PBM House Oversight Testimony Caremark, Express Scripts, OptumRx

Pbm house oversight committee testimony caremark express scripts optum rx – PBM House Oversight Committee testimony on Caremark, Express Scripts, and OptumRx – wow, what a rollercoaster! This hearing really shed light on the sometimes murky world of pharmacy benefit managers (PBMs). We’re talking about the companies that negotiate drug prices, manage formularies, and essentially control a huge chunk of the prescription drug market. This post dives into the key takeaways from the testimony, focusing on the concerns raised about pricing, patient access, and the overall competitiveness of the PBM industry.

Get ready for a deep dive!

The House Oversight Committee’s investigation isn’t just about numbers; it’s about real people and the impact these PBM practices have on their access to affordable medication. We’ll explore the specific accusations against Caremark, Express Scripts, and OptumRx, examining their pricing models, reimbursement practices, and the potential consequences for patients. We’ll also look at potential solutions and reforms that could level the playing field and ensure a more transparent and patient-centric system.

PBM Industry Overview

Source: house.gov

Pharmacy Benefit Managers (PBMs) are powerful intermediaries in the pharmaceutical supply chain, acting as administrators of prescription drug benefits for health plans, employers, and government programs. They negotiate drug prices with pharmaceutical manufacturers, manage formularies (lists of covered drugs), and process prescription claims. Their influence on drug costs and patient access is significant, making them a subject of ongoing scrutiny.

PBM Structure and Function

PBMs operate through a complex network of relationships. They contract with pharmaceutical manufacturers to secure rebates and discounts on prescription drugs. They then develop formularies, often favoring lower-cost generics or preferred brand-name drugs. This influences which medications patients can access and at what price. PBMs also process claims from pharmacies, determining reimbursement amounts and managing prior authorizations.

Finally, they provide administrative services to their clients, including data analytics and reporting on drug utilization. Their activities span negotiating prices, managing formularies, processing claims, and providing data analytics, all impacting the cost and accessibility of medications.

Caremark, Express Scripts, and OptumRx: Key Players

Caremark (a CVS Health company), Express Scripts (a Cigna company), and OptumRx (a UnitedHealth Group company) are the three largest PBMs in the United States, dominating the market and shaping the landscape of prescription drug pricing and access. Each PBM operates with a slightly different approach, but all three wield considerable influence over drug pricing and patient access to medications.

Their size and market share give them significant leverage in negotiations with both pharmaceutical manufacturers and pharmacies.

The PBM House Oversight Committee testimony on Caremark, Express Scripts, and OptumRx really highlighted the complexities of prescription drug pricing. It makes you wonder about the impact on smaller healthcare systems; I was shocked to read about the closures detailed in this article on hshs prevea close wisconsin hospitals health centers , which could be further exacerbated by PBM negotiations and pricing practices.

The whole situation underscores the need for greater transparency and reform in the pharmaceutical industry.

Comparison of PBM Business Models

While all three PBMs perform similar functions, subtle differences exist in their business models. Caremark, integrated within CVS Health, benefits from vertical integration, controlling both the pharmacy network (CVS pharmacies) and the PBM. This vertical integration allows for potential synergies and cost savings, but it also raises concerns about potential conflicts of interest. Express Scripts, now part of Cigna, offers a more traditional PBM model, focusing on negotiating drug prices and managing formularies.

OptumRx, as part of UnitedHealth Group, leverages the extensive health data within UnitedHealth to improve care coordination and manage drug utilization more effectively. These differing models impact their strategies for negotiating drug prices, managing formularies, and ultimately, the cost and accessibility of medications for patients.

Market Share, Revenue, and Services

The following table presents a simplified comparison of the three major PBMs. Precise figures fluctuate yearly, and complete, publicly available data encompassing all services is limited. This table provides an approximation based on publicly available information and industry reports.

| PBM | Approximate Market Share (%) | Approximate Annual Revenue (USD Billion) | Key Services |

|---|---|---|---|

| Caremark | ~30 | ~100+ | Pharmacy network integration, formulary management, claims processing, mail-order pharmacy |

| Express Scripts | ~25 | ~100+ | Formulary management, claims processing, specialty pharmacy services, clinical programs |

| OptumRx | ~25 | ~100+ | Formulary management, claims processing, data analytics, care coordination |

House Oversight Committee’s Interest

The House Oversight Committee’s investigation into Pharmacy Benefit Managers (PBMs) stems from growing concerns about their impact on prescription drug affordability and access for consumers. The committee’s interest is fueled by allegations of anti-competitive practices, opaque pricing structures, and the potential for PBMs to prioritize their own profits over patient needs. This investigation aims to determine the extent to which PBM practices contribute to rising drug costs and explore potential solutions to protect consumers.The committee’s concerns are multifaceted.

They range from accusations of spread pricing (the difference between what PBMs pay pharmacies and what they charge insurers), to concerns about the lack of transparency in PBM negotiations with drug manufacturers and pharmacies, and the potential for conflicts of interest when PBMs own pharmacies or operate their own mail-order pharmacies. These practices, according to the committee, can lead to higher costs for consumers, reduced access to necessary medications, and limit the ability of pharmacies to operate profitably.

Specific Concerns Raised by the Committee

The House Oversight Committee has expressed serious concerns about several key aspects of PBM operations. One major focus is the lack of transparency in PBM pricing and rebate structures. The complexity of these arrangements makes it difficult for consumers, insurers, and even pharmacies to understand how drug prices are determined. Another significant concern is the potential for PBMs to steer patients towards more expensive drugs, even if less costly alternatives are available, to maximize their profits.

The committee also investigates allegations of PBMs using their market power to negotiate unfavorable reimbursement rates for pharmacies, leading to pharmacy closures, particularly in underserved communities.

Examples of Proposed Legislation or Regulatory Actions

In response to the concerns raised by the committee and others, several legislative and regulatory actions have been proposed at the federal and state levels. These include increased transparency requirements for PBM pricing and rebate structures, prohibitions on certain anti-competitive practices such as spread pricing, and the establishment of independent audits of PBM operations. Some states have already enacted legislation aimed at regulating PBM practices, while others are considering similar measures.

For example, some states have implemented legislation requiring PBMs to disclose their rebate practices to pharmacies and insurers, and to ensure fair reimbursement rates. Federal legislation has also been proposed to address these issues, but it faces considerable challenges in the legislative process.

The Committee’s Information Gathering Process, Pbm house oversight committee testimony caremark express scripts optum rx

The House Oversight Committee employs various methods to gather information and testimony. This includes issuing subpoenas to obtain documents and data from PBMs and other relevant stakeholders. The committee also holds hearings where representatives from PBMs, insurers, pharmacies, and patient advocacy groups are invited to testify under oath. These hearings provide a platform for the committee to question witnesses and gather information about PBM practices and their impact on the healthcare system.

In addition to public hearings, the committee conducts staff-level investigations, which involves reviewing documents, interviewing experts, and analyzing data to build a comprehensive understanding of the issues.

Testimony Analysis

The House Oversight Committee testimony from Caremark, Express Scripts, and OptumRx revealed significant concerns regarding the pricing and reimbursement practices within the Pharmacy Benefit Manager (PBM) industry. The hearings highlighted the complex interplay between drug manufacturers, PBMs, and pharmacies, ultimately impacting patient access and affordability of prescription medications. This analysis will delve into the key aspects of the testimony, focusing on pricing models, reimbursement methods, and the ongoing debate around drug price transparency.

Spread Pricing

Spread pricing is a controversial practice where PBMs profit from the difference between the amount they reimburse pharmacies for a drug and the price they charge insurance plans. Essentially, PBMs act as intermediaries, negotiating lower prices from drug manufacturers and then charging insurance companies a higher price, pocketing the difference. This practice has been criticized for inflating drug costs without providing any added value to patients or the healthcare system.

For example, if a PBM negotiates a $10 price from a manufacturer, but charges an insurance plan $15, the $5 difference is the spread. This seemingly small margin, when multiplied across millions of prescriptions, results in substantial profits for the PBM, while potentially increasing costs for consumers and insurers. The testimony highlighted instances where these spreads were disproportionately high, raising concerns about potential anti-competitive behavior.

Reimbursement Methods Comparison

Caremark, Express Scripts, and OptumRx each employ slightly different reimbursement methods for pharmacies, though the core principles remain similar. All three utilize a combination of negotiated drug prices, rebates, and dispensing fees. However, the specific details of these arrangements, including the transparency of their calculations and the level of reimbursement, varied across the three PBMs. The testimony suggested inconsistencies in how these reimbursements were calculated and the lack of clear, publicly available information about the process, leading to allegations of unfair practices and potential exploitation of independent pharmacies.

While the PBMs argued that their complex pricing structures are necessary for efficient drug management, critics countered that the opacity of these systems prevents fair competition and drives up costs.

Drug Price Transparency and Rebates

A central theme throughout the testimony revolved around drug price transparency and the role of rebates. PBMs negotiate rebates from drug manufacturers, which are often kept secret from patients and pharmacies. The testimony highlighted the argument that these rebates are not always passed on to consumers in the form of lower out-of-pocket costs, leading to accusations of price gouging and a lack of accountability.

Instead, these rebates can contribute to the PBMs’ profits or be used to offset other costs. The lack of transparency around rebate negotiations and their application to patient costs was a significant point of contention. Advocates for increased transparency argue that revealing these rebates would enable consumers and insurers to better understand the true cost of medications and encourage more competitive pricing.

The PBMs, however, countered that the complexity of rebate negotiations requires a degree of confidentiality to maintain their negotiating power and secure the best possible prices for their clients.

Testimony Analysis

The House Oversight Committee’s hearing on the practices of Pharmacy Benefit Managers (PBMs) like Caremark, Express Scripts, and OptumRx revealed significant concerns about the impact of these companies on patient access to affordable and necessary medications. This analysis focuses on the testimony’s implications for patient care, specifically examining how PBM practices affect medication access, formularies, prior authorizations, and patient safety.

PBM Practices and Patient Access to Medications

PBMs’ influence on drug pricing and formulary design directly impacts patient access. Testimony highlighted how PBM negotiations with pharmaceutical manufacturers often prioritize cost reduction over patient needs. This can lead to situations where patients face higher out-of-pocket costs, are steered towards less effective or preferred medications, or experience significant delays in accessing necessary treatments due to formulary exclusions. The profit-driven nature of PBM business models, as discussed in the testimony, is a key factor contributing to these access barriers.

For example, the use of “spread pricing,” where PBMs profit from the difference between what they reimburse pharmacies and what they charge payers, can incentivize PBMs to favor less expensive drugs even if they are less clinically appropriate for individual patients.

The Role of PBMs in Managing Formularies and Prior Authorization Requirements

PBMs control which medications are included in a health plan’s formulary, essentially determining which drugs are covered by insurance. Testimony underscored the lack of transparency in formulary decisions, suggesting that PBMs may prioritize their own financial interests over clinical guidelines. Further complicating matters are prior authorization requirements, which necessitate physician approval before a patient can receive a specific medication.

These requirements, often lengthy and burdensome for both doctors and patients, can delay or even prevent access to critical treatments. The testimony cited instances where patients experienced significant delays in obtaining necessary medications, leading to worsened health outcomes, due to overly stringent prior authorization processes. One witness described a scenario where a patient with a chronic condition needed a specific medication, but the prior authorization was denied multiple times due to arbitrary reasons, causing a significant disruption to their treatment plan.

Concerns Regarding Patient Safety and Medication Adherence

The testimony raised serious concerns about the impact of PBM practices on patient safety and medication adherence. Restrictive formularies and prior authorization procedures can lead to patients switching medications or delaying treatment, potentially jeopardizing their health. The lack of transparency in PBM operations further exacerbates this issue, making it difficult for patients and physicians to understand why certain drugs are excluded or require prior authorization.

Moreover, the cost-cutting measures employed by PBMs can incentivize the use of generic medications, which, while often less expensive, may not be therapeutically equivalent for all patients, potentially leading to suboptimal treatment outcomes and increased safety risks. This was further illustrated by several anecdotal examples provided during the hearing.

Hypothetical Scenario Illustrating PBM Impact on Patient Outcomes

Imagine a patient with type 2 diabetes requiring insulin. Their insurance plan, managed by a PBM, has a restrictive formulary that excludes their preferred, long-acting insulin analog. The PBM requires prior authorization for alternative insulins, which involves extensive paperwork and delays. This results in the patient delaying treatment due to the added burden, leading to uncontrolled blood sugar, potentially resulting in serious complications like diabetic ketoacidosis or cardiovascular events.

The patient’s health deteriorates due to the PBM’s cost-cutting measures and bureaucratic processes, highlighting the significant negative consequences of PBM practices on individual patient outcomes.

Testimony Analysis

The House Oversight Committee’s hearings on the three dominant Pharmacy Benefit Managers (PBMs) – Caremark, Express Scripts, and OptumRx – revealed a complex picture of competition and market dynamics within the pharmaceutical supply chain. Analyzing their testimony illuminates the strategies these giants employ to maintain market share, the implications of industry consolidation, and the ultimate impact on consumers.

PBM Market Competition

The PBM market is characterized by an oligopoly, with a small number of extremely large players controlling a significant portion of the market. While several smaller PBMs exist, Caremark, Express Scripts, and OptumRx hold a disproportionate share of the market, creating a landscape where competition is limited. This lack of robust competition can lead to reduced price transparency and less negotiation power for payers, ultimately affecting the cost of prescription drugs for consumers.

The testimony highlighted this concentration, revealing limited opportunities for new entrants to effectively challenge the established players.

Market Consolidation and Consumer Implications

The PBM industry has experienced significant consolidation through mergers and acquisitions over the years. This trend towards fewer, larger players raises concerns about reduced competition, potential price increases, and limited choices for both payers and patients. For example, the merger of CVS and Caremark created a vertically integrated behemoth with significant control over various aspects of the pharmaceutical supply chain.

Such consolidation can lead to less price competition, potentially resulting in higher drug costs for consumers and reduced innovation in the pharmaceutical sector. The lack of significant competition also limits the ability of payers to negotiate favorable contracts, impacting their bottom line and potentially leading to higher insurance premiums.

Competitive Strategies of Caremark, Express Scripts, and OptumRx

Each of the three major PBMs employs distinct strategies to maintain and expand their market share. Caremark leverages its integration with CVS pharmacies to create a streamlined process for dispensing medications. Express Scripts focuses on its sophisticated technology and data analytics to optimize drug utilization and manage costs. OptumRx, part of UnitedHealth Group, benefits from its integration with a large health insurance provider, allowing for targeted marketing and efficient claims processing.

These strategies, while seemingly beneficial for efficiency, can also create barriers to entry for smaller competitors and limit choices for consumers.

Impact of Mergers and Acquisitions

Mergers and acquisitions have significantly shaped the PBM landscape. The consolidation trend has resulted in fewer players controlling a larger portion of the market, often leading to vertical integration, where a single company controls multiple stages of the pharmaceutical supply chain. This can create potential conflicts of interest, as a PBM might favor its own affiliated pharmacies or drug manufacturers, potentially limiting consumer choice and increasing costs.

The testimony underscored the need for greater regulatory oversight to mitigate the negative consequences of this consolidation, ensuring fair competition and protecting consumer interests.

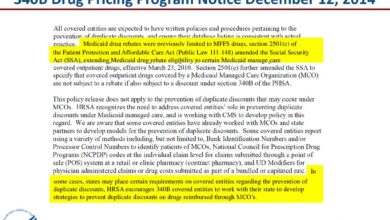

Potential Reforms and Solutions

Source: mmm-online.com

The testimony before the House Oversight Committee highlighted significant concerns regarding the practices of Pharmacy Benefit Managers (PBMs). Addressing these issues requires a multi-pronged approach involving legislative and regulatory reforms, aiming to increase transparency, foster competition, and ultimately lower drug costs for patients. This section Artikels potential reforms and examines successful examples from other states and jurisdictions.

Several key areas need reform to ensure a fairer and more efficient pharmaceutical marketplace. These reforms should focus on increasing transparency in PBM practices, strengthening regulatory oversight, and promoting greater competition among PBMs and pharmacies. The goal is to create a system that prioritizes patient access to affordable medications.

Examples of Successful PBM Reforms in Other Jurisdictions

Several states have already implemented reforms to address PBM practices. For example, some states have mandated greater transparency regarding rebates and fees paid by pharmaceutical manufacturers, requiring PBMs to disclose this information publicly. This increased transparency allows for better understanding of pricing structures and helps identify potential areas of cost savings. Other states have implemented reforms that limit or prohibit the practice of “spread pricing,” where PBMs profit from the difference between the reimbursement they receive from insurers and the amount they pay pharmacies.

The success of these reforms is measured by analyzing changes in drug costs, patient access, and overall market competition following implementation. For instance, states that have successfully implemented spread pricing reforms have often seen a decrease in prescription drug costs for consumers. While precise figures vary depending on the specific reform and the state, studies have shown a positive correlation between increased transparency and lower drug costs.

A comprehensive analysis comparing states with and without these reforms would be necessary to fully assess the impact.

The PBM House Oversight Committee testimony regarding Caremark, Express Scripts, and OptumRx highlighted the complexities of prescription drug pricing. Understanding these pricing structures is crucial, especially considering that high blood pressure, a major risk factor for stroke, is often managed with medication. Learning more about the risk factors that make stroke more dangerous helps us appreciate the importance of affordable and accessible healthcare, a key concern raised during the PBM testimony.

Ultimately, the cost of medication directly impacts patient access and health outcomes, linking back to the core issues discussed in the hearings.

Potential Legislative or Regulatory Changes

A range of legislative and regulatory changes could significantly improve the PBM landscape. These changes must be carefully considered to balance the need for reform with the potential unintended consequences.

- Mandatory PBM Transparency: Require PBMs to publicly disclose all fees, rebates, and administrative costs associated with prescription drug pricing. This includes detailing how these costs impact the final price paid by patients and insurers.

- Prohibition of Spread Pricing: Ban the practice of spread pricing, ensuring that PBMs do not profit from the difference between the reimbursement received and the payment to pharmacies. This would directly benefit pharmacies and potentially lower costs for patients.

- Increased Oversight of PBM Practices: Strengthen regulatory oversight of PBMs, including regular audits and investigations to ensure compliance with existing laws and regulations. This includes establishing clear standards for PBM operations and penalties for non-compliance.

- Promoting Competition: Implement policies that encourage competition among PBMs and pharmacies. This could involve measures to reduce barriers to entry for new market participants and ensure fair competition among existing players. Examples could include easing restrictions on independent pharmacies’ ability to negotiate directly with PBMs.

- Direct and Transparent Rebates to Consumers: Require that rebates negotiated by PBMs with pharmaceutical manufacturers be directly passed on to consumers at the point of sale, resulting in lower out-of-pocket costs. This would ensure that patients directly benefit from these negotiated discounts.

Potential Impact of Reforms on Drug Costs, Patient Access, and Competition

Implementing these reforms is expected to positively impact drug costs, patient access, and competition within the pharmaceutical market. Increased transparency and stricter regulations are likely to curb excessive PBM profits, leading to lower drug prices for consumers. Greater competition among PBMs and pharmacies could further drive down costs and improve patient access to medications. The extent of these impacts will depend on the specific reforms implemented and their effective enforcement.

However, based on experiences in other jurisdictions, a positive correlation between robust PBM regulation and improved patient outcomes is highly likely. For example, states with stronger regulations often report lower prescription drug costs and improved access to medications, especially for vulnerable populations. However, it’s crucial to monitor for unintended consequences, such as potential increases in drug prices due to reduced competition among manufacturers.

A thorough cost-benefit analysis would be needed to fully assess the potential long-term impact of these reforms.

Visual Representation of Key Findings

The following sections offer descriptive visual representations to clarify the complex relationships between Pharmacy Benefit Managers (PBMs), drug pricing, and overall healthcare costs. These visualizations aim to simplify the data presented during the House Oversight Committee testimony, making the key findings more accessible.

PBM Practices and Healthcare Costs

Imagine a bar graph. The X-axis represents years, and the Y-axis represents total healthcare spending. One bar represents the total healthcare spending for each year. A second, overlaid bar represents the portion of healthcare spending attributable to prescription drugs. A third, even smaller bar within the prescription drug bar represents the portion of prescription drug costs influenced by PBM practices, such as spread pricing, administrative fees, and rebates.

The graph would visually demonstrate how the PBM-influenced portion of prescription drug costs contributes to the overall rise in healthcare spending over time. The increasing gap between the total prescription drug cost bar and the PBM-influenced portion would highlight the potential savings if PBM practices were reformed.

Impact of PBM Rebates on Drug Manufacturer Pricing

This could be depicted using a circular flow diagram. At the center, you have the drug manufacturer. One arrow flows outward, representing the list price of the drug. Another arrow flows from the PBM to the manufacturer, representing the rebate. A third arrow flows from the manufacturer to the PBM, representing the net price received by the manufacturer after the rebate.

The recent PBM House Oversight Committee testimony featuring Caremark, Express Scripts, and OptumRx highlighted serious concerns about drug pricing. This brings to mind the skyrocketing costs discussed in a recent KFF report, medicare glp1 spending weight loss kff , which reveals the impact of rising Medicare spending on GLP-1 medications for weight loss. Understanding these escalating costs is crucial to fully grasping the complexities facing the PBM industry and its influence on patient access to vital medications.

A fourth arrow flows from the PBM to the patient (or insurer), representing the patient’s out-of-pocket cost. The size of the arrows could visually represent the magnitude of the monetary flows. The diagram would illustrate how rebates effectively lower the net price received by the manufacturer, potentially influencing the list price, while the patient’s out-of-pocket cost might not always reflect this reduction.

The difference between the list price and the patient’s out-of-pocket cost could be highlighted to show the potential for savings or increased profits for the PBM.

Market Share of the Three Major PBMs Over Time

A line graph would be ideal. The X-axis represents time (e.g., years), and the Y-axis represents market share (percentage). Three distinct lines would represent the market share of Caremark, Express Scripts, and OptumRx over the specified time period. The graph would clearly show how each PBM’s market share has changed over time, illustrating periods of growth, decline, or stability for each company.

The relative positions of the lines would visually demonstrate the dominance of one PBM over others during specific periods. The graph could also include a fourth line representing the combined market share of the three major PBMs to show their overall control of the market. This could be further enhanced by shading the area between the lines to visually represent the total market share held by the three PBMs over time.

Closing Summary: Pbm House Oversight Committee Testimony Caremark Express Scripts Optum Rx

The House Oversight Committee’s testimony on Caremark, Express Scripts, and OptumRx paints a complex picture. While these PBMs play a crucial role in managing prescription drug benefits, the hearing highlighted serious concerns about their pricing practices, impact on patient access, and the overall competitiveness of the market. The potential reforms discussed could significantly reshape the industry, leading to greater transparency, affordability, and improved patient care.

Whether these changes will actually happen remains to be seen, but the conversation has certainly been started, and that’s a step in the right direction. Stay tuned for further developments!

FAQ Compilation

What exactly

-is* a PBM?

A Pharmacy Benefit Manager (PBM) is a third-party administrator of prescription drug programs for insurance companies and employers. They negotiate drug prices, manage formularies (lists of covered drugs), and process prescription claims.

How do PBMs make money?

PBMs generate revenue through various methods, including rebates from drug manufacturers, administrative fees from payers, and spread pricing (the difference between what they reimburse pharmacies and what they charge payers).

What are some potential consequences of PBM market consolidation?

Reduced competition could lead to higher drug prices, less choice for patients, and less leverage for pharmacies to negotiate better reimbursement rates.