Guillain-Barré Syndrome Paralysis, Causes, and Recovery

Connection between guillain barre syndrome and paralysis causes and recovery – Guillain-Barré Syndrome: Paralysis, Causes, and Recovery – it sounds scary, right? And it can be. This autoimmune disorder attacks the nervous system, leading to potentially debilitating paralysis. But understanding the connection between GBS and paralysis, its causes, and the path to recovery is crucial for anyone affected or simply wanting to learn more about this often-misunderstood condition.

We’ll delve into the complexities of GBS, exploring its various subtypes, the mechanisms behind paralysis, and the hope offered by modern treatments and rehabilitation.

This post aims to shed light on the journey from diagnosis to recovery, covering everything from the initial symptoms and diagnostic tests to the long-term management of GBS. We’ll look at the various triggers that can initiate this condition, the different levels of paralysis experienced by patients, and the vital role of physical therapy and other rehabilitative approaches in regaining strength and function.

We’ll even touch upon the emotional aspects of living with GBS and the support systems available to those affected.

Guillain-Barré Syndrome (GBS) Overview

Guillain-Barré syndrome (GBS) is a rare but serious autoimmune disorder in which the body’s immune system mistakenly attacks part of the peripheral nervous system. This attack leads to inflammation that damages the myelin sheath—the protective covering around the nerves—and can even affect the nerves themselves. The resulting damage disrupts communication between the brain and the body, causing various neurological symptoms.

Understanding the autoimmune nature of GBS, its subtypes, and typical progression is crucial for effective diagnosis and management.GBS is characterized by its autoimmune nature. The immune system, designed to protect against foreign invaders, malfunctions and begins attacking the body’s own tissues. In GBS, this misguided attack targets the myelin sheath and the axons (the long fibers that transmit nerve signals) of peripheral nerves.

This process of demyelination and axonal damage disrupts nerve impulses, leading to the wide range of symptoms experienced by patients. The exact trigger for this autoimmune response remains unclear, though it’s often linked to preceding infections, such as Campylobacter jejuni bacteria, cytomegalovirus, or Epstein-Barr virus. Some individuals may also have a genetic predisposition that increases their susceptibility.

GBS Subtypes and Associated Symptoms

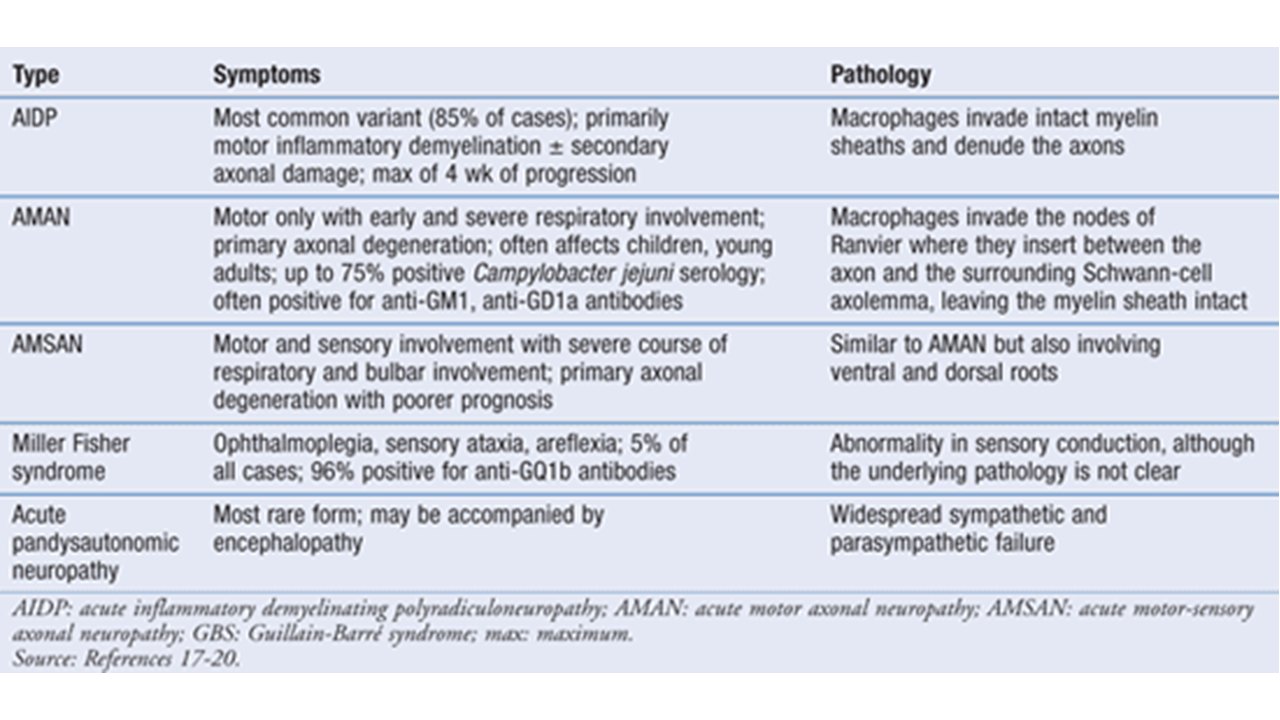

Several subtypes of GBS exist, each with slightly different clinical presentations and underlying mechanisms. The most common type is acute inflammatory demyelinating polyneuropathy (AIDP), which is characterized by demyelination. Other subtypes include acute motor axonal neuropathy (AMAN), acute motor-sensory axonal neuropathy (AMSAN), and Miller Fisher syndrome (MFS). These subtypes differ in the specific nerves affected (motor, sensory, or both) and the underlying pathological processes (demyelination or axonal damage).

The symptoms vary accordingly.AIDP, for example, often presents with progressive weakness and tingling sensations in the limbs, starting in the feet and hands and gradually spreading upwards. AMAN, on the other hand, primarily affects motor nerves, leading to muscle weakness without significant sensory involvement. AMSAN combines features of both AMAN and AIDP, showing both motor and sensory symptoms.

MFS is a rarer variant characterized by ophthalmoplegia (paralysis of the eye muscles), ataxia (loss of coordination), and areflexia (loss of reflexes). The severity of symptoms can vary greatly between individuals and subtypes.

Typical Progression of GBS Symptoms

The typical progression of GBS symptoms follows a characteristic pattern. It usually begins with a gradual onset of weakness, often starting in the legs and spreading to the arms and upper body. This weakness can progress rapidly, sometimes over a period of days or weeks, reaching its peak severity within two to four weeks. Sensory symptoms, such as tingling, numbness, and pain, frequently accompany the weakness.

In severe cases, GBS can affect the muscles involved in breathing, leading to respiratory failure. After reaching its peak, the progression of the disease usually plateaus, and then a gradual recovery phase begins. This recovery can take weeks, months, or even years, and the extent of recovery varies considerably among patients. Some individuals may make a complete recovery, while others may experience lingering weakness or other long-term effects.

Paralysis in GBS

Guillain-Barré syndrome (GBS) is a serious neurological disorder that causes progressive muscle weakness and paralysis. Understanding the mechanisms behind this paralysis and the factors influencing its severity is crucial for effective diagnosis and treatment. This section will delve into the intricacies of paralysis in GBS, exploring its causes, variations, and impact on recovery.

The paralysis experienced in GBS stems from the body’s own immune system mistakenly attacking the peripheral nerves. These nerves, responsible for transmitting signals between the brain and spinal cord to the muscles, become inflamed and damaged. This inflammation disrupts the nerve’s ability to send signals effectively, resulting in varying degrees of weakness and paralysis. The process is often described as demyelination, where the protective myelin sheath surrounding the nerves is damaged, or axonal damage, where the nerve fibers themselves are directly affected.

The severity of the damage directly correlates with the extent of the paralysis.

Levels of Paralysis in GBS

The level of paralysis in GBS varies widely among patients. Some individuals experience mild weakness in their limbs, while others develop complete paralysis, affecting their ability to breathe independently. This spectrum of paralysis can be categorized into several levels, ranging from mild weakness affecting only a few muscle groups to complete quadriplegia (paralysis of all four limbs) and respiratory failure.

The speed of progression also varies; some experience rapid onset, while others see a slower, more gradual progression of symptoms.

Factors Influencing Paralysis Severity in GBS

Several factors contribute to the severity of paralysis in GBS. The specific subtype of GBS plays a significant role, with some subtypes generally associated with more severe outcomes than others. The age of the patient, their overall health, and the promptness of treatment also influence the severity and duration of paralysis. Early and aggressive treatment, such as intravenous immunoglobulin (IVIg) or plasmapheresis, is crucial in minimizing the severity and duration of paralysis and promoting a faster recovery.

The extent of nerve damage, whether demyelinating or axonal, also dictates the severity of the paralysis and the potential for full recovery. For example, axonal damage, which involves direct injury to the nerve fibers, often leads to a slower and potentially less complete recovery compared to demyelinating GBS.

GBS Subtypes, Symptoms, Severity, and Recovery

| Subtype of GBS | Common Symptoms | Severity of Paralysis | Recovery Time |

|---|---|---|---|

| Acute Inflammatory Demyelinating Polyneuropathy (AIDP) | Progressive weakness, often starting in the legs, ascending paralysis, numbness, tingling, decreased reflexes | Variable, ranging from mild weakness to complete paralysis including respiratory involvement | Weeks to months, with most patients recovering significantly |

| Miller Fisher Syndrome (MFS) | Ophthalmoplegia (eye muscle weakness), ataxia (loss of coordination), areflexia (loss of reflexes) | Generally less severe than AIDP, rarely leading to respiratory failure | Weeks to months, usually with good recovery |

| Acute Motor Axonal Neuropathy (AMAN) | Rapidly progressive weakness, predominantly affecting the limbs | Can be severe, with potential for respiratory failure | Variable, with some experiencing slower or incomplete recovery compared to AIDP |

| Acute Motor and Sensory Axonal Neuropathy (AMSAN) | Similar to AMAN, but also involves sensory symptoms like numbness and tingling | Can be severe, with potential for respiratory failure | Variable, often with slower and less complete recovery than AIDP |

Causes of GBS

Source: emdocs.net

Guillain-Barré Syndrome (GBS) isn’t caused by a single factor; rather, it’s a complex condition triggered by an interplay of genetic predisposition and environmental factors, most notably preceding infections. Understanding these triggers and risk factors is crucial for both prevention strategies and effective management of the disease. While the exact mechanisms aren’t fully understood, research points to a misdirected immune response as the central player in GBS development.The body’s immune system, designed to protect against foreign invaders like bacteria and viruses, sometimes mistakenly attacks its own tissues.

In GBS, this autoimmune response targets the myelin sheath, the protective layer surrounding nerve fibers. This damage disrupts nerve signal transmission, leading to the characteristic weakness and paralysis.

Infections as Triggers for GBS

Many cases of GBS are preceded by an infection, often respiratory or gastrointestinal. These infections act as triggers, initiating the autoimmune cascade that results in GBS. Common culprits include Campylobacter jejuni (a type of bacteria often found in contaminated poultry), cytomegalovirus (CMV), Epstein-Barr virus (EBV), and influenza. It’s important to note that having these infections doesn’t guarantee developing GBS; the vast majority of people who contract these infections do not develop the syndrome.

The precise reason why some individuals develop GBS after an infection while others don’t remains an area of ongoing research. It is believed that a combination of genetic susceptibility and the specific strain of infecting agent plays a significant role.

Risk Factors for Developing GBS

Several factors increase the likelihood of developing GBS. While infection is the most significant trigger, other factors can heighten the risk. These risk factors often work in conjunction with an antecedent infection to increase the probability of GBS development.

Some key risk factors include:

- Age: GBS can occur at any age, but the risk increases with age, with a higher incidence in individuals over 50.

- Family History: A family history of GBS or other autoimmune disorders can slightly elevate the risk.

- Underlying Medical Conditions: Certain medical conditions, such as diabetes and HIV, are associated with a higher risk of developing GBS.

- Surgery or Immunization: While rare, GBS has been reported in association with some surgeries and immunizations, though the causal link is not always established.

Pathway from Infection to GBS Development: A Flowchart Illustration

Imagine a flowchart with several stages. First, a box labeled “Infection with a triggering agent (e.g., Campylobacter jejuni, virus).” An arrow leads to a second box: “Immune system activation.” Within this box, we would depict the immune system’s response to the infection. The next box would be “Molecular mimicry,” representing the immune system’s mistaken targeting of myelin due to similarities between the infecting agent and the body’s own tissues.

An arrow would then lead to a box labeled “Myelin sheath damage,” indicating the attack on the myelin. Finally, an arrow leads to the last box: “Guillain-Barré Syndrome,” showing the resulting symptoms of weakness and paralysis. This simplified flowchart illustrates the general pathway, but the actual process is considerably more intricate and involves numerous molecular and cellular interactions.

The precise details of this process are still under investigation.

Diagnosis and Treatment of GBS

Getting a diagnosis for Guillain-Barré Syndrome (GBS) can be a crucial first step towards effective treatment and recovery. Early and accurate diagnosis is essential because GBS can progress rapidly, and prompt treatment can significantly impact the severity of the illness and the chances of a full recovery. The diagnostic process often involves a combination of neurological examinations, blood tests, and specialized studies.

Diagnostic Methods for GBS

Diagnosing GBS relies on a combination of clinical findings and supportive tests. The characteristic progressive weakness and loss of reflexes are key indicators. However, other conditions can mimic GBS, making a comprehensive evaluation necessary. Nerve conduction studies (NCS) and electromyography (EMG) play a vital role. NCS measures the speed of nerve signals, revealing slowed conduction typical of GBS.

EMG assesses the electrical activity of muscles, helping identify nerve damage. While there’s no single definitive test for GBS, the combination of clinical presentation and these electrodiagnostic studies usually provides a strong indication. Additionally, lumbar puncture (spinal tap) to analyze cerebrospinal fluid (CSF) can reveal elevated protein levels, a common finding in GBS. This helps differentiate GBS from other neurological conditions.

Treatment Approaches for GBS

Treatment for GBS focuses on two primary areas: supportive care to manage symptoms and immunotherapies to slow or stop the disease’s progression. Supportive care is critical, focusing on managing respiratory function, preventing complications, and providing comfort. This might involve mechanical ventilation if breathing becomes difficult, blood pressure support, and physical therapy to prevent muscle contractures and promote mobility. Immunotherapies aim to modulate the immune system’s attack on the nerves.

Plasmapheresis, a procedure that filters harmful antibodies from the blood, and intravenous immunoglobulin (IVIg), which provides healthy antibodies, are the most common immunotherapies used. The choice of immunotherapy often depends on factors such as disease severity and patient-specific factors, and is usually made in consultation with a neurologist specializing in neuromuscular disorders.

Typical GBS Treatment Plan Steps

The following steps Artikel a typical approach to managing GBS. It’s important to note that this is a general guideline, and the specific treatment plan will be tailored to each individual’s needs and response to therapy.

- Comprehensive Neurological Examination: A detailed assessment of neurological function, including muscle strength, reflexes, and sensory function, to establish the extent of involvement.

- Electrodiagnostic Studies (NCS and EMG): To confirm the diagnosis and assess the severity of nerve damage.

- Lumbar Puncture (Spinal Tap): To analyze cerebrospinal fluid (CSF) for elevated protein levels.

- Respiratory Monitoring: Continuous monitoring of respiratory function, including oxygen saturation and vital capacity.

- Immunotherapy (Plasmapheresis or IVIg): Administered as early as possible to reduce the severity and duration of the illness. The specific choice of immunotherapy depends on the individual’s condition and response to treatment.

- Supportive Care: This includes managing pain, preventing complications like blood clots and pressure sores, and providing nutritional support.

- Physical and Occupational Therapy: Initiated early in the recovery phase to improve muscle strength, mobility, and functional independence.

- Regular Monitoring: Close monitoring of the patient’s progress, including neurological examinations and assessment of respiratory function, throughout the course of the illness and recovery.

Recovery from Guillain-Barré Syndrome

Source: ytimg.com

Recovery from Guillain-Barré syndrome (GBS) is a highly individual journey, varying greatly in both timeline and challenges faced. While some individuals experience a relatively swift recovery, others may face a prolonged and arduous process. Understanding the typical trajectory and potential obstacles is crucial for both patients and their support systems.The recovery process typically begins with the plateauing of the disease’s progression, marking the end of the acute phase.

This is followed by a gradual improvement in neurological function, often starting with the lower extremities and progressing upwards. Many patients will notice a slow but steady return of muscle strength, sensation, and reflexes. However, the speed of recovery is highly variable.

Recovery Timeline

The timeline for GBS recovery is unpredictable and depends on several factors, including the severity of the initial illness, the patient’s age and overall health, and the effectiveness of treatment. Some individuals may see significant improvement within weeks, while others may require months or even years to regain substantial function. For example, a patient with mild GBS might see significant improvement within a few months, while someone with severe GBS might need extensive rehabilitation over several years.

Early intervention with plasmapheresis or intravenous immunoglobulin therapy has been shown to improve outcomes and potentially shorten the recovery period.

Challenges During Recovery

The recovery process from GBS is often challenging, both physically and emotionally. Patients may experience persistent weakness, fatigue, pain, and sensory disturbances. The need for extensive physical therapy is almost universal. Many patients struggle with activities of daily living, requiring assistance with tasks such as dressing, bathing, and eating. The psychological impact of GBS should not be underestimated, with many patients experiencing anxiety, depression, and feelings of isolation.

For instance, the loss of independence and the need for constant care can lead to significant emotional distress. Furthermore, the unpredictable nature of recovery can be incredibly frustrating and demoralizing.

Factors Influencing Recovery

Several factors influence the length and success of GBS recovery. The severity of the initial illness is a major determinant, with patients experiencing more severe paralysis facing a longer and more difficult recovery. Age also plays a role, with older individuals often recovering more slowly than younger individuals. The patient’s overall health and pre-existing conditions can also impact recovery.

For instance, patients with underlying health issues might have a more complicated recovery. Finally, the quality and intensity of rehabilitation play a significant role in the outcome. Early and consistent engagement with physical therapy and other rehabilitation modalities can significantly improve recovery.

Rehabilitation Therapies in GBS Recovery

Rehabilitation plays a crucial role in maximizing recovery potential in GBS patients. A multidisciplinary approach is often employed, involving various therapies tailored to the individual’s specific needs.

- Physical Therapy: Focuses on strengthening weakened muscles, improving range of motion, and enhancing mobility. This might involve exercises to improve walking, balance, and coordination.

- Occupational Therapy: Helps patients regain independence in performing daily activities, such as dressing, eating, and using adaptive equipment.

- Speech Therapy: Addresses swallowing difficulties (dysphagia) and communication problems that may arise from GBS.

- Respiratory Therapy: Provides support for breathing difficulties, often including techniques like deep breathing exercises and airway clearance.

- Psychological Therapy: Addresses the emotional and psychological challenges associated with GBS, such as anxiety, depression, and adjustment to disability. This might involve counseling or support groups.

Long-Term Effects and Management of GBS

Guillain-Barré Syndrome (GBS) can leave lasting impacts on individuals even after the initial acute phase has passed. While many people make a full recovery, some experience persistent symptoms that significantly affect their daily lives. Understanding these potential long-term effects and the strategies for managing them is crucial for improving the quality of life for those affected.The long-term effects of GBS are highly variable and depend on several factors, including the severity of the initial illness, the speed and extent of recovery, and the individual’s overall health.

Some individuals may experience minimal residual effects, while others face significant challenges for years.

Residual Muscle Weakness and Fatigue

Residual muscle weakness is a common long-term effect. This weakness can affect various muscle groups, leading to difficulties with mobility, dexterity, and performing everyday tasks. Persistent fatigue is also frequently reported, impacting energy levels and the ability to engage in physical activity or work. Management strategies often include physiotherapy to improve muscle strength and endurance, occupational therapy to adapt daily routines, and pacing techniques to manage energy levels effectively.

For example, a person might need to use adaptive equipment, such as a mobility aid, or adjust their work schedule to accommodate periods of rest.

Autonomic Nervous System Dysfunction

GBS can disrupt the autonomic nervous system, which controls involuntary bodily functions such as heart rate, blood pressure, and digestion. This can result in persistent orthostatic hypotension (a sudden drop in blood pressure upon standing), abnormal heart rate, bowel and bladder dysfunction, and difficulties with sweating. Managing these issues may involve medication to regulate blood pressure or heart rate, dietary changes, and strategies to prevent falls.

For instance, individuals might need to wear compression stockings to mitigate orthostatic hypotension.

Pain Management

Chronic pain is another significant challenge for some individuals with long-term GBS effects. This pain can be neuropathic (nerve pain) or musculoskeletal pain related to muscle weakness and inactivity. Pain management strategies often involve a combination of approaches, including medication (such as analgesics and antidepressants), physical therapy, and alternative therapies like acupuncture or massage. A tailored pain management plan, developed in consultation with a pain specialist, is often crucial.

Cognitive and Psychological Effects

Some individuals experience cognitive difficulties, such as problems with memory, concentration, and processing speed, following GBS. Anxiety and depression are also common, often stemming from the physical limitations and the emotional impact of the illness. Cognitive rehabilitation therapy can help improve cognitive function, while counseling, support groups, and medication can address psychological challenges. For example, cognitive rehabilitation might involve memory exercises and strategies to improve organizational skills.

Support Systems for Long-Term GBS Management

Navigating the long-term effects of GBS requires a strong support system. This includes healthcare professionals such as neurologists, physiatrists, physiotherapists, occupational therapists, and pain specialists. Support groups, both in-person and online, provide a valuable platform for sharing experiences, exchanging information, and receiving emotional support from others who understand the challenges of living with GBS. Family and friends also play a vital role in providing practical assistance and emotional encouragement.

Many national and international organizations dedicated to GBS offer resources, information, and support networks for individuals and their families.

Illustrative Case Studies (without actual patient data)

Understanding Guillain-Barré Syndrome (GBS) is best achieved through examining individual experiences. While every case is unique, studying hypothetical scenarios can illuminate the typical progression, challenges, and eventual outcomes associated with this autoimmune disorder. The following case study illustrates a possible trajectory of GBS, from initial symptoms to long-term management.

Hypothetical Case Study: Sarah’s Journey with GBS

Sarah, a 35-year-old teacher, initially experienced mild tingling in her toes, which she dismissed as fatigue from a busy school year. Over the next few days, the tingling spread to her legs, accompanied by increasing weakness. Within a week, she found walking difficult and noticed some clumsiness in her hands. Alarmed by her rapidly deteriorating condition, she sought medical attention.

Diagnosis and Treatment, Connection between guillain barre syndrome and paralysis causes and recovery

Following a neurological examination, including electromyography (EMG) and nerve conduction studies, Sarah received a diagnosis of Guillain-Barré Syndrome. Her case was classified as acute inflammatory demyelinating polyneuropathy (AIDP), the most common form of GBS. She was immediately hospitalized and started on intravenous immunoglobulin (IVIg) therapy. This treatment aimed to suppress the immune system’s attack on her peripheral nerves.

Sarah also received supportive care, including respiratory support as her breathing became increasingly labored, and physical therapy to prevent muscle atrophy.

Rehabilitation and Recovery

Sarah’s recovery was gradual and challenging. Initially, even simple tasks like eating and drinking required assistance. She underwent intensive physical and occupational therapy, focusing on regaining strength, mobility, and independence in daily activities. She participated in exercises to improve her range of motion, muscle strength, and coordination. Occupational therapy helped her adapt to using assistive devices and regain her ability to perform everyday tasks.

Her emotional state fluctuated, ranging from frustration and despair to moments of determination and hope. The support of her family, friends, and medical team was crucial during this period.

Long-Term Effects and Management

After several months of intensive rehabilitation, Sarah made significant progress. While she regained most of her mobility, she still experiences some residual weakness and tingling in her extremities. She continues to participate in regular physical therapy to maintain her strength and prevent further complications. She also attends support groups to connect with other GBS survivors and share her experiences.

Though the initial experience was traumatic, Sarah’s positive outlook and commitment to rehabilitation have enabled her to adapt to her new normal and maintain an active life. She recognizes the importance of ongoing monitoring and regular check-ups with her neurologist to manage any potential long-term complications. Sarah’s story exemplifies the resilience and determination often seen in individuals recovering from GBS.

Final Conclusion

Guillain-Barré Syndrome is a challenging but not insurmountable condition. While the path to recovery can be long and arduous, with the right diagnosis, treatment, and unwavering support, significant progress is possible. Understanding the connection between GBS, paralysis, its causes, and the road to recovery empowers both patients and their loved ones. Remember, research continues, offering new hope and advancements in treatment and rehabilitation.

This knowledge, combined with a strong support network and a resilient spirit, can significantly impact the journey toward a better quality of life.

Answers to Common Questions: Connection Between Guillain Barre Syndrome And Paralysis Causes And Recovery

What is the prognosis for Guillain-Barré Syndrome?

Prognosis varies greatly depending on the severity of the case. Many people recover fully, while others may experience lingering weakness or other long-term effects.

Is Guillain-Barré Syndrome contagious?

No, GBS itself is not contagious. However, some viral or bacterial infections can trigger it.

How is Guillain-Barré Syndrome diagnosed?

Diagnosis typically involves a neurological exam, nerve conduction studies, and sometimes a lumbar puncture (spinal tap).

Are there any preventative measures for GBS?

While there’s no guaranteed prevention, maintaining good overall health and promptly treating infections can help reduce the risk.