Gearing Up for Healthcares Next Normal

Gearing up for healthcares next normal – Gearing Up for Healthcare’s Next Normal: The pandemic irrevocably shifted the healthcare landscape. We’re no longer just talking about incremental changes; this is a complete overhaul. Telehealth is here to stay, AI is transforming diagnostics, and the very definition of “patient care” is being redefined. This isn’t just about adapting – it’s about embracing a future where technology, data, and a patient-centric approach are paramount.

Get ready for a deep dive into the exciting, challenging, and ultimately transformative next chapter of healthcare.

From the evolving roles of healthcare providers and the crucial need for robust data security to the financial implications of new technologies and the critical importance of addressing health inequities, we’ll explore the key trends and challenges shaping the future of healthcare. We’ll also look at how we can leverage innovation to create a more equitable, accessible, and sustainable system for everyone.

The Shifting Landscape of Healthcare Delivery

Source: outsourceaccelerator.com

The COVID-19 pandemic acted as a powerful catalyst, accelerating pre-existing trends and fundamentally reshaping the delivery of healthcare. The resulting changes are profound and far-reaching, impacting everything from patient access to the very technologies used to diagnose and treat illness. This new landscape is characterized by increased digitalization, a greater emphasis on preventative care, and the integration of cutting-edge technologies.

Telehealth’s Permanent Impact on Patient Access and Care

The rapid expansion of telehealth during the pandemic dramatically improved patient access to care, particularly for those in rural areas or with limited mobility. Virtual consultations, remote monitoring, and digital therapeutics became commonplace, offering convenience and reducing the need for in-person visits. This shift isn’t merely temporary; telehealth has become an integral part of many healthcare systems, offering a more flexible and efficient model of care delivery.

For example, chronic disease management programs utilizing remote patient monitoring have shown improved patient outcomes and reduced hospital readmissions. This allows for proactive intervention, leading to better health management and reduced healthcare costs in the long run.

The Influence of Emerging Technologies on Healthcare Services

Artificial intelligence (AI), machine learning (ML), and genomics are transforming healthcare at an unprecedented pace. AI algorithms are being used to analyze medical images, predict patient risks, and personalize treatment plans. Machine learning helps identify patterns in large datasets to improve diagnostic accuracy and optimize resource allocation. Genomics is enabling personalized medicine, allowing for targeted therapies based on an individual’s genetic makeup.

For instance, AI-powered diagnostic tools are already being used to detect cancerous lesions in mammograms with greater accuracy than human radiologists alone. Similarly, genomic testing is guiding treatment decisions for certain cancers, leading to more effective and less toxic therapies.

Pre-Pandemic vs. Post-Pandemic Healthcare Delivery Models

The differences between healthcare delivery before and after the pandemic are striking. The following table highlights some key distinctions:

| Feature | Pre-Pandemic | Post-Pandemic |

|---|---|---|

| Primary Care Access | Primarily in-person visits; limited virtual options | Increased use of telehealth; hybrid models combining in-person and virtual care |

| Specialty Care Access | Often required in-person visits and referrals; lengthy wait times | Greater use of telehealth for consultations and follow-ups; potential for faster access through virtual platforms |

| Data Management | Mostly paper-based records; limited data sharing | Increased use of electronic health records (EHRs); enhanced data sharing and interoperability |

| Technology Adoption | Gradual adoption of technology; limited integration of AI and ML | Rapid acceleration of technology adoption; increased use of AI, ML, and genomics in diagnostics and treatment |

The Evolving Role of the Healthcare Provider

The healthcare landscape is undergoing a dramatic transformation, demanding a fundamental shift in the roles and responsibilities of healthcare providers. No longer are clinicians simply diagnosticians and treatment providers; they are now expected to be navigators of complex systems, technology experts, and collaborative leaders, all while maintaining the highest standards of patient care. This evolution necessitates a reevaluation of required skillsets and a proactive approach to professional development.

Changing Skillsets and Responsibilities

The traditional model of healthcare, largely centered around in-person consultations and reactive treatments, is giving way to a more proactive, integrated, and technology-driven approach. Providers now need to be proficient in utilizing electronic health records (EHRs), telehealth platforms, and data analytics tools to enhance patient care and operational efficiency. Beyond technical skills, strong communication and interpersonal abilities are crucial for effective collaboration with patients, colleagues, and other stakeholders.

Furthermore, a deep understanding of population health management, preventive care, and patient advocacy is increasingly important. For example, a family physician might need to utilize telehealth to monitor a patient’s chronic condition remotely, analyze data from wearable sensors to adjust treatment plans, and coordinate care with specialists through a secure digital platform.

Adaptation to New Technologies and Patient Expectations

Healthcare providers are embracing various technologies to improve patient outcomes and streamline workflows. Telehealth has become ubiquitous, enabling remote consultations, monitoring, and even remote surgery. Artificial intelligence (AI) is being used for diagnostic support, predictive analytics, and personalized medicine. Wearable technology allows for continuous patient monitoring and proactive interventions. Patients, empowered by readily available online information, expect more personalized, convenient, and transparent care.

For instance, a cardiologist might use AI-powered diagnostic tools to analyze EKGs more efficiently, providing faster diagnoses and treatment plans. Or, an oncologist could leverage personalized genomics data to tailor cancer treatments to an individual patient’s unique genetic profile. These adaptations require providers to continuously update their knowledge and skills through ongoing professional development.

The Importance of Interprofessional Collaboration

Effective interprofessional collaboration is paramount in the new healthcare normal. The complexity of modern healthcare demands a team-based approach, where physicians, nurses, pharmacists, therapists, and other healthcare professionals work together seamlessly to provide holistic patient care. This requires effective communication, shared decision-making, and a mutual understanding of each profession’s roles and responsibilities. For example, a patient with diabetes might require coordinated care from a physician, a nurse educator, a dietitian, and a pharmacist to manage their condition effectively.

Breaking down professional silos and fostering a culture of collaboration are critical for optimizing patient outcomes and improving the overall efficiency of healthcare delivery.

A Training Program for Healthcare Professionals, Gearing up for healthcares next normal

A comprehensive training program designed to equip healthcare professionals for the evolving landscape should incorporate several key components. It should include modules on: (1) Proficient use of EHRs and other digital health technologies; (2) Telehealth best practices and patient communication strategies; (3) Data analytics and its application in healthcare; (4) Principles of population health management and preventive care; (5) Interprofessional collaboration and team-based care; (6) Ethical considerations in the use of technology and data; and (7) Strategies for managing patient expectations and fostering patient engagement.

Gearing up for healthcare’s next normal means embracing innovative solutions to persistent challenges. One major hurdle is the critical shortage of medical coders, a problem that’s cleverly addressed by the ai powered solution to the medical coding worker shortage. This technology promises streamlined workflows and improved efficiency, ultimately helping us build a more resilient and effective healthcare system for the future.

It’s just one piece of the puzzle, but a vital one as we navigate this evolving landscape.

The program should utilize a blended learning approach, incorporating online modules, hands-on workshops, and simulated clinical experiences to ensure practical application of the learned skills. Regular updates and continuing education opportunities are essential to keep pace with the rapidly evolving healthcare landscape. This program should be adaptable to various healthcare professions, recognizing the unique skillsets and responsibilities of each role.

For example, nurses might focus more intensely on telehealth patient monitoring, while physicians might concentrate on AI-assisted diagnostics.

Data Privacy and Security in a Digital Age

The increasing digitization of healthcare presents unprecedented opportunities for improved patient care and operational efficiency. However, this digital transformation also brings significant challenges, particularly concerning the privacy and security of sensitive patient data. The sheer volume of data generated, coupled with the interconnectedness of healthcare systems, creates a complex landscape where breaches can have devastating consequences for both individuals and organizations.

Robust data protection strategies are no longer optional; they are essential for maintaining patient trust and ensuring the ethical and responsible use of health information.

Major Data Privacy and Security Challenges Facing Healthcare Organizations

Healthcare organizations face a multitude of threats to data privacy and security. These include insider threats (malicious or negligent employees), external cyberattacks (ransomware, phishing), and vulnerabilities in legacy systems. The complexity of healthcare data, encompassing diverse formats and storage locations, further complicates security efforts. Compliance with evolving regulations, such as HIPAA in the US and GDPR in Europe, adds another layer of complexity.

The increasing use of cloud-based services and the Internet of Medical Things (IoMT) introduces new attack vectors and expands the potential attack surface. Finally, the growing sophistication of cybercriminals requires constant vigilance and adaptation. For example, a recent ransomware attack on a major hospital system resulted in the temporary shutdown of critical services and the loss of patient data, highlighting the real-world consequences of inadequate security measures.

Strategies for Ensuring Patient Data Confidentiality and Integrity in a Connected World

Protecting patient data requires a multi-faceted approach. This includes implementing robust access control measures, encrypting data both in transit and at rest, and regularly updating software and security protocols. Employing strong authentication mechanisms, such as multi-factor authentication, is crucial for preventing unauthorized access. Regular security audits and penetration testing can identify vulnerabilities before they are exploited. Furthermore, comprehensive employee training programs are essential to raise awareness of security threats and best practices.

A robust incident response plan is also vital to minimize the impact of any data breaches. Finally, fostering a culture of security within the organization is paramount, ensuring that data protection is a top priority at all levels.

Comparison of Data Security Protocols and Their Effectiveness

Several data security protocols exist, each with varying levels of effectiveness. For example, Transport Layer Security (TLS) and Secure Sockets Layer (SSL) are widely used protocols for encrypting data transmitted over networks. However, their effectiveness depends on the implementation and the strength of the encryption keys. Virtual Private Networks (VPNs) create secure connections between devices and networks, protecting data from interception.

Data Loss Prevention (DLP) tools monitor and prevent sensitive data from leaving the organization’s control. The effectiveness of these protocols varies depending on the specific threat landscape and the organization’s overall security posture. A layered security approach, combining multiple protocols, is generally recommended to achieve comprehensive protection. For instance, a hospital might use TLS to encrypt data transmitted between its servers and a cloud-based storage provider, while simultaneously employing DLP tools to prevent unauthorized downloads of patient records.

Gearing up for healthcare’s next normal means embracing innovation, and that includes exploring groundbreaking solutions like xenotransplantation. The recent news that the FDA approved clinical trials for pig kidney transplants in humans, as reported by this article , is a huge step forward. This kind of advancement highlights how we’re pushing boundaries to improve patient care and redefine what’s possible in the future of healthcare.

Best Practices for Protecting Sensitive Patient Information

A comprehensive approach to data security necessitates a set of best practices. These include: regular security awareness training for all staff; implementing strong password policies and multi-factor authentication; encrypting all sensitive data, both in transit and at rest; conducting regular security audits and penetration testing; establishing a robust incident response plan; and maintaining up-to-date software and security patches. Adherence to relevant regulations, such as HIPAA and GDPR, is also crucial.

Furthermore, organizations should invest in robust security information and event management (SIEM) systems to monitor for suspicious activity and promptly detect and respond to security incidents. Finally, establishing clear data governance policies and procedures can help ensure that data is handled responsibly and ethically throughout its lifecycle.

The Future of Healthcare Finance and Sustainability

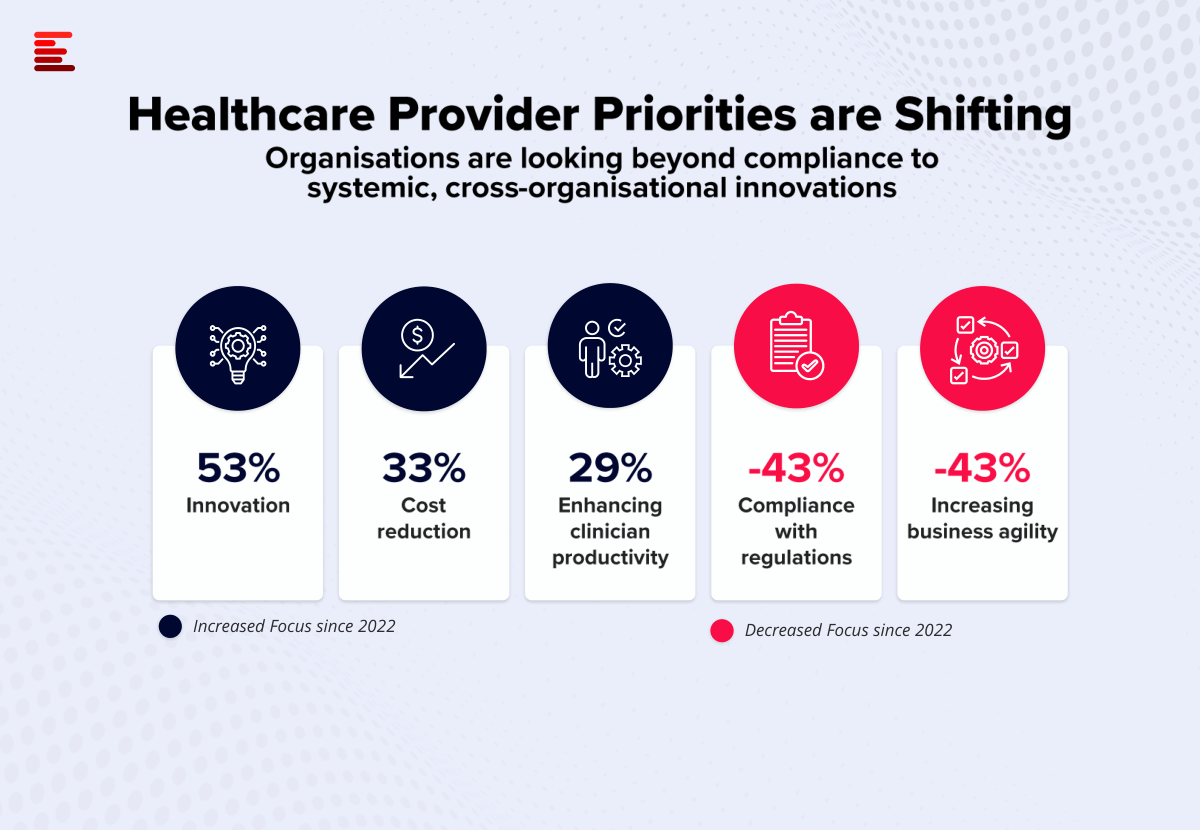

Source: ecosystm.io

The healthcare industry stands at a crossroads. Rising costs, aging populations, and the rapid advancement of technology are forcing a fundamental re-evaluation of how we finance and deliver care. Sustainability isn’t just a buzzword; it’s a necessity for ensuring accessible, high-quality healthcare for all. This section explores the financial implications of this transformation and the innovative models emerging to address the challenges.

Financial Implications of Technological Adoption and New Care Models

Implementing new technologies, such as telehealth, AI-driven diagnostics, and robotic surgery, requires significant upfront investment. Hospitals and clinics must factor in the costs of purchasing equipment, training staff, and integrating new systems into existing workflows. While these technologies offer the potential for long-term cost savings through increased efficiency and improved outcomes, the initial outlay can be substantial. For example, the implementation of a comprehensive electronic health record (EHR) system can cost millions of dollars, requiring significant upfront capital expenditure and ongoing maintenance costs.

Similarly, adopting value-based care models necessitates changes in operational structures and reimbursement mechanisms, potentially impacting short-term revenue streams before realizing long-term benefits. The transition period can be challenging financially, requiring careful planning and strategic investment.

The Role of Value-Based Care in Promoting Healthcare System Sustainability

Value-based care (VBC) shifts the focus from volume to value, rewarding providers for delivering high-quality care that improves patient outcomes. Instead of simply reimbursing for the number of services provided, VBC models incentivize providers to manage patient populations effectively, preventing hospital readmissions and improving overall health. This approach reduces unnecessary spending on costly hospitalizations and interventions. For example, a VBC program might reward a provider for successfully managing a patient with chronic heart failure, keeping them out of the hospital through proactive care and regular monitoring.

By aligning financial incentives with positive patient outcomes, VBC promotes a more sustainable and efficient healthcare system. The long-term cost savings associated with reduced hospitalizations and improved patient health significantly outweigh the initial investment in implementing VBC programs.

Innovative Financing Models Supporting Access to Quality Care

Several innovative financing models are emerging to improve access to quality care while controlling costs. These include:

- Pay-for-performance (P4P) programs: These programs incentivize providers to meet specific quality metrics, rewarding them for achieving better patient outcomes.

- Bundled payments: Providers receive a single payment for a comprehensive episode of care, encouraging coordination and efficiency.

- Accountable care organizations (ACOs): ACOs are networks of providers who collaborate to coordinate care for a defined population, sharing in the financial rewards and risks.

- Telehealth reimbursement models: Expanding reimbursement for telehealth services makes care more accessible and affordable, especially in rural or underserved areas.

These models, while diverse, share a common goal: to improve the efficiency and effectiveness of healthcare delivery while ensuring financial sustainability. Successful implementation often requires a collaborative approach between providers, payers, and policymakers.

The Financial Impact of Telehealth on Healthcare Systems

A visual representation could be a bar graph comparing the costs of traditional in-person care versus telehealth for various common healthcare services.

The graph would show two bars for each service (e.g., routine check-up, specialist consultation, follow-up appointment): one representing the total cost of in-person care (including travel, waiting time, facility fees, and provider fees) and another representing the cost of telehealth care (including technology fees and provider fees). The graph should clearly demonstrate the potential cost savings associated with telehealth for various scenarios, particularly for patients in rural areas or those with limited mobility.

For example, a routine check-up might cost $200 in-person (including travel and waiting time) but only $50 via telehealth. The visual would highlight the potential for significant cost savings across the healthcare system while simultaneously increasing access to care. Further data points could include potential savings in hospital readmission rates due to increased patient engagement facilitated by telehealth.

This would reinforce the financial benefits of telehealth beyond individual patient costs.

Patient Engagement and Empowerment: Gearing Up For Healthcares Next Normal

The healthcare landscape is shifting dramatically, placing patients at the center of their own care. This requires a fundamental change in how we approach healthcare delivery, moving away from a paternalistic model towards one that prioritizes patient engagement and empowerment. Active patient participation leads to better health outcomes, increased adherence to treatment plans, and a more satisfying healthcare experience for everyone involved.Patient engagement isn’t just about passively receiving care; it’s about actively participating in decisions about one’s health.

This includes understanding one’s condition, exploring treatment options, and collaboratively developing a care plan with healthcare providers. Empowerment, on the other hand, equips patients with the knowledge and tools to manage their health effectively, leading to improved self-management and a greater sense of control over their well-being.

Strategies for Improving Patient Engagement and Promoting Shared Decision-Making

Effective patient engagement hinges on fostering open communication and collaboration. Strategies include providing patients with easily understandable information about their condition, treatment options, and potential risks and benefits. This information should be presented in a clear, concise, and accessible format, tailored to the patient’s individual health literacy level. Active listening, empathy, and respect for patient preferences are crucial elements of shared decision-making.

Regular follow-up appointments, opportunities for questions, and a non-judgmental environment encourage patient participation and build trust. For example, a patient with diabetes might actively participate in setting glucose targets, choosing their preferred method of monitoring, and adjusting their diet and exercise regimen in collaboration with their doctor and a registered dietitian.

The Role of Digital Tools in Patient Empowerment

Digital tools offer powerful avenues for patient empowerment. Patient portals, for instance, allow patients to access their medical records, schedule appointments, communicate with their healthcare providers, and receive reminders for medications and follow-up appointments. Telehealth platforms facilitate remote consultations and monitoring, particularly beneficial for patients in rural areas or those with mobility challenges. Mobile health (mHealth) apps provide personalized health information, track health metrics, and offer support for specific conditions.

For example, an app could track a patient’s blood pressure, send alerts if it rises above a certain threshold, and provide educational materials about hypertension management. Wearable devices, such as smartwatches and fitness trackers, can collect data on activity levels, sleep patterns, and heart rate, offering valuable insights into overall health and facilitating proactive management.

The Importance of Patient Education and Health Literacy

Effective patient education is paramount in the new normal of healthcare. Health literacy, the ability to understand and use health information, is crucial for patients to make informed decisions about their care. Patients with low health literacy may struggle to understand medical instructions, leading to poor adherence to treatment plans and suboptimal health outcomes. Healthcare providers should strive to use plain language, avoid medical jargon, and employ visual aids to improve understanding.

Providing educational materials in various formats, such as brochures, videos, and interactive online modules, caters to different learning styles and preferences. For example, a patient with asthma might benefit from a video explaining how to use an inhaler correctly, coupled with a written instruction sheet using simple language.

Designing a Patient Portal that Fosters Effective Communication and Collaboration

A well-designed patient portal serves as a central hub for communication and collaboration between patients and healthcare providers. Key features include secure messaging, allowing patients to ask questions and receive timely responses from their care team. Access to medical records, including test results, lab reports, and medication lists, empowers patients to monitor their health proactively. Appointment scheduling and reminders reduce missed appointments and improve care coordination.

Educational resources, tailored to the patient’s specific condition, enhance health literacy and promote self-management. The portal’s interface should be user-friendly and intuitive, with clear navigation and easy-to-understand information. The design should also prioritize data privacy and security, ensuring patient confidentiality. For example, a patient portal might integrate with a medication management app, allowing for seamless tracking of prescriptions and refills.

Addressing Health Inequities and Access to Care

The post-pandemic world has starkly revealed the persistent and deeply rooted health inequities within our healthcare systems. While the pandemic impacted everyone, its effects were felt disproportionately by marginalized communities, exacerbating existing disparities in access to quality care and health outcomes. Addressing these inequities is not merely a matter of social justice; it’s crucial for building a resilient and equitable healthcare system for all.

Persistent Disparities in Healthcare Access and Outcomes

The pandemic highlighted existing disparities along racial, ethnic, socioeconomic, and geographic lines. For example, minority populations experienced higher rates of infection, hospitalization, and mortality from COVID-19, often linked to factors like underlying health conditions stemming from limited access to preventative care and healthy living environments. Rural communities faced challenges accessing timely testing and treatment due to limited healthcare infrastructure and provider shortages.

Socioeconomic disparities played a significant role, with lower-income individuals facing barriers like lack of health insurance, transportation difficulties, and inability to take time off work for appointments. These disparities aren’t new; they are long-standing issues that have been amplified by the pandemic. Data from the CDC and other reputable health organizations consistently show these trends.

Gearing up for healthcare’s next normal means embracing innovative diagnostic tools. One fascinating development is the potential for early dementia detection; research explores whether a simple eye test, as discussed in this insightful article can eye test detect dementia risk in older adults , could revolutionize preventative care. This highlights the exciting possibilities of proactive healthcare strategies as we move forward.

Solutions for Addressing Social Determinants of Health

Addressing health inequities requires a multi-pronged approach that tackles the social determinants of health – the conditions in which people are born, live, work, and age. This includes focusing on improving access to affordable housing, nutritious food, safe neighborhoods, quality education, and well-paying jobs. Investing in community-based health programs that address these factors can significantly improve health outcomes.

For instance, initiatives that provide transportation assistance to medical appointments, food security programs, and educational resources on health literacy can empower individuals and communities to take control of their health. Furthermore, culturally competent healthcare services are crucial to ensuring trust and effective communication between providers and patients from diverse backgrounds.

Innovative Approaches to Expand Access to Quality Care

Innovative approaches are essential to reach underserved populations. Telehealth has emerged as a powerful tool, enabling remote consultations and monitoring, particularly beneficial for rural and underserved communities. Mobile health clinics can bring healthcare directly to those who lack transportation or have limited access to facilities. Community health workers, who are often members of the communities they serve, can act as vital bridges between healthcare providers and patients, building trust and addressing cultural barriers.

Furthermore, investing in the training and recruitment of healthcare professionals from underrepresented groups can help create a more culturally competent and equitable workforce. The success of these approaches hinges on strong partnerships between healthcare organizations, community leaders, and government agencies.

Improving Healthcare Access for Rural or Remote Communities

A strategic plan to improve healthcare access in rural and remote areas requires a comprehensive approach:

- Invest in telehealth infrastructure: Expand high-speed internet access and provide telehealth equipment to rural clinics and homes.

- Recruit and retain healthcare professionals: Offer incentives such as loan forgiveness programs, scholarships, and improved compensation packages to attract healthcare providers to rural areas.

- Develop mobile health units: Establish mobile clinics that can travel to remote communities, providing essential services like preventative care, screenings, and basic medical treatment.

- Support community health worker programs: Train and employ local residents as community health workers to provide health education, outreach, and support to their communities.

- Strengthen partnerships with local organizations: Collaborate with community leaders, schools, and faith-based organizations to reach individuals and families in remote areas.

Last Recap

Source: dbmci.com

The future of healthcare is undeniably digital, data-driven, and patient-focused. Navigating this “next normal” requires a proactive approach, embracing innovation while prioritizing ethical considerations and equitable access. The journey won’t be without its challenges, but by understanding the key trends and adapting strategically, we can build a healthcare system that’s not only more efficient and technologically advanced, but also more compassionate and effective in serving the needs of all.

Commonly Asked Questions

What are the biggest challenges in implementing telehealth effectively?

Biggest challenges include ensuring digital literacy among patients, addressing technological disparities, maintaining patient privacy and data security, and integrating telehealth seamlessly into existing workflows.

How can healthcare providers upskill for the next normal?

Providers need continuous professional development focusing on digital health literacy, data analytics, patient engagement strategies, and collaborative care models. Online courses, workshops, and certifications can be invaluable.

What role does patient empowerment play in this new era?

Empowered patients are active participants in their care, leading to better health outcomes. This involves providing them with accessible information, digital tools for self-management, and opportunities for shared decision-making.