CMS Launches Making Care Primary Value-Based Care Model

CMS launches Making Care Primary value based care model – CMS launches Making Care Primary value-based care model – a game-changer in healthcare! This new model promises to revolutionize how we approach patient care, shifting the focus from quantity of services to the quality of outcomes. Get ready to dive into the details of this exciting initiative, exploring its core principles, implementation challenges, and the potential impact on both providers and patients.

We’ll unpack the financial incentives, examine real-world examples, and even peek into the future of this innovative approach.

Imagine a healthcare system where doctors are rewarded for keeping you healthy, not just for treating your illnesses. That’s the core idea behind Making Care Primary (MCP). This value-based care model, spearheaded by the Centers for Medicare & Medicaid Services (CMS), aims to improve patient outcomes while controlling costs. We’ll explore how this ambitious plan works, its potential benefits, and the hurdles it faces in its rollout.

Introduction to the Making Care Primary Value-Based Care Model

The Making Care Primary (MCP) model represents a significant shift in how healthcare is delivered and reimbursed in the United States. It’s a value-based care model designed to improve patient outcomes, enhance care coordination, and ultimately reduce healthcare costs. Instead of the traditional fee-for-service system, MCP emphasizes proactive, preventative care and focuses on the overall health and well-being of patients, rather than just treating individual illnesses.This model aims to fundamentally change the relationship between healthcare providers and patients, fostering a more collaborative and patient-centered approach.

By rewarding providers for achieving better health outcomes, rather than simply the volume of services provided, MCP incentivizes a more holistic and efficient approach to healthcare delivery.

Core Tenets of the Making Care Primary Model

The MCP model rests on several key pillars. These include a strong emphasis on primary care as the foundation of healthcare, proactive and preventative care strategies, comprehensive care management for high-need patients, and robust data collection and analysis to measure and improve performance. The model utilizes technology to improve care coordination and communication between providers and patients. Furthermore, it prioritizes patient engagement and shared decision-making, empowering individuals to actively participate in their own healthcare journey.

Finally, financial incentives are directly tied to achieving pre-defined quality metrics and improvements in patient health outcomes.

Differences Between MCP and Traditional Fee-for-Service

Traditional fee-for-service (FFS) models compensate providers for each individual service rendered, regardless of the overall outcome. This can lead to an emphasis on volume over value, potentially resulting in unnecessary tests and procedures. In contrast, MCP compensates providers based on the quality of care and the overall health of their patient population. This incentivizes providers to focus on preventative care, managing chronic conditions effectively, and coordinating care to avoid unnecessary hospitalizations and emergency room visits.

For example, under FFS, a doctor might order multiple tests to rule out various possibilities, even if the initial symptoms point towards a single diagnosis. Under MCP, the focus would be on making an accurate diagnosis efficiently and implementing a comprehensive treatment plan.

The CMS’s Role in Launching and Supporting the MCP Model

The Centers for Medicare & Medicaid Services (CMS) plays a crucial role in launching and supporting the MCP model. CMS is responsible for designing the model’s framework, establishing performance metrics, and providing financial support to participating providers. They also oversee the data collection and analysis processes, ensuring transparency and accountability. Furthermore, CMS provides technical assistance and resources to help providers transition to the value-based care model.

The agency’s active involvement is critical for the successful implementation and widespread adoption of MCP across the healthcare system. This includes developing and implementing payment models that align with the principles of value-based care, establishing quality metrics that accurately reflect the model’s goals, and providing ongoing support and guidance to participants. Through this active participation, CMS aims to drive the transformation of the US healthcare system towards a more sustainable and patient-centered model.

Value-Based Care Principles within the Making Care Primary Model

The Making Care Primary (MCP) model represents a significant shift towards value-based care, prioritizing patient outcomes and cost-effectiveness. Unlike traditional fee-for-service models, MCP focuses on rewarding providers for improving the health of their patient populations, not simply for the volume of services provided. This fundamental change requires a clear understanding of the metrics used to measure success, the financial incentives involved, and the ultimate impact on both patients and the healthcare system.

The core of the MCP model rests on aligning financial incentives with improved patient outcomes. This means that providers aren’t just paid for performing procedures; instead, their compensation is directly tied to how well they manage the health of their patients. This incentivizes a proactive, preventative approach to care, leading to better health outcomes and reduced healthcare costs in the long run.

MCP Model Metrics for Value-Based Care, CMS launches Making Care Primary value based care model

The MCP model employs a comprehensive set of metrics to evaluate performance. These metrics aren’t simply about reducing costs; they are designed to measure improvements across various aspects of patient care, ensuring a holistic approach to value. Key metrics include measures of patient satisfaction, adherence to treatment plans, and reduction in hospital readmissions and emergency department visits. For example, a key performance indicator might be the percentage of patients with diabetes achieving target blood sugar levels.

The CMS’s launch of the Making Care Primary value-based care model is a huge step towards better healthcare, and it got me thinking about how technology can support this shift. Efficient documentation is key, which is why news about nuance integrates generative ai scribe epic ehrs is so exciting. This AI-powered scribe could significantly streamline the administrative burden for doctors, freeing up more time for patient care – a crucial element for the success of Making Care Primary.

Another might track the number of patients successfully completing a prescribed course of medication. These data points, collected and analyzed regularly, provide a clear picture of the effectiveness of the care provided.

Financial Incentives and Penalties in the MCP Model

Financial rewards and penalties are directly tied to the performance metrics described above. Providers who consistently achieve or exceed pre-determined targets for improving patient health receive financial bonuses. Conversely, those who fail to meet these targets may face financial penalties. The specific financial arrangements vary depending on the contracts between providers and payers, but the underlying principle remains the same: providers are rewarded for delivering high-quality, cost-effective care.

The CMS launching its Making Care Primary value-based care model is a big deal, pushing healthcare towards better outcomes and cost efficiency. This shift highlights the increasing importance of digital health solutions, and it’s interesting to see how organizations are adapting, like Mass General Brigham, which recently buyouts its digital unit to strengthen its position in this evolving landscape.

Ultimately, this focus on digital tools will likely accelerate the success of initiatives like Making Care Primary.

This system encourages providers to invest in resources and strategies that improve patient outcomes, fostering a culture of continuous quality improvement. For instance, a provider exceeding targets for diabetes management might receive a bonus based on a percentage of the cost savings achieved through improved patient outcomes. Conversely, a provider with high rates of hospital readmissions might experience a reduction in their payment.

CMS’s launch of the Making Care Primary value-based care model is a big deal, especially considering the challenges faced by rural healthcare providers. This new model needs to effectively support services like labor and delivery, which are often strained in rural areas, as highlighted in this insightful article on Rural Hospitals Labor Delivery & the impact of payment reform.

Ultimately, the success of Making Care Primary hinges on its ability to address the unique needs of all communities, including those far from major medical centers.

Impact of the MCP Model on Patient Outcomes and Experiences

The MCP model aims to improve patient outcomes and experiences in several ways. By focusing on preventative care and patient engagement, the model aims to reduce hospitalizations, improve overall health, and enhance patient satisfaction. This translates into better health for patients, improved quality of life, and a more sustainable healthcare system. The shift from volume-based to value-based care is expected to lead to better patient-provider relationships, increased access to preventive services, and more personalized care plans.

Studies have shown that patients in value-based care models often report higher levels of satisfaction with their care due to the increased emphasis on patient engagement and shared decision-making. For example, improved access to telehealth services, enabled by the financial incentives of the MCP model, can significantly improve patient access to care, particularly for patients in rural areas or those with mobility limitations.

Implementation and Challenges of the MCP Model

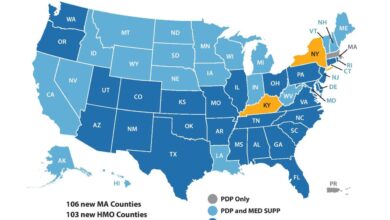

Source: ama-assn.org

Implementing the Making Care Primary (MCP) value-based care model requires a multifaceted approach, demanding significant changes in both clinical workflows and organizational structures. Success hinges on a comprehensive strategy encompassing provider engagement, technological integration, and robust data analytics. The transition isn’t without its hurdles, however, and careful planning is crucial to mitigate potential setbacks.

The implementation process typically involves several key steps. First, a thorough assessment of the existing infrastructure and capabilities is needed. This includes evaluating the electronic health record (EHR) system’s capacity to support population health management, the availability of necessary data analytics tools, and the readiness of the healthcare team to embrace new workflows. Next, provider training and education are essential to ensure a smooth transition and to address concerns about the changes.

This training should cover the new care models, payment methodologies, and performance metrics. Simultaneously, the organization must develop a robust infrastructure for data collection, analysis, and reporting, ensuring accurate measurement of performance against the established value-based care metrics. Finally, ongoing monitoring and adjustments are vital to optimize the model’s effectiveness and address any emerging challenges.

Successful and Unsuccessful MCP Model Implementations

While widespread adoption is still underway, several organizations have demonstrated success with the MCP model. For example, some large integrated health systems have reported improved patient outcomes and reduced costs through focused investments in care coordination, preventive services, and chronic disease management. These successes are often characterized by strong leadership commitment, proactive provider engagement, and a robust technological infrastructure.

Conversely, some implementations have faltered due to insufficient provider buy-in, inadequate technological support, or a lack of robust data analytics capabilities. In these cases, the inability to accurately measure performance and adapt the model based on data insights has hindered progress and led to disappointing results. A key lesson from unsuccessful implementations is the critical need for strong leadership support and a clear communication strategy to engage providers and address their concerns proactively.

Technological Limitations and Provider Resistance

Technological limitations pose a significant challenge to the widespread adoption of the MCP model. Many healthcare organizations rely on legacy EHR systems that lack the interoperability and analytical capabilities required for effective population health management. Integrating new technologies and upgrading existing systems can be expensive and time-consuming. Furthermore, provider resistance can also impede successful implementation. Physicians and other healthcare professionals may be hesitant to adopt new workflows and embrace value-based care principles if they perceive them as disruptive to their practices or if they lack confidence in the new systems and processes.

Addressing these concerns requires a multi-pronged approach that combines robust training and education with clear communication about the benefits of the MCP model. Incentives and support structures can also help to encourage provider participation and alleviate concerns about increased workload or reduced income.

Impact on Healthcare Providers and Patients: CMS Launches Making Care Primary Value Based Care Model

The Making Care Primary (MCP) value-based care model significantly alters the landscape for both healthcare providers and patients. By shifting the focus from fee-for-service to value-based reimbursement, MCP incentivizes a more holistic and coordinated approach to care, impacting how providers interact with patients and each other, and ultimately influencing patient access and healthcare costs. This section will explore these impacts in detail.

Effects on Different Healthcare Provider Types

MCP’s effects vary depending on the provider’s role within the healthcare system. Primary care physicians (PCPs) are central to the MCP model, acting as care coordinators and assuming greater responsibility for patient outcomes. This increased responsibility often translates to increased workload initially, but also to potentially higher compensation through performance-based payments. Specialists, on the other hand, may see a shift in their referral patterns and a need for stronger collaboration with PCPs.

While they might receive fewer referrals for routine matters, they could experience increased referrals for complex cases requiring specialized expertise, potentially leading to more focused and efficient use of their skills. The model fosters collaboration, reducing unnecessary specialist visits driven by fragmented care under the fee-for-service model. Hospitals and other healthcare facilities also adapt, needing to support the coordinated care approach through improved data sharing and streamlined processes.

The success of the MCP model depends on effective interoperability and information sharing among all involved providers.

Impact on Patient Access to Care and Healthcare Costs

The MCP model aims to improve patient access to care by promoting preventative services and proactive management of chronic conditions. By emphasizing coordinated care, patients experience less fragmentation and improved communication among their providers, leading to more efficient and timely treatment. This can be particularly beneficial for patients with complex medical needs or multiple chronic conditions. Regarding healthcare costs, MCP’s impact is multifaceted.

While the upfront investment in infrastructure and training may be significant, the long-term goal is to reduce overall costs by preventing hospital readmissions, reducing emergency room visits, and improving the efficiency of care delivery. For example, a successful MCP implementation might lead to a reduction in costly hospital stays for patients with well-managed diabetes through proactive monitoring and preventative measures coordinated by their PCP.

However, the success of cost reduction hinges on effective implementation and engagement from all stakeholders.

Benefits and Drawbacks of the MCP Model

The following table summarizes the key benefits and drawbacks of the MCP model for both patients and providers:

| Benefit | Drawback |

|---|---|

| For Patients: Improved coordination of care, increased access to preventative services, potentially lower overall healthcare costs, improved patient outcomes | For Patients: Potential for increased workload for PCPs initially, requiring more proactive patient engagement, potential for initial increased costs for providers to implement the system |

| For Providers: Potential for increased revenue through performance-based payments, improved patient outcomes leading to higher job satisfaction, opportunities for enhanced collaboration and professional development | For Providers: Increased administrative burden, need for robust IT infrastructure and data sharing capabilities, potential for financial risk if performance targets are not met, requirement for significant changes in practice patterns and workflows |

Future Directions and Potential Improvements

The Making Care Primary (MCP) model, while promising, faces challenges that require proactive strategies for improvement and expansion. Its long-term success hinges on addressing these hurdles and adapting to the evolving healthcare landscape. This section explores potential avenues for enhancement, focusing on strategic adjustments and future research directions.The success of the MCP model depends on continuous refinement and adaptation.

Addressing identified challenges and proactively planning for future scenarios will be critical to ensuring its long-term viability and positive impact on patient care.

Strategies to Address Challenges and Improve Effectiveness

Several key areas require attention to bolster the MCP model’s effectiveness. For example, improving data collection and analysis can provide a more comprehensive understanding of the model’s impact and identify areas for targeted improvement. This enhanced data-driven approach will allow for more precise adjustments and optimizations. Furthermore, strengthening provider engagement through robust training programs and ongoing support is crucial for sustained participation and successful implementation.

Finally, developing clearer communication strategies for patients, providers, and stakeholders will foster trust and improve overall understanding of the model’s goals and benefits. Investing in these areas will lead to a more robust and impactful value-based care system.

Modifications and Expansions for Specific Patient Populations and Settings

The MCP model’s adaptability is a key strength. Tailoring its implementation to address the unique needs of specific patient populations, such as those with complex chronic conditions or those residing in rural areas with limited access to care, is vital. For example, integrating telehealth technologies could greatly enhance access for geographically dispersed patients. Similarly, modifying the model to better serve different healthcare settings, such as long-term care facilities or community health centers, would significantly broaden its reach and impact.

This targeted approach ensures that the benefits of value-based care are extended to all patient populations, regardless of their location or health status.

Potential Future Research Areas

Understanding the long-term sustainability and effectiveness of the MCP model requires focused research. Several areas warrant investigation:

- Longitudinal studies tracking patient outcomes: Long-term studies are needed to assess the sustained impact of the MCP model on various health outcomes, including mortality, hospitalization rates, and patient satisfaction.

- Cost-effectiveness analyses: Rigorous cost-effectiveness analyses are essential to demonstrate the financial viability of the MCP model and its potential to reduce overall healthcare spending.

- Impact on health equity: Research should focus on assessing whether the MCP model improves health equity by reducing disparities in access to and quality of care across different demographic groups.

- Comparative effectiveness research: Studies comparing the MCP model to traditional fee-for-service models are needed to establish its superiority in terms of both clinical and economic outcomes.

- Factors influencing provider adoption and engagement: Research should explore the factors that influence provider participation in the MCP model, including incentives, training, and support systems.

Illustrative Case Studies

This section presents two hypothetical case studies to illustrate both the successful and less successful implementation of the Making Care Primary (MCP) value-based care model. These examples highlight the potential benefits and challenges associated with adopting this model, offering valuable insights for healthcare organizations considering similar initiatives.

Successful MCP Model Implementation: Case Study of Elderly Patient with Chronic Conditions

This case study focuses on Mrs. Eleanor Vance, a 78-year-old woman with a history of hypertension, type 2 diabetes, and osteoarthritis. Under the MCP model, her primary care physician, Dr. Ramirez, coordinated her care across multiple specialists, including a cardiologist, endocrinologist, and rheumatologist. Dr.

Ramirez utilized a comprehensive care plan that emphasized preventative measures, patient education, and close monitoring of her conditions. This involved regular telehealth check-ins, proactive medication management adjustments based on her vital signs and blood test results, and access to a dedicated care coordinator who assisted with scheduling appointments and navigating the healthcare system. The result was a significant improvement in Mrs.

Vance’s health outcomes. Her blood pressure and blood sugar levels were well-controlled, her pain from osteoarthritis was managed effectively, and she experienced a reduction in hospital readmissions. Her overall quality of life improved substantially, leading to increased independence and reduced caregiver burden. A visual representation of her progress could be a line graph showing a decrease in her blood pressure and HbA1c levels over the course of the MCP program, alongside a bar chart demonstrating a significant reduction in hospital visits.

Less Successful MCP Model Implementation: Case Study of a Young Adult with Mental Health Challenges

This case study involves Mr. David Lee, a 25-year-old struggling with anxiety and depression. While the MCP model aimed to provide coordinated care, integrating mental health services proved challenging. Communication breakdowns occurred between his primary care physician and his psychiatrist, resulting in inconsistent medication management and a lack of holistic care coordination. Furthermore, Mr.

Lee’s access to mental health resources within the MCP framework was limited due to a shortage of mental health professionals participating in the program. The lack of seamless integration between physical and mental healthcare resulted in delayed treatment and a less optimal outcome for Mr. Lee. A visual representation of this would be a Gantt chart showing the delays and gaps in his treatment plan, with different colored bars representing various healthcare providers and the timelines of their involvement.

This chart would clearly illustrate the missed opportunities for coordinated care and the resulting lack of progress. A pie chart could also illustrate the proportion of time spent on various aspects of his care, highlighting the disproportionate focus on certain areas at the expense of others.

Last Point

Source: capminds.com

The launch of the Making Care Primary value-based care model represents a bold step towards a more patient-centric and cost-effective healthcare system. While challenges undoubtedly exist, the potential benefits – improved patient outcomes, increased provider satisfaction, and better cost control – make it a worthwhile endeavor. The success of MCP will depend on effective implementation, ongoing adaptation, and a collaborative effort from all stakeholders.

It’s an exciting time for healthcare, and we’re all watching to see how this revolutionary model unfolds.

User Queries

What are the specific value-based care metrics used in the MCP model?

The specific metrics will vary depending on the specific care setting and patient population, but generally include measures of patient satisfaction, quality of care, and cost-effectiveness.

How does the MCP model impact specialist involvement?

The MCP model aims to improve coordination of care between primary care physicians and specialists, potentially leading to more efficient and effective treatment plans.

What technological limitations could hinder the MCP model’s adoption?

Interoperability issues between different electronic health record systems and the need for robust data analytics platforms are key technological hurdles.

What support does CMS offer to providers adopting the MCP model?

CMS offers technical assistance, training, and resources to help providers successfully implement the MCP model. Financial incentives are also part of the support structure.