Macpac State Transparency Medicaid, Taxes, & SDPS

Macpac state transparency medicaid financing provider taxes sdps – it’s a mouthful, right? But it’s a crucial topic affecting how our healthcare system is funded and managed. This post dives into the world of Massachusetts’s Center for Health Information and Analysis (Macpac), exploring its role in ensuring transparency in Medicaid financing, examining the impact of provider taxes, and looking at the complexities of State Dispensing Programs (SDPs).

We’ll unravel the intricate connections between these elements and see how they shape access to healthcare and impact state budgets. Get ready for a deep dive into the data and policy behind this vital aspect of public health.

We’ll break down the various funding streams for Medicaid, analyze Macpac’s key performance indicators (KPIs) for assessing efficiency, and explore potential areas for improvement. We’ll also investigate the role of provider taxes, examining different models and their effects on access and affordability. Finally, we’ll examine SDPS, their interactions with Medicaid financing, and the challenges and opportunities they present. This isn’t just about numbers; it’s about understanding how policy decisions impact real people and their access to essential healthcare.

Macpac State Transparency

Macpac, the Massachusetts Health Policy Commission, plays a crucial role in fostering transparency within the state’s Medicaid financing system. By making data readily available and accessible, Macpac aims to improve accountability, encourage efficiency, and ultimately, benefit the taxpayers and Medicaid recipients of Massachusetts. Their efforts represent a significant step towards a more open and responsible approach to public healthcare spending.Macpac utilizes several mechanisms to ensure transparency in Medicaid spending.

These include the publication of comprehensive reports detailing Medicaid expenditures, provider payments, and utilization patterns. They also maintain a user-friendly online data portal, providing easy access to this information for researchers, policymakers, and the public. Furthermore, Macpac conducts regular analyses of Medicaid spending trends and identifies areas for potential cost savings and improvements in efficiency. These analyses are then shared publicly, furthering the goal of transparency.

Comparison of Macpac’s Transparency Initiatives with Other State Agencies

While many state agencies strive for transparency in their operations, Macpac’s efforts stand out for their comprehensiveness and user-friendliness. Some states may publish limited data, often in less accessible formats. Macpac’s proactive approach, combined with its commitment to data visualization and user-friendly online resources, distinguishes it from many other state agencies. A direct comparison requires examining the specific transparency initiatives of individual state agencies, but generally, Macpac’s approach is considered a model for other states to emulate.

Examples of Successful Transparency Measures Implemented by Macpac

One successful example is Macpac’s annual report on Medicaid spending, which provides a detailed breakdown of expenditures across various categories. This allows stakeholders to easily track spending trends and identify areas requiring attention. Another example is their interactive online data portal, which allows users to explore Medicaid data using various filters and visualizations. This empowers researchers and the public to conduct their own analyses and identify potential areas for improvement.

Finally, Macpac’s regular publications on specific Medicaid programs and cost drivers offer detailed insights into the factors influencing spending, fostering a better understanding of the complexities of the system.

Understanding MacPac state transparency, Medicaid financing, provider taxes, and SDPS is crucial for healthcare policy analysis. Sometimes, the sheer volume of data can lead to repetitive strain injuries, like carpal tunnel syndrome. If you’re struggling with this, check out some non-surgical treatment options at ways to treat carpal tunnel syndrome without surgery to help manage the pain.

Then, you can return to analyzing those MacPac reports with renewed energy and focus!

Hypothetical Scenario Illustrating the Impact of Increased Transparency on Medicaid Spending

Imagine a scenario where Macpac’s transparency initiatives lead to the identification of a significant discrepancy in payments to a specific group of providers. Through detailed data analysis and public reporting, this discrepancy is brought to light, sparking an investigation. The investigation reveals overbilling, resulting in corrective actions and cost savings. This scenario demonstrates how increased transparency can lead to the detection of inefficiencies and fraud, ultimately reducing Medicaid spending and improving the allocation of resources.

This is not hypothetical; similar scenarios have occurred in other states, although the specific details and scale may vary. The increased availability of data allows for more effective auditing and oversight, preventing waste and abuse of funds.

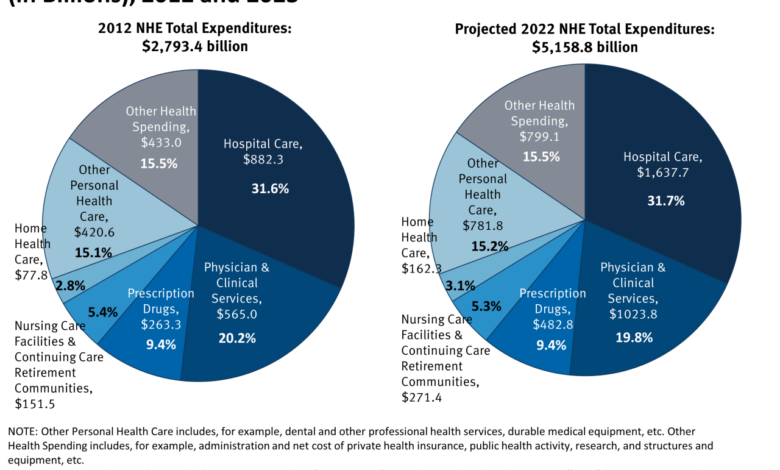

Medicaid Financing in Relation to Macpac

Source: cbpp.org

Medicaid, a joint federal and state program, relies on a complex web of funding sources to provide healthcare coverage to millions of Americans. Understanding these funding streams and how they are managed is crucial, especially given the role of organizations like the Medicaid and CHIP Payment and Access Commission (Macpac) in assessing efficiency and recommending improvements. Macpac’s analysis plays a vital role in shaping policy and influencing how states allocate and utilize Medicaid funds.

Medicaid Funding Streams

Medicaid funding is primarily derived from federal and state government sources, with the federal government contributing a larger share, though the exact percentage varies depending on the state’s per capita income. Other funding sources can include provider taxes, managed care organization (MCO) revenues, and in some cases, private donations or philanthropic contributions. The federal share is generally determined by a formula that takes into account each state’s per capita income.

States are responsible for administering their Medicaid programs and for managing their share of the funding. This necessitates careful financial planning and a focus on efficiency.

Key Performance Indicators (KPIs) Used by Macpac to Assess Medicaid Financing Efficiency

Macpac utilizes a variety of KPIs to evaluate the efficiency and effectiveness of Medicaid financing. These indicators often focus on cost containment, program access, and the quality of care provided. Examples of such KPIs include per capita Medicaid expenditures, the number of enrollees, the percentage of the population covered, the utilization of healthcare services, and the overall health outcomes of Medicaid beneficiaries.

Understanding MacPac’s state transparency initiatives on Medicaid financing, provider taxes, and SDPS is crucial for effective healthcare management. A key aspect is recognizing the impact of underlying health conditions; for example, learning about the risk factors that make stroke more dangerous helps us understand the financial burden of managing such complex cases within the Medicaid system.

Ultimately, this data informs better policy decisions around MacPac’s goals for transparency and efficient resource allocation.

Macpac analyzes these indicators to identify trends, areas of concern, and opportunities for improvement in the system. For example, a high per capita expenditure combined with low health outcomes would signal potential inefficiencies requiring further investigation.

Potential Areas for Improvement in Medicaid Financing Based on Macpac’s Findings

Macpac’s analyses regularly highlight areas needing improvement within Medicaid financing. Common themes include the need for better cost control measures, improved care coordination to reduce unnecessary hospitalizations, and greater emphasis on preventive care to reduce long-term costs. Specific recommendations may involve implementing innovative payment models, strengthening care management programs, and leveraging technology to improve efficiency and data analysis.

The commission’s findings often lead to policy recommendations aimed at improving the program’s financial sustainability and its ability to provide quality care.

Components of Medicaid Financing, Macpac state transparency medicaid financing provider taxes sdps

The following table provides a simplified overview of the various components of Medicaid financing. Note that the exact amounts and percentages can vary significantly by state and year.

| Funding Source | Amount (Illustrative Example) | Percentage of Total Funding (Illustrative Example) | Description |

|---|---|---|---|

| Federal Government | $500 Billion | 60% | Funds allocated to states based on a formula considering per capita income and other factors. |

| State Government | $333 Billion | 40% | State-allocated funds, often from general tax revenue. |

| Provider Taxes | $10 Billion | 1% | Taxes levied on healthcare providers, contributing to state Medicaid funding. |

| Other Sources | $5 Billion | <1% | Includes managed care organization revenues, private donations, etc. |

Macpac’s Data Analysis Influence on Medicaid Financing Decisions

Macpac’s rigorous data analysis significantly influences Medicaid financing decisions at both the federal and state levels. By providing objective assessments and data-driven recommendations, Macpac helps policymakers make informed choices about resource allocation, program design, and payment models. For instance, Macpac’s findings on the effectiveness of certain payment models can influence the adoption of similar models across multiple states.

Similarly, its analyses of cost drivers and access barriers can inform policy changes aimed at improving the efficiency and effectiveness of the Medicaid program. The commission’s reports and recommendations serve as a valuable resource for policymakers, researchers, and stakeholders involved in the Medicaid system.

Provider Taxes and Medicaid

Provider taxes levied on healthcare providers represent a significant funding mechanism for Medicaid programs across the United States. These taxes, while contributing to the financial stability of the system, also have complex implications for healthcare access, affordability, and the ethical responsibilities of both government and healthcare providers. Understanding the intricacies of these taxes is crucial for navigating the ongoing debate surrounding Medicaid funding and healthcare delivery.

Impact of Provider Taxes on Medicaid Financing

Provider taxes directly supplement state and federal Medicaid funding. The amount generated varies significantly depending on the tax rate, the types of providers taxed (e.g., hospitals, physicians, nursing homes), and the overall size and health needs of a state’s population. These revenues can help offset the costs of Medicaid services, potentially reducing reliance on general tax revenue or federal matching funds.

Understanding MacPAC’s role in state transparency regarding Medicaid financing, provider taxes, and SDPS is crucial. The recent news about Monali Thakur being hospitalized after struggling to breathe, as reported in this article monali thakur hospitalised after struggling to breathe how to prevent respiratory diseases , highlights the importance of preventative healthcare, a factor that impacts the overall burden on healthcare systems like Medicaid, further emphasizing the need for effective MacPAC oversight and transparent financial practices.

However, the extent of this contribution is highly variable and depends on the specific design of the provider tax system in each state. For example, states with higher provider tax rates often have a smaller reliance on general tax revenue for Medicaid funding compared to states with lower rates.

Comparison of Provider Tax Models and Their Effects

Several models exist for implementing provider taxes. Some states levy a flat percentage tax on gross revenue, while others use a graduated scale based on provider type or revenue volume. A flat percentage tax is simpler to administer but may disproportionately affect smaller providers with thinner profit margins. A graduated system can be more equitable but requires more complex calculations and potentially more administrative overhead.

The effect on Medicaid access and affordability depends on how the tax revenue is used and the overall impact on provider behavior. For instance, a tax that significantly increases the cost of care could lead to reduced access for low-income patients, negating some of the benefits of increased Medicaid funding.

Provider Tax Collection and Allocation

The collection of provider taxes typically involves state revenue agencies working with healthcare providers to assess and collect the tax liability. Providers often remit taxes quarterly or annually, along with other tax filings. The allocated funds are then channeled into the state’s Medicaid agency, contributing to the overall budget for administering and providing Medicaid services. The specific allocation of these funds might be earmarked for particular programs or services, or it might be added to the general Medicaid budget to be allocated based on the state’s needs and priorities.

Transparency in this allocation process is crucial to ensure accountability and to allow for public scrutiny of how tax revenue is used to support Medicaid beneficiaries.

Visual Representation of Provider Tax Flow

Imagine a diagram with three main boxes. The first box represents “Healthcare Providers,” showing various provider types (hospitals, doctors, etc.) contributing money. Arrows flow from this box to a second box labeled “State Revenue Agency,” depicting the collection process. From the State Revenue Agency box, another arrow points to a third box, “State Medicaid Agency,” illustrating the transfer of funds.

Smaller arrows branching from the State Medicaid Agency box could indicate the distribution of funds towards various Medicaid programs (e.g., healthcare services, administrative costs). The diagram clearly shows the flow of money from providers, through the collection agency, and finally into the Medicaid system.

Ethical Considerations of Provider Taxes

The ethical considerations surrounding provider taxes center on fairness, equity, and the potential impact on provider behavior. Concerns exist about whether the tax burden disproportionately affects smaller providers or those serving a larger share of low-income patients. Furthermore, there are concerns that taxes could lead to reduced investment in healthcare infrastructure or limit access to care, especially if providers pass the tax cost onto patients.

The ethical dilemma lies in balancing the need to fund Medicaid effectively with the potential negative consequences for providers and patients. A well-designed provider tax system should strive to minimize these negative impacts and promote equitable access to care for all Medicaid beneficiaries.

SDPS (State Dispensing Programs) and Their Interaction with Macpac

State Dispensing Programs (SDPs) play a significant role in the delivery of Medicaid-funded medications, impacting both state budgets and the overall efficiency of the Medicaid system. Their interaction with the Medicaid and CHIP Payment and Access Commission (Macpac) is crucial for ensuring transparency, accountability, and ultimately, better value for taxpayer dollars. Understanding this interplay is vital for improving the efficacy of Medicaid drug programs nationwide.SDPs interact with Medicaid financing and state budget allocations in several key ways.

Funding for SDPs often comes from a combination of state and federal Medicaid funds, with the specific allocation varying by state and program design. State legislatures typically determine the overall budget for their SDPs, balancing the need to provide access to necessary medications against budgetary constraints. The cost of medications dispensed through SDPs directly affects the overall Medicaid expenditure, influencing state budget projections and requiring careful fiscal planning.

Macpac’s role involves analyzing these budgetary impacts and evaluating the cost-effectiveness of different SDP models.

SDP Funding Mechanisms and Budgetary Impacts

The funding for SDPs varies considerably across states. Some states use a combination of state general funds, federal Medicaid matching funds, and potentially manufacturer rebates or other cost-saving mechanisms. The budget allocated to SDPs significantly impacts the affordability and accessibility of medications for Medicaid beneficiaries. Increases in drug prices, for example, can lead to budget overruns, necessitating adjustments to the program’s design or overall state Medicaid spending.

Macpac analyzes data on SDP spending, comparing it to overall Medicaid drug costs and identifying areas for potential cost savings or efficiency improvements. This analysis helps inform policy recommendations at both the state and federal levels.

Challenges and Opportunities Presented by SDPs within Macpac’s Oversight

One significant challenge lies in ensuring the equitable distribution of medications through SDPs. Variations in program design and access across states create disparities in patient care. Macpac’s oversight helps identify these disparities and promotes the adoption of best practices. Opportunities exist in leveraging technology to improve efficiency and transparency within SDPs. Real-time data tracking and analytics can improve inventory management, reduce waste, and streamline the dispensing process.

Macpac’s data analysis can highlight successful technology implementations and encourage their wider adoption. Another challenge is ensuring the quality of medications dispensed through SDPs, necessitating robust quality control measures and oversight.

Comparative Effectiveness of Different SDP Models

Several SDP models exist across states, including centralized, regionalized, and hybrid approaches. Centralized SDPs, for example, involve a single state agency managing the entire program, while regionalized models distribute responsibility among various regional entities. Macpac’s comparative effectiveness research analyzes these different models, assessing their cost-effectiveness, efficiency, and impact on patient outcomes. This research helps states learn from each other’s successes and challenges, promoting the adoption of more effective and efficient SDP designs.

For instance, a comparative analysis might reveal that a regionalized model in one state leads to faster medication delivery and improved patient satisfaction compared to a centralized model in another.

Data Points Macpac Utilizes to Monitor and Evaluate SDP Performance

Macpac uses a range of data points to monitor and evaluate SDP performance. These include data on program costs, medication dispensing volumes, patient satisfaction surveys, and quality control metrics. Specifically, they examine data on medication utilization patterns, identifying potential overutilization or underutilization of specific medications. They also analyze data on adverse drug events to assess the safety and efficacy of the dispensed medications.

The use of these data points allows Macpac to generate reports and recommendations to improve SDP efficiency and effectiveness.

Key Features of SDPS and Their Impact on Medicaid Costs

The following list details key features of SDPs and their impact on Medicaid costs:

- Program Design: The structure of the SDP (centralized, regionalized, etc.) significantly influences administrative costs and efficiency.

- Drug Formularies: The selection of drugs included in the formulary directly affects the overall cost of the program. A more restrictive formulary may lower costs but could limit patient access to certain medications.

- Negotiated Drug Prices: The ability of the SDP to negotiate lower drug prices from manufacturers directly impacts Medicaid expenditures.

- Utilization Management: Strategies to optimize medication use, such as prior authorization requirements, can significantly impact costs.

- Waste Reduction Strategies: Implementing strategies to minimize drug waste and spoilage can lead to cost savings.

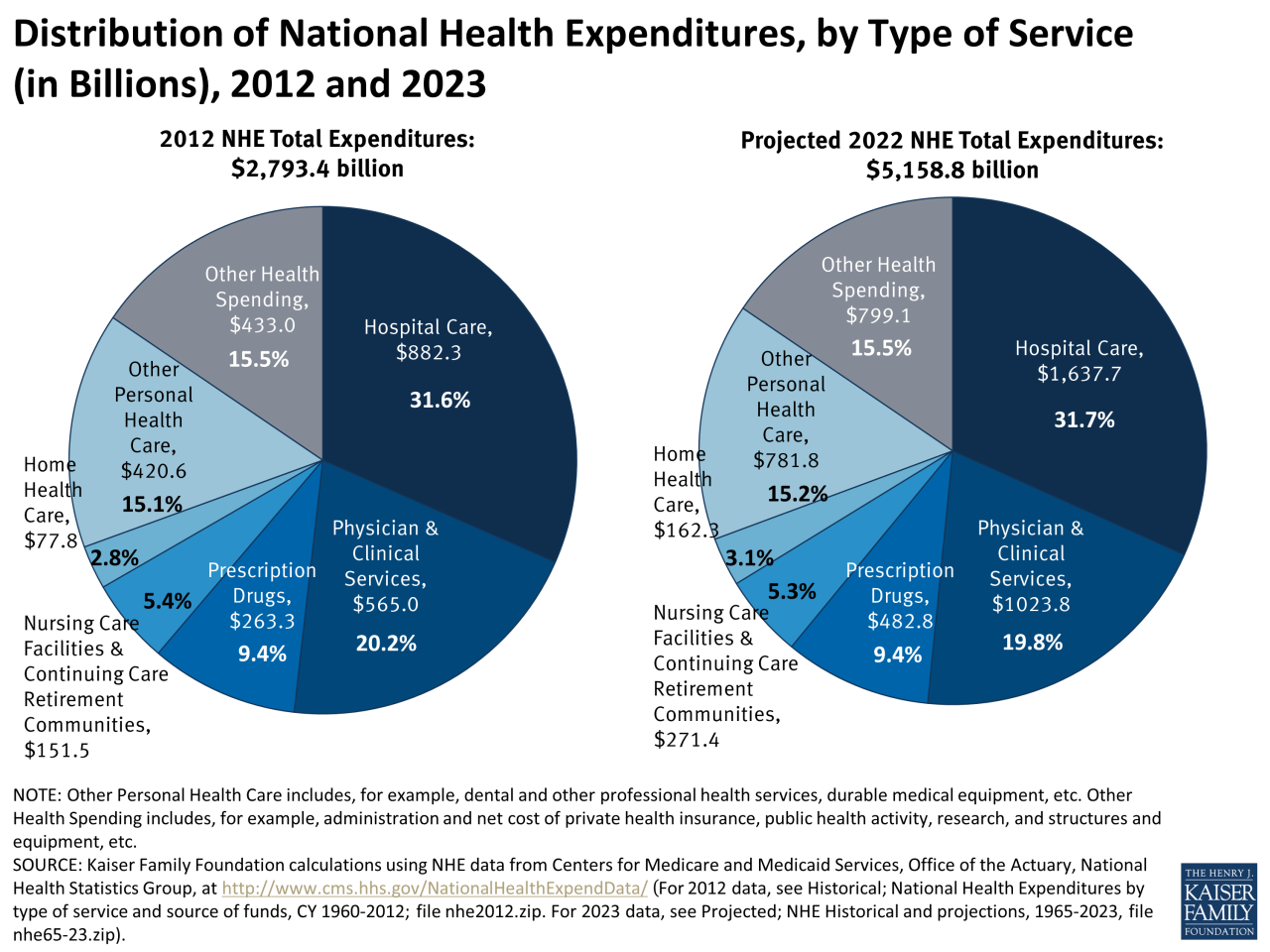

Macpac’s Role in Policy Recommendations

Source: kff.org

Macpac, or the Medicaid and CHIP Payment and Access Commission, plays a crucial role in shaping Medicaid policy through its data-driven recommendations. Its influence stems from its independent, non-partisan nature, allowing it to offer objective analyses and proposals for improving the efficiency and effectiveness of the Medicaid program. This analysis is critical in navigating the complexities of Medicaid financing and ensuring responsible allocation of resources.

The process by which Macpac develops policy recommendations is rigorous and multifaceted. It begins with extensive data analysis of Medicaid spending, utilization patterns, and program performance across states. This data is then used to identify trends, challenges, and areas for potential improvement. Macpac’s expert staff, drawing on their knowledge of health economics, policy, and program administration, conduct thorough research and analysis to inform their recommendations.

Macpac’s Policy Recommendation Process

The process begins with identifying key policy issues within the Medicaid system, often driven by data analysis revealing inefficiencies or disparities. Macpac then conducts in-depth research, including literature reviews, data analysis, and potentially, commissioned studies or expert consultations. This research phase feeds into the development of policy options and recommendations, often presented in reports and presented to various stakeholders.

Feedback from stakeholders is crucial in shaping the final recommendations, which are then submitted to Congress and relevant federal agencies.

Examples of Macpac Policy Recommendations and Their Impact

Macpac’s recommendations have had a tangible impact on Medicaid programs. For example, recommendations on improving care coordination for dual eligibles (those enrolled in both Medicare and Medicaid) have led to initiatives aimed at reducing fragmentation and improving the quality of care for this vulnerable population. Similarly, recommendations on strengthening Medicaid managed care programs have influenced the design and implementation of managed care models aimed at containing costs and improving health outcomes.

Specific examples of impact are difficult to isolate due to the complex interplay of multiple factors influencing policy changes, but Macpac’s recommendations frequently serve as a catalyst for reform efforts.

Stakeholders Involved in the Policy Recommendation Process

Numerous stakeholders participate in the policy recommendation process. These include:

A critical element is the involvement of state Medicaid agencies. They provide valuable insights into the practical implications of proposed policies and the challenges faced at the state level. Federal agencies, such as the Centers for Medicare & Medicaid Services (CMS), play a crucial role in reviewing and considering Macpac’s recommendations within the context of broader federal policy goals.

Finally, provider organizations, consumer advocacy groups, and other interested parties contribute their perspectives, ensuring a balanced and comprehensive approach to policymaking. Each stakeholder brings a unique perspective that contributes to the overall process.

Illustrative Flowchart of the Policy Recommendation Process

The policy recommendation process can be visualized as a flowchart. It begins with Data Collection and Analysis, where Macpac gathers and analyzes data from various sources. This leads to Issue Identification, pinpointing areas needing improvement. Next is Research and Analysis, where in-depth studies and consultations are conducted. This culminates in Policy Option Development, generating potential solutions.

Then comes Stakeholder Consultation, gathering feedback from various parties. Finally, Recommendation Formulation and Dissemination leads to the publication of reports and engagement with Congress and relevant agencies. This is followed by Policy Implementation (or Consideration), where the recommendations are adopted, adapted, or rejected based on various factors. This cyclical process allows for continuous improvement and refinement of Medicaid policies based on ongoing data analysis and feedback.

Challenges in Translating Data-Driven Insights into Effective Policy Changes

Translating data-driven insights into effective policy changes presents several challenges for Macpac. One key challenge is the political context. Policy decisions are often influenced by factors beyond data-driven analysis, including budgetary constraints, political priorities, and competing interests. Another challenge lies in the complexity of the Medicaid system itself. Implementing changes requires navigating the intricate interactions between federal and state governments, providers, and beneficiaries.

Finally, demonstrating a clear causal link between policy changes and improved outcomes can be difficult due to the multitude of factors affecting health care. Despite these challenges, Macpac continues to play a vital role in informing evidence-based decision-making in the Medicaid arena.

End of Discussion: Macpac State Transparency Medicaid Financing Provider Taxes Sdps

Understanding the interplay between Macpac’s transparency initiatives, Medicaid financing, provider taxes, and SDPS is critical for ensuring a sustainable and equitable healthcare system. While the complexities can be daunting, the ultimate goal is simple: to create a system that is both transparent and effective in providing vital healthcare services to those who need them most. By examining Macpac’s data-driven approach and its policy recommendations, we can gain valuable insights into how to improve the system and make it more efficient and accountable.

This journey into the heart of Medicaid financing highlights the importance of transparency and the ongoing need for effective policy changes to benefit both taxpayers and patients.

FAQ Corner

What exactly is Macpac?

Macpac, the Massachusetts Center for Health Information and Analysis, is an independent state agency that collects, analyzes, and disseminates data related to the state’s healthcare system. Its goal is to promote transparency and inform policy decisions.

How does Macpac’s work impact me as a taxpayer?

Macpac’s efforts toward transparency in Medicaid spending help ensure that taxpayer dollars are used efficiently and effectively. By identifying areas for improvement, Macpac helps to prevent waste and improve the overall value of Medicaid programs.

What are State Dispensing Programs (SDPs)?

SDPs are programs that manage the distribution of prescription drugs, often within the context of Medicaid. They play a significant role in controlling costs and ensuring access to medications.

Are there any potential downsides to provider taxes?

While provider taxes contribute to Medicaid funding, they can potentially increase healthcare costs for patients and create financial burdens for healthcare providers, especially smaller practices.