Signs You Are Not at Risk of Heart Disease

Signs you are not at a risk of heart disease? It’s a question many of us ponder, especially as we navigate the complexities of modern life. Heart disease is a significant concern, but understanding the positive indicators can be incredibly empowering. This isn’t about ignoring potential risks, but rather focusing on the proactive steps we can take and the reassuring signs that our hearts are thriving.

Let’s explore what those signs might be and how we can nurture our cardiovascular health.

Maintaining a healthy lifestyle is key. Think vibrant, colorful fruits and vegetables filling your plate, regular exercise invigorating your body, and stress-management techniques keeping your mind calm. Regular checkups are equally important, allowing for early detection of any potential issues. We’ll delve into specifics on blood pressure, cholesterol levels, family history, and other contributing factors to paint a clearer picture of what a heart-healthy life looks like.

Healthy Lifestyle Factors

Maintaining a healthy lifestyle is crucial for preventing heart disease. By focusing on diet, exercise, and stress management, you significantly reduce your risk of developing cardiovascular problems. These factors work synergistically, creating a powerful defense against heart disease.

Dietary Habits for Heart Health

A heart-healthy diet emphasizes whole, unprocessed foods while limiting saturated and trans fats, cholesterol, sodium, and added sugars. This approach nourishes your body and helps maintain healthy blood pressure and cholesterol levels.Foods to include: Fruits and vegetables rich in vitamins, minerals, and antioxidants; whole grains like brown rice and oats for fiber; lean protein sources such as fish, poultry, and beans; healthy fats from sources like avocados, nuts, and olive oil.Foods to exclude or limit: Red meat, processed meats (bacon, sausage), fried foods, sugary drinks, refined carbohydrates (white bread, pastries), and foods high in saturated and trans fats (many commercially baked goods and processed snacks).

The Importance of Regular Physical Activity

Regular physical activity is essential for cardiovascular health. It strengthens the heart muscle, improves blood circulation, helps manage weight, and lowers blood pressure and cholesterol. Aim for at least 150 minutes of moderate-intensity aerobic activity or 75 minutes of vigorous-intensity aerobic activity per week, spread throughout the week.Different types of exercise offer various benefits. Aerobic exercises like brisk walking, jogging, swimming, and cycling improve cardiovascular fitness.

Strength training exercises using weights or resistance bands build muscle mass, which boosts metabolism and helps maintain a healthy weight. Flexibility exercises such as yoga and stretching improve joint mobility and reduce the risk of injury.

Stress Management Techniques for Cardiovascular Health

Chronic stress significantly increases the risk of heart disease. High stress levels lead to increased blood pressure and hormone release, placing extra strain on the cardiovascular system. Effective stress management techniques are crucial for protecting heart health.Effective stress-reduction techniques include: regular exercise (as discussed above), mindfulness meditation, deep breathing exercises, yoga, spending time in nature, engaging in hobbies, getting sufficient sleep, and seeking social support.

Knowing you maintain a healthy weight and blood pressure are great signs you’re not at a high risk for heart disease. It’s also important to remember that managing underlying conditions, like focusing on effective strategies for your child, is crucial for overall health. For example, check out this helpful resource on strategies to manage Tourette syndrome in children , as managing such conditions can positively impact cardiovascular health.

Ultimately, a holistic approach, including managing any health concerns, contributes to lowering your heart disease risk.

Finding activities that help you relax and de-stress is key.

Sample Weekly Schedule

| Day | Meal Plan | Exercise Type | Stress Management Activity |

|---|---|---|---|

| Monday | Breakfast: Oatmeal with berries; Lunch: Salad with grilled chicken; Dinner: Baked salmon with roasted vegetables | 30 minutes brisk walking | 15 minutes of meditation |

| Tuesday | Breakfast: Greek yogurt with fruit; Lunch: Leftover salmon and vegetables; Dinner: Lentil soup with whole-wheat bread | 30 minutes cycling | Read a book |

| Wednesday | Breakfast: Scrambled eggs with whole-wheat toast; Lunch: Tuna salad sandwich on whole-wheat bread; Dinner: Chicken stir-fry with brown rice | Strength training (30 minutes) | Listen to calming music |

| Thursday | Breakfast: Smoothie with fruits and vegetables; Lunch: Leftover chicken stir-fry; Dinner: Vegetarian chili with cornbread | 30 minutes swimming | Spend time in nature |

| Friday | Breakfast: Whole-wheat pancakes with fruit; Lunch: Salad with chickpeas; Dinner: Pizza with whole-wheat crust and plenty of vegetables | Yoga (45 minutes) | Socialize with friends |

| Saturday | Breakfast: Eggs Benedict with whole wheat English muffins; Lunch: Leftovers; Dinner: Grilled chicken salad | Hiking (60 minutes) | Watch a movie |

| Sunday | Breakfast: Waffles with fruit; Lunch: Leftovers; Dinner: Roast chicken with potatoes and vegetables | Rest | Engage in a hobby |

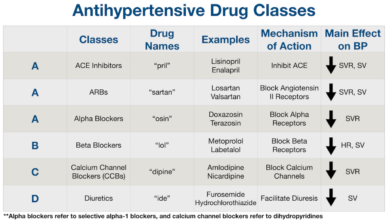

Blood Pressure and Cholesterol Levels

Maintaining healthy blood pressure and cholesterol levels is crucial for preventing heart disease. Understanding these vital numbers and how they impact your cardiovascular system is a significant step towards safeguarding your heart health. This section will delve into ideal ranges, the effects of unhealthy levels, and methods for monitoring these key indicators at home.

Ideal Blood Pressure and Cholesterol Ranges and Their Relation to Heart Disease Risk

Ideal blood pressure is generally considered to be below 120/80 mmHg (millimeters of mercury). The top number (systolic) represents the pressure when your heart beats, while the bottom number (diastolic) represents the pressure when your heart rests between beats. High blood pressure, or hypertension, consistently above 140/90 mmHg, significantly increases your risk of heart disease, stroke, and kidney damage.

Cholesterol levels are equally important. Total cholesterol should ideally be below 200 mg/dL (milligrams per deciliter). LDL (“bad”) cholesterol should be below 100 mg/dL, while HDL (“good”) cholesterol should be above 60 mg/dL. High LDL cholesterol contributes significantly to plaque buildup in arteries, narrowing them and restricting blood flow.

Impact of High Blood Pressure and High Cholesterol on the Cardiovascular System

High blood pressure forces the heart to work harder, weakening it over time. High cholesterol contributes to atherosclerosis, a process where fatty deposits (plaque) build up inside the artery walls. Imagine a healthy artery as a smooth, wide pipe allowing blood to flow freely. With high cholesterol, this pipe becomes progressively narrower and rougher due to plaque buildup.

This restricts blood flow, potentially leading to heart attacks or strokes. In a severe case, the plaque can rupture, triggering the formation of a blood clot that can completely block blood flow. This blockage can deprive the heart muscle of oxygen, resulting in a heart attack, or the brain, resulting in a stroke.

Methods for Monitoring Blood Pressure and Cholesterol Levels at Home

Home blood pressure monitors are readily available and relatively easy to use. Most use an inflatable cuff that wraps around your upper arm. The device measures the pressure in the cuff as it inflates and deflates, providing a digital reading of your systolic and diastolic pressure. For cholesterol monitoring, you’ll need to have a blood test done, typically at a doctor’s office or a blood testing center.

While home cholesterol testing kits exist, they are less accurate than laboratory tests and shouldn’t replace regular checkups with your doctor. Consistency is key: regular monitoring allows you to track your numbers and identify any potential problems early.

Comparison of Healthy and Unhealthy Blood Pressure and Cholesterol Levels

| Measurement | Healthy Range | Unhealthy Range | Risk Factors |

|---|---|---|---|

| Blood Pressure (mmHg) | Below 120/80 | Above 140/90 | Heart attack, stroke, kidney disease |

| Total Cholesterol (mg/dL) | Below 200 | Above 240 | Atherosclerosis, heart attack, stroke |

| LDL Cholesterol (mg/dL) | Below 100 | Above 160 | Atherosclerosis, heart attack, stroke |

| HDL Cholesterol (mg/dL) | Above 60 | Below 40 | Increased risk of heart disease |

Family History and Genetic Predisposition

Understanding your family history is crucial in assessing your risk of heart disease. While lifestyle choices significantly impact heart health, genetics play a considerable role, influencing our susceptibility to various cardiovascular conditions. Knowing your family’s medical history can help you and your doctor proactively manage your risk.Family history significantly impacts heart disease risk assessment. Several factors are crucial to consider.

The presence of heart disease in first-degree relatives (parents, siblings, children) increases your risk considerably. The age at which these relatives experienced heart problems is also a key indicator; early-onset heart disease (before age 55 in men and 65 in women) suggests a stronger genetic component. The type of heart disease in the family is important too; a history of coronary artery disease, heart attacks, strokes, or heart failure significantly increases risk.

Finally, the number of affected relatives also influences risk assessment; more affected relatives suggest a higher probability of inheriting predisposing genes.

Genetic Factors Influencing Heart Disease Risk

Numerous genes influence the development of heart disease. Some genes increase the risk of high cholesterol, high blood pressure, or blood clots—all major contributors to heart disease. Other genes might affect the structure and function of the heart muscle itself, increasing the risk of conditions like cardiomyopathy. For example, familial hypercholesterolemia (FH) is a genetic disorder that causes extremely high levels of LDL (“bad”) cholesterol, dramatically increasing the risk of early-onset heart disease.

Maintaining a healthy weight and blood pressure are great signs you’re lowering your heart disease risk. It’s fascinating how research explores connections between different health areas, like how an eye test, as discussed in this article can eye test detect dementia risk in older adults , might reveal potential health issues. Similarly, proactively managing your cardiovascular health is key to a long and healthy life, reducing your chances of heart problems.

Conversely, some genetic variations might offer a degree of protection against heart disease, though this is less commonly studied and understood. The interplay of multiple genes and environmental factors determines an individual’s overall risk.

Impact of Different Genetic Predispositions on Heart Health

The impact of genetic predispositions varies significantly. Individuals with strong family histories of early-onset heart disease face a substantially higher risk compared to those with no such history. Conditions like FH can lead to premature heart attacks and the need for aggressive interventions, even in relatively young individuals. Other genetic variations might subtly increase risk, making lifestyle modifications even more critical.

Conversely, individuals with genetic variations that confer some protection may still benefit from a healthy lifestyle to further reduce their risk. The overall impact depends on the specific genetic variations involved, their interaction with other genes, and the influence of environmental factors.

Genetic Testing for Heart Disease Risk

Genetic testing can provide valuable insights into an individual’s predisposition to heart disease. However, it’s important to understand both the benefits and limitations.

- Process: Genetic testing usually involves a blood or saliva sample. The sample is analyzed for specific gene variations associated with heart disease risk. Results are typically provided in a report that explains the findings and their implications.

- Benefits: Genetic testing can help identify individuals at high risk, allowing for earlier intervention and lifestyle modifications. It can inform decisions about preventive medications (such as statins) and more frequent screenings. It can also provide valuable information for family members who may also be at increased risk.

- Limitations: Genetic testing does not predict with certainty whether an individual will develop heart disease. It only assesses the likelihood based on genetic predisposition. Many factors beyond genetics, such as lifestyle and environmental influences, contribute to heart disease risk. Moreover, the interpretation of genetic test results can be complex and requires careful consideration by a healthcare professional.

The availability and cost of testing also vary.

Other Risk Factors and Protective Measures

Beyond the well-known factors like diet, exercise, and blood pressure, several other elements significantly influence your heart health. Understanding these additional risk factors and implementing protective measures can greatly improve your cardiovascular well-being. This section explores some key contributors to, and protectors against, heart disease.

The Impact of Smoking, Excessive Alcohol Consumption, and Diabetes on Heart Health

Smoking, excessive alcohol use, and diabetes are major risk factors for heart disease, each working through different but often interconnected mechanisms. Smoking damages blood vessels, increasing blood pressure and promoting the formation of blood clots. Nicotine constricts blood vessels, reducing blood flow to the heart. Excessive alcohol consumption raises blood pressure and contributes to irregular heart rhythms (arrhythmias).

Diabetes damages blood vessels over time, increasing the risk of atherosclerosis (hardening of the arteries) and heart attacks. The high blood sugar levels associated with diabetes also contribute to inflammation throughout the body, further stressing the cardiovascular system. For example, a study published in the “Journal of the American Medical Association” showed a strong correlation between heavy alcohol consumption and increased risk of atrial fibrillation, a type of irregular heartbeat.

Strategies for Quitting Smoking and Reducing Alcohol Intake

Quitting smoking is one of the most impactful steps you can take to improve your heart health. Numerous resources are available, including nicotine replacement therapy (patches, gum), prescription medications, and support groups. A multi-pronged approach is often most effective, combining medication with counseling and behavioral strategies. Similarly, reducing alcohol intake involves setting realistic goals and monitoring consumption.

Consulting a healthcare professional can help determine a safe and appropriate level of alcohol consumption, or guide you in developing a plan to reduce or eliminate it. For instance, gradually decreasing the number of drinks per week, switching to lower-alcohol beverages, or implementing alcohol-free days can be effective strategies.

Effective Approaches to Managing Diabetes

Effective diabetes management is crucial for protecting heart health. This involves maintaining blood sugar levels within a healthy range through a combination of diet, exercise, and medication (if necessary). A balanced diet low in saturated and trans fats, along with regular physical activity, can significantly improve blood sugar control. Regular monitoring of blood sugar levels, along with adherence to prescribed medications, are also essential components of effective diabetes management.

For example, studies have shown that individuals with well-controlled diabetes have a significantly reduced risk of developing cardiovascular complications compared to those with poorly controlled diabetes.

Lifestyle Modifications to Reduce Heart Disease Risk

Making consistent lifestyle changes can significantly reduce your risk of heart disease. These modifications work synergistically to protect your heart:

- Maintain a healthy weight.

- Eat a balanced diet rich in fruits, vegetables, and whole grains.

- Engage in regular physical activity (at least 150 minutes of moderate-intensity or 75 minutes of vigorous-intensity aerobic activity per week).

- Quit smoking.

- Limit alcohol consumption.

- Manage stress effectively.

- Get adequate sleep (7-9 hours per night).

- Maintain healthy blood pressure and cholesterol levels.

Regular Health Checkups and Preventative Care: Signs You Are Not At A Risk Of Heart Disease

Source: pmdstatic.net

Regular visits to your doctor are crucial for maintaining good heart health. Preventative care allows for early detection of potential problems, enabling timely intervention and significantly reducing the risk of serious complications. By establishing a proactive approach to your cardiovascular well-being, you empower yourself to take control of your health and live a longer, healthier life.

Importance of Regular Checkups

Regular checkups provide a valuable opportunity for your doctor to monitor your overall health and specifically assess your risk factors for heart disease. The frequency of these checkups will depend on your individual risk profile, age, and family history, but generally, adults should aim for annual physical examinations. More frequent visits may be recommended if you have pre-existing conditions or a high risk of developing heart disease.

These checkups go beyond simply measuring your weight and blood pressure; they provide a comprehensive assessment, allowing for early detection of issues before they become serious.

Diagnostic Tests for Heart Health

Several diagnostic tests are employed to evaluate heart health. These tests help identify potential problems and provide a clearer picture of your cardiovascular system’s functionality.

Electrocardiogram (ECG or EKG)

An ECG measures the electrical activity of your heart using electrodes placed on your chest. The resulting tracing reveals the heart’s rhythm and identifies irregularities like abnormal heartbeats (arrhythmias) or signs of previous heart attacks. The test is painless and takes only a few minutes. An abnormal ECG may necessitate further investigation.

Echocardiogram, Signs you are not at a risk of heart disease

An echocardiogram uses ultrasound waves to create images of your heart’s structure and function. It assesses the size and shape of the heart chambers, the thickness of the heart muscle, and the function of the heart valves. This test can detect problems such as valve disease, heart muscle damage, and congenital heart defects. The procedure is non-invasive and painless.

Stress Test

A stress test monitors your heart’s response to physical exertion. You’ll walk on a treadmill or pedal a stationary bike while your heart rate, blood pressure, and ECG are continuously monitored. This test helps identify coronary artery disease, which can restrict blood flow to the heart during physical activity. Variations include pharmacological stress tests using medication to simulate exercise in individuals unable to perform physical exertion.

Blood Tests

Various blood tests are crucial for assessing heart health. These include lipid panels (measuring cholesterol and triglyceride levels), blood glucose tests (assessing blood sugar levels), and tests for markers of inflammation (like C-reactive protein). These tests help identify risk factors and potential underlying conditions contributing to heart disease.

Knowing you’re at a lower risk for heart disease is reassuring! Factors like maintaining a healthy weight and blood pressure play a huge role. However, it’s also crucial to remember that respiratory health is just as vital; check out this article on preventing respiratory illnesses after reading about Monali Thakur’s hospitalization due to breathing difficulties: monali thakur hospitalised after struggling to breathe how to prevent respiratory diseases.

Ultimately, a holistic approach to wellness, encompassing both cardiovascular and respiratory health, is key to a long and healthy life.

Communicating with Healthcare Providers

Open and honest communication with your healthcare provider is paramount. Before your appointment, jot down a list of your concerns, family history of heart disease, and any symptoms you’ve experienced. During the appointment, actively participate in the discussion, ask clarifying questions, and ensure you understand your doctor’s recommendations. Don’t hesitate to express any anxieties or uncertainties you may have.

A collaborative approach to your heart health ensures the best possible outcome.

Checkup Preparation Checklist

Preparing for your heart health checkup involves several steps. This checklist will help you stay organized and ensure you get the most out of your appointment.

| Checkup Item | Preparation Steps | Questions to Ask Doctor | Follow-up Actions |

|---|---|---|---|

| Medical History | Compile a list of current medications, allergies, and past medical conditions. Note any family history of heart disease. | Are there any specific risk factors I should be more aware of given my family history? | Update your medical records with any new information. |

| Lifestyle Information | Record your daily diet, exercise routine, and smoking habits (if applicable). | What dietary changes could improve my heart health? How can I increase my physical activity safely and effectively? | Implement recommended lifestyle changes. |

| Symptoms | Note any symptoms you’ve experienced, such as chest pain, shortness of breath, or dizziness. | What could be causing these symptoms? What tests are necessary to investigate further? | Schedule any necessary follow-up tests or appointments. |

| Questions | Write down any questions you have about your heart health or the checkup process. | (This column is for the questions you prepared beforehand) | Follow your doctor’s advice and recommendations. |

Closing Summary

Source: medium.com

Taking charge of your heart health is a journey, not a destination. While there’s no magic bullet, understanding the positive signs – from healthy lifestyle choices to favorable blood work – offers a powerful sense of reassurance and motivates us to continue prioritizing our well-being. Remember, this information is for general knowledge and doesn’t replace professional medical advice. Regular checkups with your doctor remain crucial for personalized guidance and care.

So, celebrate the healthy habits, embrace the positive indicators, and continue your journey towards a healthier, happier heart!

Key Questions Answered

What if I have a family history of heart disease, but I maintain a healthy lifestyle?

Even with a family history, a healthy lifestyle significantly reduces your risk. Regular checkups are especially important to monitor your health closely.

Are there specific blood tests that indicate low heart disease risk?

Your doctor will assess several factors, including cholesterol levels (LDL, HDL), blood pressure, and blood sugar. Low levels of LDL cholesterol and high levels of HDL cholesterol are positive indicators.

How often should I get my blood pressure and cholesterol checked?

Frequency depends on your age, risk factors, and your doctor’s recommendations. Adults should generally have their blood pressure and cholesterol checked regularly, at least annually, or more frequently if advised by their physician.

Can stress truly impact my heart health?

Yes, chronic stress can contribute to high blood pressure and other heart-related problems. Practicing stress-reducing techniques like yoga, meditation, or spending time in nature is crucial.