How to Reduce Risk of Dehydration Related Diseases

How to reduce risk of dehydration related diseases? It’s a question many of us might not think about until we’re already feeling the effects of a serious case of the blahs. But understanding the subtle signs of dehydration and taking proactive steps to stay hydrated is crucial for overall health and well-being. We often underestimate the impact of even mild dehydration on our bodies, leading to fatigue, headaches, and even more serious health issues.

This post dives deep into practical strategies to keep you feeling your best by preventing dehydration-related problems.

We’ll explore the science behind dehydration, identify those most at risk, and arm you with actionable tips to build a hydration plan tailored to your lifestyle. From understanding the subtle signals your body sends to choosing the right drinks and foods, we’ll cover it all. Get ready to discover how simple changes can make a huge difference in your health and energy levels!

Understanding Dehydration and its Related Diseases

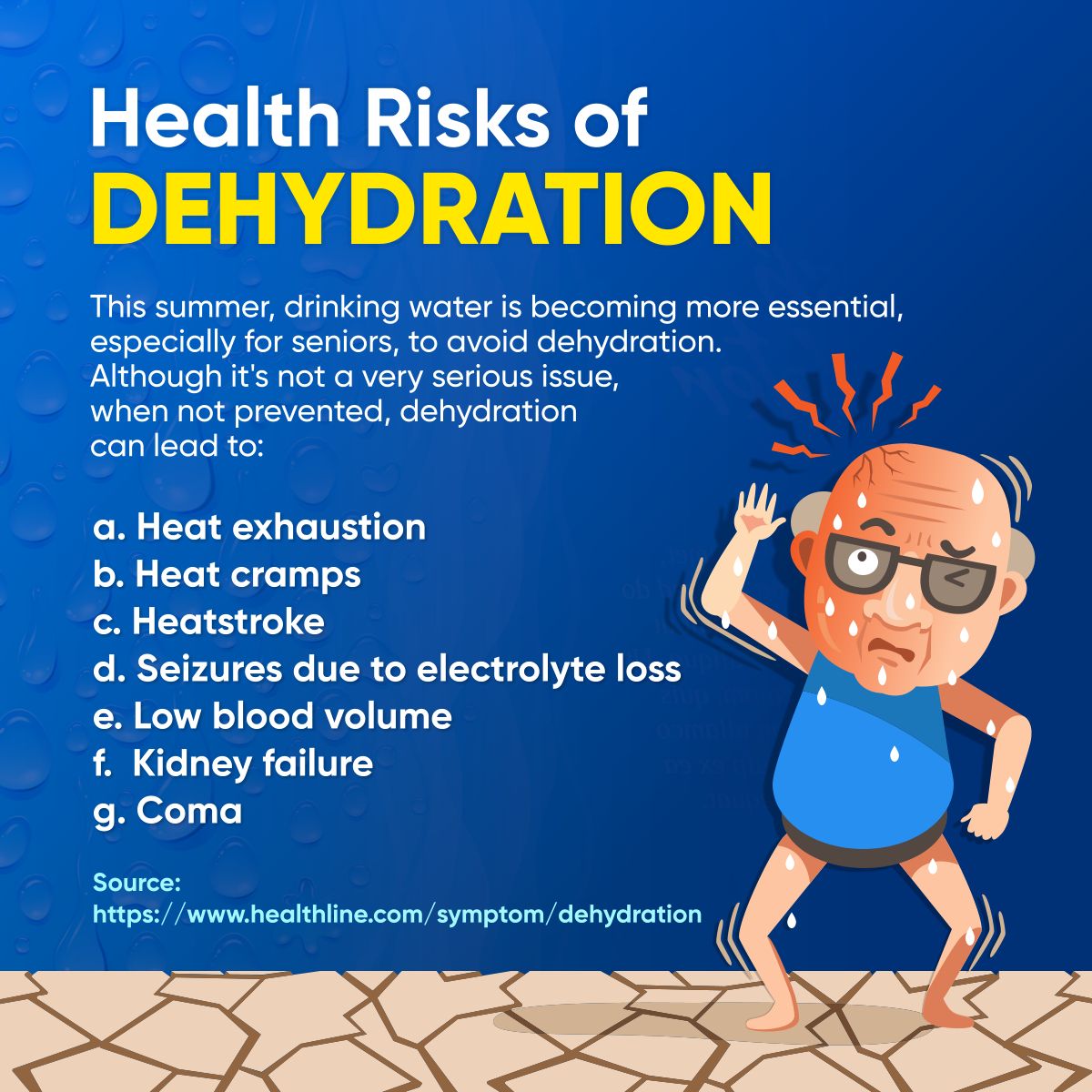

Dehydration, a condition resulting from a lack of sufficient water in the body, is far more serious than simple thirst. It disrupts crucial physiological processes and can lead to a range of health problems, some quite severe. Understanding the mechanisms behind dehydration and its associated diseases is vital for effective prevention and management.Dehydration occurs when the body loses more water than it takes in.

This loss can happen through various routes, including sweating (especially during exercise or in hot climates), urination (due to diuretics like caffeine or alcohol, or kidney problems), vomiting, diarrhea, and even excessive breathing. The body’s inability to maintain its fluid balance triggers a cascade of physiological responses, including reduced blood volume, decreased blood pressure, and impaired organ function. This can lead to a range of health complications, from mild discomfort to life-threatening conditions.

Dehydration-Related Diseases and Their Symptoms, How to reduce risk of dehydration related diseases

Several diseases are directly linked to dehydration. The severity and long-term effects vary considerably depending on the specific disease and the individual’s overall health.

- Heatstroke: This life-threatening condition occurs when the body overheats, often due to prolonged exposure to high temperatures and insufficient fluid intake. Symptoms include high body temperature (above 103°F or 39.4°C), rapid pulse, headache, dizziness, confusion, and seizures. Untreated heatstroke can lead to organ damage and death.

- Kidney stones: Dehydration concentrates urine, increasing the likelihood of mineral and salt crystallization, forming kidney stones. Symptoms include severe flank pain, nausea, vomiting, and bloody or cloudy urine. Chronic dehydration significantly increases the risk of recurrent kidney stones.

- Urinary tract infections (UTIs): Dehydration can concentrate urine, making it easier for bacteria to multiply and cause infection. Symptoms include frequent urination, burning sensation during urination, pelvic pain, and cloudy or foul-smelling urine. Recurring UTIs can lead to kidney infections if left untreated.

- Constipation: Lack of sufficient water can harden stool, making it difficult to pass. Symptoms include infrequent bowel movements, hard stools, abdominal pain, and bloating. Chronic constipation can lead to hemorrhoids and other digestive problems.

- Hypotension (low blood pressure): Severe dehydration reduces blood volume, leading to decreased blood pressure. Symptoms can include dizziness, lightheadedness, fainting, and fatigue. In severe cases, hypotension can be life-threatening.

Severity and Long-Term Effects of Dehydration-Related Diseases

The long-term effects of dehydration-related diseases depend on the specific condition and its severity. For example, untreated heatstroke can cause permanent brain damage, while recurrent kidney stones can lead to kidney failure. Chronic dehydration increases the risk of developing various health issues, including cardiovascular disease, cognitive decline, and chronic kidney disease. Mild dehydration, while usually manageable, can still lead to fatigue, headaches, and reduced cognitive function.

In contrast, severe dehydration can be life-threatening, requiring immediate medical intervention. The impact of dehydration is cumulative; repeated episodes can significantly increase the risk of developing serious health problems.

Identifying Risk Factors for Dehydration

Source: pinimg.com

Dehydration, the state of lacking sufficient body water, isn’t just about feeling thirsty. It’s a serious condition that can significantly impact health, leading to various complications. Understanding the risk factors is crucial for proactive prevention and ensuring optimal hydration. Many factors contribute to an increased risk of dehydration, ranging from individual characteristics to environmental conditions. By identifying these factors, we can better protect ourselves and those around us.

Several groups of people are particularly vulnerable to dehydration due to physiological factors, underlying health conditions, or lifestyle choices. Similarly, environmental factors like extreme temperatures and intense physical activity can dramatically increase the risk for anyone, regardless of their individual risk profile. Understanding these interconnected factors is key to effective hydration strategies.

High-Risk Groups and Contributing Factors

The following table summarizes individuals and circumstances that increase the risk of dehydration. It highlights contributing factors, common symptoms, and preventative measures. Recognizing these risk factors empowers us to take appropriate steps to maintain adequate hydration and minimize health risks.

| Risk Group | Contributing Factor | Symptoms | Preventive Measures |

|---|---|---|---|

| Infants and Young Children | Immature kidneys, higher metabolic rate, inability to communicate thirst | Dry mouth, decreased urination, lethargy, sunken eyes | Offer fluids regularly, monitor diaper output, seek medical advice for concerning symptoms |

| Older Adults | Decreased thirst sensation, reduced kidney function, medication side effects | Confusion, dizziness, fatigue, constipation | Drink fluids throughout the day, even if not thirsty, consider electrolyte drinks, monitor medication interactions |

| Athletes and Individuals Engaging in Strenuous Physical Activity | Increased sweat loss, prolonged exertion in hot environments | Muscle cramps, fatigue, headache, dizziness | Hydrate before, during, and after exercise, choose appropriate electrolyte drinks, monitor fluid intake |

| Individuals with Chronic Illnesses (e.g., Diabetes, Kidney Disease) | Frequent urination, impaired fluid regulation, medication side effects | Excessive thirst, frequent urination, fatigue, dizziness | Follow medical advice regarding fluid intake, monitor blood sugar and kidney function, discuss medication interactions with physician |

| Individuals Living in Hot or Humid Climates | Increased sweat loss due to high ambient temperatures and humidity | Excessive sweating, fatigue, headache, dizziness | Drink plenty of fluids, limit outdoor activity during peak heat, wear light clothing |

| Individuals with Diarrhea or Vomiting | Fluid loss through gastrointestinal tract | Dehydration symptoms, nausea, vomiting, diarrhea | Replace fluids lost through oral rehydration solutions or electrolyte drinks, seek medical attention if symptoms persist |

Strategies for Preventing Dehydration

Dehydration is a serious issue, but thankfully, it’s largely preventable. By understanding your body’s hydration needs and implementing simple strategies, you can significantly reduce your risk of dehydration-related illnesses. This section focuses on practical steps you can take to stay adequately hydrated throughout your day, regardless of your activity level or climate.Staying adequately hydrated is crucial for maintaining overall health and preventing dehydration-related illnesses.

This involves a conscious effort to consume sufficient fluids regularly, particularly during periods of increased fluid loss such as exercise or hot weather. Understanding the types of fluids and their hydrating properties, along with developing a personalized hydration plan, are key components of effective dehydration prevention.

Practical Tips for Maintaining Adequate Hydration

Maintaining adequate hydration involves more than just drinking water when you’re thirsty. It requires a proactive approach to fluid intake throughout the day. Consistency is key to preventing dehydration.

- Carry a reusable water bottle: This serves as a visual reminder to drink throughout the day. Aim to keep it filled and refill it regularly.

- Set reminders: Use your phone or a smart watch to remind you to drink water at regular intervals.

- Drink water before, during, and after physical activity: Exercise significantly increases fluid loss through sweat. Replenishing fluids before, during, and after workouts is vital.

- Drink water even if you don’t feel thirsty: Thirst is a late indicator of dehydration. Proactive hydration is more effective.

- Eat hydrating foods: Fruits and vegetables like watermelon, cucumbers, and spinach have high water content and contribute to your daily fluid intake.

Hydrating Beverages: A Comparison

While water is the best choice for hydration, various beverages can contribute to your daily fluid intake. However, their effectiveness varies depending on their composition.

- Water: The gold standard. It’s calorie-free, readily absorbed, and doesn’t contain added sugars or stimulants.

- Electrolyte drinks: Beneficial after intense exercise or sweating, as they replenish electrolytes lost through sweat. However, they often contain added sugar, so moderation is key.

- Fruit juices: Provide vitamins and minerals but often contain high levels of sugar. Diluting them with water can reduce sugar intake.

- Tea and coffee (in moderation): While they contain caffeine, which has a mild diuretic effect, they can still contribute to hydration, especially if consumed in moderation.

- Avoid sugary drinks: Sodas, sweetened juices, and energy drinks are high in sugar and can actually contribute to dehydration due to their diuretic effect.

Sample Daily Hydration Plan

The optimal fluid intake varies depending on factors like activity level, climate, and individual body size. This plan provides a general guideline; adjust it based on your specific needs.

| Activity Level | Fluid Intake (mL) | Examples |

|---|---|---|

| Sedentary | 2000-2500 | 8-10 glasses of water, herbal tea, diluted juice |

| Lightly Active | 2500-3000 | 10-12 glasses of water, electrolyte drink after exercise |

| Moderately Active | 3000-3500 | 12-14 glasses of water, fruit infused water, electrolyte drink |

| Very Active | 3500+ | 14+ glasses of water, electrolyte drinks, sports drinks (in moderation) |

Note: This is a general guideline. Pay attention to your body’s signals and adjust your fluid intake accordingly. Consult a healthcare professional for personalized recommendations.

Dietary Approaches to Reduce Dehydration Risk

Source: natural-cure.org

Proper hydration isn’t solely about chugging water; your diet plays a crucial role in maintaining adequate fluid balance. Consuming foods with high water content contributes significantly to your daily fluid intake, supplementing your water consumption and helping to prevent dehydration. This is particularly important for individuals at increased risk, such as the elderly or those engaging in strenuous physical activity.

High Water Content Foods

Many fruits and vegetables are naturally hydrating, providing both fluids and essential nutrients. Including these in your daily meals is a delicious and effective way to boost your hydration levels.

- Watermelon: Known for its high water content and refreshing taste, watermelon is an excellent choice for hydration. Its vibrant red flesh is approximately 92% water.

- Cucumber: Crisp and cool, cucumbers are another excellent source of hydration, boasting around 96% water content. They are also low in calories and rich in electrolytes.

- Lettuce: Various types of lettuce, such as romaine and iceberg, contribute to hydration with approximately 96% water content.

- Strawberries: These juicy berries are roughly 91% water and offer a sweet and refreshing way to stay hydrated.

- Spinach: This leafy green vegetable is around 91% water and packed with vitamins and minerals.

- Tomatoes: Juicy tomatoes contribute to hydration, containing about 95% water.

- Celery: This crunchy vegetable is approximately 95% water, making it a great snack for hydration.

Sample Hydrating Meal Plan

This sample meal plan demonstrates how to incorporate hydrating foods throughout the day to minimize dehydration risk. Remember to adjust portion sizes to meet your individual caloric needs.

| Meal | Hydrating Foods | Other Foods (Examples) |

|---|---|---|

| Breakfast | 1 cup strawberries, 1/2 cup watermelon | Oatmeal with a splash of milk, a small portion of nuts |

| Lunch | Large salad with cucumber, lettuce, and tomatoes; a side of celery sticks | Grilled chicken or fish, a small portion of whole-grain bread |

| Dinner | Steamed spinach, a side of watermelon | Baked salmon, a small portion of brown rice |

| Snacks | Cucumber slices, a handful of strawberries | A small portion of plain yogurt |

Lifestyle Modifications to Prevent Dehydration-Related Diseases

Maintaining a healthy lifestyle plays a crucial role in preventing dehydration and its associated health problems. Our daily habits significantly influence our hydration status, impacting everything from our energy levels to our susceptibility to illness. By making conscious choices about our activity levels, dietary intake, and consumption of certain beverages, we can significantly improve our overall hydration and reduce our risk of dehydration-related diseases.

Staying hydrated is key to preventing dehydration-related illnesses, so I always keep a water bottle handy. Understanding which foods best support hydration is crucial, and that’s where learning about nutritional needs comes in. Check out this article on are women and men receptive of different types of food and game changing superfoods for women to discover foods that might boost your hydration game.

Ultimately, a balanced diet and consistent water intake are your best defense against dehydration.

Regular Exercise and Hydration Needs

Regular physical activity increases our body’s fluid loss through sweating. The intensity and duration of the exercise directly correlate with the amount of sweat produced. For example, a high-intensity workout like running a marathon will lead to significantly more fluid loss than a leisurely walk. This increased fluid loss necessitates a greater intake of fluids to maintain proper hydration.

Failing to replenish these fluids can lead to dehydration, impacting athletic performance and increasing the risk of heatstroke or other heat-related illnesses. It’s important to remember that thirst isn’t always the best indicator of dehydration; proactive hydration strategies are crucial, especially during prolonged or intense exercise. Consider pre-hydrating before exercise and consistently replenishing fluids throughout and after the activity.

Effects of Alcohol and Caffeine Consumption on Hydration

Alcohol and caffeine are both diuretics, meaning they increase urine production. This leads to increased fluid loss from the body, potentially contributing to dehydration. While a moderate amount of either might not significantly impact hydration in all individuals, excessive consumption can easily lead to dehydration, especially when combined with physical activity or hot weather. For instance, consuming several alcoholic beverages at a social event, particularly without adequate water intake, can result in significant dehydration and its associated symptoms like headaches, fatigue, and dizziness.

Similarly, relying on caffeinated beverages like coffee or soda as primary sources of hydration can negatively impact fluid balance. It’s essential to balance the consumption of these diuretic beverages with sufficient water intake to maintain proper hydration.

Comparison of Hydration Effects of Different Physical Activities

Different types of physical activity exert varying demands on the body’s hydration levels. High-intensity activities like running, cycling at a high intensity, or playing team sports in hot and humid conditions lead to greater sweat loss and a higher risk of dehydration than lower-intensity activities such as walking or yoga. The duration of the activity is another crucial factor; longer durations, regardless of intensity, will increase fluid loss.

For example, a long hike in the sun will result in more dehydration than a short, brisk walk, even if the intensity is similar. Outdoor activities in hot and humid climates further exacerbate fluid loss due to increased sweating. Therefore, choosing the type and duration of exercise, and considering the environmental conditions, are vital in managing hydration effectively and minimizing the risk of dehydration-related health problems.

Monitoring Hydration Status

Staying adequately hydrated is crucial for preventing dehydration-related illnesses. Regularly monitoring your hydration status allows you to proactively address any potential deficiencies before they lead to serious health problems. This involves paying attention to several key indicators, as detailed below.

Accurate hydration assessment relies on a combination of methods, each offering a unique perspective on your body’s fluid balance. While thirst is a common indicator, it’s not always reliable, especially for older adults or individuals with certain medical conditions. Therefore, a multi-faceted approach is recommended for a comprehensive understanding of your hydration levels.

Urine Color as a Hydration Indicator

Urine color provides a simple yet effective visual cue for assessing hydration. Think of it as a built-in hydration gauge. Pale yellow or almost clear urine generally indicates good hydration, while dark yellow or amber urine suggests dehydration. Imagine a spectrum: a clear, almost colorless urine at one end representing optimal hydration; a deep, almost brown urine at the other, signifying significant dehydration.

In between, you’ll see shades of yellow, getting progressively darker as hydration decreases. A visual guide would show a gradual shift from a very light yellow (well-hydrated) to a dark amber (severely dehydrated), with intermediate shades reflecting varying degrees of hydration. Regularly checking your urine color throughout the day can provide valuable insights into your hydration status.

Body Weight Changes and Dehydration

Significant changes in body weight can be a reliable indicator of dehydration, particularly if the weight loss is rapid and unexplained. This is because water makes up a significant portion of our body weight. For instance, a sudden loss of 1-2% of body weight could signal mild dehydration, while a loss exceeding 5% might indicate severe dehydration. To effectively track your weight, weigh yourself at the same time each day, preferably before breakfast, using the same scale.

Staying well-hydrated is key to preventing dehydration-related illnesses, boosting overall health and well-being. Understanding that dehydration can worsen existing conditions is crucial; for example, check out this article on risk factors that make stroke more dangerous , as dehydration is a significant contributor to stroke risk. Therefore, consistently drinking enough water is a simple yet powerful step towards reducing your risk of serious health problems, including stroke.

Consistent monitoring will help you identify any significant and rapid weight fluctuations that might suggest dehydration. For example, if you typically weigh 150 pounds and suddenly weigh 147 pounds without any other changes in diet or exercise, this could be a warning sign.

Seeking Medical Attention: How To Reduce Risk Of Dehydration Related Diseases

Source: paulaowens.com

Dehydration, while often easily remedied with increased fluid intake, can become a serious medical condition if left untreated. Recognizing the warning signs of severe dehydration is crucial for prompt intervention and preventing potentially life-threatening complications. Understanding when to seek professional medical help is just as important as knowing how to prevent dehydration in the first place.Severe dehydration can manifest in ways that go beyond simple thirst.

It’s important to be aware of these symptoms and act quickly if you or someone you know experiences them.

Warning Signs of Severe Dehydration

Severe dehydration is a medical emergency and requires immediate attention. The following symptoms indicate a need for prompt medical care:

- Extreme thirst: Beyond the typical feeling of thirst, this involves an overwhelming and persistent desire for fluids.

- Rapid, weak pulse: Your heart rate may increase significantly as your body struggles to maintain blood flow.

- Low blood pressure: This is a critical sign, often accompanied by dizziness or lightheadedness.

- Rapid breathing: Your body works harder to compensate for the lack of fluids.

- Sunken eyes: A visible sign of dehydration, indicating significant fluid loss.

- Dry mouth and mucous membranes: Your mouth feels excessively dry, and your saliva production is significantly reduced.

- Little or no urination: Your kidneys are conserving fluids, leading to decreased urine output.

- Confusion or disorientation: Severe dehydration can affect brain function, causing mental confusion.

- Loss of consciousness: This is a life-threatening sign requiring immediate emergency medical intervention.

- Fever: High body temperature can exacerbate fluid loss.

The Importance of Professional Medical Advice

Persistent dehydration, even without the most severe symptoms, warrants a visit to a healthcare professional. Repeated episodes of dehydration, especially if accompanied by other symptoms like nausea, vomiting, or diarrhea, may indicate an underlying medical condition that requires diagnosis and treatment. A doctor can help determine the cause of the dehydration and recommend appropriate interventions. For example, persistent dehydration might be a symptom of a digestive issue, diabetes, or even a kidney problem.

Staying hydrated is key to preventing dehydration-related illnesses, from simple headaches to more serious kidney issues. This highlights the importance of advancements like the recent fda approves clinical trials for pig kidney transplants in humans , which could revolutionize organ transplantation and potentially impact those with compromised kidney function. Ultimately, though, maintaining proper hydration remains our best defense against many health problems.

Treatment Options for Dehydration-Related Illnesses

Treatment for dehydration-related illnesses varies depending on the severity and underlying cause. Mild dehydration can often be treated at home by increasing fluid intake. However, more severe cases may require hospitalization for intravenous (IV) fluid rehydration. This delivers fluids directly into the bloodstream, rapidly restoring fluid balance. In cases where dehydration is caused by an underlying illness, such as gastroenteritis or diabetes, treatment will focus on addressing the root cause alongside rehydration therapy.

Electrolyte solutions may also be recommended to replace lost salts and minerals. For example, a person experiencing severe vomiting and diarrhea might require an IV solution containing electrolytes to prevent further complications. Oral rehydration solutions (ORS) are also available and can be effective for mild to moderate dehydration. These solutions contain a precise balance of sugars and salts to help the body absorb fluids more efficiently.

Concluding Remarks

Staying adequately hydrated isn’t just about drinking enough water; it’s about making conscious choices throughout your day to support your body’s natural processes. By understanding your risk factors, adopting a proactive hydration strategy, and recognizing the signs of dehydration, you can significantly reduce your risk of related illnesses. Remember, even small changes, like carrying a reusable water bottle or adding hydrating foods to your meals, can make a big difference in your overall health and vitality.

So, let’s prioritize hydration and feel the positive impact on our energy, mood, and well-being!

FAQ Guide

What are some common myths about hydration?

Many believe only water hydrates; however, various beverages and water-rich foods contribute. Another myth is that thirst is a reliable indicator; by then, you might already be mildly dehydrated.

How much water should I drink daily?

The recommended intake varies depending on factors like activity level, climate, and individual health. Consult a doctor or use online calculators for personalized guidance.

Can I drink too much water?

Yes, excessive water intake can lead to hyponatremia (low sodium levels), a serious condition. Listen to your body and avoid over-hydrating.

What are the best ways to track my hydration?

Monitor urine color (pale yellow is ideal), pay attention to thirst cues, and weigh yourself before and after exercise to assess fluid loss.