Steward Lays Out Timeline Asset Sales & Bankruptcy

Steward lays out timeline asset sales bankruptcy – sounds intense, right? It is! This post dives into the complex world of asset sales during bankruptcy proceedings. We’ll explore the role of the steward (think trustee or receiver), the timeline involved, and the various factors that influence the sale process, from market conditions to the type of assets being sold.

Think of it as a behind-the-scenes look at a high-stakes financial drama.

We’ll cover everything from the initial assessment of assets to the final disposition, including different sale methods like auctions and private treaties. We’ll also examine the legal and ethical considerations faced by stewards, potential conflicts of interest, and strategies for mitigating risks. Get ready for a deep dive into the intricacies of bankruptcy asset sales!

Timeline of Asset Sales in Bankruptcy Proceedings

Source: cheggcdn.com

Steward Healthcare’s bankruptcy proceedings are moving forward, with a detailed timeline for asset sales now public. It’s a sobering reminder of the fragility of even large healthcare systems, especially considering the health challenges faced by individuals like actress Monali Thakur, who was recently hospitalized after struggling to breathe – you can read more about her situation and respiratory disease prevention at this article.

The Steward situation highlights the importance of robust healthcare infrastructure and access to quality care for everyone.

Bankruptcy asset sales are a complex process with many moving parts, aiming to maximize recovery for creditors. Understanding the timeline and various sale methods is crucial for all stakeholders involved. This post will Artikel the typical stages, asset types, and sale methods encountered during bankruptcy proceedings, providing a clearer picture of this often-opaque process.

Stages of Asset Sales in Bankruptcy

The process of selling assets in bankruptcy typically unfolds in several distinct stages. These stages, while not always rigidly defined, provide a framework for understanding the overall timeline. The specific duration of each stage depends on factors like the complexity of the bankruptcy case, the nature of the assets, and the market conditions.

- Initial Assessment and Valuation: This initial phase involves identifying and appraising all assets owned by the bankrupt entity. This includes real estate, equipment, intellectual property, inventory, and accounts receivable. Professional valuers are often engaged to provide objective assessments.

- Marketing and Solicitation: Once the assets are valued, they are marketed to potential buyers. This may involve advertising in specialized publications, online marketplaces, or direct outreach to known interested parties. The goal is to generate competitive bidding.

- Bidding and Negotiation: Depending on the chosen sale method (auction, private treaty, etc.), this stage involves receiving bids from potential buyers and negotiating the best possible price. This phase may involve multiple rounds of bidding or negotiations.

- Court Approval: Before any sale is finalized, it usually requires court approval. The bankruptcy court reviews the proposed sale to ensure it’s in the best interests of the creditors. This process can involve hearings and legal challenges.

- Closing and Transfer: Once the court approves the sale, the closing process begins. This involves transferring ownership of the assets to the buyer and distributing the proceeds to the creditors according to the bankruptcy plan.

Types of Assets Sold and Sale Methods

A wide range of assets can be sold during bankruptcy proceedings. The choice of sale method depends on factors like the type of asset, its value, and market conditions.

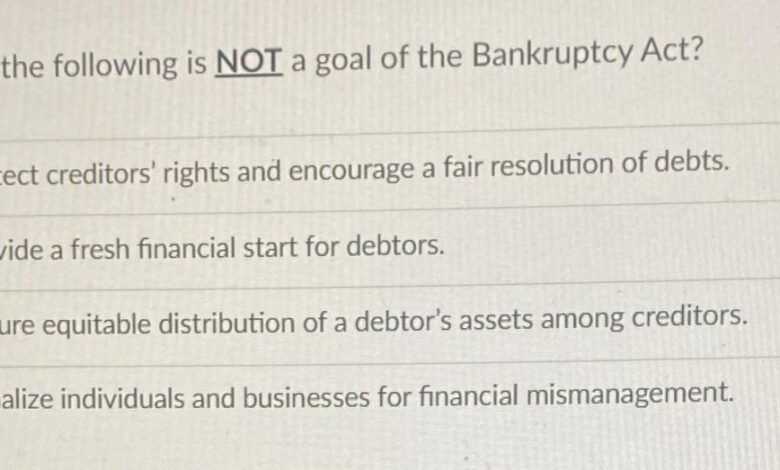

| Asset Type | Typical Sale Method | Advantages | Disadvantages |

|---|---|---|---|

| Real Estate | Auction, Private Treaty | Transparency, Competitive Bidding (Auction), Flexibility (Private Treaty) | Potential for lower price (Auction), Time-consuming (Private Treaty) |

| Equipment | Auction, Private Treaty, Online Auction | Wide reach (Online Auction), Competitive bidding (Auction), Targeted sales (Private Treaty) | Administrative costs (Online Auction), Time constraints (Auction) |

| Inventory | Auction, Bulk Sale | Quick liquidation (Bulk Sale), Competitive bidding (Auction) | Potential for lower prices (Bulk Sale), Storage costs (Auction) |

| Intellectual Property | Private Treaty, License | Preservation of value (License), Confidentiality (Private Treaty) | Longer process (Private Treaty), Limited reach (License) |

Sample Timeline of Asset Sales

This is a sample timeline and the actual duration may vary significantly.

| Stage | Typical Duration |

|---|---|

| Initial Assessment and Valuation | 1-3 months |

| Marketing and Solicitation | 2-4 months |

| Bidding and Negotiation | 1-2 months |

| Court Approval | 1-3 months |

| Closing and Transfer | 1-2 months |

The Steward’s Role in Asset Sales

Source: cheggcdn.com

The steward, whether a trustee, receiver, or other appointed official, plays a crucial role in the successful liquidation of assets during bankruptcy proceedings. Their actions directly impact the recovery of funds for creditors and the overall fairness of the process. This role requires a delicate balance of legal expertise, financial acumen, and ethical responsibility.The steward’s primary responsibility is to maximize the value realized from the sale of assets.

This involves a comprehensive understanding of the assets’ nature, market conditions, and potential buyers. They must develop and execute a strategic plan for asset disposition, often involving appraisals, marketing strategies, and negotiation with potential purchasers. The entire process needs to be transparent and documented meticulously to withstand scrutiny.

Responsibilities in Managing and Selling Assets

Stewards must meticulously manage and protect the assets entrusted to them. This includes securing the assets, preventing deterioration or loss, and ensuring accurate accounting of all transactions. The sale process itself requires adherence to legal procedures, often involving court approval for significant transactions or sales exceeding specific thresholds. They are responsible for advertising the sale, soliciting bids, and conducting the sale in a manner that ensures fairness and maximizes value for the benefit of creditors.

This might involve employing professional auctioneers or real estate agents depending on the nature of the assets. For example, in the case of a large manufacturing company, the steward might need to sell off equipment, real estate, intellectual property, and inventory separately, each requiring a different approach and expertise.

Legal and Ethical Considerations in Asset Sales

The steward operates under a strict legal framework. They are bound by fiduciary duties to act in the best interests of the creditors and the bankruptcy estate. This necessitates complete transparency, impartiality, and avoidance of conflicts of interest. Ethical considerations extend to fair and equitable treatment of all parties involved, including creditors, debtors, and potential buyers. For instance, a steward cannot favor one creditor over another in the distribution of proceeds.

They must also ensure that all sales are conducted in compliance with applicable laws and regulations, including antitrust laws, to prevent any anti-competitive practices.

Situations Where a Steward’s Decisions Might Be Challenged

A steward’s decisions regarding asset sales can be challenged in court if they are deemed to be unfair, biased, or not in the best interests of the estate. For example, a sale conducted at a price significantly below market value might lead to legal action from creditors who believe they have been deprived of a fair recovery. Similarly, a lack of transparency in the sale process, such as favoring a specific bidder without justification, could be grounds for legal challenge.

Another scenario might involve accusations of self-dealing, where the steward benefits personally from the sale, violating their fiduciary duty. The bankruptcy court will review the steward’s actions and decisions based on the standards of due diligence and best practices within the industry.

Potential Conflicts of Interest and Their Mitigation

Conflicts of interest can arise when the steward has a personal interest in the outcome of the asset sale, such as a prior business relationship with a potential buyer. Another conflict could arise if the steward, or a closely related party, is a creditor in the bankruptcy proceedings. Mitigation strategies include full disclosure of any potential conflicts to the court, seeking court approval for transactions that might raise concerns, and using independent appraisers and auctioneers to ensure impartiality in the valuation and sale of assets.

Strict adherence to established procedures and maintaining detailed records of all transactions are crucial to prevent and address potential conflicts. For instance, a blind auction process could be used to ensure fair and equitable bidding.

Factors Influencing Asset Sale Prices and Timing

Navigating the complexities of asset sales during bankruptcy proceedings requires a keen understanding of the interplay between market dynamics, asset characteristics, and valuation methodologies. The ultimate price achieved and the speed of the sale are rarely straightforward and depend on a confluence of factors.Market conditions significantly impact both the pricing and timing of asset sales in bankruptcy. A robust economy, characterized by high demand and low interest rates, generally leads to higher sale prices and faster transaction times.

Conversely, a recessionary environment or a sector-specific downturn can depress prices and prolong the sale process. For instance, the rapid decline in the commercial real estate market in 2020, following the COVID-19 pandemic, significantly impacted the valuation and sale timelines of properties owned by bankrupt companies. Buyers were less willing to pay high prices, and sales took longer to finalize due to increased due diligence and financing challenges.

Market Conditions and Their Influence

Several factors can accelerate or delay the asset sale process. A well-defined and readily marketable asset, such as a popular brand name or a piece of high-demand real estate in a thriving location, will likely sell quickly and command a premium price. Conversely, assets with complex legal entanglements, environmental liabilities, or technological obsolescence can significantly delay the sale and reduce their value.

A clear and efficient marketing strategy, involving professional advisors and targeted outreach, can shorten the timeline. Conversely, a poorly executed marketing campaign or lack of transparency can deter potential buyers and extend the sales process. Furthermore, the availability of financing for potential buyers is a crucial factor. During periods of tight credit, fewer buyers are able to participate in the bidding process, leading to lower prices and slower sales.

Valuation Methods in Bankruptcy Asset Sales

Several valuation methods are commonly employed to determine the fair market value of assets in bankruptcy proceedings. These methods include market-based approaches (comparing similar assets that have recently sold), income-based approaches (estimating future cash flows generated by the asset), and cost-based approaches (estimating the replacement cost of the asset). The selection of the most appropriate method depends on the type of asset being valued and the availability of reliable data.

For example, valuing a piece of real estate might rely heavily on comparable sales data, while valuing a technology company’s intellectual property might require a more complex income-based approach, projecting future licensing revenue. Often, a combination of methods is used to provide a more robust and comprehensive valuation. The court ultimately approves the valuation, ensuring fairness and transparency.

Asset Type and Sale Strategy

The type of asset significantly influences the sale strategy and timeline. Real estate sales, for example, often involve a longer process due to the complexities of title searches, environmental assessments, and regulatory approvals. Liquid assets like cash or readily marketable securities can be sold quickly. Intellectual property, such as patents or trademarks, requires a more specialized approach, often involving licensing agreements or outright sales to technology companies.

Equipment sales might involve auctions or direct negotiations with potential buyers, depending on the equipment’s value and market demand. Each asset type necessitates a tailored strategy, influencing the overall timing and pricing of the sale within the bankruptcy proceedings. For instance, the sale of a manufacturing plant’s equipment might involve a phased approach, selling individual pieces of equipment over time to maximize value, rather than a single bulk sale.

Communication and Transparency in Asset Sales

Effective communication and transparency are paramount during asset sales within bankruptcy proceedings. Stakeholders – creditors, debtors, employees, and even the public – need consistent and accurate information to maintain trust and avoid costly disputes. Open communication fosters cooperation, speeds up the process, and ultimately leads to better outcomes for all involved parties.Open and honest communication builds trust, which is essential in the often-fraught environment of bankruptcy.

Steward’s announcement of the asset sale timeline for their bankruptcy proceedings has everyone talking. It’s a complex situation, made even more interesting considering the recent news about rfk jr confirmed hhs secretary robert f kennedy jr , and how potential healthcare policy shifts could impact future bankruptcies and corporate restructuring. Ultimately, the Steward timeline remains the focus, highlighting the difficult choices facing companies navigating financial distress.

When stakeholders understand the process and the reasons behind decisions, they’re more likely to cooperate and less likely to challenge the sale’s validity. This reduces legal costs and delays, maximizing the value realized from the assets. Transparency also protects the reputation of the involved parties, minimizing long-term negative consequences.

Effective Communication Strategies

A well-defined communication plan is crucial for disseminating information effectively and consistently. This plan should detail key messages, target audiences, communication channels, and timelines. For example, a regular email newsletter to creditors, detailing the progress of the asset sale process, is a good start. Town hall meetings or webinars can address larger groups and allow for direct question-and-answer sessions, providing an opportunity to address concerns in real-time.

Individualized communication, such as phone calls or personal meetings, may be necessary for significant stakeholders or those with complex concerns.

So, Steward’s laying out its timeline for asset sales and bankruptcy – a pretty grim picture, right? It makes you think about the broader economic challenges, and how automation might help. For example, I recently read about the ai powered solution to the medical coding worker shortage , which could potentially alleviate some workforce pressures in other sectors.

Ultimately, though, Steward’s situation highlights the need for proactive financial planning, regardless of industry trends.

Sample Communication Plan

The following table Artikels a sample communication plan. This is a basic example and needs to be tailored to the specific circumstances of each case.

| Message | Target Audience | Delivery Method | Timeline |

|---|---|---|---|

| Announcement of bankruptcy filing and initiation of asset sale process. | All stakeholders | Press release, website announcement, email notification | Immediately upon filing |

| Regular updates on the progress of the asset sale process, including key milestones and timelines. | Creditors, debtors | Email newsletters, website updates | Weekly or bi-weekly |

| Notification of significant developments, such as the receipt of bids or the selection of a winning bidder. | All stakeholders | Email notification, press release | Immediately upon occurrence |

| Explanation of the rationale behind key decisions, such as the selection of a specific bidder or the pricing strategy. | Creditors | Dedicated Q&A session, email correspondence | As needed |

| Final report on the asset sale process, including financial results and distribution of proceeds. | All stakeholders | Formal report, website announcement | Upon completion of the sale |

Transparency in Asset Sales and Trust Building

Transparency minimizes misunderstandings and disputes. By openly sharing information, such as the valuation process, bidding procedures, and the criteria for selecting a winning bidder, the process becomes more credible and less susceptible to challenges. This fosters trust among stakeholders and demonstrates the fairness and impartiality of the process. For example, publishing a summary of all bids received (while protecting the identities of bidders) demonstrates transparency and fairness.

Similarly, openly sharing the appraisal reports used to determine the fair market value of assets reinforces confidence in the process.

Documenting and Archiving Communications

Meticulous documentation is critical for maintaining transparency and accountability. All communications, including emails, letters, meeting minutes, and phone call logs, should be carefully documented and archived. A secure, centralized system for storing and retrieving these documents ensures easy access for all relevant parties and provides a clear audit trail of the entire asset sale process. This is vital not only for legal compliance but also for maintaining the integrity and credibility of the process.

This might include a dedicated database or a secure file-sharing platform with access controls. A well-defined retention policy should be established to ensure compliance with legal and regulatory requirements.

Potential Challenges and Risks in Asset Sales

Navigating asset sales during bankruptcy proceedings is inherently complex, fraught with potential pitfalls that can significantly impact the outcome for all stakeholders. From valuation disputes to legal challenges, the process demands meticulous planning and execution to maximize value recovery while minimizing risks. A thorough understanding of these challenges is crucial for stewards involved in such delicate transactions.The inherent uncertainty surrounding bankruptcy proceedings creates a unique set of challenges for asset sales.

The compressed timeframe, often dictated by creditor pressures and legal deadlines, can limit the pool of potential buyers and restrict opportunities for thorough due diligence. Simultaneously, the distressed nature of the assets themselves often necessitates significant investment in repairs, remediation, or restructuring before they can be successfully marketed and sold. This adds another layer of complexity and cost to an already challenging process.

Valuation Disputes

Determining the fair market value of assets in distress is notoriously difficult. Different valuation methodologies may yield widely disparate results, leading to disputes among creditors, buyers, and the bankruptcy court. For example, a property’s assessed value might differ significantly from its market value in a distressed sale. This necessitates a robust and transparent valuation process, ideally involving multiple independent appraisals using different methods, to support the sale price and mitigate potential disputes.

A clear and defensible valuation report is essential in defending against challenges.

Due Diligence Challenges

Conducting thorough due diligence on assets in bankruptcy is often hampered by limited access to information, incomplete records, and time constraints. Buyers are naturally wary of hidden liabilities or environmental concerns. A comprehensive due diligence process, involving environmental assessments, title searches, and operational reviews, is critical to minimize the risk of unexpected costs or liabilities post-sale. A well-structured due diligence process will Artikel a clear timeline and assign responsibilities, minimizing potential delays.

Legal and Regulatory Compliance

Bankruptcy asset sales are subject to numerous legal and regulatory requirements, including disclosure obligations, bidding procedures, and court approvals. Non-compliance can lead to delays, challenges, and even the invalidation of the sale. Engaging experienced legal counsel is crucial to ensure compliance with all applicable laws and regulations. This includes navigating complex bankruptcy codes and adhering to strict procedural rules, as a single oversight can lead to substantial setbacks.

Failed Asset Sales and Disputes

The failure to secure a buyer for an asset or disputes arising from the sale process can significantly impact the bankruptcy estate’s recovery. Failed sales can lead to further delays, increased costs, and potentially lower recovery rates for creditors. Contingency planning, including alternative sale strategies and potential liquidation options, is vital to mitigate this risk. For instance, a reserve auction price can provide a safety net against undervaluation.

Potential Legal Liabilities for Stewards

Effective risk mitigation involves proactive measures. A steward’s actions in asset sales can expose them to various legal liabilities. To avoid these, careful adherence to legal and ethical standards is paramount.

- Breach of Fiduciary Duty: Failing to act in the best interests of the bankruptcy estate can result in personal liability. This includes conflicts of interest and self-dealing. Maintaining meticulous records and seeking independent advice will help avoid this.

- Negligence: Failure to exercise reasonable care in managing the asset sale process can lead to claims for negligence. This involves proper due diligence, valuation, and marketing. Thorough documentation of each step is crucial.

- Fraudulent Conveyance: Selling assets below market value to favored buyers can lead to accusations of fraudulent conveyance. Transparency and fair market valuation are essential. A properly structured auction process mitigates this risk.

- Violation of Bankruptcy Code: Non-compliance with bankruptcy laws and regulations can result in severe penalties. Seeking expert legal counsel throughout the process is critical.

Illustrative Case Study

This case study examines the hypothetical bankruptcy and subsequent asset sale of “TechCorp,” a once-promising tech startup that experienced rapid growth followed by a sudden downturn. We’ll follow the process from the initial bankruptcy filing to the final sale of assets, focusing on the role of the court-appointed steward and the challenges faced throughout.

TechCorp Bankruptcy Filing and Initial Assessment

TechCorp, a developer of innovative AI-powered software, filed for Chapter 11 bankruptcy protection in Q3 2023 after failing to secure a crucial round of venture capital funding. The company’s primary assets included its intellectual property (IP), including patents and software code; specialized hardware and server infrastructure; and a small portfolio of existing customer contracts. The initial assessment by the court-appointed steward revealed significant liabilities exceeding assets, necessitating a swift and strategic asset sale to maximize recovery for creditors.

Timeline of Asset Sales

| Date | Event |

|---|---|

| October 26, 2023 | Chapter 11 bankruptcy petition filed. Steward appointed. |

| November 15, 2023 | Initial marketing materials for asset sale prepared and distributed to potential buyers. |

| December 15, 2023 | Deadline for initial bids on the IP portfolio. |

| January 15, 2024 | Selection of preferred bidder for IP. Negotiations begin. |

| February 1, 2024 | Sale of IP portfolio finalized. |

| February 15, 2024 | Marketing of hardware and server infrastructure begins. |

| March 15, 2024 | Sale of hardware and server infrastructure finalized. |

| April 1, 2024 | Remaining customer contracts sold. |

The Steward’s Role in Asset Sales

The steward’s role was crucial in maximizing the value obtained from TechCorp’s assets. Their key decisions included selecting the most effective marketing strategy to attract a wide range of potential buyers, negotiating favorable terms with bidders, and ensuring transparency and fairness throughout the process. For instance, the steward actively engaged with multiple potential buyers for the IP, leading to a competitive bidding process that resulted in a higher sale price than initially anticipated.

The steward also successfully negotiated favorable terms for the sale of the hardware, ensuring a quick and efficient sale that minimized storage and maintenance costs.

Challenges Faced and Solutions Implemented

One major challenge was the valuation of the IP. The innovative nature of the software made traditional valuation methods difficult. The steward engaged an independent expert to perform a detailed valuation, considering factors such as potential future revenue streams and the competitive landscape. Another challenge was the limited time available to complete the asset sales. To overcome this, the steward prioritized the most valuable assets (the IP) and sold them first, generating cash to cover immediate expenses and facilitate the sale of the remaining assets.

Outcome of Asset Sale and Impact on Stakeholders, Steward lays out timeline asset sales bankruptcy

The asset sales generated sufficient funds to cover a significant portion of TechCorp’s liabilities. While not all creditors were fully repaid, the outcome was considerably better than a liquidation scenario would have produced. Shareholders received minimal return, as expected in a bankruptcy proceeding. Creditors, however, received a significantly larger recovery than anticipated initially. The sale of the IP to a larger tech company ensured the continuation of the software’s development, safeguarding jobs and potentially benefiting consumers through continued innovation.

Epilogue

Navigating the turbulent waters of bankruptcy asset sales requires a clear understanding of timelines, legal responsibilities, and market dynamics. The steward’s role is crucial in ensuring a fair and transparent process, maximizing returns for creditors, and minimizing risks. While challenges are inevitable, effective communication, meticulous planning, and a proactive approach can significantly improve the outcome. Hopefully, this exploration sheds light on this often-opaque process, offering insights for both those directly involved and those simply curious about the inner workings of financial recovery.

Clarifying Questions: Steward Lays Out Timeline Asset Sales Bankruptcy

What happens if the assets don’t sell for enough to cover debts?

If the proceeds from asset sales are insufficient to satisfy all creditor claims, the remaining debt may be discharged, or creditors may pursue other avenues of recovery, depending on the jurisdiction and specifics of the bankruptcy case.

Can a steward be held personally liable for mistakes in the asset sale process?

Yes, stewards can face personal liability if they act negligently or breach their fiduciary duties. This highlights the importance of thorough due diligence, proper documentation, and adherence to legal and ethical guidelines.

How long does the entire asset sale process typically take?

The timeline varies greatly depending on factors like the complexity of the bankruptcy case, the number and type of assets, and market conditions. It can range from several months to several years.