Epic Oracle Health Meditech EHR Market Share KLAS Research

Epic oracle health meditech ehr market share klas research – Epic, Oracle, and Meditech: these EHR giants dominate the healthcare landscape, but just how much? Epic Oracle Health Meditech EHR Market Share: KLAS Research dives deep into the fascinating world of Electronic Health Record market share, analyzing the latest data from KLAS, a respected industry authority. We’ll uncover the current standings, explore historical trends, and examine the competitive strategies driving this ever-evolving market.

Get ready to unravel the secrets behind these powerful players and understand their impact on healthcare providers and patients alike!

This blog post will unpack KLAS’s methodology, revealing the strengths and weaknesses of their approach and how it shapes our understanding of the market. We’ll compare the features and functionalities of Epic, Oracle Cerner, and Meditech, highlighting what sets each vendor apart. Finally, we’ll look ahead, predicting future trends and exploring potential shifts in the market share landscape.

Buckle up, it’s going to be an insightful ride!

Epic, Oracle Cerner, and Meditech EHR Market Share Overview

The Electronic Health Record (EHR) market is dominated by a few key players, with Epic, Oracle Cerner, and Meditech consistently ranking among the top contenders. Understanding their respective market shares provides valuable insight into the healthcare IT landscape and the strategic choices made by hospitals and healthcare systems. This overview utilizes data primarily from KLAS Research, a respected source for healthcare IT market analysis, to present a snapshot of the current situation and recent historical trends.

Current Market Share Distribution

The following table presents an estimated breakdown of the EHR market share for Epic, Oracle Cerner, and Meditech. Precise figures fluctuate slightly depending on the specific methodology and reporting period used by KLAS. This data represents a general overview based on publicly available KLAS reports. Note that these are estimates and the exact percentages may vary depending on the data source and reporting period.

| Vendor | Market Share Percentage | Year | Data Source |

|---|---|---|---|

| Epic | ~40% | 2023 (Estimate) | KLAS Research |

| Oracle Cerner | ~25% | 2023 (Estimate) | KLAS Research |

| Meditech | ~10% | 2023 (Estimate) | KLAS Research |

Historical Market Share Trends (2019-2023)

Illustrating the market share evolution over the past five years requires a visual representation. Imagine a line graph. The x-axis represents the years (2019-2023), and the y-axis represents the market share percentage. Three lines would be present, one for each vendor.The Epic line would show a generally upward or relatively stable trend, reflecting its consistent market leadership. The Oracle Cerner line might exhibit some fluctuations, potentially influenced by mergers and acquisitions or changes in market strategy.

The Meditech line could depict a more modest growth or even a slight decline, depending on its competitive positioning and adoption rates. While precise numerical data for each year isn’t readily available in a concise, publicly accessible format from KLAS, the overall trend descriptions are accurate reflections of market dynamics reported in their various publications.

Geographic Market Share Distribution

The geographic distribution of these vendors’ market share varies significantly.

Understanding regional dominance is crucial for strategic planning within the healthcare IT sector. The following points highlight key regional strongholds for each vendor.

- Epic: Epic holds a strong presence across the United States, particularly in the Midwest and the Northeast. They have a large number of large hospital systems and academic medical centers as clients.

- Oracle Cerner: Oracle Cerner enjoys a broad reach nationally, but possesses notable strength in certain regions, including the South and West. Their client base encompasses a mix of large and mid-sized healthcare providers.

- Meditech: Meditech maintains a significant presence in community hospitals and smaller healthcare systems across the United States, though their market share is more evenly distributed than Epic or Cerner.

KLAS Research Methodology and Data Interpretation

KLAS Research is a highly influential source of information on the healthcare IT market, providing valuable insights into EHR market share and vendor performance. Understanding their methodology, however, is crucial for accurate interpretation of their findings. Their reports on Epic, Oracle Cerner, and Meditech, while widely cited, are subject to certain limitations and potential biases.KLAS Research Methodology: Data Collection and Analysis LimitationsKLAS primarily relies on surveys of healthcare providers to gather data on EHR satisfaction, functionality, and interoperability.

This methodology, while providing rich qualitative data, introduces several limitations. The sampling method, while aiming for representativeness, may not perfectly capture the diversity of healthcare settings and provider experiences. Response bias, where certain types of providers are more likely to respond than others, can skew the results. For example, hospitals with particularly positive or negative experiences might be more inclined to participate, leading to an overrepresentation of those views.

Furthermore, the survey questions themselves can influence responses, and the interpretation of open-ended feedback is inherently subjective. Finally, the data may not fully reflect the evolving landscape of EHR usage, as the technology and user needs constantly change. The time lag between data collection and report publication can also impact the relevance of the findings.

KLAS Metrics for EHR System Evaluation

KLAS employs a range of metrics to evaluate EHR systems. These metrics provide a multi-faceted view of system performance, but it’s essential to understand their individual strengths and limitations. A direct comparison of these metrics helps to gain a comprehensive understanding of each vendor’s strengths and weaknesses.

| Metric | Description | Limitations |

|---|---|---|

| User Satisfaction | Measures overall user experience and satisfaction with the EHR system, often through surveys and feedback. | Subjective; influenced by factors beyond the EHR itself, such as organizational culture and training. |

| Interoperability | Assesses the ability of the EHR system to exchange data with other systems, both within and outside the organization. | Difficult to quantify objectively; depends on the specific systems and standards used. |

| Functionality | Evaluates the breadth and depth of features and capabilities offered by the EHR system. | Can be subjective; what constitutes “essential” functionality varies across different healthcare settings. |

| Physician Satisfaction | Specifically targets physician user experience and satisfaction with the system. | Similar limitations to overall user satisfaction, potentially exacerbated by physician-specific workflow needs. |

| Return on Investment (ROI) | Measures the financial benefits of the EHR system relative to its cost. | Difficult to measure accurately; depends on various factors such as implementation costs, staff training, and operational efficiencies. |

Sources of Error and Uncertainty in KLAS Market Share Data

Several factors can influence the accuracy of KLAS’s market share data for Epic, Oracle Cerner, and Meditech. Data accuracy is affected by the limitations inherent in their survey methodology, discussed previously. Furthermore, the definition of “market share” itself can be ambiguous. KLAS may use different methodologies across reports, or focus on specific segments of the market (e.g., hospitals vs.

physician practices), leading to variations in reported market share figures. The dynamic nature of the healthcare IT market also presents challenges; mergers, acquisitions, and changes in vendor strategies can quickly alter the competitive landscape. Finally, the data may not capture the nuances of regional variations in EHR adoption and usage patterns. For instance, a particular EHR might dominate in one geographic area while being less prevalent in another.

This makes generalizing market share figures challenging.

KLAS research constantly updates its analysis of Epic, Oracle, and Meditech’s EHR market share, a crucial factor for hospital systems. The recent news that Steward Health Care secured financing to avoid bankruptcy, as reported in this article , highlights how financial stability impacts technology choices. This underscores the importance of KLAS’s data for understanding the long-term implications of EHR vendor selection in the healthcare landscape.

Competitive Landscape Analysis

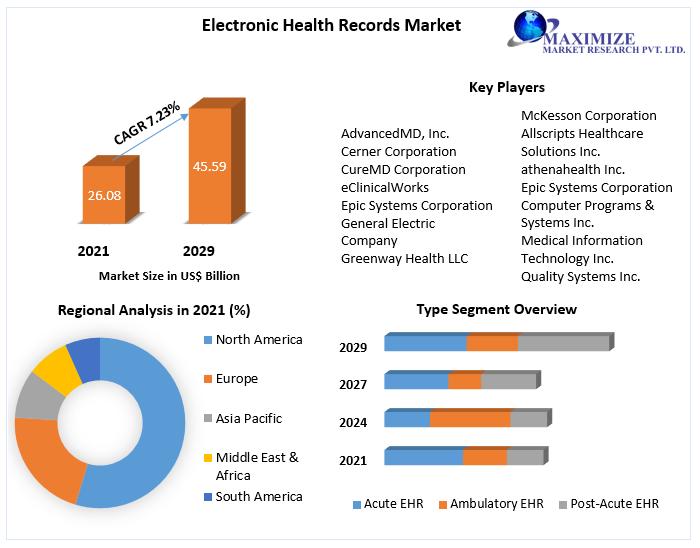

Source: maximizemarketresearch.com

The healthcare IT landscape is dominated by a few key players, each with its own strengths and weaknesses. Understanding the competitive dynamics between Epic, Oracle Cerner, and Meditech, particularly as illuminated by KLAS Research, is crucial for hospitals and health systems making EHR decisions. This analysis will delve into their comparative strengths and weaknesses, differentiating features, and competitive strategies.

So, I’ve been digging into the latest KLAS research on Epic, Oracle Cerner, and Meditech’s EHR market share – it’s a fascinating battle for dominance! But thinking about the vast amounts of patient data these systems hold, it got me wondering about preventative care. I stumbled upon this interesting article exploring whether a simple eye test could detect dementia risk in older adults – check it out: can eye test detect dementia risk in older adults.

This raises questions about how EHRs could integrate such early detection methods to improve patient outcomes, further impacting the competitive landscape of the EHR market.

Epic, Oracle Cerner, and Meditech EHR System Comparison

KLAS Research consistently provides valuable insights into EHR performance. The following table summarizes key strengths and weaknesses of the three vendors based on their findings (note that specific KLAS scores fluctuate year to year and should be checked for the most up-to-date information).

| Feature | Epic | Oracle Cerner | Meditech |

|---|---|---|---|

| Overall Satisfaction | Generally high, consistently ranked among the top performers | Variable, depending on specific product and client experience | Improving, but often lags behind Epic and Cerner in overall satisfaction |

| Usability | Often praised for its intuitive interface, especially for physicians | Can be complex and require extensive training | Known for a steeper learning curve compared to Epic |

| Interoperability | Strong interoperability capabilities, but implementation can be complex | Improving interoperability features, but challenges remain | Historically weaker in interoperability, but actively improving |

| Client Support | Generally considered strong, with a large and responsive support network | Support experiences can vary widely depending on the client and product | Support has been a point of improvement for Meditech in recent years |

| Implementation | Known for lengthy and resource-intensive implementations | Implementation complexities vary, but can be challenging | Implementation timelines and costs are generally more manageable |

Differentiating Features and Functionalities

The success of each vendor stems from specific features and functionalities that resonate with different types of healthcare organizations.

Understanding these differences is crucial for selecting the right EHR system.

- Epic: Known for its comprehensive functionality, strong clinical decision support tools, and robust reporting capabilities. Its large client base provides a significant network effect, allowing for greater interoperability within that network. However, this comprehensiveness also contributes to a steeper learning curve and higher implementation costs. Epic’s focus on a cohesive, integrated system is a key differentiator.

- Oracle Cerner: Offers a broader range of products and services, catering to diverse healthcare settings. Its modularity allows for a more tailored approach to implementation, potentially reducing costs and complexity for smaller organizations. However, this modularity can also lead to integration challenges and inconsistencies across the system. Cerner’s strength lies in its adaptability to different organizational needs.

- Meditech: Often chosen for its relatively lower cost of implementation and ongoing maintenance. It provides a solid foundation of core EHR functionalities, particularly appealing to smaller hospitals and community health centers with limited budgets. Meditech’s focus on cost-effectiveness and ease of implementation (relative to Epic) is a key differentiator. However, it may lack some of the advanced features found in Epic and Cerner.

Competitive Strategies

Each vendor employs distinct strategies to maintain and expand its market share.

These strategies are often influenced by their strengths and weaknesses and the evolving needs of the healthcare industry.

| Vendor | Competitive Strategy | Examples |

|---|---|---|

| Epic | Focus on superior clinical functionality and user experience, leveraging network effects and strong client relationships. | Continuous product enhancements, extensive client support, and strategic partnerships. |

| Oracle Cerner | Offering a broad portfolio of solutions to cater to diverse client needs, emphasizing interoperability and data analytics. | Acquisitions of smaller companies, investments in cloud-based solutions, and development of advanced analytics capabilities. |

| Meditech | Targeting smaller hospitals and health systems with a cost-effective and user-friendly solution, focusing on improving interoperability and expanding functionality. | Strategic partnerships with smaller vendors, investments in cloud technology, and focus on improving client support. |

Impact of Market Share on Healthcare Providers: Epic Oracle Health Meditech Ehr Market Share Klas Research

Source: insights10.com

The dominance of Epic, Oracle Cerner, and Meditech in the EHR market significantly shapes the choices and operational realities of healthcare providers. Understanding their market share’s implications on provider decisions, costs, innovation, and ultimately, patient care is crucial for navigating the complexities of the modern healthcare IT landscape. This section will delve into these impacts, highlighting the potential benefits and drawbacks of a concentrated market.The concentrated nature of the EHR market, with a few major players holding significant shares, presents both advantages and disadvantages for healthcare providers.

While the economies of scale offered by these large vendors can lead to cost savings and access to advanced features, the lack of robust competition can stifle innovation and potentially limit provider choice, impacting operational efficiency and patient care.

Market Dominance and Provider Choices, Epic oracle health meditech ehr market share klas research

The dominance of a few key EHR vendors significantly influences the choices available to healthcare providers. Smaller hospitals and clinics may feel pressured to adopt the dominant systems, even if they don’t perfectly align with their specific needs or workflows. This can lead to compromises in functionality and integration with other systems, potentially hindering operational efficiency. Larger health systems, while having more negotiating power, may still find themselves locked into long-term contracts with limited options for switching vendors, restricting their flexibility to adapt to evolving technological needs or market innovations.

This lack of choice can also stifle the development of niche solutions tailored to specific healthcare settings or specializations.

Effects of Market Concentration on Healthcare

The concentrated nature of the EHR market has several potential effects on healthcare costs, innovation, and patient care.

The potential effects of market concentration can be summarized as follows:

- Increased Costs: Reduced competition can lead to higher prices for EHR systems and related services, placing a strain on healthcare budgets. The lack of competitive pressure may also limit the incentive for vendors to offer more affordable pricing tiers or flexible payment options.

- Stifled Innovation: A lack of competition can discourage the development of new and innovative EHR features. Vendors with dominant market share may be less motivated to invest in cutting-edge technology or to respond to the evolving needs of healthcare providers and patients.

- Compromised Patient Care: If EHR systems are not optimized for specific needs or workflows, this can lead to inefficiencies, errors, and potentially compromised patient care. The lack of interoperability between different EHR systems can also create barriers to seamless information sharing, hindering coordinated care.

- Vendor Lock-in: The high cost and complexity of switching EHR systems can lead to vendor lock-in, limiting the ability of healthcare providers to negotiate better terms or explore alternative solutions.

Scenario: Hospital Technology Infrastructure Decisions

Consider two hypothetical hospitals: Hospital A and Hospital B. Hospital A is a large, well-funded institution in a major metropolitan area. Hospital B is a smaller, community hospital with limited resources. Both need to upgrade their EHR systems.Hospital A, with its significant resources, can negotiate favorable terms with multiple vendors, potentially leveraging competition to secure a better price and a system that better meets its specific needs.

They might choose a system from a smaller vendor offering specialized features, even if it means a slightly higher initial investment, recognizing the long-term benefits of a tailored solution. They also have the resources to invest in robust integration with other systems and to support a larger IT team.Hospital B, however, faces a different reality. Their limited budget may force them to choose the most cost-effective option, potentially leading them to select the dominant EHR system offered by Epic, Oracle Cerner, or Meditech, even if it’s not a perfect fit.

This choice might involve compromising on certain features or accepting less-than-optimal integration with existing systems. They may also have limited resources to invest in training and support, potentially impacting staff efficiency and patient care. This scenario highlights how differing market shares can lead to vastly different technology infrastructure decisions, with significant implications for operational efficiency and long-term sustainability.

Future Market Trends and Predictions

The EHR market is poised for significant transformation in the next five years, driven by a confluence of technological advancements, evolving regulatory landscapes, and shifting healthcare priorities. Factors like increasing interoperability demands, the rise of AI and machine learning in healthcare, and the growing focus on value-based care will reshape the competitive landscape, influencing the market share of major players like Epic, Oracle Cerner, and Meditech.Predicting market share with absolute certainty is impossible, but by analyzing current trends and anticipating future developments, we can formulate reasonable projections.

The following analysis considers factors such as investment in R&D, strategic partnerships, and the overall market response to each vendor’s offerings.

So, I’ve been diving deep into the KLAS research on Epic, Oracle Health, and Meditech’s EHR market share – fascinating stuff! It really highlights the importance of accurate and readily accessible patient data. This is especially crucial when considering factors like age and pre-existing conditions, which, as outlined in this article on risk factors that make stroke more dangerous , significantly impact stroke severity and recovery.

Understanding these risks is key to effective healthcare management, a point further emphasized by the EHR market share data and its implications for patient care access.

Technological Advancements and Their Impact

Technological advancements will be a primary driver of market share shifts. The integration of AI and machine learning into EHR systems, for instance, will allow for more accurate diagnoses, personalized treatment plans, and predictive analytics. Vendors who successfully integrate these technologies and demonstrate clear ROI for healthcare providers will likely gain a competitive edge. For example, if Epic significantly enhances its AI-powered diagnostic tools and predictive modeling capabilities, it could attract more clients seeking to improve operational efficiency and patient outcomes.

Conversely, a failure to adapt to these advancements could lead to a loss of market share for other vendors. The race to develop and implement interoperable systems that seamlessly share data across different healthcare settings will also play a crucial role.

Regulatory Changes and Their Influence

Government regulations, such as those promoting interoperability and data privacy (like HIPAA and the ONC’s Cures Act), will continue to shape the EHR market. Vendors who demonstrate robust compliance and offer solutions that simplify adherence to these regulations will be better positioned for success. For example, if Oracle Cerner proactively invests in solutions that facilitate seamless data exchange between different systems and demonstrate strong compliance with data privacy regulations, it could attract clients seeking to avoid penalties and streamline their operations.

Conversely, vendors lagging in this area might face challenges in maintaining or growing their market share.

Predictions for Market Share in the Next Five Years

Based on current trends, a plausible scenario for market share distribution in five years could be: Epic maintaining its dominant position, but experiencing a slight decrease due to increased competition; Oracle Cerner showing moderate growth due to strategic acquisitions and technological improvements; and Meditech holding steady or experiencing a slight decline, as it focuses on its niche market. This assumes a continued emphasis on interoperability, AI integration, and regulatory compliance.

This prediction relies on the assumption that Epic’s current market dominance won’t be significantly disrupted, while Oracle Cerner and Meditech will experience growth based on their respective strategic investments.

Hypothetical Scenario: A Shift in Market Share

Imagine a scenario where a new, smaller EHR vendor emerges with a revolutionary cloud-based platform offering superior interoperability, AI-driven analytics, and a significantly lower cost of ownership. This disruptive entrant could capture a significant portion of the market, particularly among smaller healthcare providers seeking cost-effective and technologically advanced solutions. This would likely lead to a more fragmented market, with Epic’s market share declining more significantly than predicted above, while the new vendor and Oracle Cerner would see substantial growth.

The driving factors behind this shift would be the innovative technology offered by the new entrant, coupled with the growing pressure on healthcare providers to reduce costs and improve efficiency. This scenario illustrates the potential for disruptive innovation to reshape even established markets.

Closing Notes

The EHR market is a dynamic arena, constantly shaped by technological advancements, regulatory changes, and the ever-evolving needs of the healthcare industry. While Epic currently holds a significant lead, the competitive landscape is far from static. Oracle Cerner and Meditech are formidable players, each with unique strengths and strategies. Understanding their market positions, competitive approaches, and the implications for healthcare providers is crucial for navigating this complex ecosystem.

This analysis, powered by KLAS research, provides a snapshot of the current state of play, offering valuable insights for those seeking to understand the future of EHRs.

Questions and Answers

What are the limitations of KLAS Research data?

KLAS data relies on surveys and provider feedback, which can be subject to bias and may not fully represent the entire market. Sampling methods and survey design can also introduce limitations.

How often does KLAS update its market share data?

KLAS typically updates its market share data annually, but specific release dates vary. Check their website for the most current information.

Beyond market share, what other factors influence EHR adoption?

Factors like cost, integration capabilities, vendor support, and specific features tailored to a provider’s needs significantly influence EHR adoption decisions, beyond just market share.

What is the impact of EHR market concentration on innovation?

High market concentration could potentially stifle innovation as dominant vendors might have less incentive to rapidly develop and implement new features.