Private Equity Stakeholder Project Deals Medicare Advantage

Private equity stakeholder project deals medicare advantage – Private equity stakeholder project deals in Medicare Advantage are reshaping the healthcare landscape. This isn’t just about money; it’s about access, quality of care, and the future of senior healthcare. We’re diving deep into the strategies, impacts, and controversies surrounding private equity’s growing role in this vital sector. Get ready to explore the complexities of this fascinating, and sometimes controversial, intersection of finance and healthcare.

From investment strategies and due diligence processes to regulatory hurdles and stakeholder concerns, we’ll examine the multifaceted nature of private equity’s influence on Medicare Advantage. We’ll analyze the financial performance of plans under private equity ownership, comparing them to those under different structures. We’ll also explore the potential positive and negative effects on the member experience, considering both improvements in efficiency and potential downsides to care quality.

This isn’t just a dry analysis; we’ll be looking at real-world examples and the human element behind the numbers.

Private Equity Investment Strategies in Medicare Advantage

The Medicare Advantage (MA) market presents a compelling opportunity for private equity (PE) firms, driven by an aging population and increasing demand for managed healthcare. PE firms leverage various strategies to capitalize on this growth, focusing on both operational improvements and market consolidation. These strategies are often underpinned by a thorough due diligence process to mitigate risk and maximize returns.

Common Investment Strategies

Private equity firms employ a range of strategies when investing in Medicare Advantage providers. These strategies often involve identifying companies with significant growth potential or those ripe for operational restructuring. A common approach is to acquire underperforming or fragmented organizations, consolidate operations, and improve efficiency, leading to increased profitability. Another strategy involves investing in companies focused on specific niches within the MA market, such as specialized care for chronic conditions or technologically advanced care delivery models.

Finally, some firms focus on building platforms through acquisitions, creating larger, more diversified MA organizations with greater market power.

Due Diligence Processes

Due diligence in the MA sector is particularly rigorous due to the complex regulatory environment and the sensitivity of patient data. PE firms typically conduct extensive financial analysis, scrutinizing historical performance, membership trends, reimbursement rates, and risk adjustment methodologies. Operational due diligence focuses on evaluating the provider’s network adequacy, care management capabilities, technology infrastructure, compliance with regulatory requirements (CMS regulations are paramount), and the quality of care delivered.

Legal and regulatory due diligence is critical, ensuring the organization is compliant with all applicable laws and regulations related to healthcare, data privacy (HIPAA), and anti-kickback statutes. Finally, a thorough assessment of the management team’s capabilities and experience is essential.

Typical Exit Strategies

The most common exit strategies for PE investments in MA involve a sale to a strategic buyer, such as a larger healthcare organization or another PE firm. This can be a full sale or a partial divestment, depending on the investment thesis and market conditions. Initial Public Offerings (IPOs) represent another potential exit strategy, particularly for larger, well-established MA organizations.

Finally, some PE firms may choose to hold their investments for an extended period, realizing returns through organic growth and increased profitability before ultimately selling. The timing of the exit strategy depends on several factors, including market conditions, the achievement of key performance indicators, and the overall investment horizon of the PE firm.

Comparison of Investment Approaches

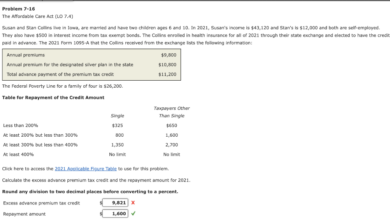

The table below compares and contrasts different private equity investment approaches within the Medicare Advantage sector.

| Strategy | Target Company Characteristics | Investment Risks | Potential Returns |

|---|---|---|---|

| Leveraged Buyout (LBO) | Established MA organizations with strong cash flow, potential for operational improvements. | High leverage, interest rate risk, integration challenges, regulatory scrutiny. | High, driven by operational improvements and multiple expansion. |

| Growth Equity | High-growth MA organizations with innovative business models or strong market positions. | Execution risk, competition, dependence on successful market penetration. | High, driven by significant revenue growth and market share gains. |

| Add-on Acquisitions | Smaller MA organizations complementary to existing portfolio companies. | Integration challenges, cultural differences, potential for operational disruptions. | Moderate to high, driven by synergies and increased market share. |

| Distressed Debt Investment | Financially troubled MA organizations facing operational challenges. | High risk of default, significant operational restructuring required. | Potentially high, driven by debt recovery and turnaround success. |

Impact of Private Equity on Medicare Advantage Member Experience: Private Equity Stakeholder Project Deals Medicare Advantage

Source: amazonaws.com

Private equity (PE) firms are increasingly investing in the Medicare Advantage (MA) market, raising important questions about the potential impact on the quality of care and member experience. While PE investment can bring financial resources and operational expertise, leading to potential improvements, concerns remain regarding the prioritization of profits over patient well-being. This exploration examines both the positive and negative consequences of PE ownership on the MA member experience.The influence of private equity on Medicare Advantage member experience is multifaceted and complex.

It’s not a simple case of good or bad, but rather a nuanced interplay of various factors, including the specific strategies employed by the PE firm, the pre-existing state of the MA plan, and the regulatory environment. Understanding these factors is crucial to assessing the overall impact.

Member Satisfaction and Access to Care

PE investments can lead to both improvements and declines in member satisfaction and access to care. Some PE firms may invest in technology upgrades and improved care coordination, resulting in enhanced member experiences. For example, a PE-backed MA plan might implement a user-friendly mobile app for appointment scheduling, medication refills, and communication with providers, improving access and convenience. Conversely, a focus on cost-cutting measures driven by profit maximization could lead to reduced provider networks, longer wait times for appointments, and decreased access to specialized care.

A real-world example could involve a PE-owned plan reducing its network of specialists to cut costs, resulting in members needing to travel further for necessary care or facing longer delays in receiving treatment. This directly impacts member satisfaction. The success hinges on the PE firm’s strategic approach.

Regulatory Oversight and Compliance

The Centers for Medicare & Medicaid Services (CMS) regulates MA plans, including those owned by PE firms, setting standards for quality of care and member experience. These regulations mandate reporting on key performance indicators (KPIs) such as member satisfaction scores, access to care, and quality of care measures. Non-compliance can result in significant penalties. CMS closely scrutinizes MA plans for adherence to these regulations, regardless of ownership structure.

However, the sheer volume of plans and the complexity of the regulatory landscape pose challenges to effective oversight. The effectiveness of regulatory oversight in protecting member experience within the context of PE ownership is a continuous area of evaluation and debate.

- Potential Improvements to Member Experience: Improved technology infrastructure, enhanced care coordination, expanded provider networks in underserved areas, proactive outreach programs, and increased investment in member services.

- Potential Drawbacks to Member Experience: Reduced provider networks, longer wait times for appointments, decreased access to specialized care, prioritization of cost-cutting measures over quality of care, and increased administrative burden on members.

Financial Performance and Market Trends

Private equity’s foray into the Medicare Advantage (MA) market has significantly altered the landscape. Understanding the financial performance of these plans and the broader market trends is crucial for investors, policymakers, and the beneficiaries themselves. This section delves into the key financial metrics used to assess MA plans under private equity ownership, compares their performance to those under different ownership structures, and illustrates the major market forces driving investment in this sector.The financial health of a Medicare Advantage plan under private equity ownership is assessed through a range of indicators, reflecting profitability, efficiency, and growth potential.

So, I’ve been digging into private equity stakeholder project deals in the Medicare Advantage space lately, and it’s fascinating how these investments are shaping the landscape. It’s all tied into the broader changes in healthcare, like the recent announcement that the CMS launched a new primary care Medicare model ACO, as reported in this article: cms launches primary care medicare model aco.

This shift towards value-based care directly impacts how private equity firms are structuring their Medicare Advantage deals, pushing them to focus on improving care coordination and outcomes.

These indicators provide a comprehensive picture of the plan’s financial performance and its ability to deliver sustainable returns to investors.

Key Financial Performance Indicators for Private Equity-Owned Medicare Advantage Plans

Several key financial metrics are employed to evaluate the performance of private equity-backed Medicare Advantage plans. These metrics provide a holistic view of the plan’s financial health and its capacity to generate profits. Profitability, efficiency, and member growth are paramount considerations.

The impact of private equity stakeholder project deals on Medicare Advantage plans is a complex issue, especially considering the recent consolidation in the healthcare industry. News of HSHS and Prevea closing Wisconsin hospitals and health centers, as reported on this Santenews article , highlights the challenges faced by providers. This kind of restructuring inevitably affects the network access for Medicare Advantage beneficiaries, further complicating the already intricate relationship between private equity and healthcare access under these plans.

- Medical Loss Ratio (MLR): This metric represents the percentage of premium revenue spent on healthcare services and quality improvement activities. A lower MLR indicates higher profitability, as more revenue is retained after covering medical expenses. Private equity firms generally target plans with low MLRs, suggesting efficient cost management.

- Net Income Margin: This shows the percentage of revenue remaining after all expenses, including administrative costs, are deducted. A higher net income margin reflects greater profitability and efficiency.

- Return on Equity (ROE): This key indicator measures the profitability of a company relative to the shareholders’ equity. A higher ROE suggests a more efficient use of capital and higher returns for investors.

- Member Growth Rate: This metric assesses the plan’s ability to attract and retain members. Strong member growth contributes to increased revenue and market share.

- Star Ratings: While not strictly a financial metric, CMS star ratings significantly influence member enrollment and contract negotiations. Higher star ratings translate to improved profitability and market competitiveness.

Comparison of Financial Performance Under Different Ownership Structures

Direct comparison of financial performance across different ownership structures (private equity, non-profit, for-profit) is challenging due to data limitations and variations in reporting practices. However, anecdotal evidence and industry analyses suggest that private equity-owned MA plans often demonstrate a stronger focus on cost containment and efficiency, potentially leading to higher profit margins compared to some non-profit plans. This doesn’t necessarily translate to superior member care, and indeed, careful analysis is needed to ensure that cost-cutting measures do not compromise the quality of services.

Market Trends Affecting Private Equity Investment in Medicare Advantage

The Medicare Advantage market is dynamic, influenced by several key trends that shape private equity investment strategies. A visual representation could be a chart with four quadrants, each representing a major trend.

Quadrant 1: Aging Population and Increasing Enrollment: This section shows a steadily rising line graph illustrating the growth of the Medicare-eligible population, directly correlating with increasing MA enrollment. The graph would highlight the significant market expansion opportunity this presents to private equity investors.

Quadrant 2: Government Regulations and Policy Changes: This section would be represented by a bar chart comparing the relative impact of various regulatory changes (e.g., changes in reimbursement rates, risk adjustment models) on the profitability of MA plans. The chart would show fluctuations in profitability based on policy shifts.

Quadrant 3: Technological Advancements and Data Analytics: This section could be visualized with a spider chart depicting the improvement in various technological capabilities (e.g., telehealth adoption, predictive analytics, data-driven member engagement). The chart would illustrate how technological advancements improve efficiency and cost-effectiveness.

Quadrant 4: Consolidation and Competition: This section would use a pie chart to represent the market share held by different MA plan owners (private equity, for-profit, non-profit), illustrating the increasing consolidation and competitive dynamics within the sector. The chart would showcase the growing dominance of certain players.

Regulatory and Legal Considerations

Private equity investment in Medicare Advantage (MA) plans operates within a complex regulatory landscape. Understanding and navigating these legal and compliance requirements is crucial for successful investment and risk mitigation. Failure to comply can result in significant financial penalties, reputational damage, and even legal action.

Key Regulatory Hurdles and Compliance Challenges

Private equity firms investing in MA plans face numerous regulatory hurdles stemming from federal and state laws designed to protect beneficiaries and ensure the integrity of the Medicare program. These include stringent requirements related to financial solvency, operational efficiency, member protections, and anti-fraud and abuse measures. The Centers for Medicare & Medicaid Services (CMS) plays a central role in overseeing these regulations.

For example, CMS conducts rigorous audits and reviews to ensure compliance with all applicable rules and regulations. Failure to meet these standards can lead to sanctions, including fines, corrective action plans, and even termination of contracts.

Implications of Relevant Healthcare Laws and Regulations

Several key laws and regulations significantly impact private equity transactions in the MA space. The Affordable Care Act (ACA), for instance, introduced provisions influencing MA plan operations, such as requirements for minimum essential health benefits and restrictions on medical loss ratios. The Stark Law and the Anti-Kickback Statute aim to prevent conflicts of interest and financial incentives that could compromise patient care.

Compliance with these laws requires meticulous due diligence during the investment process and ongoing monitoring of the MA plan’s operations. Non-compliance can lead to substantial financial penalties and legal repercussions. For example, a private equity firm might face investigations and potential lawsuits if its investment activities are found to violate the Stark Law or the Anti-Kickback Statute.

Potential Legal Risks and Liabilities, Private equity stakeholder project deals medicare advantage

Private equity ownership of MA plans carries inherent legal risks and liabilities. These include risks related to data privacy and security (HIPAA compliance), potential litigation from beneficiaries or providers, and liability for the financial performance of the acquired plan. Thorough due diligence, robust compliance programs, and strong governance structures are essential to mitigate these risks. Moreover, private equity firms need to be prepared for potential regulatory scrutiny and investigations.

A history of regulatory violations by the acquired MA plan, for instance, could increase the risk of future penalties for the private equity investor.

Summary of Key Regulations and Their Impact

| Regulation | Description | Impact on PE Investment | Compliance Measures |

|---|---|---|---|

| Affordable Care Act (ACA) | Sets minimum essential health benefits and medical loss ratio requirements. | Influences investment strategy and plan operations; requires assessment of compliance with ACA provisions. | Regular review of plan benefits and financial performance to ensure compliance with MLR requirements; development of strategies to address any potential shortfalls. |

| Stark Law | Prohibits physicians from referring Medicare patients for designated health services to entities with which the physician (or an immediate family member) has a financial relationship. | Requires careful due diligence to identify and mitigate potential conflicts of interest; necessitates robust compliance programs. | Thorough review of physician relationships; implementation of robust compliance protocols to ensure compliance with referral regulations. |

| Anti-Kickback Statute | Prohibits offering, paying, soliciting, or receiving remuneration to induce or reward referrals of items or services payable by Medicare or other federal healthcare programs. | Requires careful structuring of transactions to avoid potential violations; necessitates robust compliance programs. | Careful review of all contracts and agreements; development of compliance policies and procedures to ensure adherence to the Anti-Kickback Statute. |

| Health Insurance Portability and Accountability Act (HIPAA) | Establishes national standards for the electronic exchange of protected health information and protects the privacy and security of health information. | Requires stringent data security and privacy measures; necessitates investment in robust IT infrastructure. | Implementation of comprehensive data security protocols; regular security audits and penetration testing; employee training on HIPAA compliance. |

Stakeholder Perspectives and Concerns

Source: hbecpa.com

The increasing involvement of private equity (PE) firms in the Medicare Advantage (MA) market has sparked considerable debate among various stakeholders. While PE investment promises potential benefits like increased efficiency and innovation, significant concerns exist regarding its impact on beneficiary access to care, cost, and overall quality within the MA system. Understanding these diverse perspectives is crucial for navigating the complex interplay between private capital and public healthcare.

The private equity world is buzzing with activity around Medicare Advantage, especially with the influx of stakeholder project deals. It’s a complex landscape, and the recent news regarding Walmart Health’s closure, as highlighted in this insightful article, despite Walmart Healths closure the company healthcare destination Scott Bowman , makes you wonder about the future of retail healthcare. Ultimately, these shifts only increase the pressure on private equity to find the next big thing in Medicare Advantage.

Medicare Beneficiary Perspectives

Medicare beneficiaries, the ultimate consumers of MA plans, are central to this discussion. Their primary concerns revolve around potential trade-offs between cost and access. For example, a PE-backed MA plan might prioritize cost-cutting measures, potentially leading to narrower provider networks, longer wait times for appointments, and restricted access to specialized care. This could disproportionately affect beneficiaries with complex medical needs or those residing in rural areas with limited healthcare options.

Conversely, some beneficiaries might experience improved plan offerings and better customer service due to PE investment leading to operational efficiencies and technological advancements. The net effect on the beneficiary experience remains a point of contention, and depends heavily on the specific PE firm and its management practices.

Healthcare Provider Perspectives

Healthcare providers, including physicians, hospitals, and other healthcare facilities, also have a significant stake in the PE influence on MA. Concerns exist regarding reimbursement rates and contracting practices. PE firms, focused on maximizing returns, might negotiate lower reimbursement rates with providers, impacting provider profitability and potentially leading to reduced access to care. Furthermore, the emphasis on cost-control measures might influence the types of services offered, potentially leading to limitations on comprehensive care.

Conversely, some providers might welcome the increased efficiency and technological advancements brought about by PE investments, leading to streamlined administrative processes and improved data management. The impact on providers hinges on the specific negotiation strategies employed by PE-backed MA plans.

Government Agency Perspectives

Government agencies, primarily the Centers for Medicare & Medicaid Services (CMS), play a critical role in overseeing the MA market and ensuring beneficiary protection. Their concerns center on maintaining the integrity of the MA program and ensuring equitable access to quality care. CMS monitors PE involvement to prevent practices that could jeopardize beneficiary welfare or undermine the financial stability of MA plans.

This involves scrutinizing reimbursement rates, provider networks, and quality metrics. However, the regulatory framework’s ability to effectively address the unique challenges posed by PE investment remains a subject of ongoing discussion and refinement. Recent regulatory actions demonstrate an increased focus on transparency and accountability within PE-backed MA plans, though ongoing monitoring and adjustments to regulations are expected.

Closing Notes

The involvement of private equity in Medicare Advantage is a dynamic and evolving story. While promising increased efficiency and potentially improved access, it also raises significant concerns about the potential impact on patient care and the overall integrity of the system. Understanding the intricate interplay of financial interests, regulatory frameworks, and the needs of Medicare beneficiaries is crucial. Ultimately, navigating this complex landscape requires a nuanced perspective, acknowledging both the potential benefits and the inherent risks involved.

The conversation continues, and the stakes are high.

Detailed FAQs

What are the typical return expectations for private equity firms investing in Medicare Advantage?

Return expectations vary depending on the investment strategy, but generally, private equity firms aim for significant returns, often exceeding those of traditional investments. This is driven by the growth potential of the Medicare Advantage market.

How does private equity investment affect innovation in Medicare Advantage plans?

Private equity investment can both stimulate and stifle innovation. While capital infusion can fuel technological advancements and operational improvements, the focus on short-term returns may sometimes prioritize cost-cutting over long-term innovation.

What role do government agencies play in overseeing private equity involvement in Medicare Advantage?

Agencies like CMS (Centers for Medicare & Medicaid Services) play a crucial role in regulating the industry, ensuring compliance with healthcare laws and protecting beneficiary interests. Their oversight includes monitoring financial performance, quality of care, and adherence to regulations.