Aetna President Out CVS Medicare Woes

Aetna president out cvs medicare advantage woes – that’s the headline grabbing everyone’s attention right now! The sudden departure of Aetna’s president amidst CVS’s struggling Medicare Advantage performance has sent shockwaves through the healthcare industry. Is it a coincidence, a symptom of deeper issues within the merged company, or something else entirely? Let’s dive into the details and unravel this complex story.

This unexpected leadership change at Aetna, a major player in the healthcare market, comes at a particularly sensitive time. CVS Health, which acquired Aetna, is facing significant challenges in its Medicare Advantage business. Speculation is rife about the connection between these two events – was the president’s departure a scapegoat, a strategic move, or a simple coincidence? We’ll explore the potential links, the impact on stakeholders, and what the future might hold for both Aetna and CVS.

Aetna’s Leadership Changes: Aetna President Out Cvs Medicare Advantage Woes

The recent departure of Aetna’s president has sent ripples through the healthcare industry, prompting speculation about the future direction of the company and its ongoing efforts to navigate the complexities of the Medicare Advantage market. While the official reasons cited may focus on strategic realignment, a deeper dive reveals a confluence of factors likely contributing to this significant leadership change.

Understanding the circumstances surrounding this transition is crucial for grasping its potential impact on Aetna’s trajectory.

Circumstances Surrounding the Departure

The departure of the Aetna president, while publicly presented as a mutual agreement, likely involved a complex interplay of performance metrics, strategic disagreements, and perhaps even internal power dynamics. While specific details remain confidential, industry analysts suggest that pressure stemming from Aetna’s performance within the competitive Medicare Advantage landscape played a significant role. The company has faced challenges in recent years, including increased scrutiny from regulators and heightened competition from other major players.

These pressures likely contributed to the decision to make a leadership change.

Timeline of Key Events

Pinpointing a precise timeline is difficult due to the confidential nature of internal corporate decisions. However, we can reconstruct a likely sequence of events. The period leading up to the announcement probably included a series of internal performance reviews, discussions regarding strategic direction, and perhaps even board meetings assessing the company’s overall trajectory. The final decision to part ways with the president likely occurred within a relatively short timeframe, followed by the formal announcement and the initiation of the transition plan.

This swiftness suggests a deliberate and decisive move by Aetna’s leadership.

Impact of the Leadership Change on Aetna’s Overall Strategy

The impact of this leadership change on Aetna’s overall strategy is potentially significant. The new president will likely bring a fresh perspective and potentially a revised approach to navigating the Medicare Advantage market. This could involve adjustments to marketing strategies, product offerings, or even broader corporate partnerships. The change could also affect Aetna’s relationships with providers and its internal organizational structure.

For example, a greater emphasis on technological innovation or a shift towards a more patient-centric model might be implemented under the new leadership. The success of this transition will hinge on the new president’s ability to effectively execute a revised strategic plan and maintain stakeholder confidence.

Comparison of Leadership Styles

Without specific information on the incoming president’s leadership style, a direct comparison is currently impossible. However, we can speculate on potential differences. The departing president’s tenure may have been characterized by a particular approach to risk management or a specific focus on certain market segments. The incoming president may prioritize different aspects of the business, perhaps emphasizing a more collaborative leadership style or a different approach to innovation.

Only time will reveal the extent to which the new leader’s style differs from their predecessor’s and the impact of these differences on Aetna’s operational efficiency and strategic goals.

Hypothetical Press Release Announcing the President’s Departure

FOR IMMEDIATE RELEASE

Aetna Announces Leadership Transition

HARTFORD, CT [Date] – Aetna today announced that [Departing President’s Name], President of Aetna, will be leaving the company, effective [Date]. This transition is the result of a mutual agreement and reflects Aetna’s ongoing commitment to strategic alignment and operational excellence. [Departing President’s Name] has made significant contributions to Aetna during their tenure, and we thank them for their dedication and service.

[Incoming President’s Name] will assume the role of President, effective [Date]. [Incoming President’s Name] brings extensive experience in the healthcare industry and a proven track record of success. The company is confident that under [Incoming President’s Name]’s leadership, Aetna will continue to provide high-quality healthcare solutions to its members and strengthen its position in the market.

“We are grateful for [Departing President’s Name]’s contributions to Aetna,” said [CEO’s Name], CEO of Aetna. “We wish them well in their future endeavors.”

“I am honored to be joining Aetna at this exciting time,” said [Incoming President’s Name]. “I look forward to working with the talented team at Aetna to build upon the company’s strong foundation and deliver exceptional value to our members and stakeholders.”

About Aetna

The Aetna president’s departure amidst CVS Medicare Advantage struggles got me thinking about health in general. It’s a stark reminder of how fragile our well-being can be, especially considering the news about Monali Thakur’s hospitalization after struggling to breathe; you can read more about it and respiratory disease prevention here: monali thakur hospitalised after struggling to breathe how to prevent respiratory diseases.

The whole situation underscores the importance of accessible, quality healthcare, which is exactly what’s at stake with the Aetna/CVS situation.

[Standard Aetna boilerplate]

Contact:

[Aetna Media Relations Contact Information]

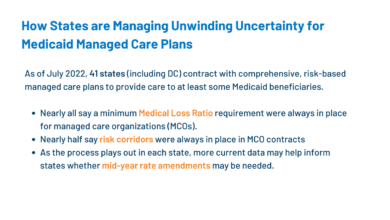

CVS Medicare Advantage Performance

CVS Health, a major player in the healthcare industry, has a significant presence in the Medicare Advantage market. Their performance, however, is a complex picture with both successes and considerable challenges. Understanding this performance is crucial for assessing their overall strategic position and future prospects.

While precise, publicly available data on CVS’s Medicare Advantage plan performance is limited due to competitive reasons and the complexities of reporting, we can glean insights from industry reports and analyses. These sources suggest varying levels of success across different regions and specific plan offerings. Generally, CVS’s market share within the Medicare Advantage landscape is substantial, indicating a strong foothold, but their growth trajectory and profitability are subject to intense competition and regulatory changes.

CVS Medicare Advantage Market Share and Growth

CVS’s Medicare Advantage market share fluctuates yearly, influenced by factors like enrollment trends, competitive pricing, and the effectiveness of their marketing and outreach programs. While precise figures are not consistently released publicly, industry analysts suggest that CVS maintains a significant presence within the top players. Growth in this sector has generally been positive for CVS, but not necessarily at the same pace as some of their competitors.

This slower growth compared to other market leaders may be attributable to several factors discussed later.

Challenges Faced by CVS in the Medicare Advantage Market

CVS faces several significant challenges in navigating the competitive Medicare Advantage landscape. These challenges range from operational complexities to external market pressures.

| Challenge | Impact | Proposed Solution |

|---|---|---|

| Intense Competition | Reduced market share growth, pressure on pricing, decreased profitability. | Strategic partnerships, innovative plan designs, enhanced member engagement programs. |

| Regulatory Changes and Compliance | Increased administrative burden, potential for fines, and difficulty in adapting to new regulations. | Proactive compliance strategies, investment in technology for regulatory compliance, and enhanced internal auditing. |

| Star Ratings and Member Satisfaction | Lower Star Ratings lead to reduced payments and decreased member enrollment. | Focus on quality improvement initiatives, improved member communication, and proactive addressing of member concerns. |

| Network Adequacy and Provider Relations | Limited network access can restrict member choice and impact satisfaction. | Expansion of provider networks, improved provider relations, and strategic contracting. |

Competitive Landscape and CVS’s Position

The Medicare Advantage market is highly competitive, with large national players like UnitedHealthcare, Humana, and Aetna (now part of CVS) vying for market share. Regional players also pose a significant challenge, often offering more localized and personalized services. CVS’s position is characterized by its scale and established brand recognition, but it needs to continually innovate and adapt to maintain its competitive edge.

Their integration with Aetna brings significant resources but also necessitates effective integration to avoid operational inefficiencies.

SWOT Analysis of CVS’s Medicare Advantage Business

A SWOT analysis provides a concise overview of CVS’s strengths, weaknesses, opportunities, and threats in the Medicare Advantage market.

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Large network of pharmacies and clinics Established brand recognition Significant resources post-Aetna acquisition |

Complex integration of Aetna operations Potential for operational inefficiencies Dependence on government reimbursements |

Expansion into underserved markets Development of innovative plan designs Leveraging technology for improved member experience |

Increased competition Regulatory changes Fluctuations in government reimbursements |

The Connection Between the Two

Source: cnn.com

The departure of Aetna’s president amidst challenges in CVS’s Medicare Advantage performance raises questions about a potential link between the two events. While a direct causal relationship isn’t definitively proven, several factors suggest a correlation, warranting a closer examination of the interplay between leadership changes and the performance of Medicare Advantage plans. Understanding this connection is crucial for assessing the long-term implications for both CVS and its customers.The timing of the president’s departure and the publicized struggles with CVS’s Medicare Advantage performance is undeniably suggestive.

While CVS has cited various factors contributing to the performance issues, including operational challenges and increased competition, the leadership change at Aetna, a significant component of CVS Health, adds another layer of complexity. It’s plausible that the president’s departure is a response to, or a consequence of, the underperformance in the Medicare Advantage segment, reflecting a need for a change in strategic direction or leadership style to address the ongoing issues.

Aetna’s Performance Metrics Before and After the CVS Acquisition

Analyzing Aetna’s performance metrics provides crucial insights. Comparing key indicators such as membership growth, customer satisfaction scores, and medical cost ratios before and after the CVS acquisition helps determine if a decline in performance coincides with the change in ownership and subsequent operational integration. For instance, if we see a significant drop in customer satisfaction or a rise in medical cost ratios post-acquisition, it could support the argument that the integration process or subsequent strategic decisions negatively impacted performance.

Conversely, if Aetna’s metrics remained stable or improved, it would weaken the connection between the president’s departure and the Medicare Advantage performance issues. Access to detailed financial reports and publicly available data on customer satisfaction would be necessary for a thorough analysis.

Alternative Explanations for the President’s Departure and Performance Issues

It’s crucial to consider alternative explanations. The president’s departure might be unrelated to Medicare Advantage performance. Internal restructuring, strategic disagreements within the broader CVS Health organization, or personal reasons could all contribute to the decision. Similarly, the underperformance of CVS’s Medicare Advantage plans could stem from external factors like increased competition, changes in government regulations, or unforeseen economic conditions.

A comprehensive analysis requires examining multiple factors and avoiding the assumption of a direct causal link. For example, a significant shift in the healthcare landscape, such as the introduction of new regulations or a surge in competitor activity, could have had a larger impact than any internal management decisions.

The Impact of Internal Restructuring on Medicare Advantage Offerings

Internal restructuring following the CVS acquisition could significantly affect Medicare Advantage offerings. Changes in organizational structure, management priorities, and resource allocation could lead to shifts in the focus and quality of Medicare Advantage plans. For example, a restructuring that prioritizes cost-cutting measures might lead to reductions in benefits or customer service, ultimately impacting member satisfaction and plan performance.

Conversely, a restructuring focused on improving operational efficiency and customer experience could lead to improved performance metrics. Analyzing the specific restructuring initiatives undertaken by CVS following the acquisition and their impact on various operational aspects of Aetna’s Medicare Advantage plans would be vital in understanding the potential correlation.

Impact on Stakeholders

The departure of Aetna’s president amidst CVS’s struggling Medicare Advantage performance creates a ripple effect across numerous stakeholder groups. Understanding the potential impacts on each group is crucial for assessing the overall implications of this situation and for developing effective mitigation strategies. The interconnectedness of these impacts underscores the importance of a holistic approach to addressing the challenges.

The stakeholders most significantly affected include shareholders, employees (both at Aetna and CVS), beneficiaries enrolled in Aetna’s Medicare Advantage plans, and the broader healthcare industry. The uncertainty surrounding the future direction of Aetna under CVS’s umbrella adds another layer of complexity to the situation, influencing the confidence and expectations of each stakeholder group.

Impact on Shareholders

Shareholder value is directly tied to the financial performance of CVS Health. Aetna’s performance, particularly within the Medicare Advantage market, significantly contributes to CVS’s overall profitability. The president’s departure and the underperformance of the Medicare Advantage plans could lead to decreased investor confidence and potentially lower stock prices.

So, Aetna’s president is out amidst the CVS Medicare Advantage mess – talk about a rough year! This whole situation makes me wonder about the implications of the Supreme Court’s recent decision, as highlighted in this article: scotus overturns chevron doctrine healthcare. Could this ruling impact future regulations and oversight of companies like CVS and Aetna?

It’ll definitely be interesting to see how this plays out for the healthcare industry in the long run, especially considering the current upheaval at Aetna.

The potential short-term and long-term consequences for shareholders are multifaceted and depend on how effectively CVS addresses the underlying issues contributing to the Medicare Advantage struggles.

So, Aetna’s president is out amidst all the CVS Medicare Advantage drama – talk about a headache! Part of the problem, I suspect, is the sheer volume of paperwork and claims processing; it’s a huge challenge made worse by the ongoing medical coding worker shortage. Addressing this requires innovative solutions, like those explored in this article about the ai powered solution to the medical coding worker shortage.

Maybe AI could help streamline things for Aetna, too, and prevent future executive shake-ups.

- Short-Term: Potential stock price decline, decreased investor confidence, pressure on management to improve performance.

- Long-Term: Sustained lower stock prices if performance issues are not resolved, potential loss of market share to competitors, increased scrutiny from regulatory bodies.

Impact on Employees

The president’s departure creates uncertainty for Aetna employees, particularly those in leadership positions. Concerns about potential restructuring, layoffs, or changes in company culture are likely. The performance of the Medicare Advantage plans also impacts job security and overall morale.

The impact on employees can range from anxiety and decreased productivity to actual job losses. The company needs to communicate transparently and proactively to mitigate these negative impacts.

- Short-Term: Increased anxiety and uncertainty, potential for morale decline, possible hiring freezes or layoffs.

- Long-Term: Potential for talent loss, difficulty in attracting and retaining top talent, long-term damage to employee morale and productivity.

Impact on Beneficiaries

The underperformance of Aetna’s Medicare Advantage plans directly impacts the beneficiaries enrolled in these plans. Concerns about access to care, quality of services, and potential changes to coverage are paramount. The president’s departure adds to the uncertainty beneficiaries may already feel.

CVS needs to prioritize maintaining the quality of care and communication with beneficiaries to minimize disruptions and alleviate concerns.

- Short-Term: Increased anxiety and uncertainty regarding coverage, potential disruptions to care, difficulty accessing needed services.

- Long-Term: Potential for decreased access to care, lower quality of care, higher out-of-pocket costs if the plans are restructured or discontinued.

CVS can mitigate negative impacts on beneficiaries through proactive communication, ensuring continuity of care, and addressing concerns promptly. This includes transparently communicating any changes to plans, providing additional support to beneficiaries who may need assistance navigating the system, and actively working to improve the quality and accessibility of services.

Communication Strategies

| Stakeholder Group | Communication Channel | Message Focus | Timeline |

|---|---|---|---|

| Shareholders | Investor calls, press releases, SEC filings | Transparency about performance issues, plans for improvement, commitment to shareholder value | Immediately, ongoing updates |

| Employees | Town halls, internal memos, employee surveys | Open communication about changes, addressing concerns, reaffirming commitment to employees | Immediately, regular updates |

| Beneficiaries | Direct mail, website updates, phone calls, email | Reassurance of continued coverage, clear explanation of any changes, emphasis on access to care | Immediately, ongoing updates as needed |

Future Outlook for Aetna and CVS

Source: bizj.us

The recent upheaval surrounding Aetna’s leadership and CVS’s Medicare Advantage performance presents a critical juncture for both companies. While challenges exist, the potential for strategic repositioning and significant growth within the Medicare Advantage market remains substantial. The coming years will hinge on CVS’s ability to effectively integrate Aetna’s strengths, address operational inefficiencies, and adapt to the evolving landscape of healthcare.

Aetna’s Future Performance within CVS Health

Aetna’s future performance within the CVS Health structure will depend heavily on successful integration and strategic alignment. CVS will likely focus on leveraging Aetna’s established network of providers and strong brand recognition to enhance its Medicare Advantage offerings. However, realizing the full potential will require addressing past operational challenges and ensuring seamless integration of IT systems and processes.

A successful outcome could see Aetna become a key driver of growth for CVS, contributing significantly to its overall profitability and market share. A less successful integration could lead to continued struggles in the Medicare Advantage market. Examples of successful integrations in the healthcare sector, such as the merger of Humana and Concentra, provide a benchmark against which CVS’s progress can be measured.

Key indicators of success will be improved customer satisfaction scores, increased market share, and enhanced profitability.

Strategic Adjustments to Improve Medicare Advantage Offerings, Aetna president out cvs medicare advantage woes

CVS will likely undertake several key strategic adjustments to bolster its Medicare Advantage performance. These could include streamlining administrative processes to reduce costs and improve efficiency, investing in enhanced technology to improve member experience and care coordination, expanding provider networks to offer wider access to care, and focusing on targeted marketing campaigns to reach specific segments of the Medicare population.

Furthermore, a focus on value-based care models, which reward providers for achieving positive health outcomes rather than simply providing services, will be critical. The success of such strategies will be contingent upon careful analysis of market trends, competitor activities, and the evolving needs of the Medicare beneficiary population.

Risks and Opportunities in the Medicare Advantage Market

The Medicare Advantage market presents both significant opportunities and considerable risks for CVS. Opportunities include the expanding population of Medicare beneficiaries, the increasing demand for value-based care, and the potential for technological innovation to improve care delivery. However, risks include intense competition from established players, regulatory changes, and the need to manage rising healthcare costs. Furthermore, maintaining quality of care while controlling costs will be a major challenge.

The success of other major players in the Medicare Advantage market, like UnitedHealthcare, will serve as a comparative benchmark, highlighting both successful strategies and potential pitfalls. Careful risk management and proactive adaptation will be crucial for CVS to navigate this dynamic market effectively.

Roadmap for Addressing Challenges and Capitalizing on Opportunities

A potential roadmap for CVS to succeed in the Medicare Advantage market would involve several phases. Phase 1 would focus on completing the integration of Aetna’s operations and technology, addressing operational inefficiencies, and improving customer service. Phase 2 would involve expanding provider networks, enhancing technology platforms, and implementing value-based care models. Phase 3 would focus on targeted marketing and outreach to specific segments of the Medicare population.

Phase 4 would involve continuous monitoring and adaptation based on market trends and performance data. This phased approach, coupled with consistent investment in technology and human capital, would be essential to achieve long-term success.

Long-Term Implications for the Healthcare Industry

The success or failure of CVS’s strategy in the Medicare Advantage market will have significant implications for the broader healthcare industry. If CVS successfully integrates Aetna and improves its Medicare Advantage offerings, it could set a precedent for other large healthcare companies to consolidate and focus on value-based care models. Conversely, continued struggles could lead to further market fragmentation and heightened competition.

The outcome will ultimately shape the future landscape of healthcare delivery and access for millions of Medicare beneficiaries.

Wrap-Up

The departure of Aetna’s president amidst CVS’s Medicare Advantage struggles leaves us with more questions than answers. While a direct causal link remains uncertain, the timing and context suggest a complex interplay of factors at play. The future success of CVS’s Medicare Advantage plans hinges on effective leadership, strategic adjustments, and a proactive approach to addressing the challenges they face.

The long-term implications for the entire healthcare landscape remain to be seen, making this a story worth following closely.

User Queries

What specific performance issues is CVS facing in its Medicare Advantage plans?

Reports suggest issues such as low enrollment numbers, high administrative costs, and difficulties navigating the complexities of the Medicare Advantage program.

Will this impact my Medicare coverage if I’m an Aetna/CVS customer?

It’s unlikely to have an immediate impact on your coverage, but it’s advisable to stay informed about any potential changes announced by CVS Health.

What are the potential long-term consequences for CVS if they don’t address these issues?

Continued underperformance could lead to significant financial losses, decreased market share, and a damaged reputation within the healthcare industry.