive online health risk assessment and personalized wellness plan recommendations | All members | Promote proactive health management | 20% increase in member engagement with wellness resources |

| Targeted SMS reminders for upcoming appointments and health screenings | All members | Reduce missed appointments and improve screening rates | 10% reduction in missed appointments and 5% increase in screening rates |

Comparison to Other Health Plan Models

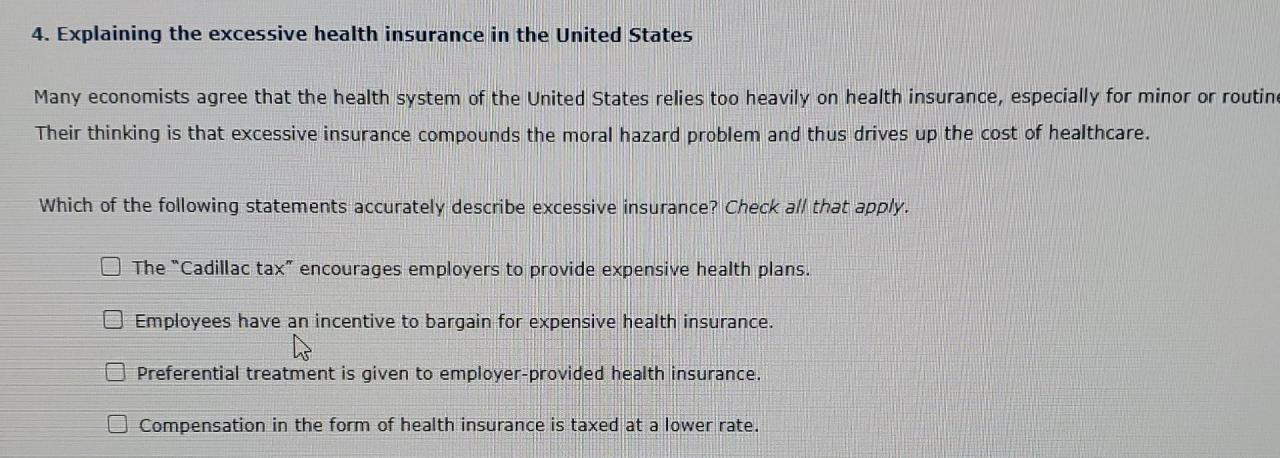

Understanding member satisfaction requires comparing commercial plans to other models like HMOs, PPOs, and POS plans. Each model offers a different balance between cost, choice, and access to care, directly impacting member experience. This analysis will highlight key differences in member satisfaction across these models and explore the factors contributing to these variations.

So many people are frustrated with their commercial health plans – high costs, limited choices, the whole shebang. I was reading this fascinating study widespread digital twins healthcare recently, and it got me thinking – could personalized digital health models help address some of these issues? Maybe better predictive care could lead to fewer expensive emergencies and happier, healthier members overall, improving satisfaction with commercial plans.

Member satisfaction levels vary significantly across different health plan models. While comprehensive data directly comparing satisfaction across all models is difficult to obtain consistently, general trends and characteristics can be observed based on available research and industry reports.

Member Satisfaction Across Different Health Plan Models

The following table presents a generalized comparison of member satisfaction across different health plan models. It’s crucial to remember that actual satisfaction levels can vary greatly depending on the specific plan, provider network, and individual member experiences. The data presented here reflects general trends based on available research and should not be considered definitive for all plans.

| Health Plan Model | Member Satisfaction (General Trend) | Key Factors Influencing Satisfaction |

|---|---|---|

| HMO (Health Maintenance Organization) | Often lower satisfaction due to restricted provider networks, but potentially higher satisfaction due to lower premiums. | Network limitations, referral requirements, cost-effectiveness |

| PPO (Preferred Provider Organization) | Generally higher satisfaction due to broader provider networks and greater choice, but potentially lower satisfaction due to higher premiums. | Network breadth, choice of providers, out-of-pocket costs |

| POS (Point of Service) | Moderate satisfaction, a compromise between HMO and PPO models. | Balance between cost and choice, gatekeeper physician role |

| Commercial Health Plans (General) | Varied, dependent on specific plan features and network. Often falls somewhere between PPO and HMO in terms of satisfaction, depending on plan design. | Plan features (deductibles, copays, etc.), network adequacy, claims processing |

Factors Differentiating Member Satisfaction Across Health Plan Models

Several key factors contribute to the differences in member satisfaction across various health plan models. These factors interact in complex ways, making it difficult to isolate the impact of any single factor.

- Network Adequacy and Access: HMOs typically have narrower networks, potentially limiting member choice and access to specialists. PPOs generally offer broader networks, leading to greater member satisfaction in this area. POS plans offer a compromise.

- Cost-Sharing: Higher deductibles and copays in some PPO plans can negatively impact member satisfaction, even with greater provider choice. HMOs often have lower premiums, potentially offsetting network limitations for some members.

- Administrative Processes: Efficient claims processing and responsive customer service are crucial for all models. Negative experiences in these areas can significantly reduce satisfaction regardless of the plan type.

- Provider Relationships: Strong relationships between the health plan and its providers can lead to improved care coordination and member satisfaction. Weak provider relationships can result in poor communication and delays in care.

Benefits and Drawbacks of Different Health Plan Models

Understanding the benefits and drawbacks of each health plan model is essential for members to make informed decisions about their healthcare coverage. The following points summarize the key advantages and disadvantages, keeping in mind that individual experiences may vary.

HMOs:

- Benefits: Typically lower premiums, preventative care often covered at no cost.

- Drawbacks: Restricted provider networks, need for referrals to specialists, potential difficulties accessing specialized care.

PPOs:

- Benefits: Broader provider networks, greater choice of doctors and specialists, no referral requirements.

- Drawbacks: Higher premiums, higher out-of-pocket costs if using out-of-network providers.

POS Plans:

- Benefits: Offers a balance between cost and choice, combines aspects of HMO and PPO models.

- Drawbacks: Can be complex to navigate, may require referrals for out-of-network care, potentially higher costs than HMOs if using out-of-network providers.

Last Word

Source: cheggcdn.com

So, are you frustrated with your commercial health plan? You’re definitely not alone. This post highlighted some of the biggest pain points – high costs, poor communication, and limited network access – and explored potential solutions. While there’s no magic bullet, demanding better from your insurer, understanding your rights, and advocating for change are key steps towards a more positive healthcare experience.

Remember, your voice matters! Let’s work together to make our healthcare system better for everyone.

Query Resolution

What are my rights if my claim is denied?

You have the right to appeal a denied claim. Your health plan should have a clear appeals process Artikeld in your policy documents. Carefully review the denial reason and gather any supporting documentation to strengthen your appeal.

Can I switch health plans outside of open enrollment?

You may be able to switch plans outside of open enrollment if you experience a qualifying life event, such as marriage, divorce, job loss, or the birth or adoption of a child. Check with your state’s insurance marketplace for specific rules.

How can I find a doctor in my plan’s network?

Most health plans have online provider directories where you can search for doctors by specialty, location, and other criteria. You can usually access this directory through your plan’s website or mobile app.

What if I’m having trouble understanding my explanation of benefits (EOB)?

Don’t hesitate to contact your health plan’s customer service department for clarification. They can help you understand the charges, payments, and your remaining out-of-pocket costs.