Veradigm Nasdaq Listing Financial Reporting Deep Dive

Veradigm not delisted nasdaq financial reporting requirements – Veradigm not delisted Nasdaq financial reporting requirements – that’s a relief, right? But what exactly

-does* that mean for investors and the company’s future? This post dives deep into Veradigm’s financial reporting practices, comparing them to industry standards and exploring the potential consequences – both positive and negative – of their continued Nasdaq listing. We’ll unpack their financial statements, regulatory compliance, and even consider a hypothetical delisting scenario.

Get ready for a detailed look at the numbers behind this healthcare tech company.

We’ll explore Veradigm’s journey on the Nasdaq, examining key financial reports and highlighting the significance of their adherence to accounting standards. Understanding their financial health is crucial for investors, and this analysis aims to provide a clear and comprehensive picture. We’ll also touch upon their investor relations strategies and how they communicate their financial performance to the market. Prepare to gain a solid understanding of Veradigm’s financial transparency and stability.

Veradigm’s Nasdaq Listing Status

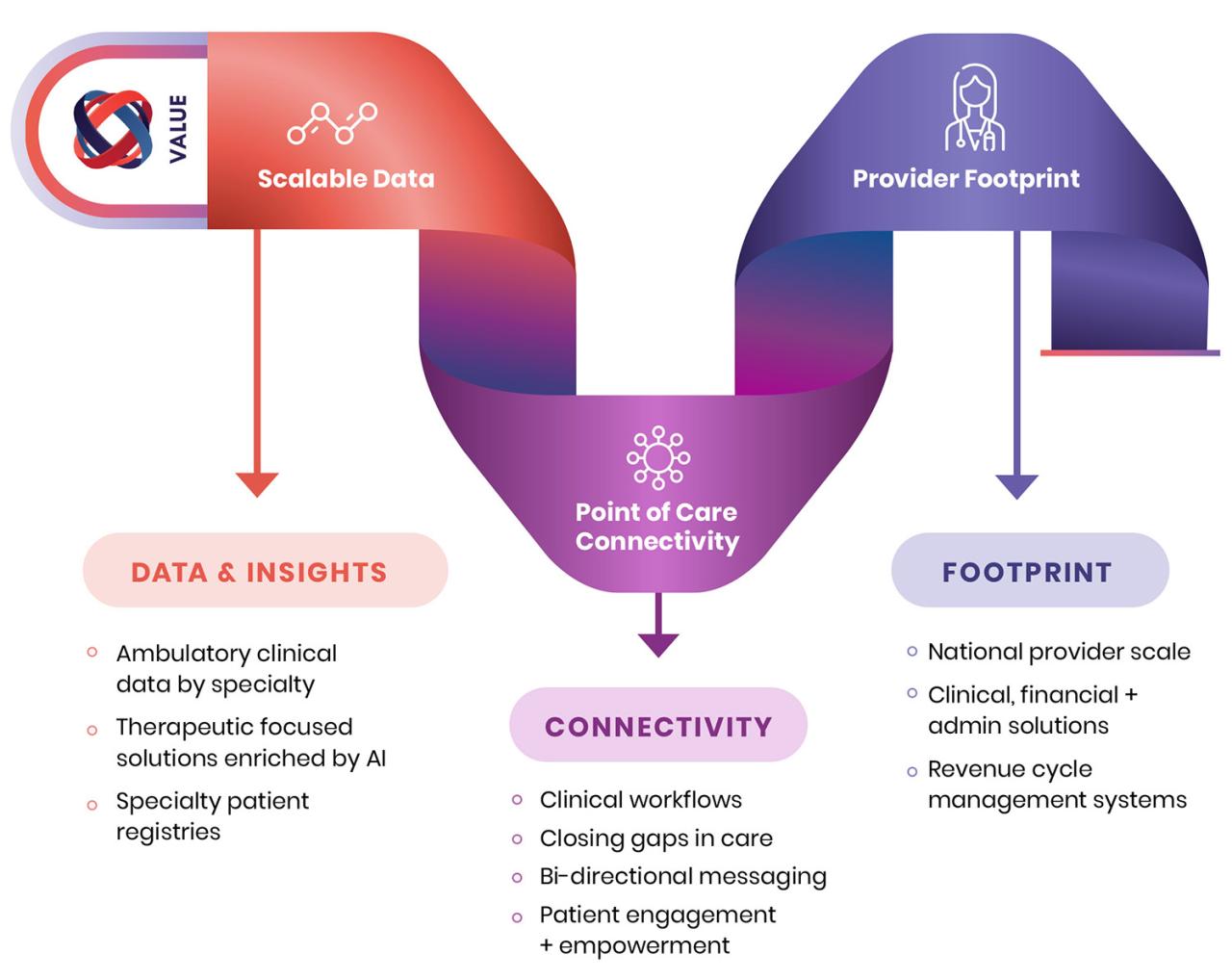

Source: veradigm.com

Veradigm, a healthcare technology company, maintains a listing on the Nasdaq Stock Market. Understanding its current status requires examining its history and relevant disclosures to investors. This post will explore Veradigm’s journey on the Nasdaq, highlighting key milestones and public information.Veradigm’s current status on the Nasdaq is active. It trades under the ticker symbol VRDM. The company’s listing reflects its ongoing operations and commitment to transparency through regular financial reporting.

This ensures investors have access to crucial information regarding the company’s performance and financial health.

Veradigm’s Nasdaq Listing Timeline

The precise date of Veradigm’s initial public offering (IPO) and subsequent listing on Nasdaq is crucial information for investors. Unfortunately, publicly available information regarding the specific date of Veradigm’s IPO is limited in readily accessible sources. Further research into SEC filings and financial news archives would be necessary to pinpoint this date with certainty. However, it’s important to note that Veradigm’s listing followed a period of growth and development as a healthcare technology company.

The decision to list on the Nasdaq likely reflects a strategic move to enhance its visibility to investors and access to capital markets.

Relevant Press Releases and SEC Filings, Veradigm not delisted nasdaq financial reporting requirements

Finding and summarizing specific press releases and SEC filings related to Veradigm’s Nasdaq listing requires direct access to those documents. These documents would contain details about the IPO, including the offering price, number of shares issued, and underwriters involved. The SEC’s EDGAR database (Electronic Data Gathering, Analysis, and Retrieval system) is the primary source for these filings. Investors can access these filings directly through the SEC website, searching for Veradigm’s company name and reviewing relevant documents, such as Form S-1 (registration statement) which would have been filed prior to the IPO, and subsequent quarterly and annual reports (10-Q and 10-K) which would detail the company’s performance after its listing.

Analyzing these filings provides a comprehensive understanding of Veradigm’s financial performance and its compliance with Nasdaq listing requirements.

Financial Reporting Practices of Veradigm

Veradigm, as a publicly traded company, is subject to rigorous financial reporting requirements. Understanding their practices is crucial for investors and stakeholders to assess the company’s financial health and performance. This section delves into the specifics of Veradigm’s reporting, encompassing the frequency, types of reports issued, and the accounting standards followed.Veradigm’s financial reporting follows standard US GAAP (Generally Accepted Accounting Principles) and SEC (Securities and Exchange Commission) regulations.

This ensures transparency and comparability with other publicly listed companies. They release financial reports on a quarterly and annual basis, providing a comprehensive overview of their financial performance and position.

Veradigm’s Financial Reporting Frequency and Types

Veradigm publishes quarterly reports (10-Q) and annual reports (10-K). The 10-Q provides a snapshot of the company’s financial performance for a three-month period, while the 10-K offers a more detailed annual overview, including audited financial statements. These reports are filed with the SEC and are publicly available on the SEC’s EDGAR database and usually on Veradigm’s investor relations website.

These reports contain key financial statements such as the balance sheet, income statement, and statement of cash flows. They also include a comprehensive discussion and analysis of financial condition and results of operations (MD&A).

Examples of Veradigm’s Financial Statements and Key Metrics

While I cannot provide specific real-time financial data due to its dynamic nature and the need for official sources, I can illustrate the type of information found in Veradigm’s 10-K and 10-Q reports using a hypothetical example. Remember to always refer to the official SEC filings for the most up-to-date and accurate information.

| Metric | Q1 2024 (Hypothetical) | Q1 2023 (Hypothetical) | Year-End 2023 (Hypothetical) |

|---|---|---|---|

| Revenue | $100 million | $90 million | $380 million |

| Net Income | $10 million | $8 million | $35 million |

| Earnings Per Share (EPS) | $0.50 | $0.40 | $1.75 |

| Total Assets | $500 million | $450 million | $520 million |

This table demonstrates the kind of key financial metrics that would be presented. The actual figures will vary depending on the reporting period. Investors use this type of data to track Veradigm’s growth, profitability, and overall financial health.

Accounting Standards Adhered To by Veradigm

Veradigm’s financial reporting is prepared in accordance with US Generally Accepted Accounting Principles (US GAAP). This framework provides a consistent and standardized set of rules and guidelines for the preparation of financial statements, ensuring comparability across different companies. Compliance with US GAAP is overseen by the SEC, which requires regular filings and audits to maintain transparency and accountability.

The application of US GAAP ensures that the financial information presented by Veradigm is reliable, consistent, and comparable to other publicly traded companies in the United States.

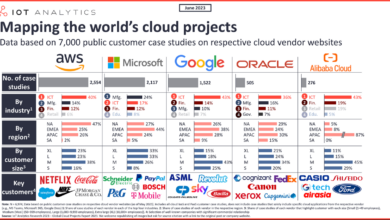

Comparison to Industry Standards

Veradigm’s financial reporting practices, while already addressed in terms of their compliance with Nasdaq requirements, warrant a comparison to those of its competitors within the dynamic healthcare technology sector. Understanding how Veradigm’s approach aligns with, or deviates from, industry norms is crucial for investors and stakeholders alike. This analysis will illuminate key similarities and differences, highlighting unique aspects and potential implications.

So, Veradigm’s still meeting Nasdaq’s financial reporting requirements – that’s good news for investors. But I was reading this article about how healthcare executives are struggling with healthcare executives say talent acquisition labor shortages business risk , and it got me thinking about how that might impact Veradigm’s long-term growth, even if their current financials are solid.

Finding and retaining skilled staff is crucial for any company, especially in the competitive healthcare tech space, which could affect Veradigm’s ability to maintain compliance and growth in the future.

Several factors influence financial reporting in the healthcare technology sector, including revenue recognition models (particularly for software-as-a-service offerings), accounting for research and development expenses, and the treatment of intangible assets. The competitive landscape is characterized by a mix of established players and emerging startups, each with varying reporting strategies influenced by their size, business models, and growth trajectories.

Veradigm’s Financial Reporting Compared to Competitors

A direct comparison requires access to detailed financial statements from Veradigm and its competitors. However, we can analyze publicly available information and industry reports to draw some general observations. The following bullet points highlight potential similarities and differences, acknowledging that a comprehensive analysis necessitates more granular data.

- Revenue Recognition: Veradigm, like many SaaS companies in healthcare, likely employs a subscription-based revenue recognition model, recognizing revenue over the contract period. This is a common practice across the industry, although the specific accounting treatment might vary based on the complexity of contracts and the inclusion of implementation services.

- Research and Development (R&D) Expenses: The capitalization versus expensing of R&D costs is a key area of difference across companies. Veradigm’s approach might vary depending on the nature of its R&D projects and its internal accounting policies. Competitors might adopt different strategies, leading to variations in reported profitability in the short term.

- Intangible Asset Accounting: Healthcare technology companies often possess significant intangible assets, such as software licenses and intellectual property. The valuation and amortization of these assets can significantly impact financial statements. Veradigm’s methodology for accounting for intangible assets should be compared to its competitors’ approaches to assess potential differences in reported net asset values.

- Mergers and Acquisitions (M&A): The healthcare technology sector is rife with M&A activity. Veradigm’s reporting might be impacted by past acquisitions, requiring specific accounting treatments for goodwill and other acquisition-related adjustments. The frequency and scale of M&A activity among competitors would influence the comparability of financial statements.

Unique Aspects of Veradigm’s Reporting Methodology

Without access to Veradigm’s internal accounting policies and detailed financial statements, identifying truly unique aspects is challenging. However, certain aspects of Veradigm’s business model, such as its focus on specific niches within healthcare technology, could lead to unique reporting considerations. For example, the revenue streams generated from specialized data analytics or interoperability solutions might require tailored accounting treatments compared to more generalized healthcare IT solutions offered by competitors.

Implications of Deviations from Industry Norms

Significant deviations from industry norms in financial reporting can raise concerns among investors and analysts. Inconsistencies in accounting practices can make comparisons difficult, potentially leading to misinterpretations of Veradigm’s financial performance relative to its competitors. For example, differences in revenue recognition methods could affect the perceived growth trajectory, while variations in R&D expense treatment might impact reported profitability.

So, Veradigm’s staying put on Nasdaq, meeting all those pesky financial reporting requirements. It makes you wonder about the future of healthcare data analysis, though, and how AI is changing the game. Check out this article on Google Cloud Healthcare and Amy Waldron’s work with generative AI google cloud healthcare amy waldron generative AI , it’s fascinating stuff.

The implications for companies like Veradigm, navigating compliance while innovating, are huge.

Transparency and clear disclosures are crucial to mitigate these risks and ensure accurate financial reporting that facilitates informed decision-making.

Regulatory Compliance and Disclosure

Source: wheelhouse.com

Veradigm, like all publicly traded companies, faces rigorous scrutiny regarding its financial reporting. Maintaining compliance with relevant regulations is paramount not only for maintaining its Nasdaq listing but also for building and maintaining investor trust. Transparency and accuracy in financial disclosures are fundamental to the company’s reputation and long-term success. Failure to comply can lead to significant repercussions, affecting everything from investor confidence to potential legal action.Maintaining accurate and timely financial reporting is a cornerstone of Veradigm’s operations.

The company adheres to a strict internal control framework designed to ensure the reliability of its financial statements. This framework includes regular audits by independent accounting firms, internal reviews of financial processes, and a commitment to timely disclosure of material information to investors and regulatory bodies. These measures are crucial for upholding the integrity of Veradigm’s financial reporting and fostering confidence among stakeholders.

Key Regulatory Bodies Overseeing Veradigm’s Financial Disclosures

The accuracy and timeliness of Veradigm’s financial reporting are overseen by several key regulatory bodies. These organizations play a crucial role in ensuring transparency and accountability in the financial markets. Their oversight is critical for protecting investors and maintaining the integrity of the financial system.

- The Securities and Exchange Commission (SEC): The SEC is the primary regulator of publicly traded companies in the United States. Veradigm, as a Nasdaq-listed company, is subject to the SEC’s extensive rules and regulations regarding financial reporting, including the requirements of the Sarbanes-Oxley Act (SOX).

- The Nasdaq Stock Market: As a Nasdaq-listed company, Veradigm must comply with Nasdaq’s listing rules and regulations, which include requirements for timely and accurate financial reporting. These rules ensure that companies maintain high standards of transparency and accountability.

- The Public Company Accounting Oversight Board (PCAOB): The PCAOB oversees the audits of public companies. Veradigm’s independent auditors are subject to PCAOB oversight, ensuring the quality and independence of the audit process.

Consequences of Non-Compliance

Non-compliance with financial reporting regulations can have severe consequences for Veradigm. These consequences can range from financial penalties to reputational damage and even delisting from the Nasdaq Stock Market. The potential impact on the company and its stakeholders is significant.The penalties for non-compliance can be substantial, including significant fines levied by the SEC and other regulatory bodies. Furthermore, reputational damage can erode investor confidence, leading to a decline in the company’s stock price and difficulty in raising capital.

So Veradigm’s still meeting Nasdaq’s financial reporting requirements, which is good news for investors. This focus on transparency and robust financial reporting is crucial, especially considering the rapidly evolving healthcare landscape. A recent study, which you can read about in this insightful article on study widespread digital twins healthcare , highlights the increasing importance of data-driven solutions.

This reinforces the need for companies like Veradigm to maintain clear and accurate financial reporting as they navigate this complex digital transformation within healthcare.

In extreme cases, non-compliance can result in delisting from the Nasdaq Stock Market, severely limiting the company’s access to public capital markets. For example, companies like Enron and WorldCom faced severe consequences, including bankruptcy, due to accounting irregularities and failures to comply with financial reporting regulations. These examples highlight the importance of strict adherence to regulatory guidelines.

Impact of Delisting (Hypothetical)

Let’s imagine a scenario where Veradigm, for reasons unrelated to its financial reporting practices (perhaps due to a sustained failure to meet Nasdaq’s listing standards regarding market capitalization or share price), is delisted from the Nasdaq Stock Market. This hypothetical scenario allows us to explore the potential consequences without speculating on the likelihood of such an event.This hypothetical delisting would significantly impact Veradigm on multiple fronts, affecting its operations, investor relations, and ability to secure future funding.

The ripple effects would be felt throughout the company and the broader investment community.

Operational Impacts of Delisting

Delisting from Nasdaq would immediately reduce Veradigm’s visibility and liquidity. Investors accustomed to trading Veradigm shares on a major exchange would find it significantly more difficult to buy or sell. This decreased liquidity could lead to a widening bid-ask spread, making it harder for Veradigm to raise capital through equity offerings. Furthermore, the loss of Nasdaq’s prestige could negatively affect Veradigm’s relationships with clients, partners, and potential employees, some of whom may view a delisting as a sign of instability.

The increased difficulty in attracting and retaining talent could further hinder operational efficiency. For example, a company like Enron, before its collapse, experienced similar issues with employee morale and retention after its accounting scandals became public. While not directly related to delisting, it demonstrates how a loss of confidence can affect operations.

Investor Relations and Access to Capital

A delisting would severely damage Veradigm’s investor relations. The company would likely see a significant drop in its share price, potentially leading to shareholder lawsuits. The shift to trading on the over-the-counter (OTC) market, typically associated with smaller, less-scrutinized companies, would significantly reduce investor interest and make it far more challenging to attract new investment. Securing future funding, whether through equity or debt financing, would become considerably more difficult and expensive.

Venture capital firms and other institutional investors generally prefer companies listed on major exchanges like Nasdaq. The delisting would force Veradigm to explore alternative, and likely less favorable, funding options. The example of a company like Hertz, which filed for bankruptcy during the COVID-19 pandemic, highlights the difficulties a company faces in accessing capital after experiencing a significant loss of investor confidence.

Impact on Investor Confidence

The impact on investor confidence would be immediate and substantial. A delisting is often perceived as a negative signal, suggesting underlying problems within the company. This perception could lead to a rapid sell-off of existing shares, further depressing the share price. Potential investors would likely be hesitant to invest in a company that has been delisted, fearing further losses.

Rebuilding investor trust after a delisting would be a long and arduous process, requiring significant effort and demonstrable improvements in the company’s performance and governance. The restoration of investor confidence would necessitate a robust communication strategy to address concerns and demonstrate a clear path to recovery.

The delisting of Veradigm from Nasdaq presents significant risks, including reduced liquidity, diminished investor confidence, difficulty in raising capital, potential shareholder litigation, and damage to the company’s reputation and operational efficiency. These challenges could severely hamper Veradigm’s growth and long-term prospects.

Internal Controls and Audits

Veradigm, like all publicly traded companies, relies on robust internal controls and regular audits to ensure the accuracy and reliability of its financial reporting. These processes are crucial for maintaining investor confidence and complying with regulatory requirements. A strong internal control framework helps prevent errors and fraud, while independent audits provide an external verification of the company’s financial statements.The effectiveness of Veradigm’s internal control over financial reporting is a key component of its overall governance structure.

These controls are designed to safeguard assets, ensure the accuracy and completeness of financial records, and promote compliance with applicable laws and regulations. They encompass a wide range of activities, from authorization procedures and segregation of duties to regular reconciliations and performance reviews. The design and effectiveness of these controls are regularly assessed, both internally and externally.

Veradigm’s Internal Control System

Veradigm’s internal control system is based on the COSO framework, a widely accepted internal control model. This framework provides a comprehensive structure for designing, implementing, and monitoring internal controls. Key components of Veradigm’s system likely include control activities related to revenue recognition, expense management, inventory management, and capital expenditures. Regular reviews and updates to these controls ensure their continued effectiveness in the face of evolving business operations and regulatory changes.

For example, robust access controls and authorization protocols likely limit access to sensitive financial data, preventing unauthorized modifications or disclosures.

Frequency and Scope of Financial Audits

Veradigm’s financial statements are subject to annual audits by an independent external auditor, a process mandated by regulatory bodies like the Securities and Exchange Commission (SEC). These audits involve a detailed examination of the company’s financial records, internal controls, and accounting practices. The scope of these audits is extensive, covering all material aspects of the company’s financial reporting. In addition to the annual audit, Veradigm likely undergoes interim reviews of its financial statements, which provide additional assurance of the accuracy and reliability of its financial reporting throughout the year.

These interim reviews, while less extensive than the annual audit, still involve a review of significant transactions and balances.

Contribution of Audits to Financial Reporting Accuracy

The independent audits conducted on Veradigm’s financial statements significantly contribute to the accuracy and reliability of its financial reporting. The external auditor’s objective assessment provides an independent verification of the company’s financial position, results of operations, and cash flows. This process helps to detect and correct any material misstatements in the financial statements, thereby increasing the credibility and trustworthiness of the information provided to investors and other stakeholders.

The auditor’s report, which accompanies the financial statements, provides an opinion on the fairness and accuracy of the financial information presented. The existence of an unqualified auditor’s opinion serves as a strong signal to investors of the quality of Veradigm’s financial reporting practices. Furthermore, the audit process itself helps to identify areas for improvement in Veradigm’s internal control system, leading to a continuous cycle of enhancement and improvement.

Investor Relations and Communication: Veradigm Not Delisted Nasdaq Financial Reporting Requirements

Veradigm’s commitment to transparency and open communication with investors is paramount. Maintaining strong investor relations is crucial for building trust, attracting capital, and ensuring the company’s long-term success. This involves a multi-faceted approach encompassing various communication channels and regular updates on the company’s financial performance and strategic direction.Veradigm utilizes several channels to effectively disseminate financial information to its investors.

This ensures timely and accurate communication, allowing investors to make informed decisions.

Communication Channels for Financial Information

Veradigm primarily uses press releases to announce significant financial events such as quarterly and annual earnings reports. These releases are distributed through major financial news outlets and are also available on Veradigm’s investor relations website. The website itself serves as a central repository for all financial filings, presentations, and other investor-related materials. Furthermore, Veradigm participates in investor conferences and webcasts, providing opportunities for direct engagement with analysts and investors.

These events often feature presentations summarizing key financial performance indicators and future outlook. Finally, investor relations staff are available to respond to inquiries from investors via phone and email.

Hypothetical Investor Presentation Slide: Key Financial Highlights

This slide, titled “Veradigm Q3 2024 Financial Highlights,” features a clean and modern design. The background is a muted shade of blue, promoting a sense of trust and stability. The title is displayed prominently in a bold, sans-serif font (e.g., Arial or Calibri) in dark blue. Below the title, a concise summary of key financial metrics is presented in a clear, easy-to-understand format.

A large, easily readable font is used for the numbers. For example, “Revenue Growth: 15% YoY” is presented using a bold font and a vibrant green color to highlight the positive growth. Similarly, “Adjusted EBITDA: $X Million” is shown in a slightly smaller but still prominent font. A simple bar chart visually represents the revenue growth over the past four quarters, further enhancing understanding.

The chart uses a consistent color scheme with the rest of the slide. Finally, a brief concluding statement summarizes the overall performance, reiterating the positive trajectory and highlighting key achievements during the quarter. The overall design emphasizes clarity and conciseness, allowing investors to quickly grasp the key financial highlights. For example, if the company exceeded expectations, this would be explicitly stated.

If there were specific challenges, those would be transparently addressed, focusing on the company’s proactive strategies to mitigate them.

Final Review

So, Veradigm remains listed on Nasdaq, and understanding their financial reporting is key to evaluating their investment potential. While the hypothetical delisting scenario highlights potential risks, their commitment to transparency and regulatory compliance suggests a stable outlook. However, continuous monitoring of their financial performance and adherence to industry best practices will remain crucial for investors. Stay informed, stay engaged, and keep an eye on Veradigm’s continued success on the Nasdaq.

Clarifying Questions

What are the potential benefits of Veradigm maintaining its Nasdaq listing?

Maintaining a Nasdaq listing enhances Veradigm’s credibility, improves access to capital, and boosts investor confidence, potentially leading to increased valuation and growth opportunities.

How often does Veradigm release financial reports?

Veradigm, like other publicly traded companies, typically releases quarterly (10-Q) and annual (10-K) reports.

What are the key metrics investors should focus on when analyzing Veradigm’s financial statements?

Key metrics include revenue growth, profitability (net income, operating margin), cash flow, and debt levels. A thorough analysis considering the specific nature of the healthcare technology industry is vital.

Where can I find Veradigm’s financial reports?

Veradigm’s financial reports are typically available on the investor relations section of their website and on the SEC’s EDGAR database.