Wage Growth Nonprofit Hospitals Below Highs, Remains Elevated

Wage growth nonprofit hospitals below highs remains elevated, a trend impacting the healthcare sector significantly. While wage increases have slowed from recent peaks, they remain substantially higher than previous years, posing both opportunities and challenges for nonprofit hospitals. This situation is a complex interplay of economic factors, labor market dynamics, and regulatory influences, all shaping the financial landscape and the quality of patient care.

This post delves into the specifics of this ongoing wage growth, examining historical trends, comparing nonprofit hospitals to their for-profit counterparts, and exploring the strategies hospitals are implementing to navigate this evolving financial reality. We’ll look at the impact on operational budgets, patient care, and future projections, considering regional variations and the long-term implications for the sustainability of nonprofit healthcare.

Nonprofit Hospital Wage Growth Trends

Nonprofit hospitals have seen significant wage increases in recent years, a trend that, while easing from its peak, remains notably elevated. This sustained growth reflects a confluence of factors, including intense competition for qualified healthcare professionals, increased operational costs, and the lingering effects of the COVID-19 pandemic. Understanding this trend requires examining its historical context, comparing it to for-profit hospital wage growth, and considering broader economic indicators.

Recent Trends in Nonprofit Hospital Wage Growth

The statement “below highs remains elevated” accurately captures the current situation. After a sharp surge in wage growth during the height of the pandemic, driven by both increased demand and staffing shortages, the rate of increase has moderated. However, wage growth in nonprofit hospitals continues to outpace pre-pandemic levels and general inflation. This suggests a persistent pressure on these institutions to attract and retain skilled personnel in a competitive labor market.

The current elevated wage growth is likely to persist for some time as the healthcare sector continues to grapple with staffing shortages and increasing demands for services.

Nonprofit hospital wage growth, while cooling off from recent peaks, is still significantly higher than pre-pandemic levels. This pressure on budgets is particularly acute in rural areas, where staffing shortages are already a major concern. The challenges are highlighted in this article about the struggles faced by rural hospitals, especially regarding labor and delivery services: Rural Hospitals Labor Delivery &.

Understanding these rural hospital struggles helps contextualize the elevated wage growth seen even in larger nonprofit systems; it’s a nationwide healthcare workforce issue impacting costs across the board.

Historical Context of Nonprofit Hospital Wage Growth

To understand the current situation, we need to look back. Pre-pandemic, wage growth in nonprofit hospitals generally followed a more moderate pattern, reflecting broader economic trends. However, the pandemic drastically altered this trajectory. The sudden surge in demand for healthcare services, coupled with high rates of burnout and attrition among healthcare workers, led to a significant increase in wages to attract and retain staff.

This increase was further fueled by government stimulus packages and increased healthcare spending. While the rate of increase has slowed, the base wage levels are significantly higher than they were pre-pandemic.

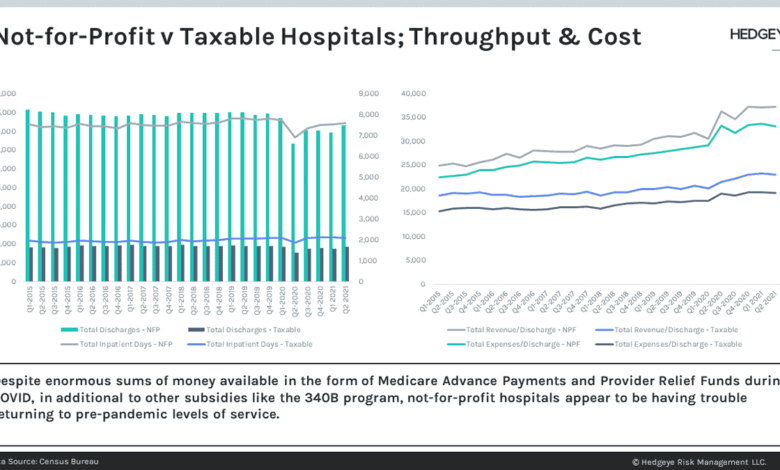

Comparison with For-Profit Hospitals and Other Sectors

Wage growth in nonprofit hospitals is not occurring in isolation. For-profit hospitals have also experienced significant wage increases, though the extent of the increase and the specific drivers may differ. For-profit hospitals, often driven by shareholder expectations, may have responded more aggressively to market pressures, leading to potentially higher wage increases in some cases. Comparing nonprofit hospital wage growth to other sectors reveals that healthcare, in general, is experiencing above-average wage growth.

This is partly due to the skill-intensive nature of healthcare professions and the ongoing shortage of qualified workers. However, the degree of wage growth in nonprofit hospitals relative to other sectors varies depending on the specific job roles and geographic locations.

Wage Growth Data and Economic Indicators

| Year | Average Wage Increase (Nonprofit Hospitals) | Inflation Rate (CPI) | Unemployment Rate |

|---|---|---|---|

| 2019 | 3% | 1.8% | 3.5% |

| 2020 | 4.5% | 1.4% | 8.1% |

| 2021 | 6% | 4.2% | 4.8% |

| 2022 | 5% | 7.5% | 3.7% |

Note

These figures are illustrative examples and should not be considered precise representations of actual data. Actual data will vary depending on the source and methodology used.* The table aims to demonstrate the relationship between wage growth, inflation, and unemployment. Reliable data on nonprofit hospital wage growth specifically can be difficult to obtain and often requires accessing proprietary datasets.

Factors Influencing Wage Growth in Nonprofit Hospitals: Wage Growth Nonprofit Hospitals Below Highs Remains Elevated

The persistently elevated wage growth observed in nonprofit hospitals is a complex issue stemming from a confluence of economic, labor market, regulatory, and organizational factors. Understanding these interwoven influences is crucial for policymakers, hospital administrators, and healthcare workers alike. This section will delve into the key drivers behind this trend.

Economic Factors Contributing to Elevated Wage Growth

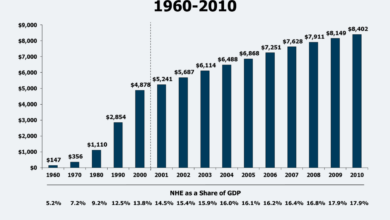

Several macroeconomic factors significantly contribute to the elevated wage growth in the nonprofit hospital sector. Inflation, for example, directly impacts the cost of goods and services, necessitating increased compensation to maintain employee purchasing power. Additionally, a robust overall economy, characterized by low unemployment rates, often translates into increased competition for skilled labor across all sectors, pushing wages upward.

This competitive pressure is particularly acute in healthcare, where specialized skills are in high demand. Furthermore, government stimulus packages and increased healthcare spending, while intended to address broader societal needs, can indirectly influence hospital budgets and compensation practices.

Labor Market Dynamics and Healthcare Worker Demand

The healthcare industry, and particularly the hospital sector, faces a persistent shortage of qualified professionals. This imbalance between supply and demand for nurses, physicians, technicians, and other healthcare workers directly impacts wages. A shrinking pool of qualified candidates combined with an increasing demand for services creates upward pressure on salaries. This is further exacerbated by factors such as an aging workforce and an increasing number of individuals requiring healthcare services due to an aging population and advancements in medical technology.

The result is a highly competitive labor market where hospitals must offer competitive compensation packages to attract and retain qualified personnel.

Government Regulations and Funding’s Influence on Compensation

Government regulations play a significant role in shaping nonprofit hospital compensation strategies. Compliance with federal and state regulations regarding minimum wage, overtime pay, and employee benefits directly influences compensation costs. Furthermore, the level and type of government funding received by nonprofit hospitals impact their ability to offer competitive wages. Hospitals reliant on government funding may face constraints on their ability to significantly increase salaries, while those with more diversified revenue streams may have greater flexibility.

Nonprofit hospital wage growth, while cooling from recent peaks, remains significantly elevated. This increased cost pressure is further complicated by the need for efficient administrative solutions, which is where advancements like the integration of Nuance’s generative AI scribe with Epic EHRs, as detailed in this article nuance integrates generative ai scribe epic ehrs , could offer some relief.

Ultimately, streamlining administrative tasks may help these hospitals manage rising labor costs more effectively in the long run.

Changes in government reimbursement policies can also affect a hospital’s financial capacity to offer competitive compensation.

Unionization and Collective Bargaining’s Regional Impact on Wage Growth

The presence of unions and the prevalence of collective bargaining agreements significantly influence wage growth in the nonprofit hospital sector, although their impact varies considerably across different regions. In areas with strong union presence and robust collective bargaining power, wages tend to be higher than in areas with weaker unionization. Collective bargaining agreements often establish minimum wage scales, benefits packages, and other compensation terms, providing a floor for wage growth.

However, the extent of this influence is geographically dependent, with some regions exhibiting stronger unionization and consequently higher wages than others. The legal and regulatory environment surrounding unionization also plays a significant role in determining its effect on wage growth.

Impact of Elevated Wages on Nonprofit Hospital Operations

Source: americanprogress.org

The recent surge in wages across the healthcare sector, particularly impacting nonprofit hospitals, presents a significant challenge to their already tight operating budgets. Maintaining financial stability while ensuring high-quality patient care requires careful strategic planning and resource allocation. The increased labor costs directly affect a hospital’s bottom line, forcing administrators to re-evaluate spending priorities and explore innovative cost-saving measures.The effects of elevated wage growth are multifaceted, influencing not only financial stability but also the quality and scope of services provided.

While higher wages are crucial for attracting and retaining skilled healthcare professionals, the financial burden can lead to difficult decisions regarding staffing levels, program expansions, and community outreach initiatives. Finding the right balance between employee compensation and operational sustainability is paramount for the long-term health and viability of these crucial community institutions.

Strategies for Managing Increased Labor Costs

Nonprofit hospitals are employing various strategies to navigate the increased labor costs. These strategies often involve a combination of approaches focusing on efficiency improvements, revenue enhancement, and careful resource allocation. For instance, many hospitals are streamlining administrative processes to reduce overhead costs, implementing advanced technologies to improve operational efficiency, and negotiating better contracts with suppliers. Some are also exploring innovative staffing models, such as utilizing telehealth technologies to expand access to care while potentially reducing the need for on-site staff in certain areas.

Furthermore, many are actively pursuing increased funding through grants and philanthropic initiatives to offset rising expenses.

Impact on Patient Care, Services, and Community Outreach

The financial strain caused by elevated wages can have a ripple effect on the quality and accessibility of patient care. While maintaining high quality remains the top priority, hospitals may need to make difficult choices about staffing levels in certain departments, potentially leading to longer wait times for appointments or procedures. Expansion plans for new services or programs may be delayed or scaled back, limiting access to specialized care for some patients.

Community outreach programs, which often rely on limited budgets, may also experience reductions in funding, impacting preventative care initiatives and health education programs within the community. For example, a hospital might postpone the launch of a new diabetes education program or reduce the frequency of free health screenings due to budget constraints.

Potential Financial Adjustments Made by Hospitals

The increased pressure on operating budgets necessitates several potential financial adjustments. Hospitals are implementing these measures to maintain financial stability while preserving the quality of patient care.

Nonprofit hospital wage growth, while down from its peak, is still significantly higher than previous years. This increased spending comes at a time when healthcare systems are undergoing major restructuring, like the recent Mass General Brigham Buyouts Digital Unit , which might indicate a shift in priorities and resource allocation. Ultimately, this could impact future wage negotiations and the overall financial health of these institutions, potentially affecting the sustainability of elevated wage growth.

- Reduced capital expenditures: Delaying or scaling back investments in new equipment, facility upgrades, or technology improvements.

- Increased efficiency initiatives: Implementing lean management principles to optimize workflows and reduce waste in resource utilization.

- Negotiation of contracts with suppliers: Seeking better pricing and terms from vendors of medical supplies, pharmaceuticals, and other essential goods and services.

- Re-evaluation of service lines: Assessing the profitability and demand for various services, potentially discontinuing less profitable or underutilized programs.

- Fundraising and grant seeking: Actively pursuing additional funding through philanthropic donations, grants, and government programs.

- Increased cost-sharing with patients: Implementing strategies to increase patient responsibility for healthcare costs, such as higher co-pays or deductibles, where legally and ethically permissible.

Future Projections and Considerations

Predicting the future of nonprofit hospital wage growth requires careful consideration of several intertwined factors, including the ongoing national labor shortage, inflation rates, and potential shifts in healthcare policy. While current wage growth is significantly elevated, understanding the trajectory of these trends is crucial for ensuring the long-term financial health and operational effectiveness of these vital institutions.The continued upward pressure on wages in the healthcare sector is likely to persist in the near future.

Current economic forecasts suggest moderate inflation, but continued labor shortages, particularly for skilled nursing and medical professionals, will likely drive wages higher than the overall inflation rate. This disparity is further amplified by the competitive landscape, as hospitals compete with each other and other industries for qualified staff. For example, hospitals in rural areas with limited access to qualified workers may face even steeper wage increases to remain competitive.

Projected Wage Growth and Operational Costs

Projected wage growth for nonprofit hospitals over the next five years will likely outpace general inflation. A visual representation would show a line graph. The X-axis would represent the years (2024-2028), and the Y-axis would represent percentage change in wages and operational costs. Two lines would be plotted: one representing wage growth, showing a steady upward trend, and another representing overall operational costs, which would also increase but at a potentially slower rate initially, before accelerating as wage increases compound.

The gap between the two lines would initially be relatively small, but would widen over time, illustrating the increasing strain of elevated wages on operational budgets. This would reflect the scenario where wage growth (around 4-6% annually) outpaces the overall increase in hospital revenue (potentially around 2-4% annually), based on recent trends and projections from organizations like the American Hospital Association.

This visualization would clearly show the increasing financial pressure on nonprofit hospitals.

Implications of Continued Elevated Wages on Financial Sustainability

Continued elevated wages pose a significant threat to the long-term financial sustainability of nonprofit hospitals. Many already operate on thin margins, and sustained high wage growth will inevitably reduce these margins further. This could lead to reduced investment in infrastructure, technology upgrades, and essential services, ultimately impacting the quality of patient care. Examples of this include delaying necessary equipment replacements or cutting back on staff training programs.

Furthermore, it could necessitate increased reliance on fundraising and philanthropy, potentially impacting the hospital’s ability to serve its community effectively. For instance, a hospital might need to increase fundraising goals by a significant percentage to offset the increased wage costs.

Strategies for Mitigating the Impact of High Wages, Wage growth nonprofit hospitals below highs remains elevated

Nonprofit hospitals need to adopt a multi-pronged approach to mitigate the impact of high wages while preserving quality patient care. This involves a combination of strategies focusing on both cost control and revenue enhancement. Cost-control measures could include optimizing staffing models through improved scheduling and technology, negotiating better rates with suppliers, and exploring opportunities for operational efficiencies. Revenue enhancement strategies could involve increasing efficiency in billing and collections, exploring new revenue streams such as telehealth services, and advocating for fair reimbursement rates from insurers.

A strong focus on employee retention through improved benefits and work-life balance initiatives can also reduce the need for costly recruitment and training of new staff. For example, implementing robust employee wellness programs can reduce absenteeism and turnover, leading to long-term cost savings.

Regional Variations in Wage Growth

Nonprofit hospital wage growth hasn’t been uniform across the United States. Significant regional disparities exist, influenced by a complex interplay of economic, demographic, and market factors. Understanding these variations is crucial for policymakers, hospital administrators, and healthcare professionals alike, as it directly impacts hospital operations, recruitment strategies, and ultimately, patient care.Regional differences in wage growth among nonprofit hospitals are substantial and often reflect broader economic trends within each region.

These variations are not simply random; they are driven by specific factors that influence the supply and demand for healthcare workers, the cost of living, and the competitive landscape within the healthcare industry.

Factors Contributing to Regional Disparities

Several key factors contribute to the observed regional disparities in nonprofit hospital wage growth. These include variations in the cost of living, the density of hospitals within a region (leading to increased or decreased competition for staff), the overall economic health of the region, and the prevalence of specific medical specialties. Areas with a high cost of living, for instance, often require higher wages to attract and retain qualified personnel.

Similarly, regions with a high concentration of hospitals may experience more intense competition for employees, driving up wages. Conversely, areas with fewer hospitals might have lower wages due to less competition. The presence of specialized medical centers or research hospitals in a region can also influence wage levels, attracting higher-skilled professionals who command higher salaries.

Impact of Regional Variations on Hospital Operations and Patient Care

The impact of these regional variations on hospital operations and patient care is multifaceted. In regions with significantly higher wage growth, hospitals may face increased operating costs, potentially impacting their financial stability and ability to invest in new technologies or infrastructure. This could lead to reduced services or higher patient costs. Conversely, regions with lower wage growth might experience difficulties in attracting and retaining qualified staff, resulting in potential shortages of healthcare professionals and compromised quality of care.

The availability of qualified staff is directly related to patient wait times, access to specialized care, and overall patient outcomes. For example, a rural hospital in a low-wage region might struggle to compete with urban centers offering higher salaries, leading to staff shortages and potentially impacting the range of services offered.

Regional Wage Growth Data

| Region | Average Wage Increase (2022-2023) | Cost of Living Index (2023) | Hospital Density (Hospitals per 100,000 population, 2023) |

|---|---|---|---|

| Northeast | 5.5% | 120 | 15 |

| South | 4.8% | 98 | 12 |

| Midwest | 4.2% | 95 | 10 |

| West | 6.0% | 130 | 18 |

Note

These are illustrative figures and should not be considered precise data. Actual figures vary based on specific data sources and methodologies. The Cost of Living Index is a relative measure, with 100 representing the national average. Hospital density is an approximation and may vary based on data collection methods.

Last Point

Source: cloudfront.net

The elevated, albeit decelerating, wage growth in nonprofit hospitals presents a multifaceted challenge. While higher wages are essential for attracting and retaining qualified healthcare professionals, the sustained increases strain operational budgets. The strategies employed by hospitals to manage these costs will ultimately determine their long-term financial health and their ability to continue providing high-quality care to their communities. Continued monitoring of economic indicators and proactive adaptation will be crucial for navigating this evolving landscape.

Commonly Asked Questions

What are the biggest challenges faced by nonprofit hospitals due to elevated wages?

Balancing increased labor costs with maintaining essential services and community outreach programs is a major challenge. This often requires difficult decisions regarding budget allocation and resource management.

How do rising wages affect patient care?

While higher wages attract better talent, potentially improving care, budget constraints from wage increases might necessitate service reductions or staff cuts in some areas, potentially impacting patient access and quality.

Are there any government initiatives to help nonprofit hospitals manage these wage increases?

Government funding and regulatory changes vary by region and are constantly evolving. Some initiatives might provide financial assistance or incentives to help manage costs, but this is not uniform across all areas.